The ‘wait-and-see’ approach “could come at a big cost”, they are warned.

Savers are quickly running out of time to make the most of any remaining ISA allowance, as the start of the next tax-year is now less than three months away. And, with 2026/27 the last year those under 65 can put away up to £20,000 in cash ISAs, it could prove all the more important to maximise your contributions.

While optimistic savers may be tempted to stall their search until March or April (when competition in the ISA market traditionally heats up), Caitlyn Eastell, Personal Finance Analyst at Moneyfactscompare.co.uk, warned the ‘wait-and-see’ approach “could come at a big cost”.

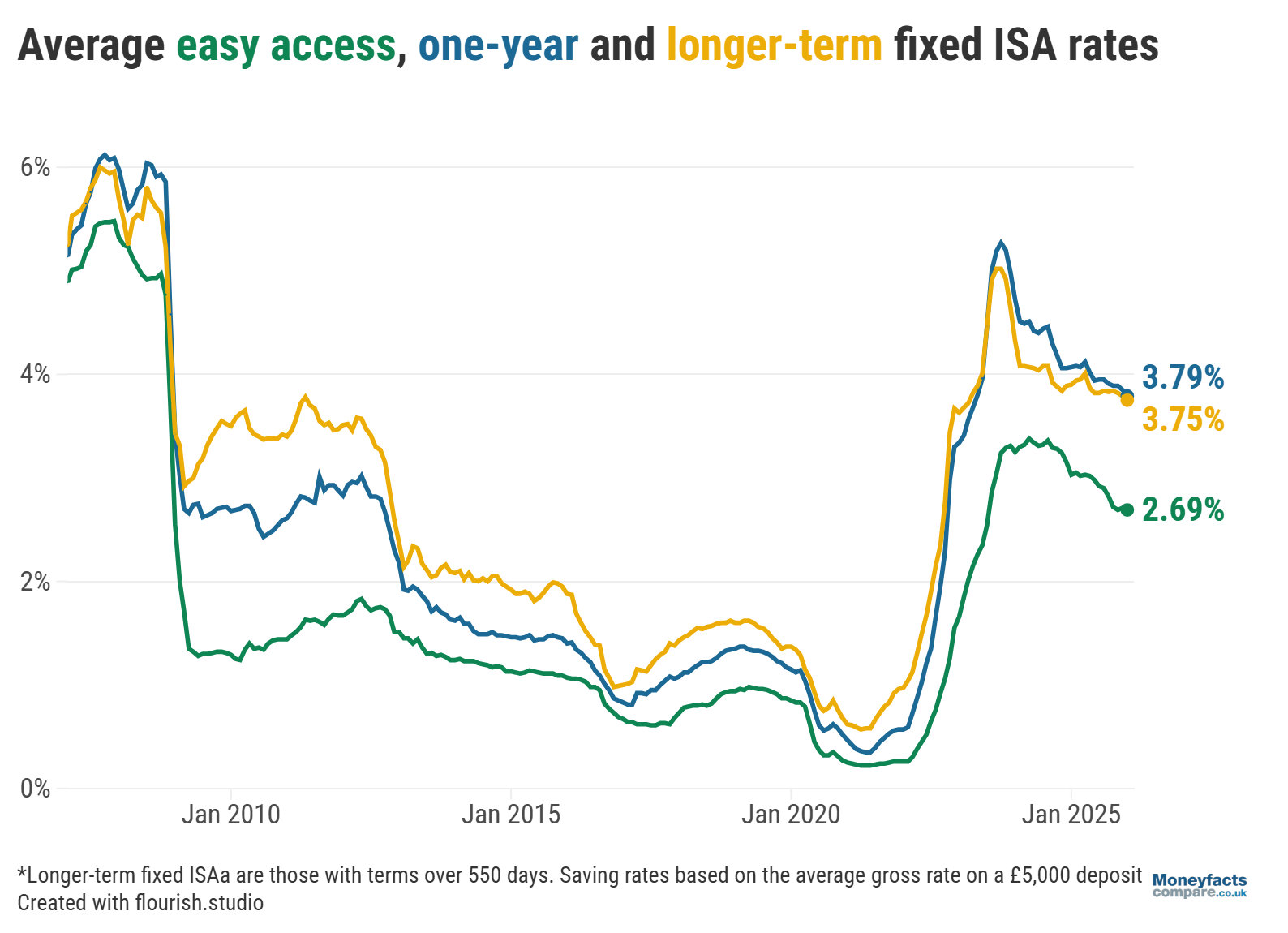

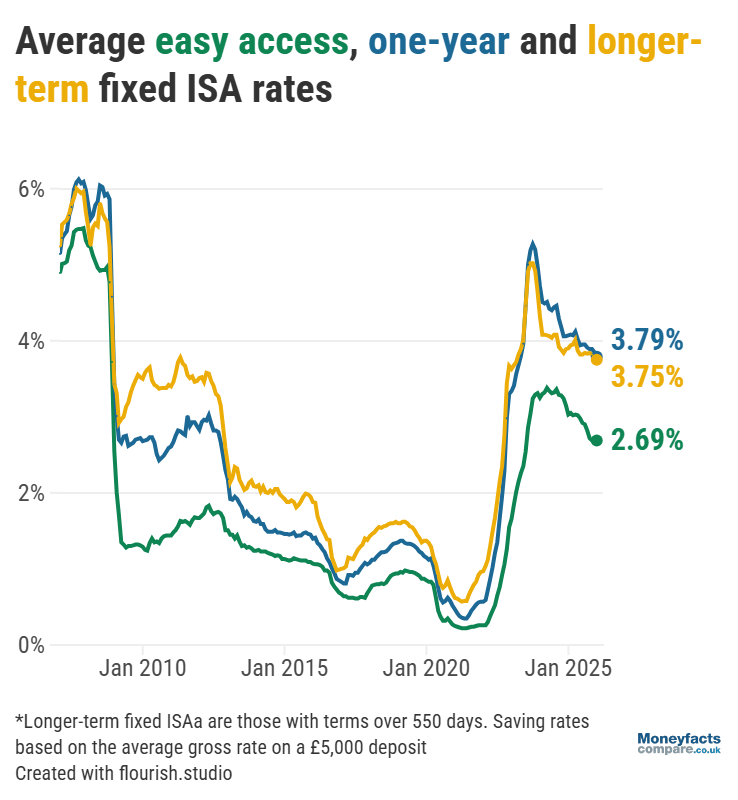

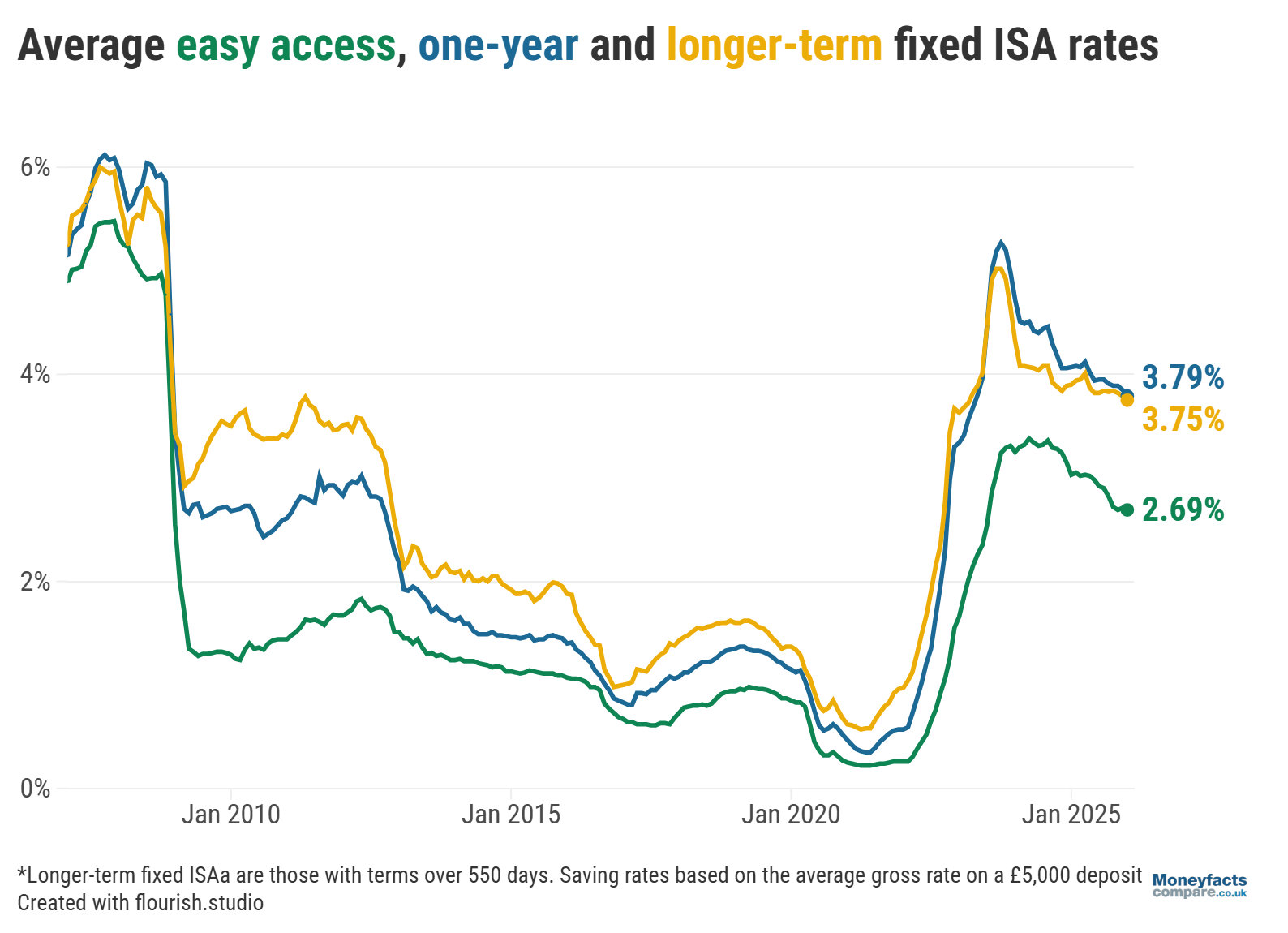

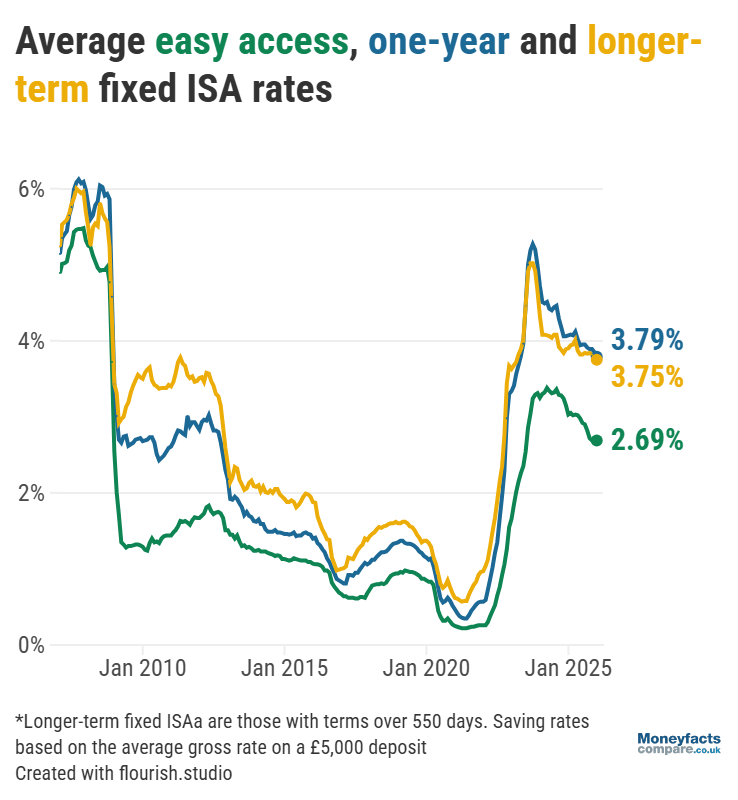

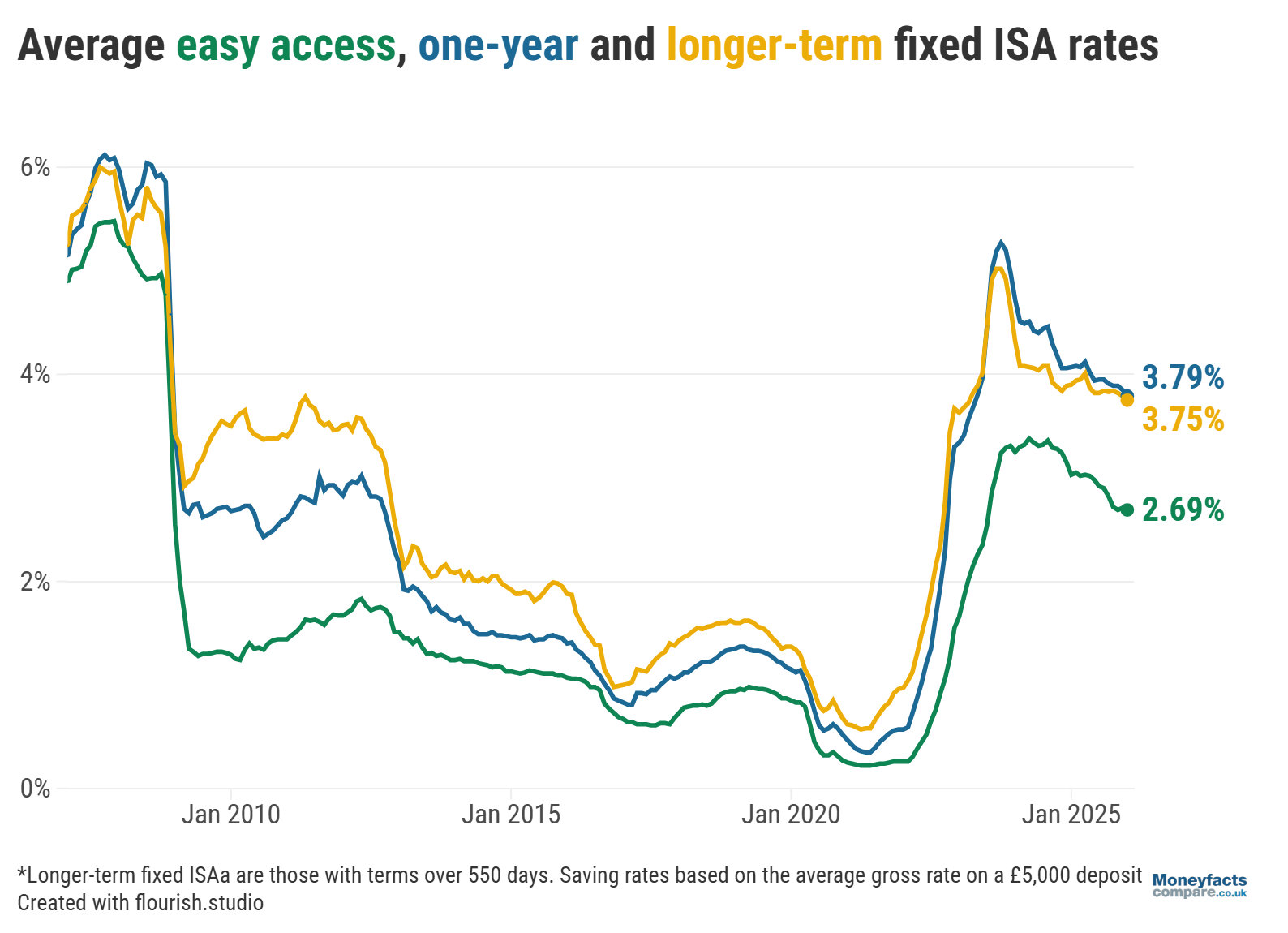

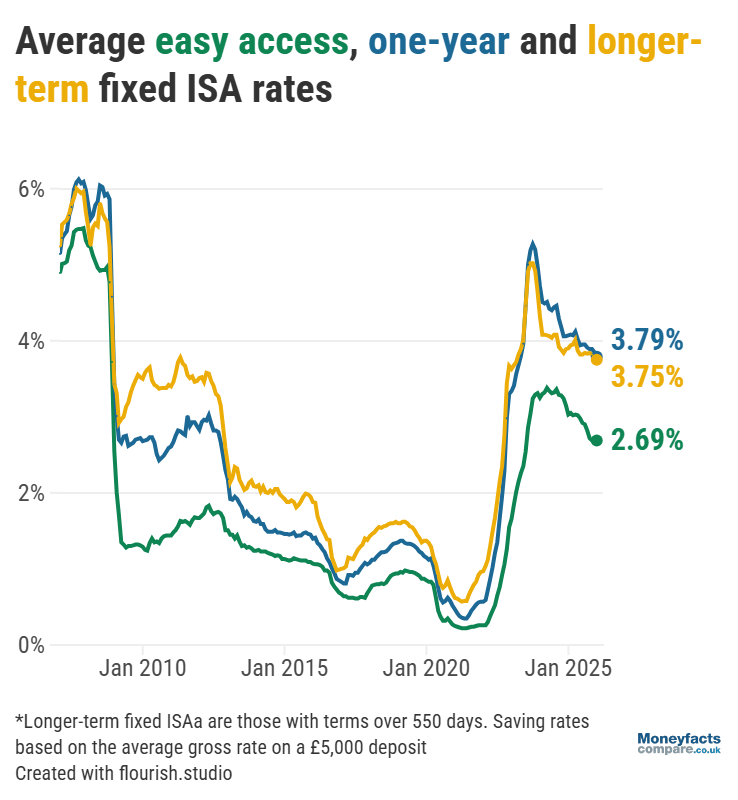

The average returns on an easy access and notice ISA have dropped by 0.02 and 0.06 percentage points, respectively, to 2.69% and 3.34% since the start of December and January, according to the latest Moneyfacts UK Savings Trends Treasury Report. Furthermore, it found the typical rate paid by a one-year and longer-term fixed ISA fell by 0.06 and 0.04 percentage points, respectively, to 3.79% and 3.75% over the same timeframe. If forecasts for interest rates to come down further this year are to be believed, it could be we see returns continue to tumble.

UK ISA trends: Graph showing average ISA rates between 2008 and 2026.

To make matters worse, there will be a portion of savers who are already earning a below-average rate as their loyalty goes unrewarded by some high street banks. A selection of easy access ISAs* from Barclays Bank, HSBC, Lloyds Bank, NatWest and Santander pay just 1.53% on average, analysis by Moneyfacts revealed. In contrast, it’s possible to find both variable and fixed rate ISAs currently offering in excess of 4.00%.

Cash ISAs are a popular choice among savers – especially those who earn enough interest to risk exceeding their Personal Savings Allowance (PSA) and being stung with a tax bill.

However, in last year’s Autumn Budget, the Chancellor of the Exchequer, Rachel Reeves, announced the amount savers can put away in cash ISAs each tax-year will be lowered from £20,000 to £12,000 for those under the age of 65 as of April 2027.

