This is the lowest the annual rate of inflation has been in 10 months.

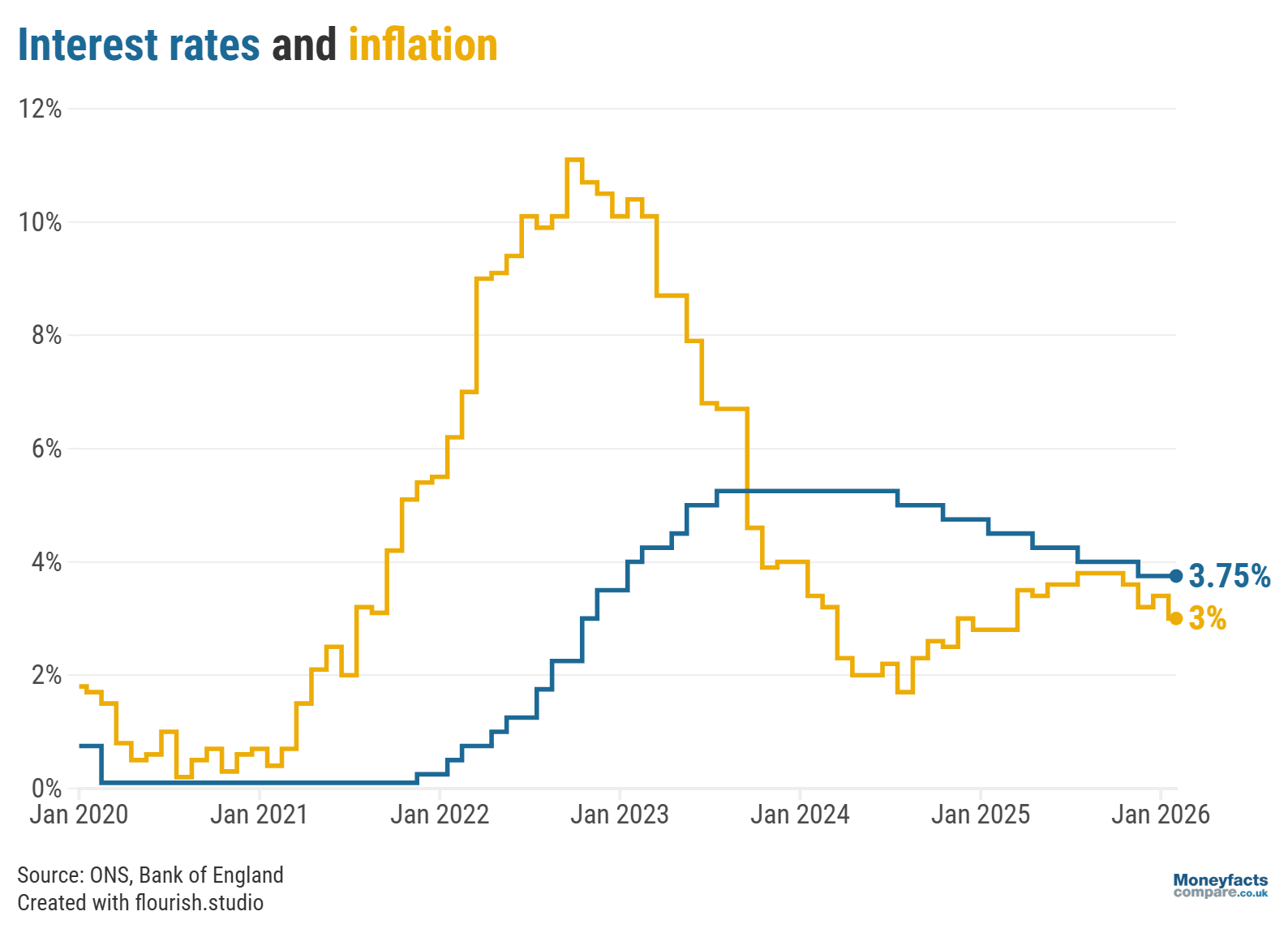

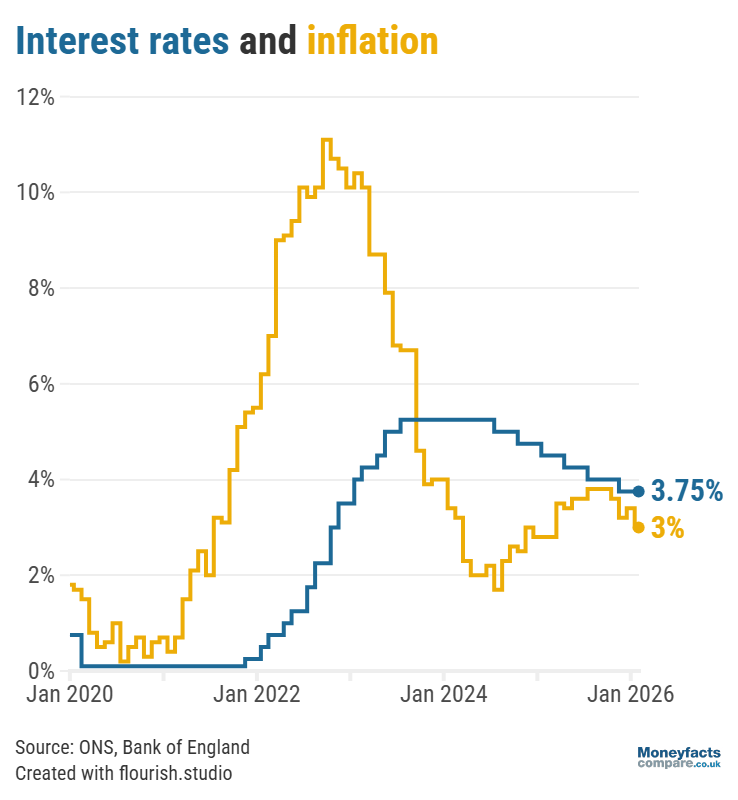

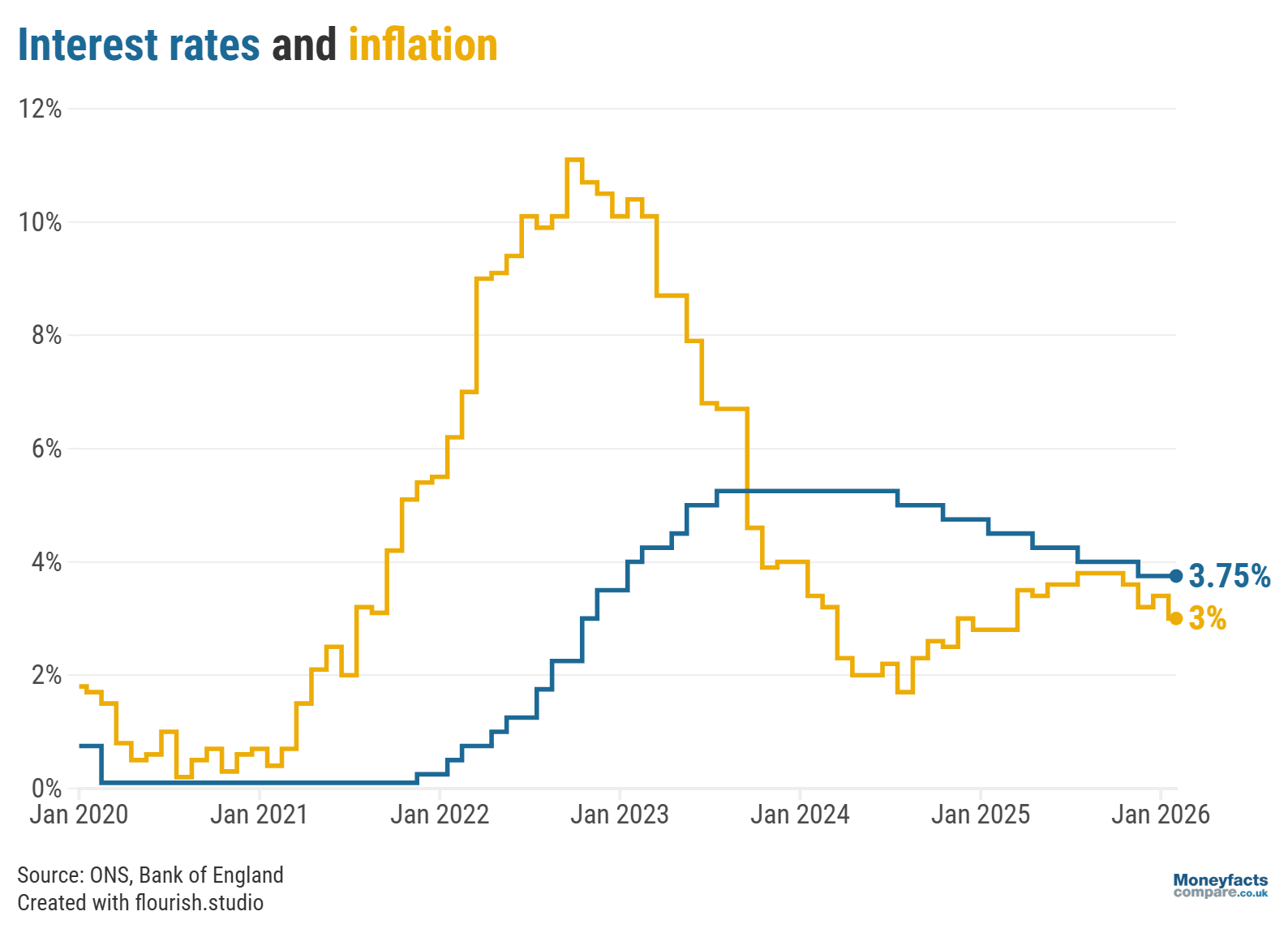

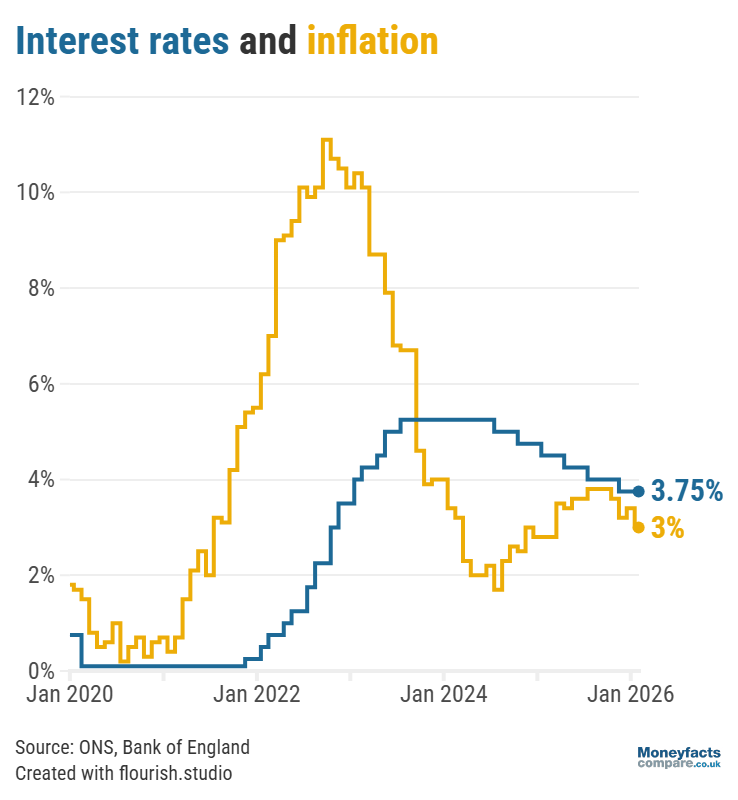

After increasing slightly to 3.4% in December, the rate of UK inflation eased to 3.0% in the 12 months to January 2026. This is according to the Consumer Price Index (CPI) released by the Office for National Statistics (ONS), which looks at how the cost of different household goods and services have changed over the past year.

The rate of inflation was last lower in March 2025 (when it stood at 2.6%) and, although it remains significantly higher than the Bank of England’s target of 2%, this decline could encourage the Monetary Policy Committee (MPC) to cut the base rate at one of its upcoming meetings.

Even though inflation is lower in January 2026 than the previous month, it doesn’t mean the overall price of goods and service is getting cheaper. The latest figures mean that prices have risen by 3.0% over the previous year, which is slower than the pace of price increases in December (3.4%). So, in January, prices still increased, just not as much as in previous months.

See our guide to find out more about inflation and how it is measured.

Many experts had forecast that inflation would ease in the first month of 2026, with several now predicting that the MPC could lower the base rate as soon as March. But, while a base rate cut could prompt mortgage lenders to lower rates, potentially benefiting borrowers, this could also result in lower savings rates meaning savers will get a smaller return on their money.

