How might this affect people’s finances heading into 2026?

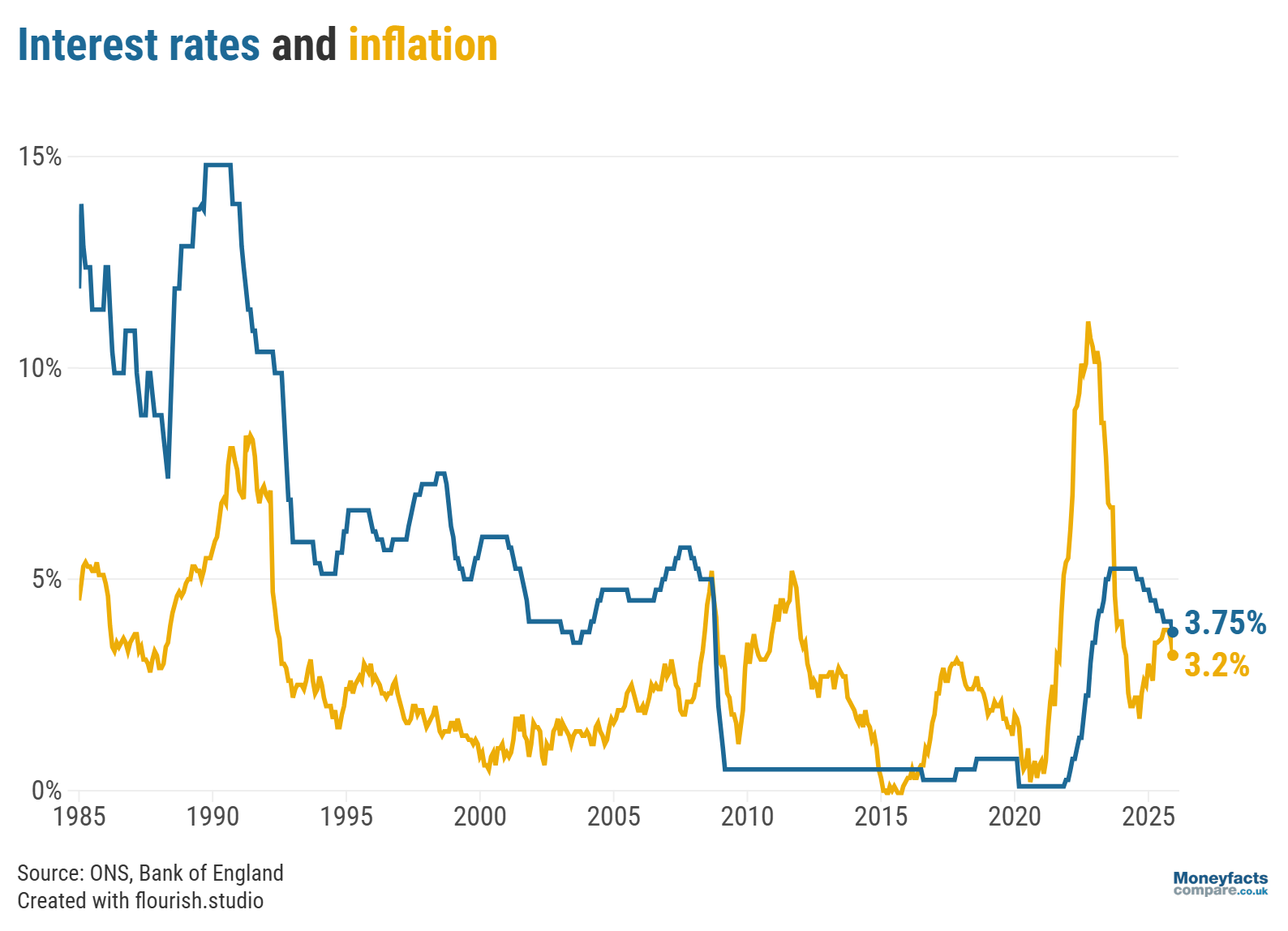

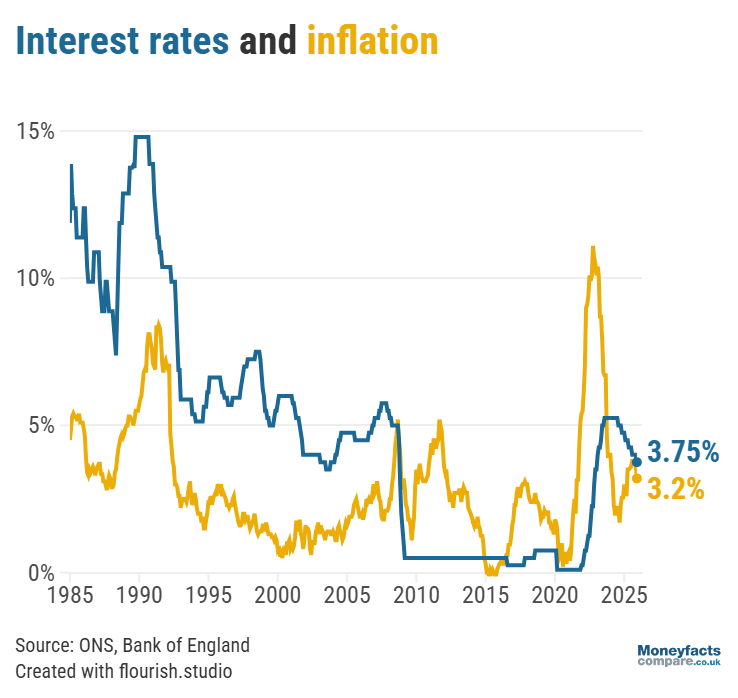

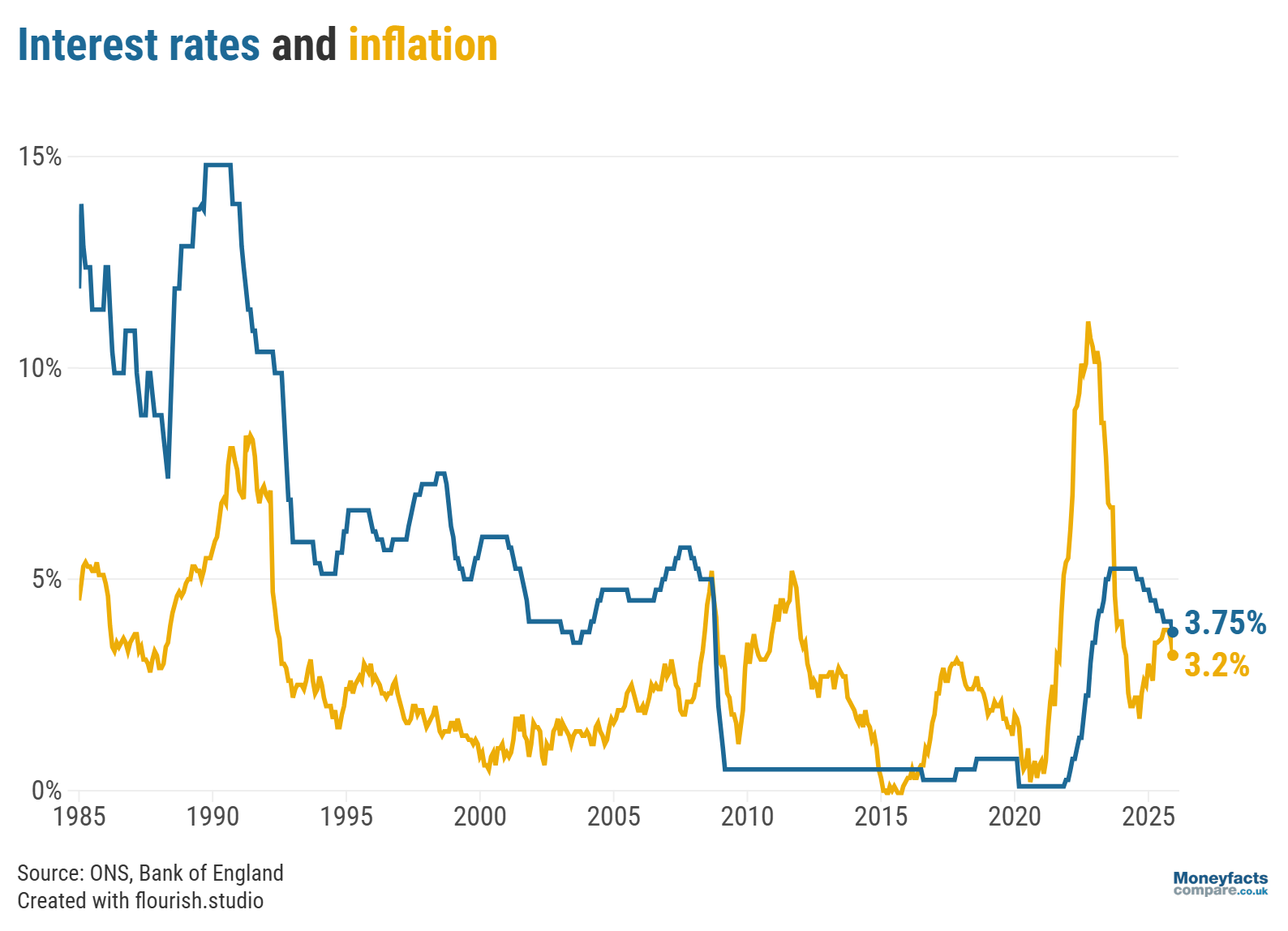

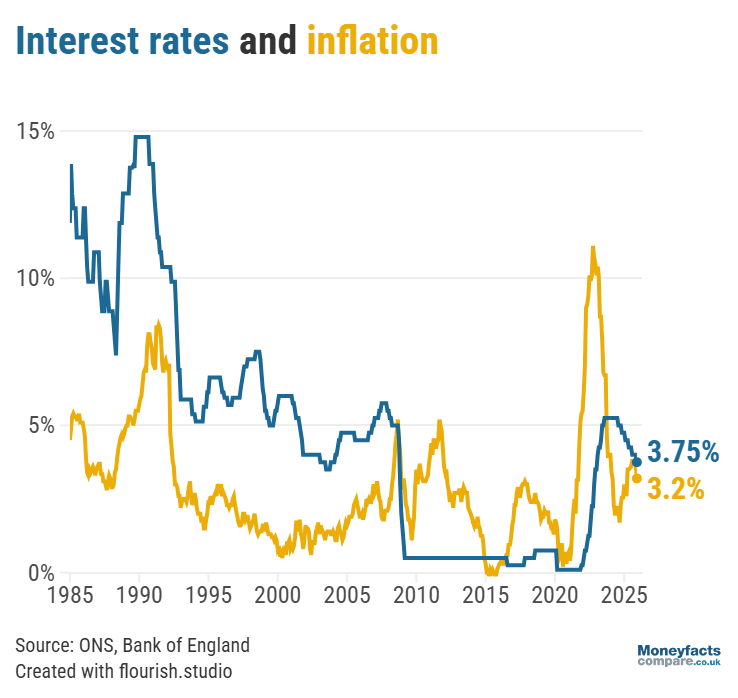

Anyone resolved to save more in 2026 should prepare themselves for lower interest rates after the Bank of England’s Monetary Policy Committee (MPC) today voted in favour of reducing the base rate to 3.75%. This is the first time the UK’s central interest rate has sat below 4% in over two-and-a-half years.

Also known as the ‘bank rate’, the base rate is the amount of interest the Bank of England charges other financial institutions to borrow money which, in turn, can influence the pricing of mortgages and savings products.

