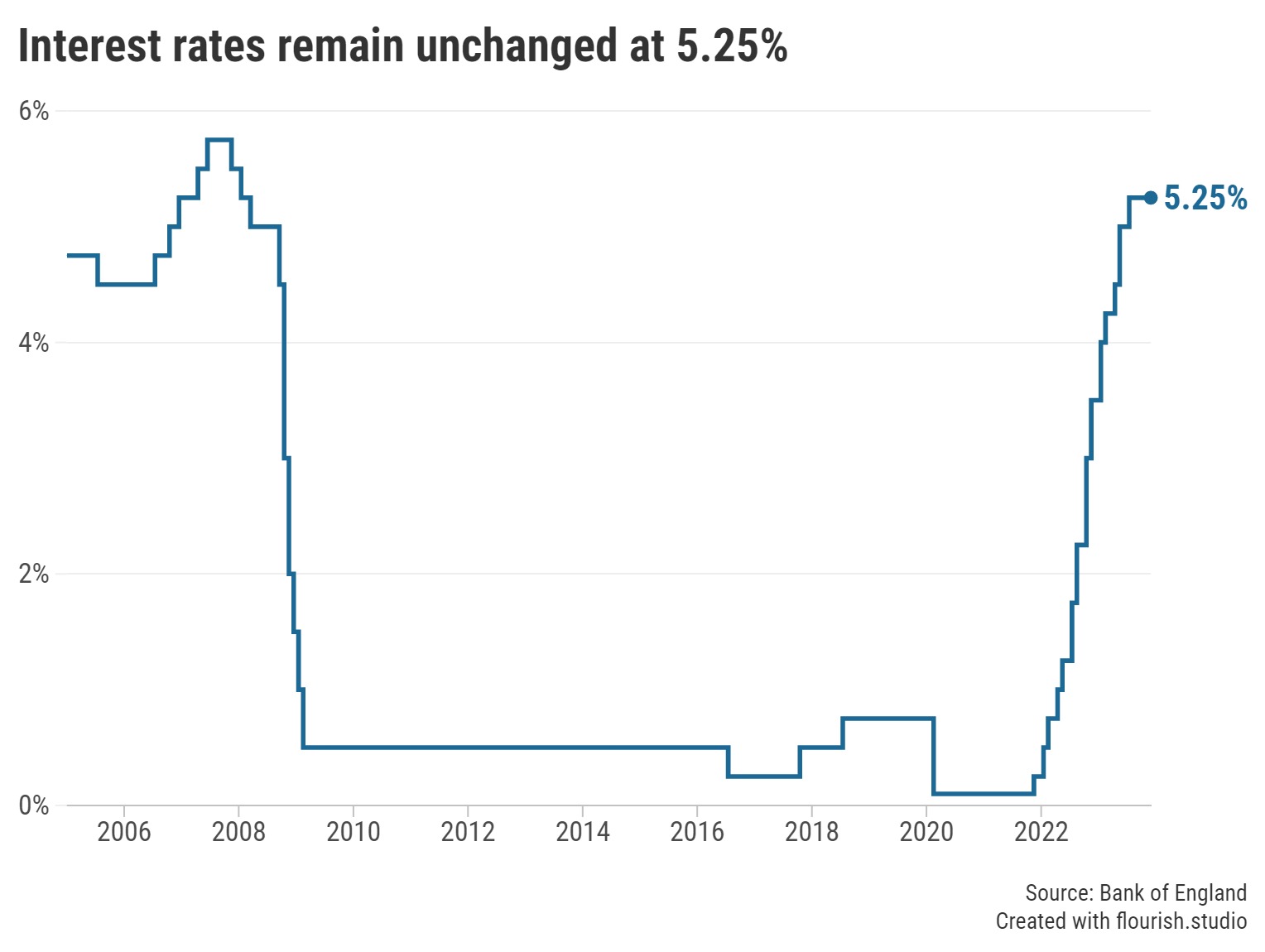

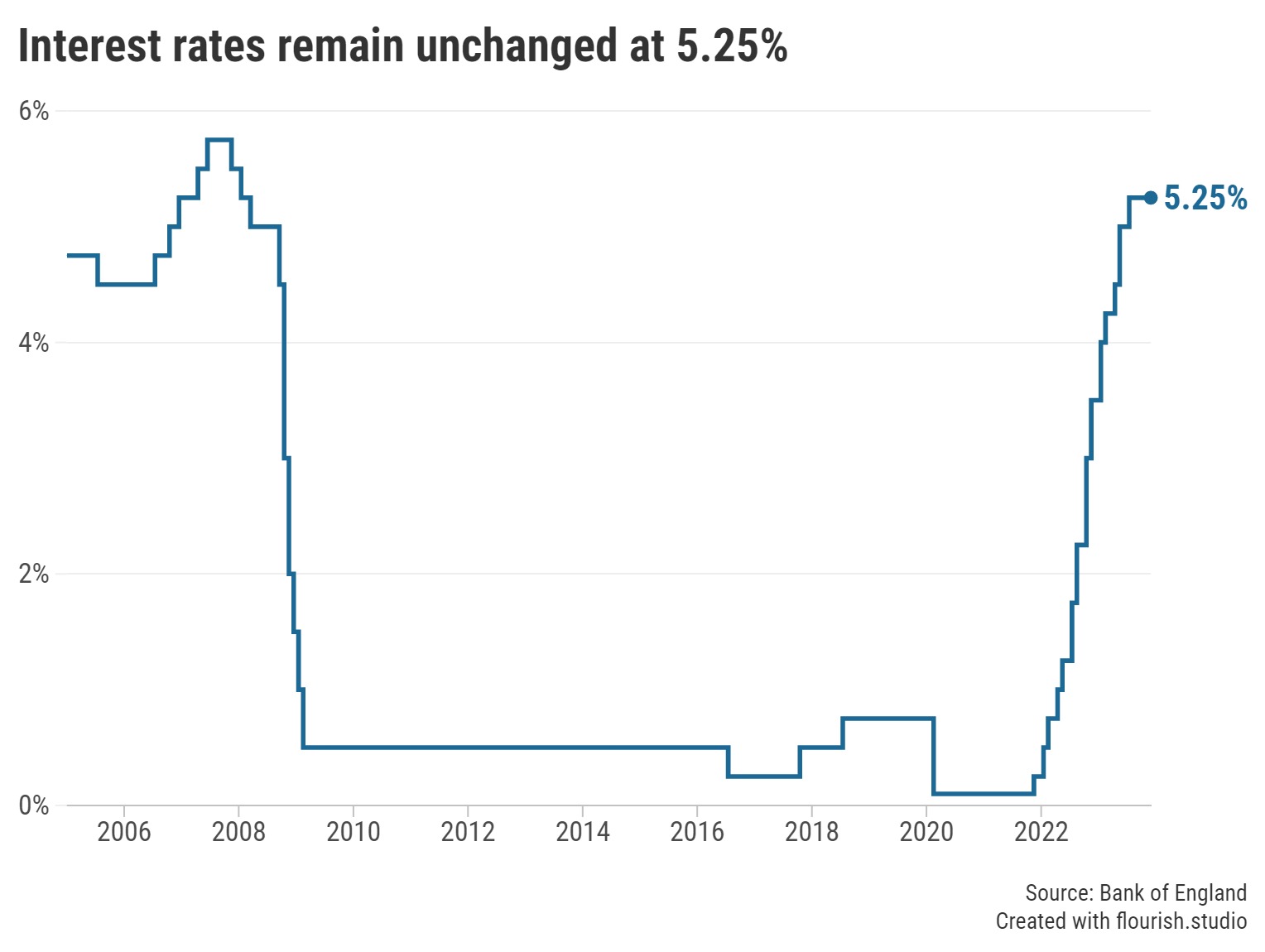

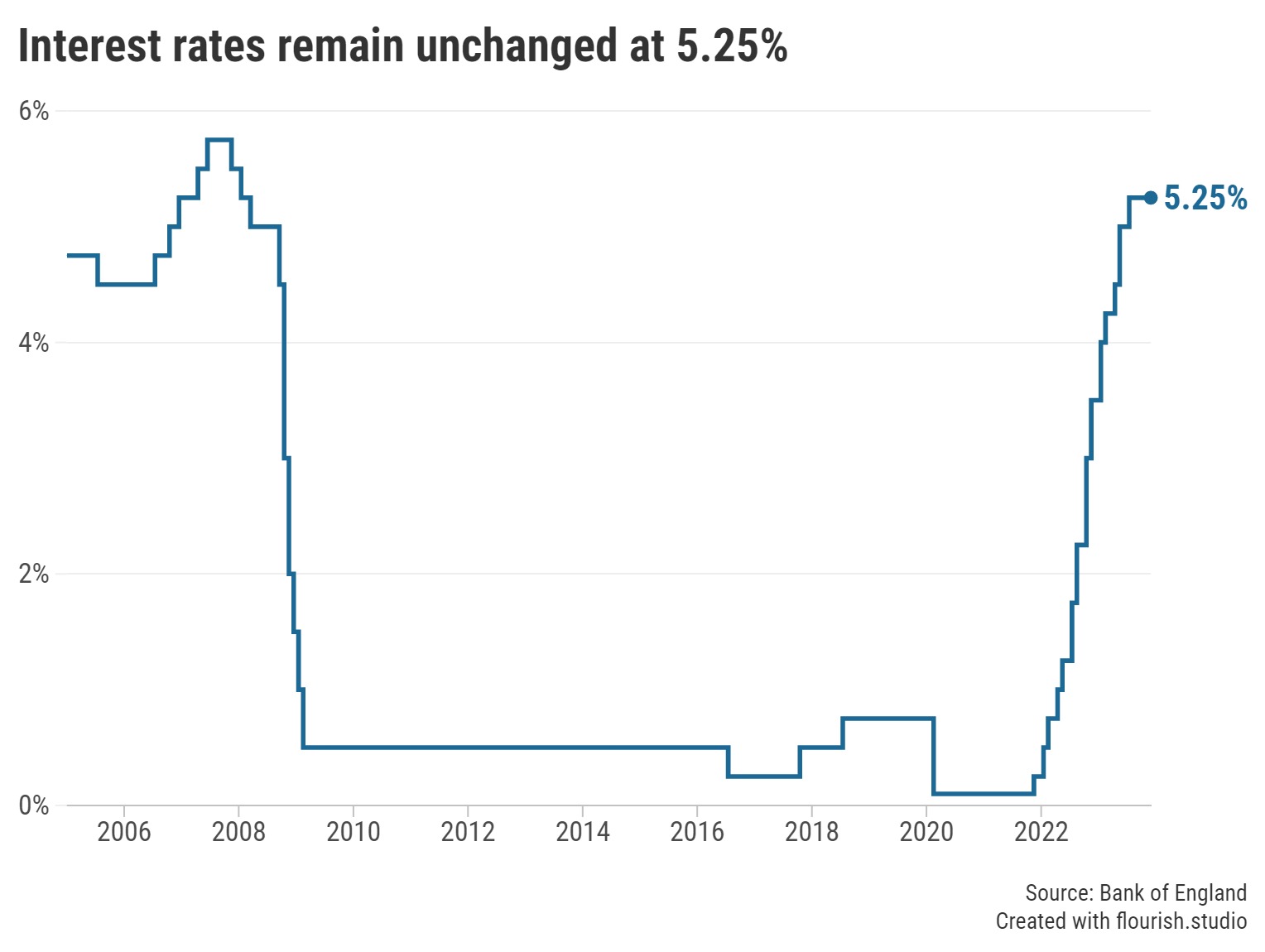

