With inflation at an eight-month low, will the Bank of England cut interest rates tomorrow?

UK inflation fell by a bigger-than-anticipated margin to 3.2% in the year to November, according to data released today by the Office for National Statistics (ONS). This continues the downwards trend seen in the previous month (when inflation slowed from 3.8% to 3.6%) and means costs of goods and services are rising at their lowest level in eight months.

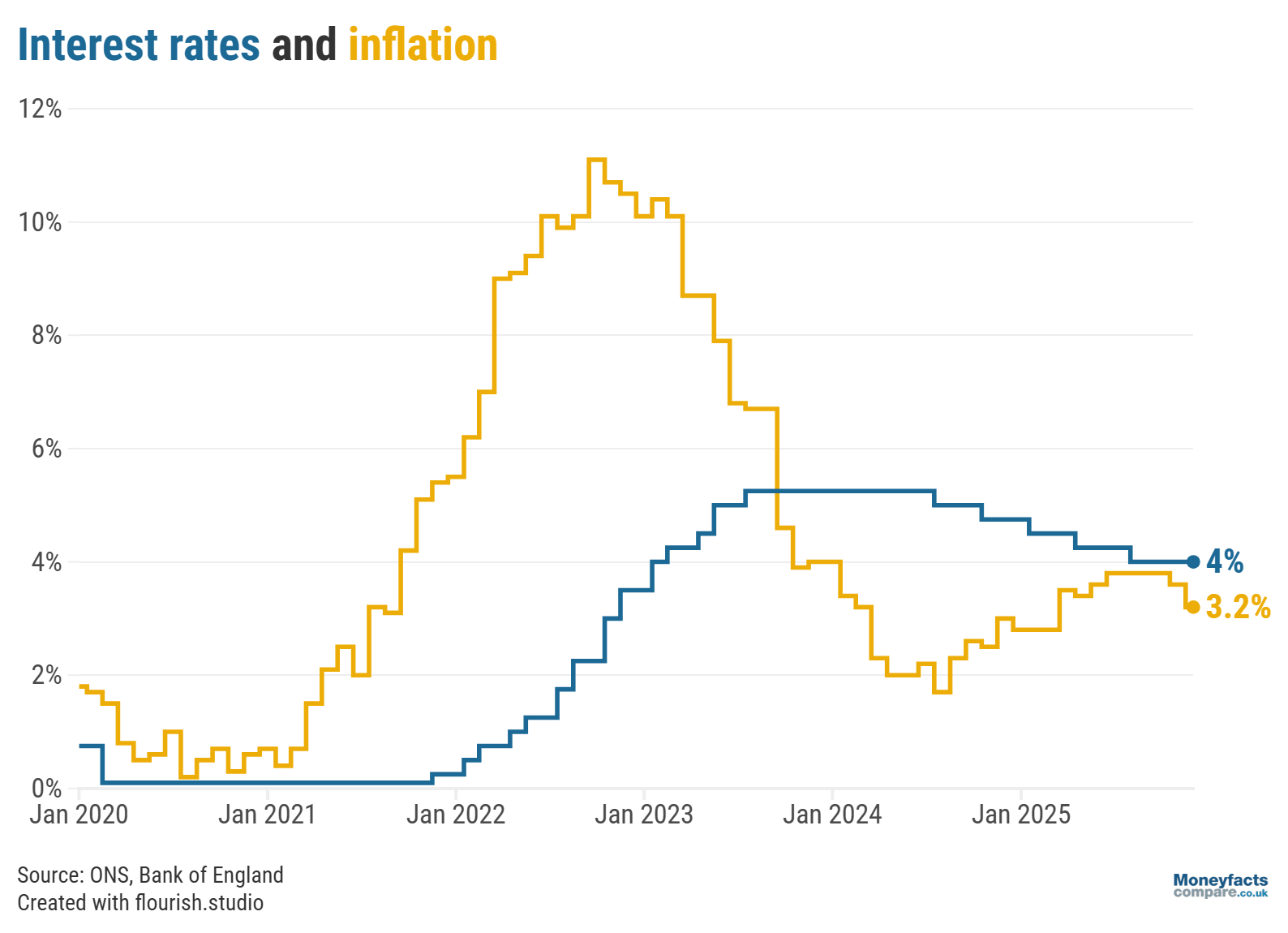

