Consumers may need to take action as the future direction of interest rates is cloudy.

There’s uncertainty over when we’ll next see a cut to the UK’s central interest rate, after it was today revealed the Bank of England’s Monetary Policy Committee (MPC) voted to maintain the base rate at its current level of 4%.

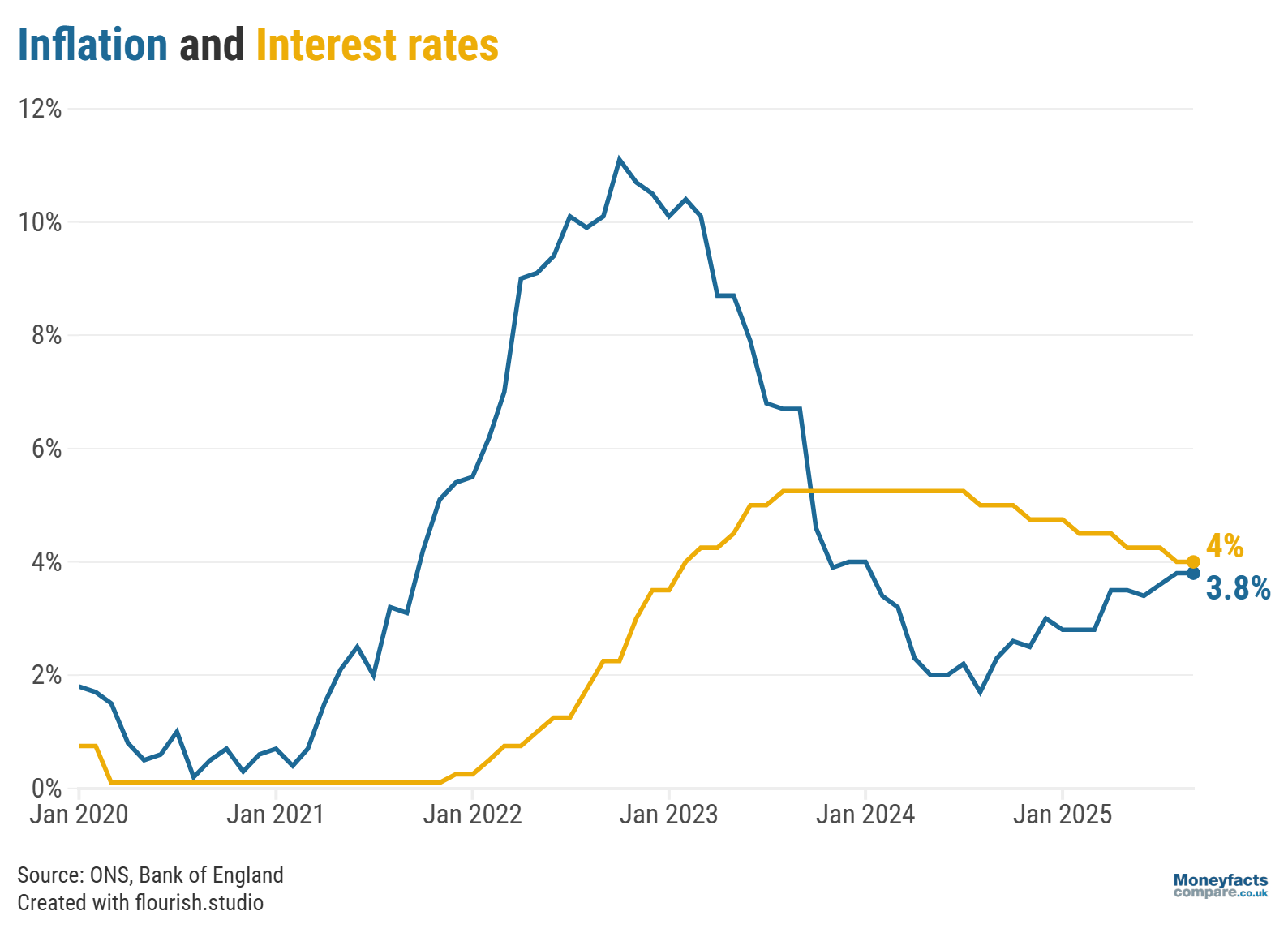

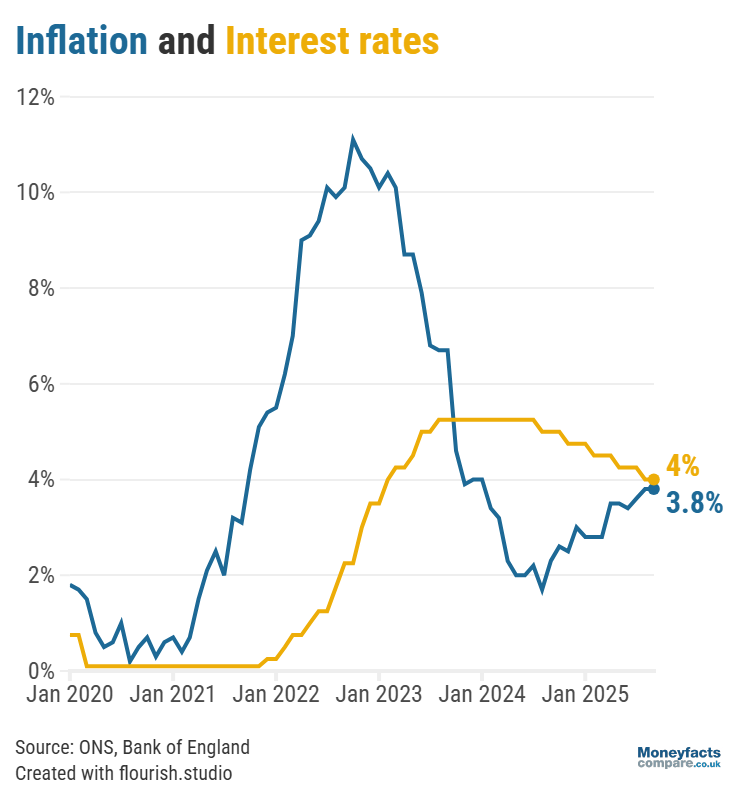

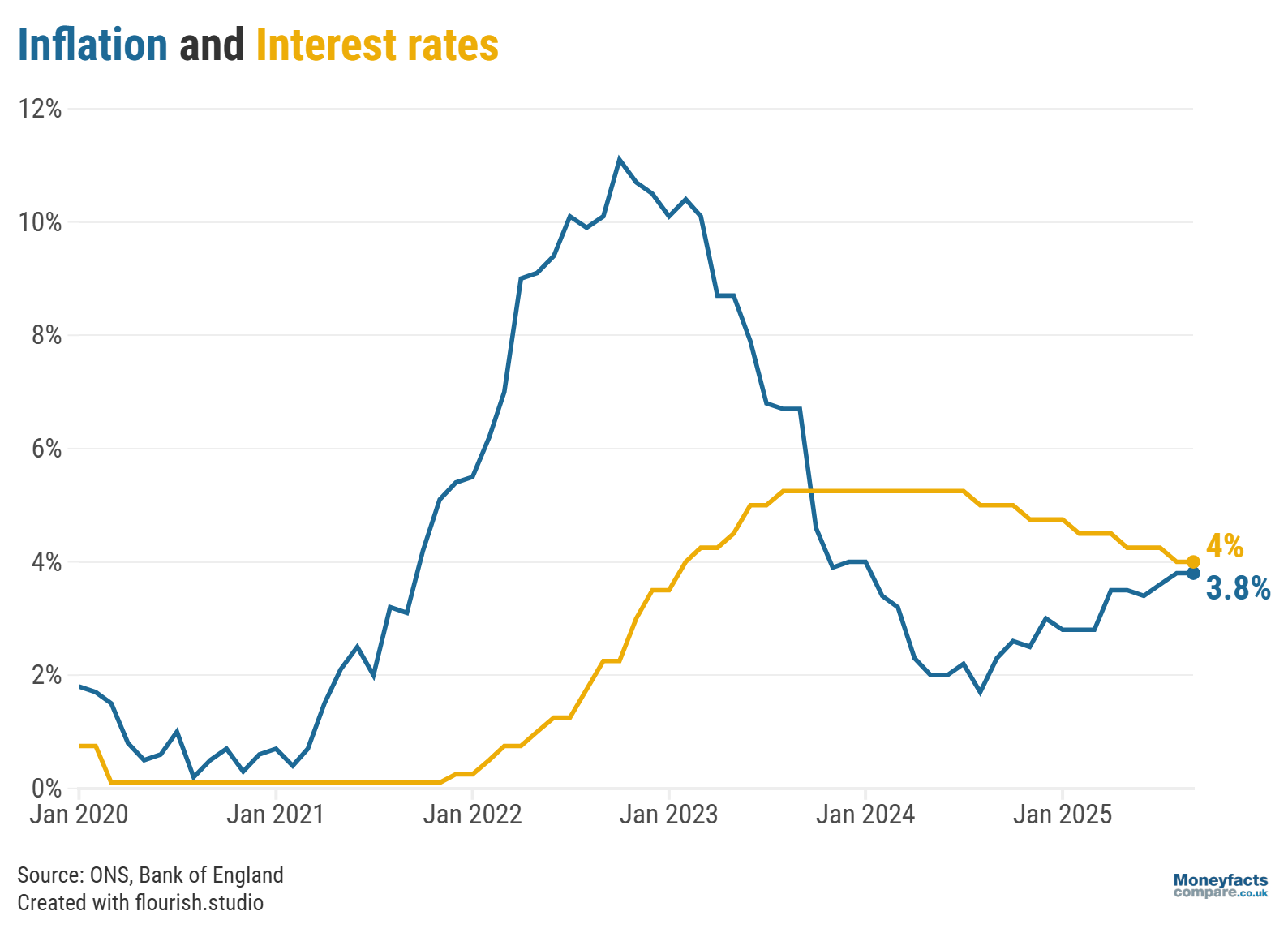

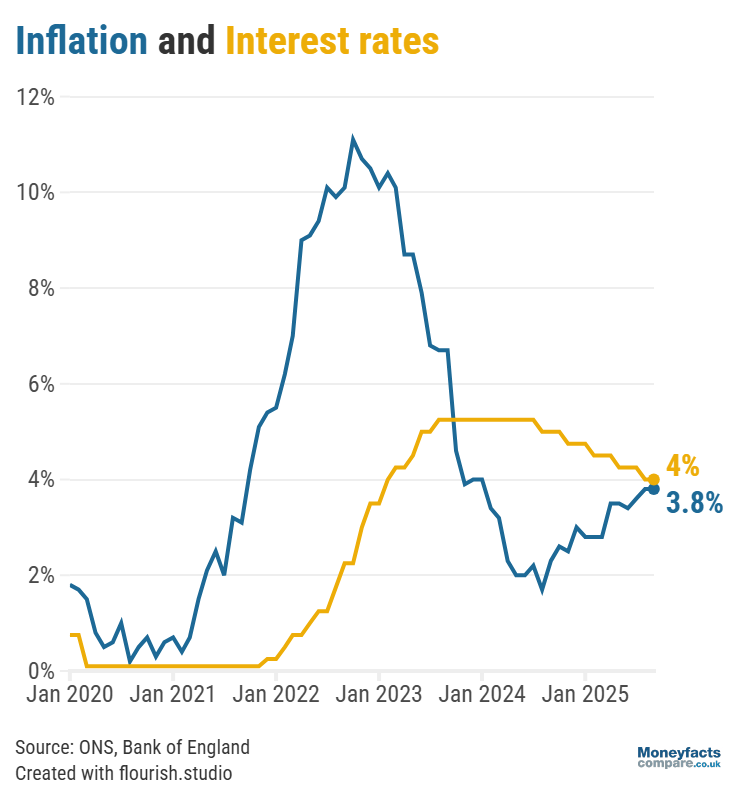

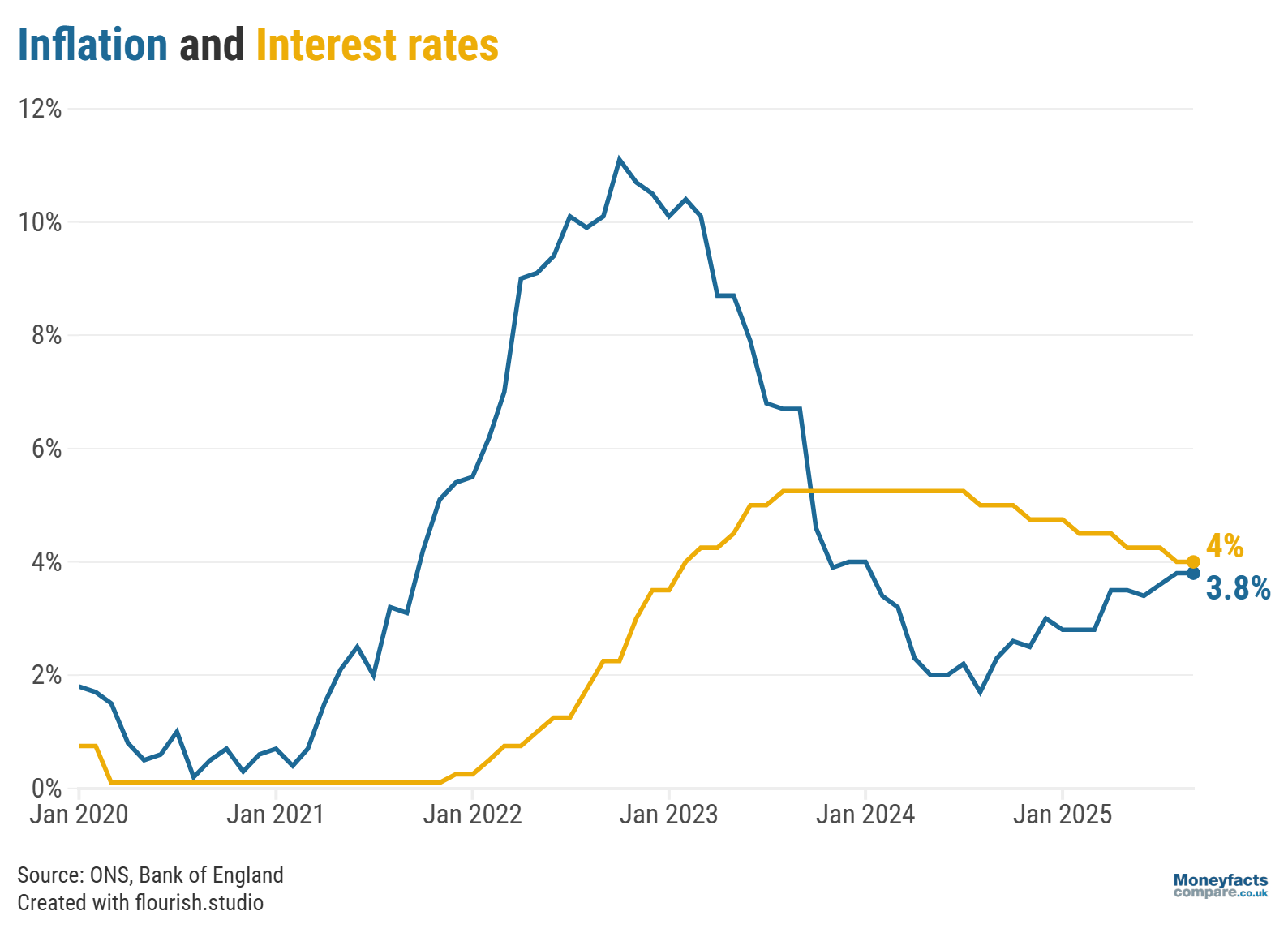

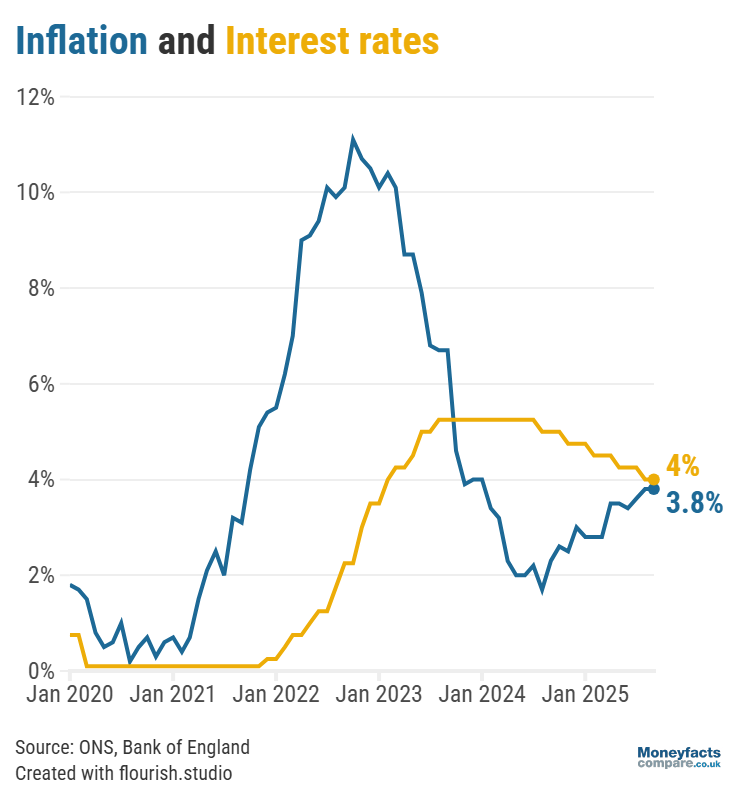

It had been hoped last month’s 0.25 percentage point reduction would inspire greater economic growth and strengthen the jobs market. However, it’s become clear the Bank may need to consider a more measured approach as latest figures found UK inflation is proving stubborn and remains at its highest level in more than 18 months (3.8%).

Graph: Bank of England base rate versus the rate of inflation between 2020 and 2025.

The base rate is the amount the Bank of England charges other retail banks to borrow money which, in turn, influences the pricing of their mortgages and savings accounts.

Lowering the base rate can help to boost the economy, as it makes borrowing cheaper which encourages greater levels of spending. On the other hand, raising the base rate can help to keep inflation in check as it makes borrowing expensive and incentivises savers with higher returns.