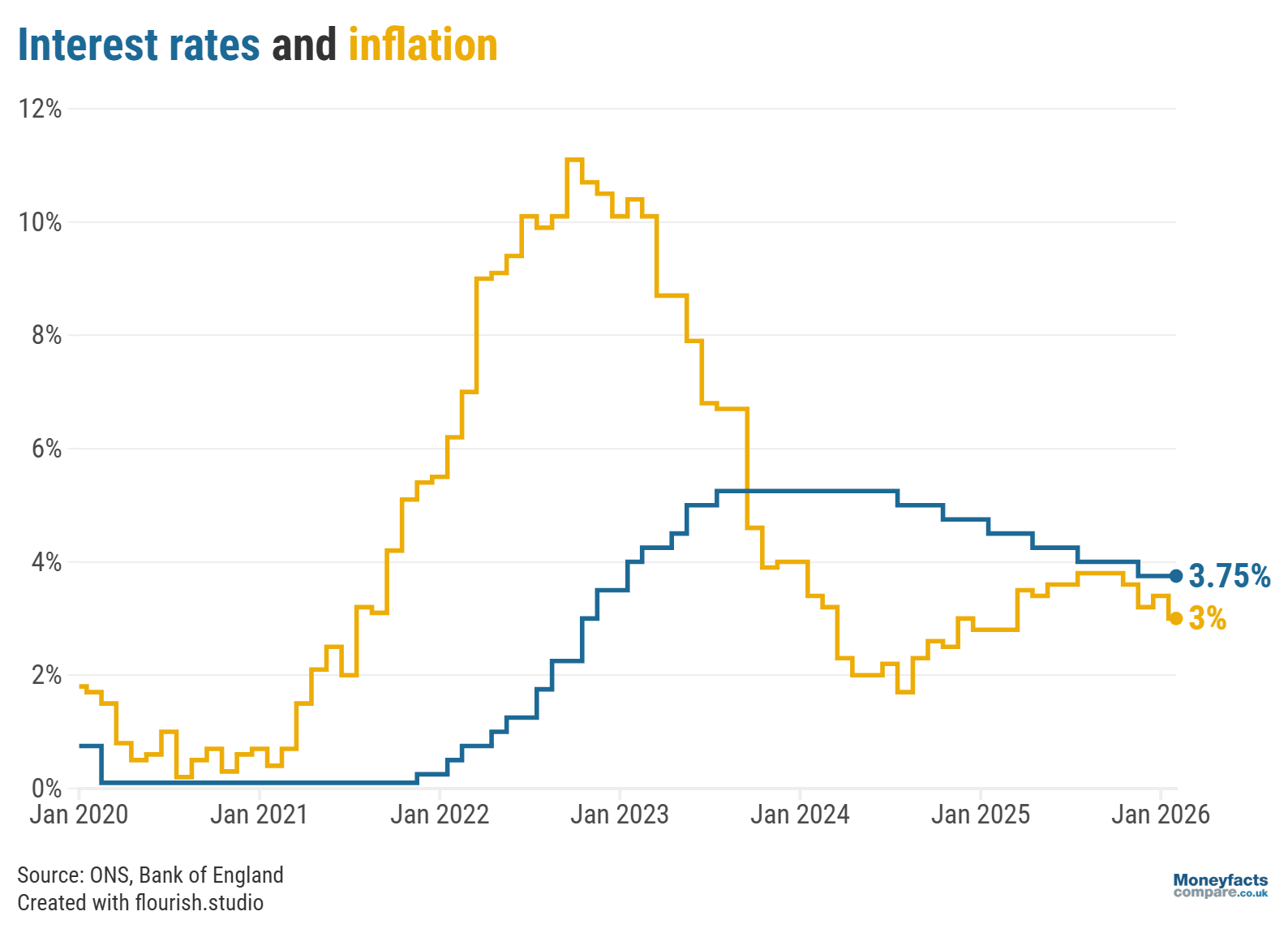

UK Finance Trends: The Bank of England base rate vs the rate of UK inflation since 2020.

Encouragingly, price increases eased across the transport division and the food and non-alcoholic beverages sector in January 2026, which could make a difference to household budgets.

For example, prices in the transport category rose by just 2.7% in the year to January, compared to an increase of 4.0% in the year to December 2025. This lower rate was partly due to petrol and diesel costs, which dropped by 3.1 and 3.2 pence per litre, respectively, between December 2025 and January 2026, as well as falling airfare prices.

Prices in the food and non-alcoholic drinks sector recorded an annual rate of inflation of 3.6% in January 2026, down from 4.5% in the previous month. Cheaper household staples, including bread and cereals and meat, were notable contributors to this slowing inflation rate.

However, prices in the restaurant and hotels sector increased by 4.1% in the year to January, up from 3.8% in December, with rising hotel costs being a major factor in this uptick.

