This comes as mortgage and savings rates continue to tumble.

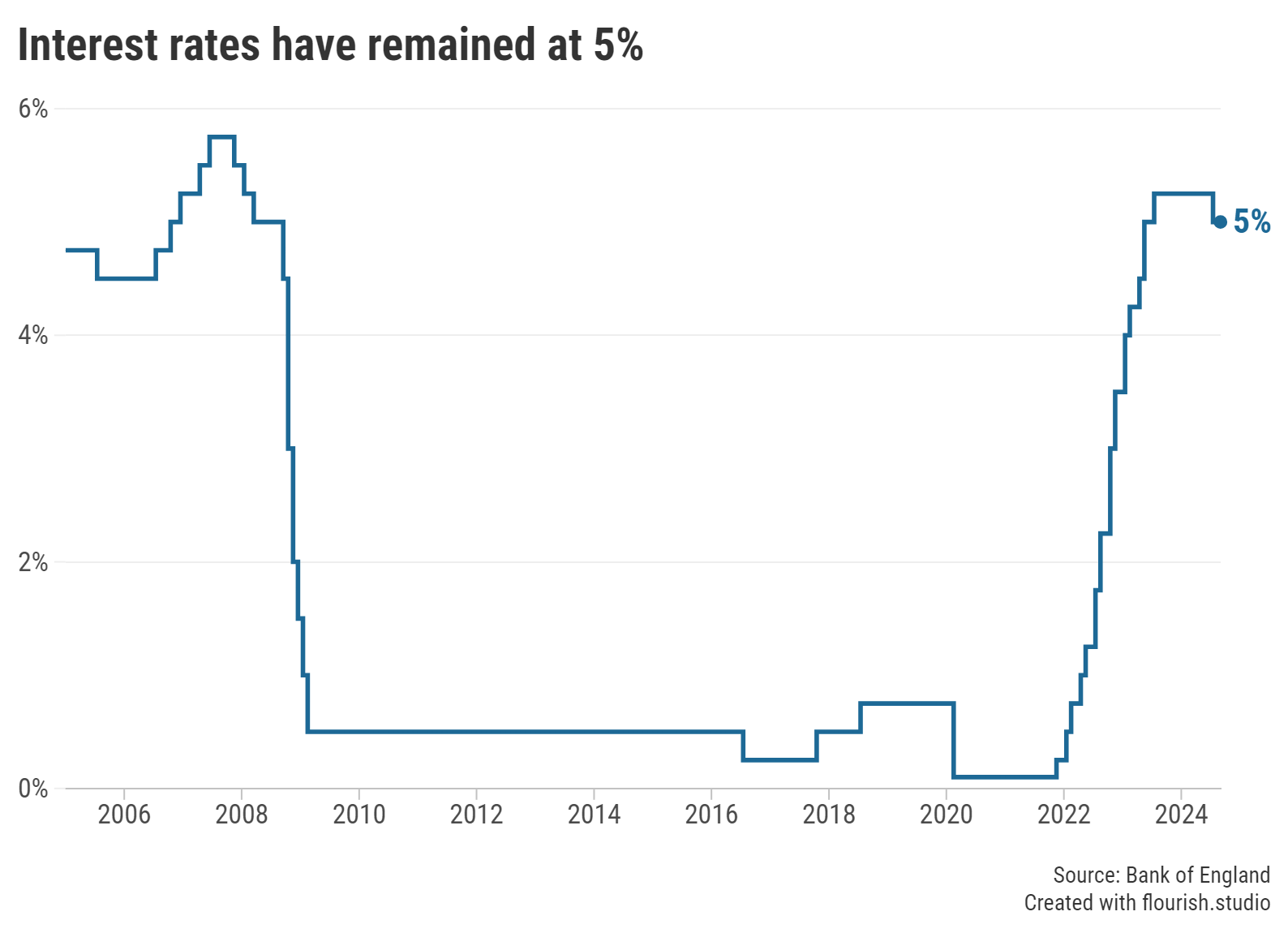

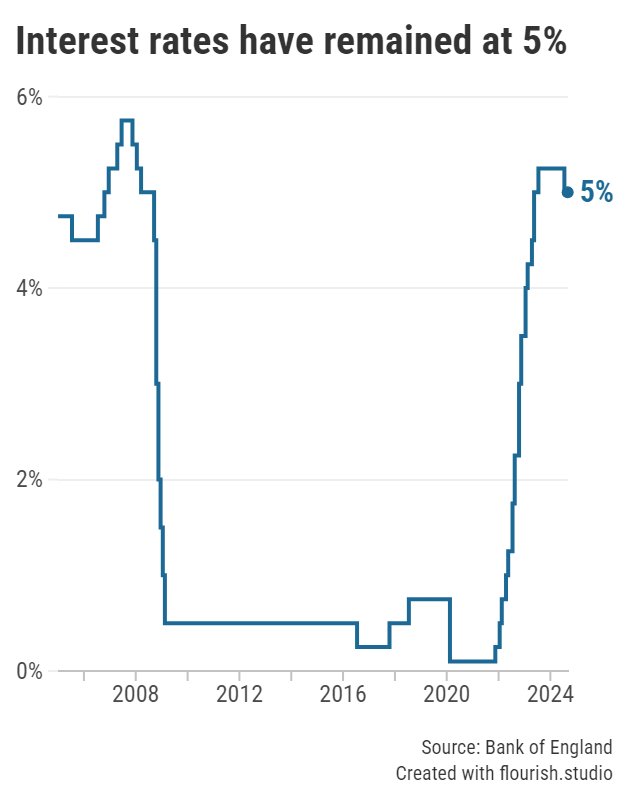

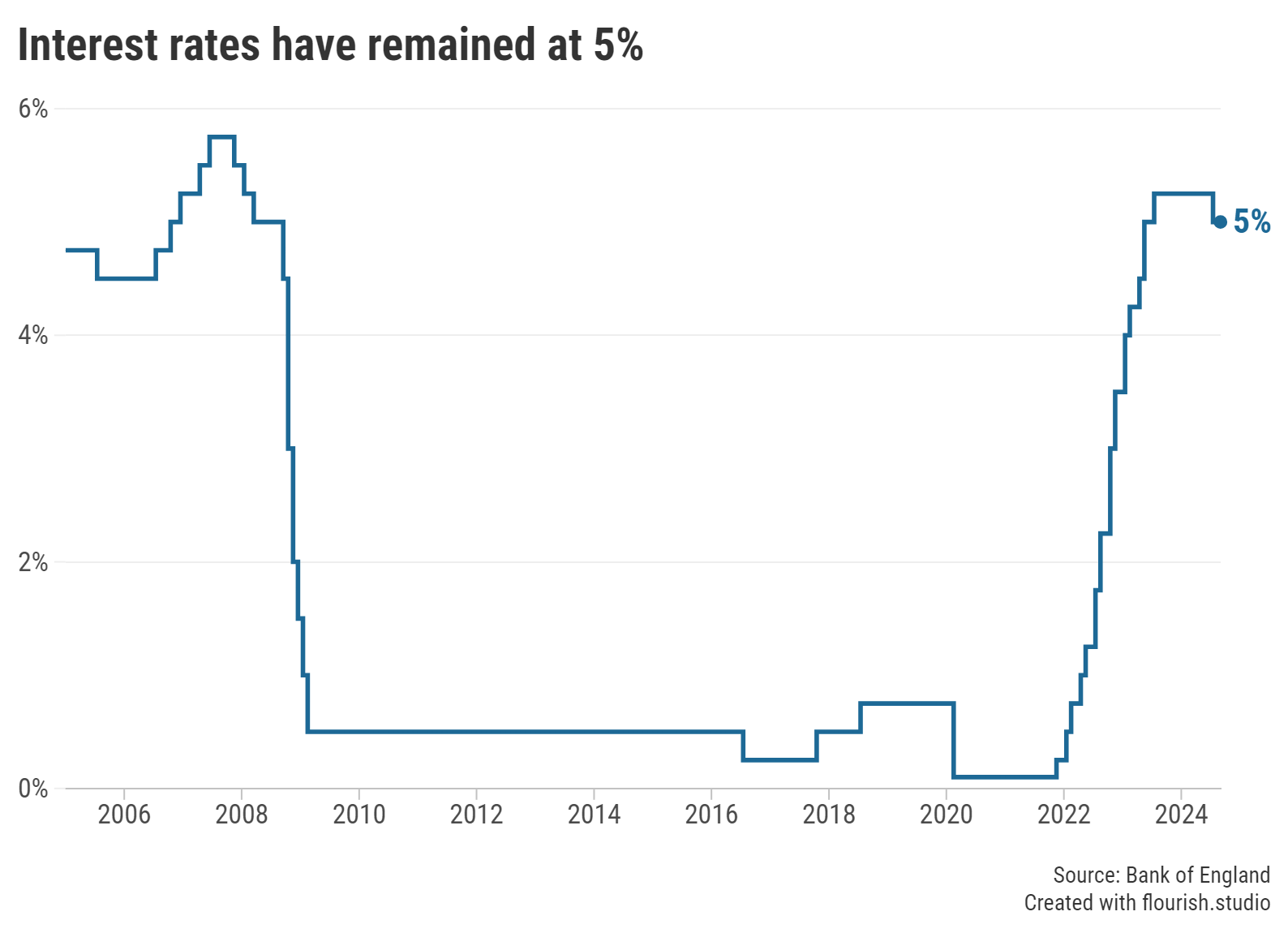

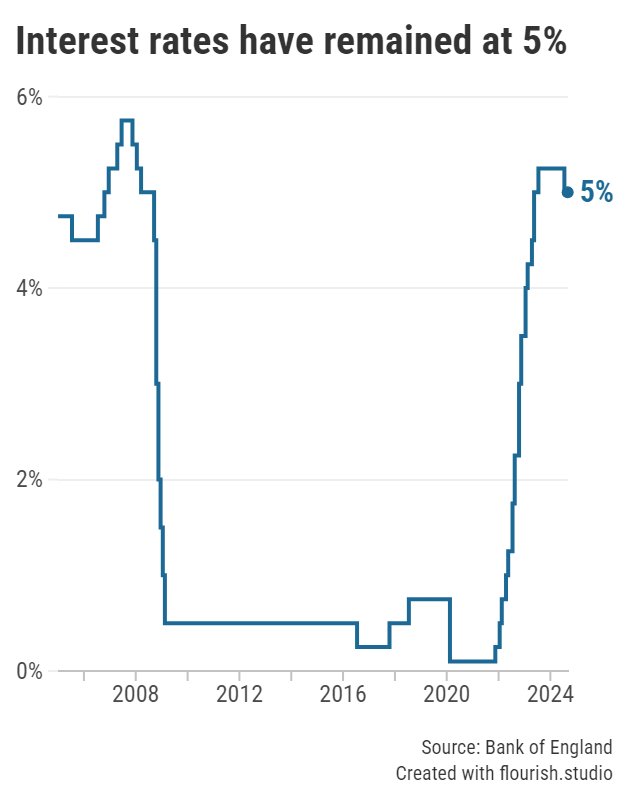

