At a glance

Investing your money into the right unit trust could be a great way to expose your portfolio to shares, bonds, and other investment vehicles. Plus, if you’re a novice investor, it offers the peace of mind that your money is being managed by a trained professional.

However, there are some caveats to note before putting your money into a unit trust. Below we’ve explained what unit trusts are and how they’re managed, and highlighted some of the best performing funds on the market.

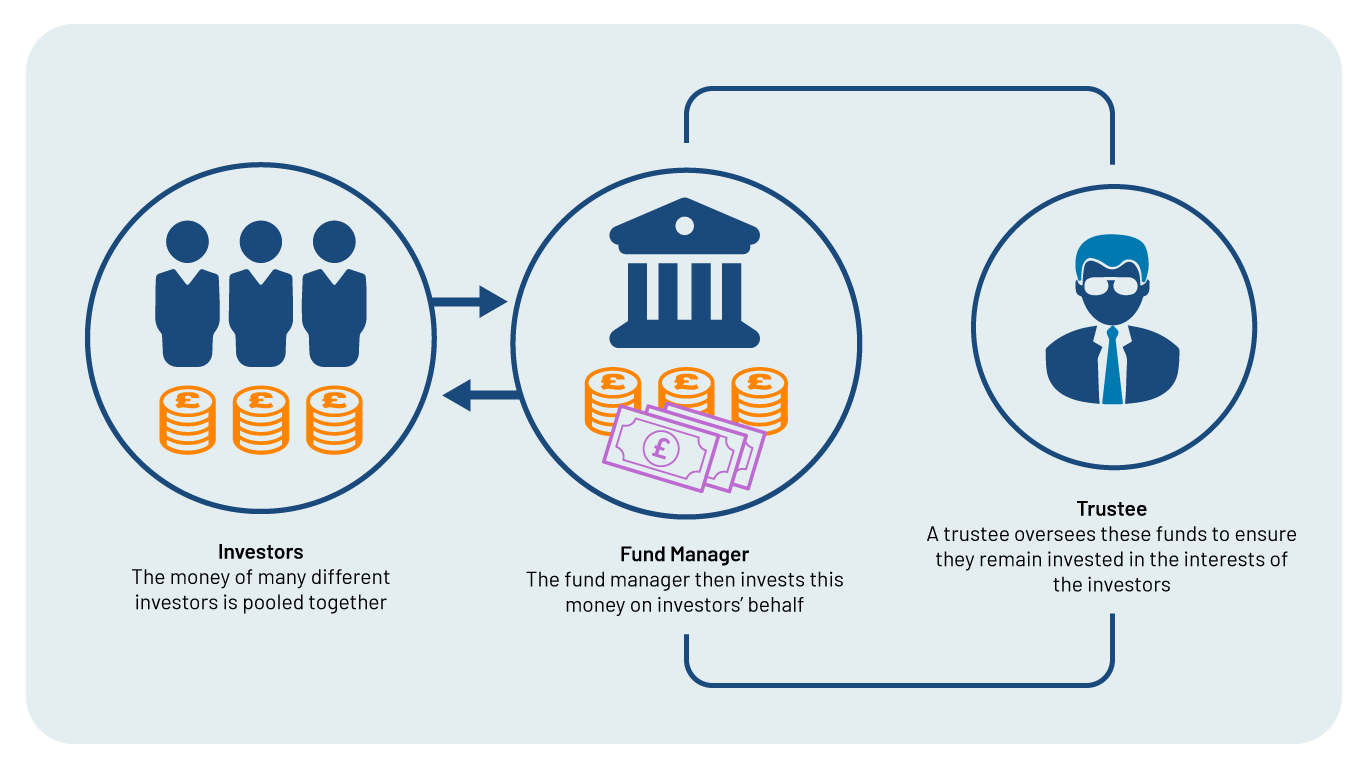

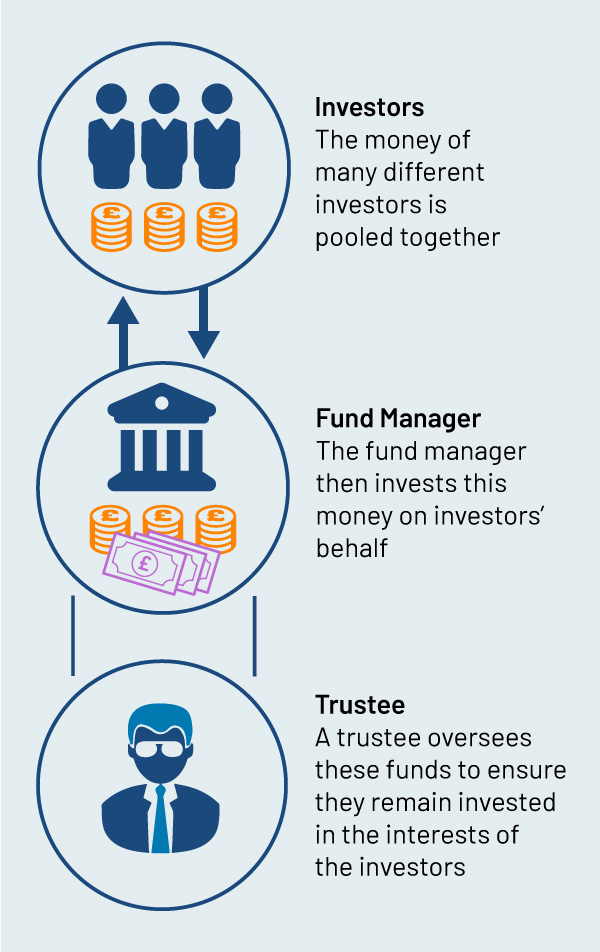

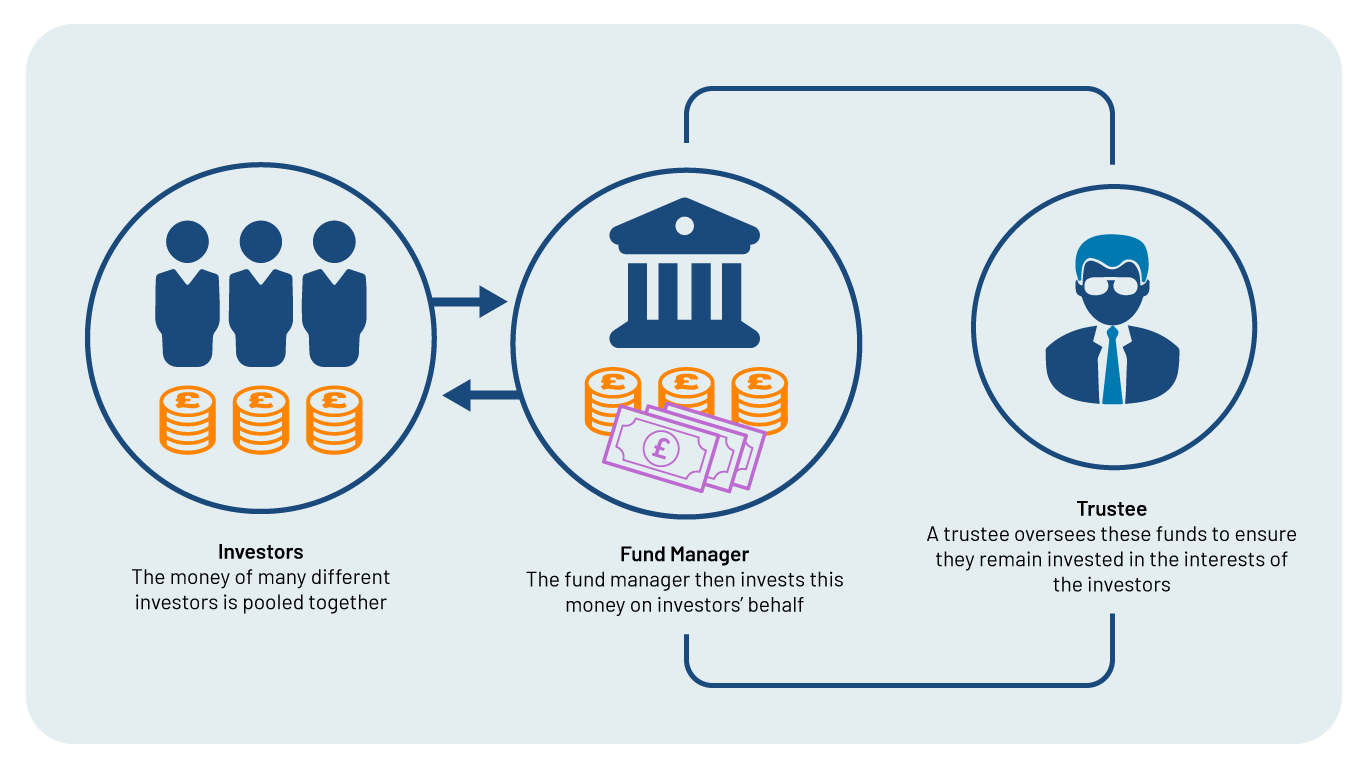

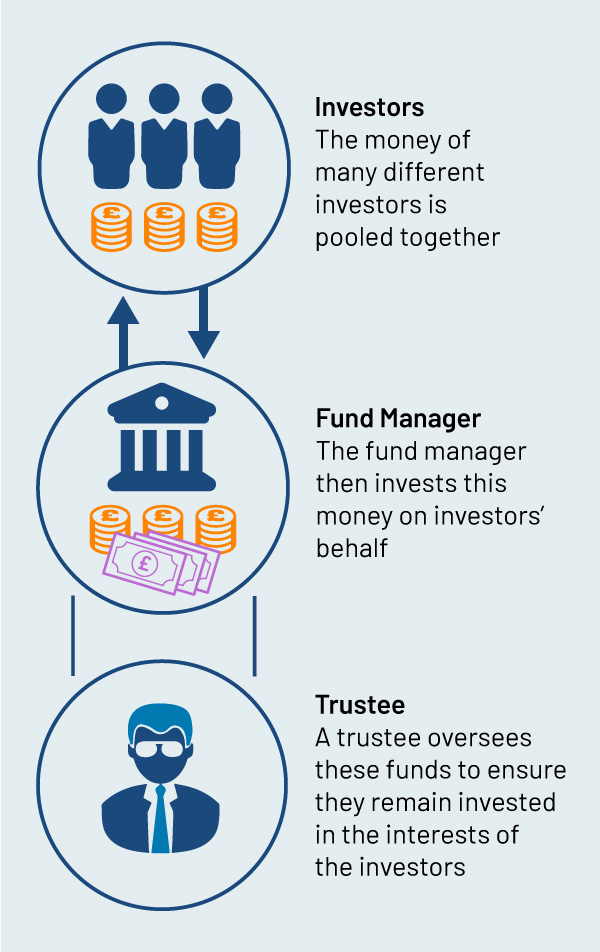

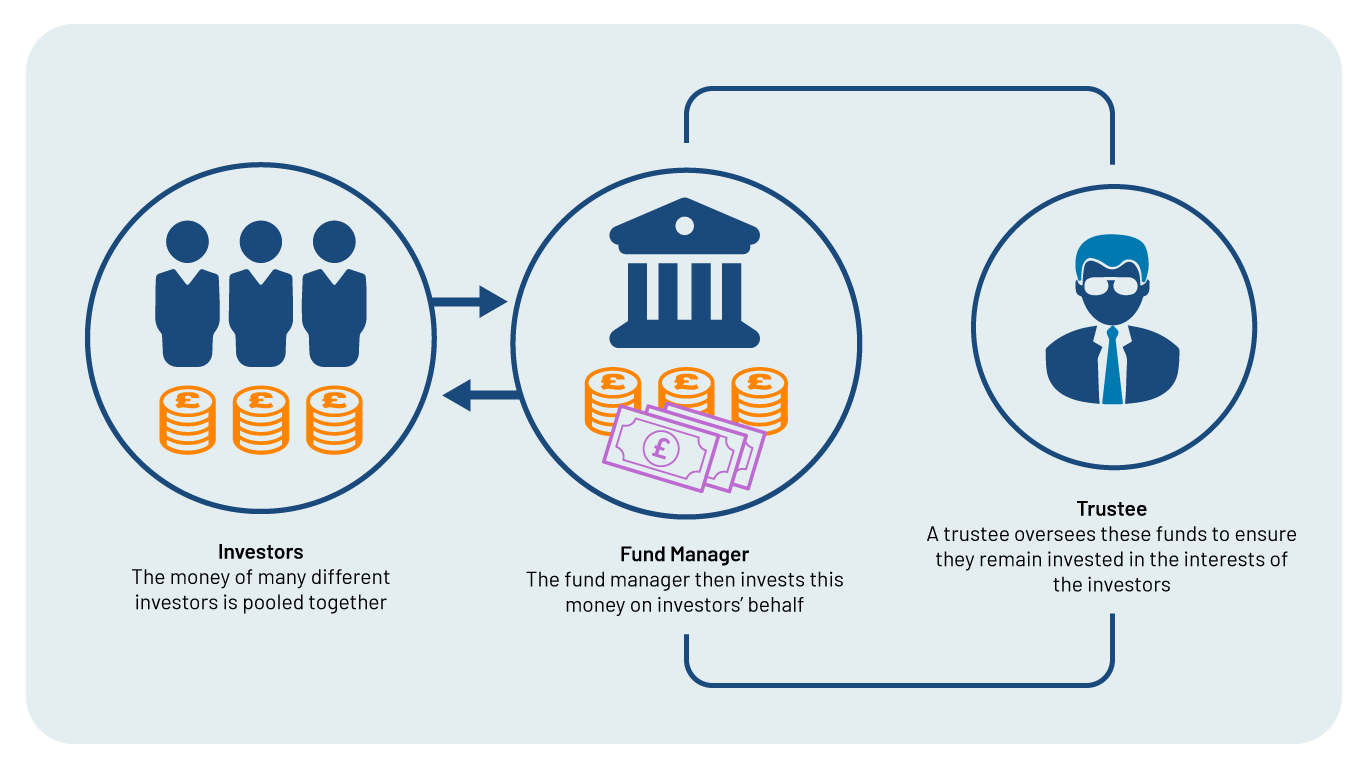

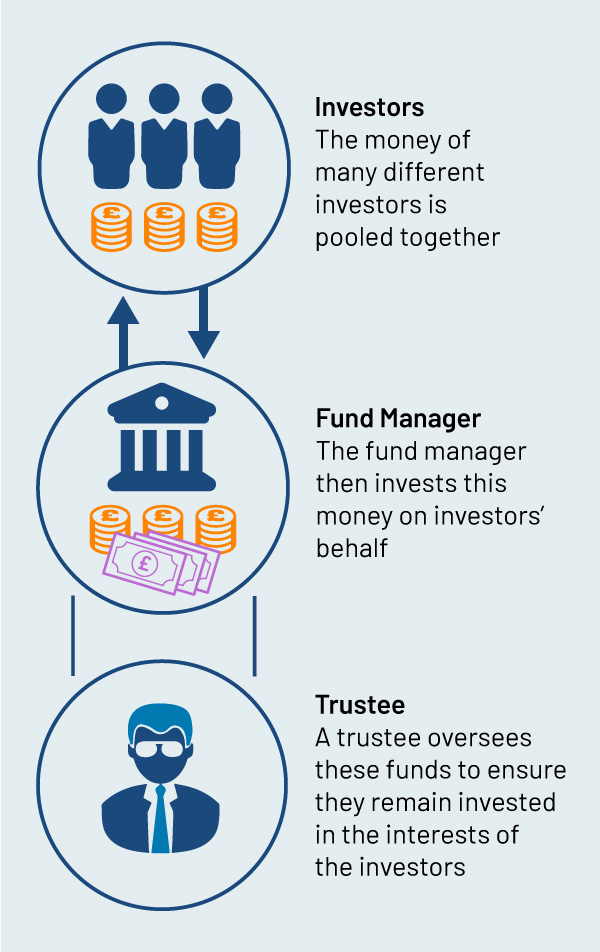

A unit trust is a fund where money from many different investors is pooled together and used to invest in a portfolio of assets. These investments are chosen and managed by a professional fund manager, who aims to ensure that the returns generated are in line with the fund’s objectives. These investments are also overseen by an independent trustee, who ensures that the fund performs in accordance with its stated aims.

