This gives the economy time to digest measures announced on 26 November.

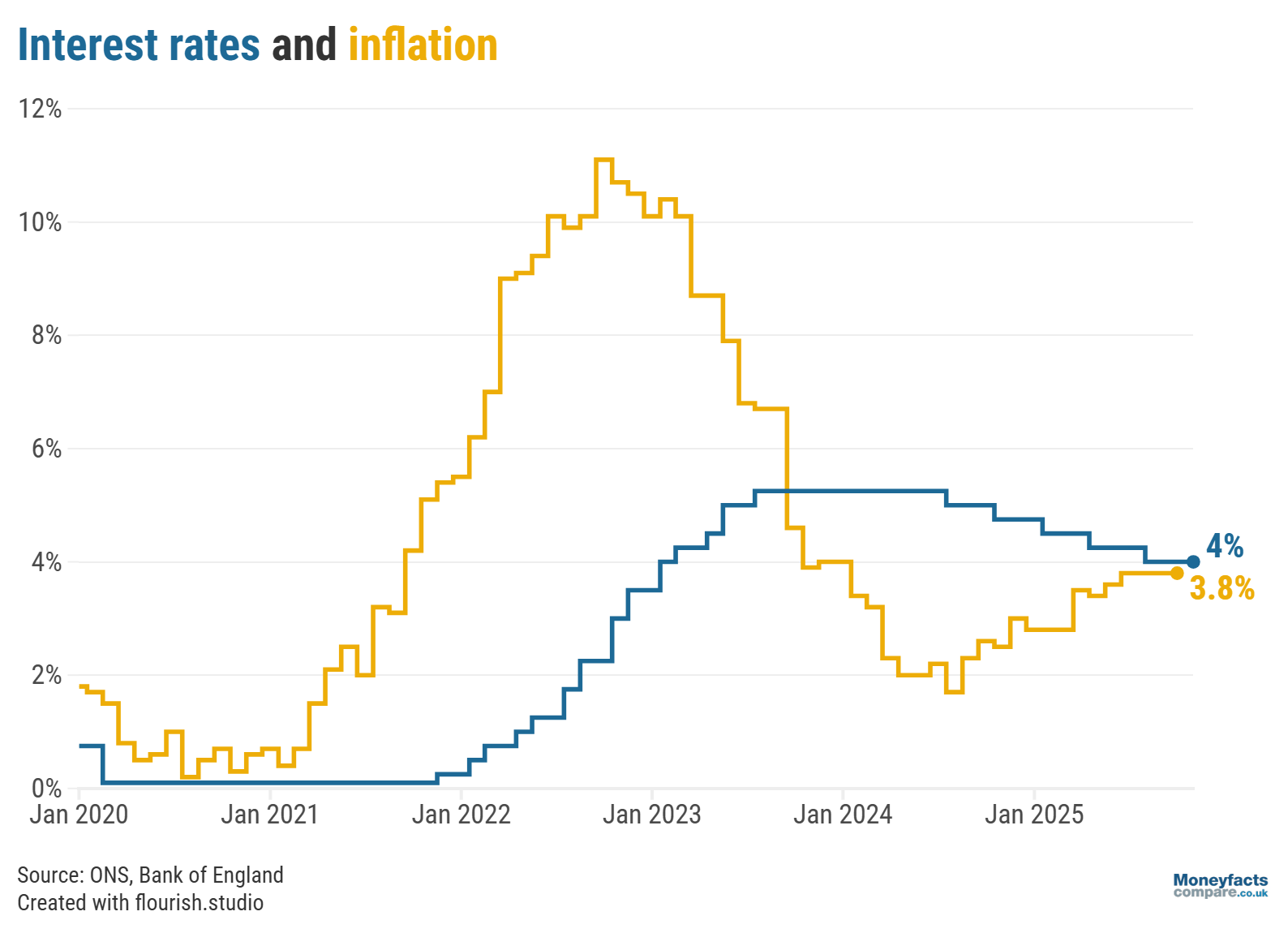

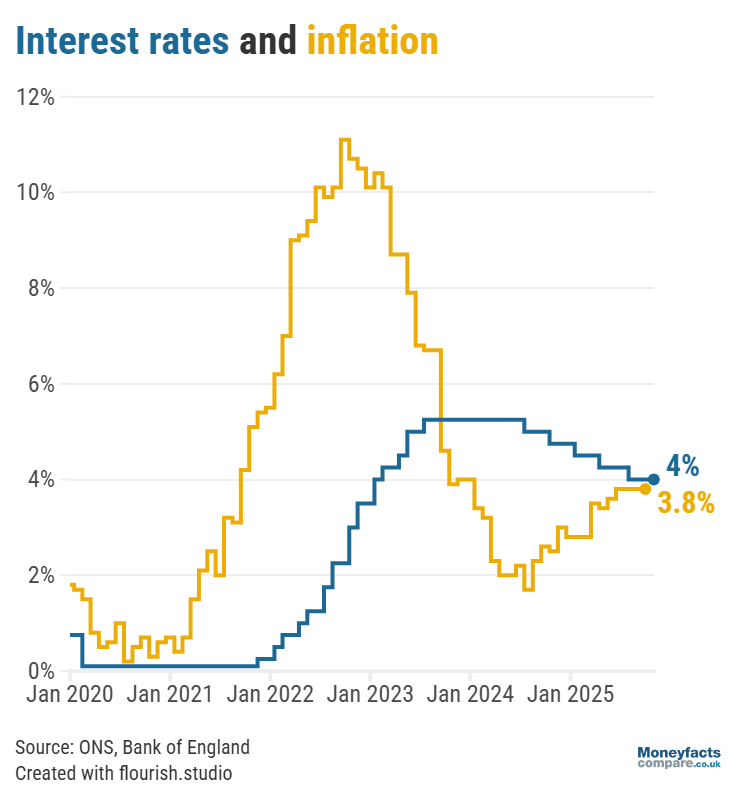

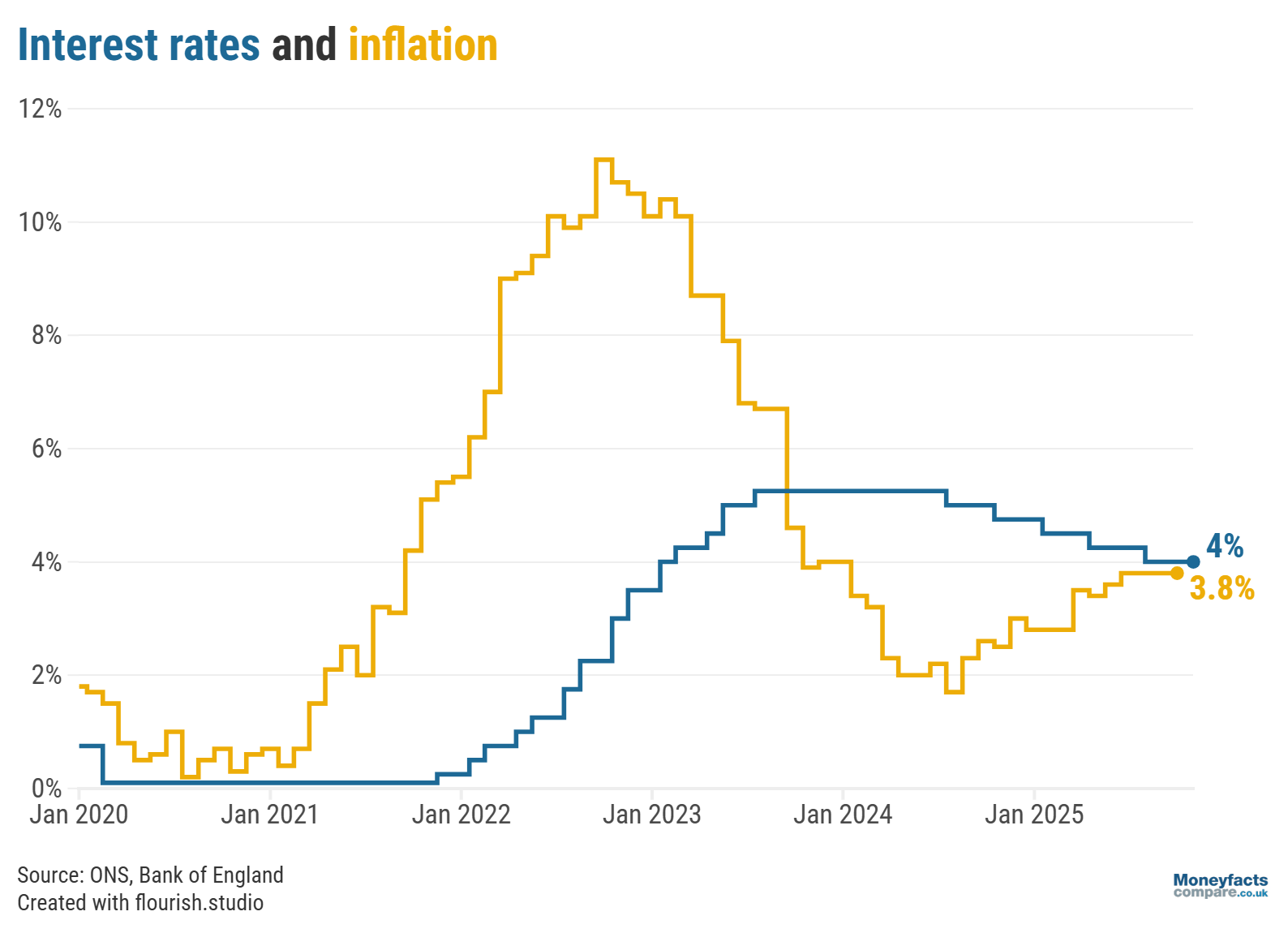

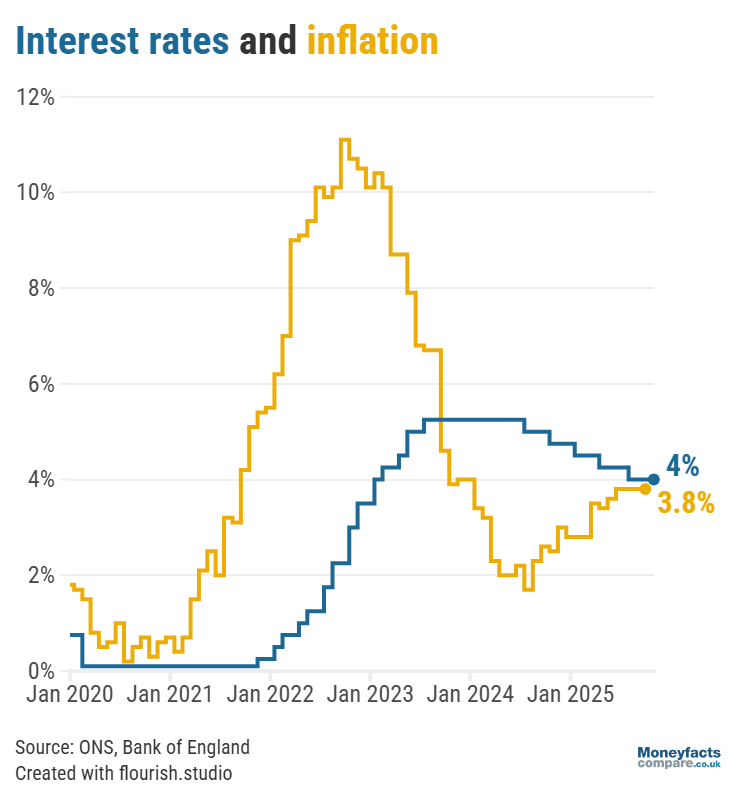

With the Autumn Budget only a few weeks away, the Bank of England’s Monetary Policy Committee (MPC) refrained from making any changes to the base rate today and instead voted to hold the UK’s central interest rate at 4% for a second consecutive time.