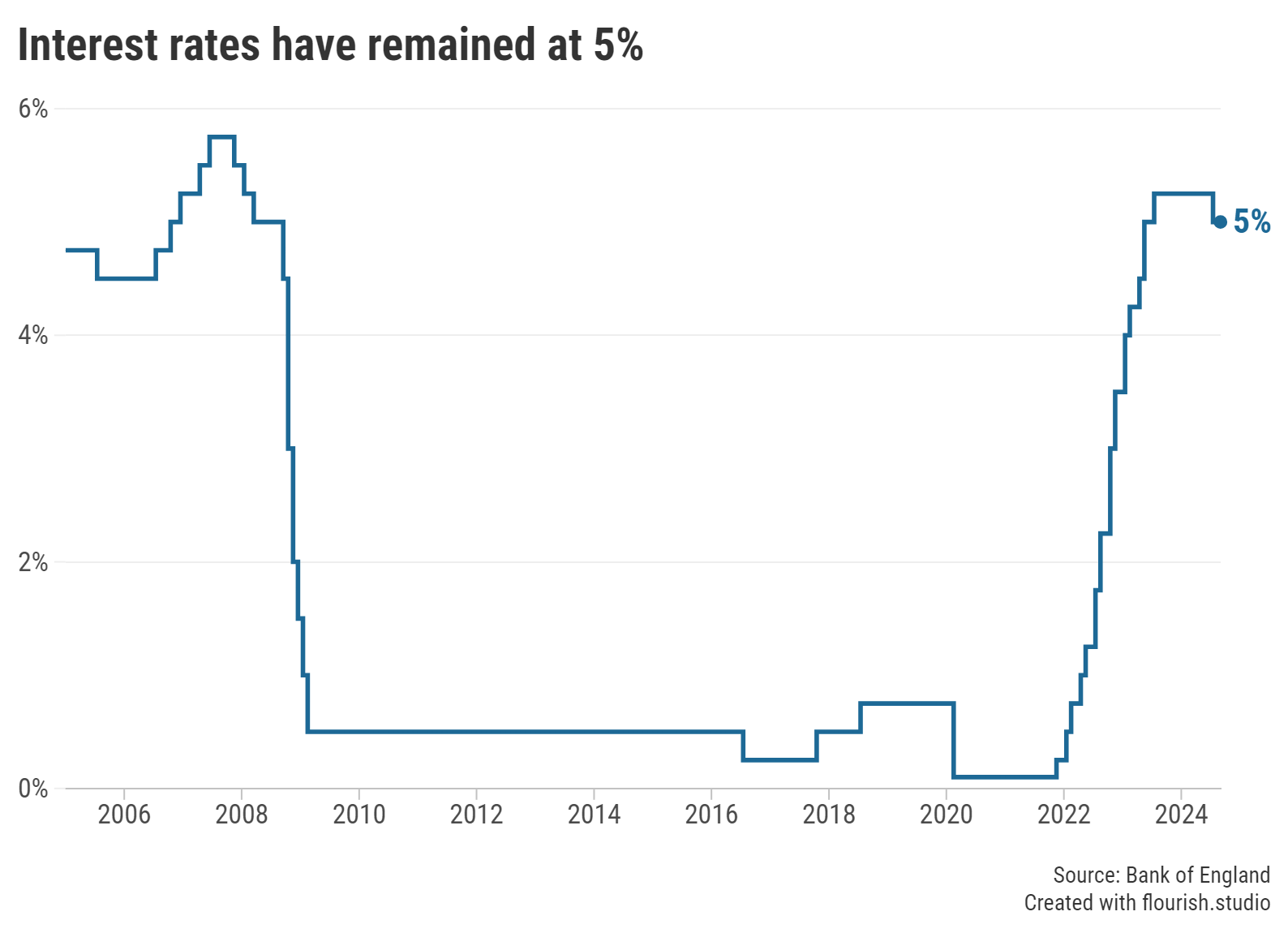

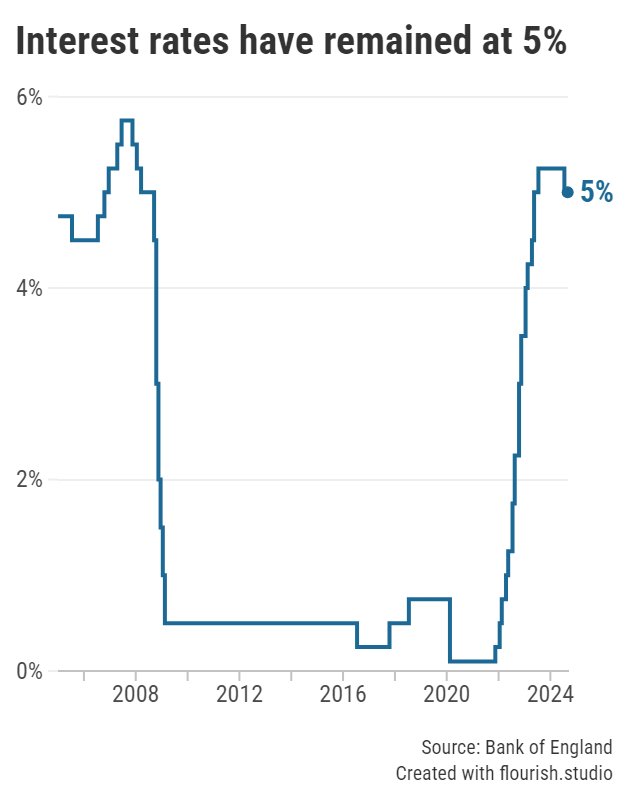

After making a long-anticipated cut to the base rate at its previous meeting in August, today the Bank of England’s Monetary Policy Committee (MPC) voted 8 to 1 in favour of maintaining it at 5.00%.

Many experts predicted that this would be the case, particularly as the latest inflation figures remained at 2.2%, slightly above the Bank of England’s target of 2%.

Graph: Interest rates between 2005 and 2024.

