This comes as the Chancellor of the Exchequer, Rachel Reeves, announced in last month’s Budget that the limit on cash ISA deposits will be reduced from April 2027.

Cash ISAs are a popular choice for savers, with over £30 billion deposited into these accounts since the start of April 2025 alone. However, many will have seen their money dwindle in real terms over the past 15 years, as typical returns on cash ISAs struggled to keep pace with the rate of inflation.

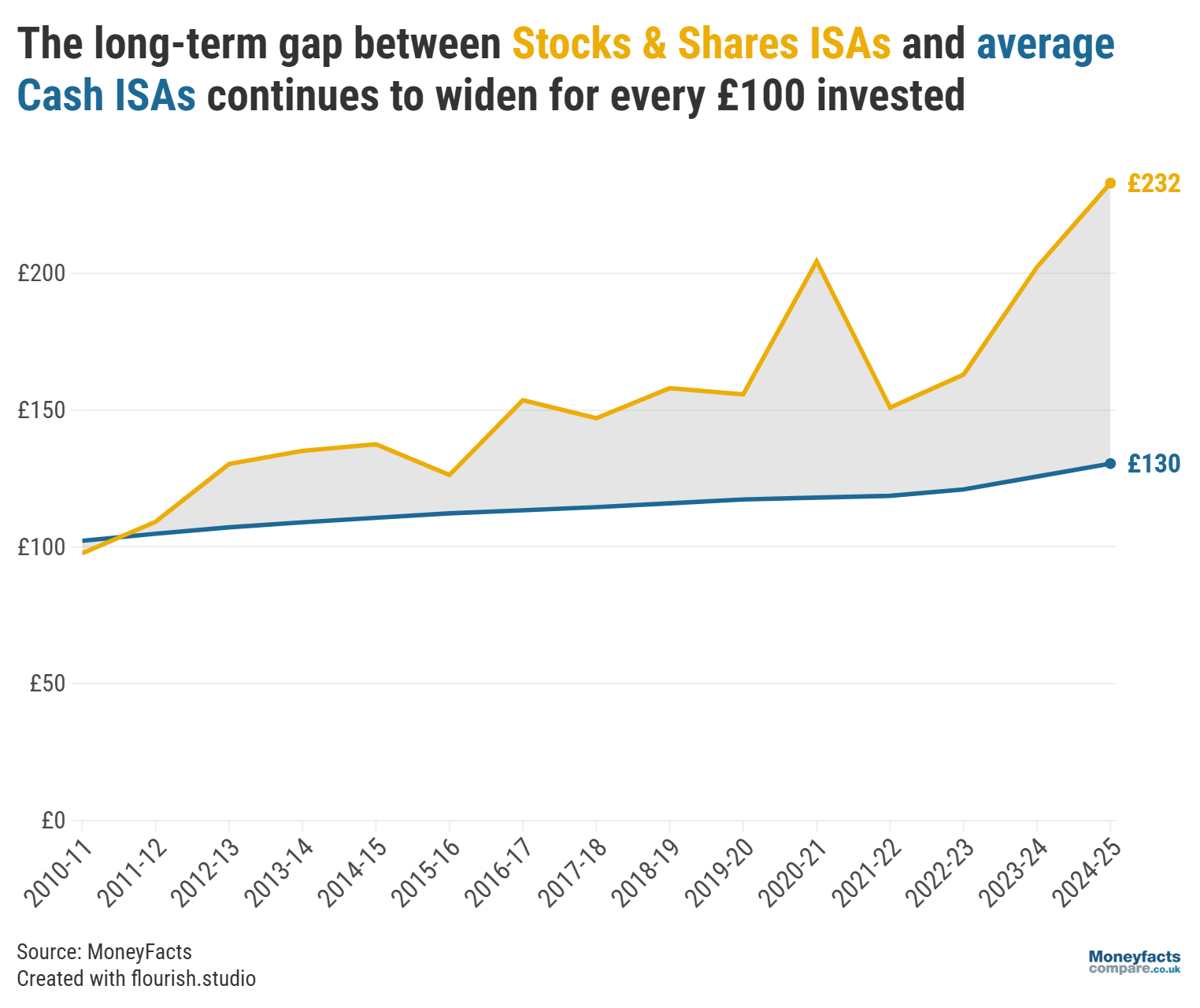

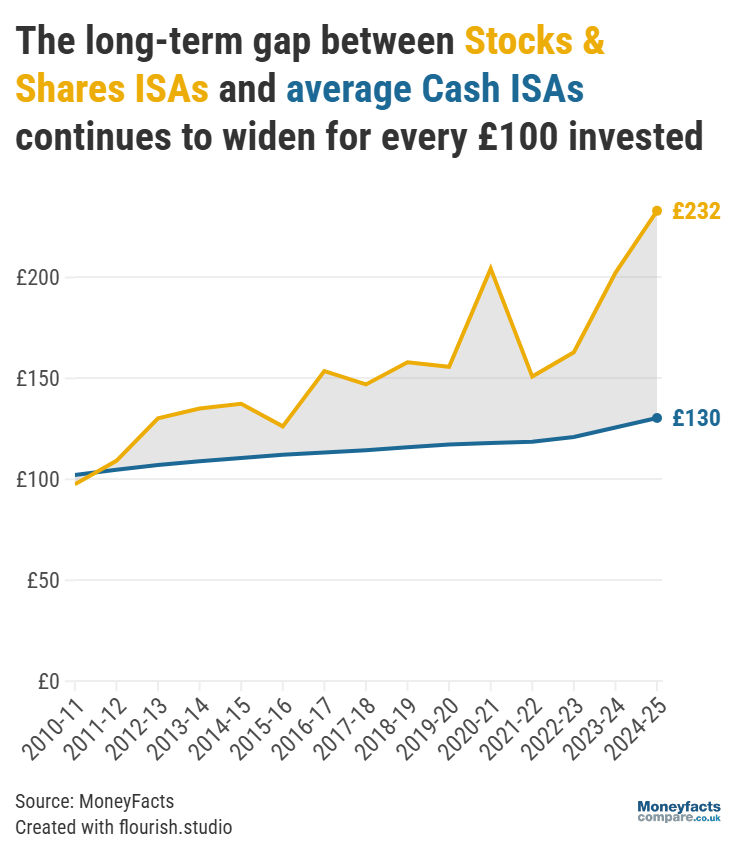

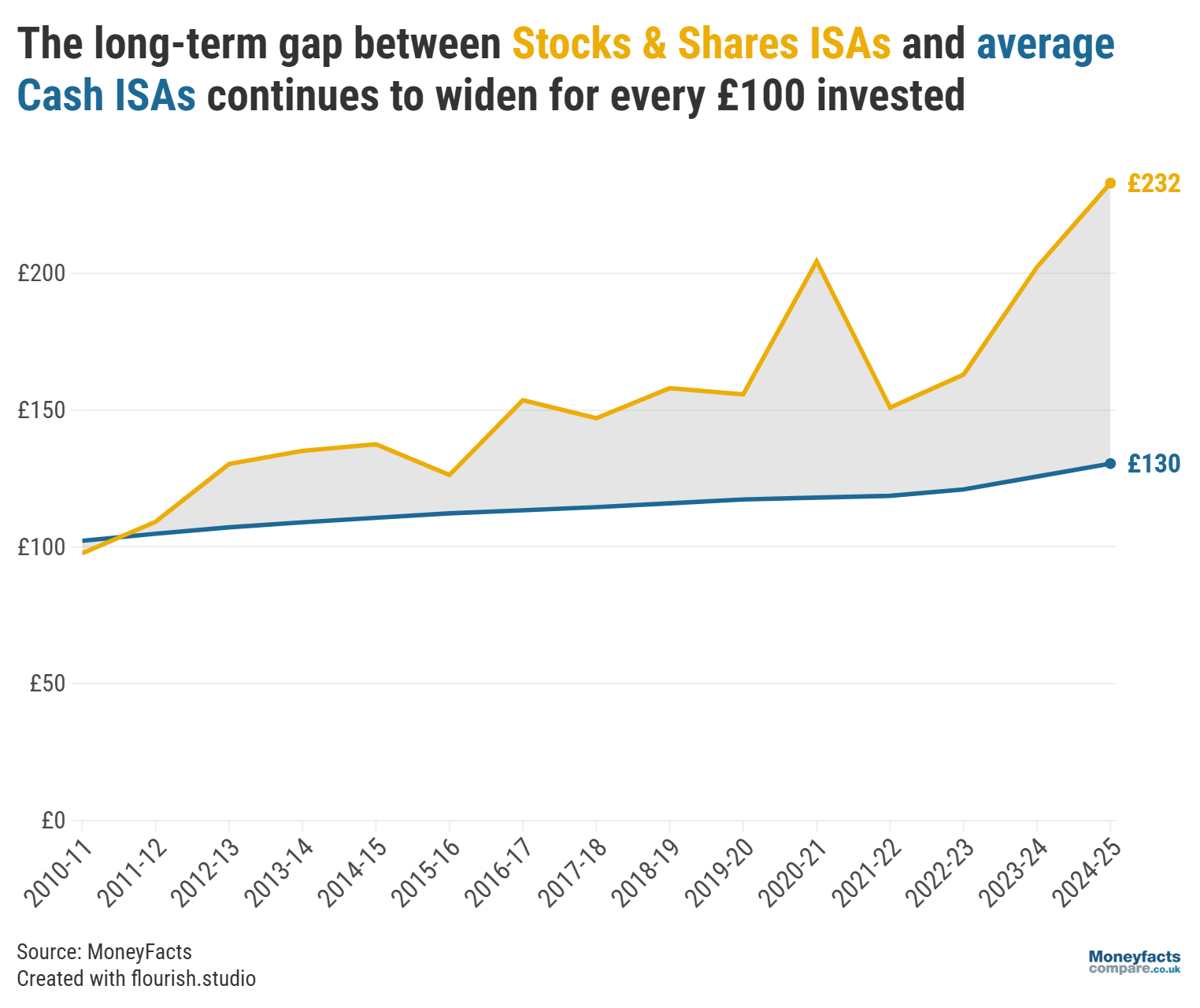

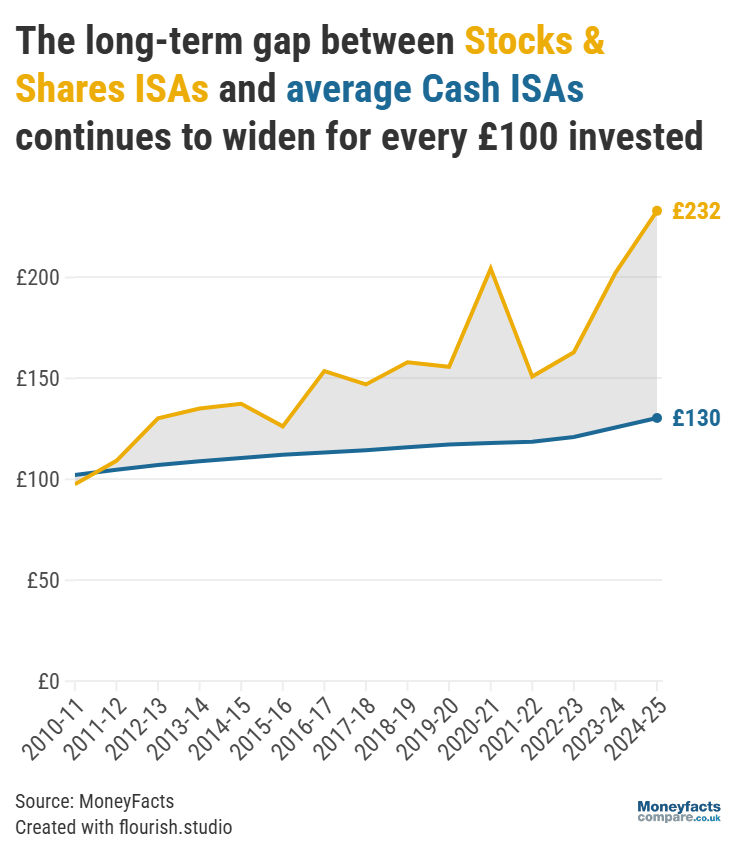

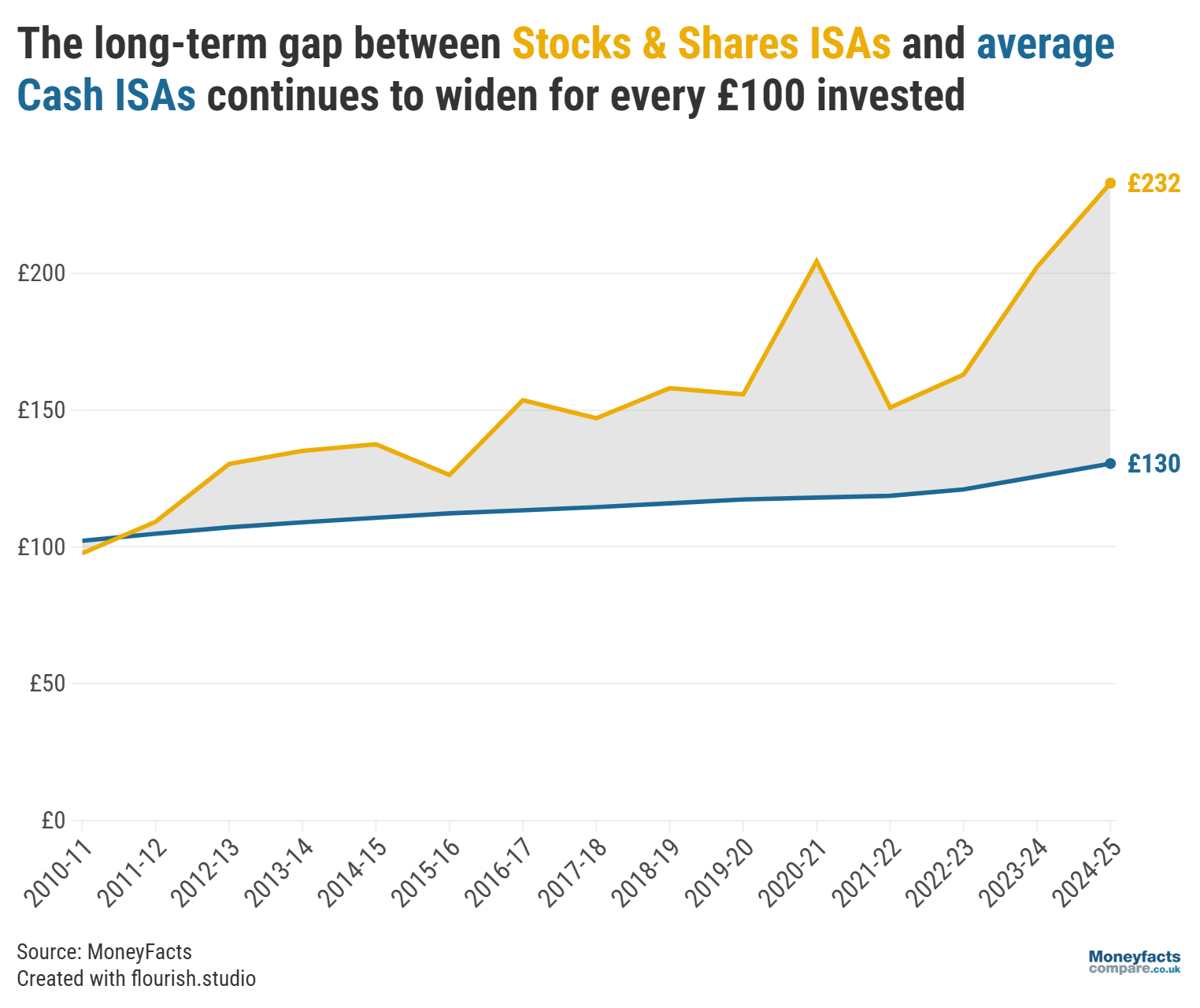

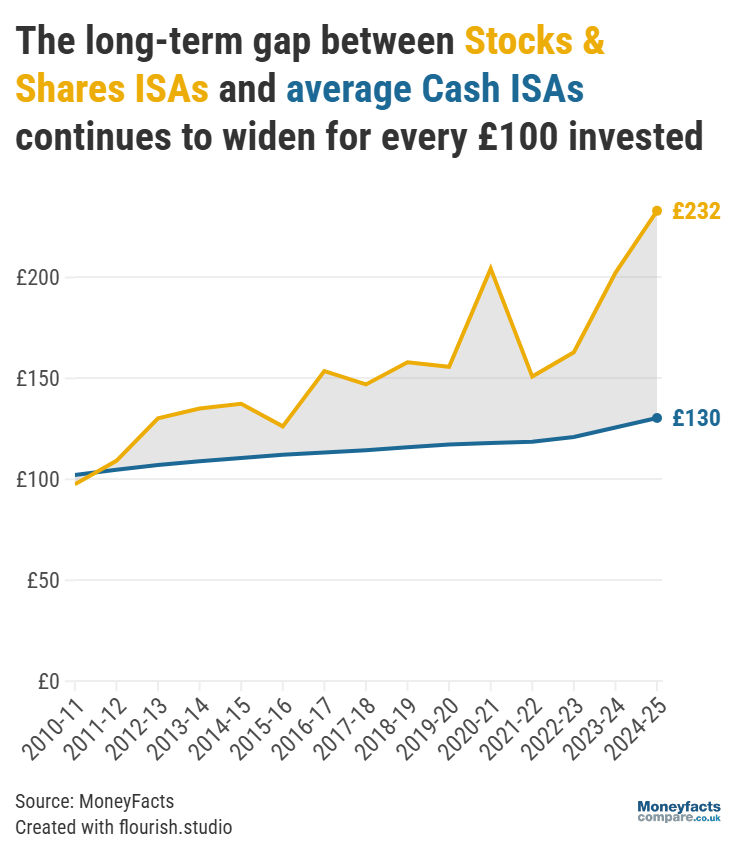

