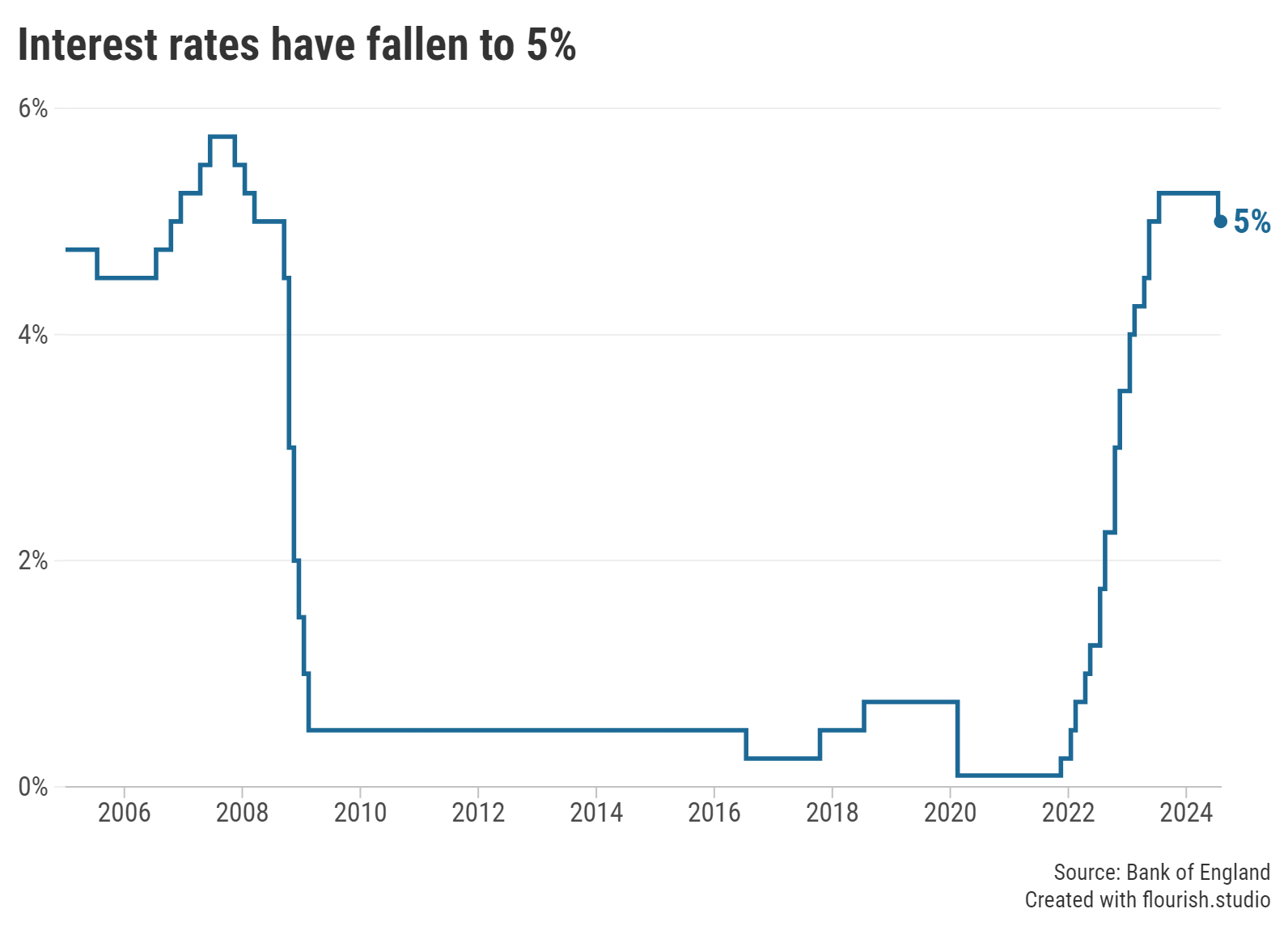

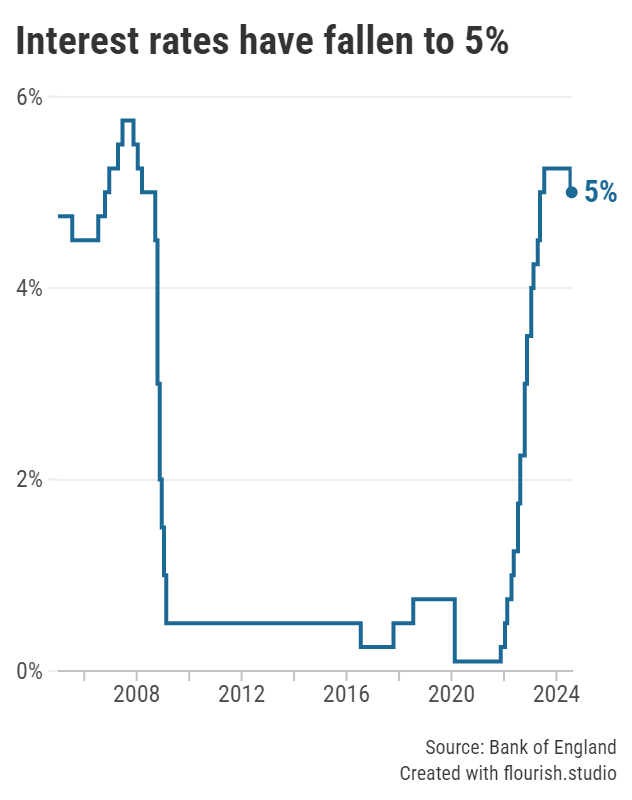

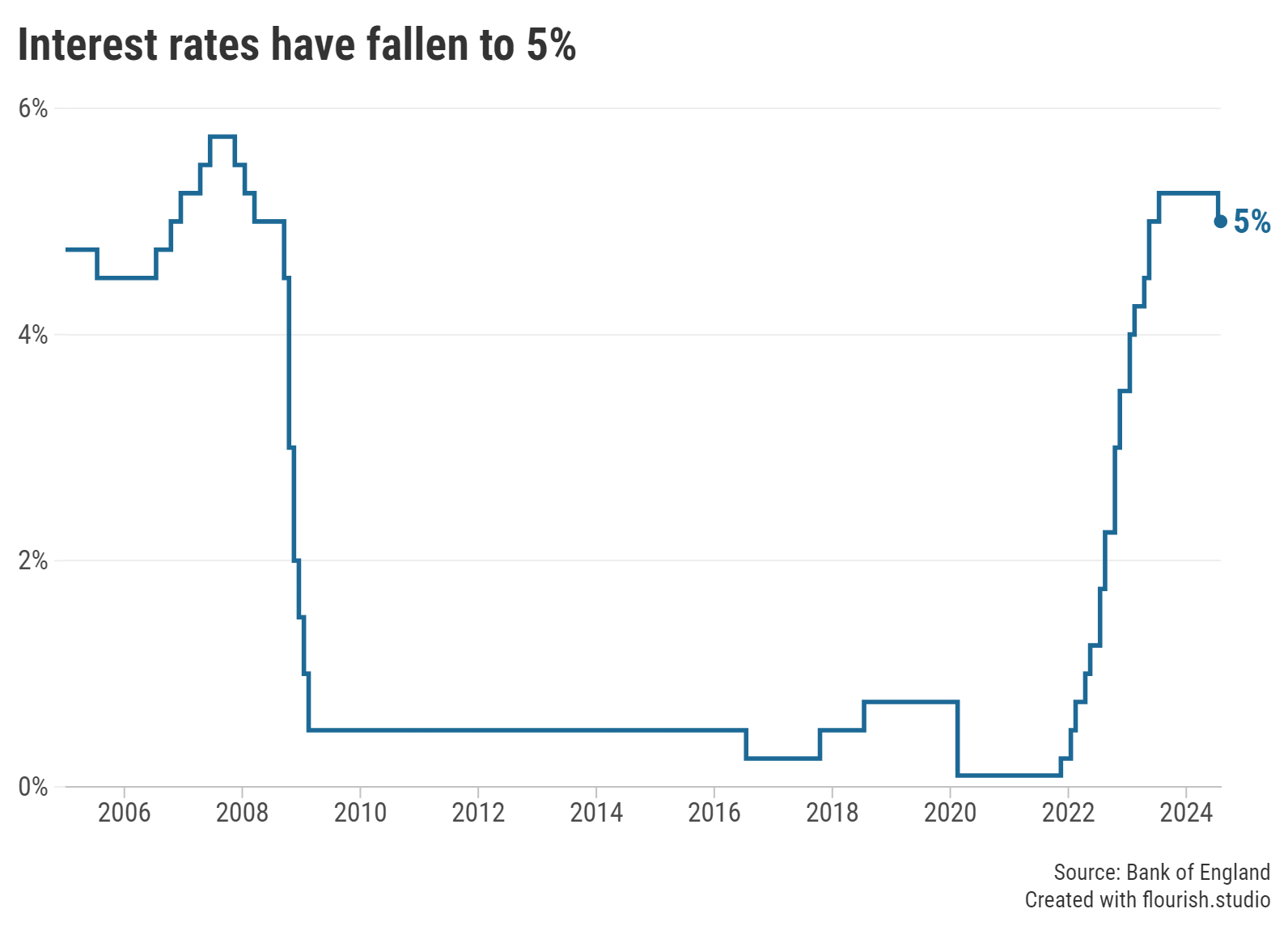

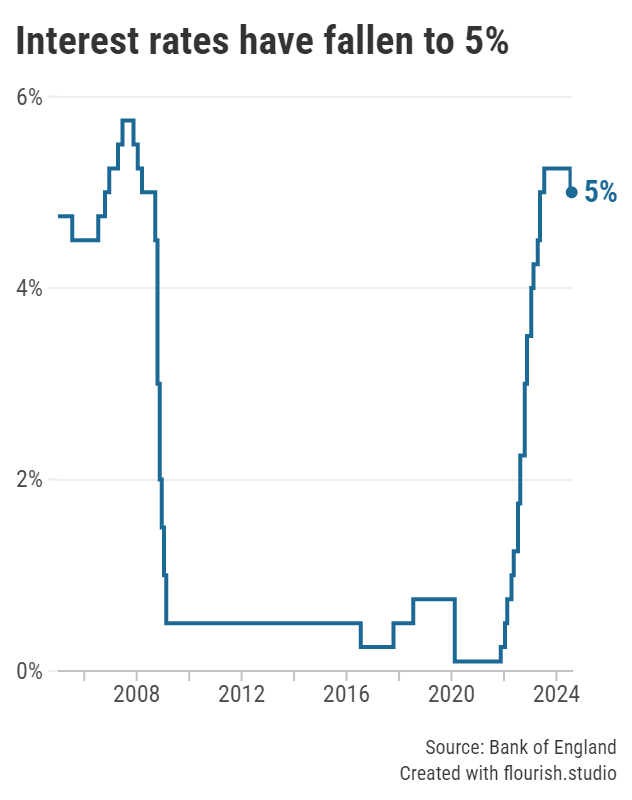

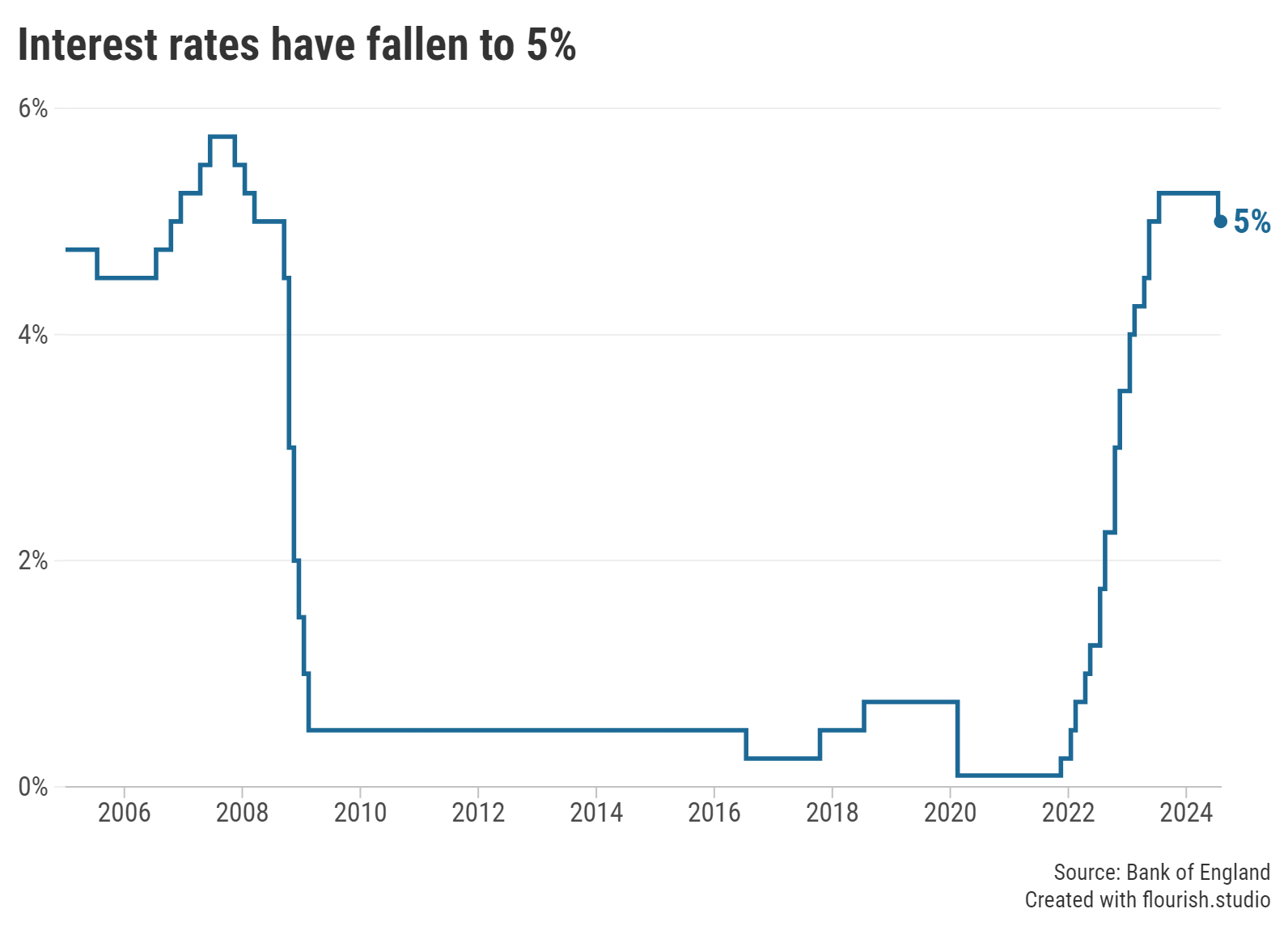

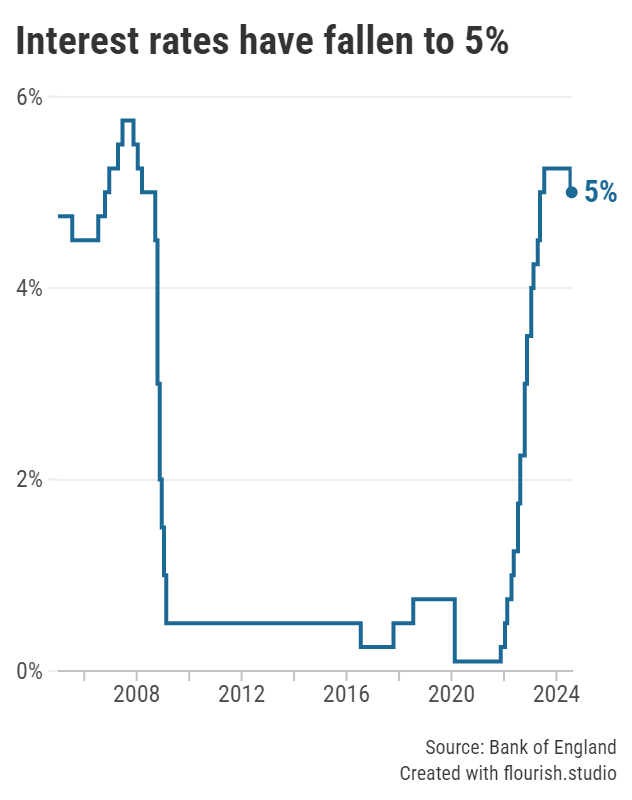

This marks the first cut to the base rate in over four years.

The Bank of England’s Monetary Policy Committee (MPC) voted 5 to 4 in favour of reducing the base rate to 5.00% in its meeting today; the 0.25 percentage point cut brings an end to a year-long interest rate pause.

Between 2021 and 2023, the base rate experienced 14 consecutive hikes as the Bank of England attempted to quell chronically high inflation. By August 2023, it reached a 16-year high of 5.25% - where it has remained until now.

Related Guide: UK base rate explained – and how to respond to changes

Graph: Interest rates between 2005 and 2024.