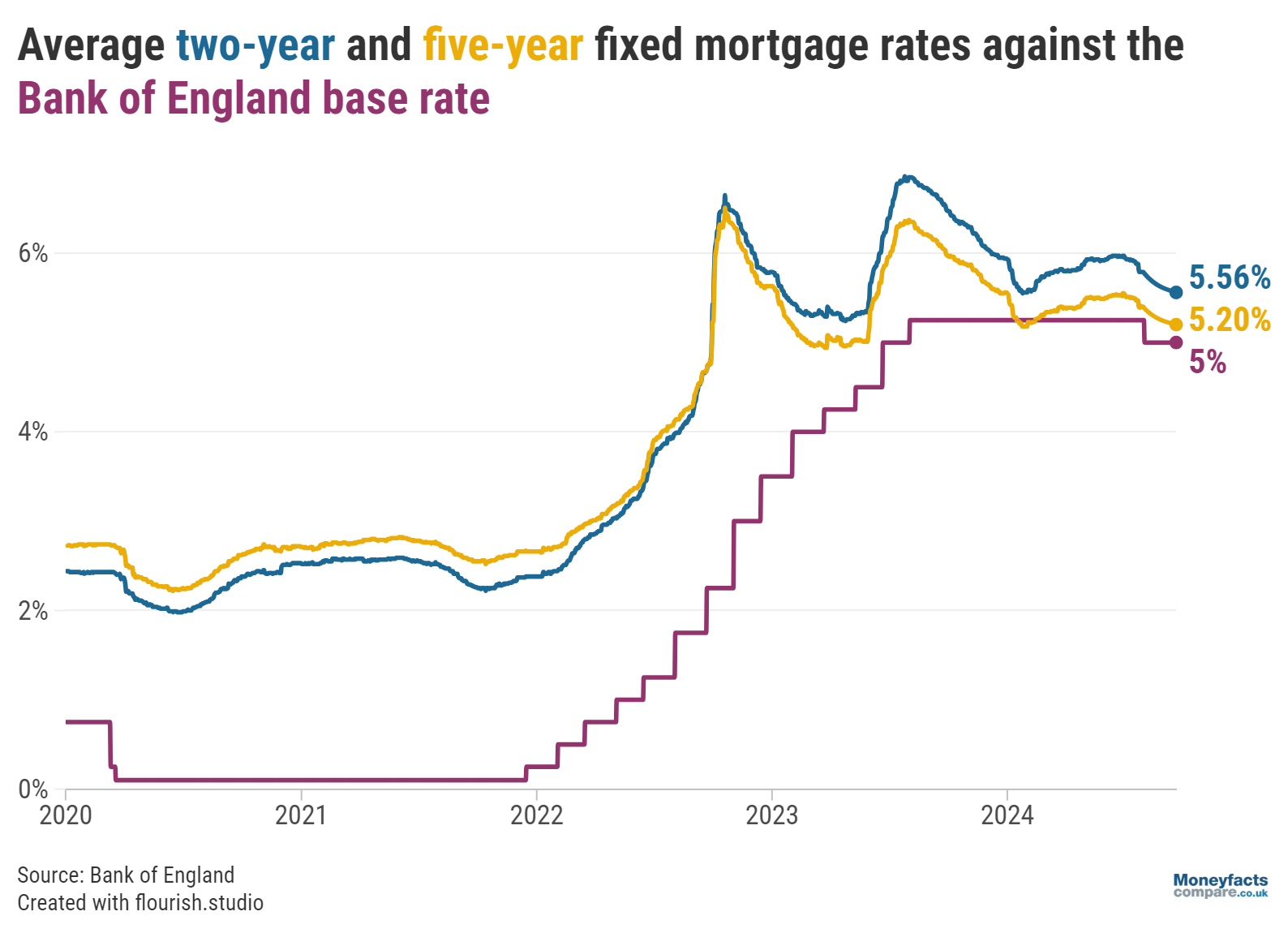

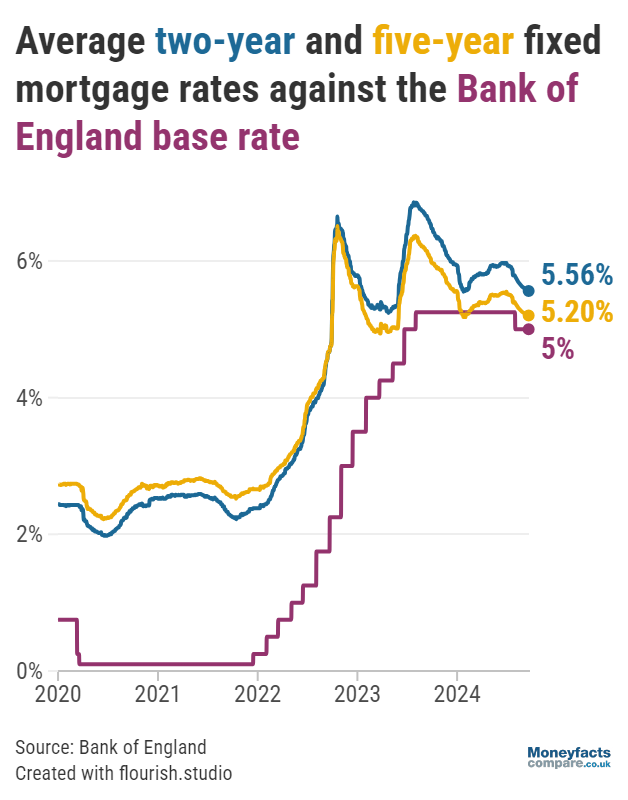

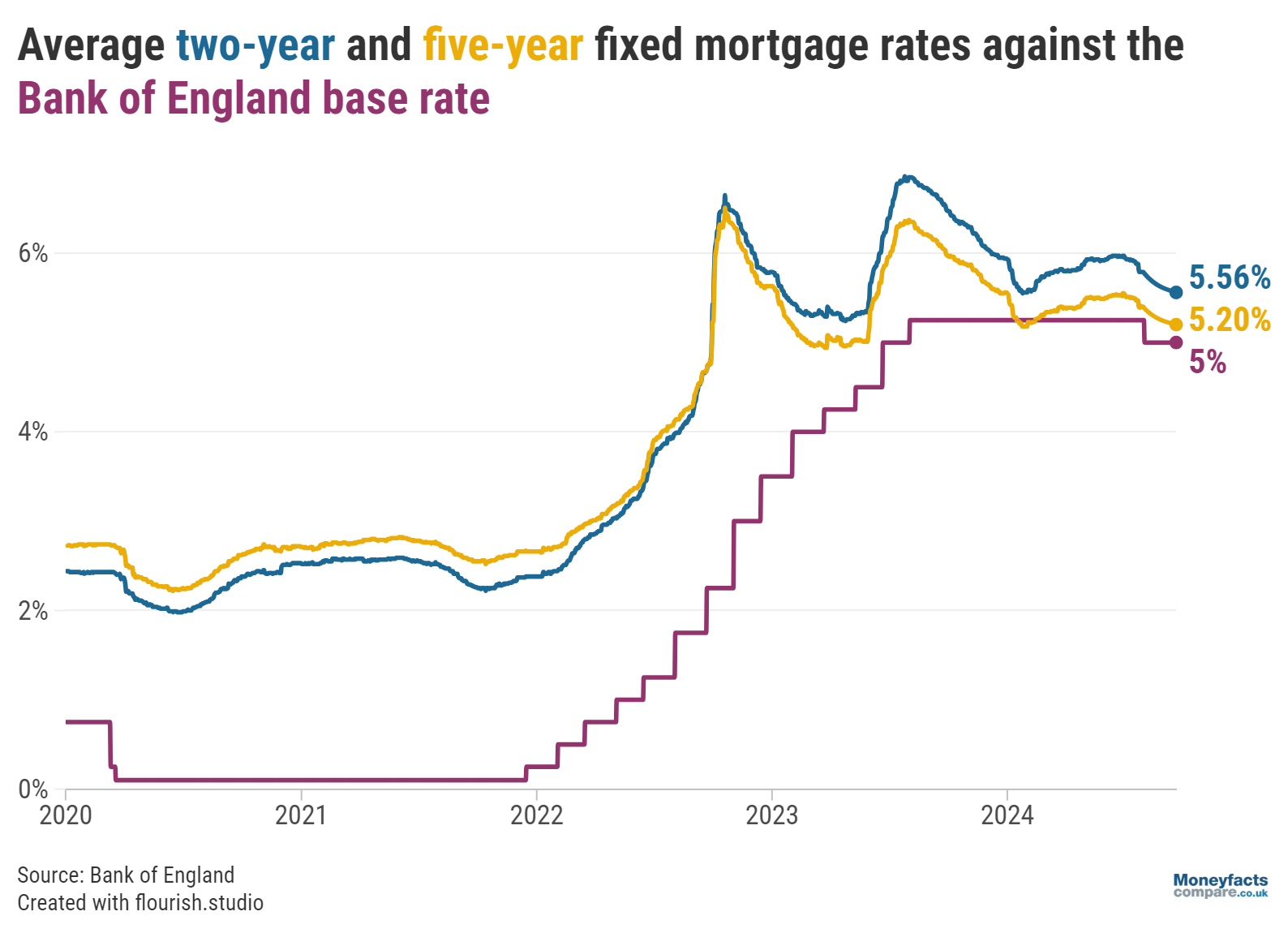

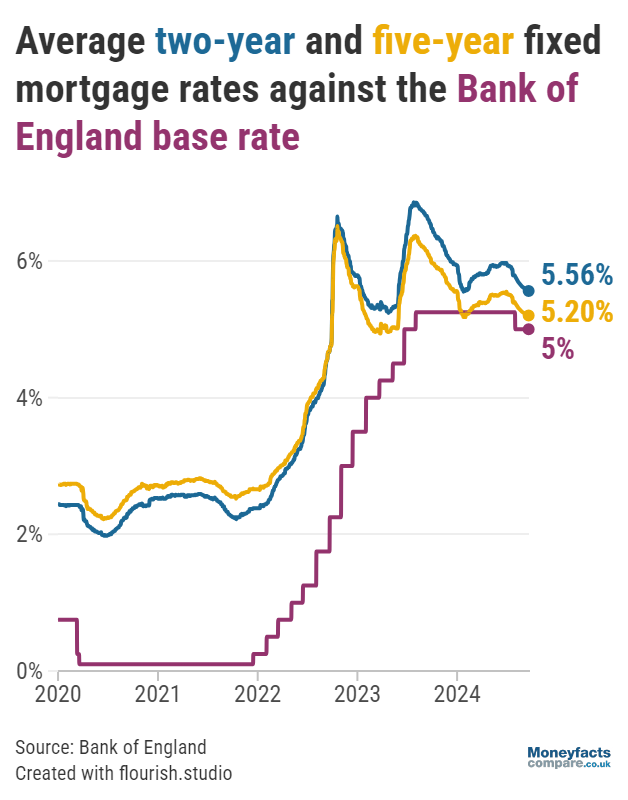

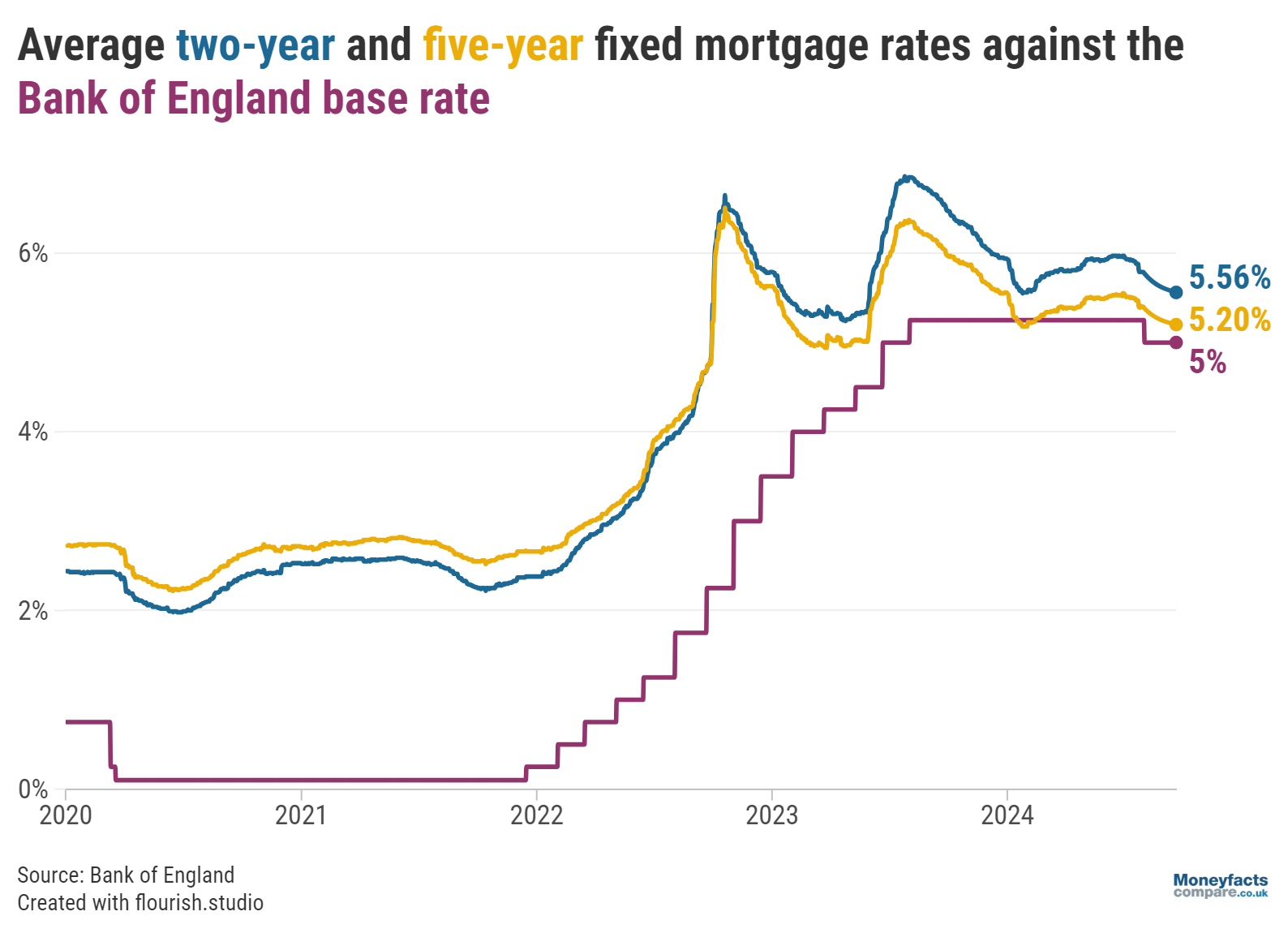

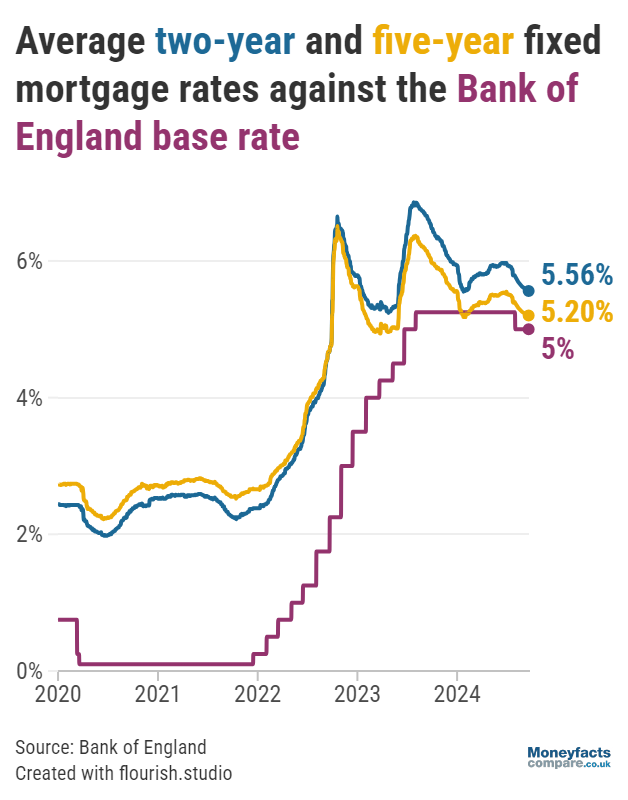

While mortgage borrowers may have hoped for another reduction, they have still benefited from falling rates since the start of August. The average two- and five-year fixed mortgage rates dropped to 5.56% and 5.20% respectively in September, compared to 5.77% and 5.38% one month earlier.

Graph: Average two and five-year fixed mortgage rates between 2020 and 2024.