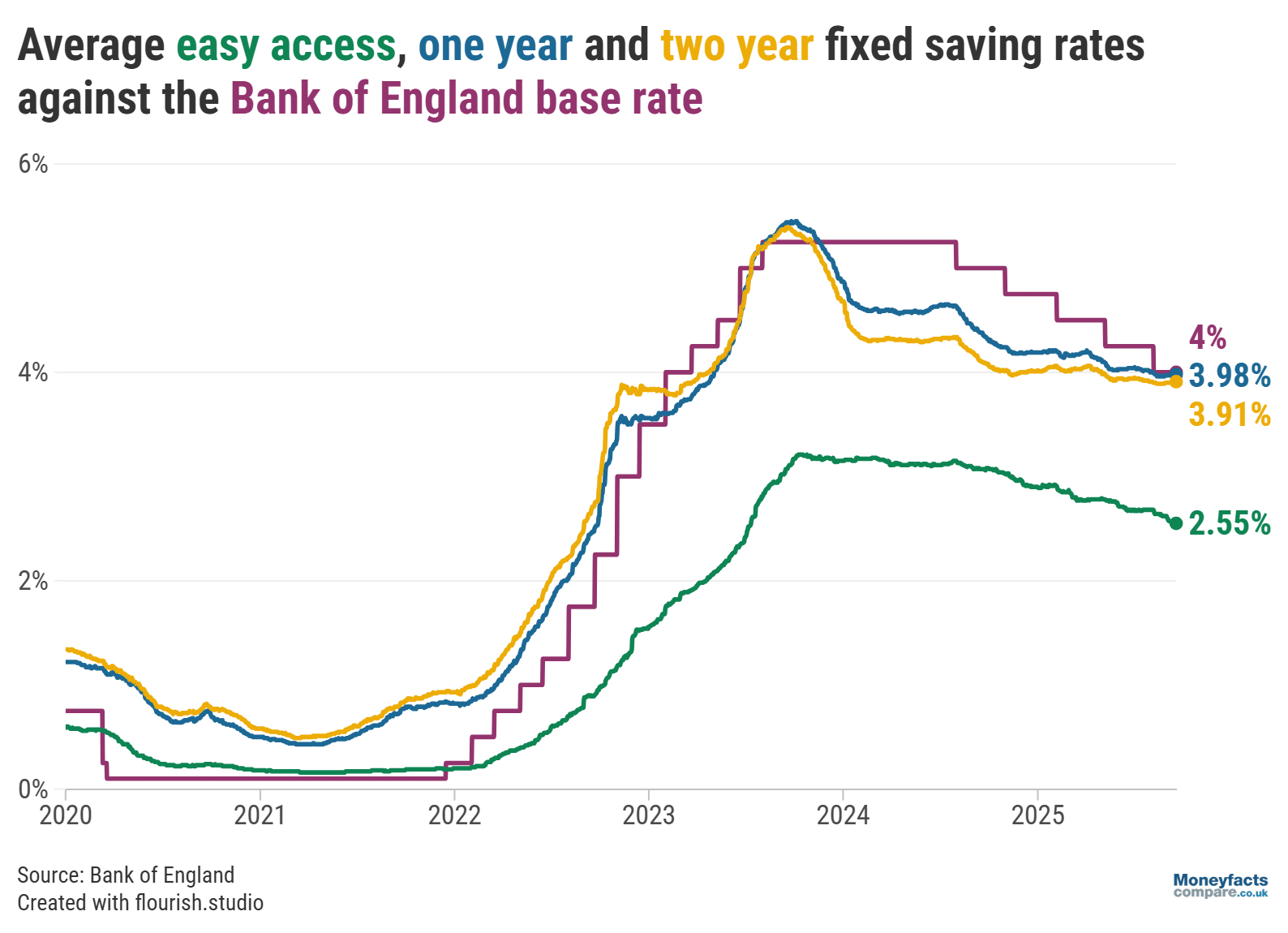

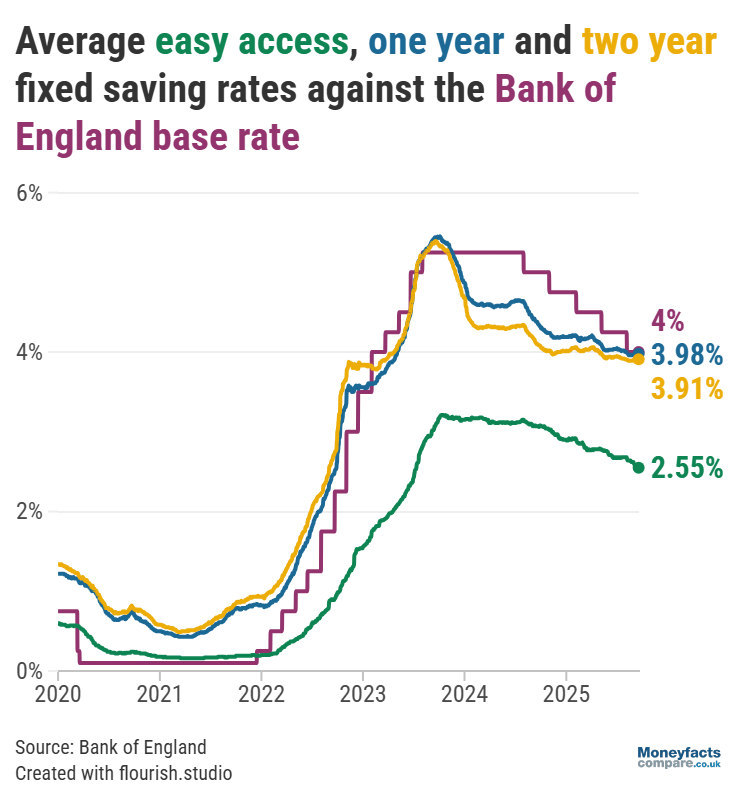

Savers at least will be grateful for a reprieve from falling rates, as many banks and building societies acted swiftly to pass the five base rate reductions since August last year onto their variable accounts.

In the month to September alone, the average rate paid by an easy access savings account and easy access ISA each dropped by 0.08 percentage points to 2.60% and 2.82%, respectively. Meanwhile, typical returns on a notice account and notice ISA fell more dramatically over the same time frame, by 0.10 percentage points to 3.53% and 0.12 percentage points to 3.37%, respectively.

