Looking to grow your cash reserves? Setting up a business savings account can be a great way to put some of your capital to work. Compare the very best business easy access, business notice accounts and business bonds. Involved with a charity or club? Compare charity and club savings accounts.

Those looking to borrow at least £25,000 might wish to consider a commercial mortgage. Visit our chart to find the best rates, terms, and financing options on the market.

In order to grow your business, you may need an injection of capital. But with so many forms of financing available what option is best for your business? Our pages and charts explain.

Looking for a business current account to manage your cashflow? Compare fees, benefits, and eligibility requirements on our charts.

A business credit card can help start-up businesses build their credit score and can be a great way to keep track of your day to day spending. Our charts list some of the best cards on offer, with their rates, interest free periods, and other benefits.

Sometimes unfortunate events happen. So protect yourself from the unexpected by taking out a comprehensive business insurance policy. Use our website to compare the different types of cover, from public liability to professional indemnity insurance.

Devices such as card machines and online payment services can be an important tool for your business. Click here to find a payment service tailored for your business.

As your business grows it could become more challenging to balance the books. It might be worth investing in specialised accounting software to make it easier to manage your funds. This, plus some of best card machines, are explained in more detail.

Looking to grow your cash reserves? Setting up a business savings account can be a great way to put some of your capital to work. Compare the very best business easy access, business notice accounts and business bonds. Involved with a charity or club? Compare charity and club savings accounts.

Those looking to borrow at least £25,000 might wish to consider a commercial mortgage. Visit our chart to find the best rates, terms, and financing options on the market.

In order to grow your business, you may need an injection of capital. But with so many forms of financing available what option is best for your business? Our pages and charts explain.

Looking for a business current account to manage your cashflow? Compare fees, benefits, and eligibility requirements on our charts.

A business credit card can help start-up businesses build their credit score and can be a great way to keep track of your day to day spending. Our charts list some of the best cards on offer, with their rates, interest free periods, and other benefits.

Sometimes unfortunate events happen. So protect yourself from the unexpected by taking out a comprehensive business insurance policy. Use our website to compare the different types of cover, from public liability to professional indemnity insurance.

Devices such as card machines and online payment services can be an important tool for your business. Click here to find a payment service tailored for your business.

As your business grows it could become more challenging to balance the books. It might be worth investing in specialised accounting software to make it easier to manage your funds. This, plus some of best card machines, are explained in more detail.

Looking to grow your cash reserves? Setting up a business savings account can be a great way to put some of your capital to work. Compare the very best business easy access, business notice accounts and business bonds. Involved with a charity or club? Compare charity and club savings accounts.

Those looking to borrow at least £25,000 might wish to consider a commercial mortgage. Visit our chart to find the best rates, terms, and financing options on the market.

In order to grow your business, you may need an injection of capital. But with so many forms of financing available what option is best for your business? Our pages and charts explain.

Looking for a business current account to manage your cashflow? Compare fees, benefits, and eligibility requirements on our charts.

A business credit card can help start-up businesses build their credit score and can be a great way to keep track of your day to day spending. Our charts list some of the best cards on offer, with their rates, interest free periods, and other benefits.

Sometimes unfortunate events happen. So protect yourself from the unexpected by taking out a comprehensive business insurance policy. Use our website to compare the different types of cover, from public liability to professional indemnity insurance.

Devices such as card machines and online payment services can be an important tool for your business. Click here to find a payment service tailored for your business.

As your business grows it could become more challenging to balance the books. It might be worth investing in specialised accounting software to make it easier to manage your funds. This, plus some of best card machines, are explained in more detail.

