This marks the fourth consecutive time the base rate has gone unchanged.

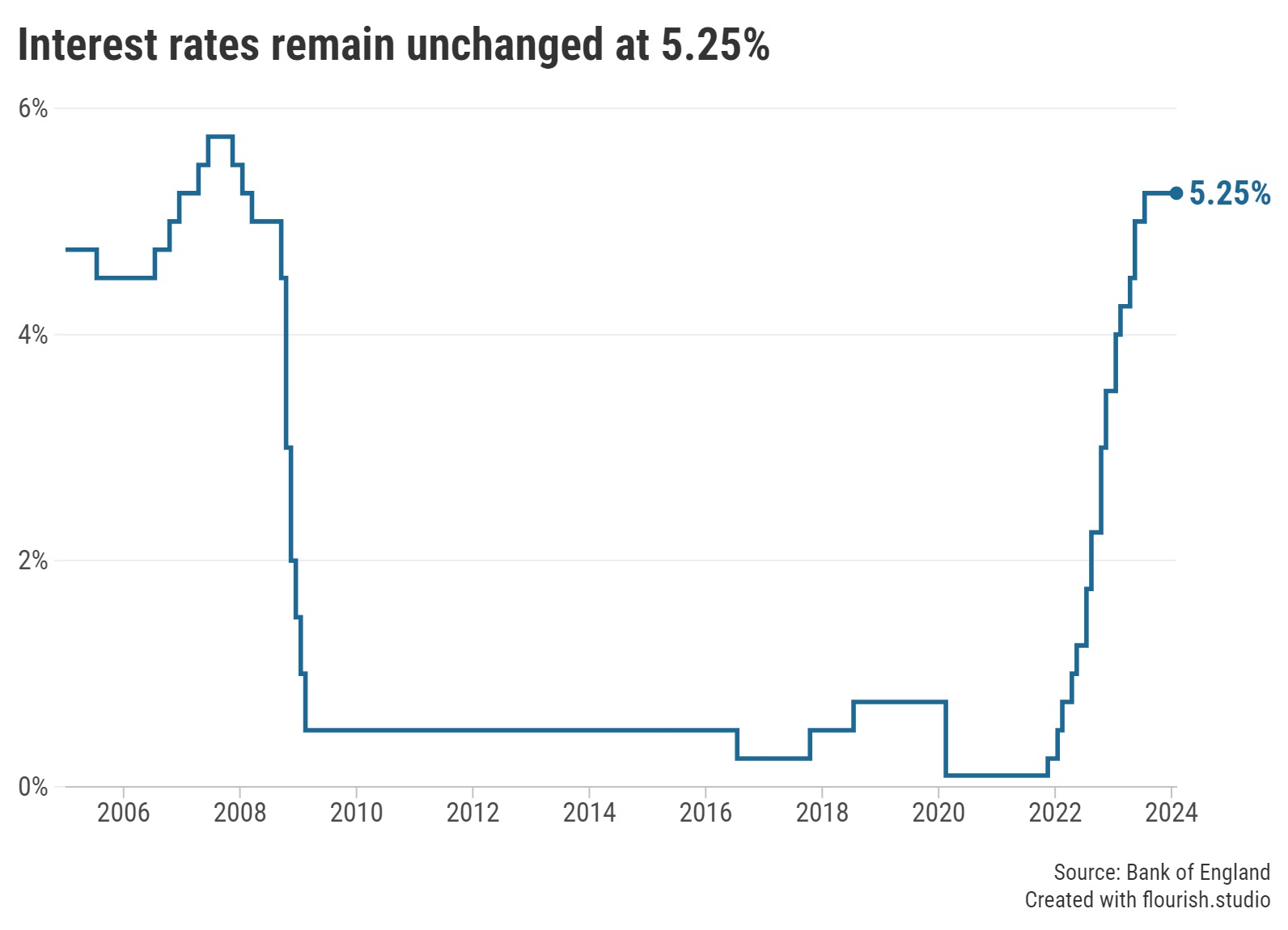

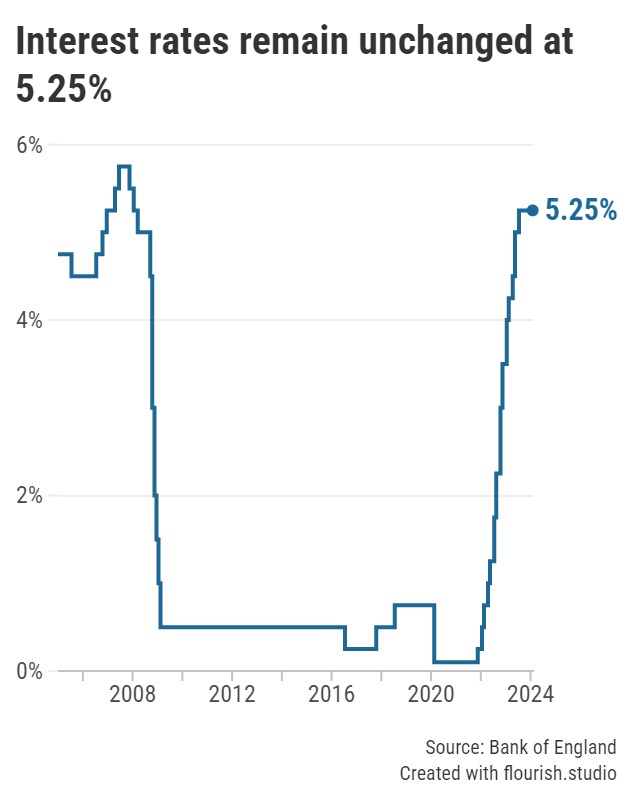

The Bank of England base rate is to remain at 5.25% after the Monetary Policy Committee (MPC) decided by a 6 to 3 majority in favour of extending the pause in interest rates. Today’s vote marks the fourth consecutive time the base rate has gone unchanged and follows an unexpected uptick in December’s inflation figures.