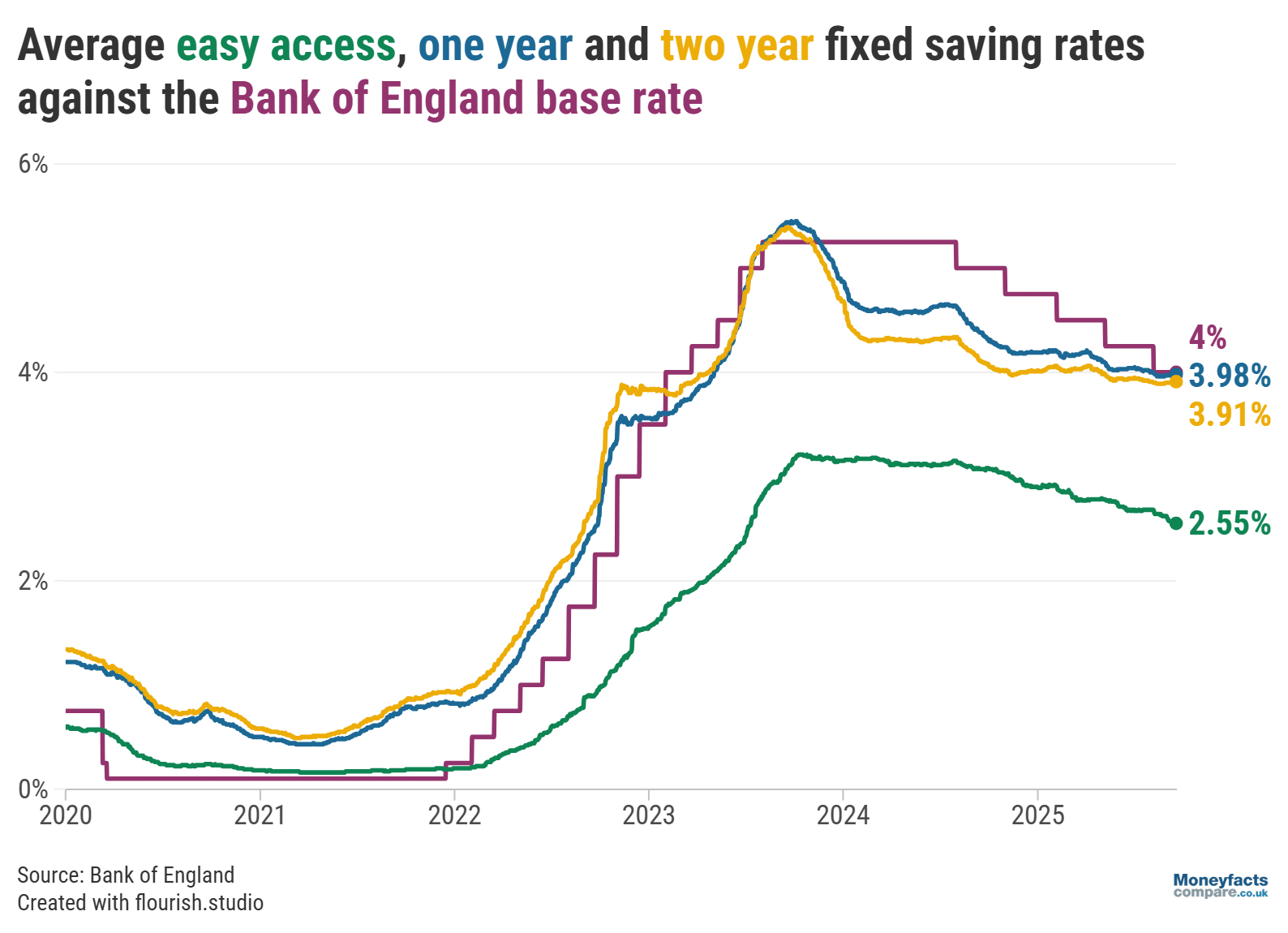

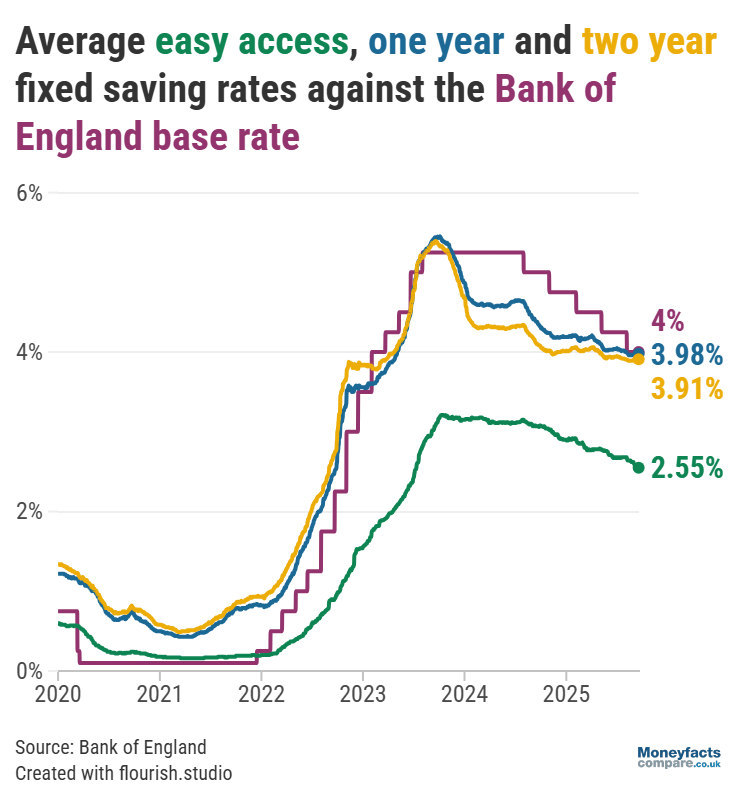

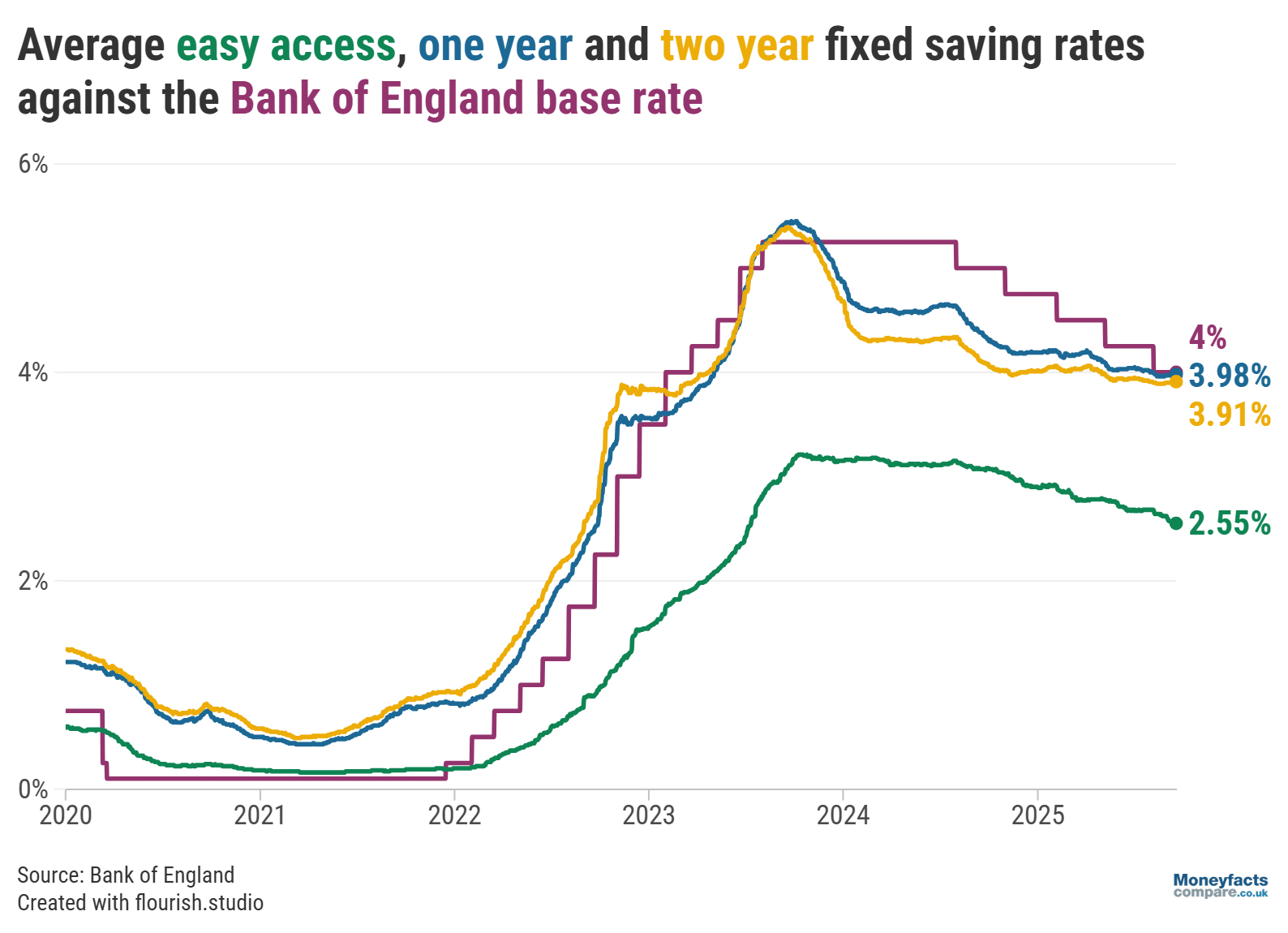