The impending cash ISA allowance cut and potential return of lower interest rates (relative to recent buoyancy) both stand to alter the savings landscape over the coming months and years.

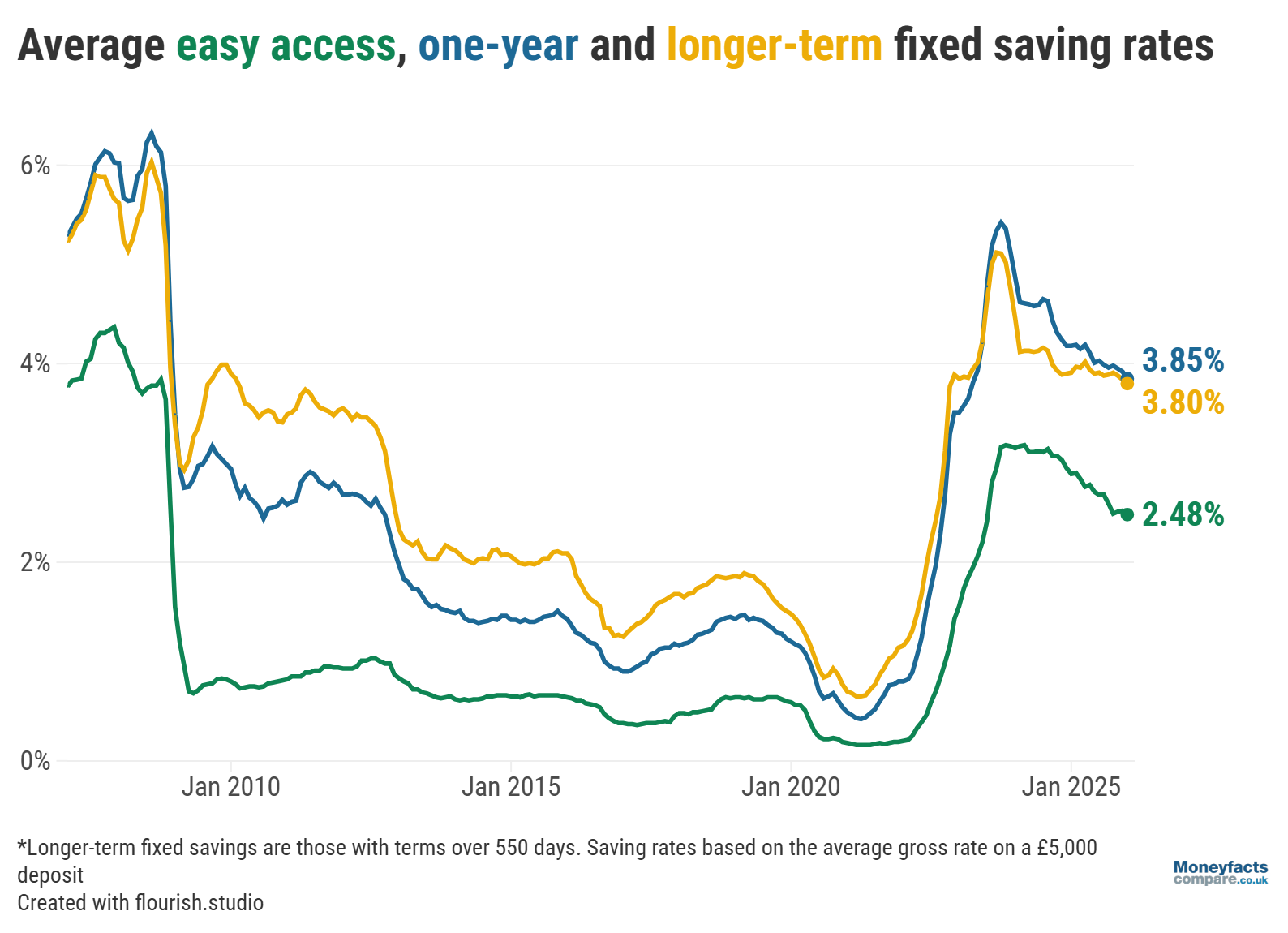

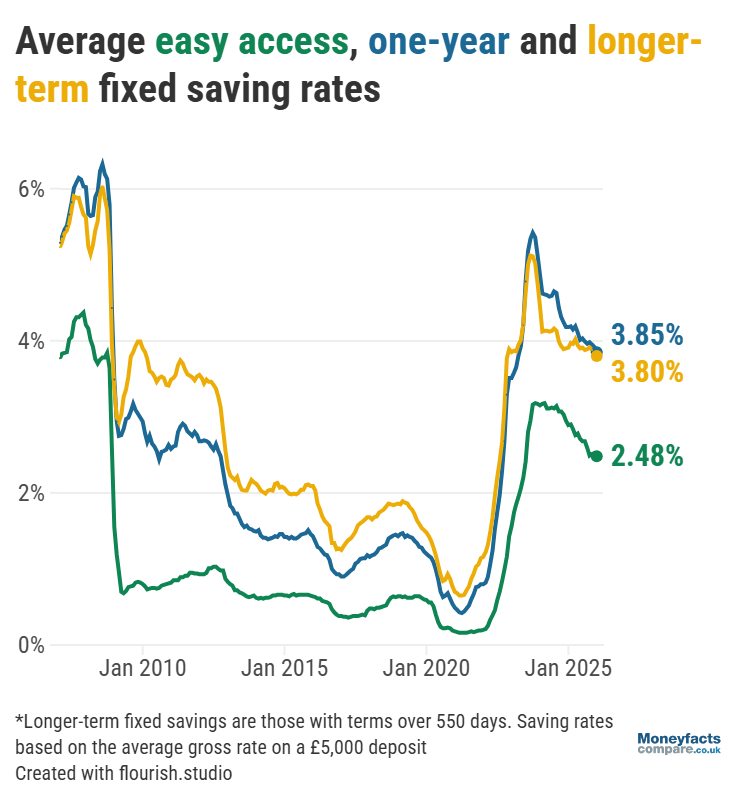