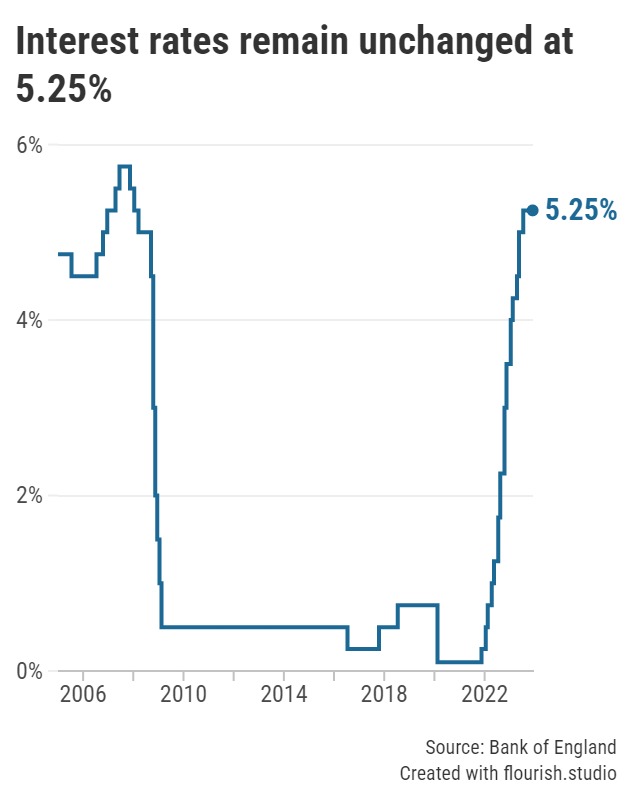

This is the third consecutive time the base rate has been held.