When investing into a unit trust, your money will buy a weighted portion of the fund’s underlying assets. These weighted portions are known as units and, because a unit trust is an open-ended fund, there’s no limit to the cash they’re willing to accept.

This means that when it accepts money in, it creates more “units” to reflect the price of the underlying assets.

Since there’s no fixed supply of units, the price of your units aren’t influenced by demand for that trust. In theory, a wealthy investor can double the fund size overnight and it won’t affect your holdings.

Instead, you’ll only earn money if your underlying units gain value over time. Likewise, if your fund manager makes poor investment decisions, then your holdings will decrease in value.

But unit trusts aren’t designed to be traded like equities, they’re generally bought by investors who wish to make money over the long-term.

During the long-term, you’ll also earn dividends or interest from your unit trust. This can either be reinvested into the fund for more units or can be paid away to use elsewhere.

|

|

Spreads the risk –Instead of placing your money in one equity or bond a unit trust diversifies its risk across a range of different investments. This means your returns aren’t reliant on the performance of a single asset and, if it performs badly, its losses can be accounted for through other successes. Investing in a range of unit trusts across different asset classes can further spread your risk. |

|

|

Managed by a professional – Those who don’t have the time or skill to identify a profitable investment sector can benefit from the expertise of a professional fund manager. |

|

|

Easy access to your money – Like an easy access savings account, you can access your money through an investment trust quickly. This is because your money is never locked into a fixed period. |

|

|

No control over your money – While spreading the risk of your investments is key, they still need to be made into the right asset classes. If you don’t agree with the investments made in the unit trust on your behalf, you can’t change them to your liking. |

|

|

