But will there be cuts later in the year?

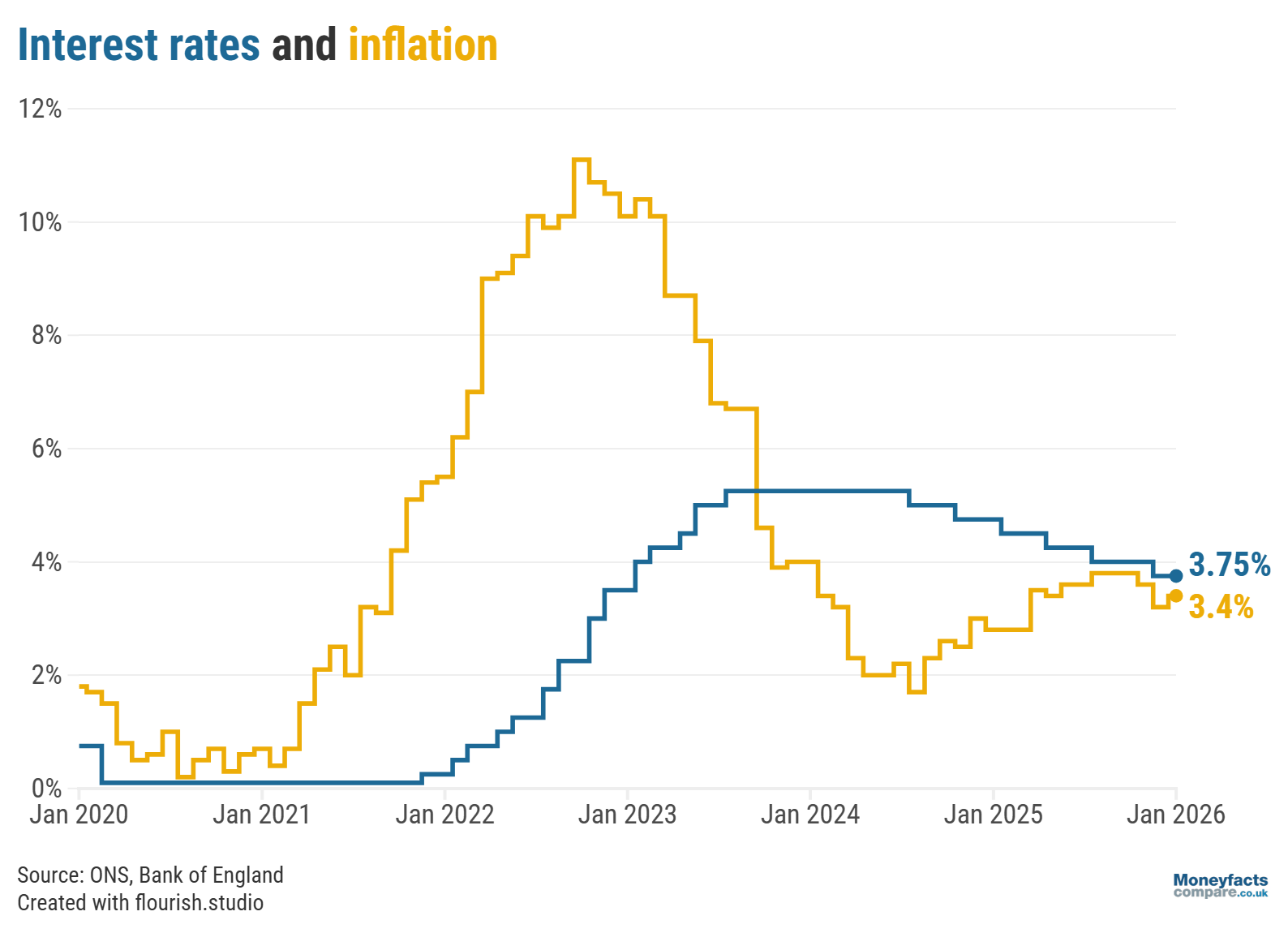

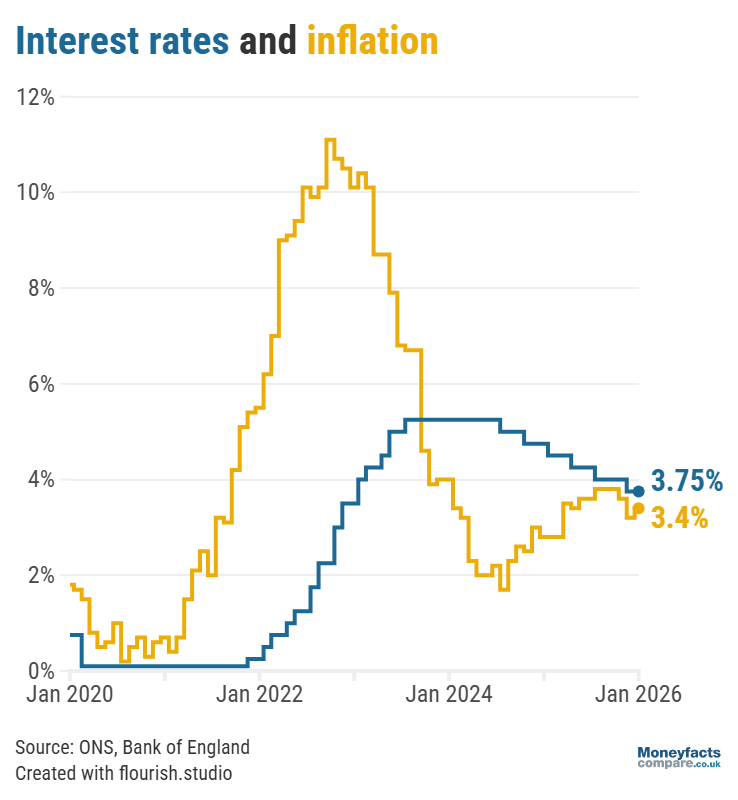

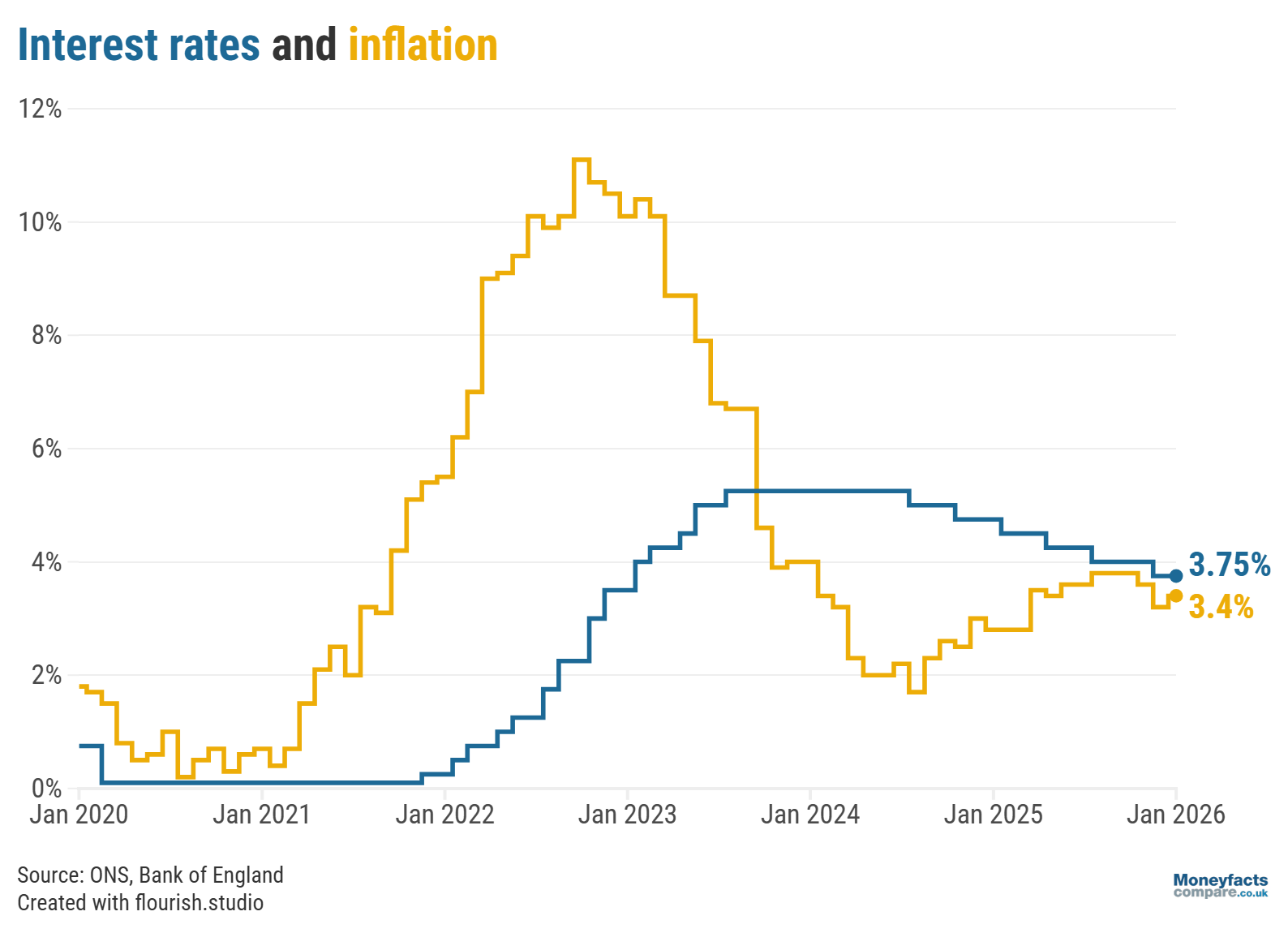

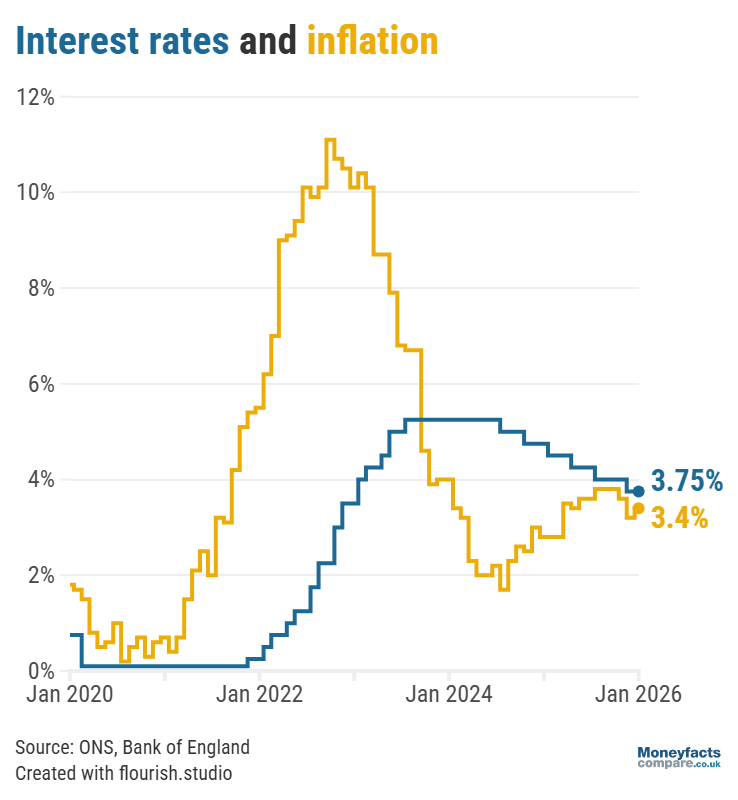

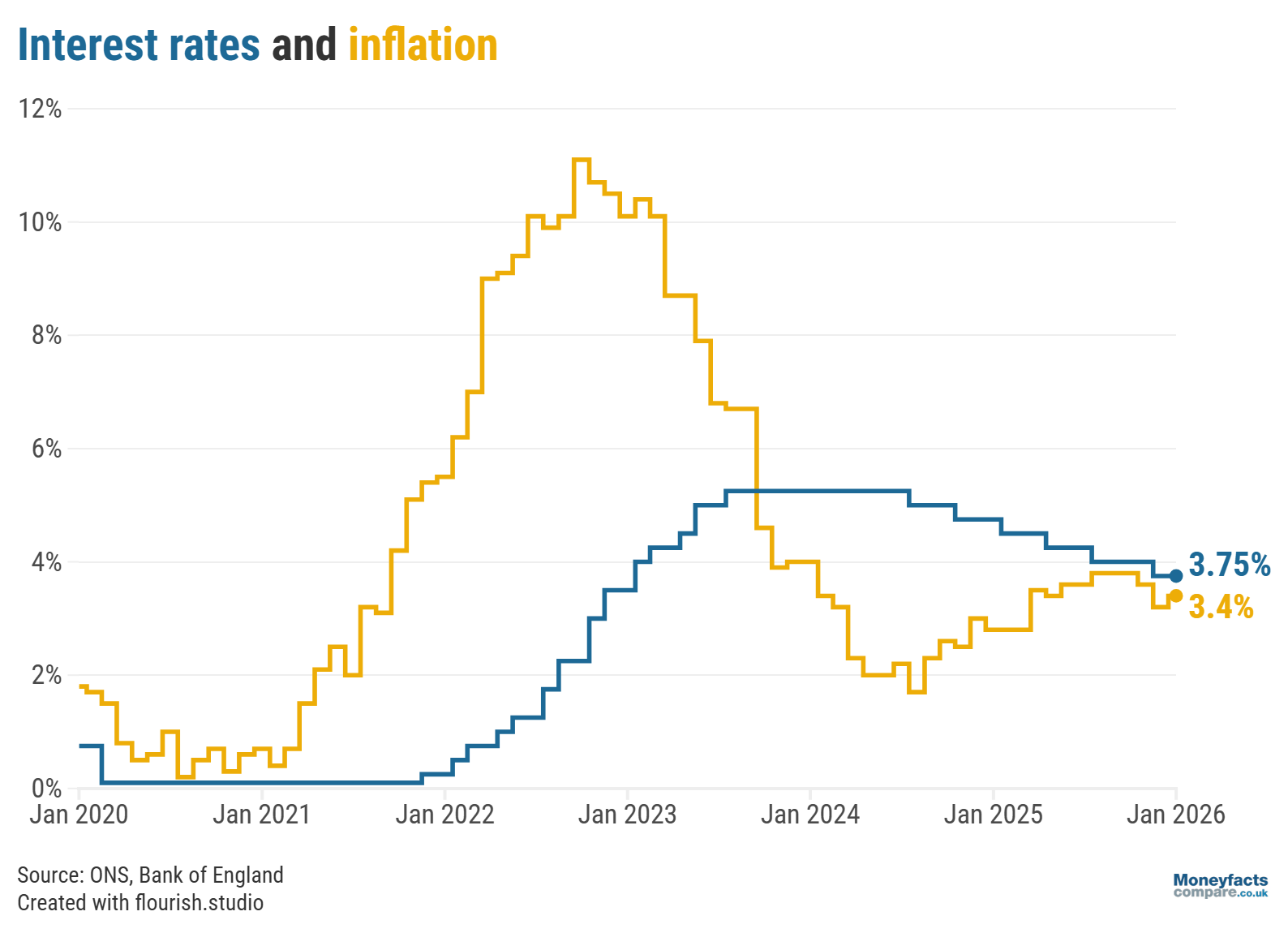

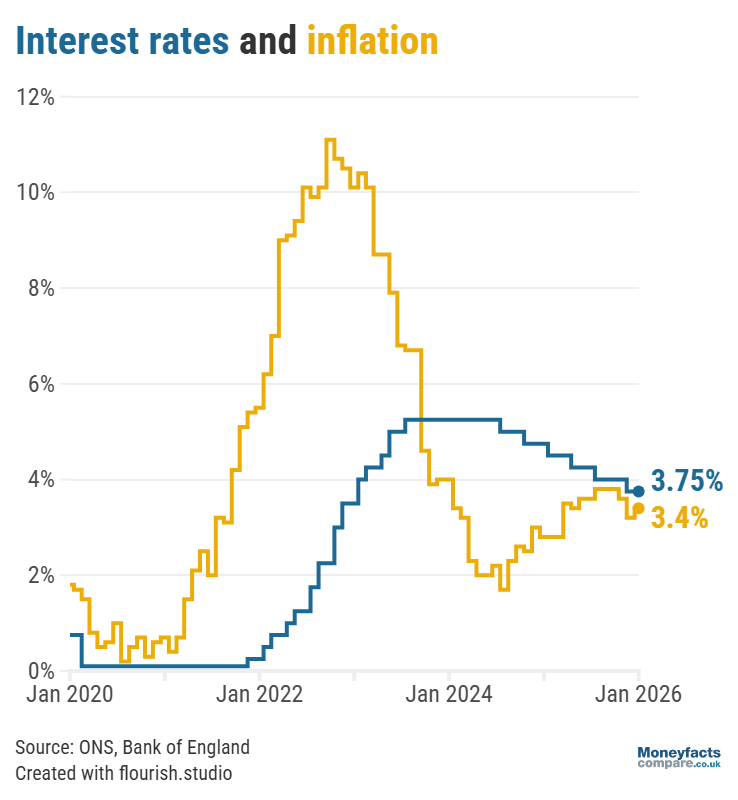

At its first meeting of 2026, the Bank of England’s Monetary Policy Committee (MPC) decided by a majority of 5 to 4 to hold the base rate at 3.75%. Most experts had predicted this, particularly as the labour market remains weak and the latest inflation figures for December 2025 came in at 3.4%, slightly higher than the previous month.

The base rate is an important tool to control inflation so, while the cost of goods and services continues to increase by more than the Bank’s target of 2%, it’s to be expected that the MPC will show caution and restraint when it comes to making any cuts. But, if inflation eases over the coming months (as forecast), the MPC may be persuaded to lower the base rate if it believes the economy needs a boost to encourage growth.

Several economists predict that we could see a base rate cut in March or April, with the split in the latest MPC vote perhaps indicating how soon it may decide to lower it.

UK inflation vs the Bank of England base rate: Inflation rose to 3.4% in December 2025 while the base rate remains at 3.75% after February's announcement.

The base rate, also known as the UK’s central interest rate, is how much the Bank of England charges banks, building societies and other providers to borrow money. As a result, this influences the interest rate that lenders charge consumers on mortgages, loans and credit cards, for example, as well as the interest that savings providers pay on customers’ money.

Read more on the base rate and what it means for your money.