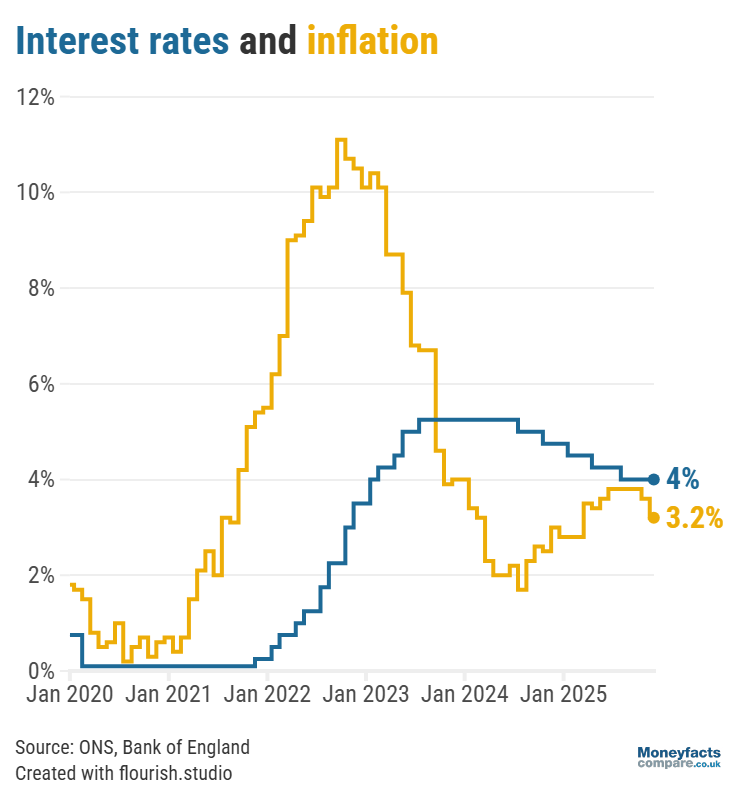

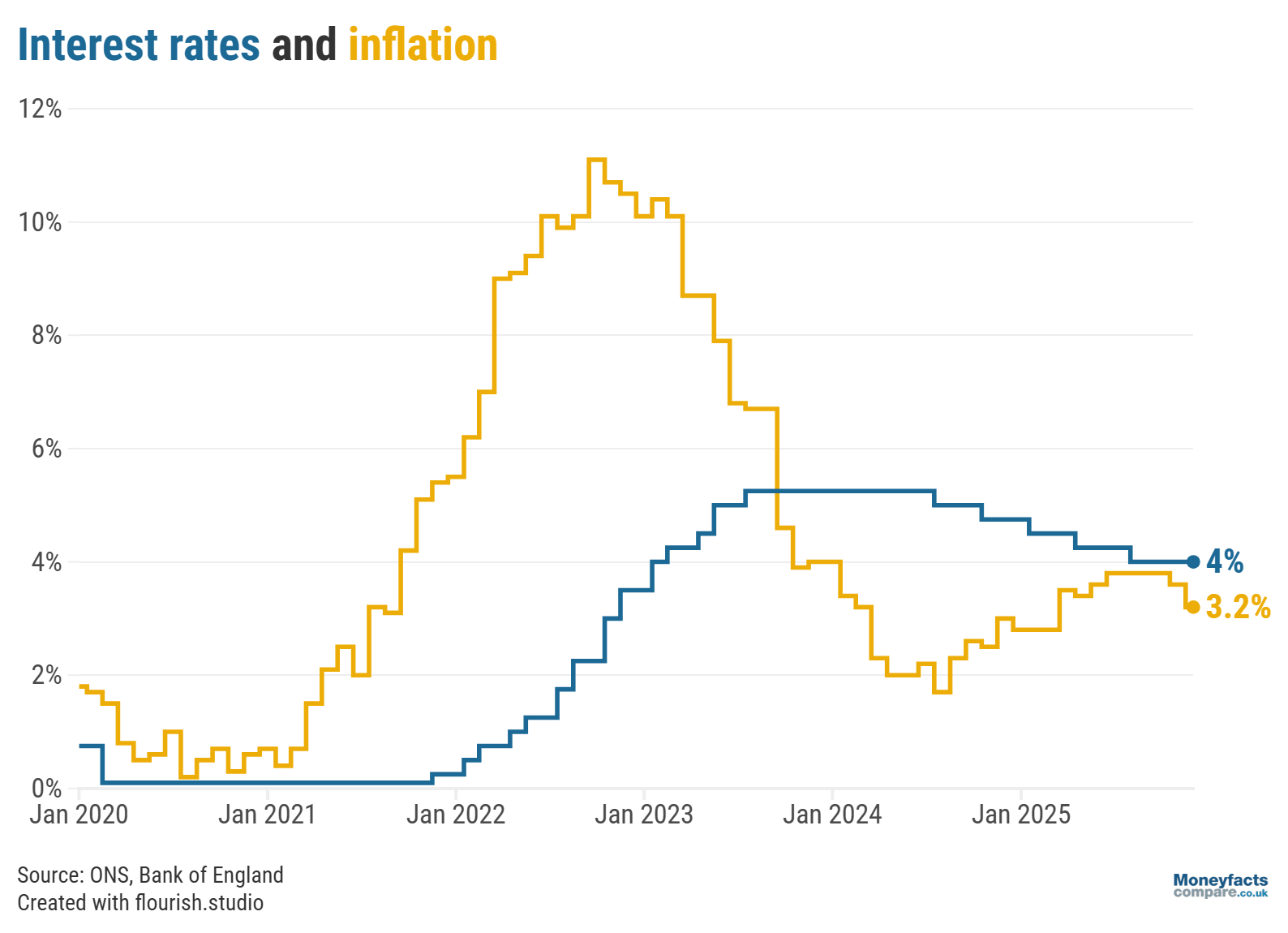

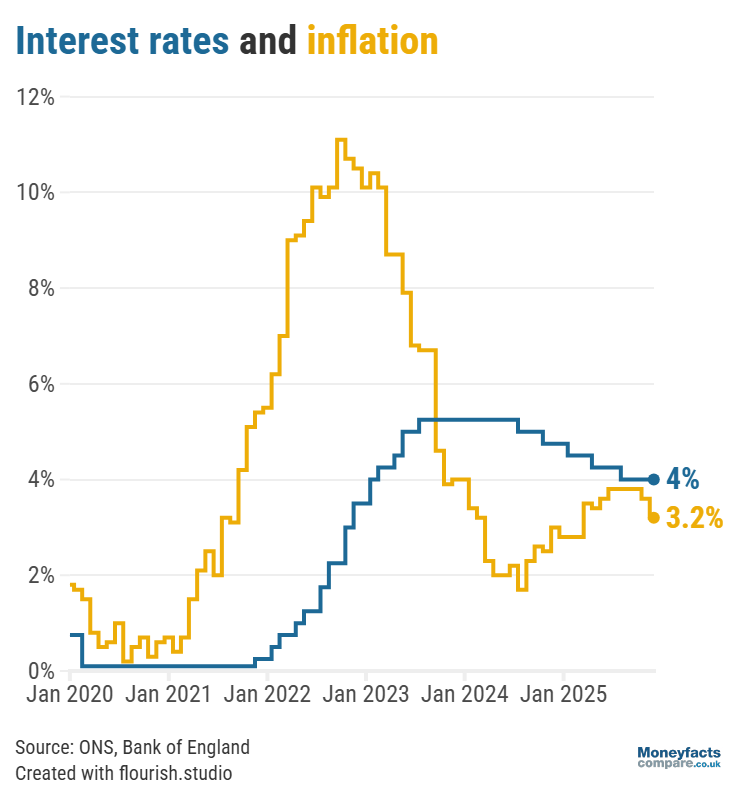

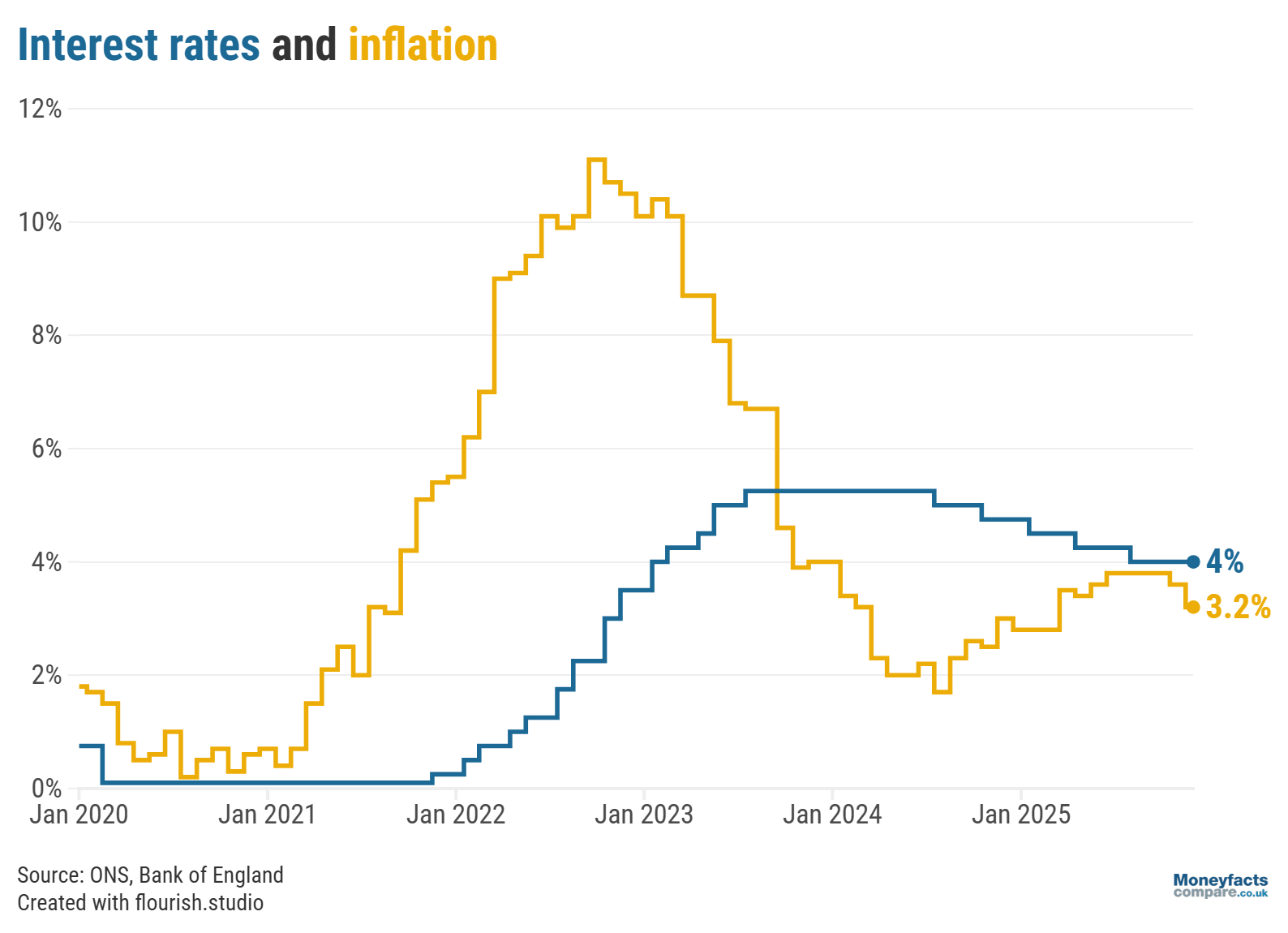

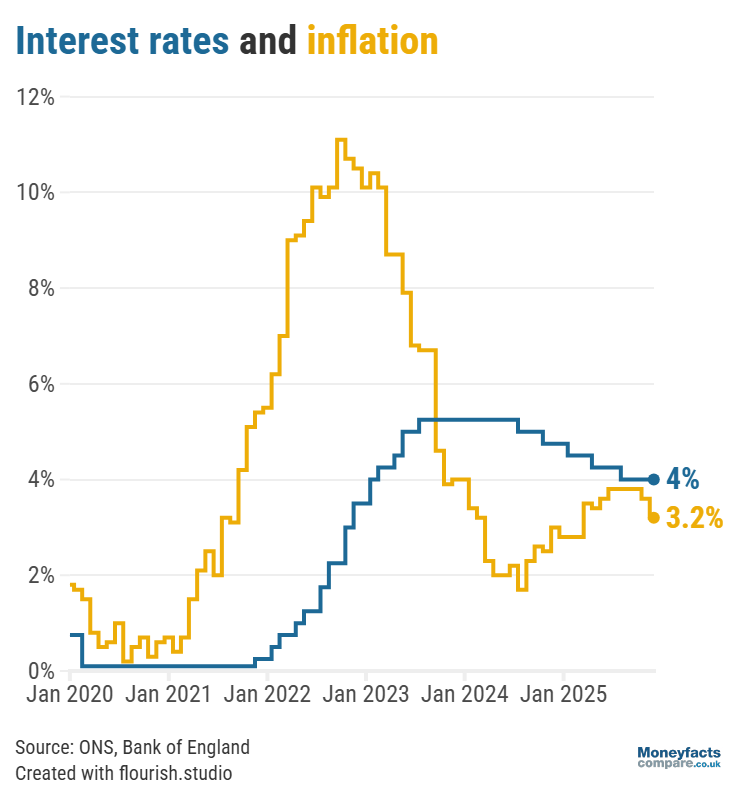

UK Finance Trends: Graph showing the Bank of England base rate vs the rate of UK inflation.

Alongside a small jump in unemployment and the economy contracting in October, these latest figures fuel expectations for the Bank of England to cut interest rates tomorrow.

