The Government's Help to Buy Scheme was first launched in April 2013. It aims to help borrowers secure a 95% loan-to-value (LTV) mortgage on a new build property. The English, Scottish and Northern Irish scheme is now closed to new applications.

The English Help to Buy equity loan involved the Government lending you up to 20% of the value of a new build home outside of London and up to 40% in London. There is a similar scheme available in Wales up to March 2023 but there may be differences in how this schemes work. You would need to have saved at least 5% of the property value as a deposit to qualify for a Help to Buy equity loan. You could then use this deposit of at least 25% to access a range of Help to Buy mortgages from participating lenders for the remaining 75% of the cost of your new home.

It is important to note that Help to Buy equity loans could only be taken out for new build properties and cannot be used to help with the purchase of older properties, and it must be your only residence.

Successful applicants pay nothing on the sum lent to them by the Government for the first five years. After this time, you will pay interest on the loan of 1.75%. This rate then increases each year by the CPI (Consumer Price Index – a measure of inflation) plus 2% and continues until you repay the loan in full. From the start of the loan, you will pay a monthly management fee of £1 until the loan is repaid.

It’s important here to stress that the money you pay to the Government at the start of year six and beyond is for the interest on your loan only. The capital amount (i.e. the sum you borrowed from the Government) will not decrease and remains outstanding.

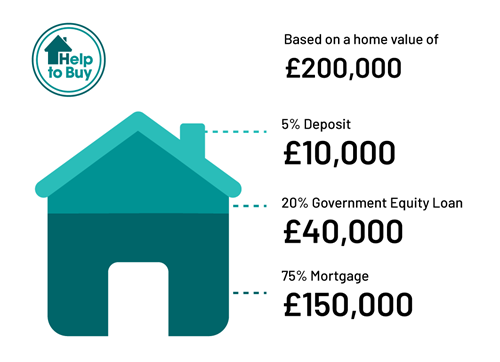

Let’s say that you took out a Help to Buy equity loan for a new build property worth £200,000. The Government would expect you to contribute 5% of the mortgage price (5% of £200,000 = £10,000) leaving £190,000 to finance.

For those outside of London, the maximum Government loan is 20% of the property price. In this case, 20% of £200,000 = £40,000.

You would then get a mortgage for the remaining £150,000 (£200,000 less your deposit of £10,000 and the Government’s equity loan of £40,000).

For those living in London, you can increase the equity loan to 40% of the property’s value.

You must repay the equity loan when you pay off your repayment mortgage, sell your home or reach the end of your loan term, normally 25 years. An important point to note is that the value of the Government’s equity loan is tied to the property value, not the initial amount you borrowed. This means that if property prices have increased since you took out the equity loan then you will need to pay more back, likewise if house prices have dropped, you’ll repay less (subject to interest and fees).

You can repay the loan in full or in part at any time. However, if you choose to pay it off in parts, then these must be a minimum of 10% of the value of the loan.

If no part repayments have been made, at the point you are ready to pay back your Help to Buy equity loan you will need to pay 20% of your property’s current value – not the amount you initially borrowed. In addition, you will need to pay back interest and charges.

If the house price has increased:

Let’s say you originally purchased your house for £200,000 and this has now increased in value to £250,000. If you borrowed the full (outside of London) amount of 20% then you will now have to pay back £50,000 – even though the Government only lent, you £40,000 originally (20% of £250,000 = £50,000).

If the price of your home has gone down:

If your £200,000 house is now only worth £175,000 then the amount you must pay back likewise goes down. In this example, you had borrowed 20% from the Government and would therefore repay 20% of £175,000 = £35,000, even though your original loan was for £40,000.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of MoneyfactsCompare

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0800 031 8553 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0800 031 8553. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

As most of the schemes are now closed you should seek the advice of a qualified adviser, for example for mortgages still available under the Welsh scheme.

Registered builders and developers would advertise if their properties were available under the Help to Buy scheme.

For the Welsh scheme, you must either contact a Help to Buy agent in the area you want to live in or contact a participating house builder. To find an agent in your local area, visit the relevant Government website.

You can enjoy tax-free saving for your first home using a lifetime ISA.

Armed Forces Help to Buy

Designed specifically for people serving in the armed forces, this is a special Help to Buy scheme. Just as with the ordinary Help to Buy scheme, armed forces personnel can get a favourable, interest-free loan, backed by the UK Government to help towards a home deposit and costs.

Rent to Own - Wales

People living in Wales who do not have enough saved for a deposit on a new house are covered by this scheme, which allows them to rent a home that they can buy at a later date. The future mortgage deposit is subsidised by the rent that person pays. This is not specifically covered within this guide.

Help to Buy in Wales

People in Northern Ireland have the Ireland Co-ownership scheme. Borrowers in Wales are covered by the Help to Buy (Wales) scheme.

Other Help to Buy schemes

There are several other schemes all aimed at helping people to own at least a share in their own home. These include Starter Homes, Social HomeBuy and Help to Buy - Shared ownership.

Interested in discussing your options? Why not speak to a mortgage broker. Alternatively, find exactly what you are looking for on our mortgage comparison charts.

Content published on 07 February 2020.

Disclaimer: This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.