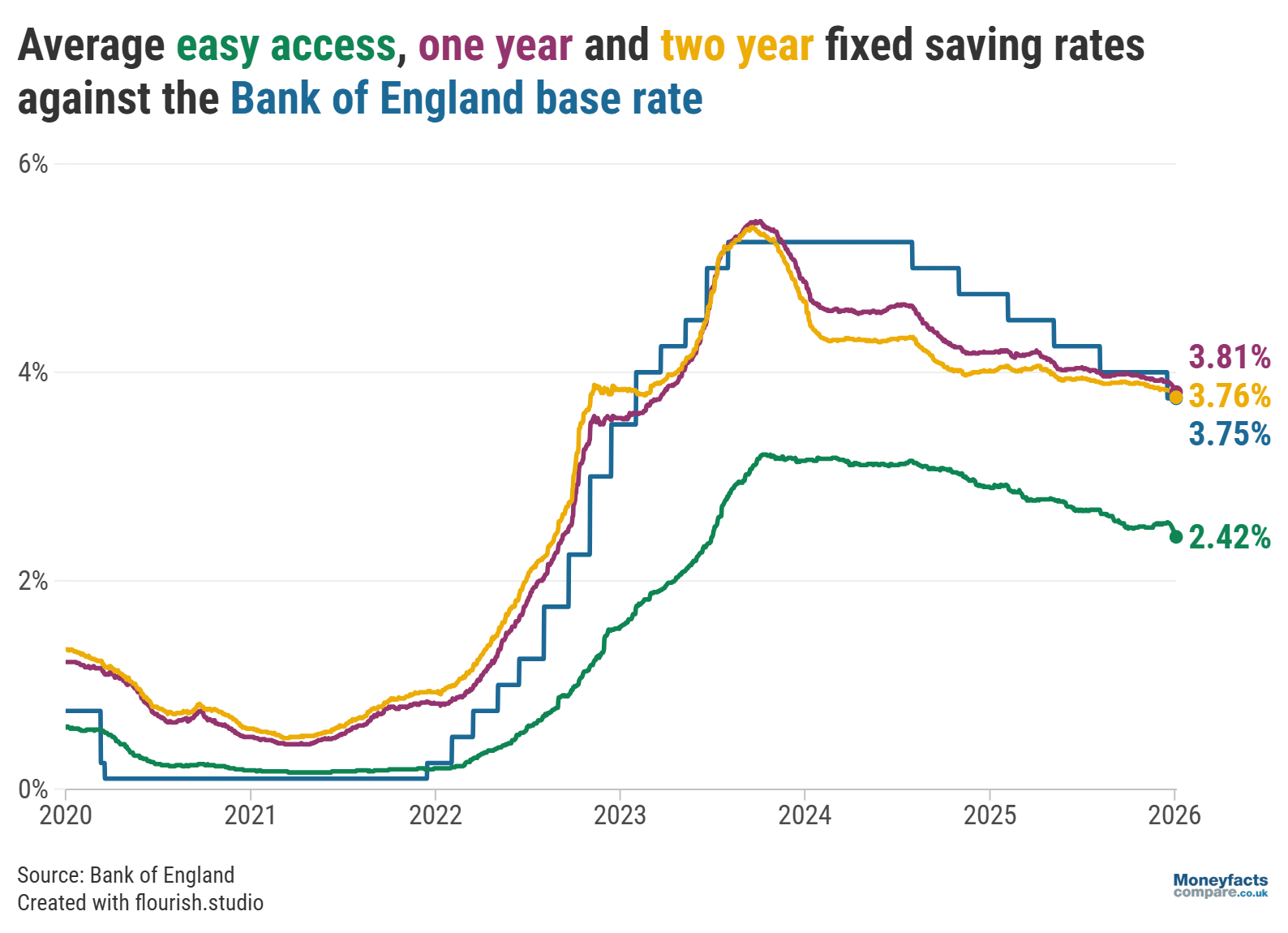

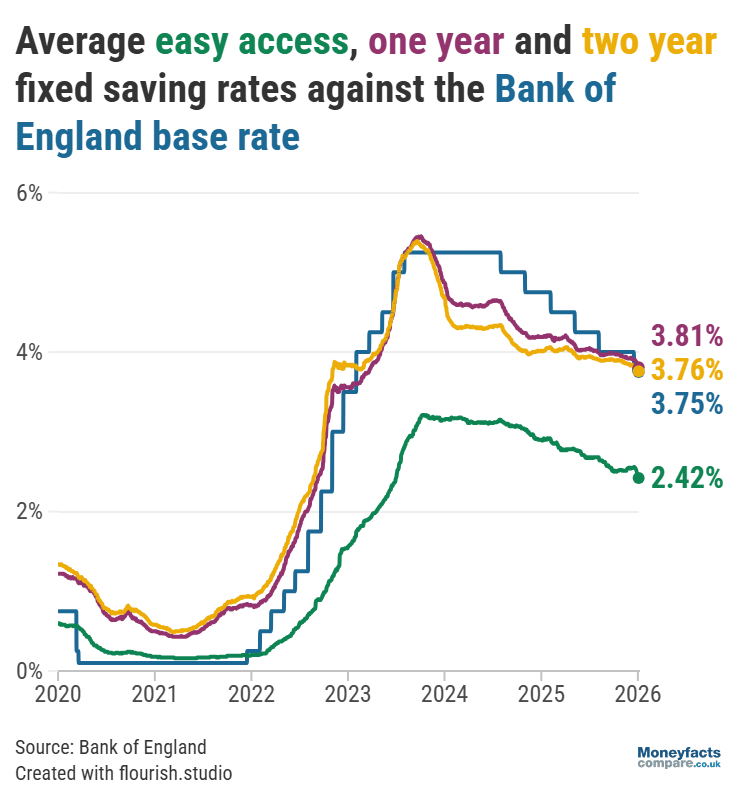

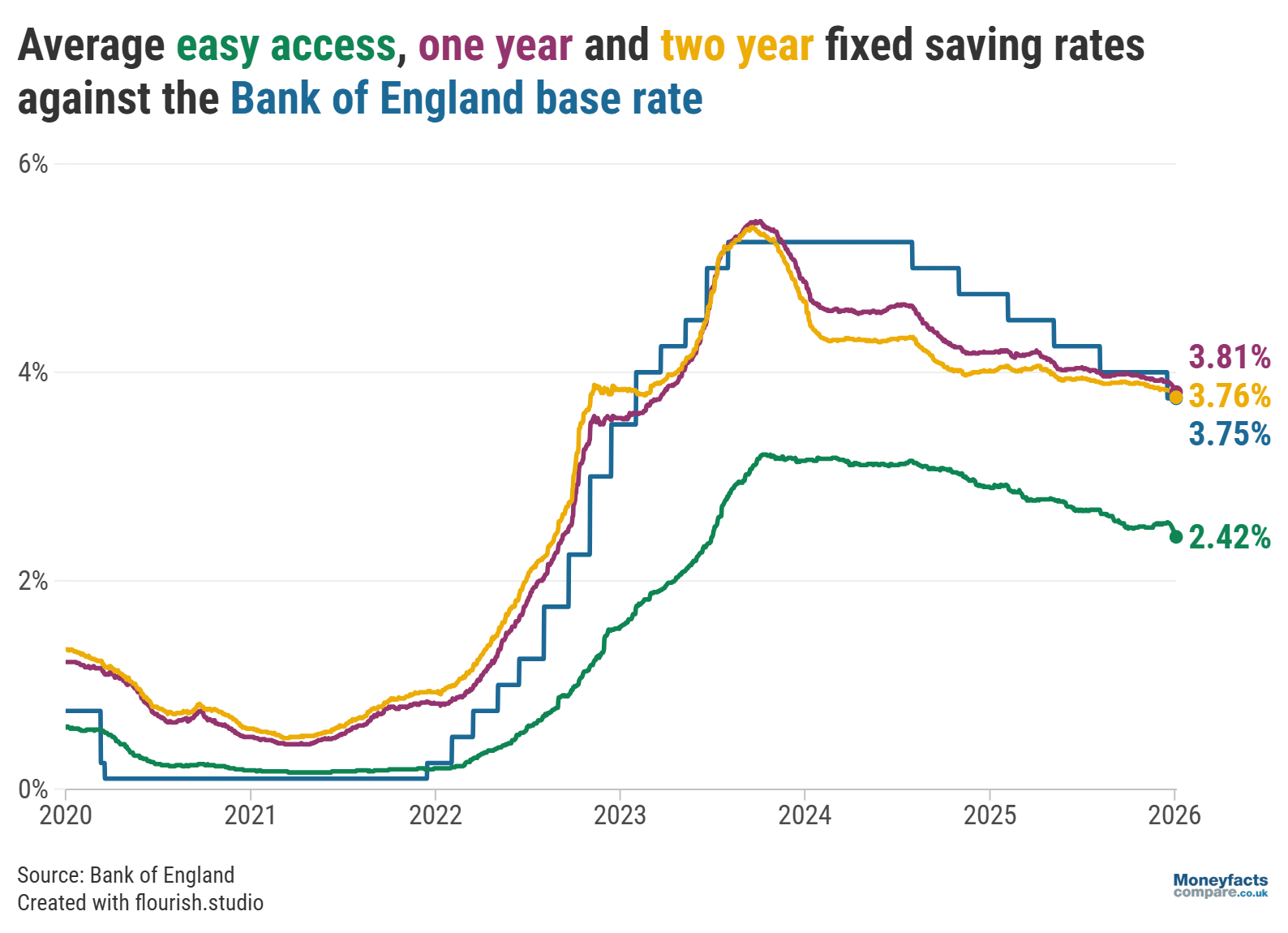

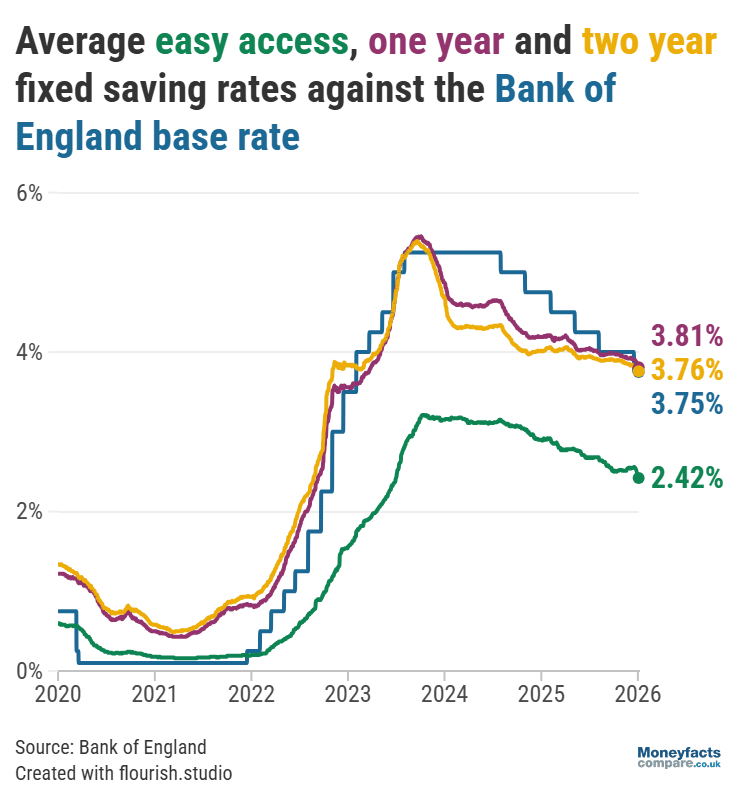

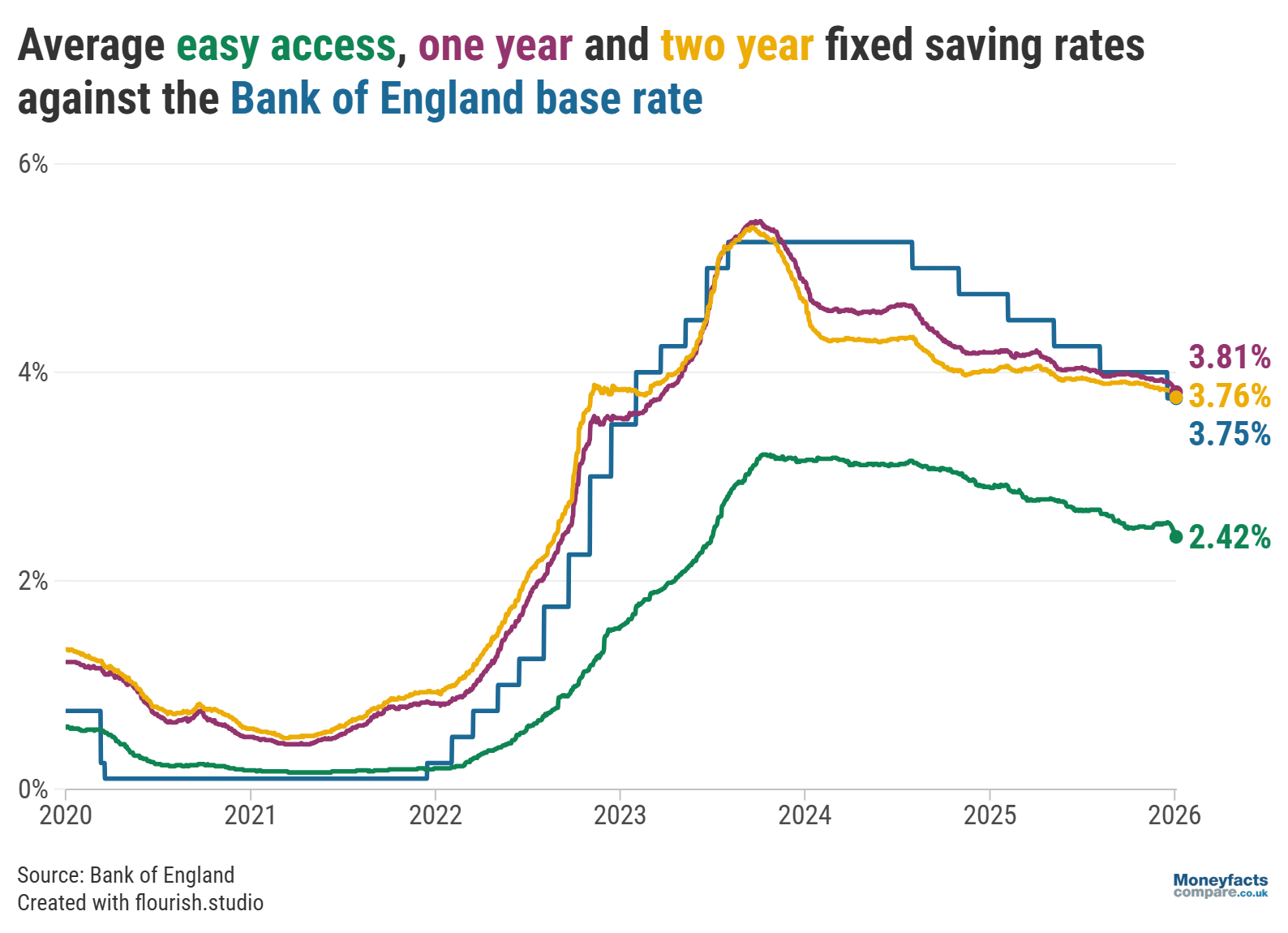

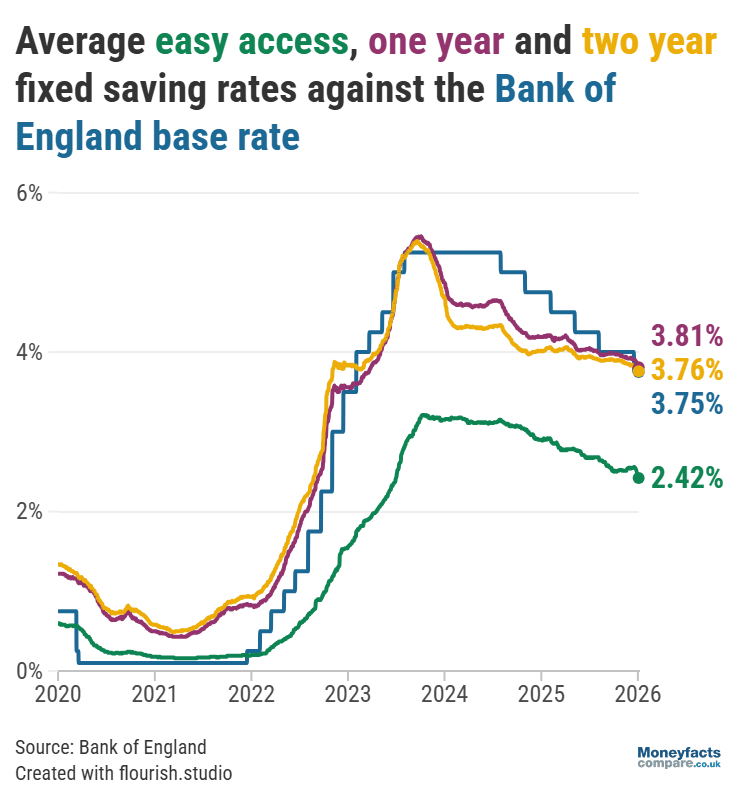

Savers may be relieved that we didn’t see another cut to the base rate after the 0.25 percentage point reduction in December 2025. However, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, argues that this lack of change is “irrelevant” as “there has already been irreversible damage done to the savings market over the last 12 months” after four cuts to the base rate in 2025.