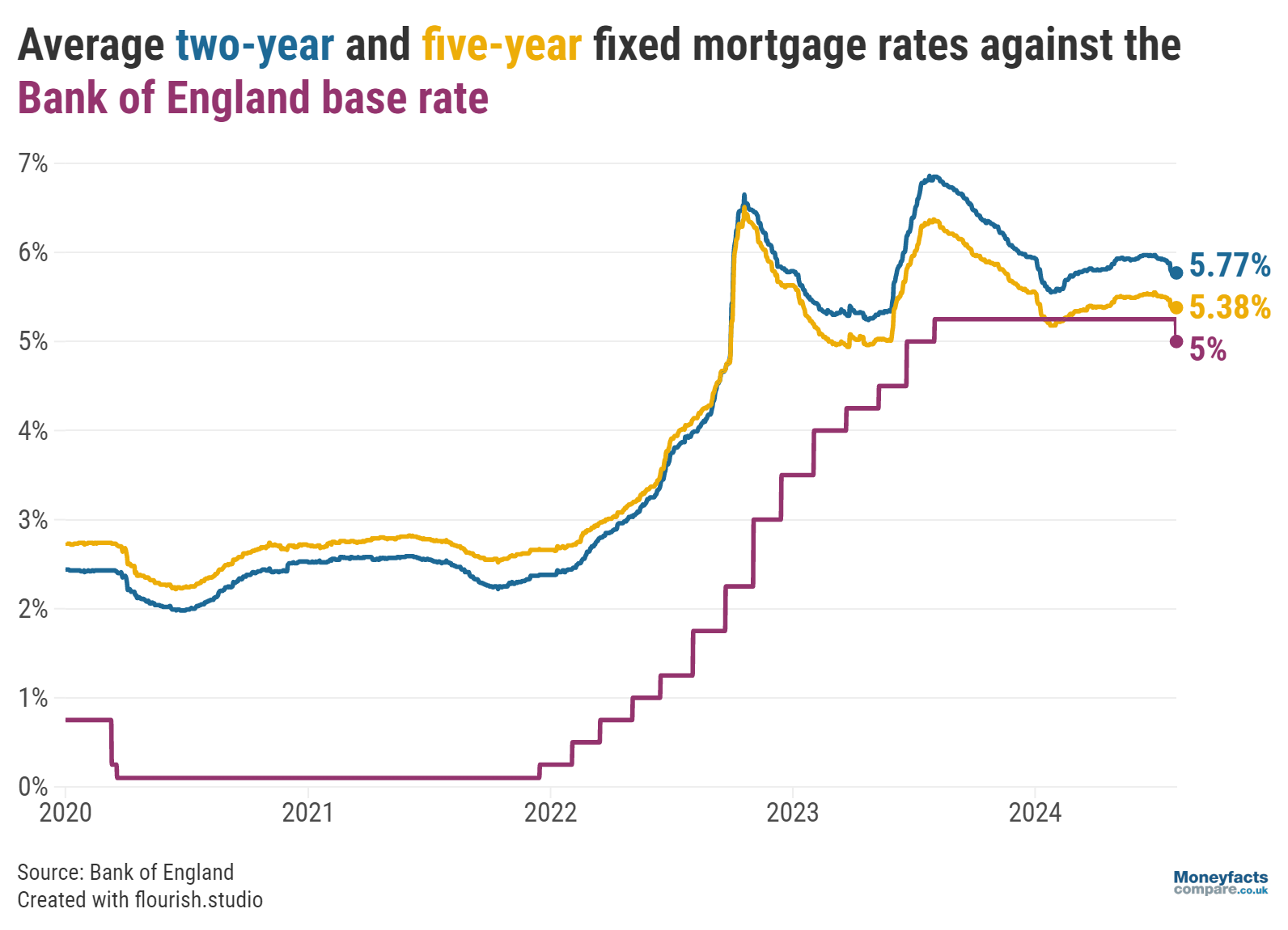

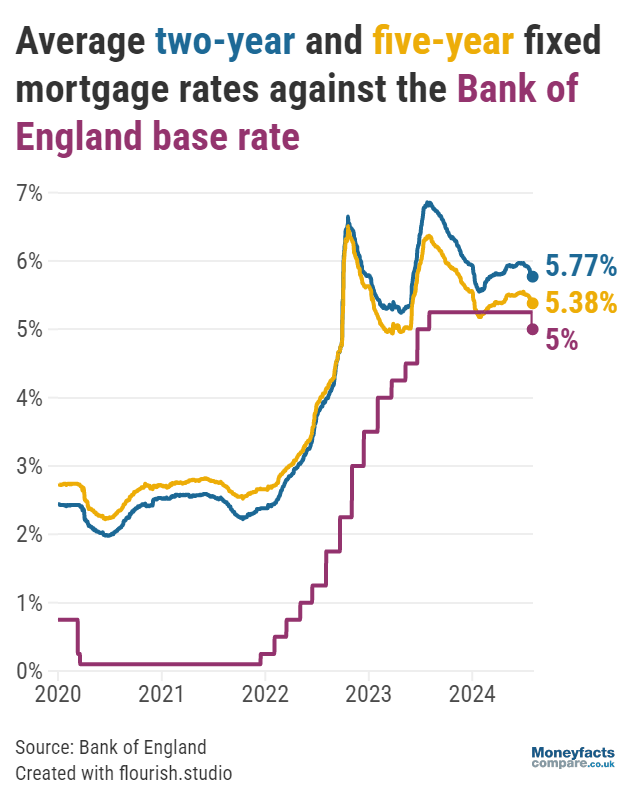

While the decision will be met with relief from many borrowers, the mortgage market has already made optimistic strides over recent weeks.

“Fixed mortgage rates have been falling at a steady pace, with lenders feeling more encouraged to re-price their deals due to positive swap rates,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