Inflation measures the rate at which costs of goods and services are rising. However, even though inflation fell in November, this doesn’t mean prices are getting any cheaper. Instead, they are continuing to rise – albeit at a slower rate.

In times of rampant inflation (when prices are rising rapidly), the Bank of England might consider raising the UK’s central interest rate (commonly known as the ‘base rate’). This can help to bring inflation back under control by making it more expensive to borrow money (which thereby reduces spending and lowers demand). Once inflation approaches the Bank of England’s 2% target, it might then look to lower the base rate.

Learn more with our guide: UK inflation explained

Falling inflation was largely caused by lower food prices which, Grant Fitzner, Chief Economist at the ONS, said traditionally rise at this time of year. Having previously increased at 4.9% in the year to October, the cost of food and non-alcoholic beverages rose at a slightly slower rate of 4.2% in November. Meanwhile, prices dropped by 0.2% on a monthly basis.

In particular, the cost of cakes, biscuits and breakfast cereals all declined, while smaller downwards contributions were made by dairy products, chocolate and confectionery.

Elsewhere, the rate at which prices of alcohol and tobacco are rising eased from 5.9% in the year to October to 4.0% in November – possibly a result of when changes to tobacco duty came into effect this year and last year. The division also recorded a 0.4% monthly drop which helped to drive inflation down.