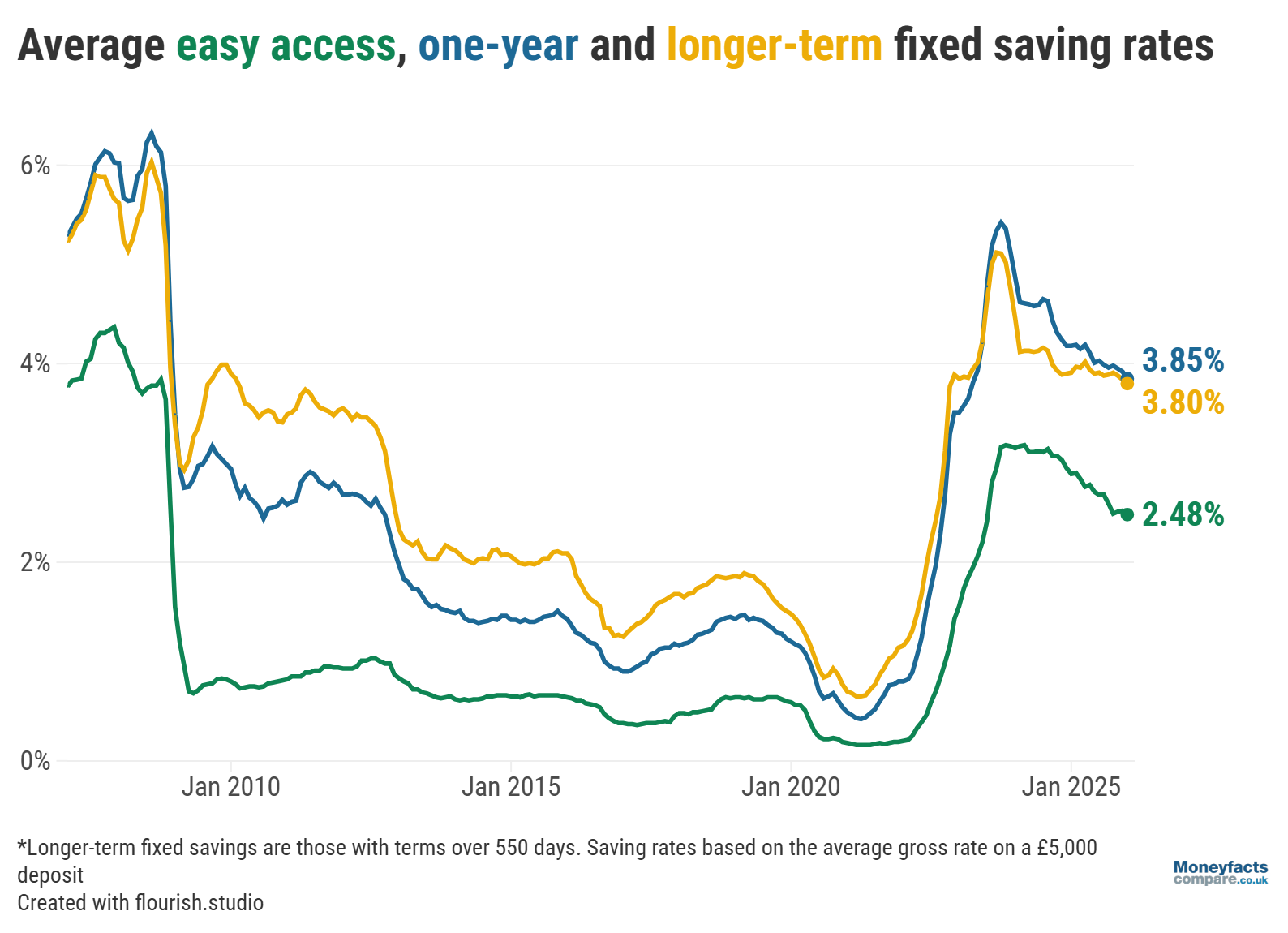

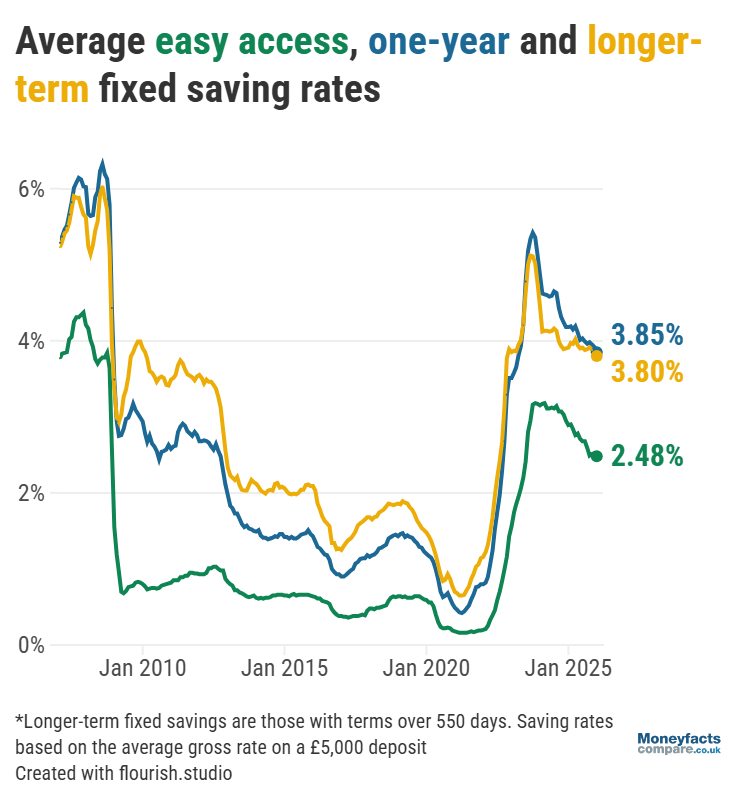

“A new era in the savings market may be taking shape,” said Eastell, adding that “rates are anticipated to fade from the peaks caused by the market volatility seen over the past three years”.