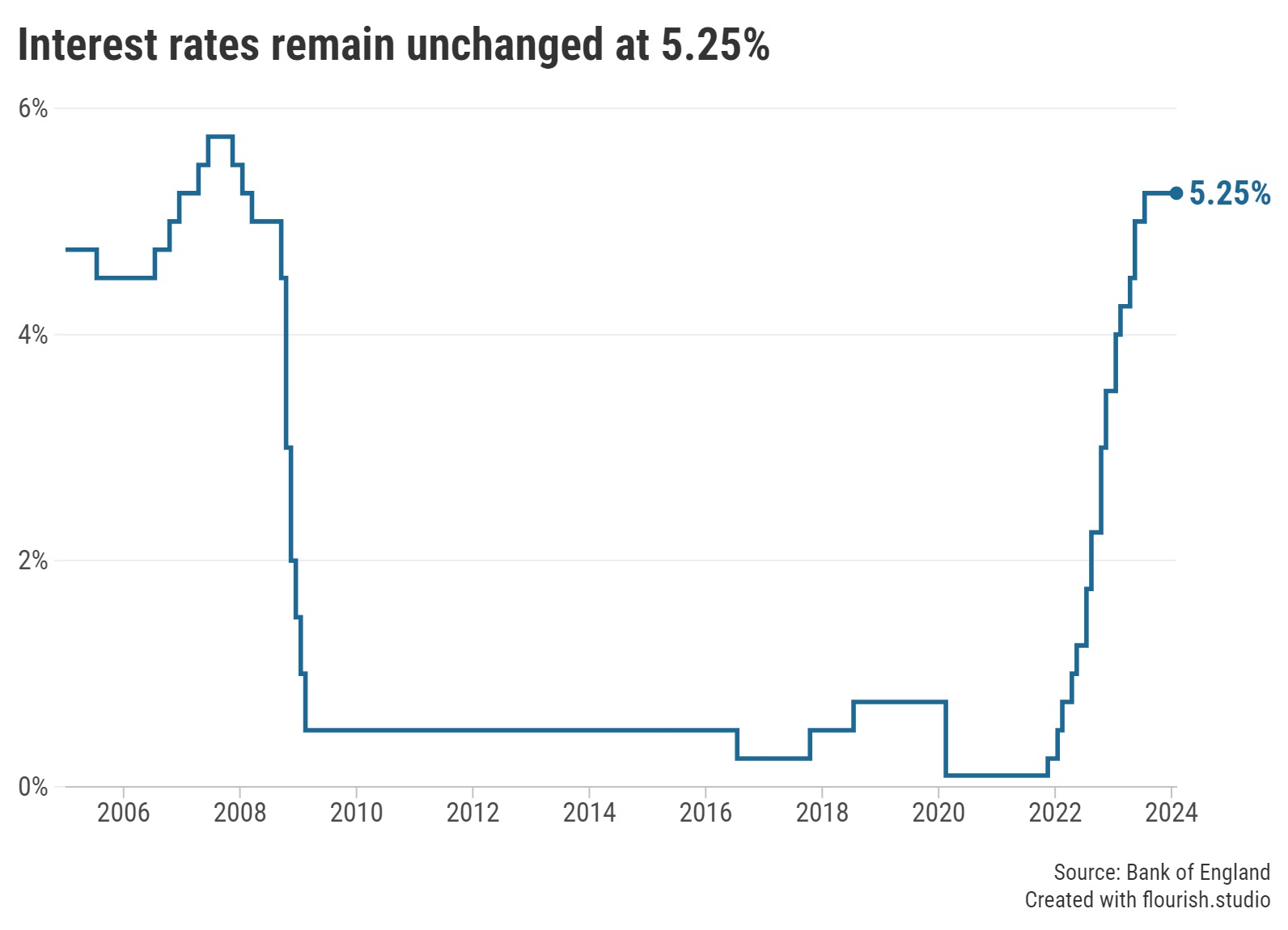

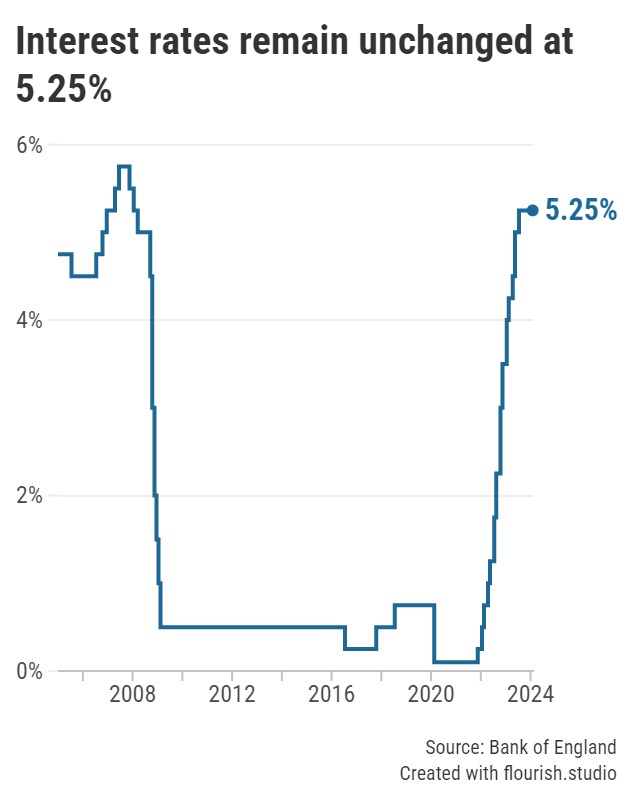

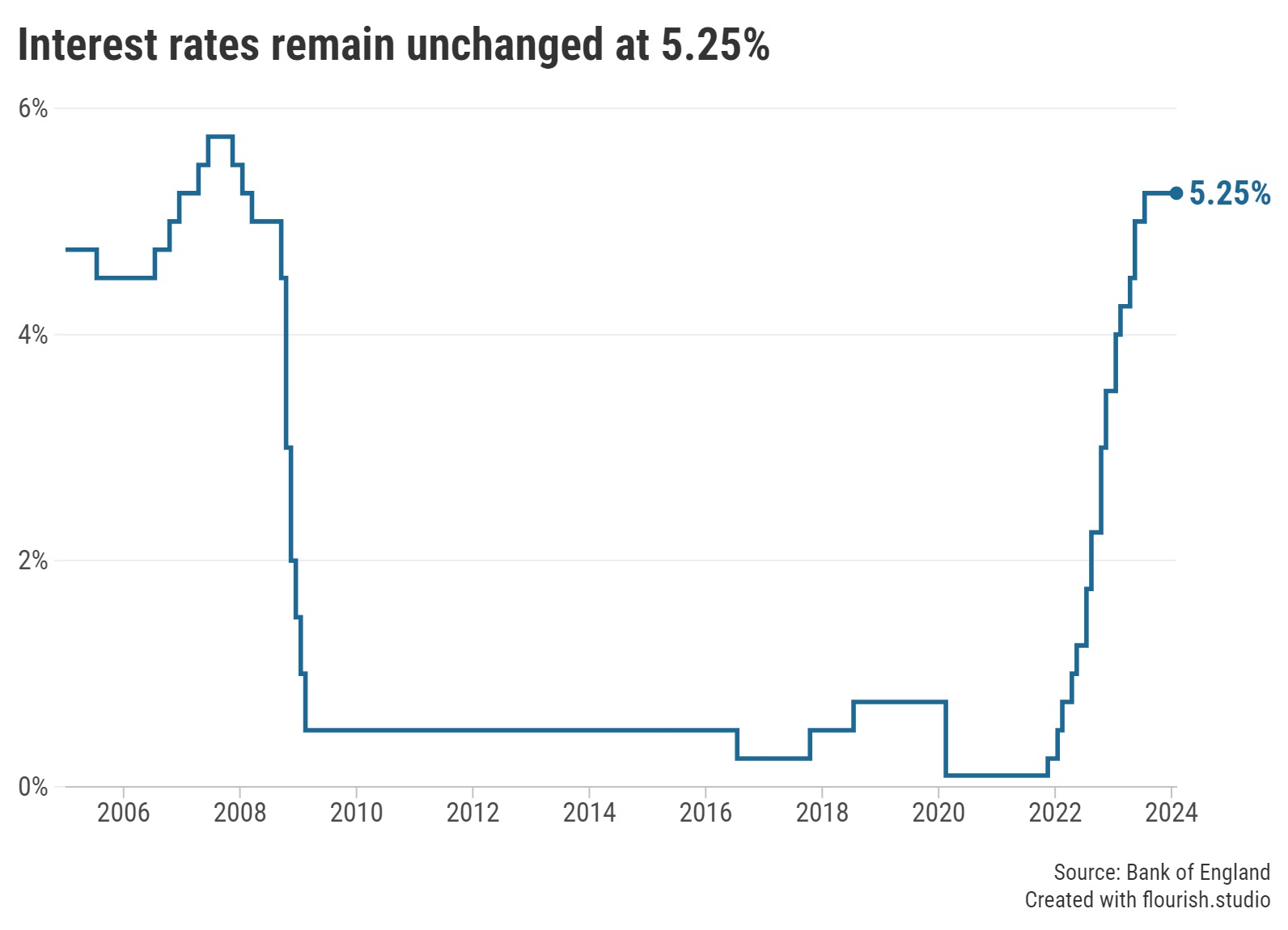