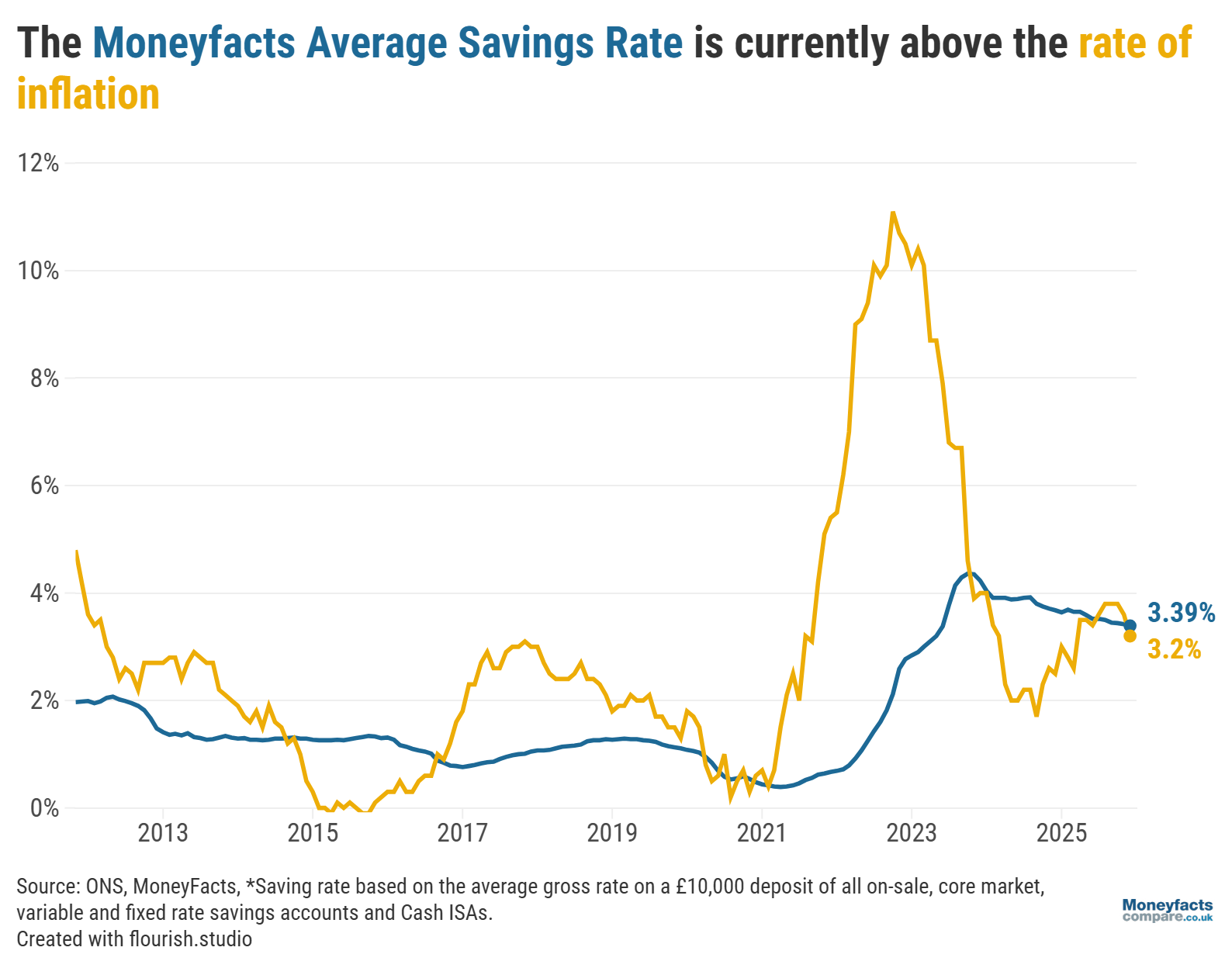

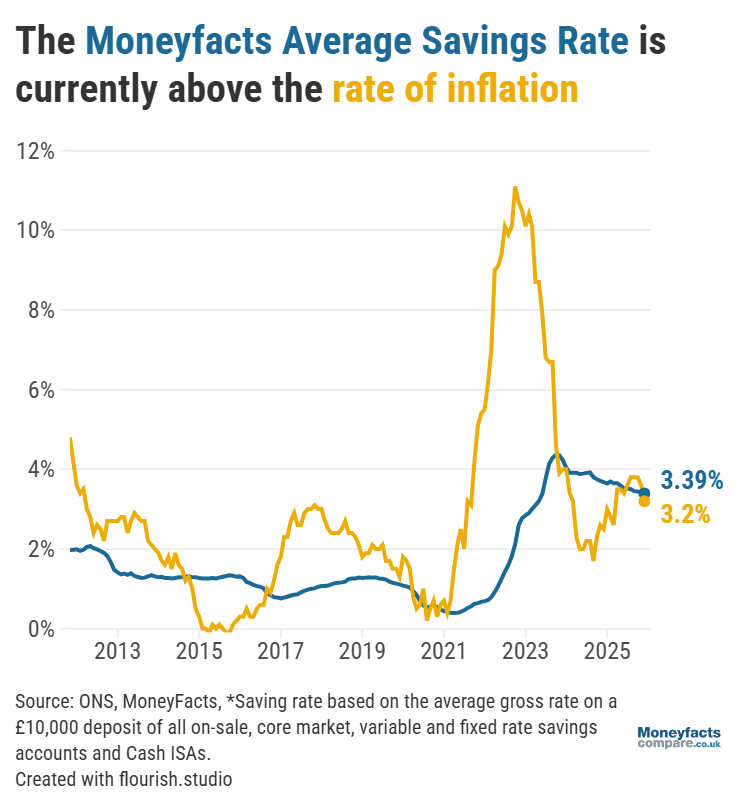

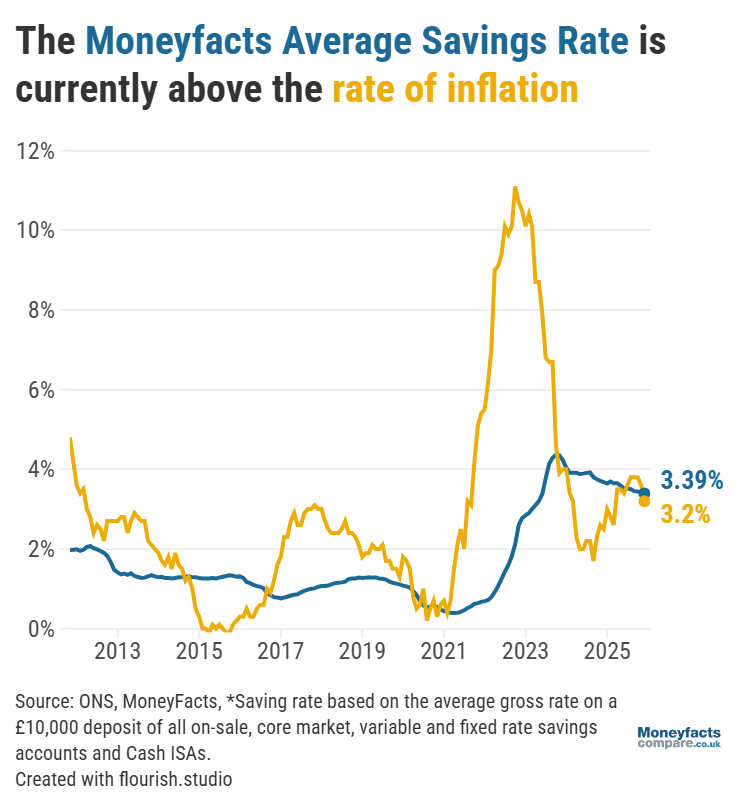

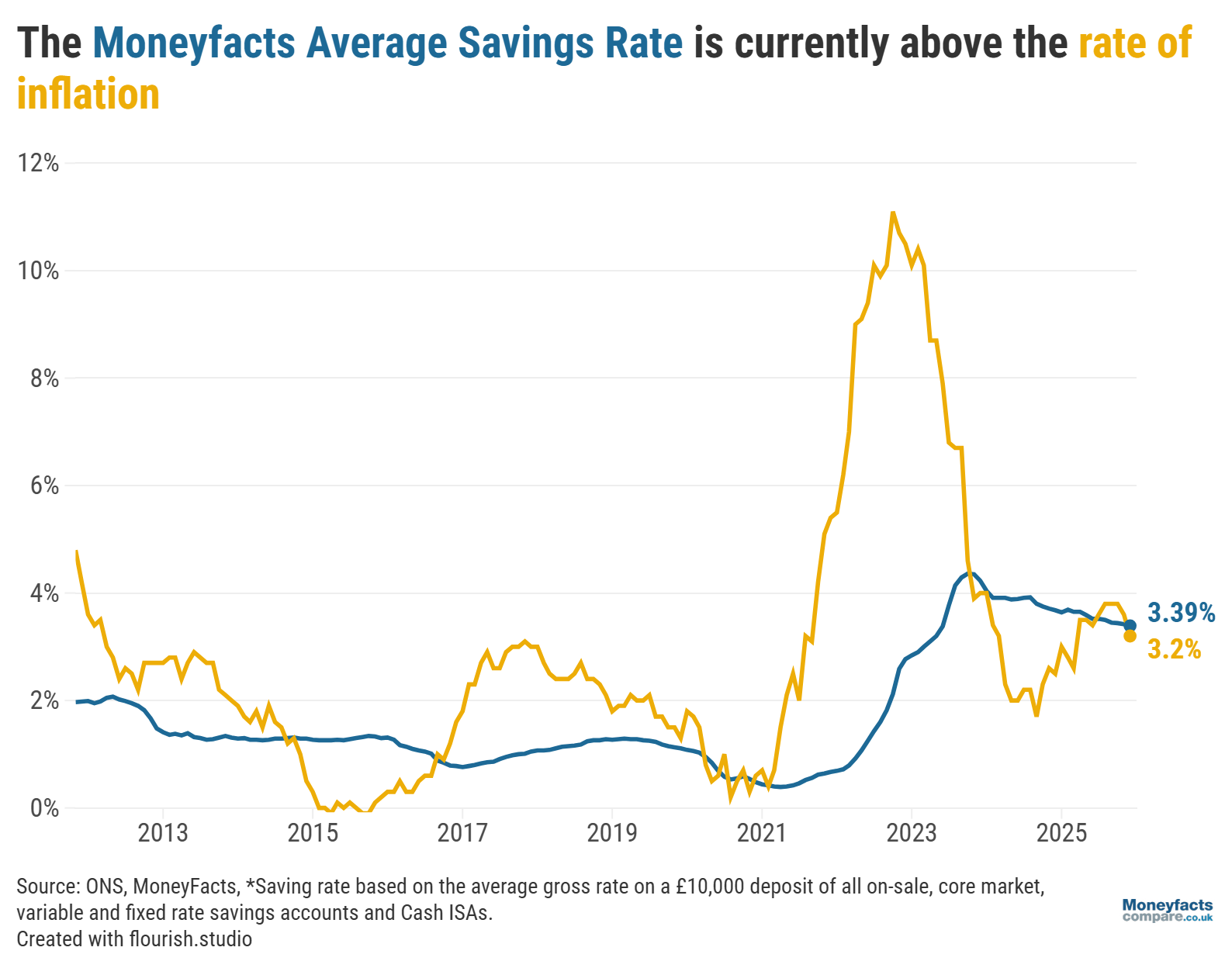

While there are currently 1,512 savings accounts that can beat inflation and see savers’ money grow in real terms, this number could shrink if a base rate cut is on the cards tomorrow - so savers may need to act fast.

“This year inflation has averaged 4.01% and the Moneyfacts Average Savings Rate at 3.50%, meaning cash savings have failed to keep pace. For someone with £10,000, this equates to being around £50 worse off in real terms,” said Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk.

UK Savings Trends: Graph showing UK inflation vs the Moneyfacts Average Savings Rate.

However, with the Office for Budget Responsibility (OBR) forecasting inflation to average at around 2.5% in 2026, she explained that savers could be £100 better off in real terms if savings rates were to hold steady.

“It’s as crucial as ever that savers now pay closer attention to how to get their money working its hardest,” said Eastell.