“The mortgage market has seen a bustle of activity over the last month, with the Bank of England base rate cut, and a more favourable swap rate market, creating a positive influence on fixed rate pricing,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

“There have also been several lenders passing on the 0.25% base rate cut to customers, leading to the Standard Variable Rate (SVR) falling below 8% for the first time since August 2023,” she added. But, despite this drop in the average SVR, it’s likely to still be more cost-effective to lock into a fixed deal.

Many borrowers seem to have been taking advantage of the lower mortgage rates, with Oliver Dack, Spokesperson for Mortgage Advice Bureau, highlighting that, “while the summer is traditionally quiet, we saw last month’s base rate reduction generate more confidence and an increased appetite among consumers”.

“Although a further cut to the base rate would have been well-received, the mortgage market is entering a naturally buoyant period. As people return from their holidays and with children back at school, borrowers typically have more time to shop around for a new deal,” he noted.

Anyone who is ready to apply for a mortgage may find it useful to speak to a mortgage broker to help them find the right deal for their individual requirements.

See our regularly-updated mortgage charts for the latest rates on offer.

However, bear in mind that the lowest priced deal may not be the most cost-effective or suitable deal for your circumstances. Our weekly mortgage roundup provides more information on products offering the lowest rates and includes some Moneyfacts Best Buy alternatives which are chosen based on their overall true cost.

