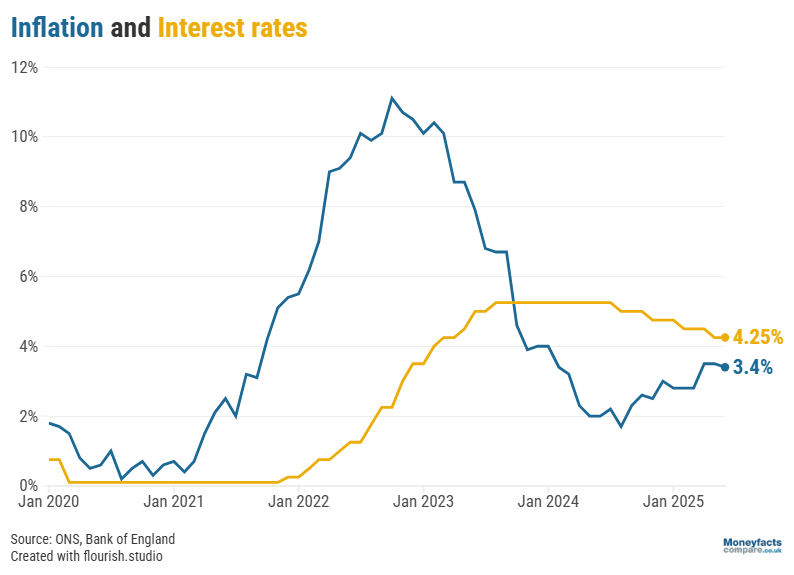

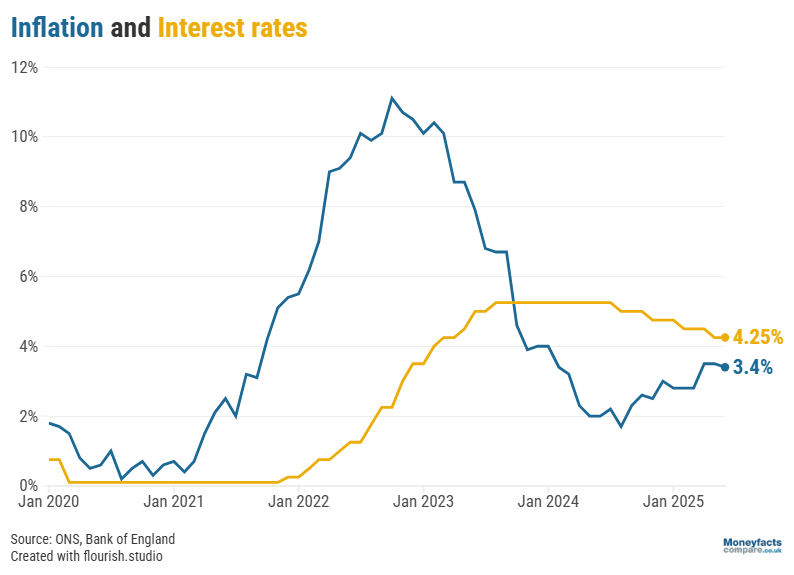

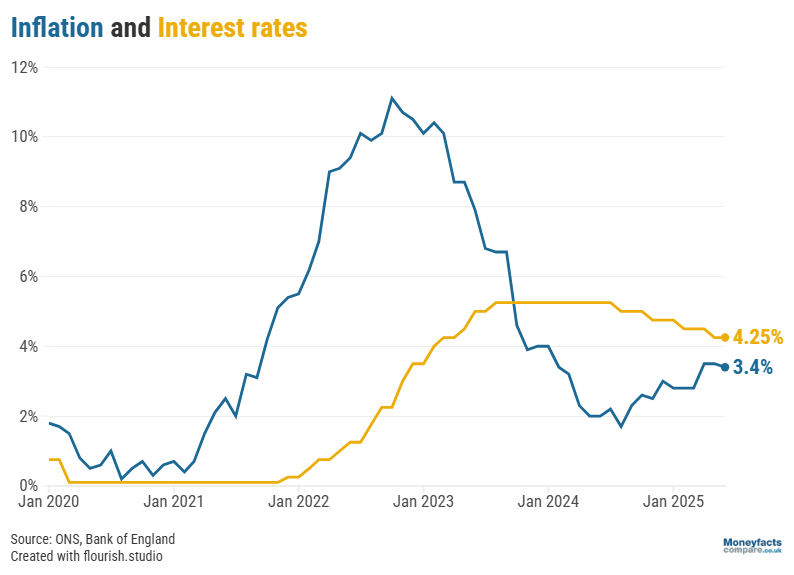

As inflation remains well above the Bank’s 2% target.