Since 2010, cash ISAs returned just 1.79% on average each year, according to latest analysis conducted by Moneyfactscompare.co.uk. This means a balance of £100 in 2010 would now be worth £130 – a modest increase of £30.

Meanwhile, costs of goods and services have gone up at a higher rate of 2.92% each year (on average) over the same timeframe – causing something previously priced at £100 to now be worth around £150. As a result, savers may find their money held in a cash ISA has lost some of its purchasing power and that they’re having to dig a little deeper into their pockets at the checkout.

In contrast, stocks and shares ISAs have significantly outperformed both cash ISAs and the rate of inflation over the past 15 years; since 2010, the average stocks and shares ISA returned 6.79% per year – five percentage points more than the typical cash ISA. In monetary terms, £100 invested in 2010 is now worth roughly £230 today (£100 more than average returns on a cash ISA over the same period). That being said, it’s important to remember your capital is at risk when investing and, because past performance doesn’t mean certain future success, that returns are never guaranteed.

Latest ISA trends: Returns on a cash ISA vs stocks and shares ISA between 2010 and 2025.

Encouragingly for investors, growth hasn’t been hampered by recent bouts of stock market turbulence (caused by Brexit, a global pandemic and the cost of living crisis). “It proves that staying invested, despite periods of volatility, pays off,” affirmed Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk.