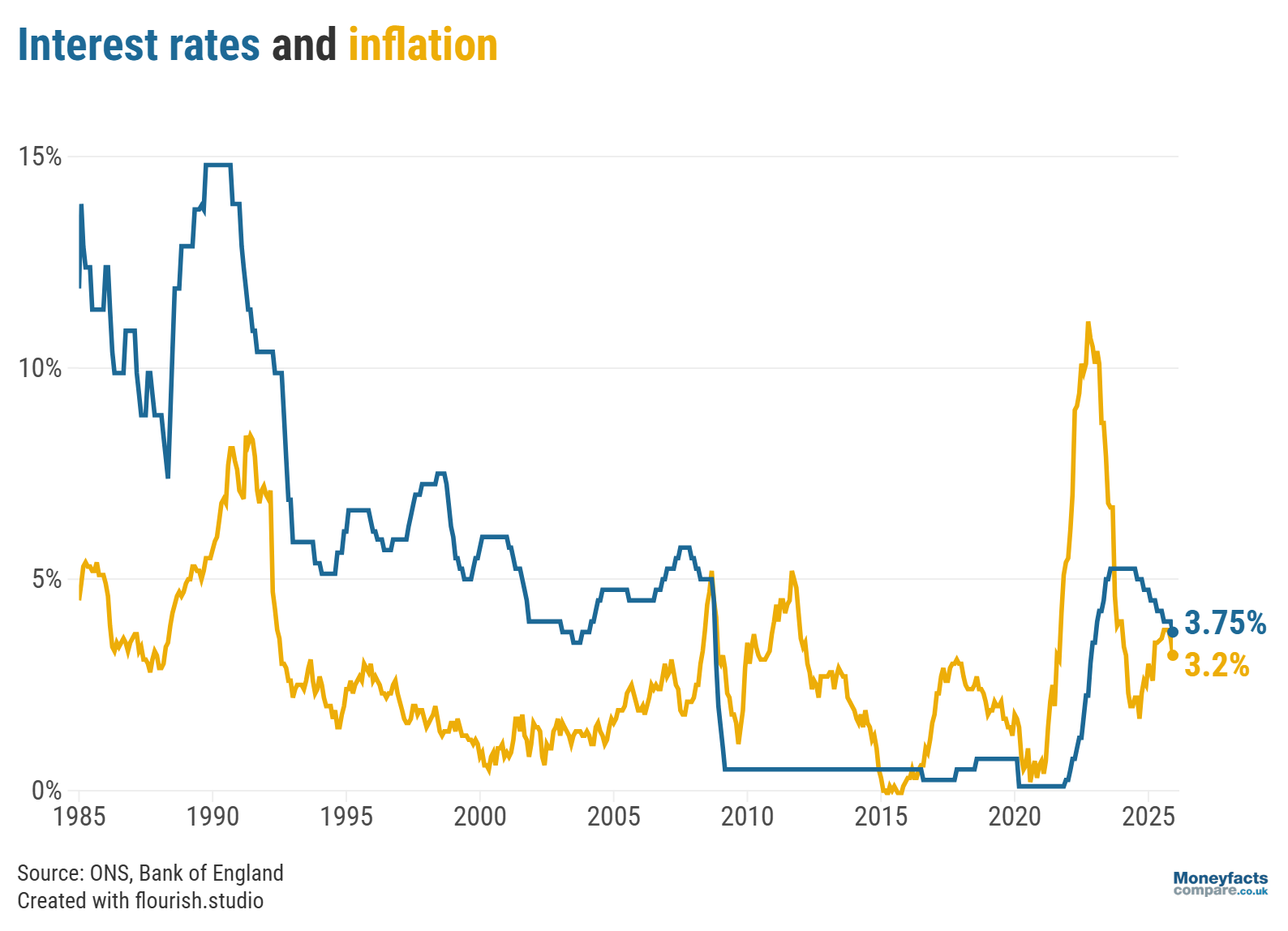

Last month, the MPC decided by a knife-edge to hold the base rate at 4%. However, with latest figures from the Office for National Statistics (ONS) revealing inflation dropped more than expected to 3.2% in November, while the economy shrank and unemployment rose slightly in October, this might have spurred the nine-person rate-setting committee into action.