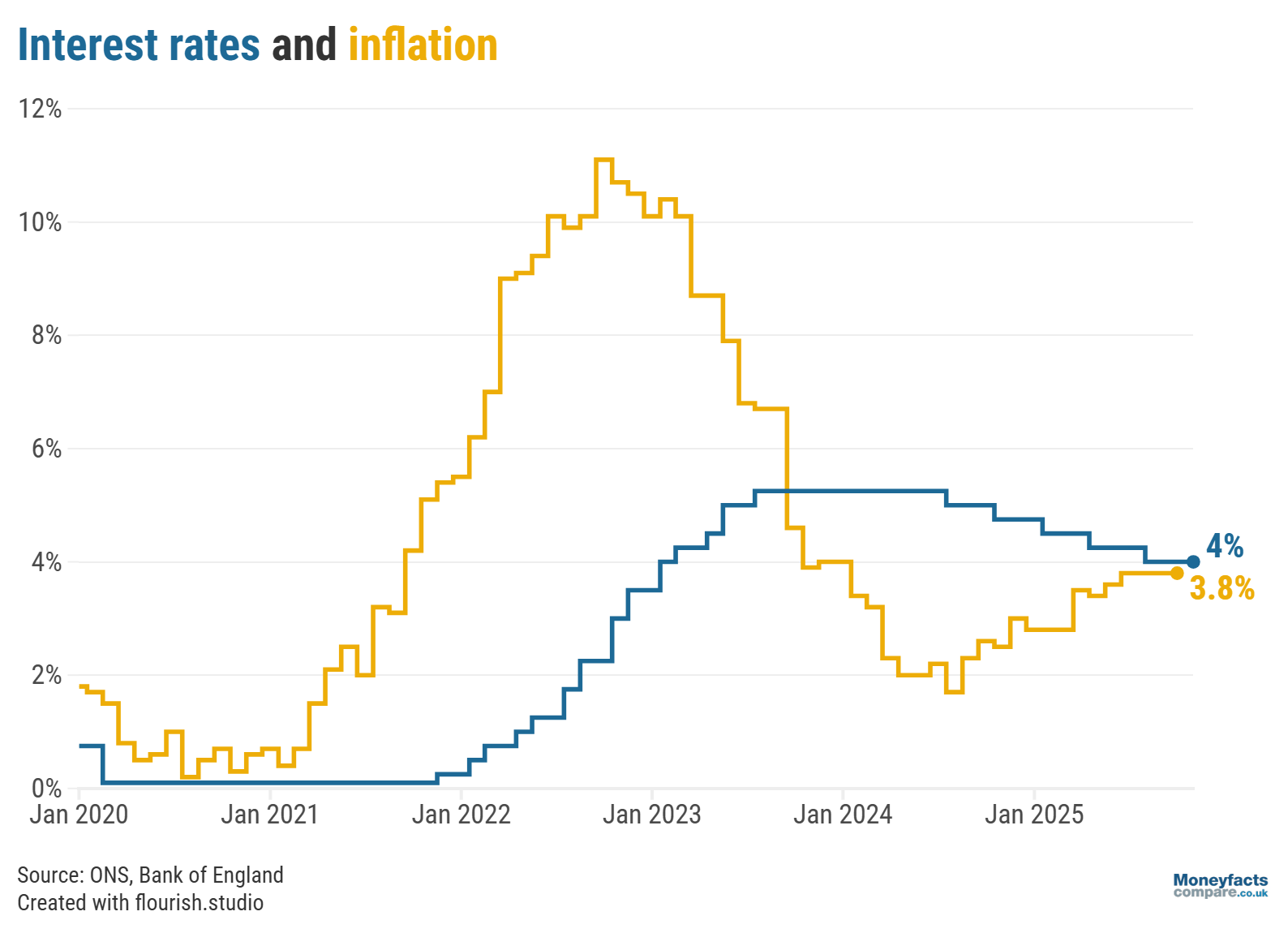

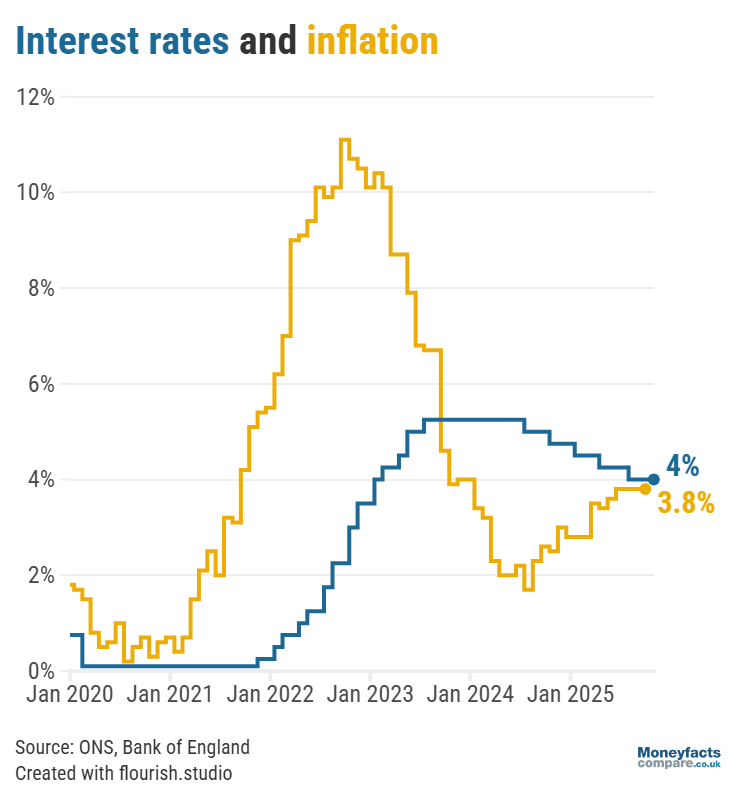

This outcome was largely expected. While inflation rising at a slower-than-anticipated pace of 3.8% in September offered a window of opportunity to lower the base rate, it may be that the MPC is waiting to see what effects any measures announced in the Budget have on the economy before it takes decisive action.

UK inflation vs Bank of England base rate: Rates between January 2020 and November 2025.

The base rate is the amount of interest the Bank of England charges other banks and building societies to borrow money. In turn, it influences how much these providers charge for their mortgages and pay on their savings accounts.

Holding the base rate at a high level can help to keep inflation in check, as it typically makes borrowing more expensive and incentivises savers with better returns. By contrast, cutting the base rate could boost the economy, as it encourages spending by making it cheaper to borrow money.

Savers may still need to take action, as it’s been reported that the Chancellor of the Exchequer, Rachel Reeves, is looking to stimulate greater levels of investing by reducing the amount savers can deposit in cash ISAs each year from £20,000 to £10,000.

“It is unlikely such a radical change would happen overnight, so savers should not panic,” said Rachel Springall, Finance Expert at Moneyfactscompare.co.uk. However, she added that it would be unwise of savers not to review their old accounts and make the most of their remaining cash ISA allowance.

“This is particularly important for those impacted by fiscal drag, where basic-rate taxpayers who edge up into the higher-rate tax bracket at 40% will have their Personal Savings Allowance (PSA) halved from £1,000 to £500,” Springall explained.