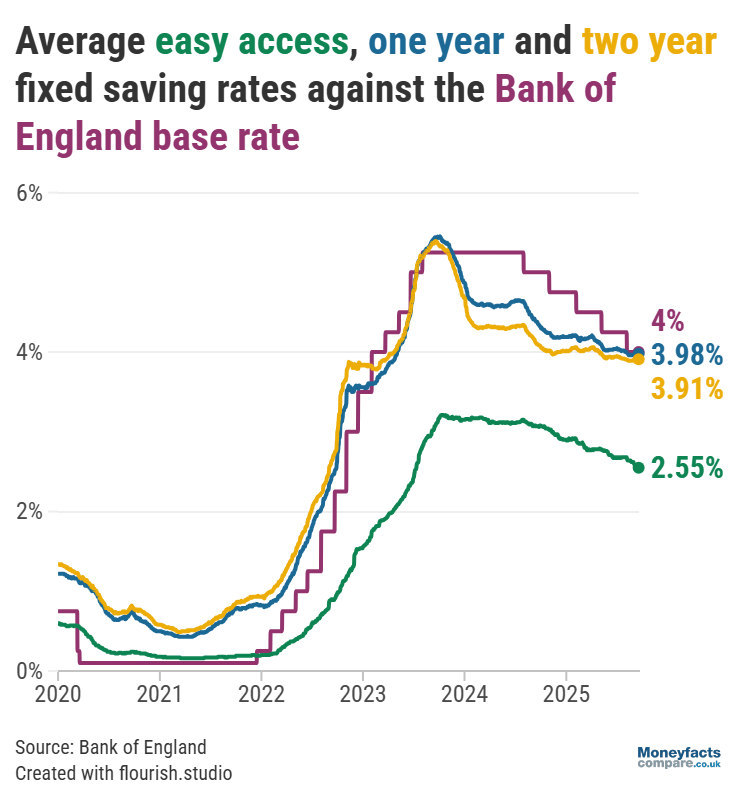

Graph: Bank of England base rate versus average savings rates between 2020 and 2025.