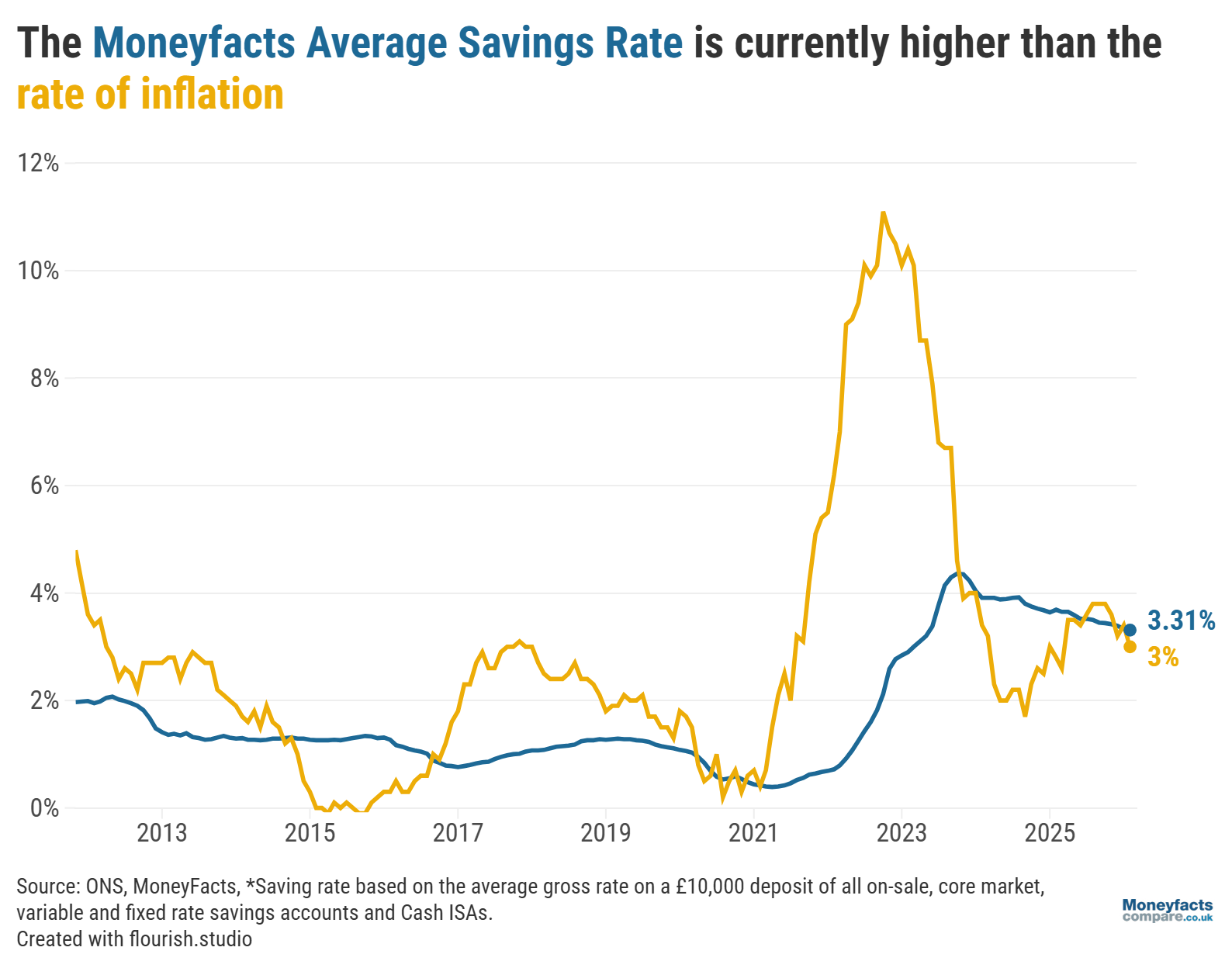

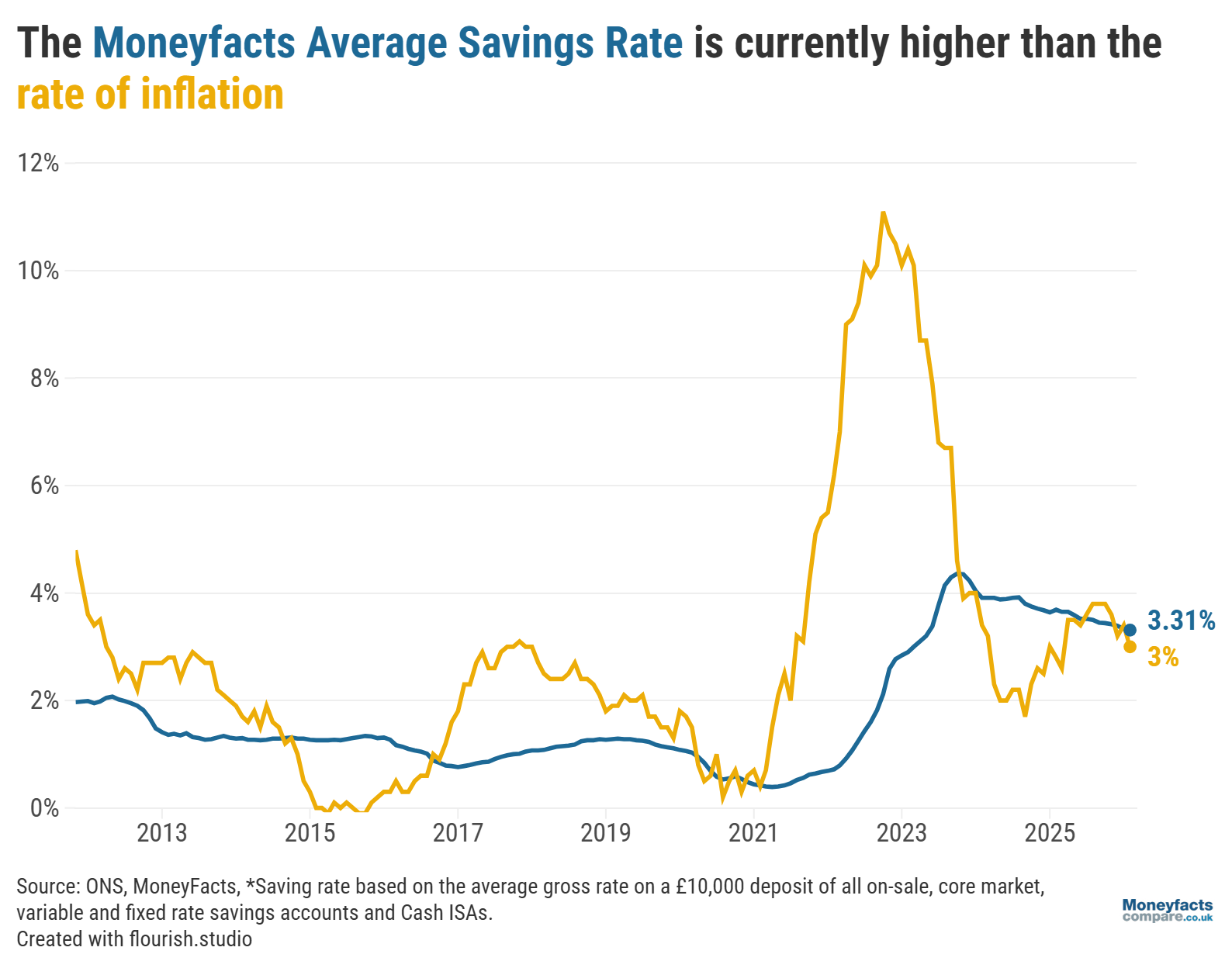

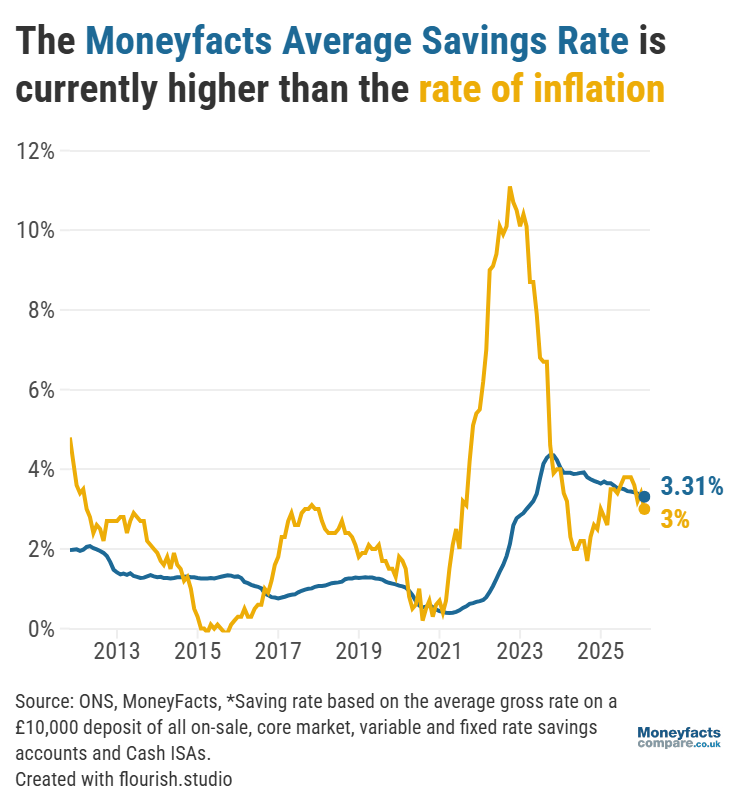

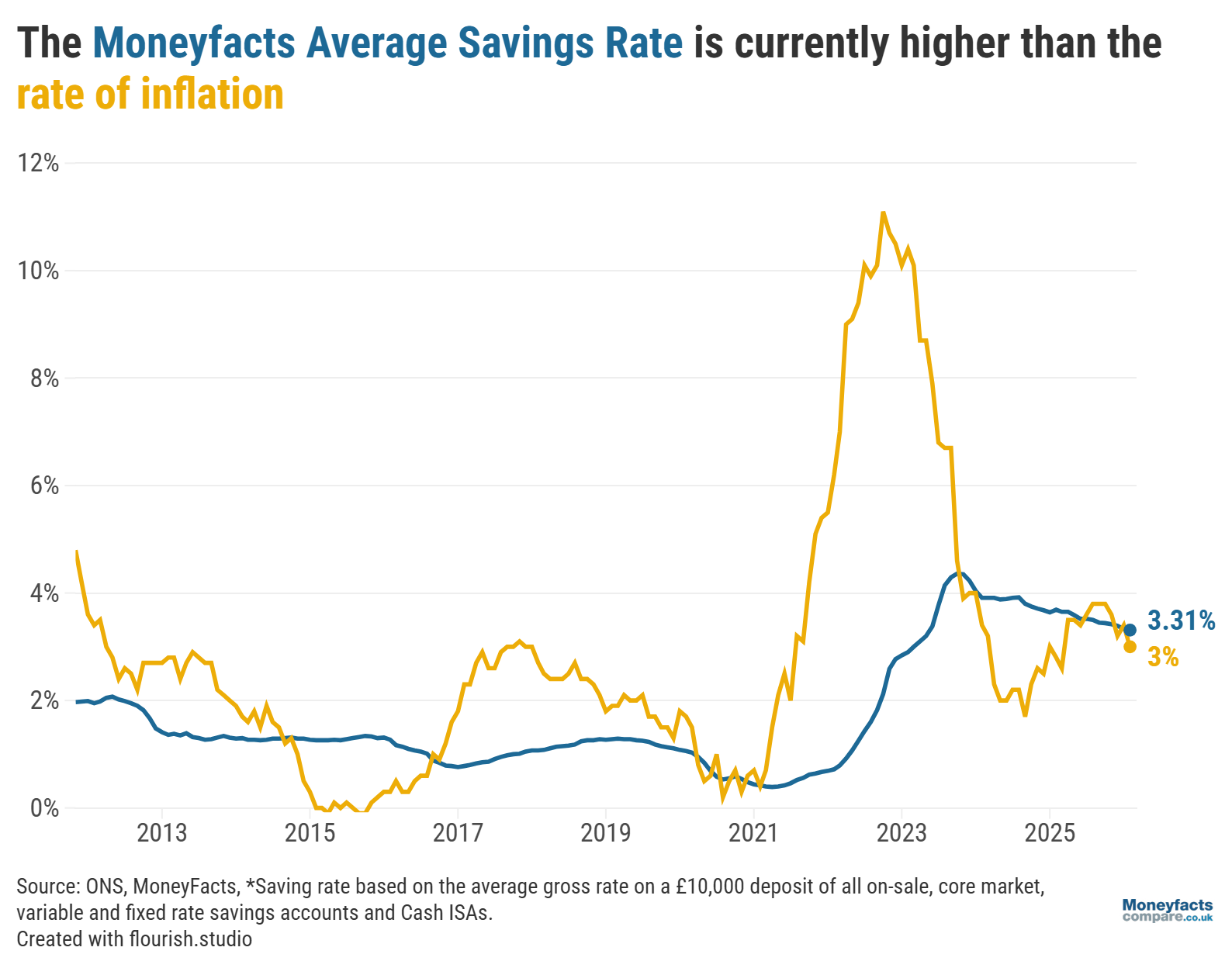

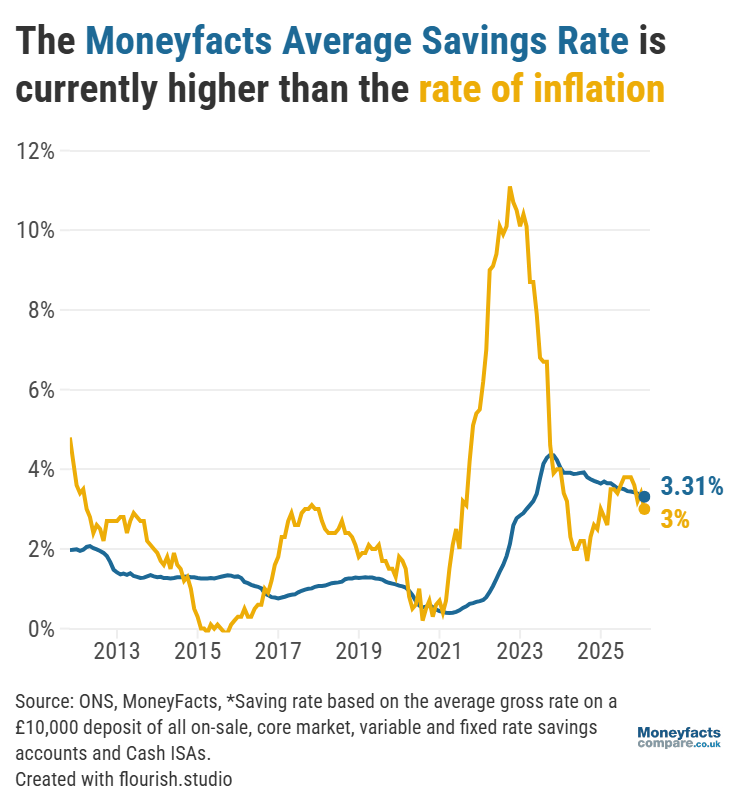

“Savers have lost almost £1,200 on average in real terms over the past five years, despite savings rates hitting post-2008 highs, as inflation surged to over 40-year peaks and ate away at the value of cash savings,” Caitlyn Eastell, Personal Finance Analyst at Moneyfactscompare.co.uk, commented.

“However, with inflation set to cool, savers could soon choose from a larger pool of products that offer inflation-busting returns even with potential base rate cuts looming because inflation is falling faster than savings rates,” she added.

UK Savings Trends: UK inflation vs the Moneyfacts Average Savings Rate since 2013. Because inflation has slowed to 3%, the Moneyfacts Average Savings Rate now sits above the current level of inflation.