The Bank of England’s Monetary Policy Committee (MPC) held off making any further changes to the base rate and instead announced today the UK’s central interest rate will be maintained at its current level of 4.25%.

Concern global tariff turmoil would stunt economic growth paved the way for a 0.25 percentage point reduction last month. However, any hopes of back-to-back cuts were dashed after the Office for National Statistics (ONS) revealed UK inflation reaccelerated rapidly to 3.5% in April as many households faced higher bills.

Graph: Bank of England base rate plotted against UK inflation between 2020 and 2025.

The Bank of England base rate is the amount of interest the UK’s central bank charges other commercial banks and building societies to borrow money. In turn, this influences how much interest these banks and building societies pay savers and charge borrowers.

It’s unlikely the Bank of England would lower the base rate during a period of high inflation; a heightened base rate makes borrowing more expensive and discourages spending which can help to keep inflation in check.

Related guide: What is inflation and how does it affect your finances?

While latest figures released yesterday found the costs of goods and services rose at a marginally slower pace of 3.4% in May, some are calling for the Bank of England to act more cautiously in lowering the base rate to help bring inflation down closer to its 2% target.

In contrast, others – such as the millions of mortgage borrowers coming to the end of a fixed deal this year – may prefer to see more vigorous cuts that could send interest rates spiralling down.