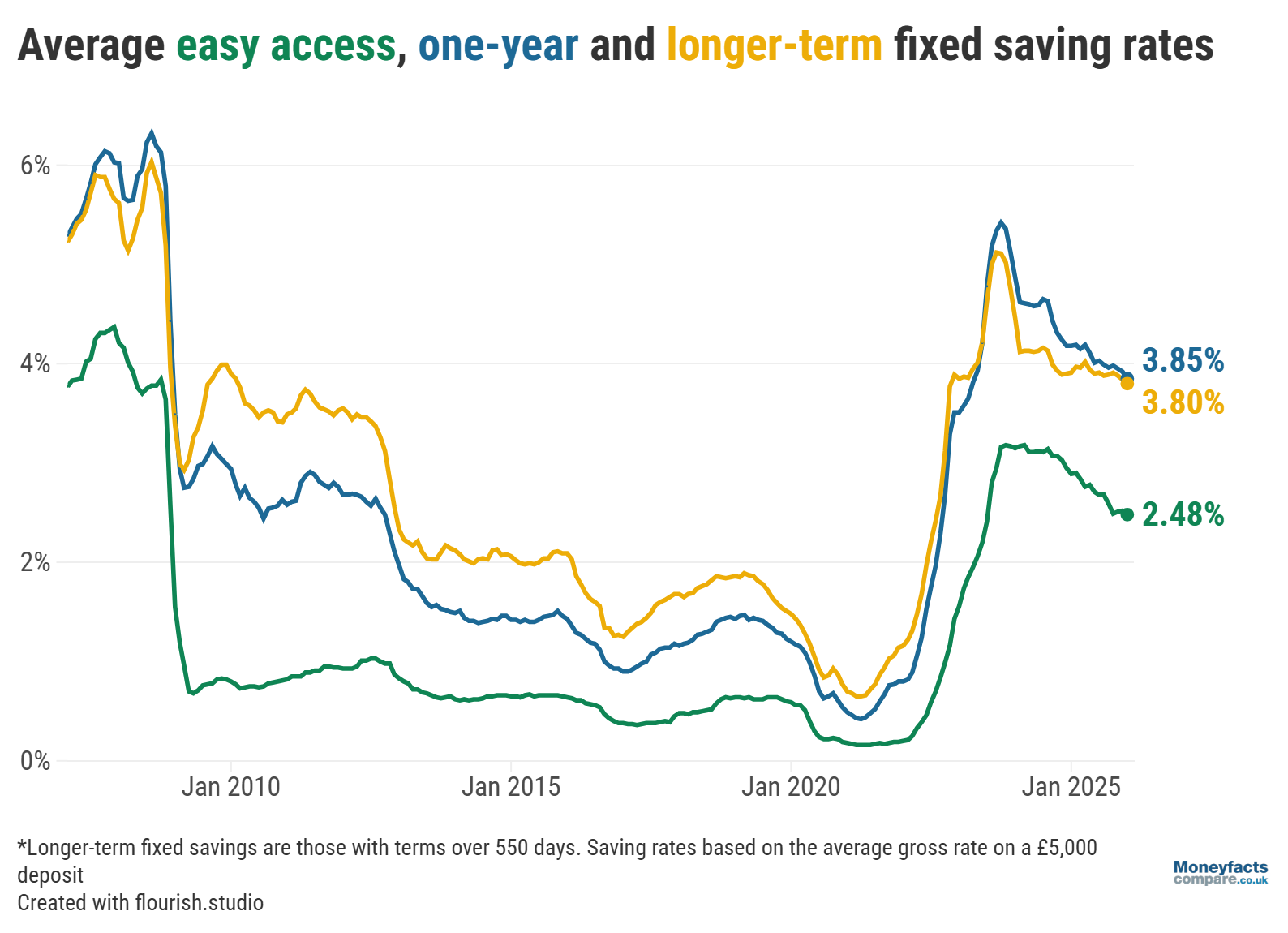

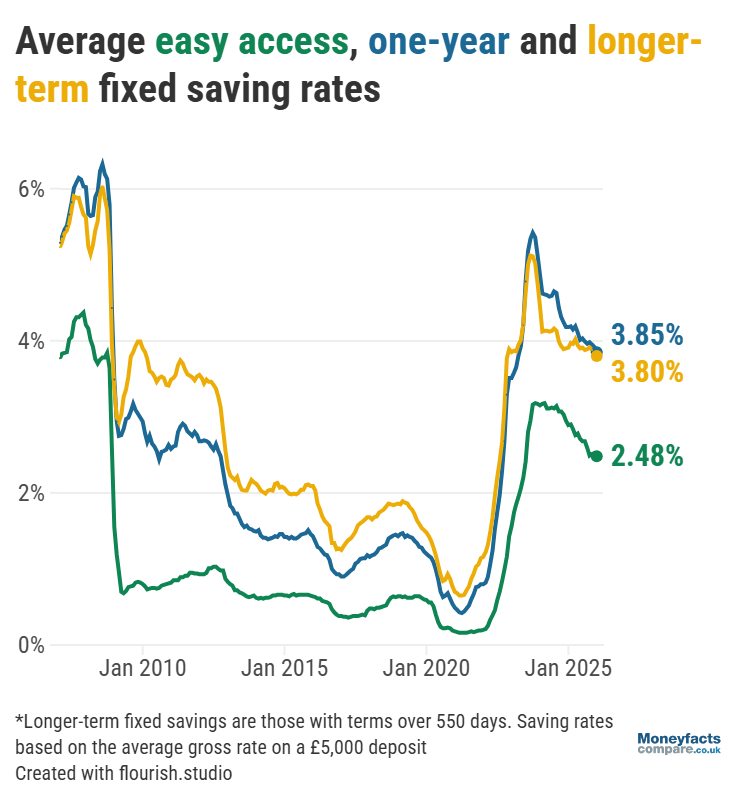

Since the start of December and January, typical savings rates have fallen across the board for the first time in more than six months (likely spurred by a reduction in the Bank of England base rate). Markets are predicting that further cuts throughout 2026 could bring the UK’s central interest rate down to levels last seen in December 2022 (around 3.25% - 3.50%), when a typical savings account paid approximately 2.80%. In contrast, the Moneyfacts Average Savings Rate stood at 3.35% at the start of this year.

UK Savings Trends: Graph showing average savings rates between 2008 and 2026

With changes on the horizon, it’s crucial savers take time to review their accounts and make sure their money is working as hard as possible. This might involve securing a competitive savings rate while still available or maximising their cash ISA allowance before it gets lowered to £12,000 from April 2027.

Our charts are regularly updated throughout the day so you can easily find the best savings rates – whether you’re looking for an easy access account, fixed bond or cash ISA.

Alternatively, read our weekly savings and ISA roundups for more information on the most competitive accounts, or subscribe to our Savers Friend newsletter for weekly updates on changes from across the savings market.

*Big bank easy access cash ISA selection. Includes linked (non-funded): Barclays Bank, Instant Cash ISA – Issue 1, 1.05%. HSBC Loyalty Cash ISA – Current account customers, 2.47%. Lloyds Bank, Cash ISA Saver (New customers), 1.00%. NatWest, Cash ISA, 1.14%. Santander, Easy Access ISA (Issue 26), 2.00%.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.