For example, the average easy access savings rate fell by 0.50 percentage points between the start of February 2025 and February 2026 to reach 2.42%, while the average easy access ISA rate dropped from 3.06% to 2.60% over the same period. These are now at their lowest levels since July 2023. Fixed savings rates haven’t been immune from these cuts, as the average one-year bond plummeted to a three-year low of 3.81% at the start of February 2026.

“The slaughter of savings rates will sadden hard-pressed savers,” Springall noted, highlighting that more than two thirds (70%) of savings providers have cut rates since the start of this year alone.

UK Savings Trends 2026: The Bank of England base rate vs average savings rates between 2020 and February 2026.

The combination of falling rates and the above-target level of inflation means that many savers may be struggling to get a real return on their money. But Springall warns against the “dangerous attitude of apathy” that this may instil in savers, as there are still opportunities to maximise the return on your money by regularly reviewing and switching your accounts.

If you want to make sure your savings are working hard enough and providing you with a competitive return, discover the latest rates available on our savings charts. Whether you want an easy access account that you can dip into in an emergency or a fixed bond to ensure you receive a guaranteed rate, our charts show today’s top accounts.

Alternatively, if you want to make the most of your tax-free ISA allowance, visit our ISA charts.

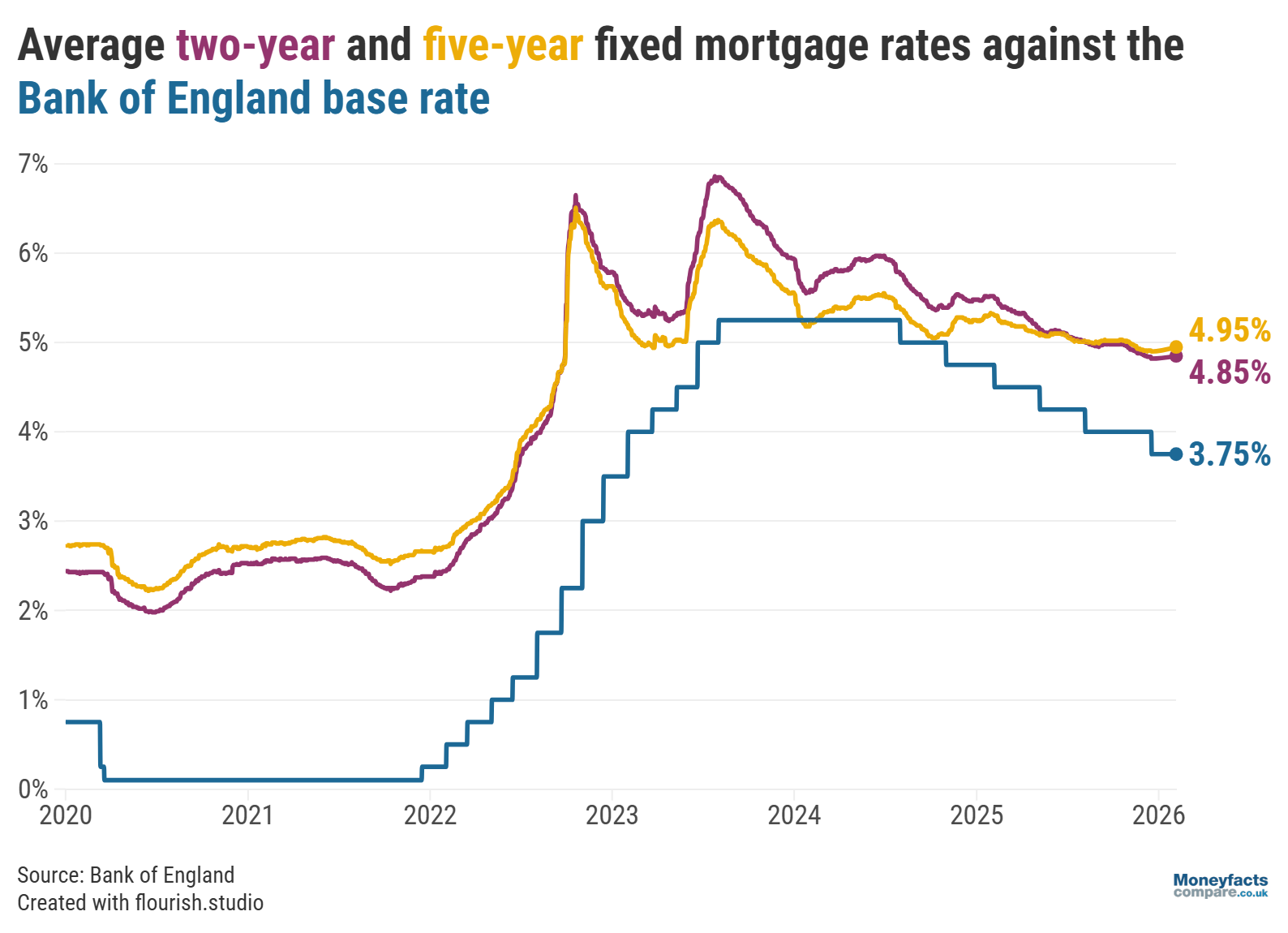

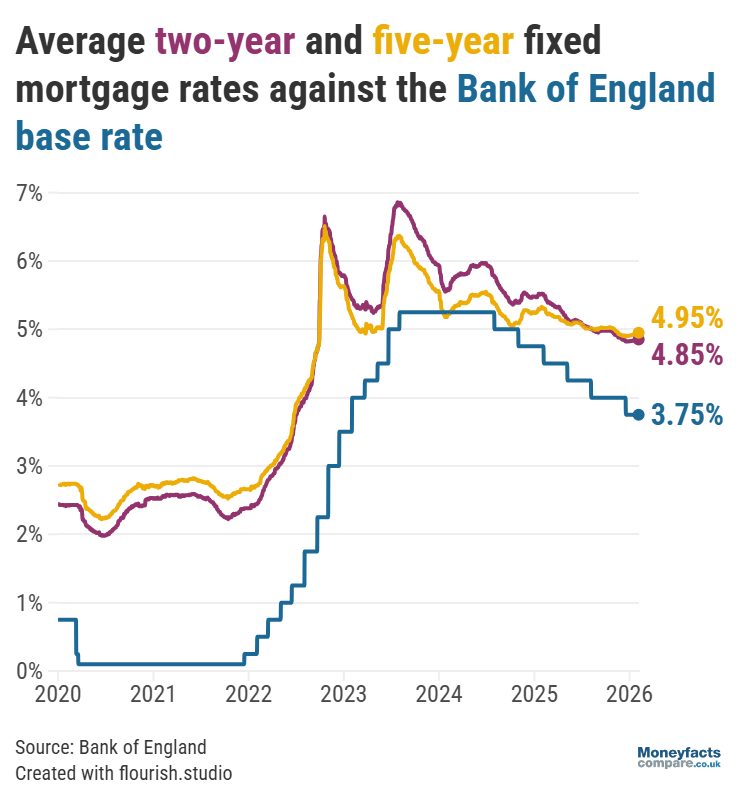