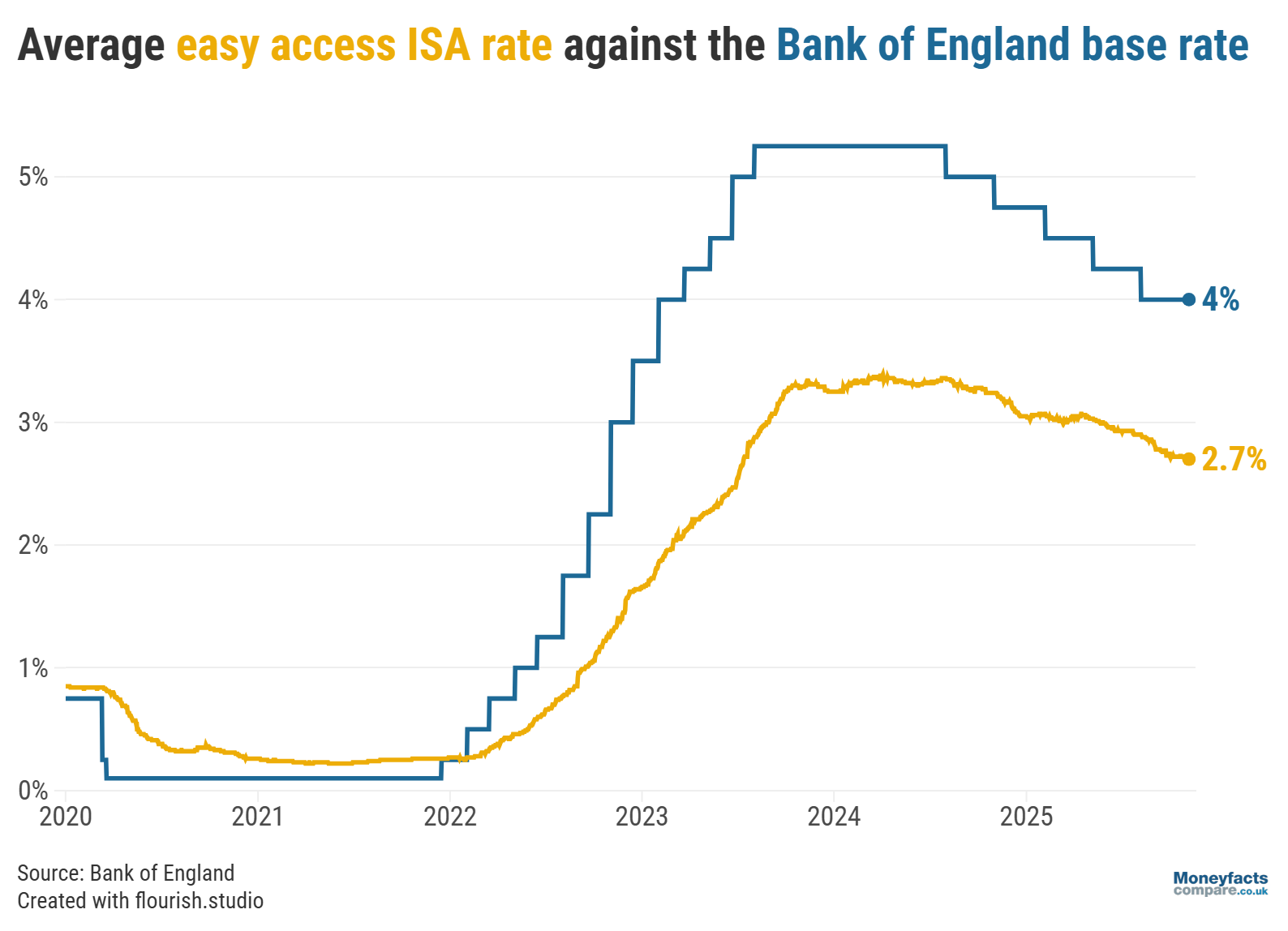

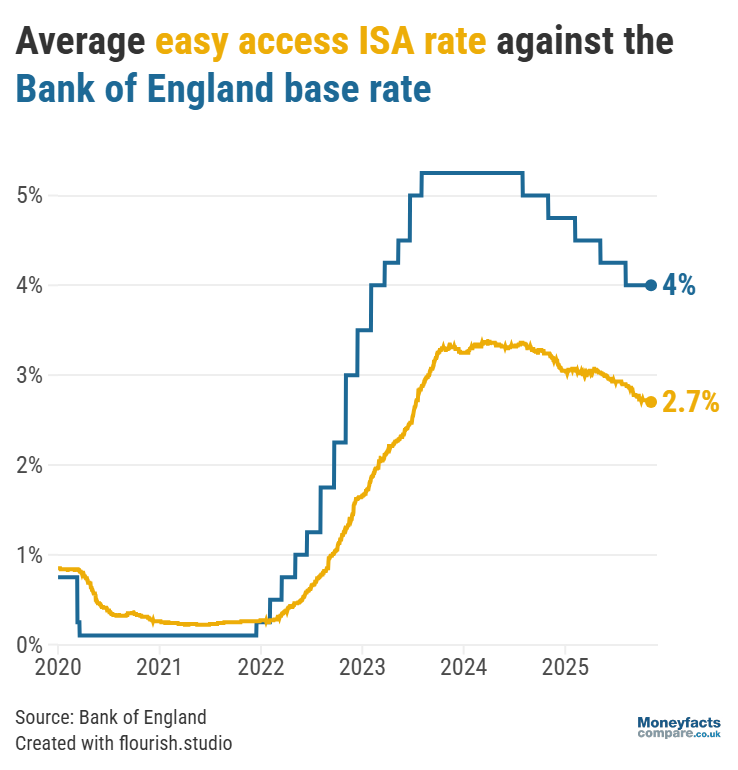

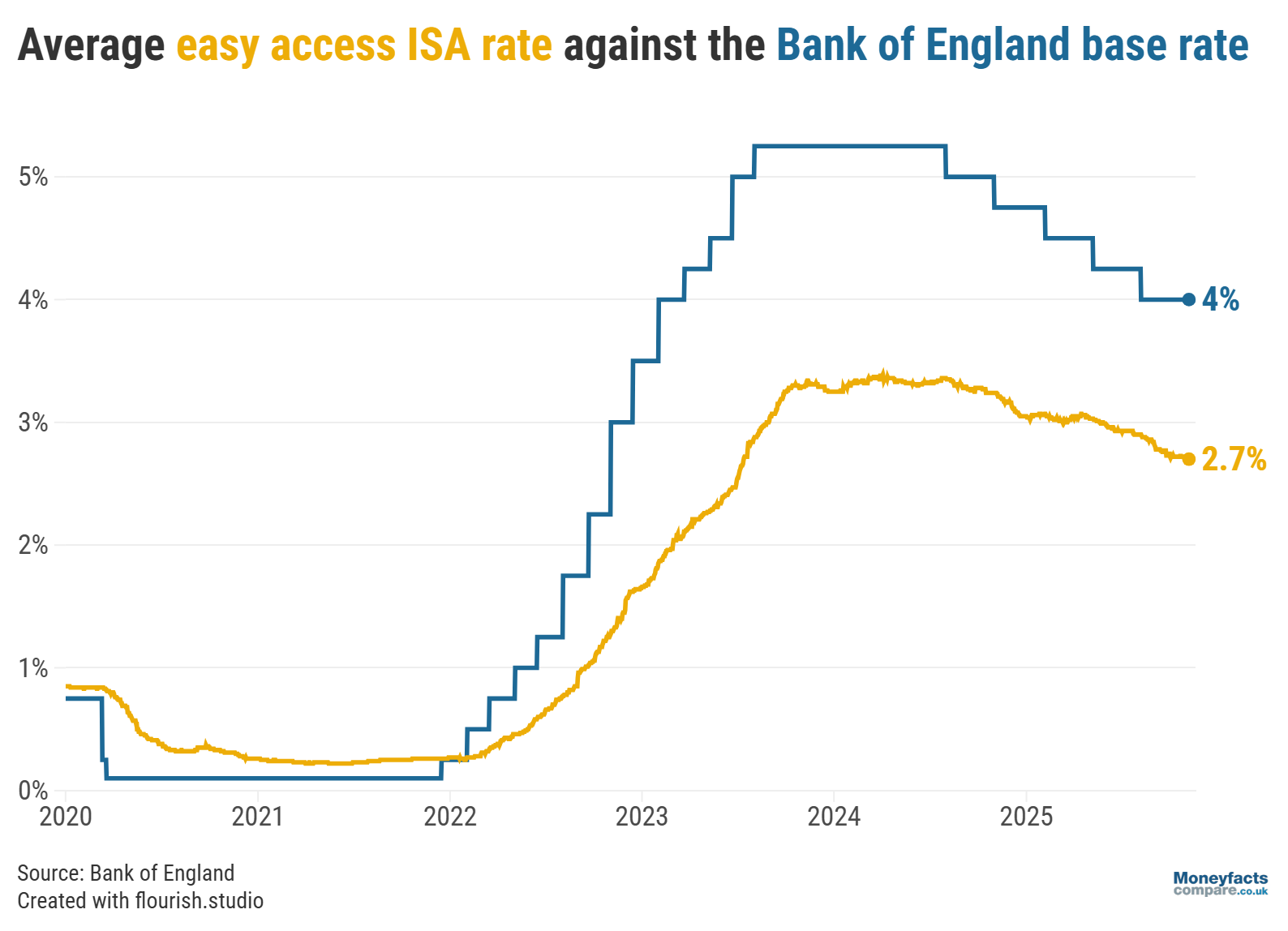

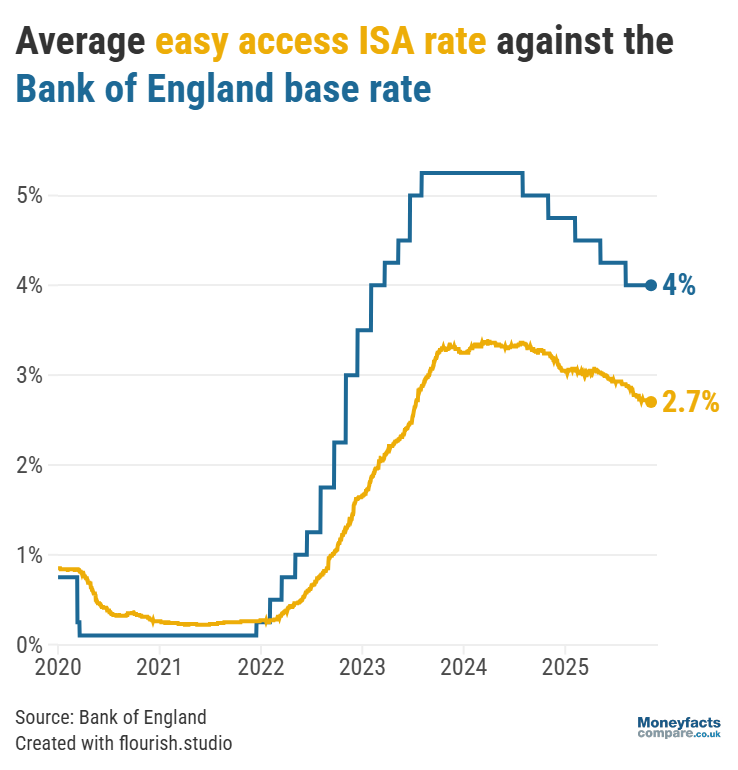