In the final scheduled vote of this year, the Bank of England’s Monetary Policy Committee decided by 6 to 3 to maintain the base rate at 5.25% heading into 2024. This is the third consecutive time the MPC voted in favour of a pause to interest rates.

Sitting at 3.50% in January, there were a total of five base rate rises this year as the Bank of England attempted to tackle chronically high inflation - part of 14 consecutive rises that took place since December 2021.

Caption: The Bank of England's Monetary Policy Committee (MPC) holds the base rate at 5.25% for the third consecutive time.

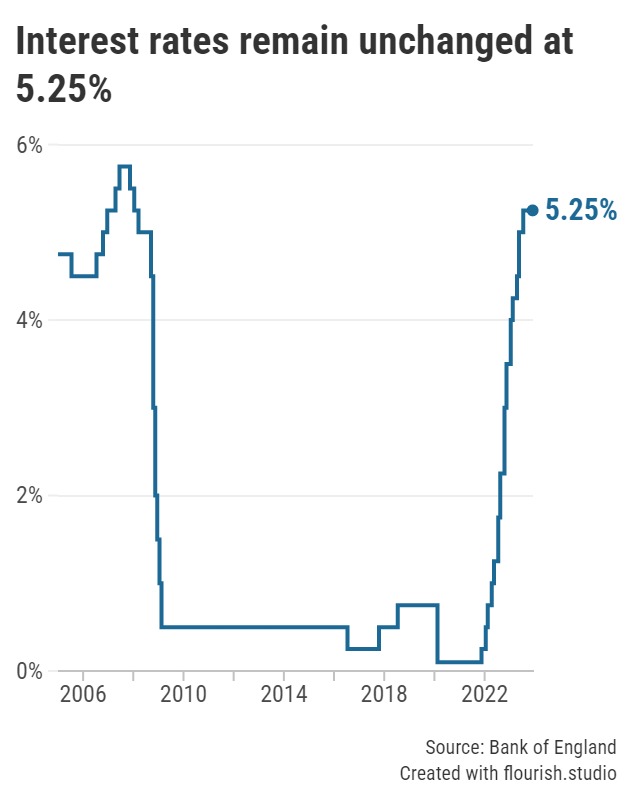

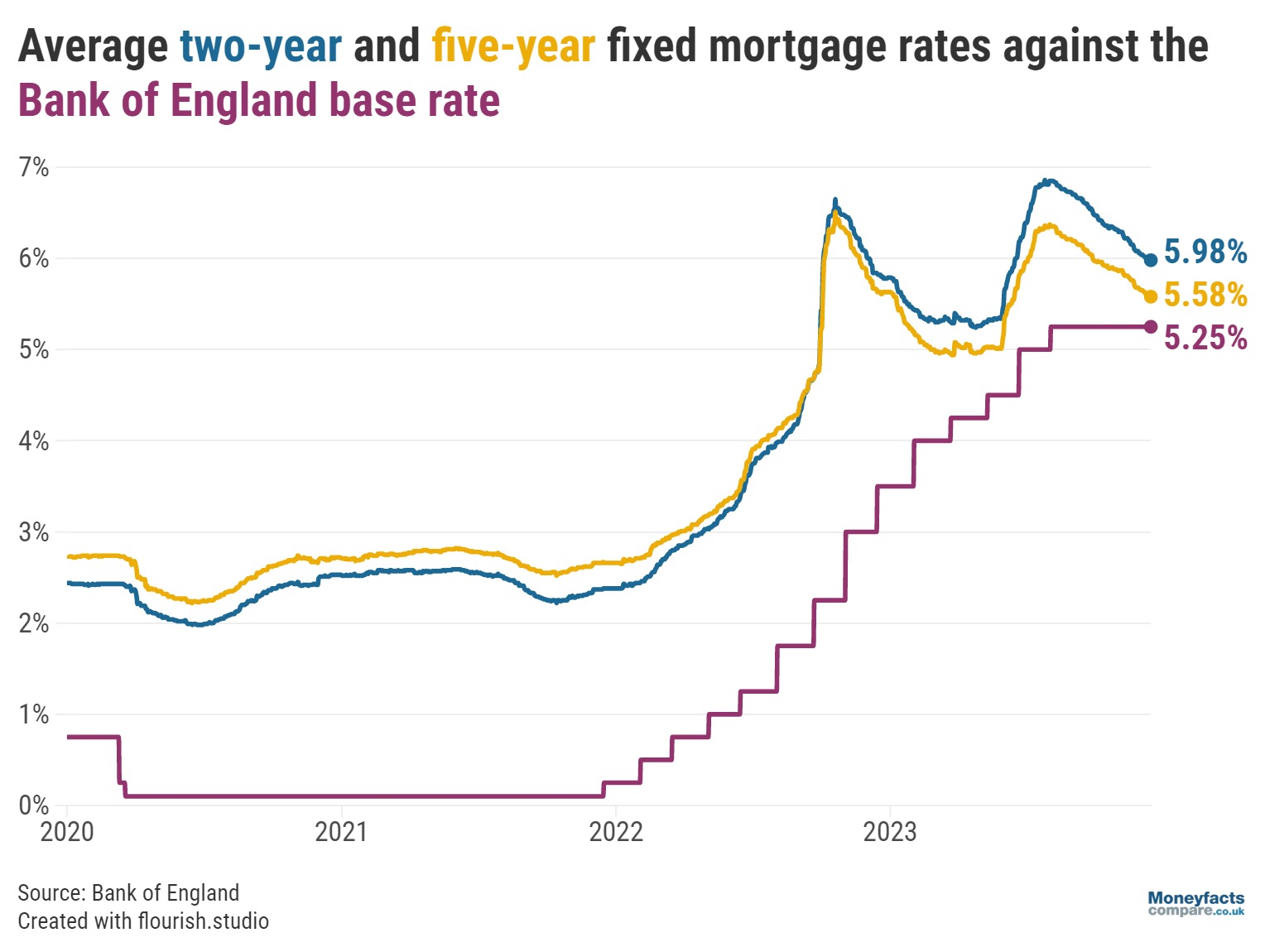

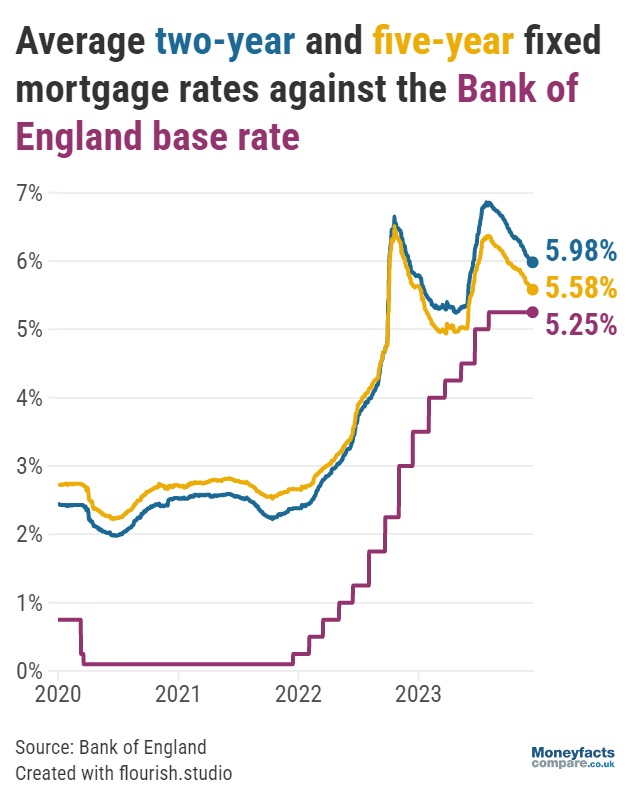

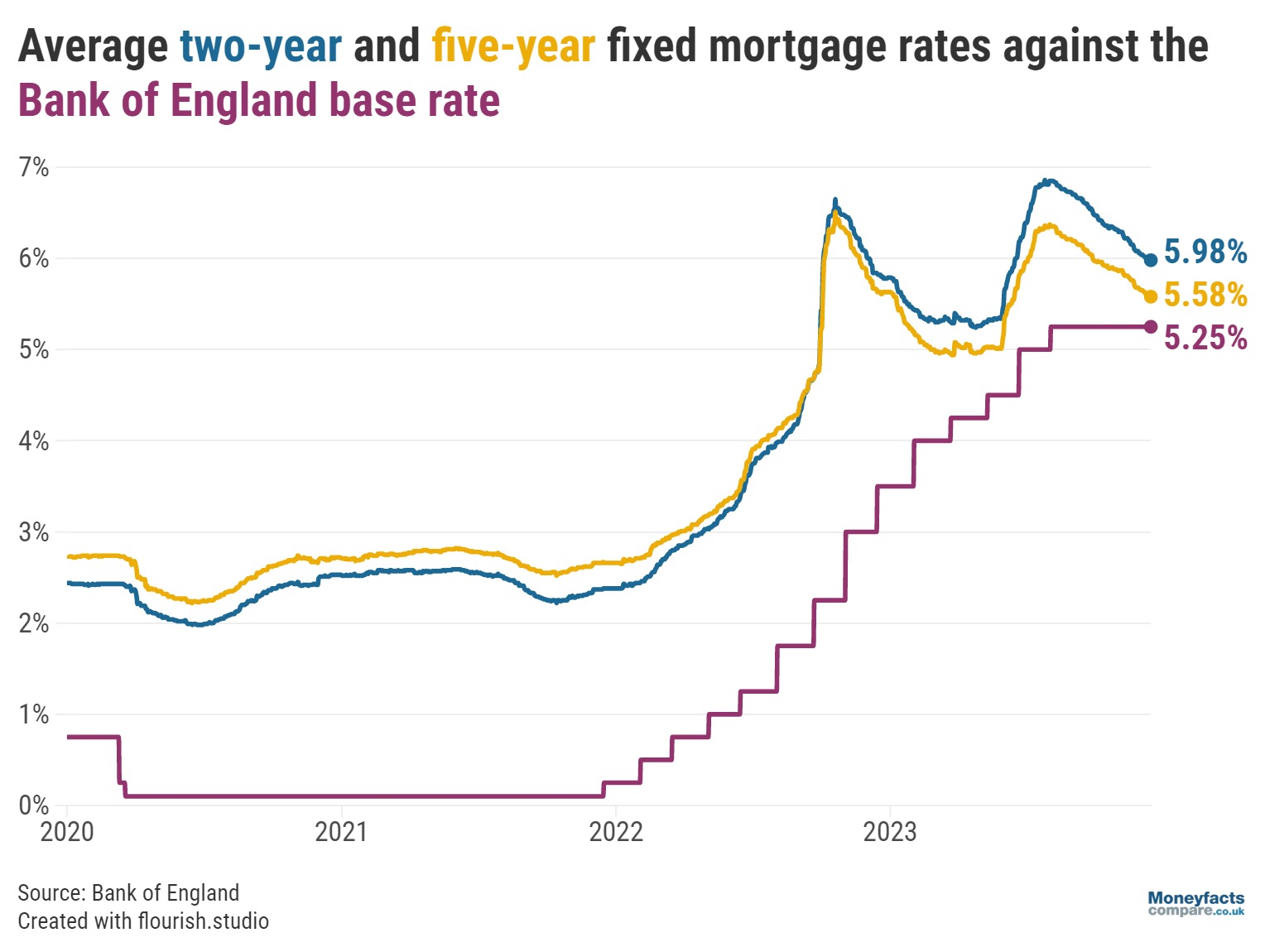

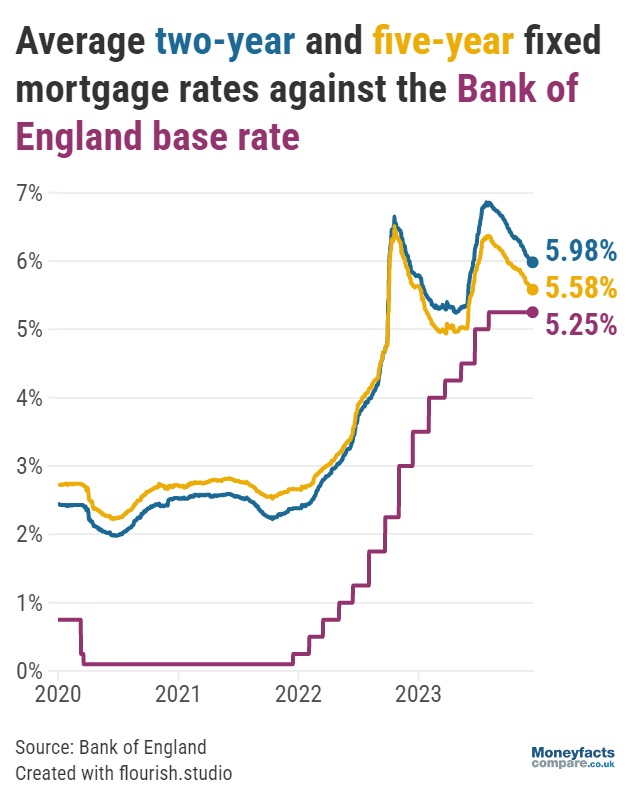

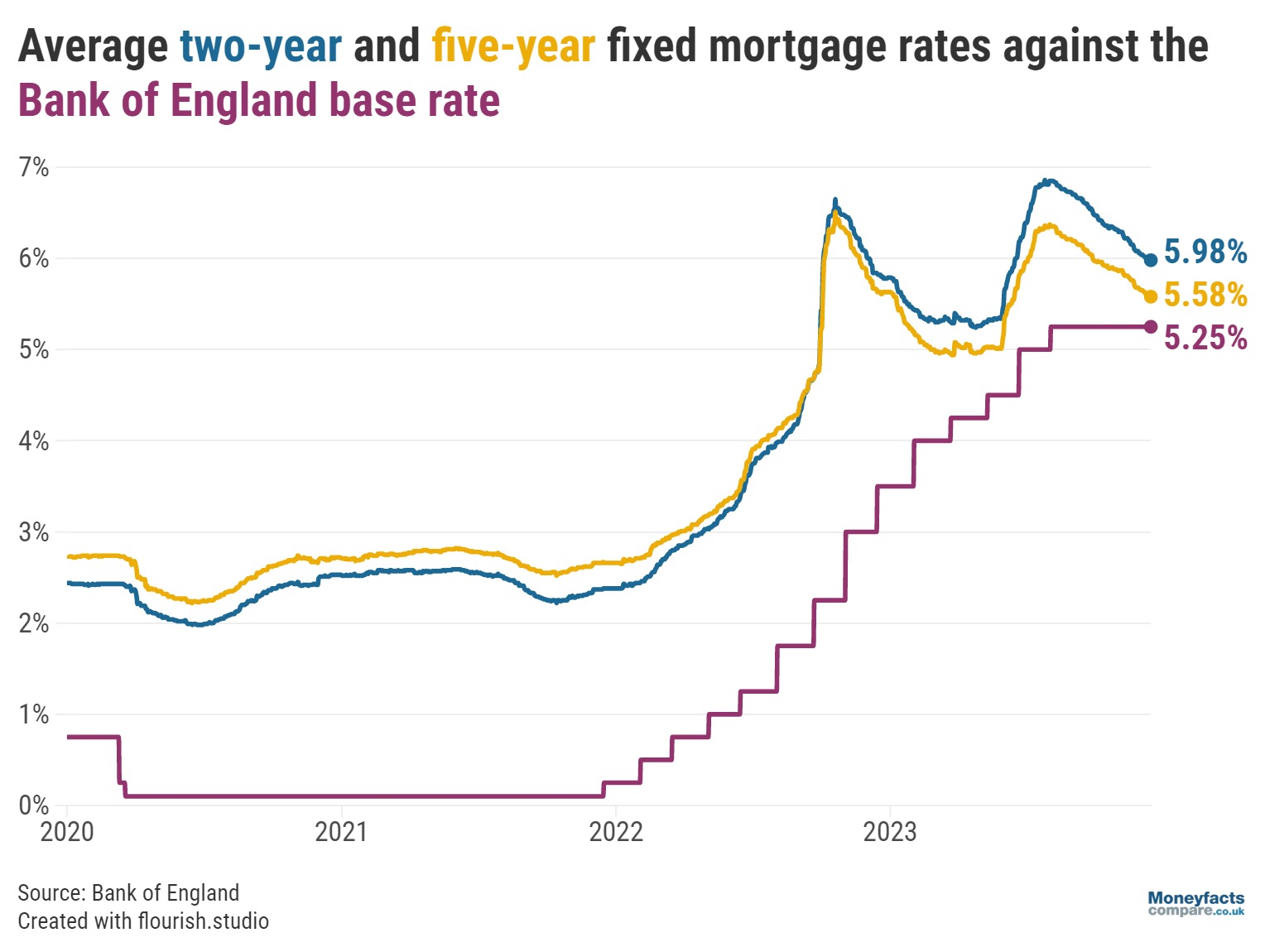

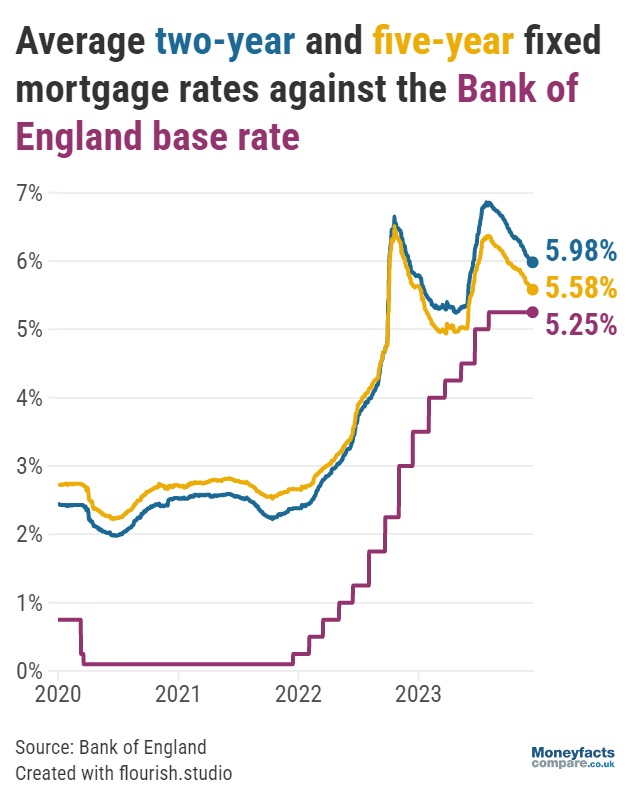

These increases to the base rate have taken their toll on the mortgage market. “The past two years have proven to be an unprecedented period of interest rate volatility for mortgages,” said Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

“Those coming off a fixed rate deal and wishing to fix once more will likely have to cover a much higher mortgage repayment, with the average two-year fixed rate more than double what it was in December 2021,” Springall added.

Caption: With the Bank of England base rate once again going unchanged, average fixed mortgage rates continue to fall.

Indeed, at the start of December 2021, the average fixed rate for a two-year mortgage stood at 2.34%. Today, this rate now sits at 5.98%. Nevertheless, the market is now showing some signs of improvement, with this figure down from 6.29% at the start of November 2023.