“It might be disheartening for savers to find the rate on their account has been cut over the past month, but now is not the time to become apathetic,” said Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

“Those with cash stashed away for convenience with one of the biggest high street banks will find they pay an average of 1.52%1 across easy access accounts,” she explained.

In fact, only a quarter of all savings accounts on the market pay more than the Bank of England base rate which means many are at risk of having their hard-earned cash lose value to inflation in real terms.

“Now is the time for savers to ditch and switch elsewhere, such as to mutuals or challenger banks that are paying attractive rates,” said Springall.

Our savings charts are regularly updated throughout the day so you can easily browse accounts offering the best rates.

You can also learn more about the most competitive accounts by subscribing for free to our weekly savings newsletter, or by staying up to date with our weekly savings and ISA roundups.

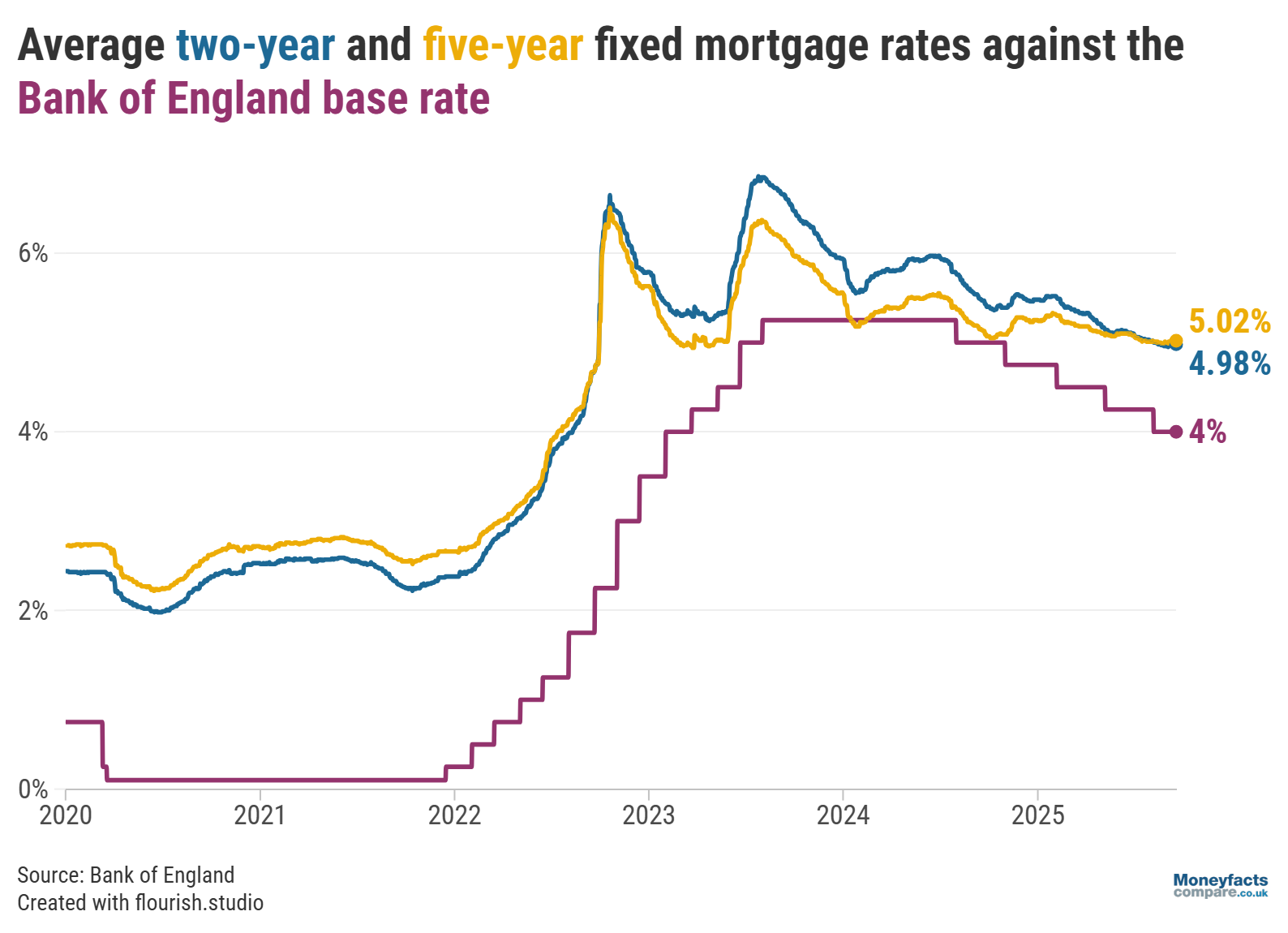

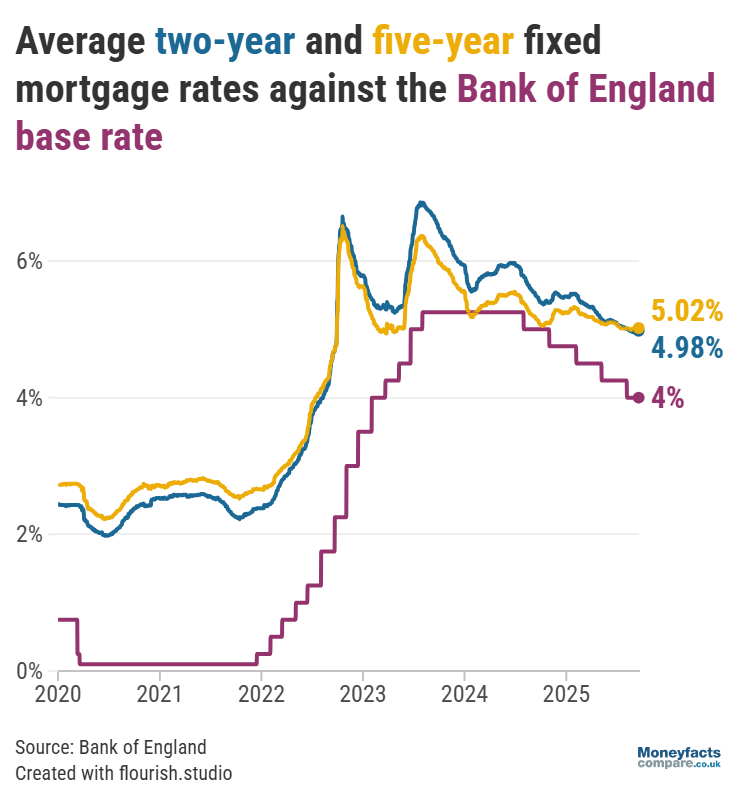

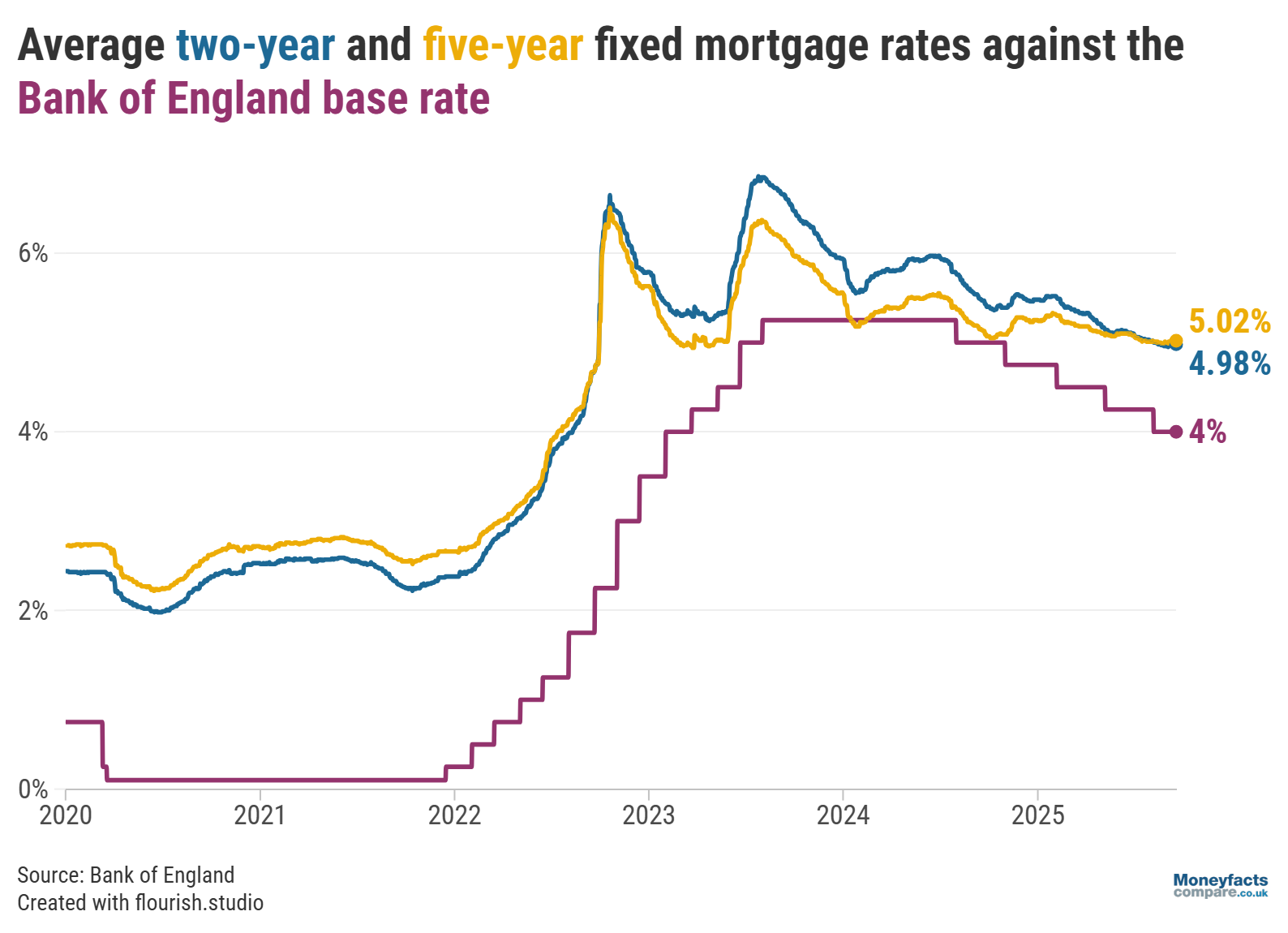

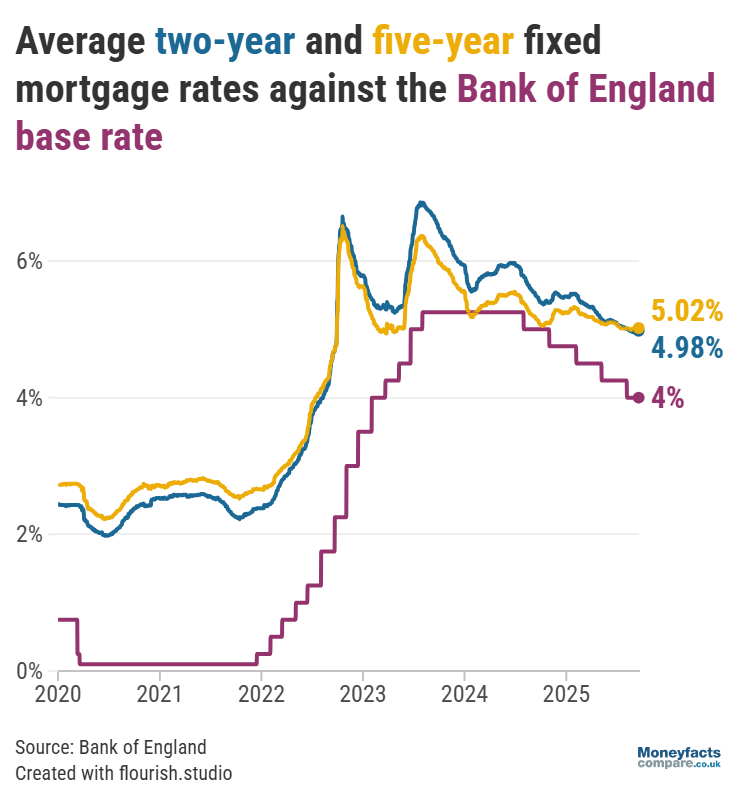

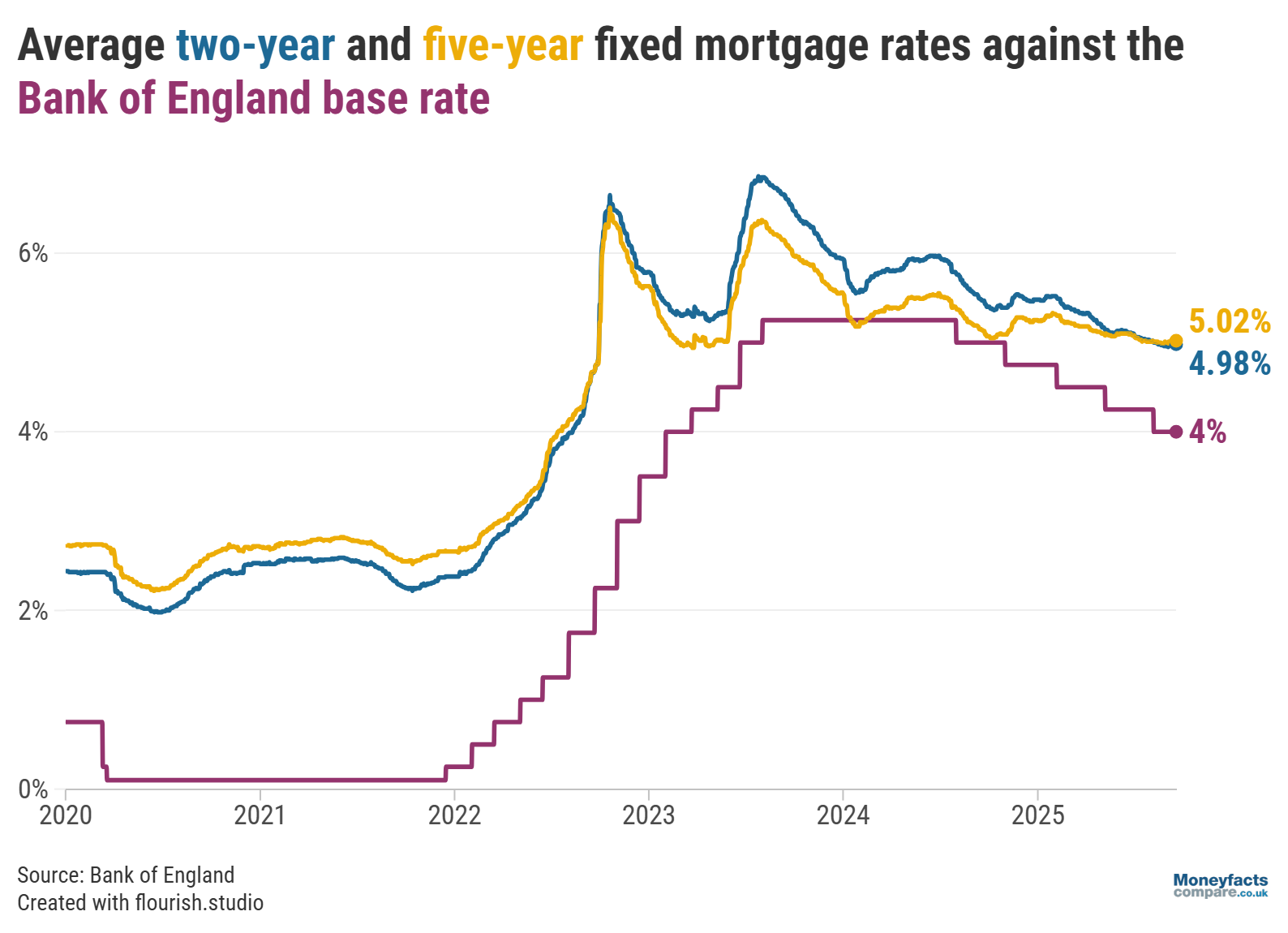

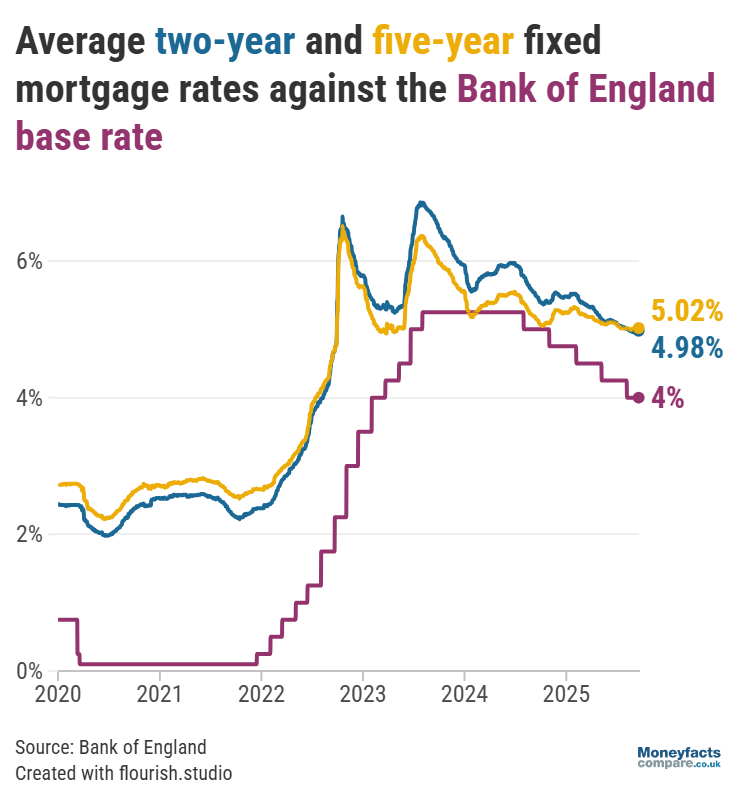

While a base rate reduction often helps to bring down the cost of borrowing, fixed mortgage rates fell by smaller margins between August and September than seen in previous months - despite the most recent cut.