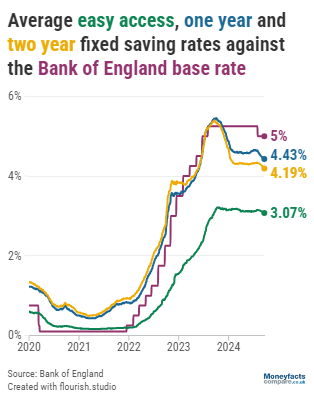

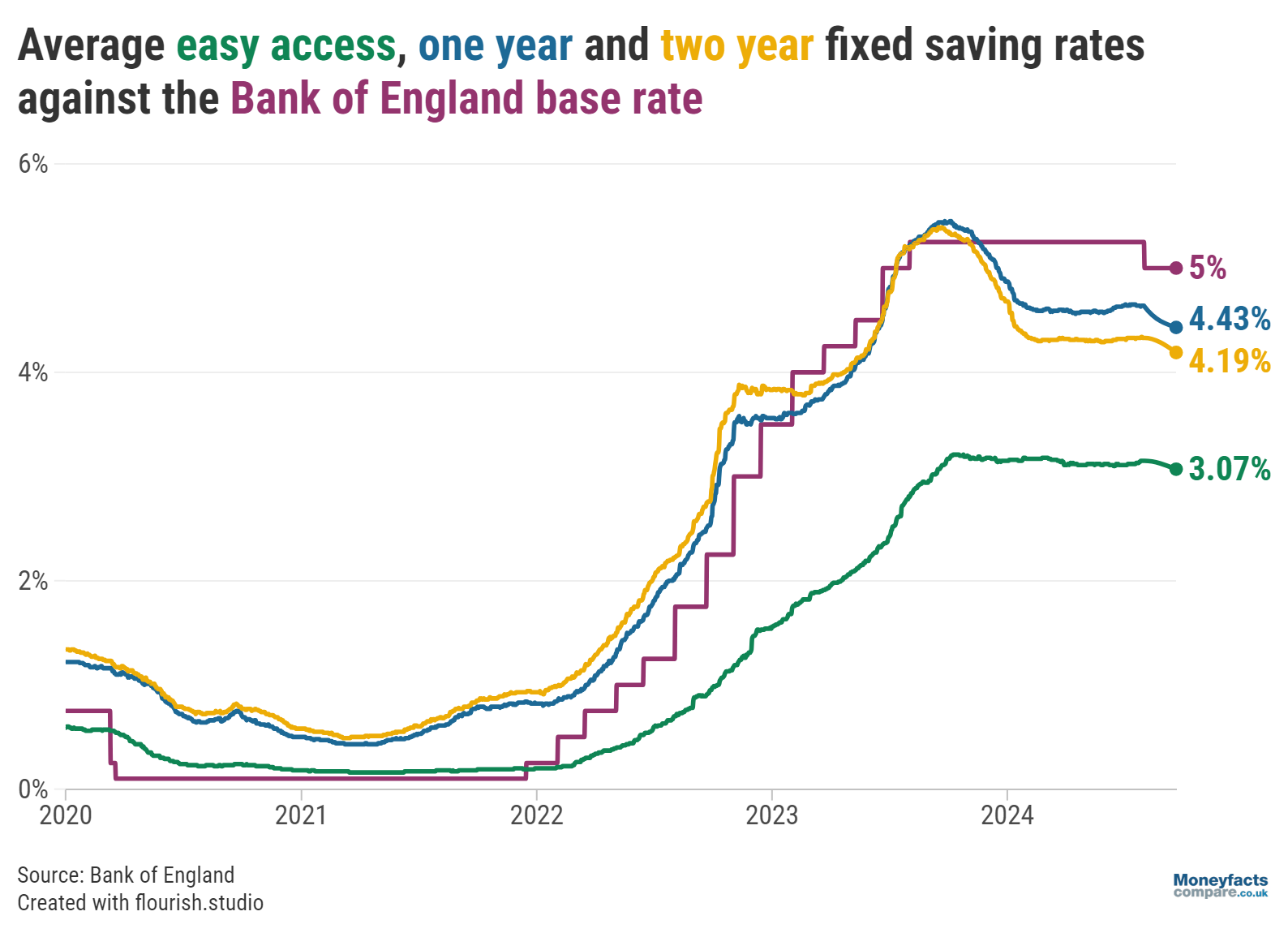

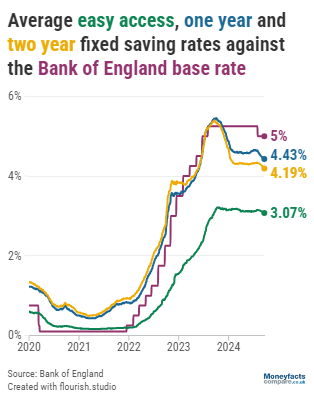

Many savings providers made reductions following the Bank of England’s cut to the base rate in August. Although not all providers lowered rates by the full 0.25%, savers have seen variable rates drop notably in the month to September, with the average easy access savings and easy access ISA rates falling 0.07 percentage points to 3.07% and 3.29% respectively.

Graph: Average easy access, one and two-year fixed savings rates between 2020 and 2024.

As the base rate remains at 5% for now, savers may be hopeful that rates will stabilise and that any reductions will slow. However, it’s still crucial that they review their existing accounts and act quickly if they think they could be earning more interest on their money. There are still some competitive accounts to choose from, but it’s impossible to know how long they will be available for.

“There is an expectation that base rate will be cut twice more before the year is over, so savers need to prepare themselves for more interest rate cuts,” Springall noted.

“Those who are happy to lock their cash away for a guaranteed return could look towards a fixed rate bond or fixed cash ISA, and with rates expected to decrease further, savers may wish to choose a longer-term deal,” she continued.

Bear in mind that, while variable savings rates are particularly linked to any changes in the base rate, providers may also lower the rates on their fixed accounts to accommodate the potential for further cuts later in the year.

For an up-to-date list of the top easy access, notice and fixed rates, see our savings charts.

Alternatively, see our ISA charts if you want to make the most of your tax-free ISA allowance.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.