“The lending space is currently very competitive, which is good news for our clients,” said Oliver Dack, Spokesperson for Mortgage Advice Bureau. “Not only this, but there are lots of products available below the current base rate.”

Borrowers can use our mortgage charts to compare the deals currently available. For help navigating the mortgage market, consider speaking with a mortgage broker.

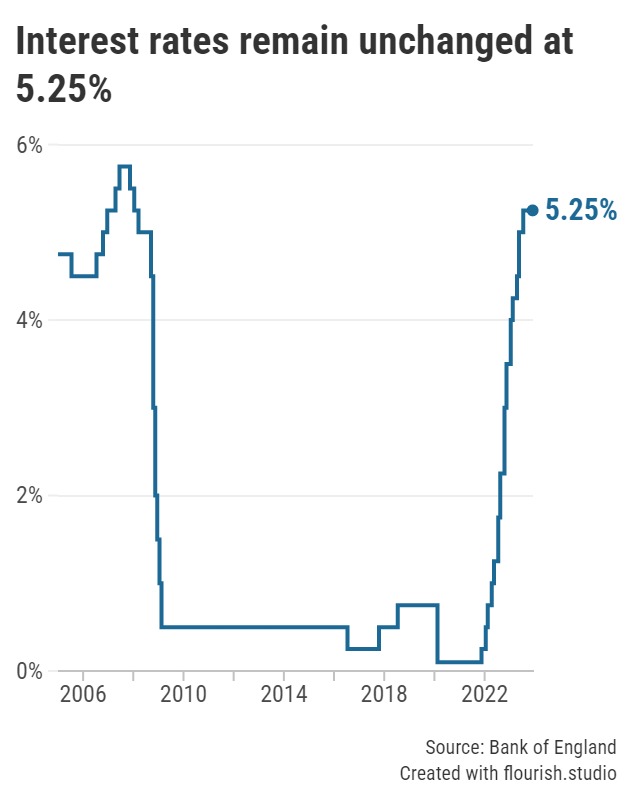

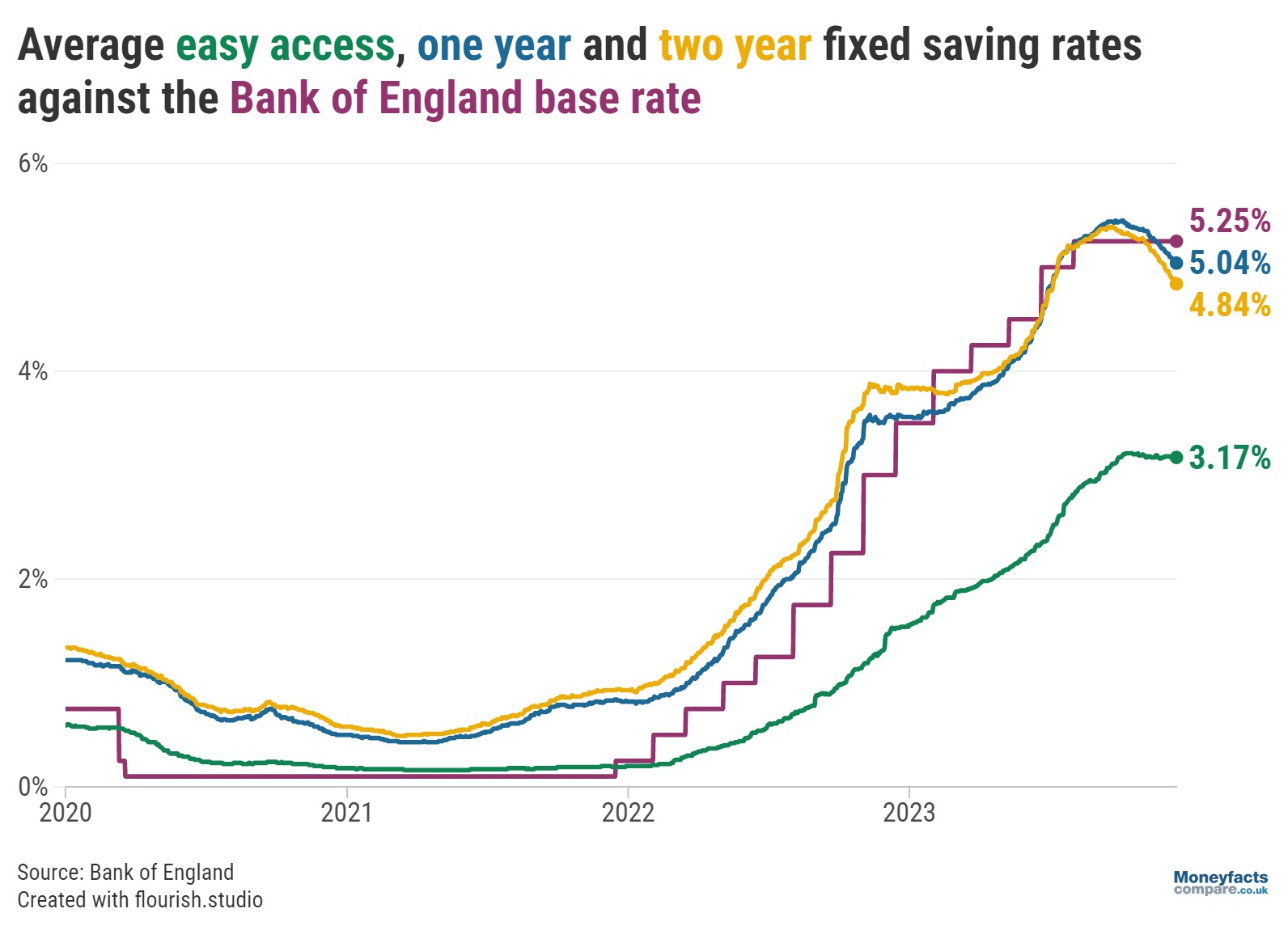

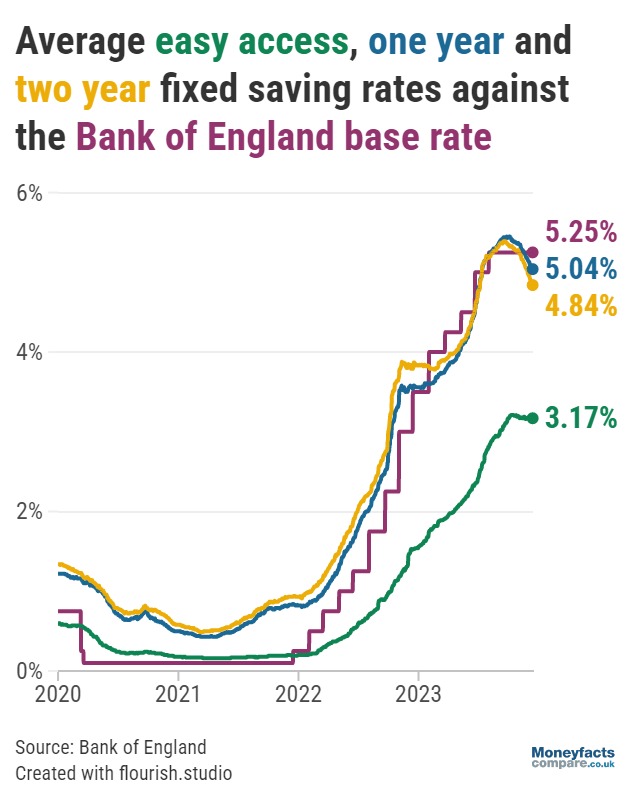

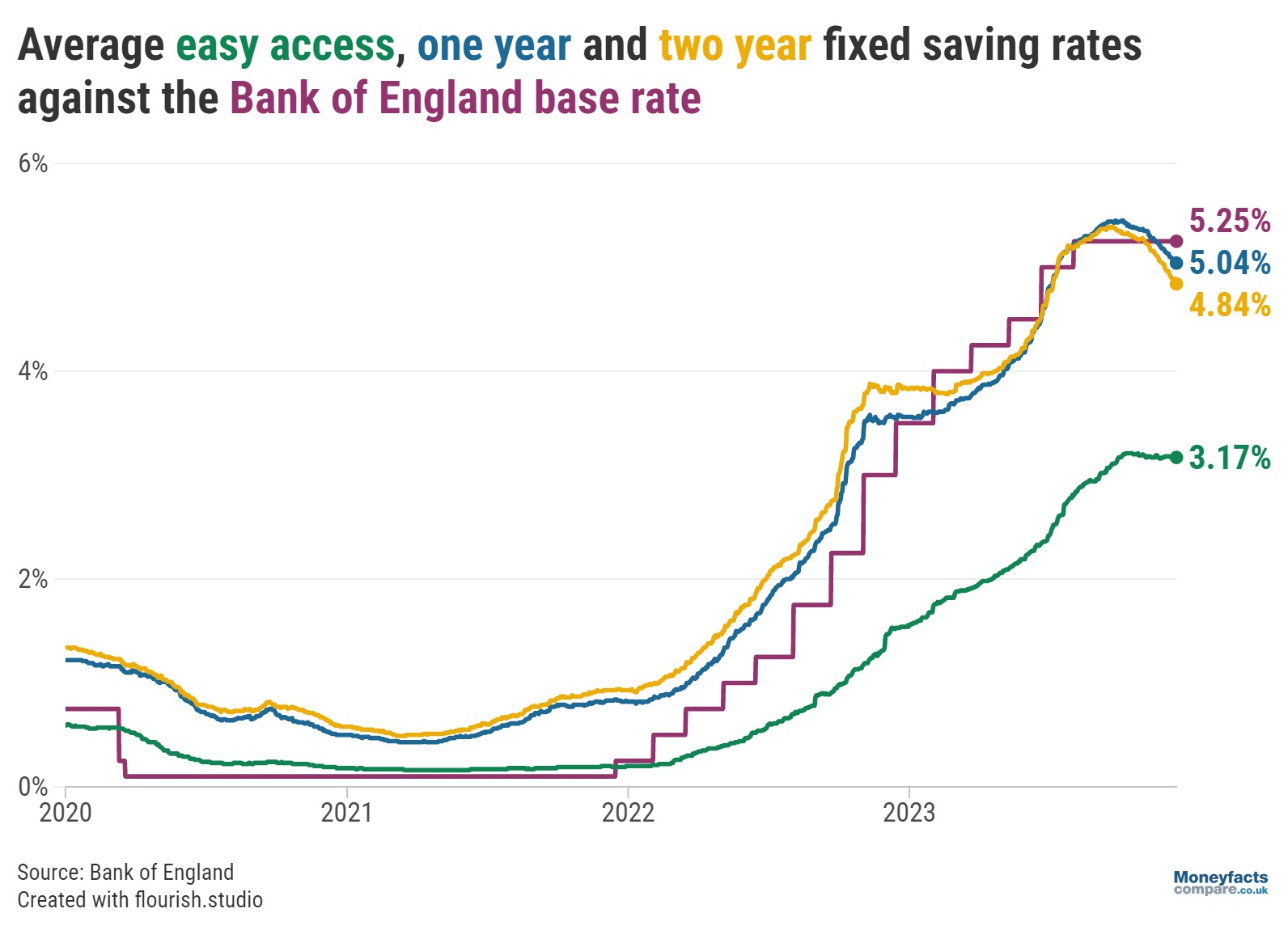

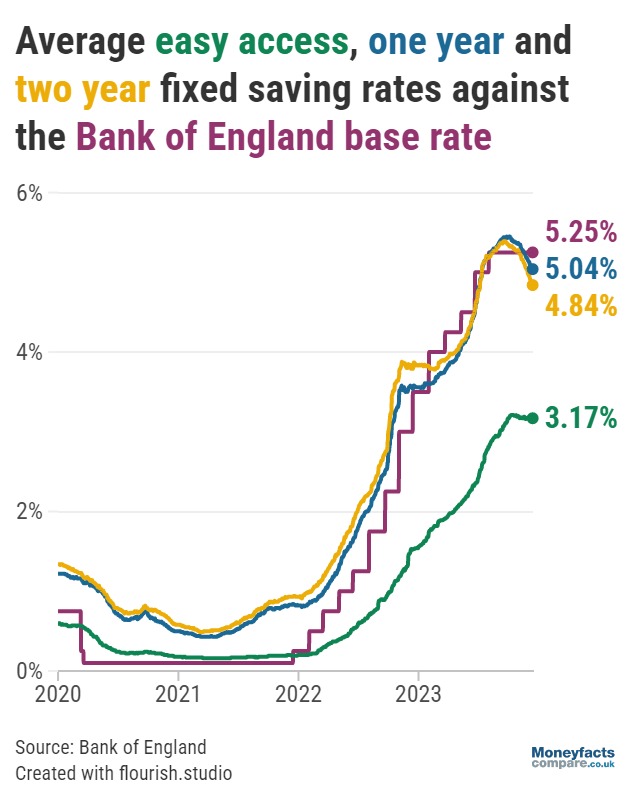

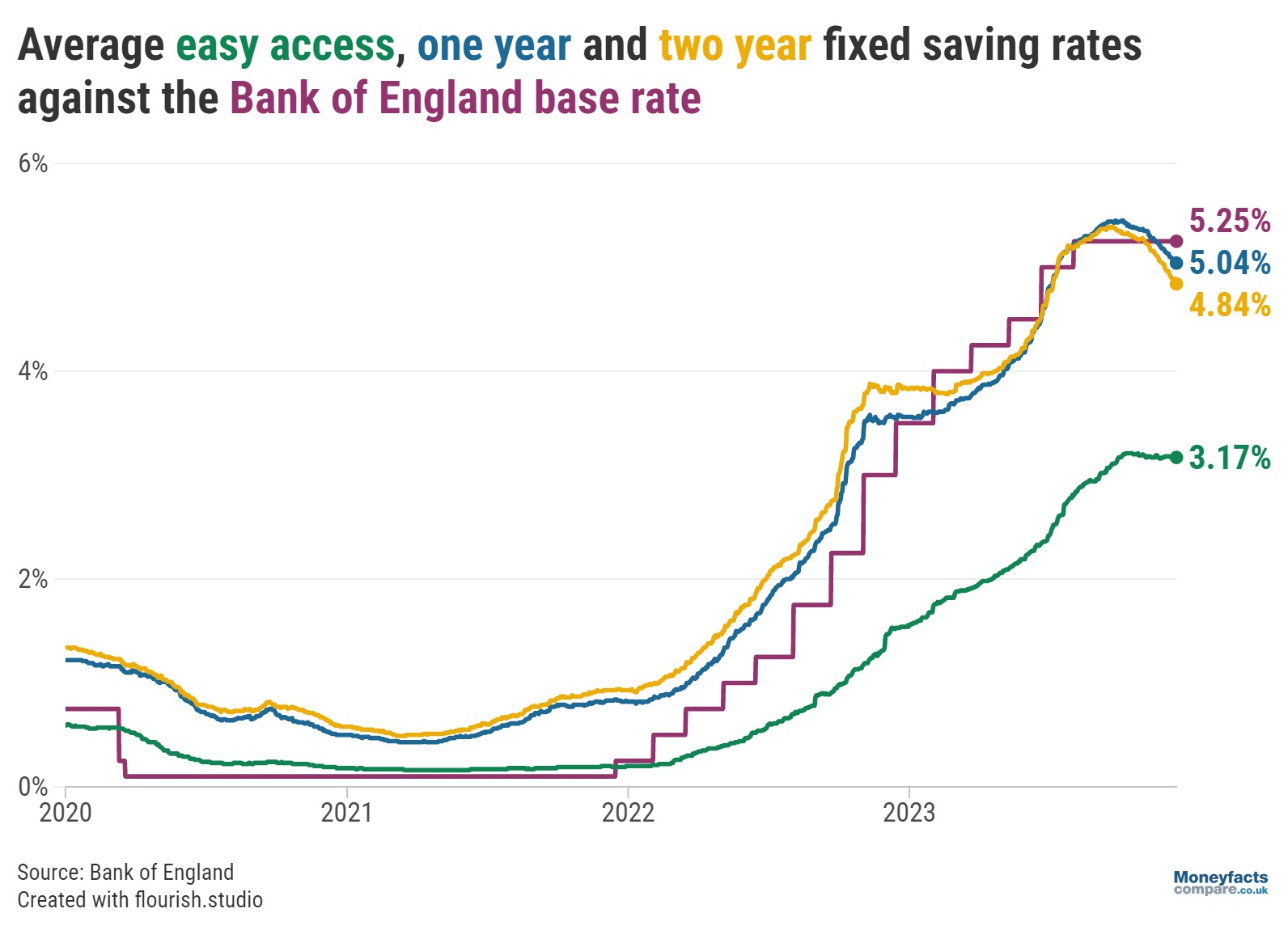

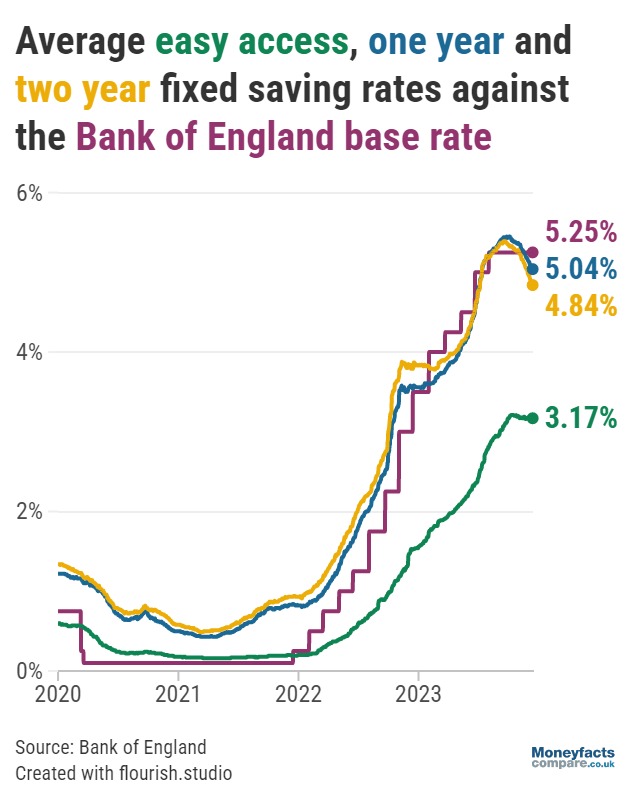

Savers may be disappointed to see the base rate go unchanged for the third time, after consecutive rises resulted in 2023 providing “much better returns”, according to Springall.

“The Bank of England base rate rises played their part by encouraging providers to boost the variable rates on offer to savers, and many challenger banks and building societies have worked hard to provide better rates for customers.”

This can be seen with the average gross rate for an easy access savings account standing at 3.17% this morning, up from 1.44% December last year, and 0.20% at the start of December 2021.

Caption: The 14 consecutive base rate rises since December 2021 encouraged providers to boost their variable savings rates.

However, Springall said a few high street banks continue to offer meagre returns and encouraged savers to shop around if their loyalty isn’t being rewarded.

With the Office for National Statistics (ONS) finding inflation slowed significantly from 6.7% to 4.6% in October, meeting the Government’s pledge to halve inflation by the end of the year, some may be hopeful there won’t be any further base rate rises in 2024.

As inflation remains well above the Bank of England’s 2% target, though, the possibility of more interest rate hikes next year can’t be ruled out.

Our dedicated savings charts are updated regularly throughout the day to show you the best savings rates available. Compare the top savings accounts here.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.