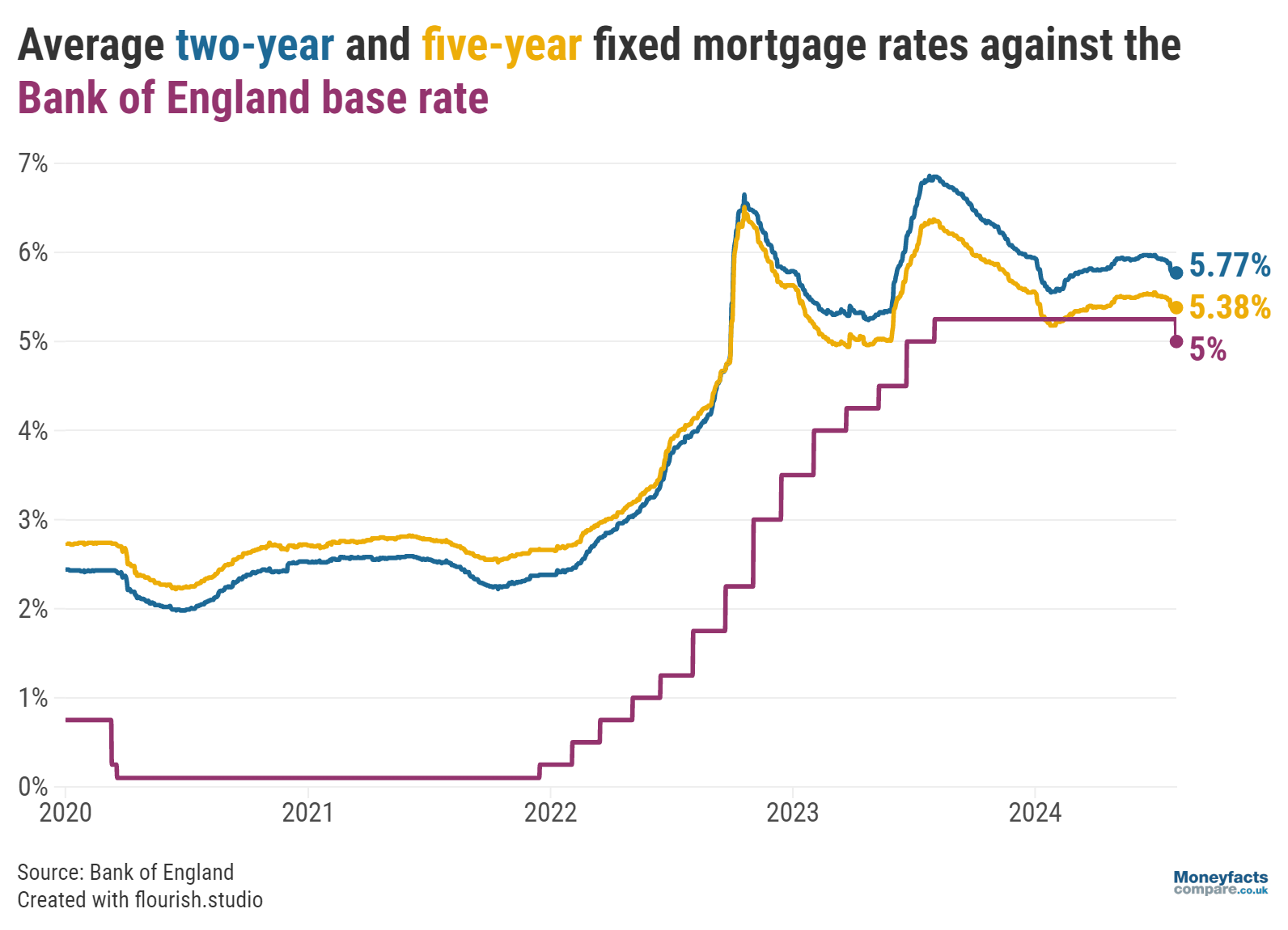

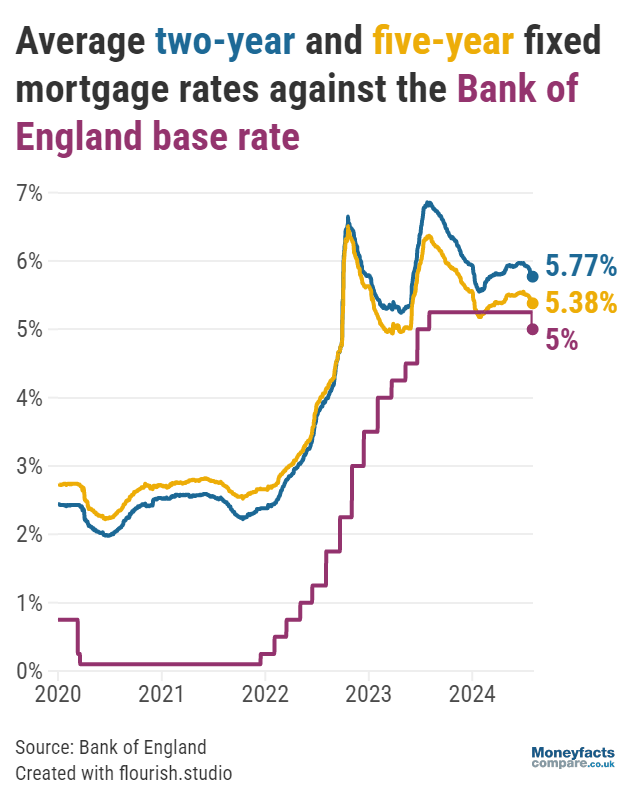

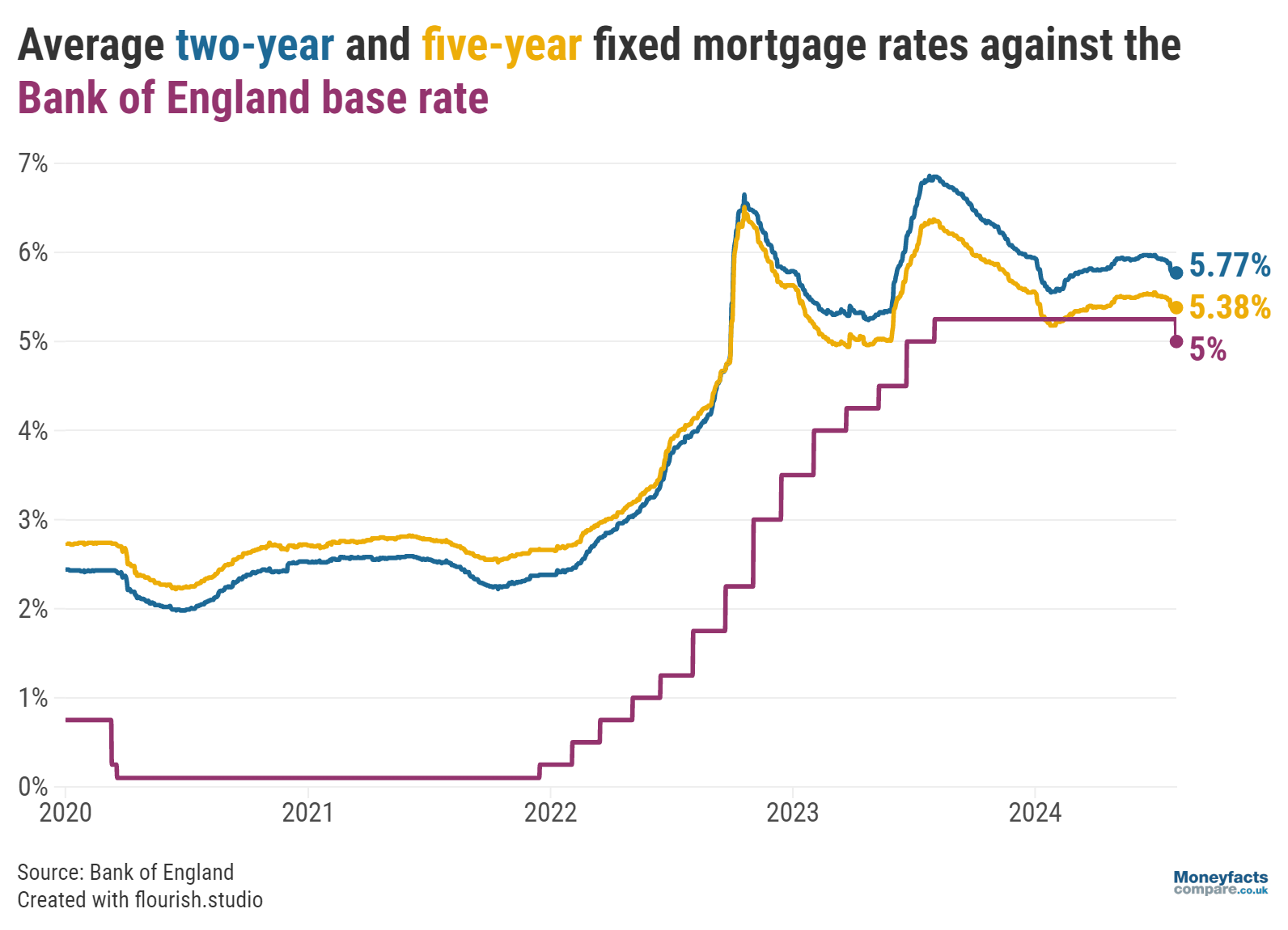

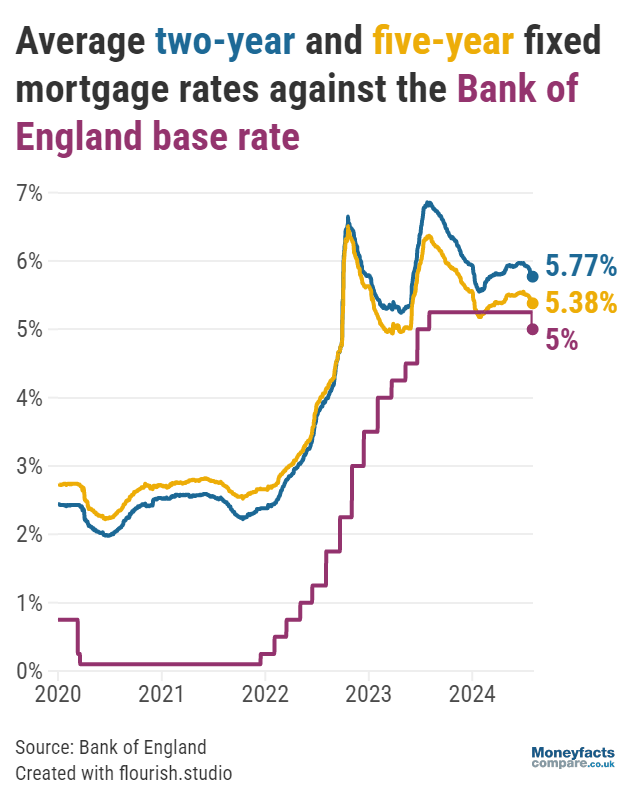

As a result, average two- and five-year fixed mortgage rates decreased considerably month-on-month for the first time since February 2024, and now sit at 5.77% and 5.38%, respectively, Moneyfacts’ data today revealed. Furthermore, last month also saw the brief return of sub-4% mortgages for the first time since April 2024.

