Despite ongoing affordability issues, conditions in the mortgage market show signs of improvement.

While first-time buyers are still likely to face obstacles on their path to homeownership, there’s plenty of reason to be optimistic about the year ahead, according to analysis of the latest Moneyfacts UK Mortgage Trends Treasury Report.

The positive outlook follows a rise in product choice, greater support shown by lenders and expectations for borrowing costs to come down throughout 2026.

“This year is setting itself up to be a fruitful one for first-time buyers, and really, they need all the help they can get amid the lack of affordable housing,” commented Rachel Springall, Finance Expert at Moneyfactscompare.co.uk. Only last week, the most recent House Price Index (HPI) from Halifax found the average cost of a UK home had risen above £300,000 in January 2026 for the first time on record.

But, despite this, recent interest rate volatility and an anticipated seasonal ‘slowdown in activity’, Springall said that “the latest boost to product choice and sentiment towards relaxing stress tests will be encouraging news to borrowers”.

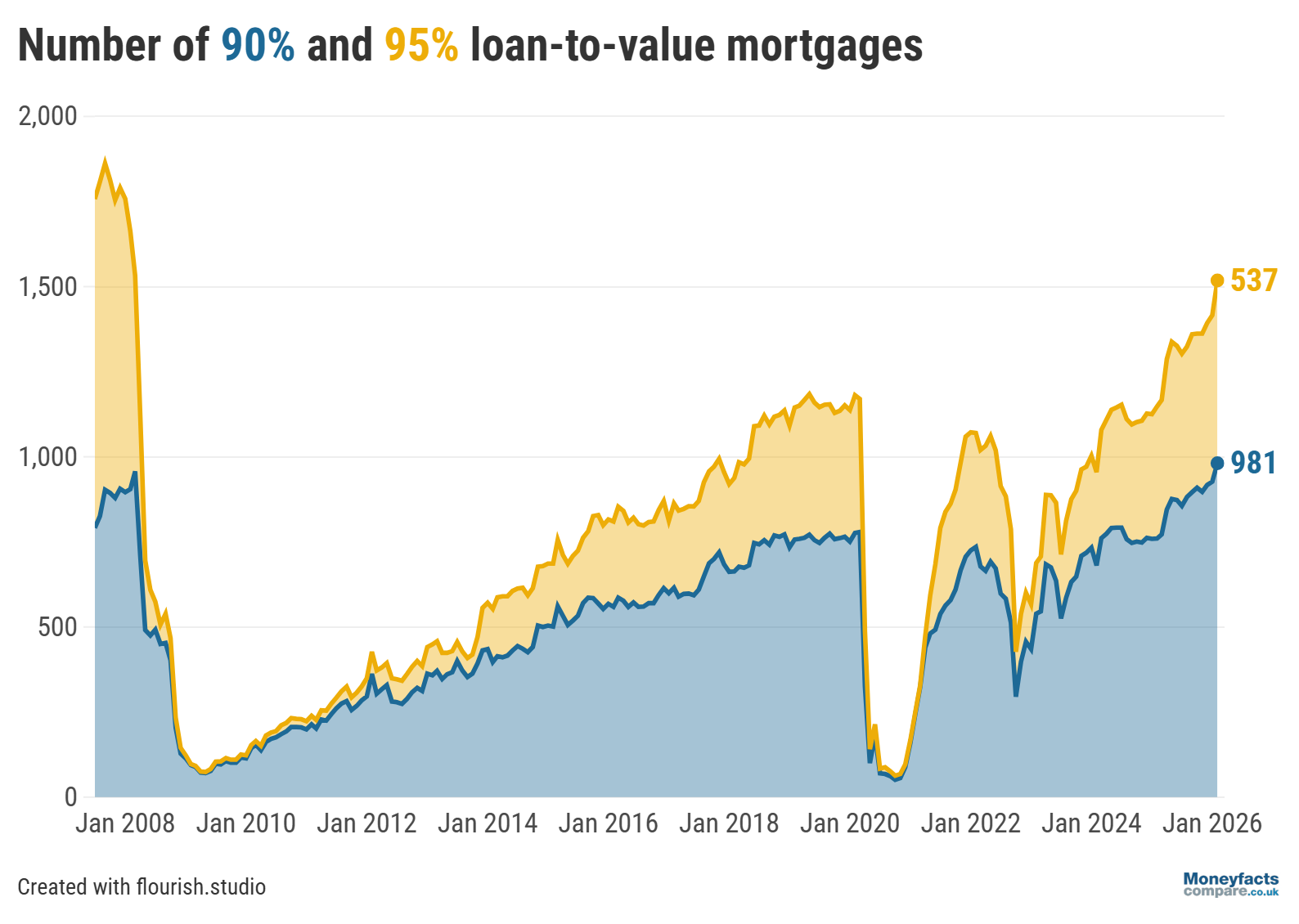

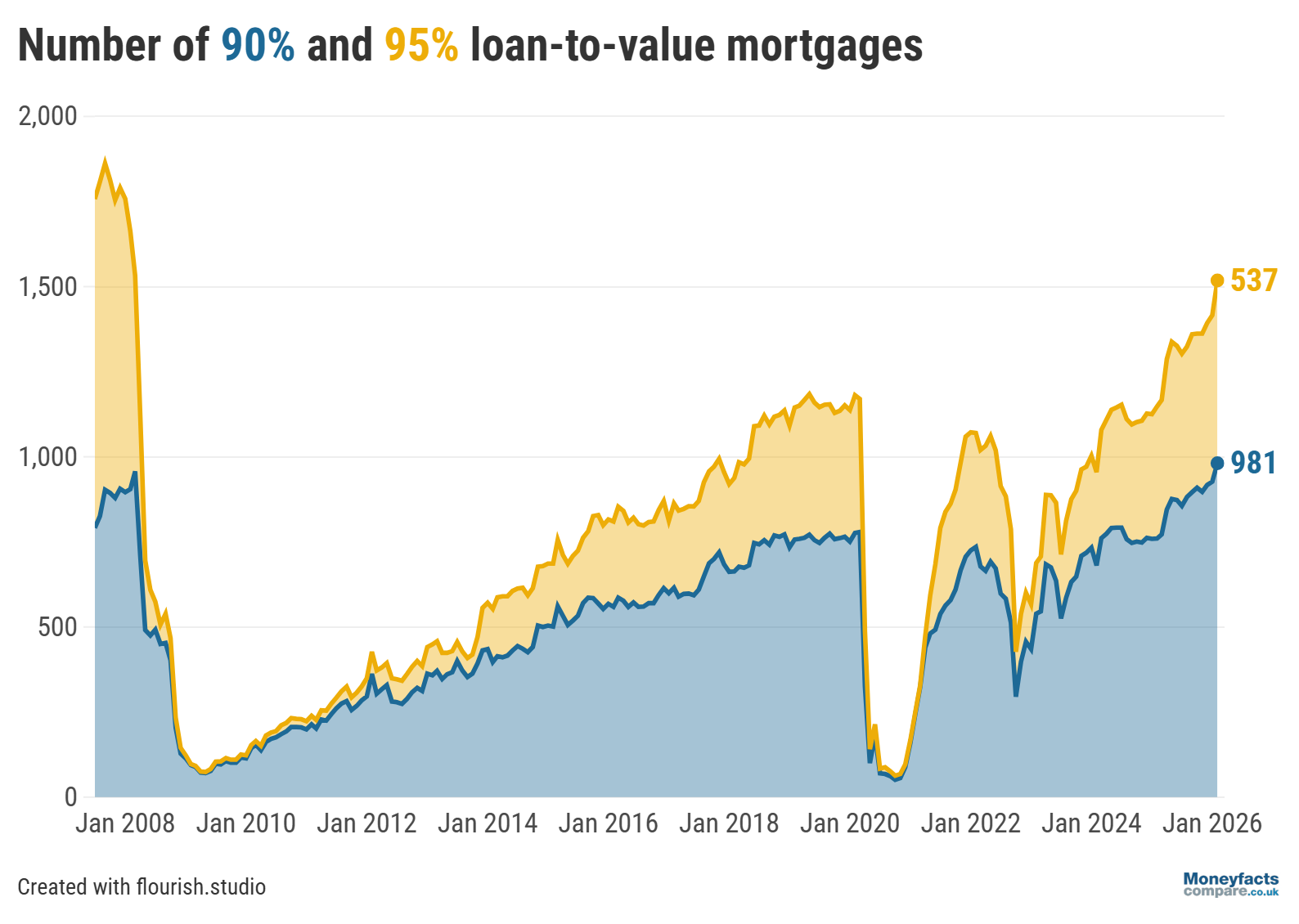

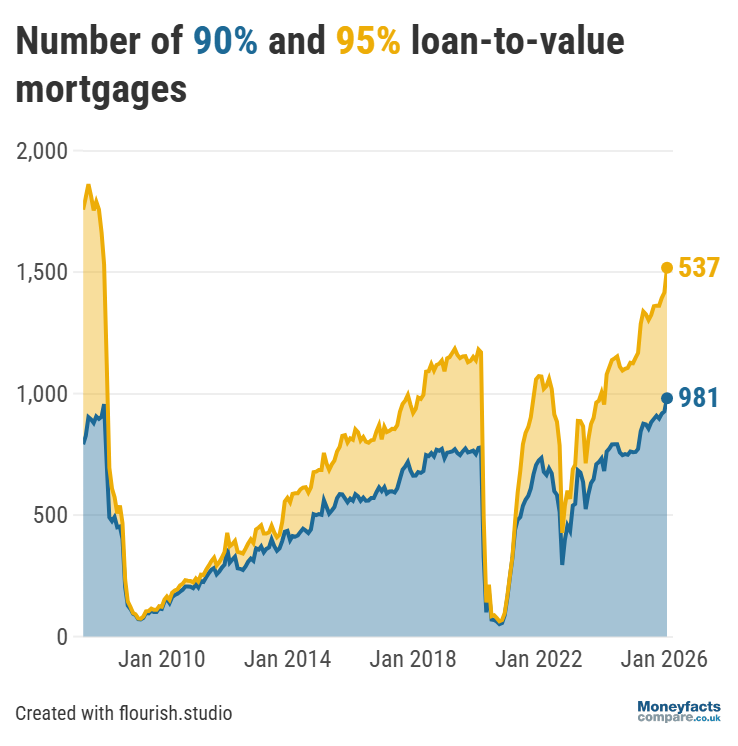

The total number of mortgages on the market rose above 7,500 by the start of this month – meaning borrowers have over 1,000 more deals to consider than a year ago. This figure includes a record number of products available to first-time buyers with a 10% deposit (or those with less equity).