UK Money Trends: Bank of England base rate vs inflation between 1985 and 2025

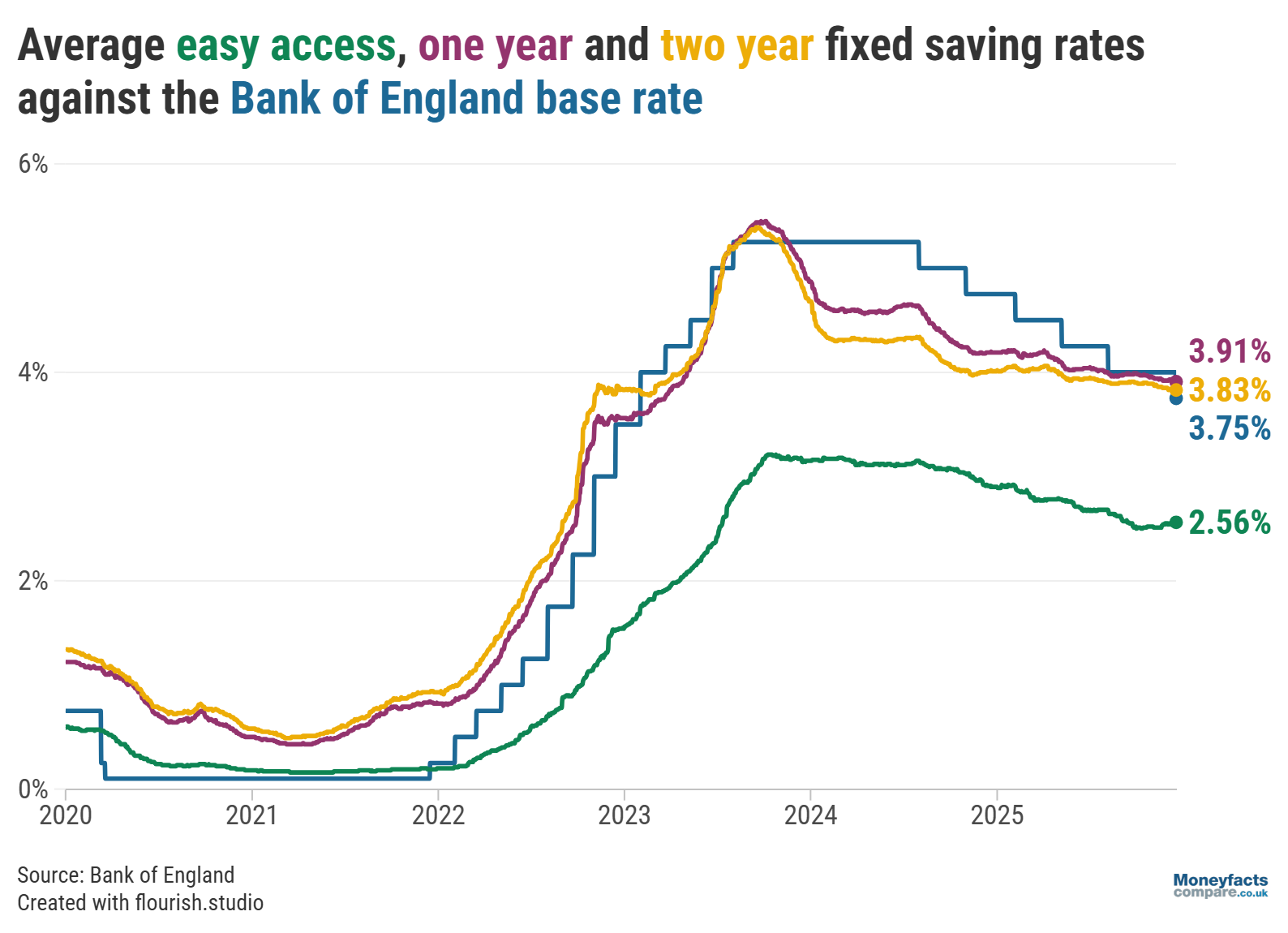

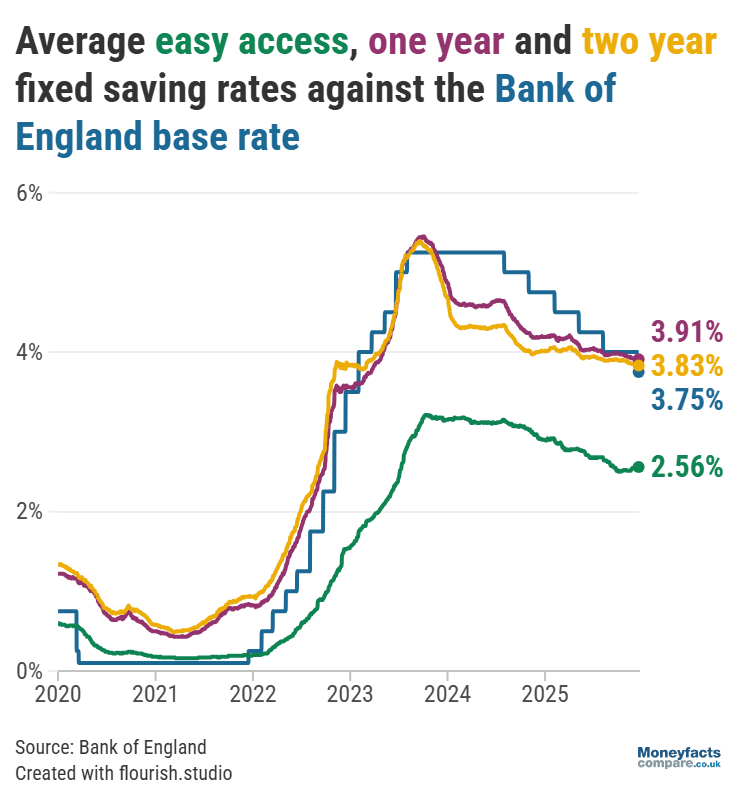

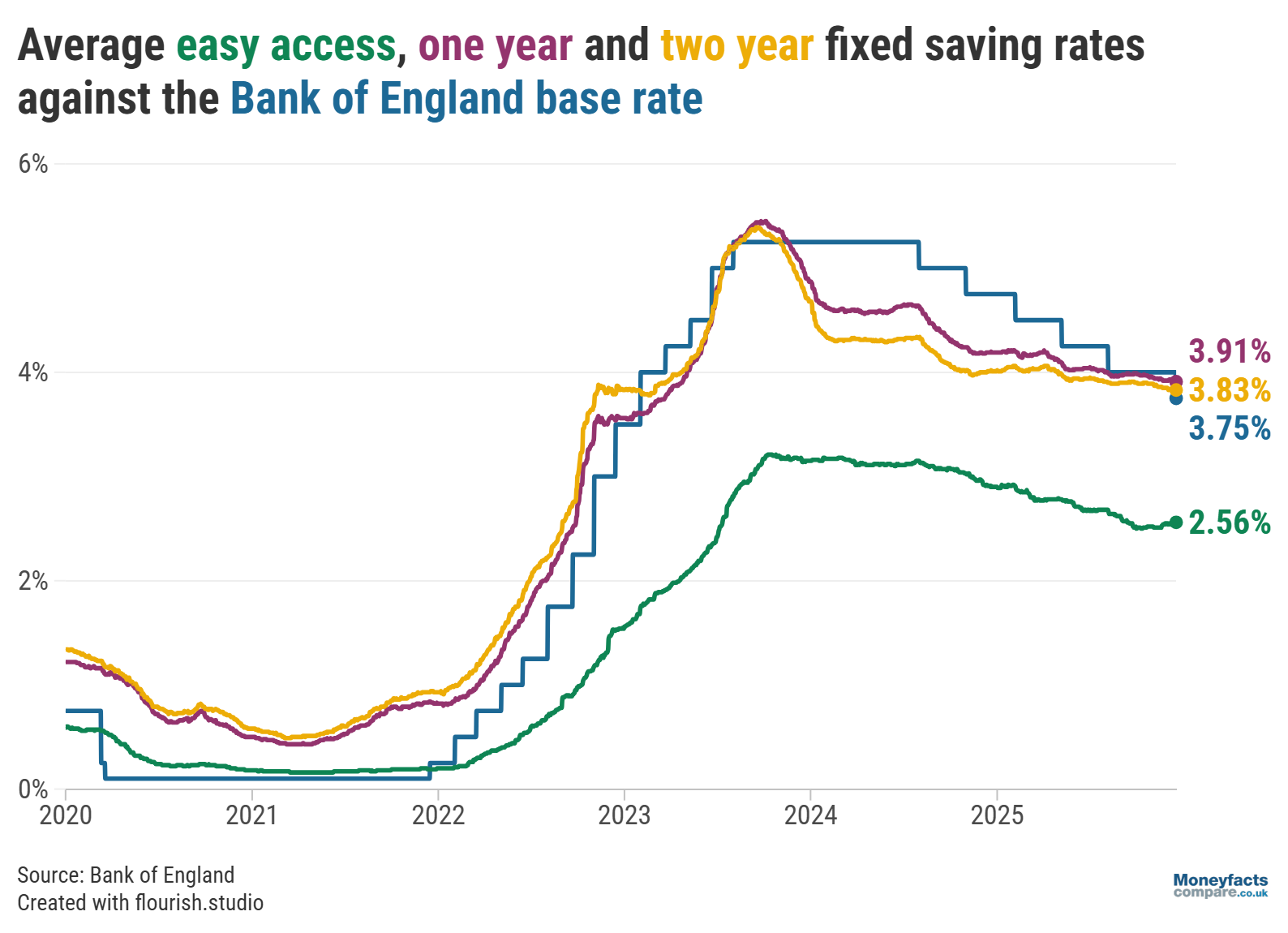

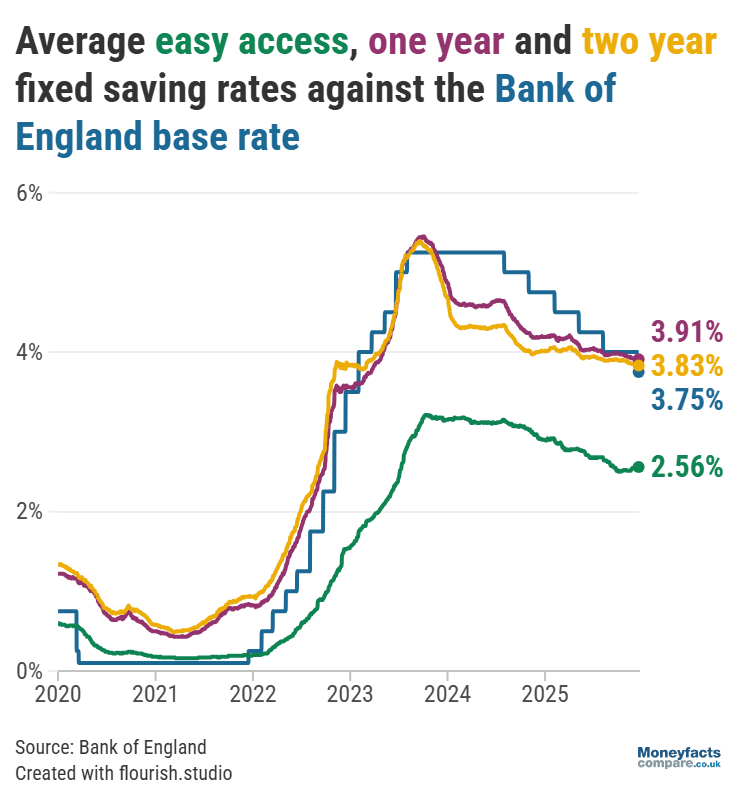

But, even though lowering the base rate can help to boost the economy (by making borrowing cheaper and stimulating greater levels of spending), it could spell misery for savers as banks and building societies take the opportunity to cut rates. In fact, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, revealed more than 90% of savings providers have lowered rates in some form since the last base rate reduction in August.

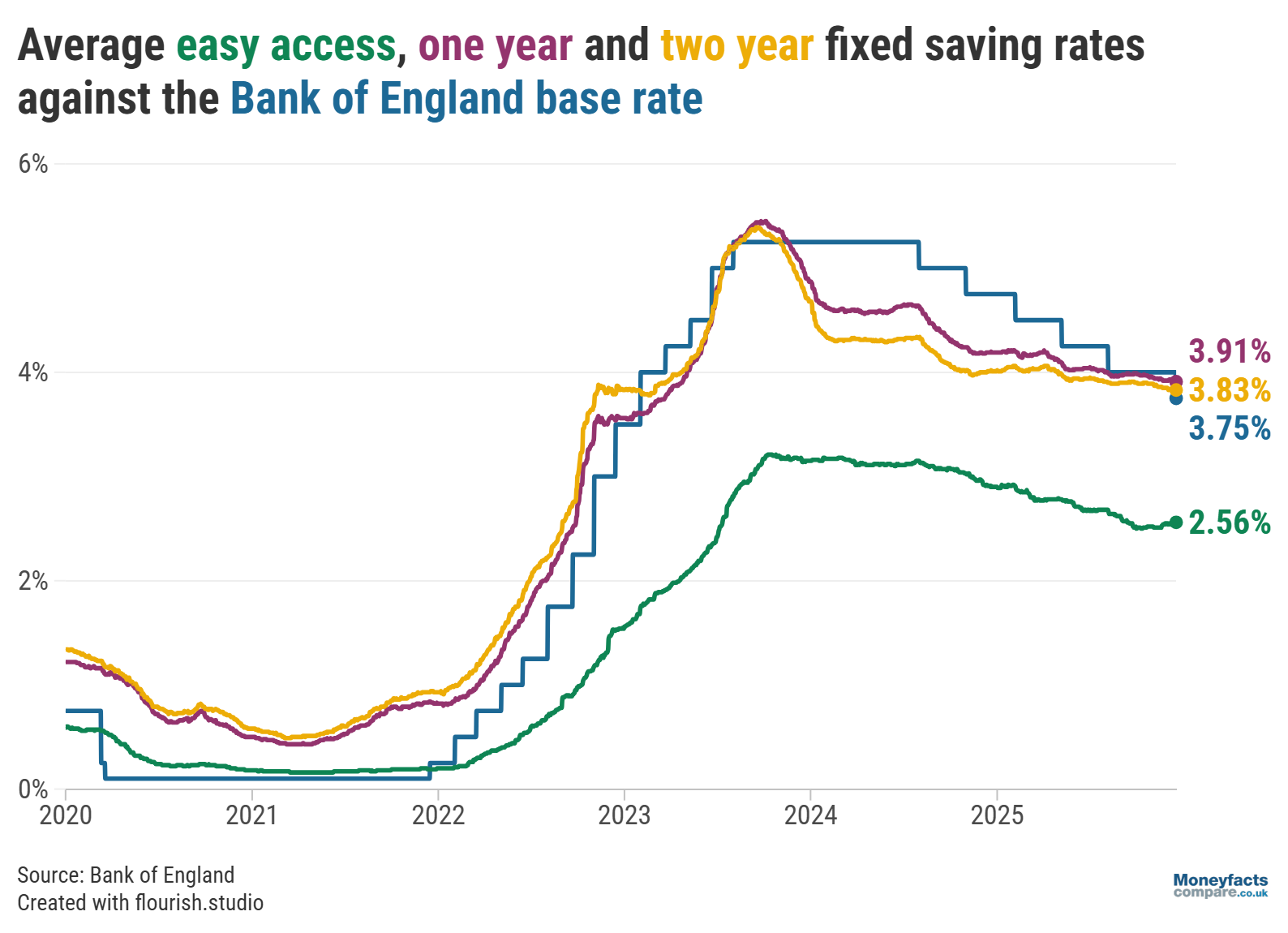

Over the course of a year, this (and two previous base rate cuts in February and May) saw the Moneyfacts Average Savings Rate fall from 3.68% in December 2024 to 3.40% by the start of this month.

Variable savings rates are especially vulnerable to changes to the base rate, with typical returns on an easy access and notice accounts dropping 0.42 and 0.60 percentage points to 2.54% and 3.50%, respectively, year-on-year. In fact, more than three-quarters (77%) of easy access accounts currently on sale pay less than 3.75%, with only one in 10 offering more than 4.00%.

UK Savings Trends 2025: Bank of England base rate vs average savings rates between 2020 and December 2025.

The Moneyfacts Savings Trends Index 2025 discovered many consumers want to save more in 2026 in order to improve their financial well-being – however, poor returns can fuel apathy.

Our savings charts are regularly updated throughout the day so you can find the best rates currently available. Meanwhile, our savings and ISA roundups provide more detail on the most competitive accounts each week.

Or, why not subscribe to our weekly savings newsletter for free and receive regular updates from across the market?