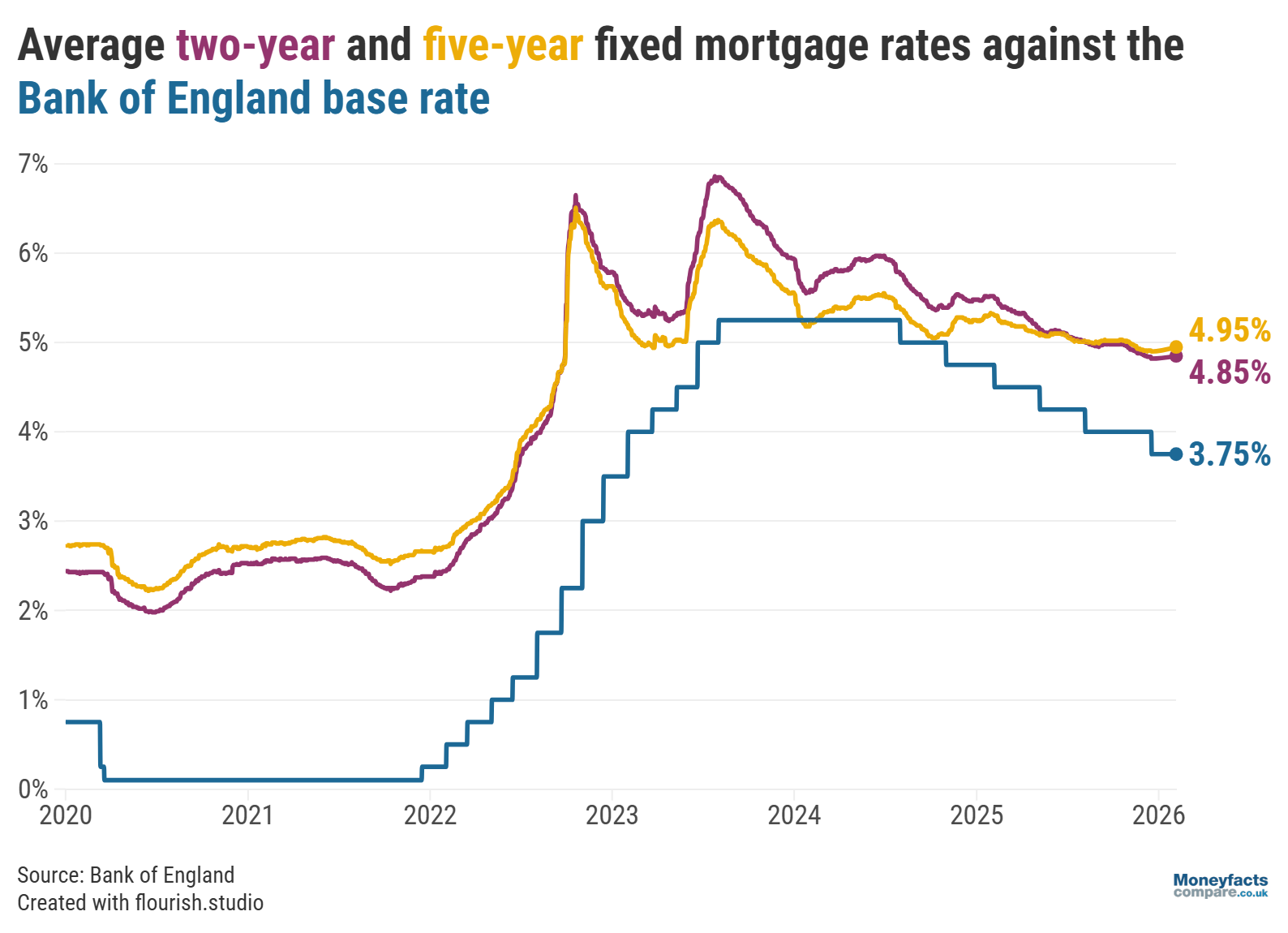

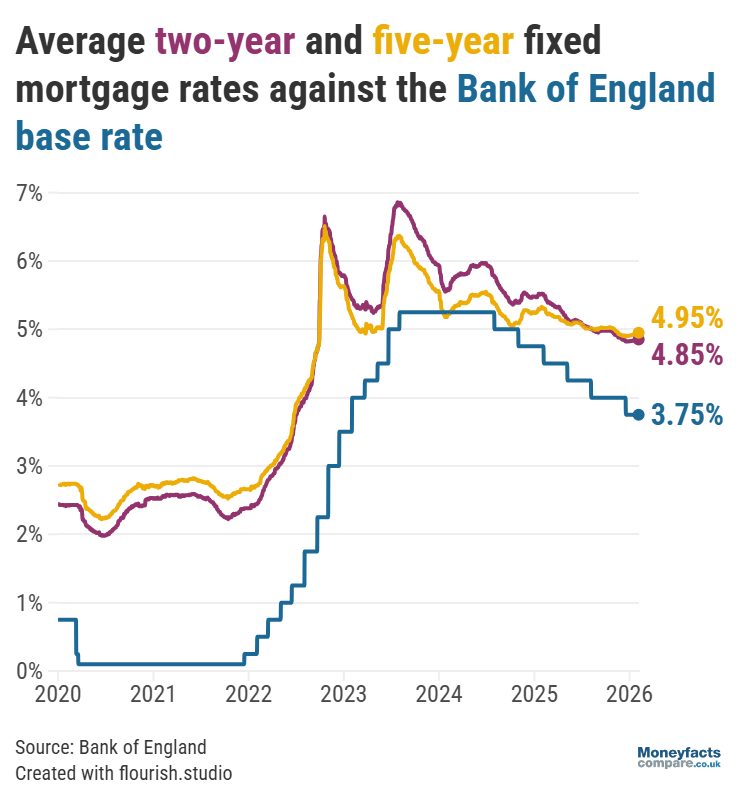

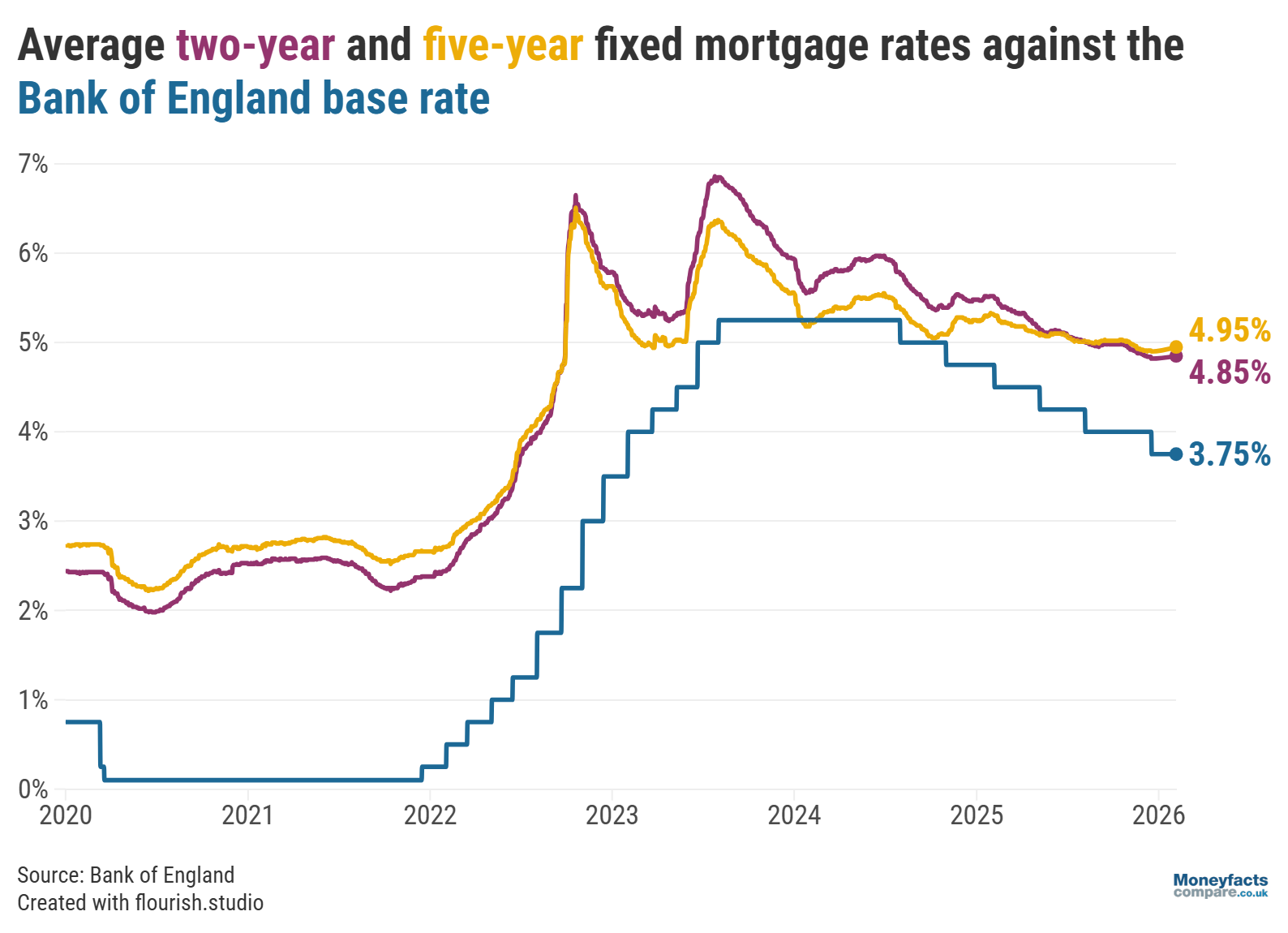

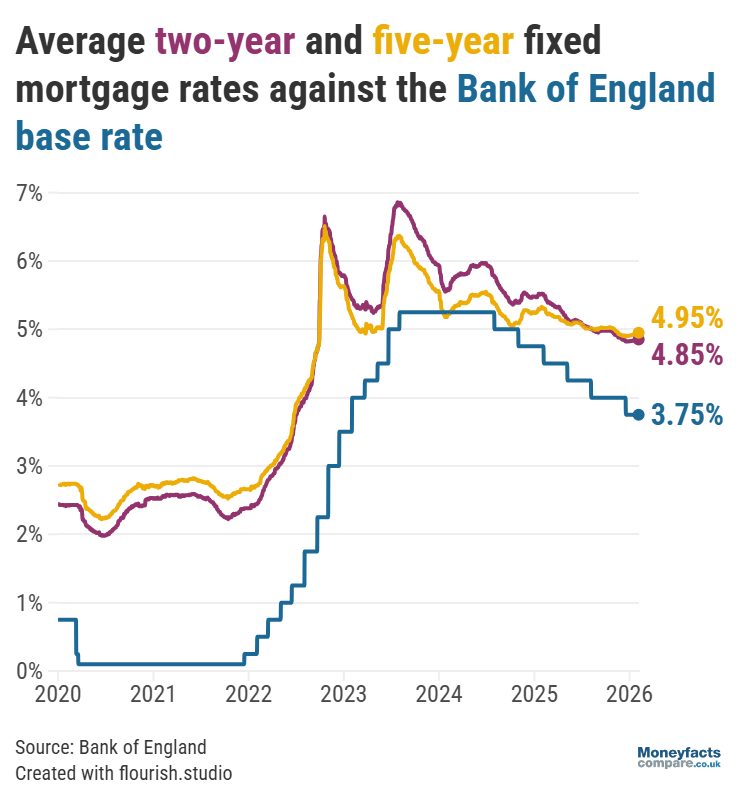

While the series of base rate cuts last year punished savers, those taking out a mortgage have benefited from cheaper deals, with the average two- and five-year fixed rates finally falling below 5% in 2025 (reaching 4.85% and 4.94% respectively at the start of this month). However, in addition to the base rate, other factors, such as swap rates and the broader economic situation, can influence the price of mortgages.

“Wider market uncertainty is starting to impact mortgage rate setting,” Springall commented, adding that “swap rates have been on the rise over recent weeks”. As a result, many lenders may put any cuts to their mortgage products on hold, while some major providers have even raised rates over the past week.

However, there are still competitive deals to be found, and Oliver Dack, Spokesperson at Mortgage Advice Bureau, cautions that “although the Bank of England didn’t have any surprises in store today, borrowers shouldn’t be complacent”.

“There will likely be many who let the late December base rate cut fly under the radar, amid the busy festive season and inclement weather,” he continued, pointing out that many borrowers, particularly those sitting on their lender’s Standard Variable Rate (SVR), “could stand to benefit from securing a new deal”.

“While there are expectations for the cost of borrowing to come down in 2026, there are never any guarantees, and it could prove more cost effective to lock into a fixed deal sooner rather than later,” Dack explained.