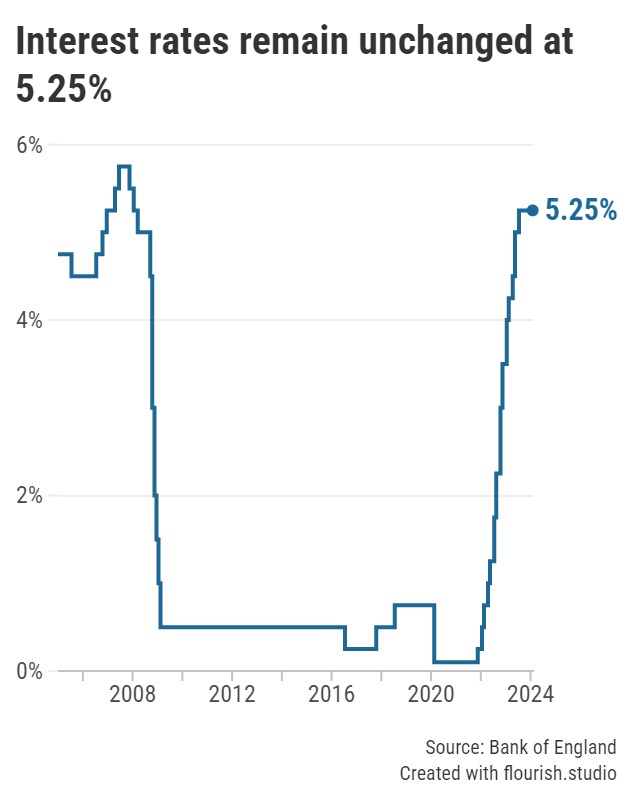

Caption: Bank of England base rate since 2005.