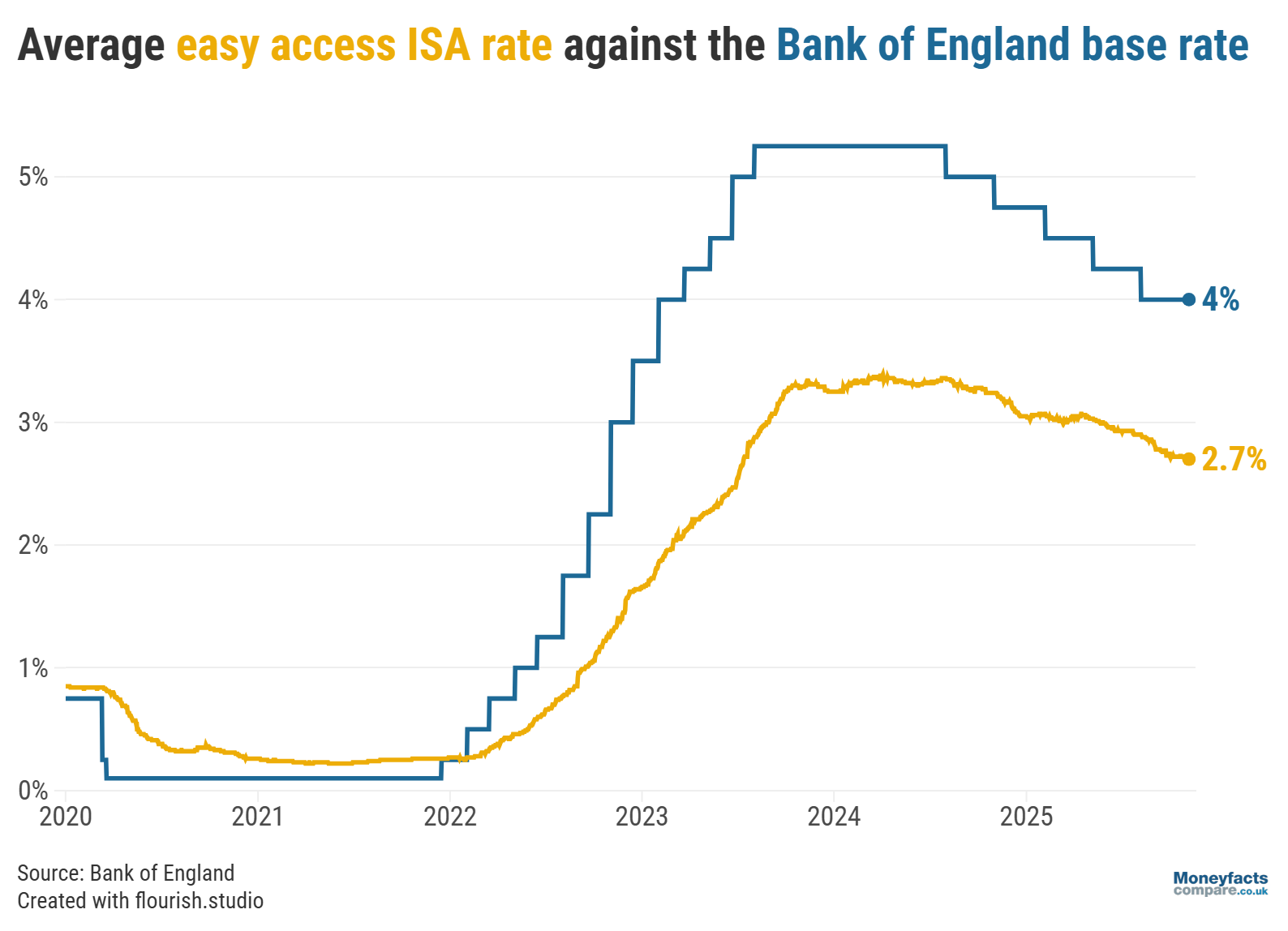

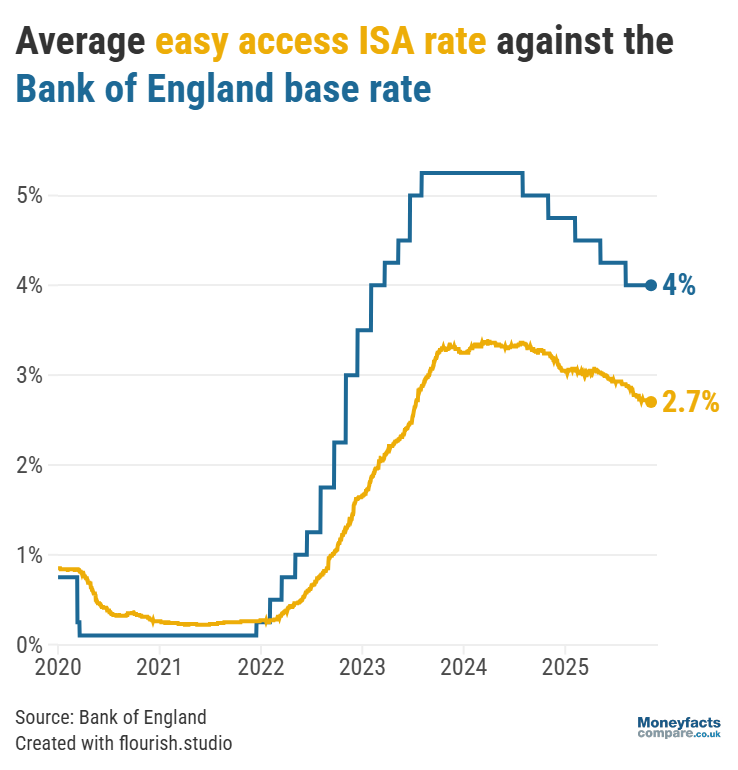

UK Savings Trends: Graph showing average easy access ISA rates vs Bank of England base rate between 2020 and 2025.