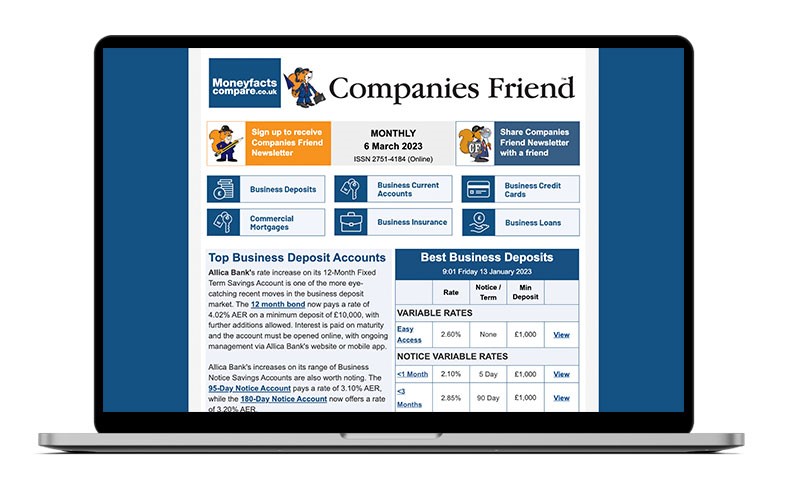

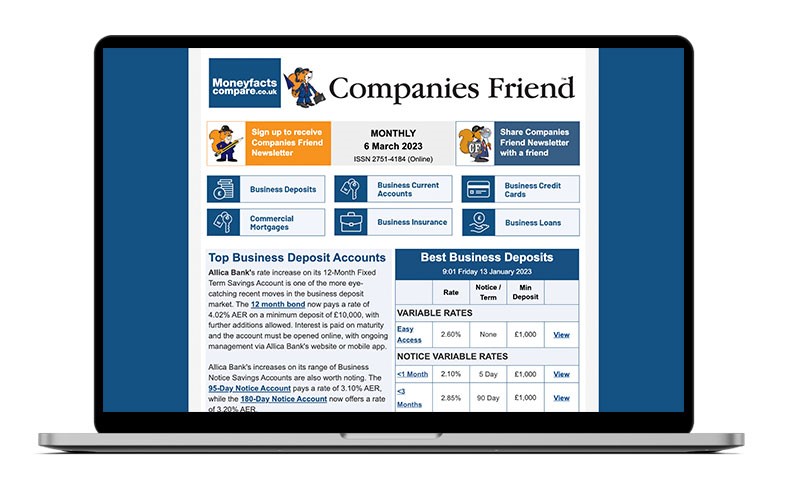

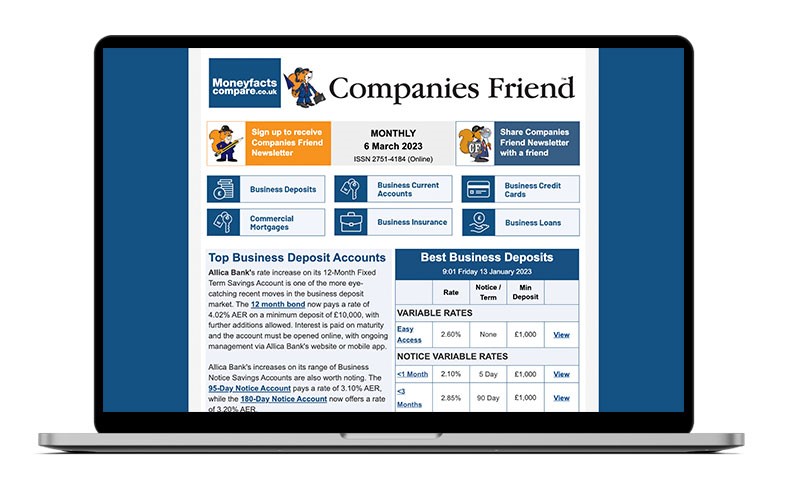

Receive our newsletter, emailed on the first Monday of every month and stay informed with the best business deals.

Companies Friend is dedicated to bringing you the best savings and finance options for your business, whatever its size. Our newsletter features everything from the best business savings accounts for your surplus income to financing options to help your cashflow. Sign up today for FREE.