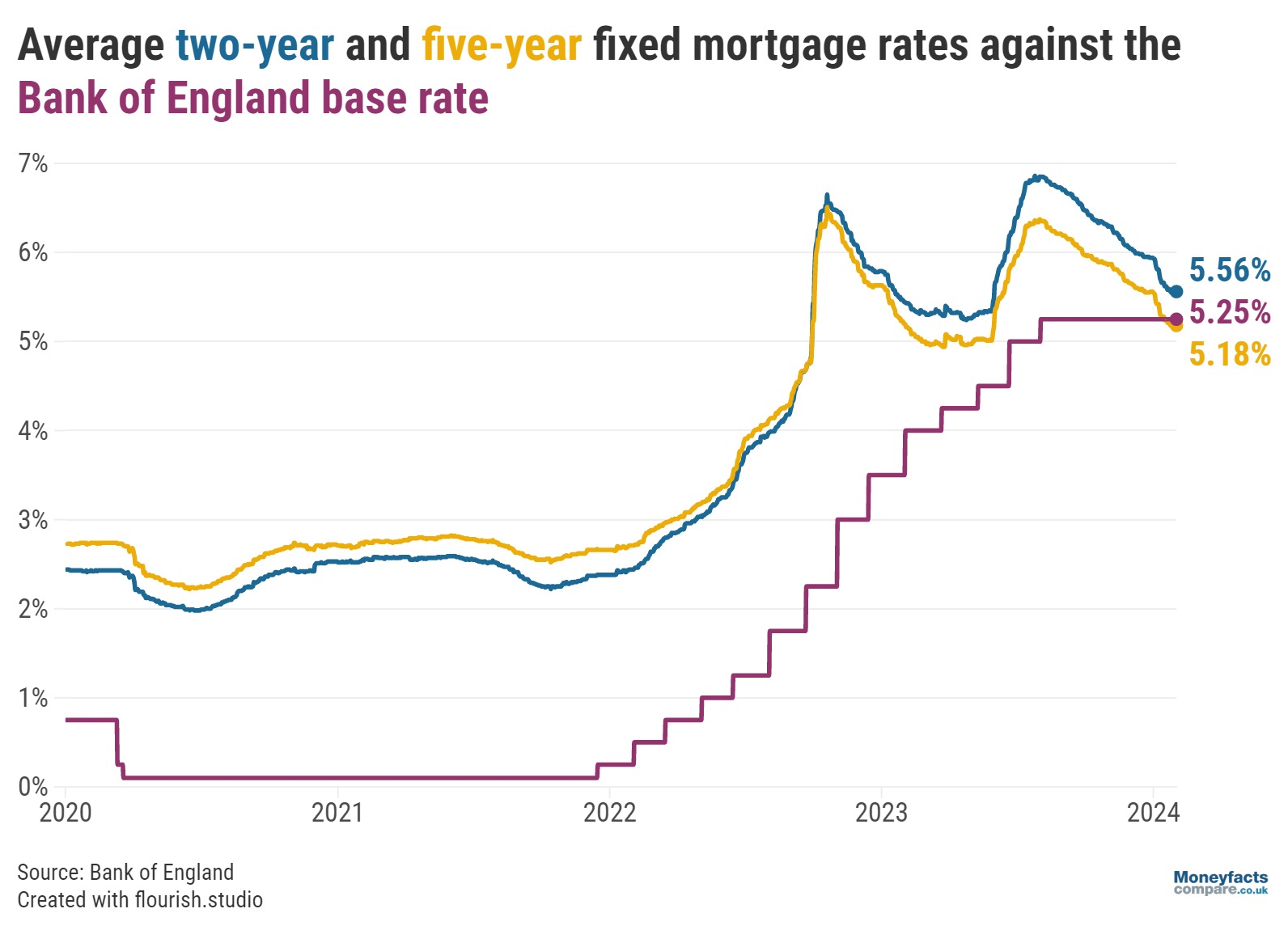

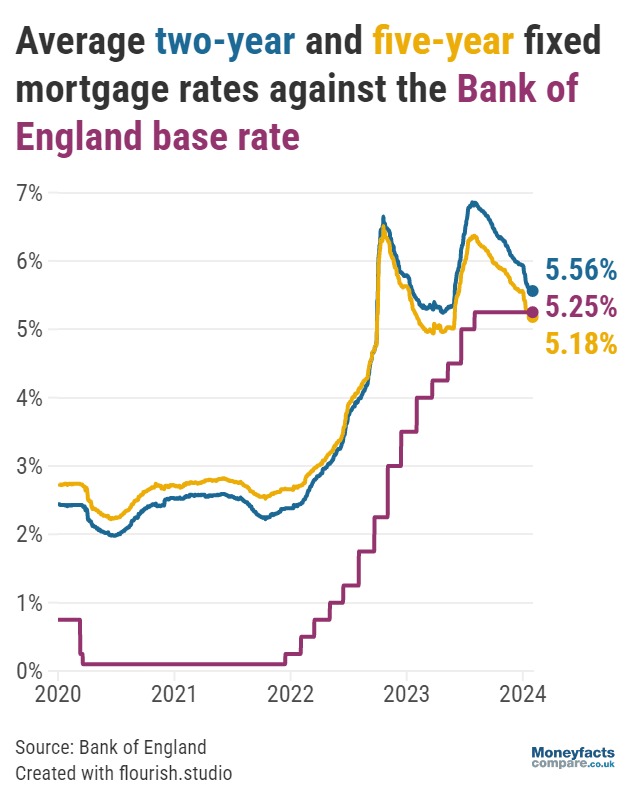

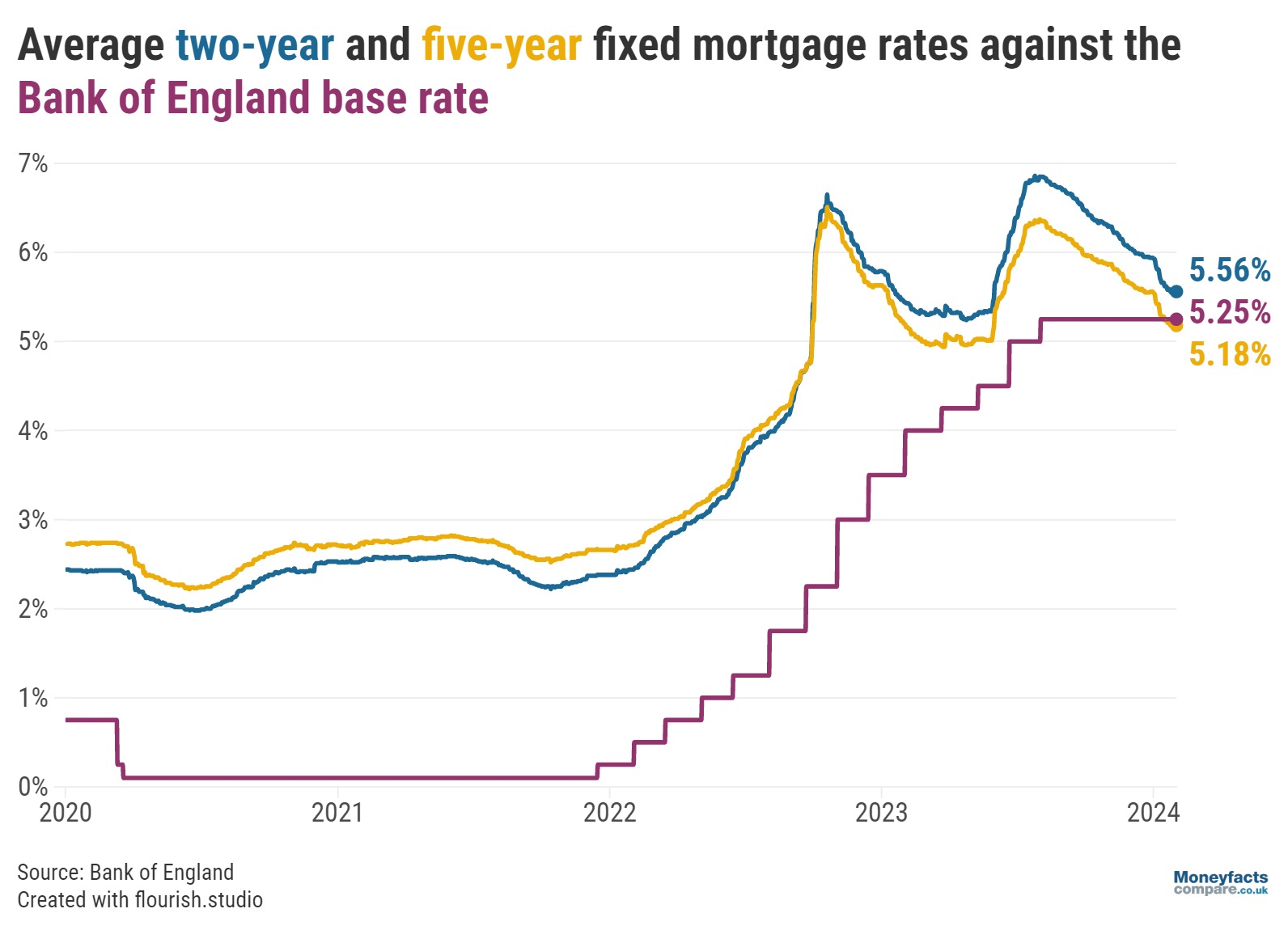

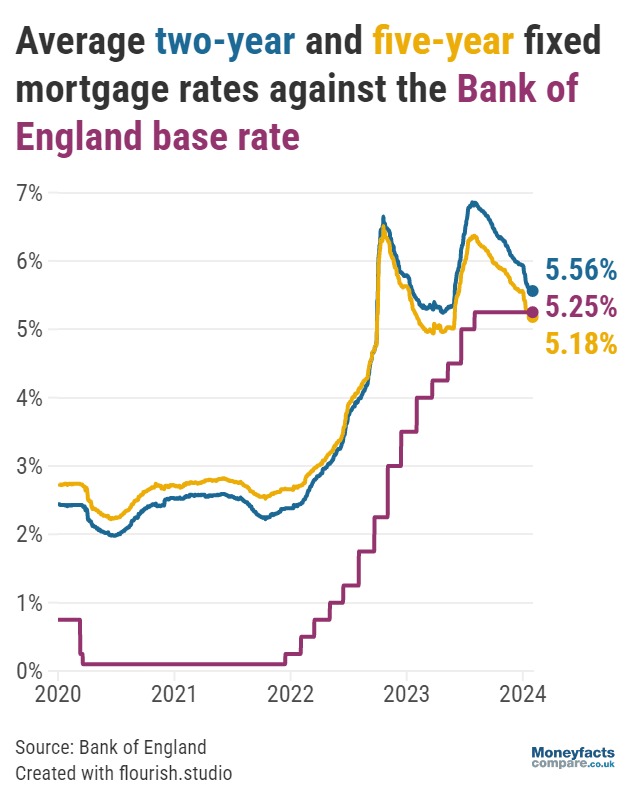

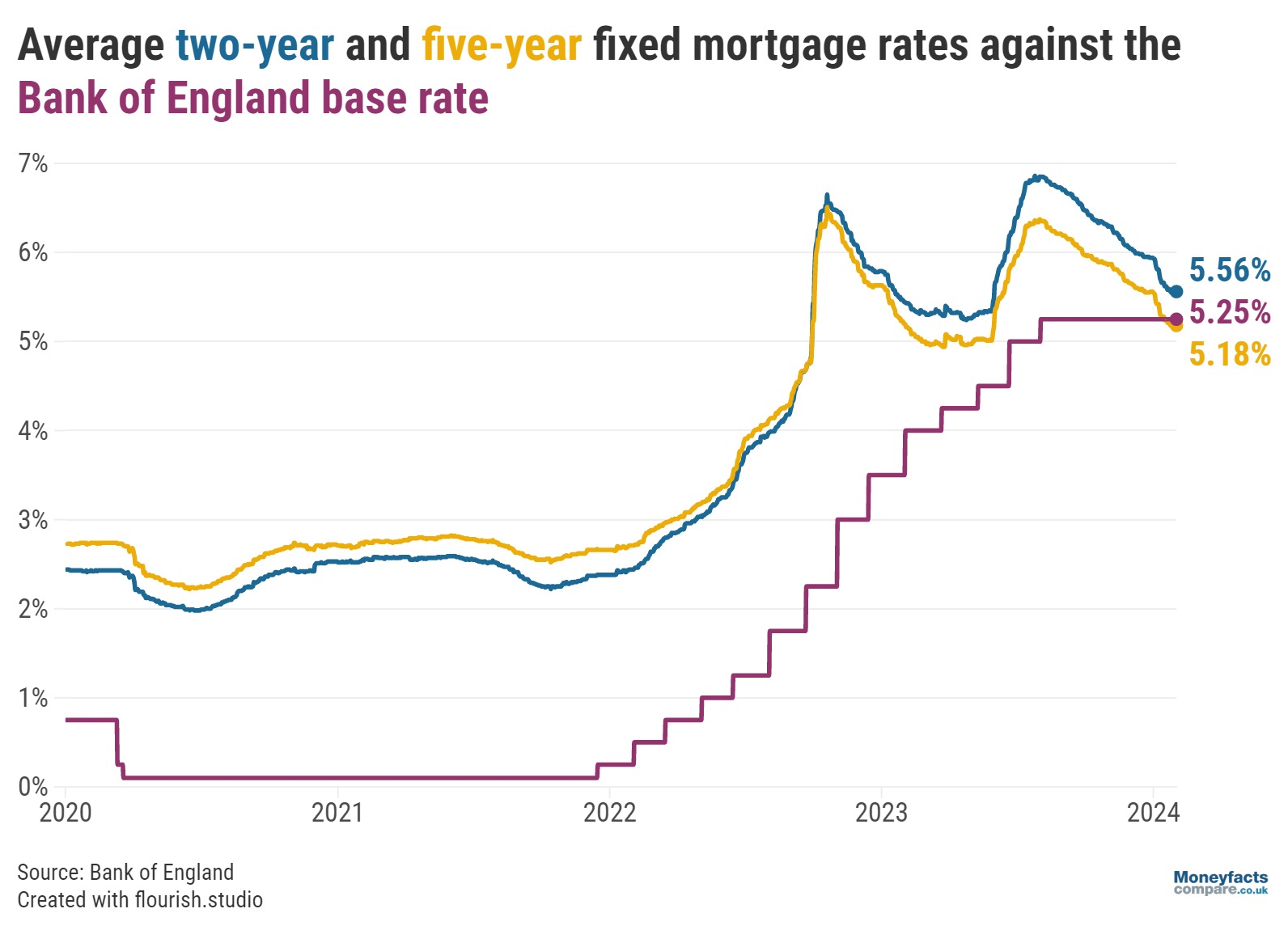