Despite seeing a significant decline over the past year as providers acted quickly to pass on previous base rate reductions, the average returns on an easy access ISA held fairly steady between October and November – dropping by just 0.01 percentage point to 2.71%. What’s more, many of the most competitive accounts in the sector continue to pay more than 4.00% (although savers should keep a close eye on when any introductory bonuses are set to expire).

Meanwhile, “frustrated savers who are fed up of seeing their cash eroded by inflation might be more inclined to open a fixed bond or ISA,” said Springall. Many of the market-leading accounts in these sectors also offer in excess of 4.00%.

Our savings and ISA charts are regularly updated throughout the day so you can easily compare accounts offering the best rates.

Alternatively, you can learn more about the most competitive accounts by subscribing for free to our Savers Friend newsletter or reading our weekly savings and ISA roundups.

It’s not just savers who stand to be affected by measures unveiled in the Budget later this month. A cut to the cash ISA allowance “could also cause havoc in the mortgage market, as it would reduce funding for loans,” warned Springall, which in turn could drive up borrowing costs.

“Memories of previous Budgets (and their aftermaths) live long in the minds of consumers, which could explain why we’ve seen increased appetite among remortgage borrowers looking to secure a new deal over the past month,” said Oliver Dack, Spokesperson at Mortgage Advice Bureau.

A change to the cash ISA allowance isn’t the only rumour making the rounds. There are also suggestions that the Chancellor is looking to replace stamp duty with a new form of property taxation. “The proposals on paying tax put the burden on sellers, rather than buyers,” explained Springall. She added that other ideas being floated include removing Capital Gains Tax (CGT) exemptions on primary residences and the introduction of a ‘mansion tax’ on high-valued properties.

“In contrast to the refinance market, we’re seeing a number of house purchase customers delay their search as they wait to find out how they may be impacted by potential tax changes,” said Dack. Nevertheless, he reminded prospective buyers that it may still be worth speaking to a mortgage broker sooner rather than later to prepare for a wide range of eventualities.