“Mortgages at the 90% loan-to-value (LTV) tier now represent a 13% proportion of the residential mortgage market, with 95% LTV deals representing a small fraction of just 7%,” said Springall. “The rise in choice included the entry of specialist lender West One onto our systems in January, but also from Penrith Building Society launching higher LTV options,” she explained.

Latest Mortgage Trends: Graph showing the number of products available at 90% and 95% loan-to-value between 2008 and 2026.

Although there’s still room for improvement, Oliver Dack, Spokesperson at Mortgage Advice Bureau, said those looking to get on the property ladder may have “more options than they think” - adding that it might be worth first-time buyers speaking to a mortgage broker for help exploring different possibilities.

First-time buyers might also be surprised to learn how much they could borrow, as some lenders have relaxed their affordability assessments after being urged by the Government to do more to support homeownership.

Only last week, Santander launched its ‘My First Mortgage’ which can finance up to 98% of an existing house in Great Britain at a fixed rate for five years. First-time buyers will need a deposit of at least £10,000 and could borrow as much as £500,000. However, it’s limited to 4.45 times annual income.

Alternatively, the Helping Hand range from Nationwide BS was expanded in September 2024 to allow eligible first-time buyers to borrow up to six times their income. Last month, the building society confirmed it will also be extending six times lending to new and existing remortgage customers and homemovers.

Of course, when borrowing large multiples or taking out a mortgage with less equity, it’s important to remember there’s a risk of falling into negative equity if property prices drop. You should also consider whether you could still afford repayments if interest rates rise at the end of a fixed term. For tailored advice, it’s worth speaking to a mortgage broker.

While sticky inflation and recent global instability might have prompted some lenders to err on the side of caution and increase rates over recent weeks, first-time buyers will be relieved that borrowing costs are still widely expected to come down in 2026.

The Bank of England predicts that inflation will fall to its 2% target by later this spring – which it says should leave “scope for some further cuts to the Bank Rate this year”. Lenders often consider forecasts for the Bank of England base rate when setting their fixed pricing (alongside a range of other factors), which means mortgage rates could follow suit.

However, rates have already come a long way since the recent highs seen in the aftermath of the September 2022 mini-Budget. “When comparing the options of renting vs monthly repayments for a mortgage, clients are often surprised by how in reach homeownership is,” concluded Dack.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfactscompare.co.uk visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Our mortgage charts are regularly updated throughout the day so you can compare the latest rates currently available.

You can also read our weekly mortgage roundup for more information on the cheapest-priced deals, as well as some Moneyfacts Best Buy alternatives.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.