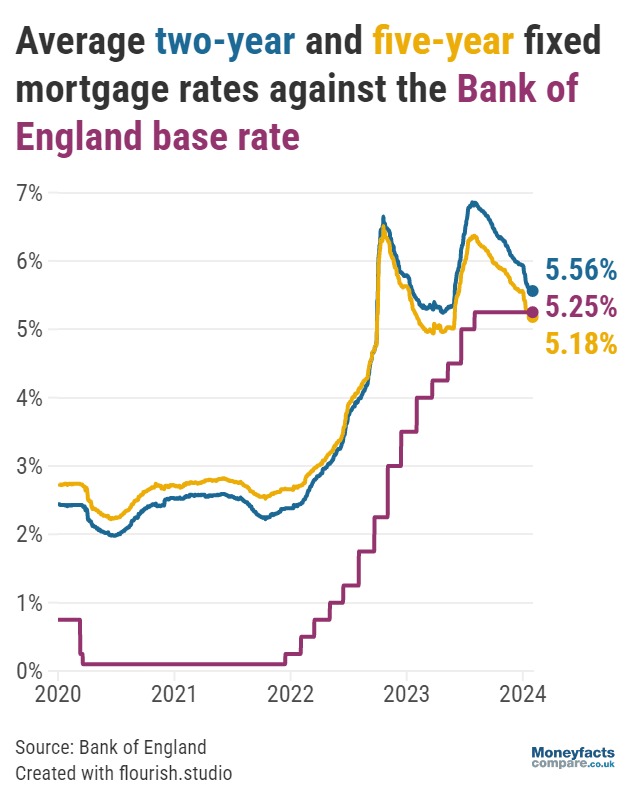

Although borrowers may have preferred to see a cut to the base rate, they can be reassured that mortgage rates are already experiencing a downwards trajectory.