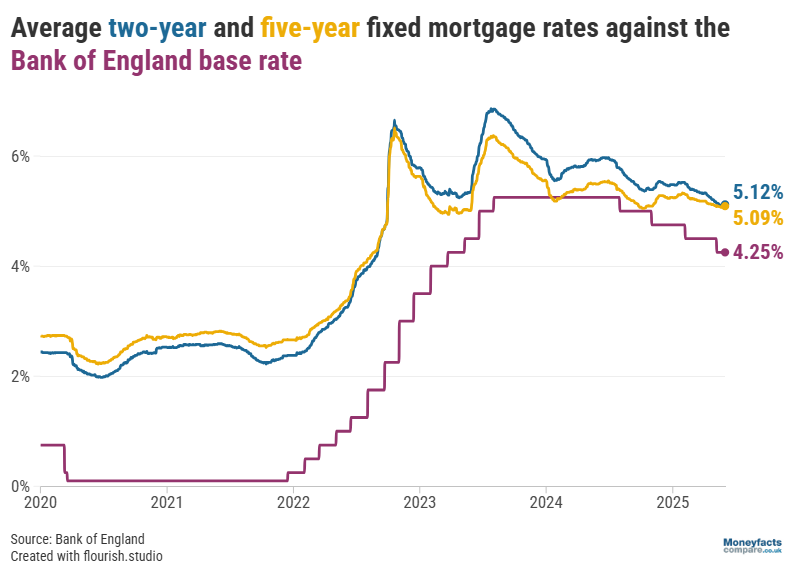

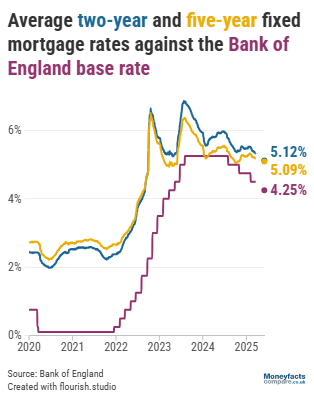

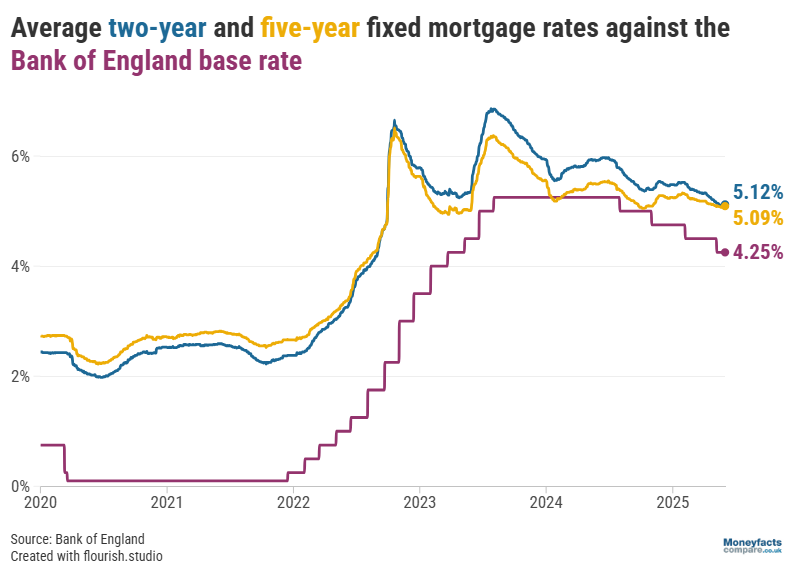

That being said, it’s important to remember fixed mortgage deals are less beholden to sudden changes to the base rate, as lenders typically price forecasts in ahead of time. Furthermore, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, explained “sticky inflation”, “current global pressures” and “swap rate volatility” are among other factors that have a hold on fixed pricing.

This might explain why the average five-year fixed rate dropped just 0.01 percentage point in the month to June to charge 5.09%, despite last month’s base rate reduction. The average rate charged by a two-year fixed deal, meanwhile, fell by 0.06 percentage points to 5.12% over the same timeframe.

Graph: Bank of England base rate plotted against average two- and five-year fixed mortgage rates between 2020 and 2025.

With such a fine margin between typical two- and five-year fixed rates, Oliver Dack, Spokesperson at Mortgage Advice Bureau, said “when it comes to settling on a fixed term, borrowers should consider how long they want to leave before next reviewing their mortgage”.

“Committing to a five-year fixed deal could offer stability, however, those thinking about moving home in the not-too-distant future may prefer to lock into a shorter term,” Dack added. He encouraged those unsure about the best option for their needs and circumstances to seek advice from a broker.

No matter the length of term, securing a new fixed deal is likely to be more cost effective than reverting to a lender’s Standard Variable Rate (SVR), which charged 7.48% on average at the start of this month. While down from 7.58% in May, borrowers can still expect to pay £365 more per month than if they opted for a typical two-year fixed deal (based on a £250,000 mortgage over a 25-year term).

Lower rates and potentially cheaper monthly repayments may even prompt some borrowers to take out a larger loan – particularly those looking to carry out home improvements over the summer months. Indeed, Dack confirmed that last month’s base rate cut had the “much-welcomed effect” of instilling greater confidence in their clients who, in turn, were open to borrowing more.

While you can find the lowest mortgage rates using our regularly updated chart, it’s important to remember the cheapest-priced deal may not be the most cost-effective for your circumstances.

Our weekly mortgage roundup provides more information about deals charging the lowest rates and also features some Moneyfacts Best Buy alternatives (based on their overall true cost). Alternatively, speak to a mortgage broker for personalised advice.