Graph: Average two and five-year fixed mortgage rates between 2020 and 2024.

Nevertheless, those looking to refinance will likely find rates higher than the last time they fixed; the average two-year mortgage charged 3.95% in August 2022, while the average five-year fixed rate was 2.84% in August 2019.

“Borrowers coming off a deal this year must acknowledge that they will need to set aside more of their income to cover higher repayments,” urged Springall.

However, with the average Standard Variable Rate (SVR) remaining persistently high at above 8.00%, securing a new fixed deal could still prove more cost-effective than awaiting further reductions while sitting on a lender’s ‘revert to’ rate.

Indeed, Oliver Dack, Spokesperson for Mortgage Advice Bureau, noted the company had already seen a rise in clients “taking matters into their own hands and proactively considering their options” in the weeks and months prior to today’s announcement.

“A cut to the base rate is undoubtedly welcome news for the mortgage market and we hope it incentivises more people to look for a new deal,” he said.

“Recently, there’s been an increased appetite for shorter-term fixed deals among our clients; it seems people are open to reviewing rates more frequently – especially if they believe there’ll be further cuts to the base rate in the not-too-distant future.

“To this extent, we’ve also had more borrowers express interest in tracker mortgages, but it’s important to keep in mind these products can come with a greater number of restrictions and therefore don’t always offer much flexibility. We’d encourage anyone interested in a tracker mortgage to seek advice in order to ensure it’s suited to their circumstances.”

You can compare the lowest mortgage rates on the market using our regularly updated charts.

However, it's important to remember the lowest priced deal may not be the most cost-effective or best suited to your circumstances. Our weekly mortgage roundup provides more information on products offering the lowest rates and includes some Moneyfacts Best But alternatives which are chosen based on their overall true cost.