The average rate charged by a two and five-year fixed mortgage fell more than one percentage point over the past six months, to stand at 5.56% and 5.18%, respectively, today.

While some may find these rates higher than the last time they locked into a fixed deal, they are perhaps a more attractive option than being transferred to a lender’s ‘revert to’ rate, with the average Standard Variable Rate (SVR) currently sitting at 8.17%.

At this rate, monthly repayments would be approximately £1,566 based on a £200,000 mortgage over a 25-year term, compared to £1,235 per month at the average two-year fixed rate.

“The recent volatility surrounding fixed mortgage rates may make it more pressing for borrowers to secure as soon as possible,” said Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

“Lenders can pull deals if they have an influx of applications, and a volatile swap rate market can put pressure on pricing where margins are already tight.”

Caption: Average two and five-year fixed mortgage rates compared to the Bank of England base rate.

“It would be inevitable to see a mix of both fixed rate rises and cuts,” said Springall, adding lenders will need to juggle consumer demand, their own targets and future base rate expectations when considering pricing.

However, Oliver Dack, Spokesperson for Mortgage Advice Bureau, urged consumers not to be too preoccupied with base rate headlines and to instead focus on what options best suit their needs and circumstances.

“We are seeing some really competitive rates being offered by lenders that are undercutting the Bank of England base rate by some margin,” said Dack.

“Clients are finding borrowing cheaper than six months ago, and as a result we’ve seen an increased appetite for people wanting to move home.”

As for borrowers who are not looking to move, Dack proposed speaking with an adviser at least six months in advance of their current product ending, in order to be best prepared for finding a new deal.

“We are constantly monitoring rates and, while the base rate hasn’t changed, the mortgage market has seen better product options become available which some clients have been able to take advantage of before their current deal ends,” he said.

Borrowers concerned about their existing mortgage or looking for a new deal would be wise to speak to their lender or to seek advice from a broker.