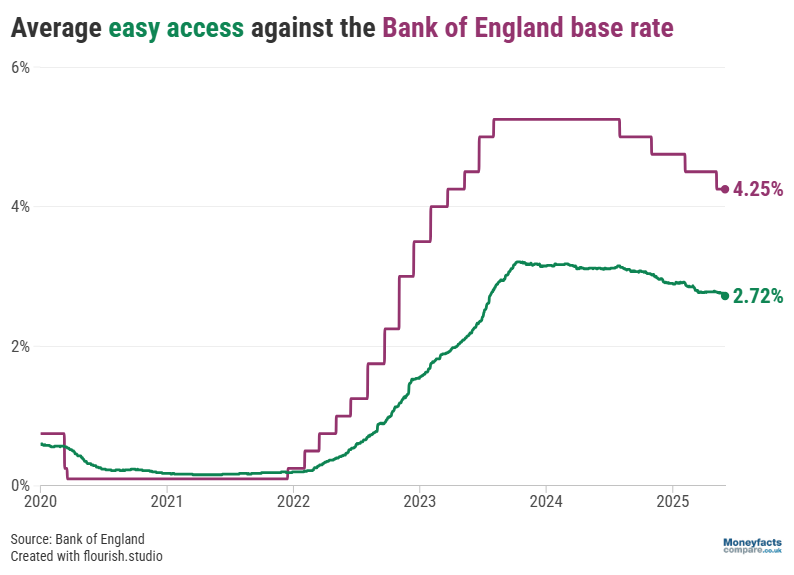

Meanwhile, savers may be hopeful today’s pause offers a reprieve from declining returns. “Cuts to the Bank of England base rate spell misery for savers, as banks are quick to slash rates in response [which] can create an apathetic attitude among aspiring savers as a result,” Springall explained.

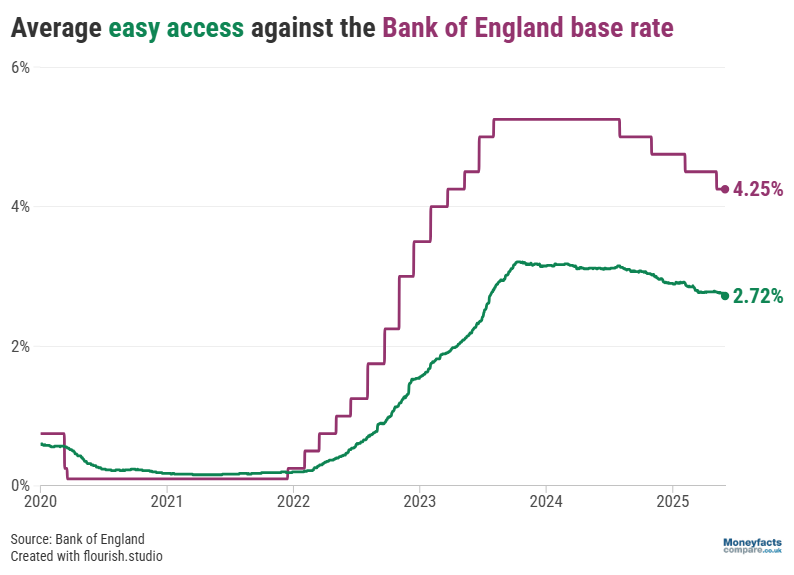

The typical rate paid by an easy access account, for instance, fell from 2.79% to 2.72% between May and June as providers passed the interest rate reduction onto their customers. Similarly, average returns on a notice account plummeted from 3.78% to 3.68% month-on-month.

Graph: Bank of England base rate plotted against average easy access savings rates between 2020 and 2025.

“Loyalty does not pay so it comes down to savers to proactively review rates and switch their account if they are getting a poor return on their hard-earned cash,” urged Springall. She added it’s “vital that savers look beyond the high street banks and instead take notice of the many challenger banks and mutuals competing in the savings arena”.

A number of the UK’s biggest high street brands currently pay just 1.56%* on average across a selection of their easy access accounts – far less than the rate of inflation, which means some savers aren’t seeing their money grow in real terms. By comparison, many of the best easy access accounts offer over 4.50% AER.

Those worried about earning enough interest to risk breaching their Personal Savings Allowance (PSA) could opt for an ISA instead; this may particularly appeal to the millions of savers forecast to pay higher-rate tax at 40% this year who receive a smaller PSA of £500 (compared to £1,000 for basic-rate taxpayers). While the average rate offered by an easy access ISA fell by 0.05 percentage points in the month to June to pay 2.98%, top rates in this sector also currently sit in excess of 4.50% AER.

Our savings charts are regularly updated throughout the day to show those accounts which currently offer the best rates and could help to combat the rising cost of living.

You can also find out more about the top-performing accounts by reading our weekly savings and ISA roundups, or by subscribing for free to our weekly Savers Friend newsletter.

*High street banks include Bank of Scotland, Barclays Bank, Halifax, HSBC, Lloyds Bank, NatWest, Royal Bank of Scotland and Santander. Averages collected from gross interest rates paid across all live easy access accounts with these brands based on a £10,000 deposit, latest rates as at 16 June 2025.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.