This is likely because lenders tend to pre-empt changes to the base rate when setting their fixed pricing. With doubt over when the central interest rate will next be lowered, the average rate charged by a two-year fixed mortgage dropped by a modest 0.05 percentage points month-on-month to 4.96%. Meanwhile, the average five-year fixed mortgage rate decreased by just 0.01 percentage points to 5.01%.

In contrast, the average 10-year fixed mortgage rate rose by 0.07 percentage points and, at 5.67%, is higher than a year ago.

Graph: Bank of England base rate versus average fixed mortgage rates between 2020 and 2025.

“Uncertainties surrounding the outlook for interest rate moves have been evident over recent weeks, with volatile swap rates leading to a more cautious approach from lenders to make any significant changes. Not only this, but many will be waiting with bated breath for the Budget,” said Springall.

“This waiting game, alongside forecast for inflation to remain above target, makes it less likely for the Bank of England to make further rate cuts this year,” she explained.

In the meantime, borrowers sitting on their lender’s Standard Variable Rate (SVR) could expect to pay £363 more per month than if they opted for an average-priced two-year fixed deal2.

It’s for this reason that Oliver Dack, Spokesperson for Mortgage Advice Bureau, is urging people not to delay locking in a new fixed rate:

“Last month’s base rate cut couldn’t counteract a summer slump in consumer appetite. But now, with people having returned from their holidays and children back at school, we’re encouraging borrowers to find the time to review their mortgage rates – particularly those coming to the end of their current fixed deal.”