But, while the Government is pushing to get more people investing (with the Chancelor of the Exchequer announcing in last month’s Autumn Budget that the cash ISA allowance will be cut to £12,000 from April 2027 for those under 65), Eastell recognised it’s not a suitable option for everyone.

“Consumers [who] need access to their money within the next few years may be less inclined to invest because short-term market swings may damage their returns,” she explained. Therefore, cash ISAs still have an important role to play as they offer more stable returns better suited for achieving short-term goals, such as building an emergency fund, Eastell added.

Furthermore, there are mixed feelings among commentators as to whether reducing the amount savers can put away in cash ISAs each year will actually encourage more people to invest. “While it may push some savers towards investing, lots of work still needs to be done to shift the attitudes of savers [who] are more risk averse,” said Eastell.

Even though, on average, cash ISAs have failed to beat inflation over the past 15 years, today’s best ISA rates better the rate at which costs of goods and services are currently rising and could see your money grow in real terms. Discover the most competitive cash ISA rates using our charts or subscribe to our weekly savings newsletter for regular updates.

Alternatively, those interested in investing can explore stocks and shares ISA providers with another of our dedicated charts.

Source: Average cash ISA from Moneyfactscompare.co.uk. All stocks and shares ISA data based on Lipper IM Primary funds. Inflation figures from Bank of England.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.