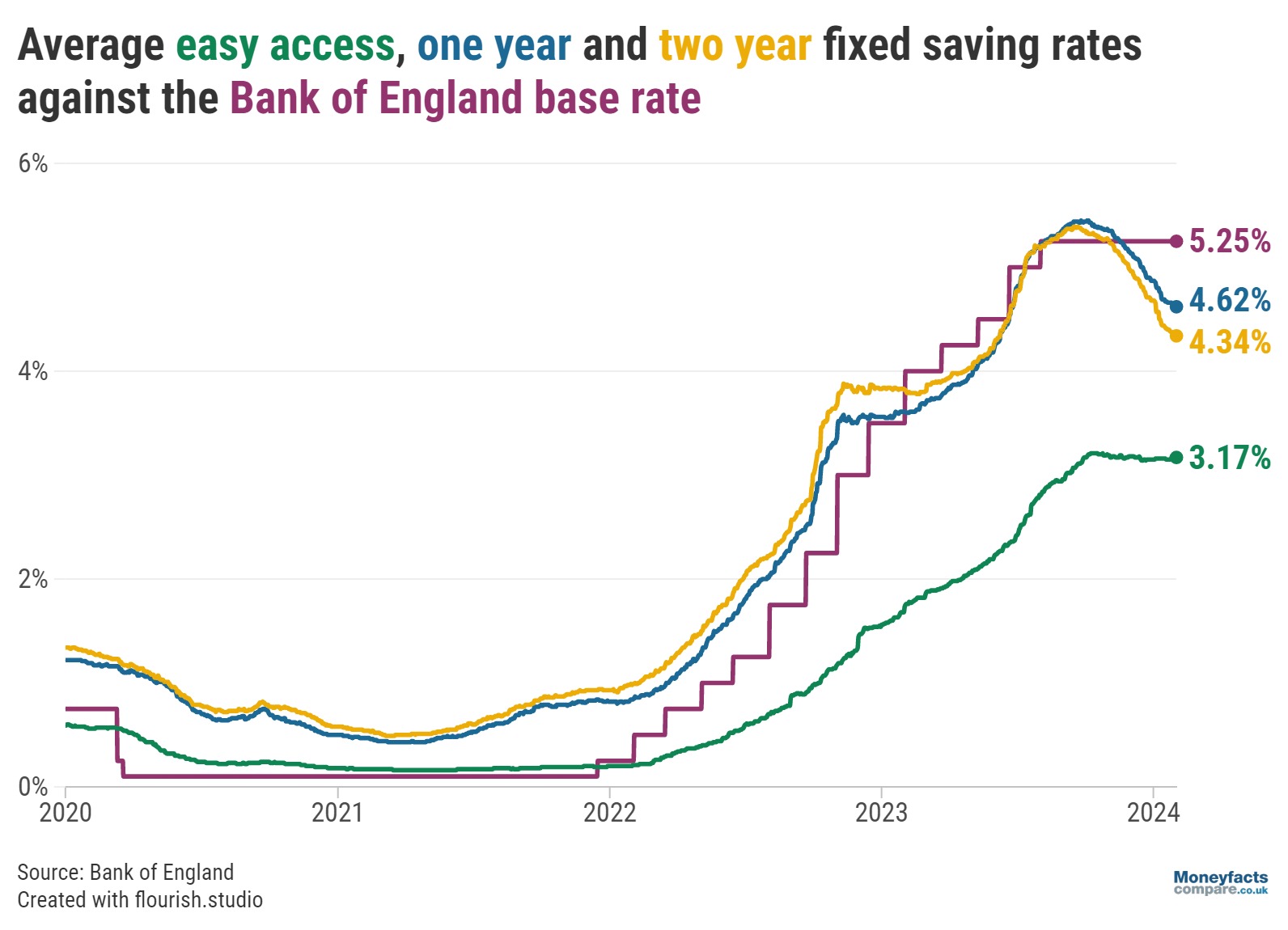

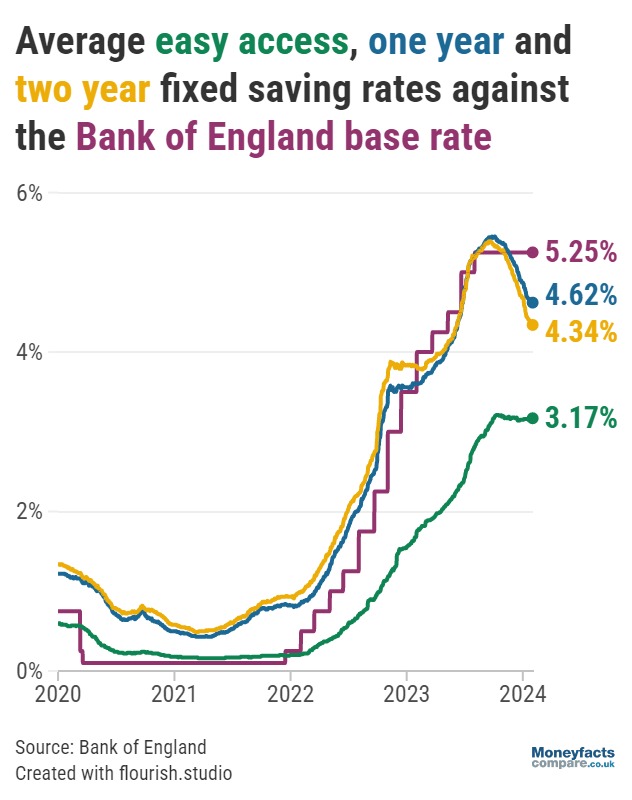

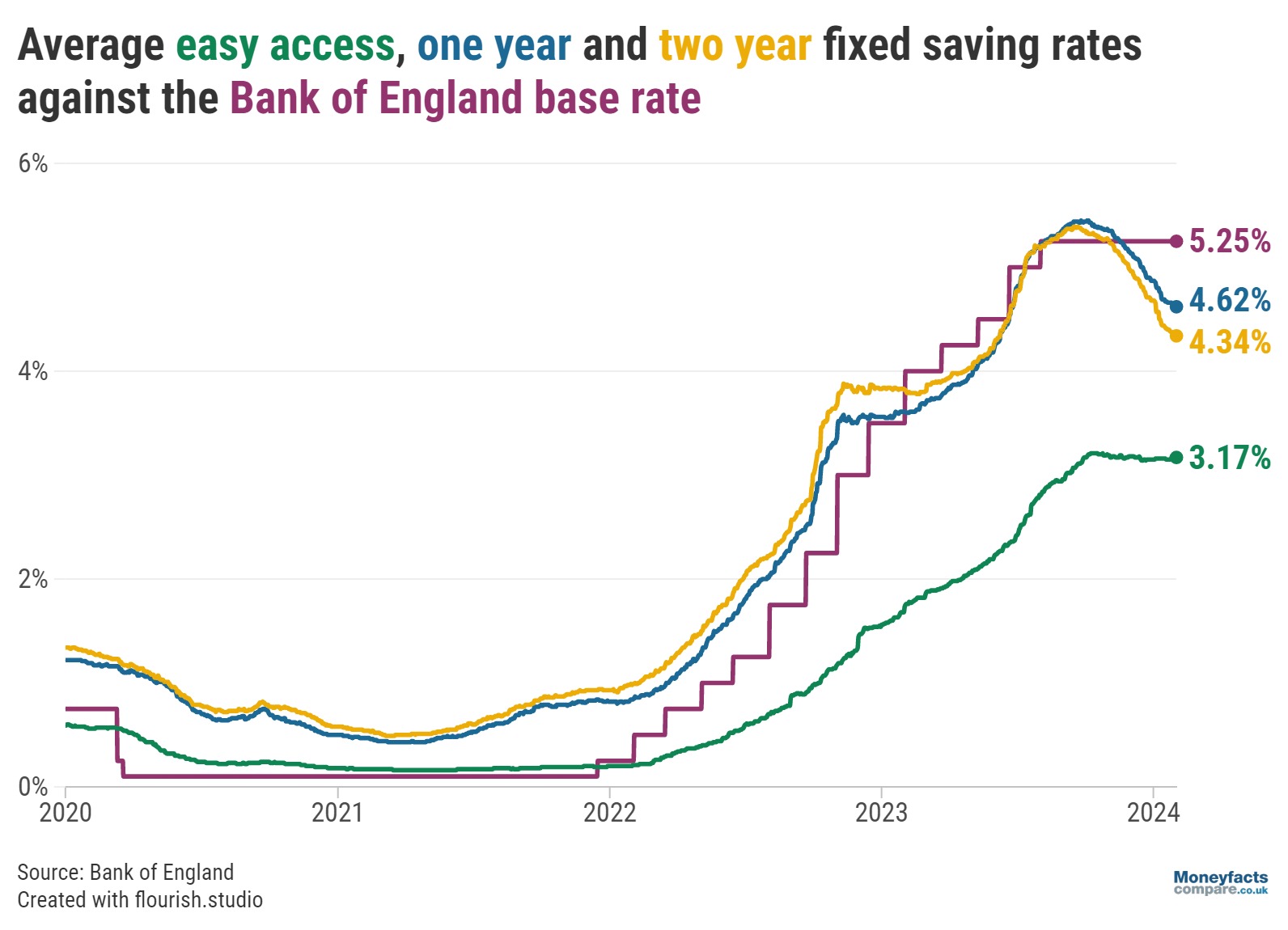

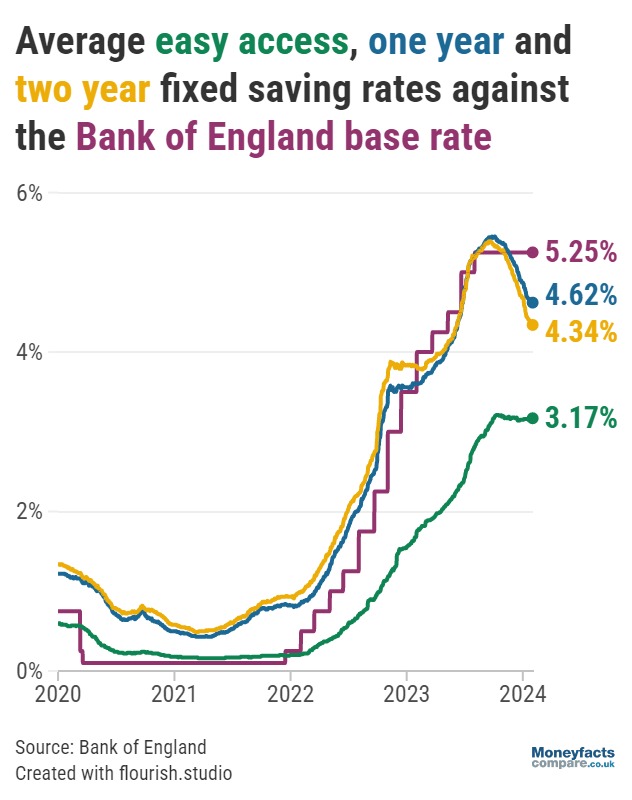

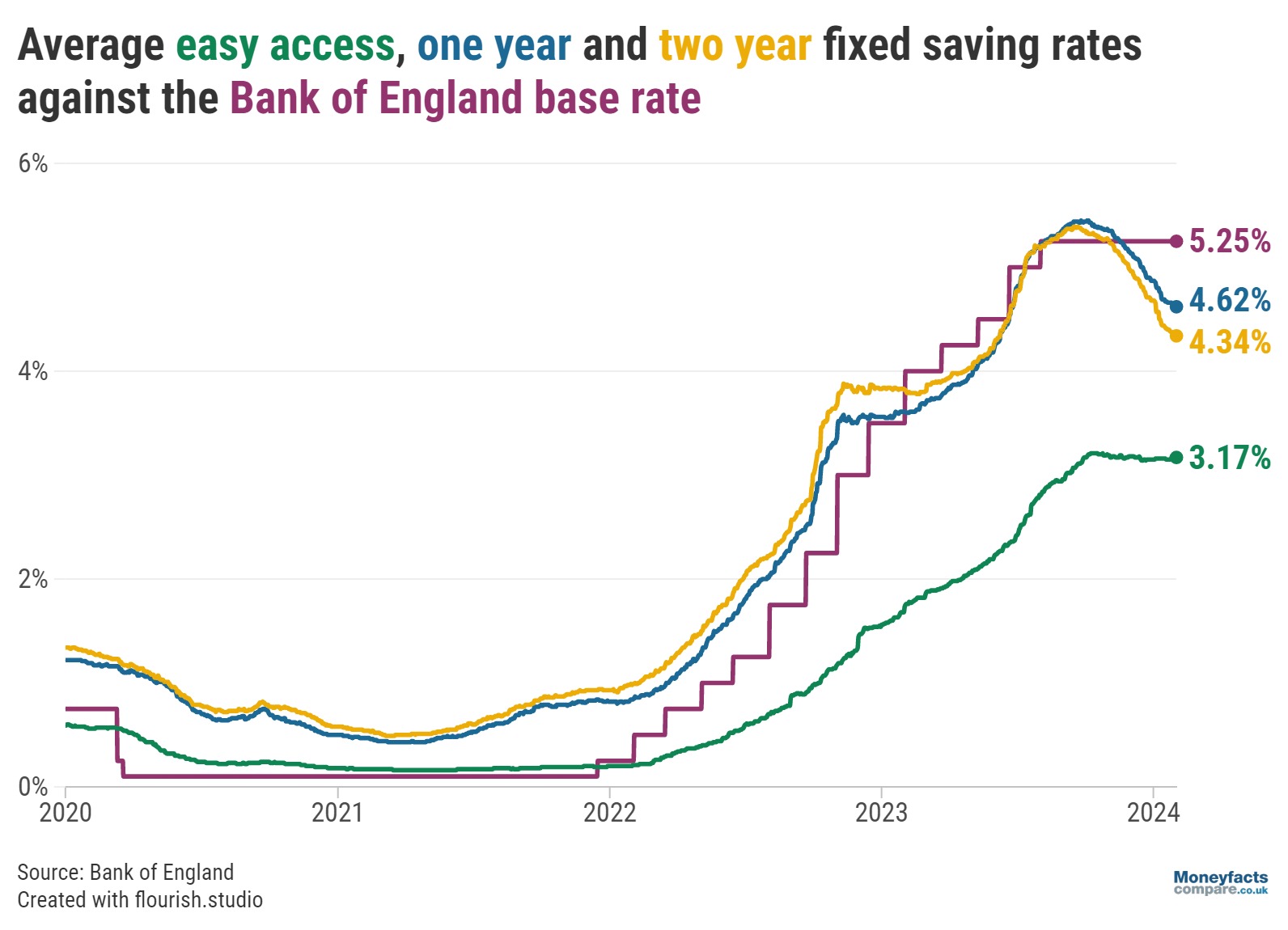

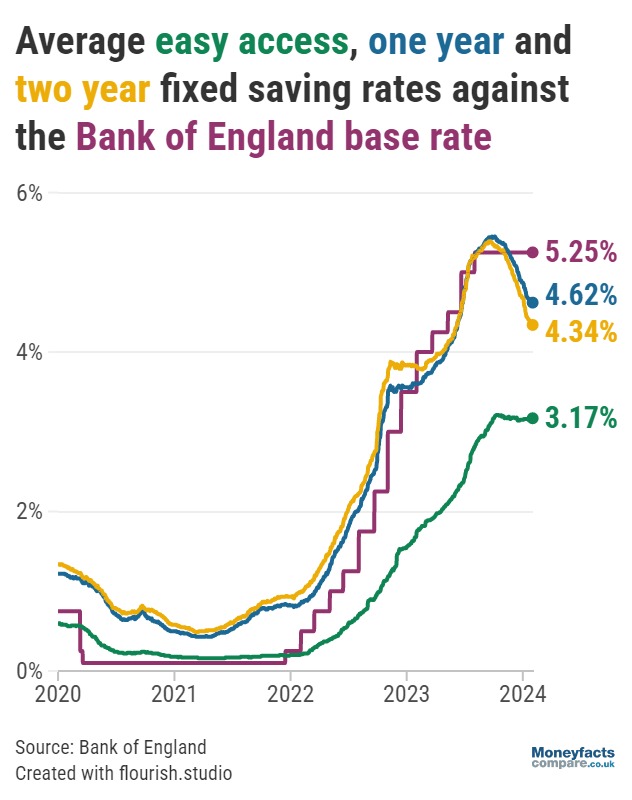

Meanwhile, despite there being no change to the base rate since August 2023, variable savings rates have continued to thrive, with the average easy access rate rising to 3.17% today.

Caption: Average savings rates compared to the Bank of England base rate.

Springall reminded savers not to be complacent, though, stating: “It’s imperative consumers are proactive to review and switch their savings account if their loyalty is not being rewarded.”

This is especially true as we approach the end of the current tax-year and the start of another ISA season. Providers are expected to launch new, attractive deals as they seek custom from savers looking to use up their current ISA allowance or those thinking ahead to the new tax-year.

As a result, the average easy access ISA rate has already seen month-on-month increases, rising to 3.30% today.

However, any notion of a cut to the base rate could see variable savings rates tumble. “It will be interesting to see how resilient the market will be in the months to come,” concludes Springall.

Our dedicated savings charts are updated regularly throughout the day to show you the best savings rates available. Compare the top savings accounts here.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.