Fees involved – While access to a skilled investment professional has its advantages, this comes with a cost. Many unit trusts primarily make their money through fees, and these are charged even if the fund is underperforming. |

|

|

Capital at risk – Like with most types of investments, your capital is at risk. This means you could get back less than what you put in. |

|

|

Spreads the risk –Instead of placing your money in one equity or bond a unit trust diversifies its risk across a range of different investments. This means your returns aren’t reliant on the performance of a single asset and, if it performs badly, its losses can be accounted for through other successes. Investing in a range of unit trusts across different asset classes can further spread your risk. |

|

|

Managed by a professional – Those who don’t have the time or skill to identify a profitable investment sector can benefit from the expertise of a professional fund manager. |

|

|

Easy access to your money – Like an easy access savings account, you can access your money through an investment trust quickly. This is because your money is never locked into a fixed period. |

|

|

No control over your money – While spreading the risk of your investments is key, they still need to be made into the right asset classes. If you don’t agree with the investments made in the unit trust on your behalf, you can’t change them to your liking. |

|

|

Fees involved – While access to a skilled investment professional has its advantages, this comes with a cost. Many unit trusts primarily make their money through fees, and these are charged even if the fund is underperforming. |

|

|

Capital at risk – Like with most types of investments, your capital is at risk. This means you could get back less than what you put in. |

|

|

Spreads the risk –Instead of placing your money in one equity or bond a unit trust diversifies its risk across a range of different investments. This means your returns aren’t reliant on the performance of a single asset and, if it performs badly, its losses can be accounted for through other successes. Investing in a range of unit trusts across different asset classes can further spread your risk. |