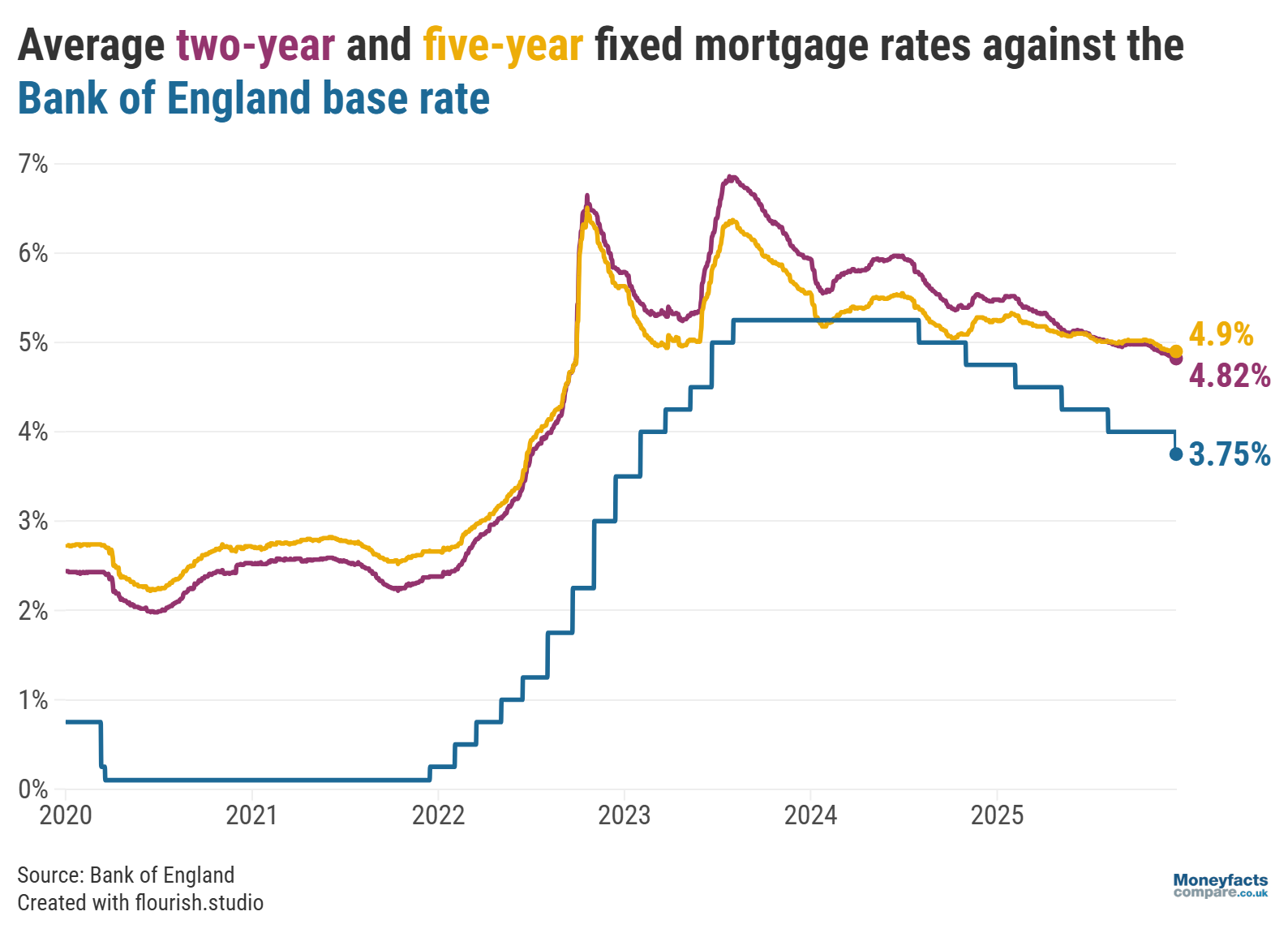

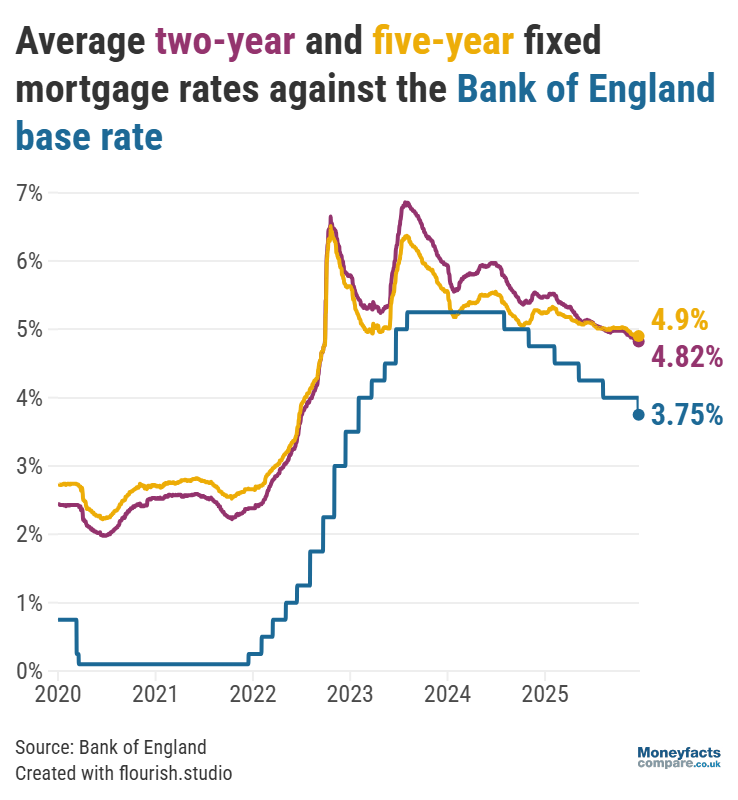

In contrast, mortgage borrowers might consider today’s base rate reduction to be an early Christmas present. But, keep in mind only those on a variable rate are likely to feel any immediate benefit as lenders often pre-emptively price in market forecasts when setting their fixed mortgage rates.

That being said, anyone sitting on their lender’s Standard Variable Rate (SVR) may find it more affordable to secure a fixed deal. “The incentive to switch from a revert to rate to a two-year fixed could save borrowers £369 per month on their mortgage repayments, which is almost £4,500 over 12 months*,” said Springall.