Indeed, Springall estimates that homeowners could save around £350 per month by securing a two-year fixed deal at the average rate of 4.85% instead of paying the average SVR of 7.15%. Calculations based on a £250,000 mortgage over a 25-year term on a repayment basis.

UK Mortgage Trends 2026: The Bank of England base rate vs average mortgage rates between 2020 and February 2026.

To stay up to date with all the latest rates, whether you’re remortgaging, moving home or buying your first property, visit our mortgage charts.

However, bear in mind that the deals offering the cheapest rates may not always be the most suitable for you or provide you with the best value. This is why our weekly mortgage roundup highlights some deals that feature as Moneyfacts Best Buys based on their overall cost, as well as the week’s cheapest rates.

Instead of locking into a fixed deal, some borrowers may be considering a tracker mortgage as forecasts still suggest we could see the base rate cut at least once this year. The interest rate on most tracker mortgages follows the Bank of England base rate so, if the MPC makes a 0.25 percentage point cut, for example, the lender should lower the interest rate on the tracker mortgage by the same amount, reducing your monthly payments.

But, while these deals could be appealing, they may not necessarily be the best option for all borrowers. It’s worth comparing fixed and variable deals from across the market, as well as speaking to a broker, to help you find the right mortgage for your individual requirements.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfactscompare.co.uk visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.