“Inflation remains one of the biggest threats, however, fiscal drag also plays a major role. The income tax threshold freeze could haul millions of consumers into higher tax brackets and subsequently receiving a surprise tax bill as their personal savings allowance is halved from £1,000 to £500. Although the interest rates offered on cash ISAs are typically lower than their non-ISA counterparts, they may be more favourable in the long run as all interest earned is tax-free,” she added.

But, with the Moneyfacts Savings Trends Index 2025 finding that one in four savers have never switched accounts and as loyalty often goes unrewarded, Eastell offered the reminder that “the markets are most generous to those who proactively search for the highest-paying deals”.

Our charts are regularly updated throughout the day so you can discover the best savings rates currently available.

Alternatively, read our weekly savings and ISA roundups for more information on the most competitive accounts or subscribe to our weekly Savers Friend newsletter for regular updates from across the savings market.

In contrast, mortgage borrowers may be optimistic that today’s figures prompt the Bank of England to lower interest rates tomorrow in the hopes this brings down lending costs.

“Although mortgage rates remain significantly higher than the ultra-low levels seen in previous years, lenders have been drip feeding cuts as inflation eases, fuelling speculation for a base rate cut. The most recent GDP figures only add fuel to the fire,” said Eastell.

“In December 2023 the average two-year fixed rate was 6.04% and the ‘typical’ borrower could expect a monthly repayment of around £1,600. Remortgage customers could now see their repayments drop by almost £180, which will ease a significant burden. However, for first-time buyers higher borrowing costs continue to limit their purchasing power,” she added.

It’s important to remember that base rate reductions only tend to immediately impact mortgage borrowers on a variable rate. This is because lenders often consider market forecasts pre-emptively when setting their fixed pricing.

Our charts are regularly updated throughout the day so you can find some of the lowest mortgage rates available. However, it’s also important to bear in mind that the cheapest-priced deal may not be the most effective for your circumstances. That’s why our weekly mortgage roundup features some Moneyfacts Best Buy alternatives based on their overall true cost.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.