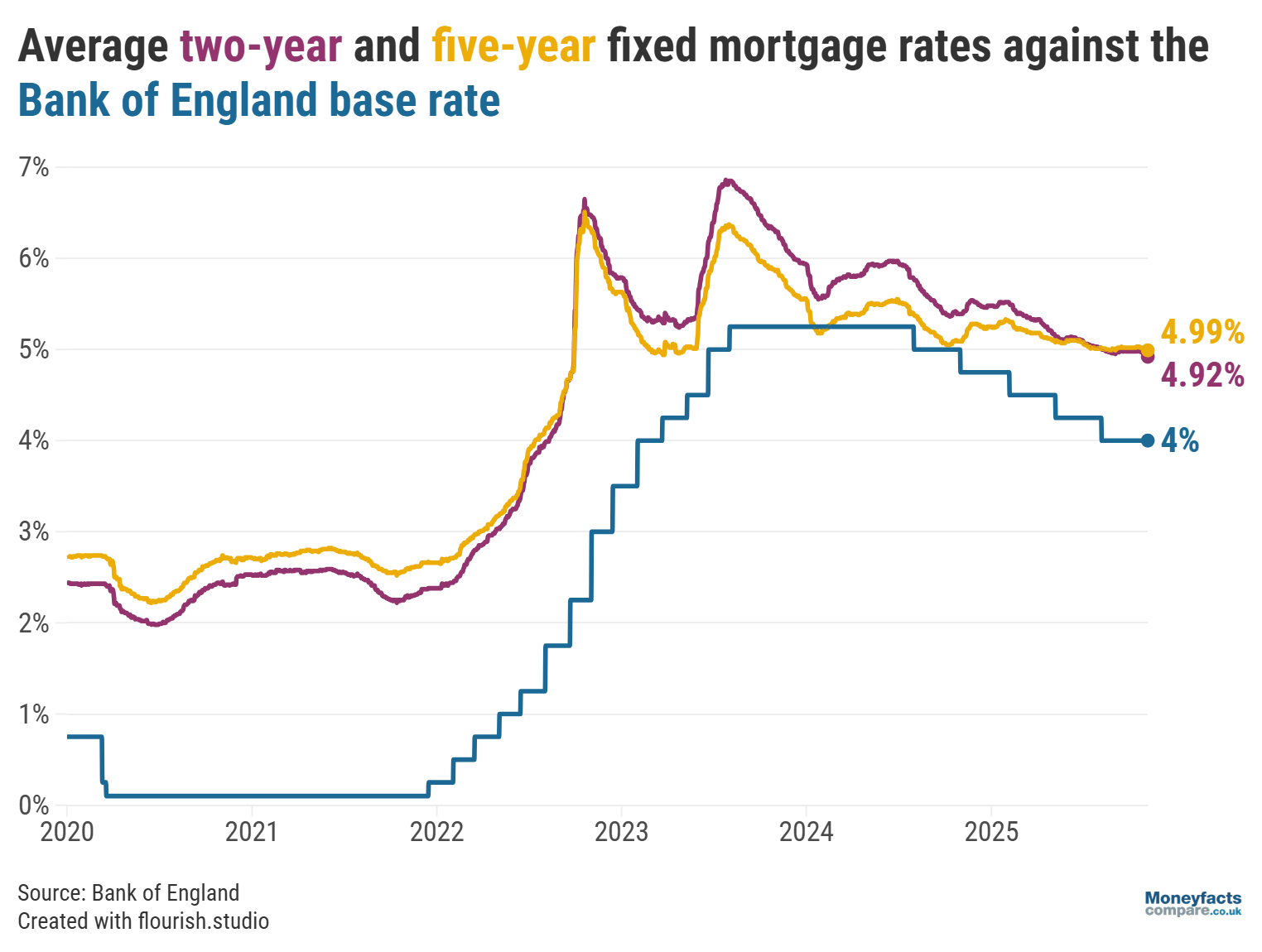

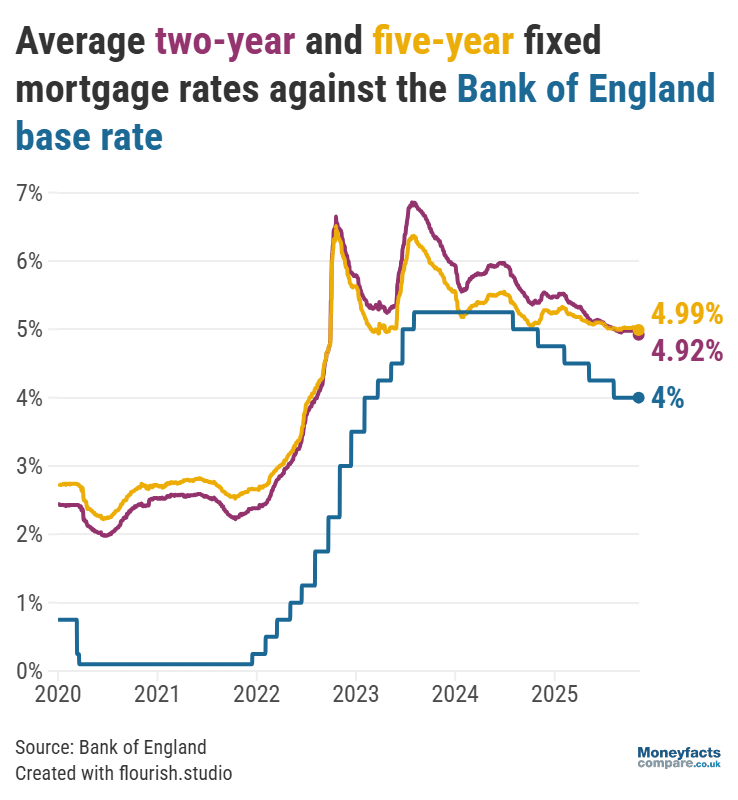

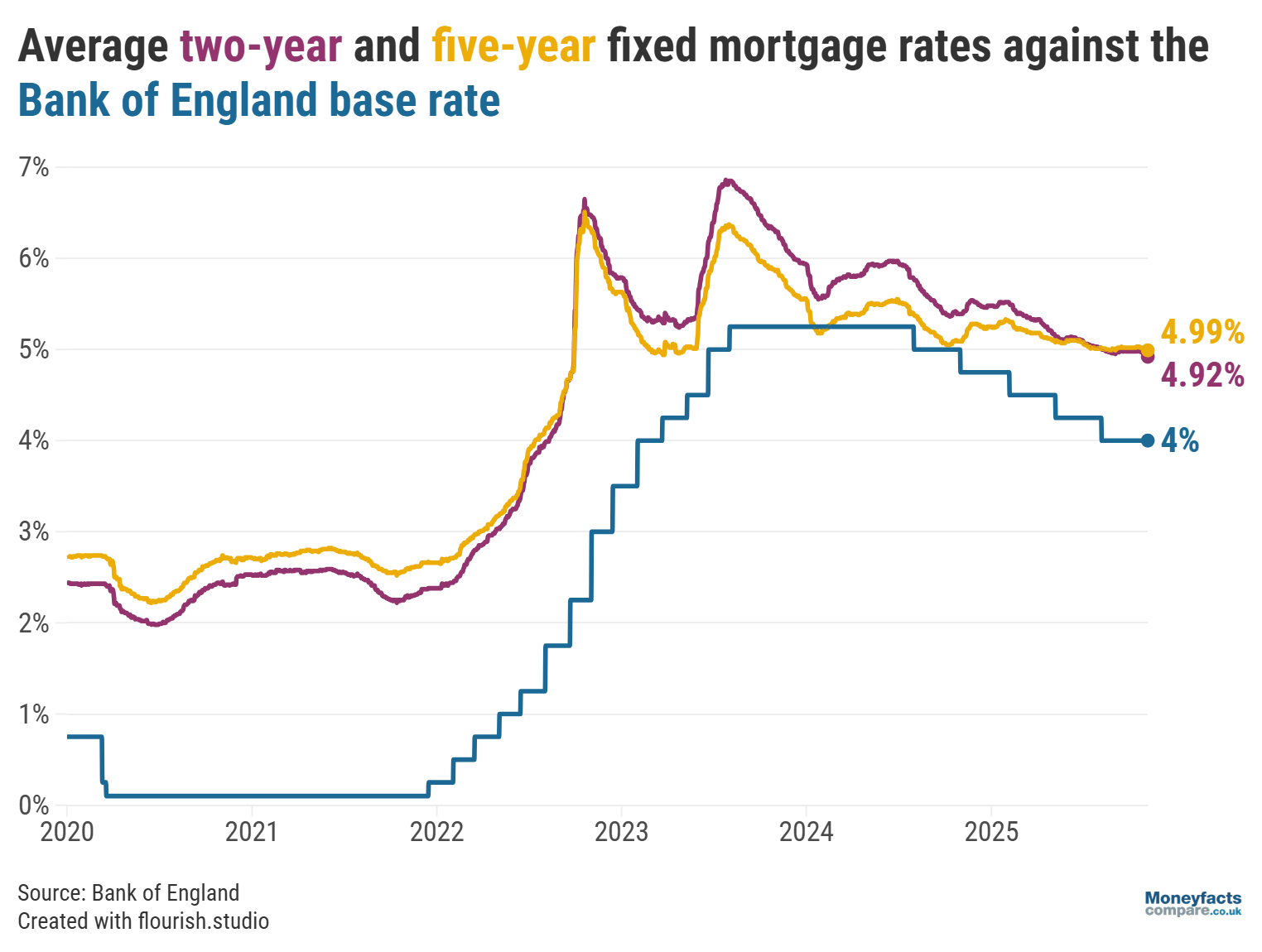

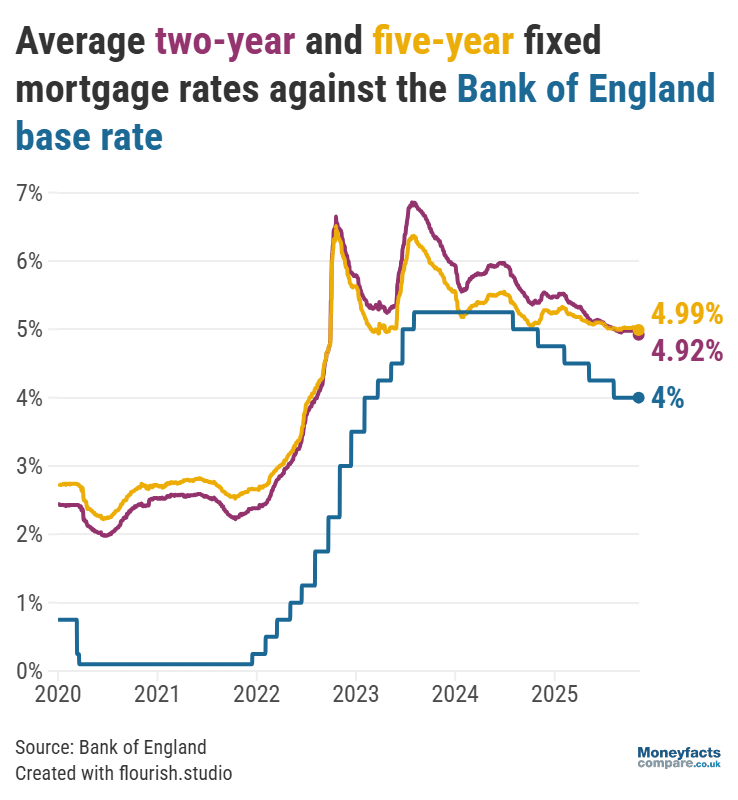

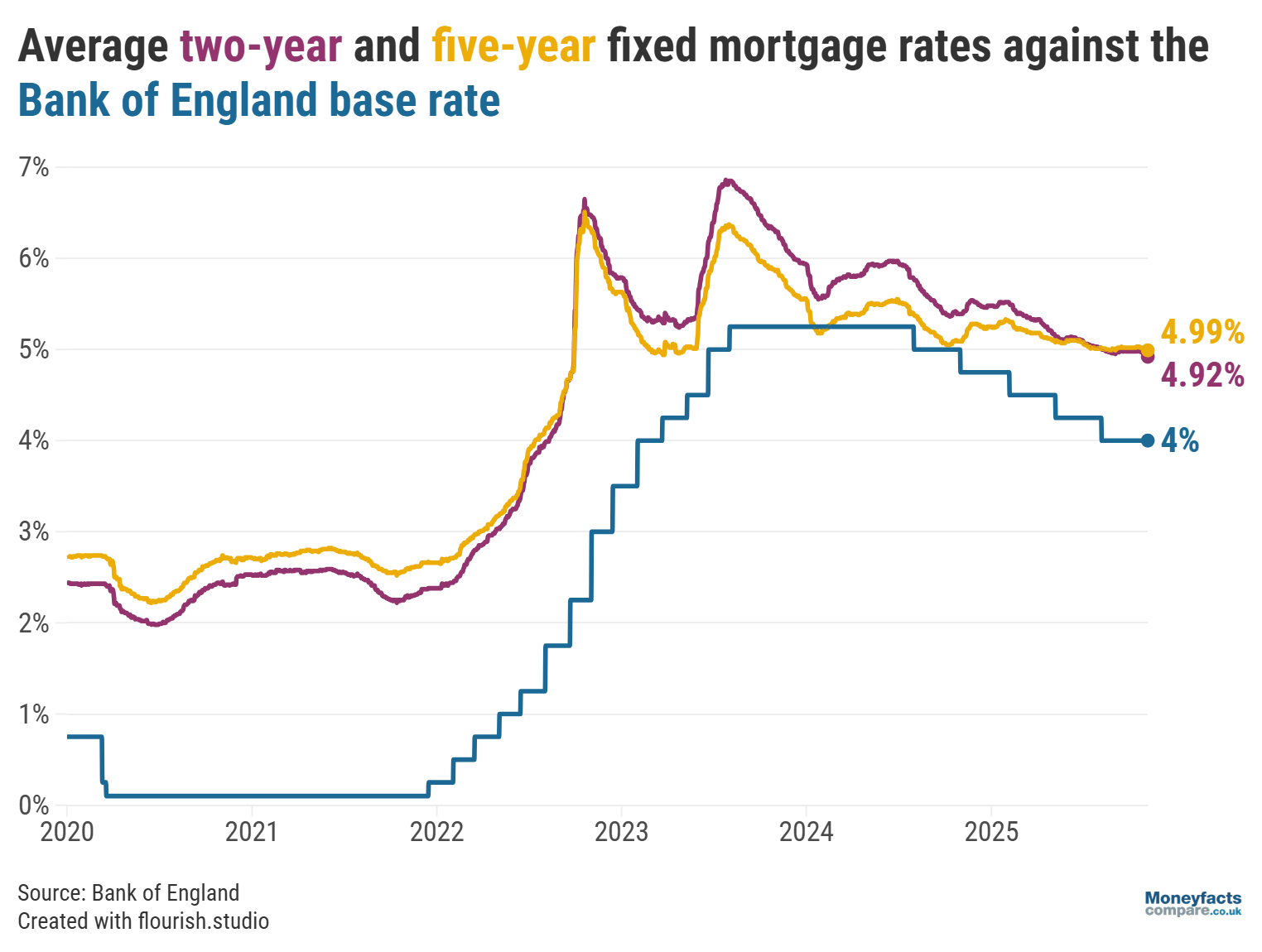

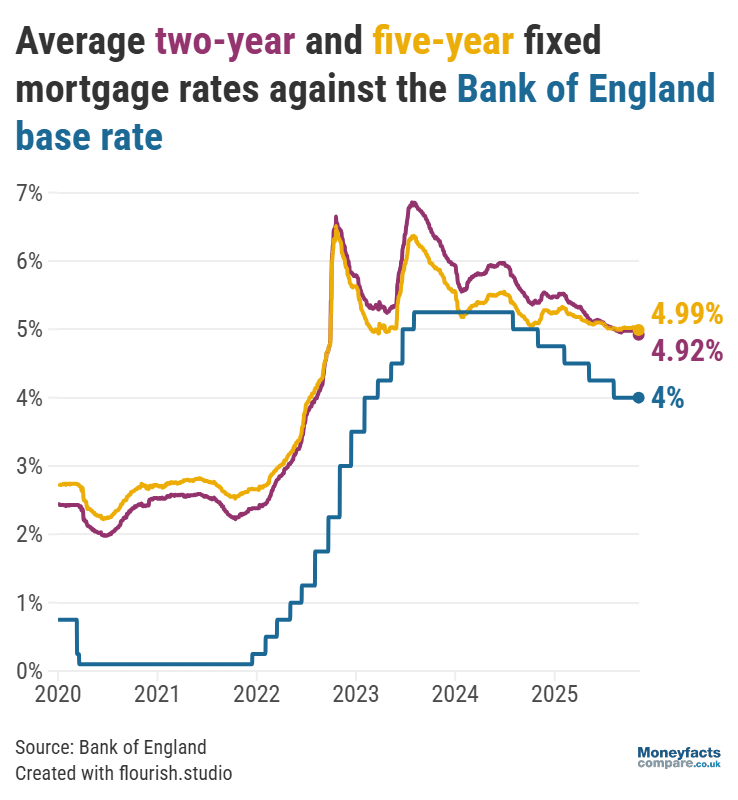

UK Mortgage Trends: Graph showing average fixed two- and five-year fixed mortgage rates vs Bank of England base rate between 2020 and 2025.

Even though the base rate has stood at its current level since August 2025, many lenders have taken encouragement from a less volatile swap market to lower their rates over recent weeks. As a result, the typical rate charged by a two-year fixed mortgage fell from 4.98% in October to 4.94% by the start of this month, while average five-year fixed mortgage rates dropped by a smaller margin from 5.02% to 5.01% over the same period. Furthermore, the Moneyfacts Average Mortgage Rate reached a major milestone after dipping below 5.00% earlier this week for the first time (sustainably) in more than three years.

But, there’s no guarantee this positive momentum will continue. “As we quickly approach the end of the year, it may be that some lenders are already ahead of their targets and are no longer chasing the market,” said Dack. And, with the average Standard Variable Rate (SVR) going unchanged month-on-month at 7.27%, too much hesitation could prove costly.

When it comes to looking for a new mortgage deal, our regularly-updated mortgage charts can be a good place to start. But, it's important to consider all features of a mortgage carefully and remember that the cheapest-priced deal may not be the most cost-effective depending on your individual circumstances.

That's why our weekly mortgage roundup not only summarises the lowest fixed rates, but provides details about some other deals that feature on our Moneyfacts Best Buy charts based on their overall true cost.

Alternatively, you could speak to a mortgage broker for personalised help.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.