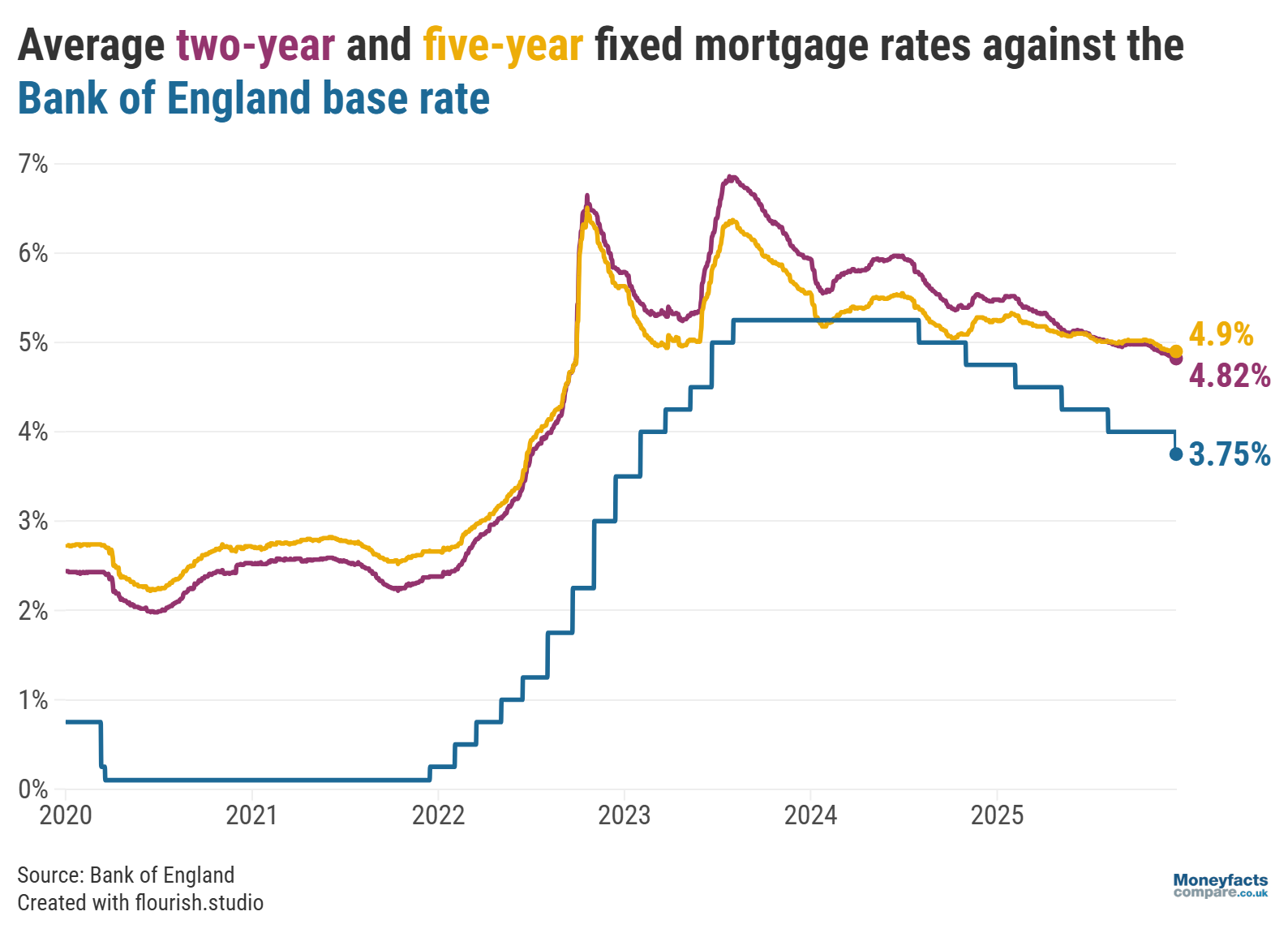

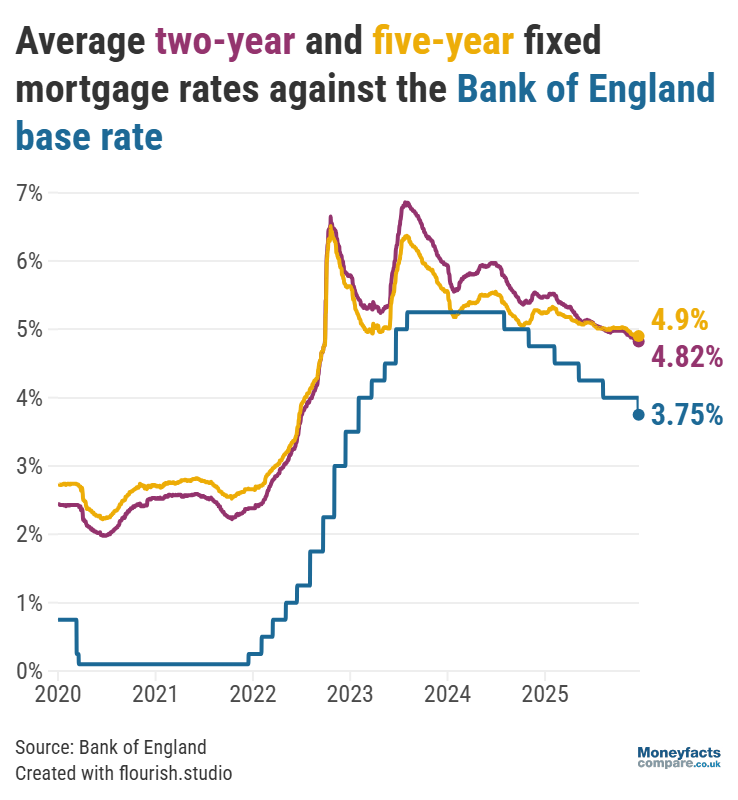

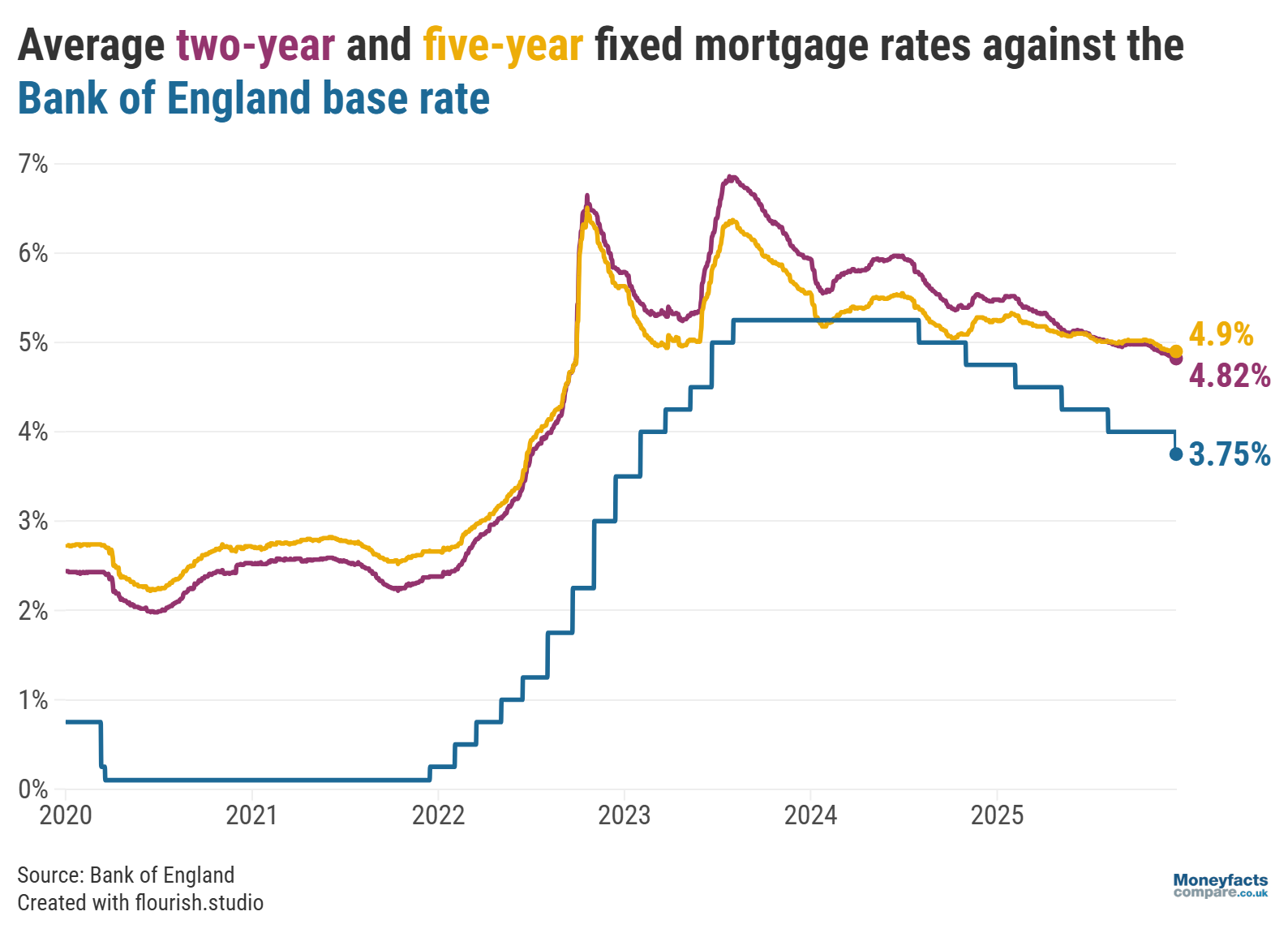

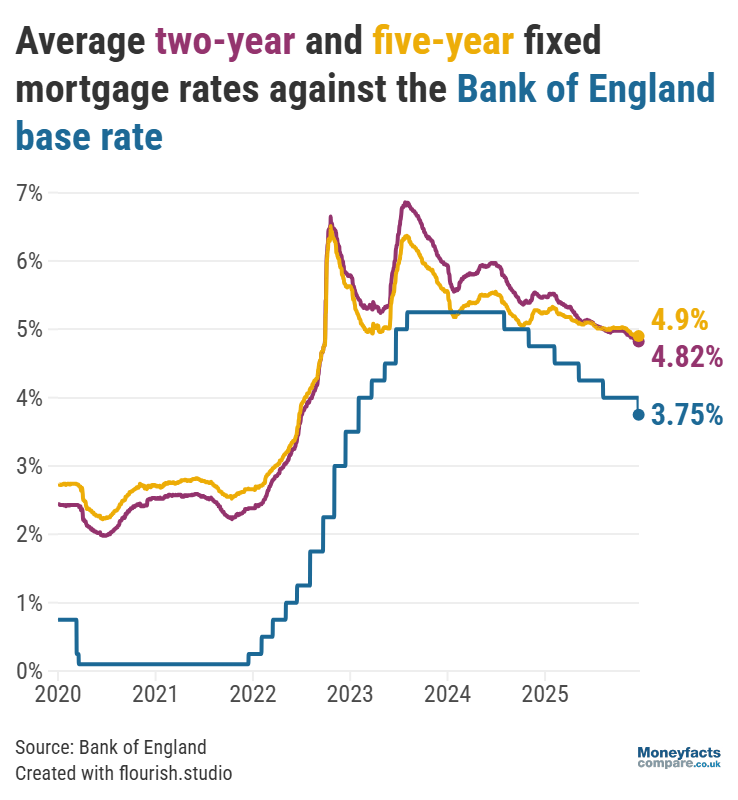

Anticipation of interest rate cuts this year mean fixed mortgages are now cheaper than in December 2024. The average rate charged by a two-year fixed deal fell from 5.52% to 4.86% year-on-year, for instance, while the average five-year fixed rate dropped from 5.28% to 4.91% over the same period. And, with UK Finance estimating that 1.8 million fixed mortgages are due to expire in 2026, this will no doubt be welcome news to many borrowers.

UK Mortgage Trends 2025: Bank of England base rate vs average mortgage rates between 2020 and December 2025

“Those coming to the end of their fixed term may feel uncertain about what to expect heading into 2026. However, today’s base rate cut could be a positive sign of things to come,” said Oliver Dack, Spokesperson at Mortgage Advice Bureau.

“We’re expecting interest rates to continue falling next year, in which case, those who locked into a more expensive fixed deal only a couple of years ago could benefit from talking through their options with a mortgage broker – even if they’re still a way off reaching the end of the term,” he added.

“In some instances, it might be more cost-effective to shoulder any Early Repayment Charges (ERCs) and move onto a lower rate. Alternatively, those who can comfortably meet their monthly repayments may find they’re able to borrow more money or repay their mortgage early with a cheaper deal,” Dack explained.

Meanwhile, Springall warned those who took out a cheap fixed deal five years ago that they must accept they’ll have to cover higher repayments – adding that the Bank of England expects 3.9 million households will refinance onto more expensive rates over the course of the next three years.

Borrowers looking for a new mortgage deal in 2026 would be wise to monitor the lowest rates. However, it’s important to remember that the cheapest-priced deal won’t necessarily be the most cost-effective for your circumstances. That’s why our weekly mortgage roundup provides some Moneyfacts Best Buy alternatives that feature based on their overall true cost.

Alternatively, speak to a mortgage broker for advice tailored to your situation.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

*Average standard variable rate (SVR) is currently 7.27%. Calculations based on a £250,000 mortgage over a 25-year term on a repayment basis. SVR repayment £1,810 per month, versus £1,441 per month on 4.86% two-year fixed rate.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.