Over the past month, Eastell points out that variable rates and accounts with shorter fixed terms have “suffered the biggest blows”, which may suggest that “the window to secure competitive rates is closing as providers could already be pricing in future rate cuts”.

Longer-term savings accounts and ISAs may become increasingly attractive if rates continue to fall as they offer a guaranteed return, but Eastell warns they “may not be for everyone, and savers should carefully balance the appeal of certainty against their need for access”.

With a lower level of inflation, there are now more savings accounts and ISAs that can offer a real return on your money compared to the previous month.

At the time of the latest announcement, there were 1,607 savings accounts and ISAs that paid above 3.0%, including easy access accounts and fixed bonds, as well as easy access cash ISAs and fixed rate ISAs. This means savers have plenty of chances to secure a competitive rate, but it’s crucial to actively shop around and switch to make sure you’re getting the best return on your money.

See our savings charts to discover the latest rates and find an inflation-beating account.

Average mortgage rates have seen a small uptick in recent weeks, as lenders reassessed their margins and adjusted their pricing in response to volatile market conditions.

However, Eastell points out that “swap rates have hit 30-day lows following the latest unemployment stats, which means we may see lenders beginning to make rate cuts in the next few weeks”.

“Pair this with cooling inflation and the Bank of England could move towards a base rate cut,” she added, pointing out this could be welcome news for borrowers as it may encourage lenders to reduce rates.

Eastell also notes that there is reason for those hoping to get on the property ladder to feel optimistic, as “recent research from the Building Societies Association (BSA) reveals that many aspiring first-time buyers are closer to homeownership than they realise, despite ongoing challenges with affordability and saving for a deposit”.

“Building societies continue to create innovative solutions, such as Skipton Building Society’s Track Record Mortgage, a 100% mortgage that allows renters to use their payment history to secure a mortgage, and Nationwide Building Society’s Helping Hand initiative, which enables first-time buyers to borrow up to six times their income, significantly increasing their buying power,” she explained.

Whether you’re taking your first steps into the housing market or you’re an existing homeowner looking for a new mortgage deal, it can be useful to speak to a mortgage broker to help you find the right deal for your circumstances.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfactscompare.co.uk visitors that call on 0800 031 8553. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.