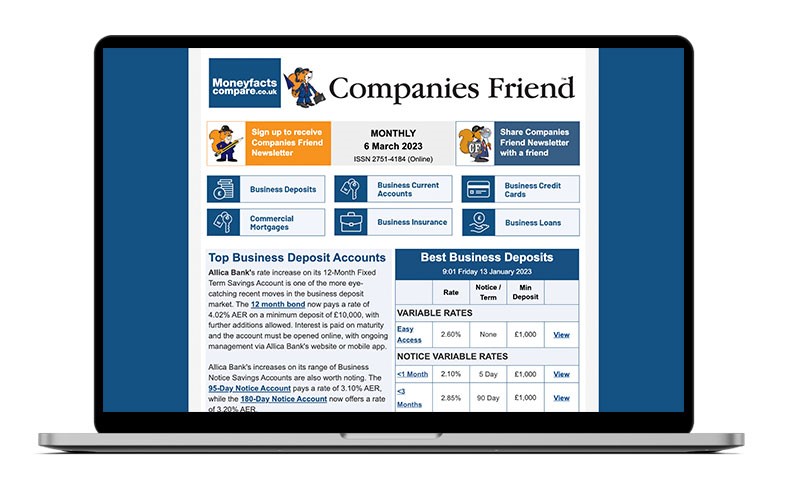

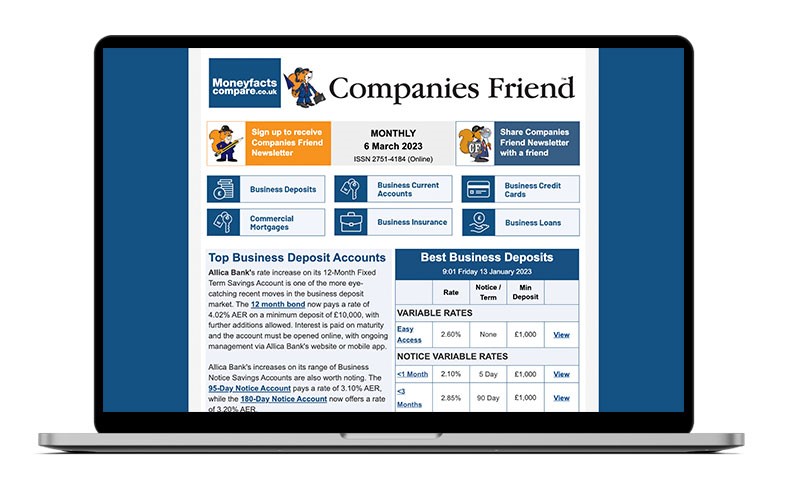

Receive our newsletter, emailed on the first Monday of every month and stay informed with the best business deals.

Companies Friend is dedicated to bringing you the best savings and finance options for your business, whatever its size. Our newsletter features everything from the best business savings accounts for your surplus income to financing options to help your cashflow. Sign up today for FREE.

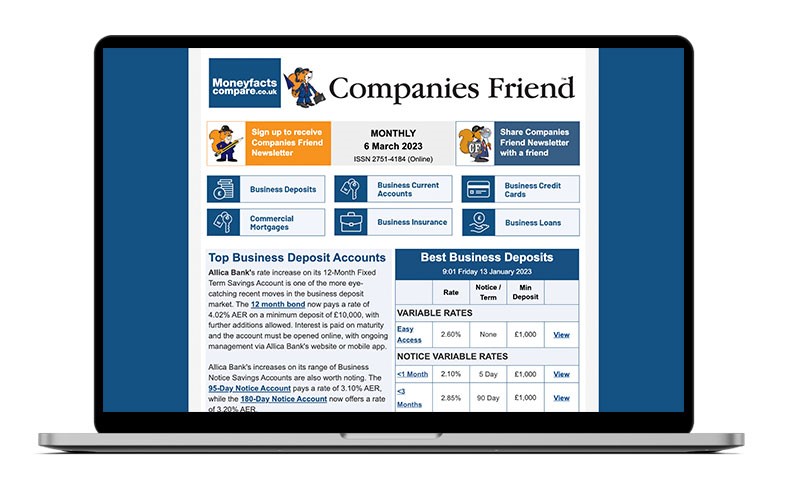

Receive our newsletter, emailed on the first Monday of every month and stay informed with the best business deals.

Companies Friend is dedicated to bringing you the best savings and finance options for your business, whatever its size. Our newsletter features everything from the best business savings accounts for your surplus income to financing options to help your cashflow. Sign up today for FREE.