|

|

Managed by a professional – Those who don’t have the time or skill to identify a profitable investment sector can benefit from the expertise of a professional fund manager. |

|

|

Easy access to your money – Like an easy access savings account, you can access your money through an investment trust quickly. This is because your money is never locked into a fixed period. |

|

|

No control over your money – While spreading the risk of your investments is key, they still need to be made into the right asset classes. If you don’t agree with the investments made in the unit trust on your behalf, you can’t change them to your liking. |

|

|

Fees involved – While access to a skilled investment professional has its advantages, this comes with a cost. Many unit trusts primarily make their money through fees, and these are charged even if the fund is underperforming. |

|

|

Capital at risk – Like with most types of investments, your capital is at risk. This means you could get back less than what you put in. |

This will depend on your appetite for risk and financial goals. Below, we’ve highlighted some of the best performing unit trusts invested in UK and global equities respectively.

Performance is based on the return generated from a £1,000 investment made over a one-year period. Please note, past performance is not an indication of future performance.

To find the best investment for you we encourage you to speak to an independent financial adviser.

Funds which invest at least 80% of their assets globally in UK equities which have a primary objective of achieving capital growth.

|

Rank |

Unit Trust |

Value of £1,000 lump sum over one year (no charges applied) |

Growth % |

|

1 |

Artemis SG UK Equity R Acc |

£1,306.56 |

30.7% |

|

2 |

Artemis UK Select R Acc |

£1,256.43 |

25.6% |

|

3 |

Ninety One UK Special Situations A Inc |

£1,224.66 |

22.5% |

|

4 |

SVS Zeus Dynamic Opportunities A Retail Acc |

£1,215.26 |

21.5% |

|

5 |

HSBC UK Multi-Factor Equity Inst Acc Fund | £1,191.30 | 19.1% |

Source: Lipper/Moneyfacts Investment Life and Pensions Magazine. Note: the table above is ordered by the best performance up to 1 July 2025 over the past 12 months.

Funds which invest at least 80% of their assets globally into equities. Funds must be diversified by geographic region.

|

Rank |

Unit Trust |

Value of £1,000 lump sum over one year (no charges applied) |

Growth % |

|

1 |

SVS Aubrey Global Conviction Retail A Acc |

£1,315.46 |

31.5% |

| 2 | Equitile Resilience Feeder C USD Acc |

£1,191.28 |

19.1% |

|

3 |

VT Holland Advisors Equity Fund R Acc |

£1,181.67 | 18.2% |

|

4 |

IFSL Meon Adaptive Growth P Acc |

£1,176.70 |

17.7% |

|

5 |

Orbis OEIC Global Equity Standard Acc |

£1,174.98 |

17.5% |

Source: Lipper/Moneyfacts Investment Life and Pensions Magazine. Note: the table above is ordered by the best performance up to 1 July 2025 over the past 12 months.

Besides the unit trusts listed above, there are several highly established companies which offer unit trusts in the UK. These include US-founded asset managers Blackrock, London-based Legal & General, and Scottish investment company Abrdn among others.

Yes, the growth on your unit trust is liable for income or capital gains tax if the unit trust is held outside of a stocks and shares ISA.

Yes, but this is only if your investment provider goes bust. This means it doesn’t offer protection if you lose money through volatile investment periods.

In cases where you have lost money due to the ill-advice of a qualified, regulated financial adviser you may be awarded compensation from the Financial Ombudsman Service.

No, to purchase your units you will need to approach your investment firm directly or through a savings platform.

This is one of the differences between an Exchange Traded Fund (ETF) and a unit trust.

A fund manager will be a lot more involved in an actively managed unit trust, compared to a passive managed unit trust. They may employ a variety of trading strategies to achieve the fund’s growth objectives.

A passively managed unit trust will act similarly to an ETF, weighting its investments in order to track the performance of a certain index. As a result, costs for these funds are typically lower than actively managed funds.

Disclaimer: This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.