“While some may be tempted to wait until after the Chancellor of the Exchequer delivers her Autumn Budget in November before booking a new deal, there are no guarantees as to what’s in store. The mortgage market can easily be spooked – as was seen in the wake of the tumultuous mini-Budget around three years ago,” Dack added.

“Instead, it’s important borrowers shake any distractions and focus solely on their own circumstances. Locking into a fixed deal can offer sense of security in the face of an uncertain future and is often a cheaper alternative to falling onto a lender’s SVR.”

If you’re looking for a new mortgage deal, our regularly updated charts can be a good place to start. However, it’s important to remember that that the cheapest-priced deal may not necessarily be the most cost-effective depending on your needs and circumstances.

That’s why our weekly mortgage roundup not only includes the lowest fixed rates but also features some Moneyfacts Best Buy alternatives (based on their overall true cost). Alternatively, speak to a mortgage broker for specialist advice.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

[1] High street banks include Bank of Scotland, Barclays Bank, Halifax, HSBC, Lloyds Bank, NatWest, Royal Bank of Scotland and Santander. Averages collected from gross interest rates paid across all live easy access accounts with these brands based on a £10,000 deposit, latest rates as at 16 September 2025.

[2] Based on a £250,000 mortgage over a 25-year term at a rate of 7.32% (this month’s average SVR).

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.