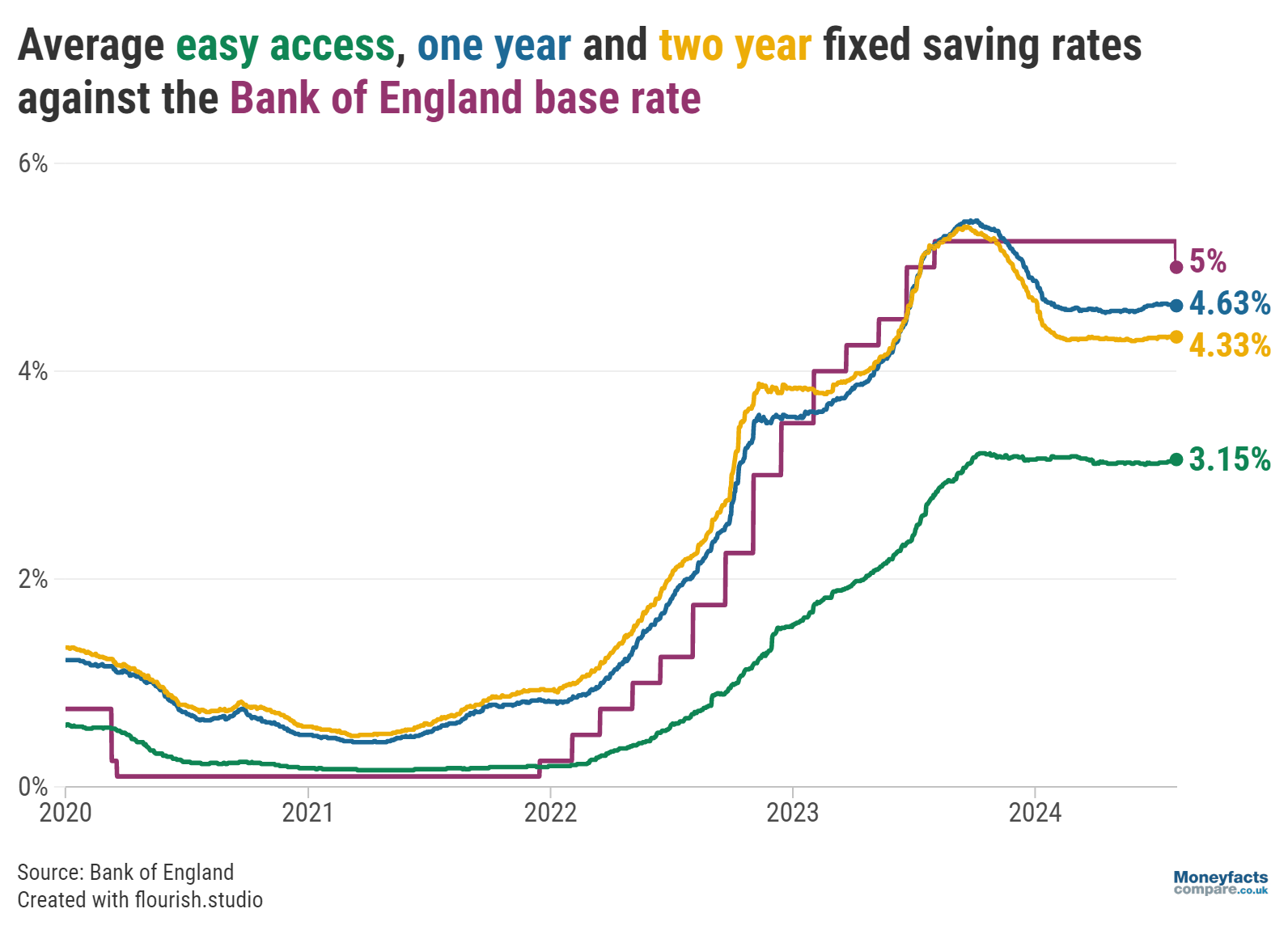

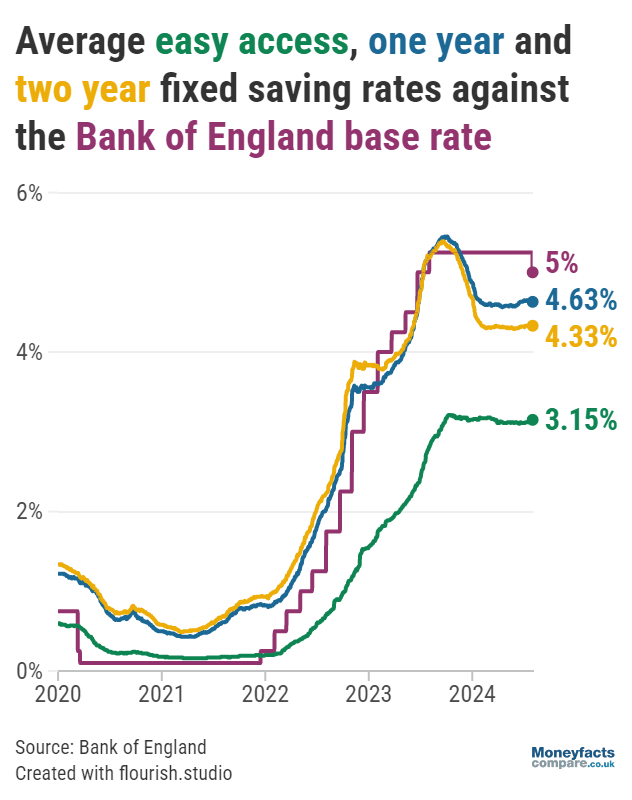

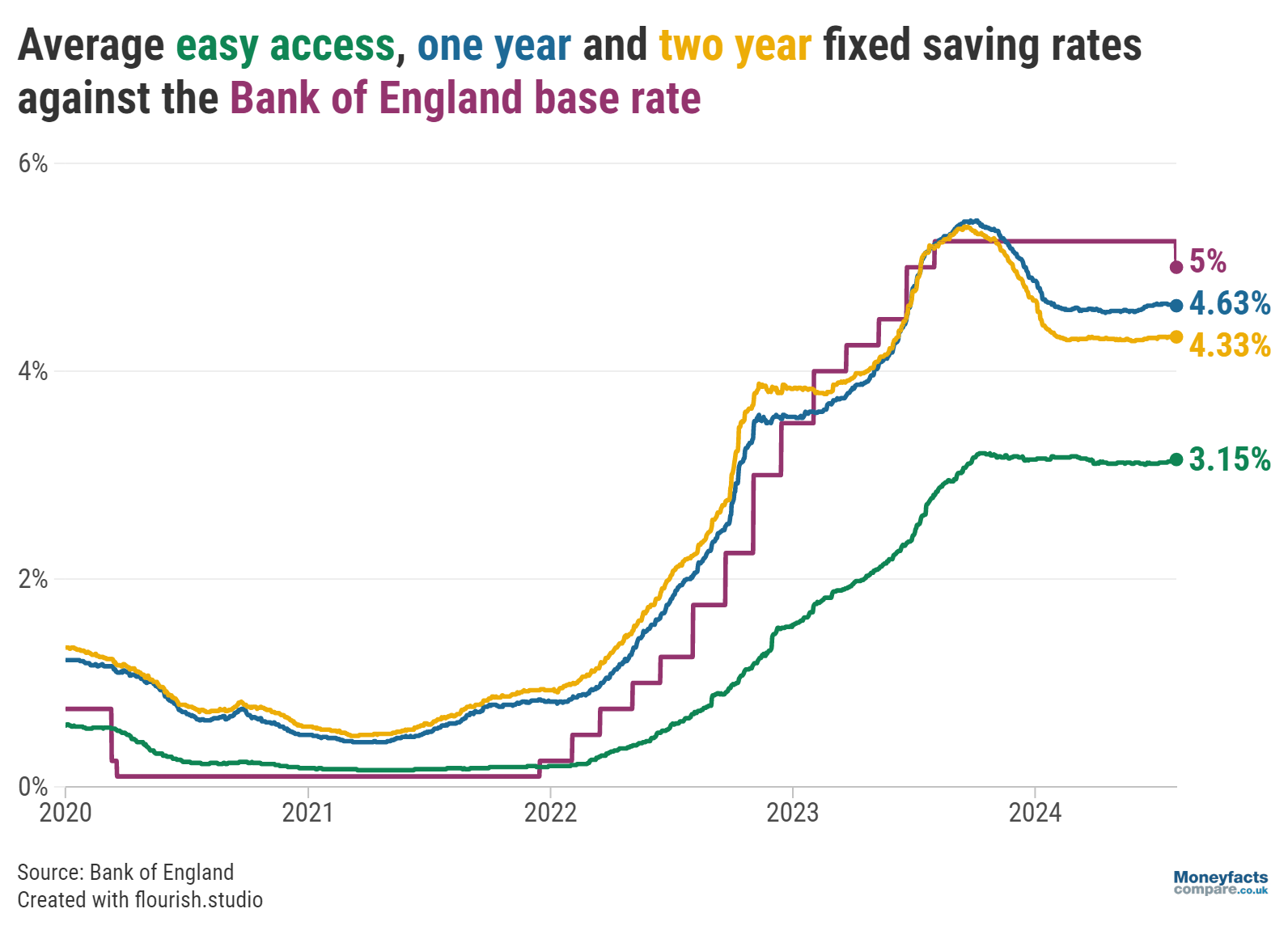

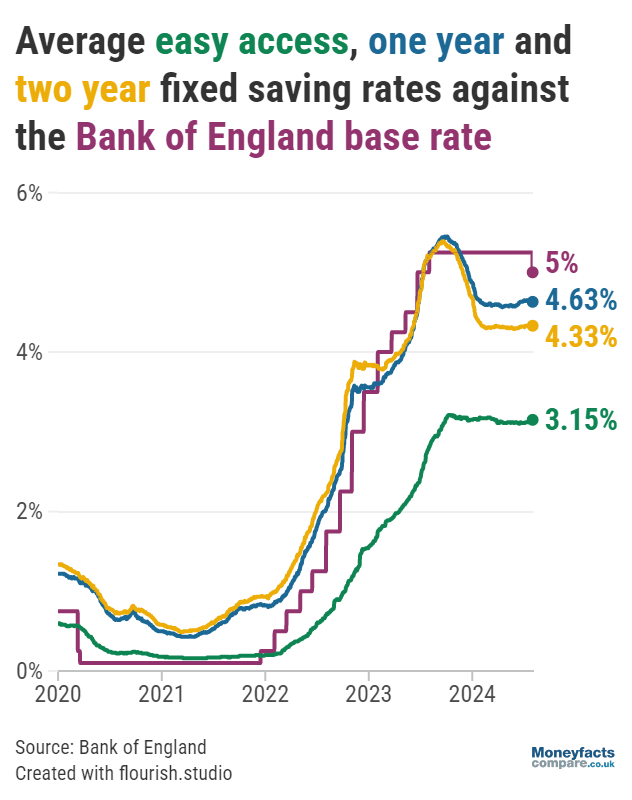

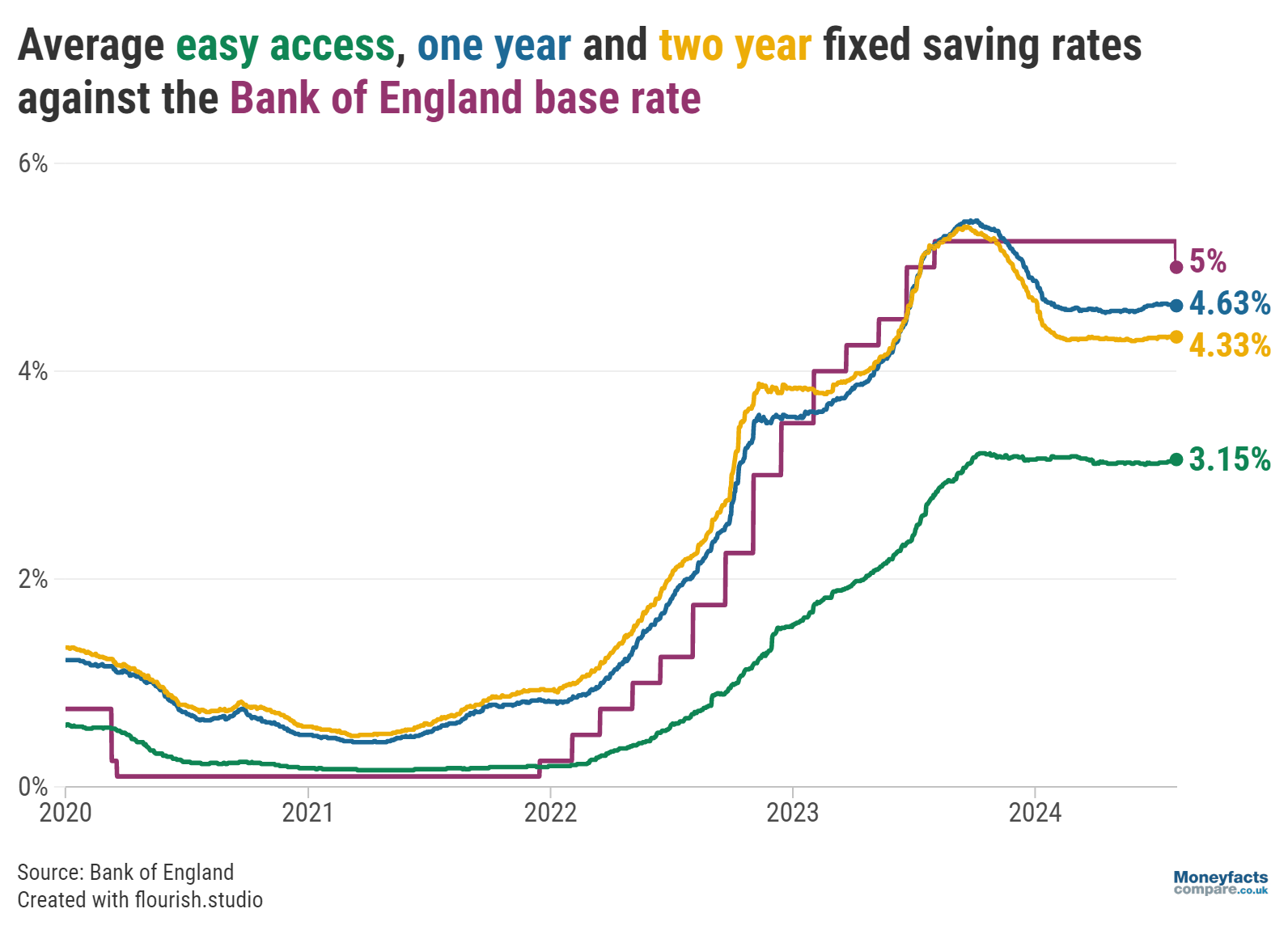

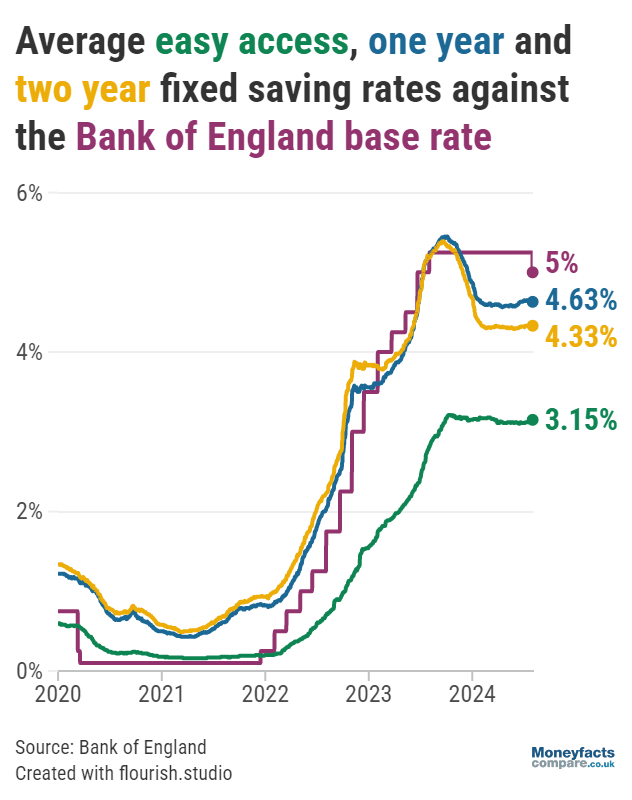

Meanwhile, savers will need to closely monitor their existing variable accounts over the coming weeks; as has been seen in the past, providers are often quicker to pass on cuts to the base rate compared to rises.

“In March 2020, the base rate was cut twice, down from 0.75% to 0.25% and then again to 0.10%,” recalled Springall. “In six months thereafter, the average easy access rate fell from 0.56% at the start of March 2020 to 0.22% in September 2020.”

Even so, variable rates have so far remained resilient despite the UK’s central interest rate going unchanged for a year. Today, the average easy access savings account and ISA pay 3.15% and 3.36% respectively – up from 3.11% and 3.32% at the start of July – with challenger banks offering some of the most competitive rates.

Graph: Average easy access, one and two-year fixed savings rates between 2020 and 2024.

Those wanting to secure guaranteed returns could opt for a fixed bond or ISA instead but may need to act fast to take advantage of an attractive deal before it disappears. While a reduction in the base rate tends to have a bigger short-term impact on the variable rate market, Springall highlighted it can also “trigger providers to adjust fixed rates as a consequence”.

Our savings charts are regularly updated throughout the day to show the best fixed, easy access and notice rates currently available.

Alternatively, those wanting a tax-wrapper for their savings can compare the best rates for ISAs.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.