High interest rates prove effective as inflation slows significantly.

In its meeting today, the Bank of England’s Monetary Policy Committee (MPC) voted 8 to 1 in favour of maintaining the base rate at 5.25% for a fifth consecutive time.

The decision comes as figures released yesterday by the Office for National Statistics (ONS) revealed UK inflation slowed significantly to 3.4% in the year to February – its lowest level since September 2021.

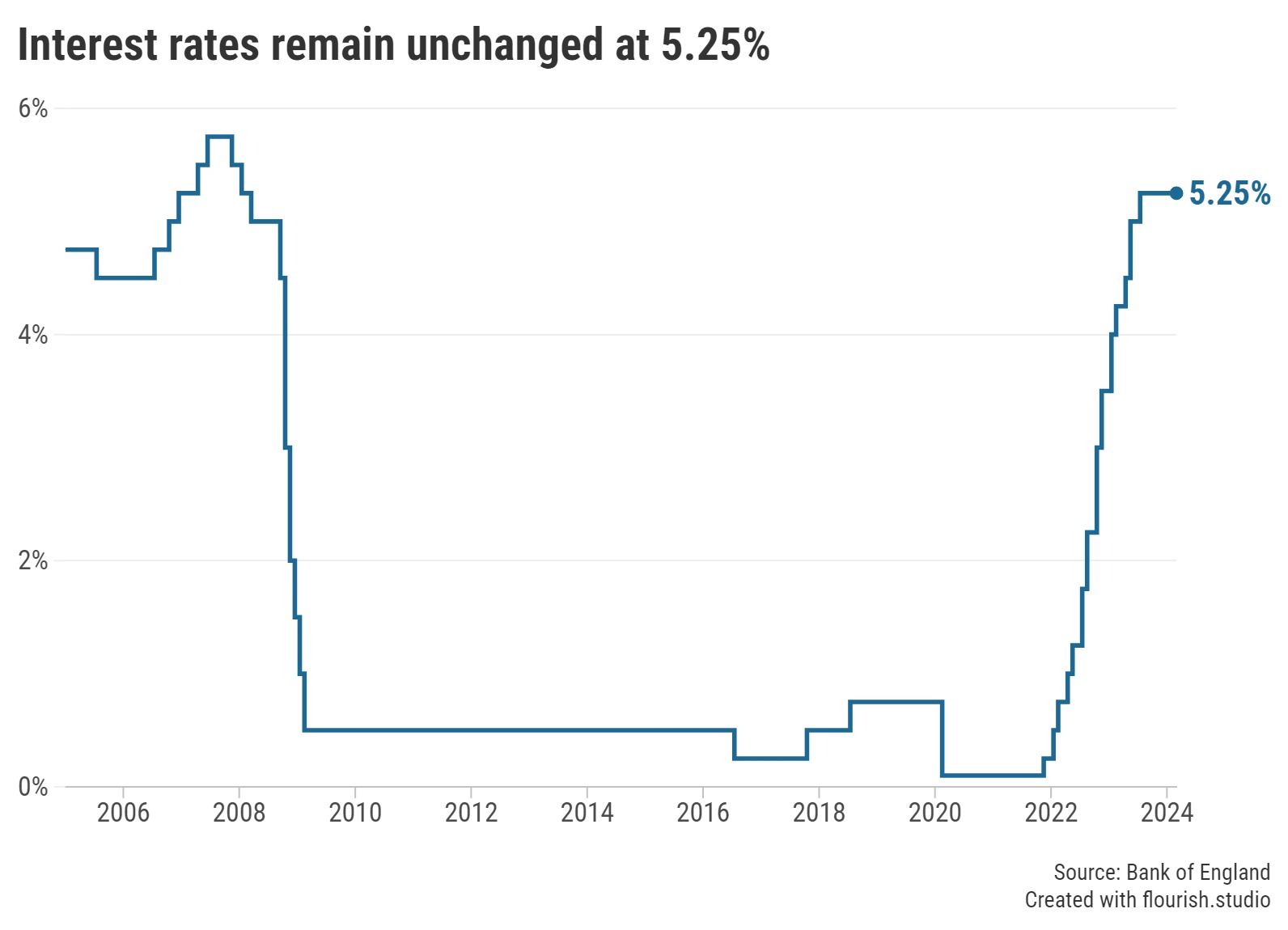

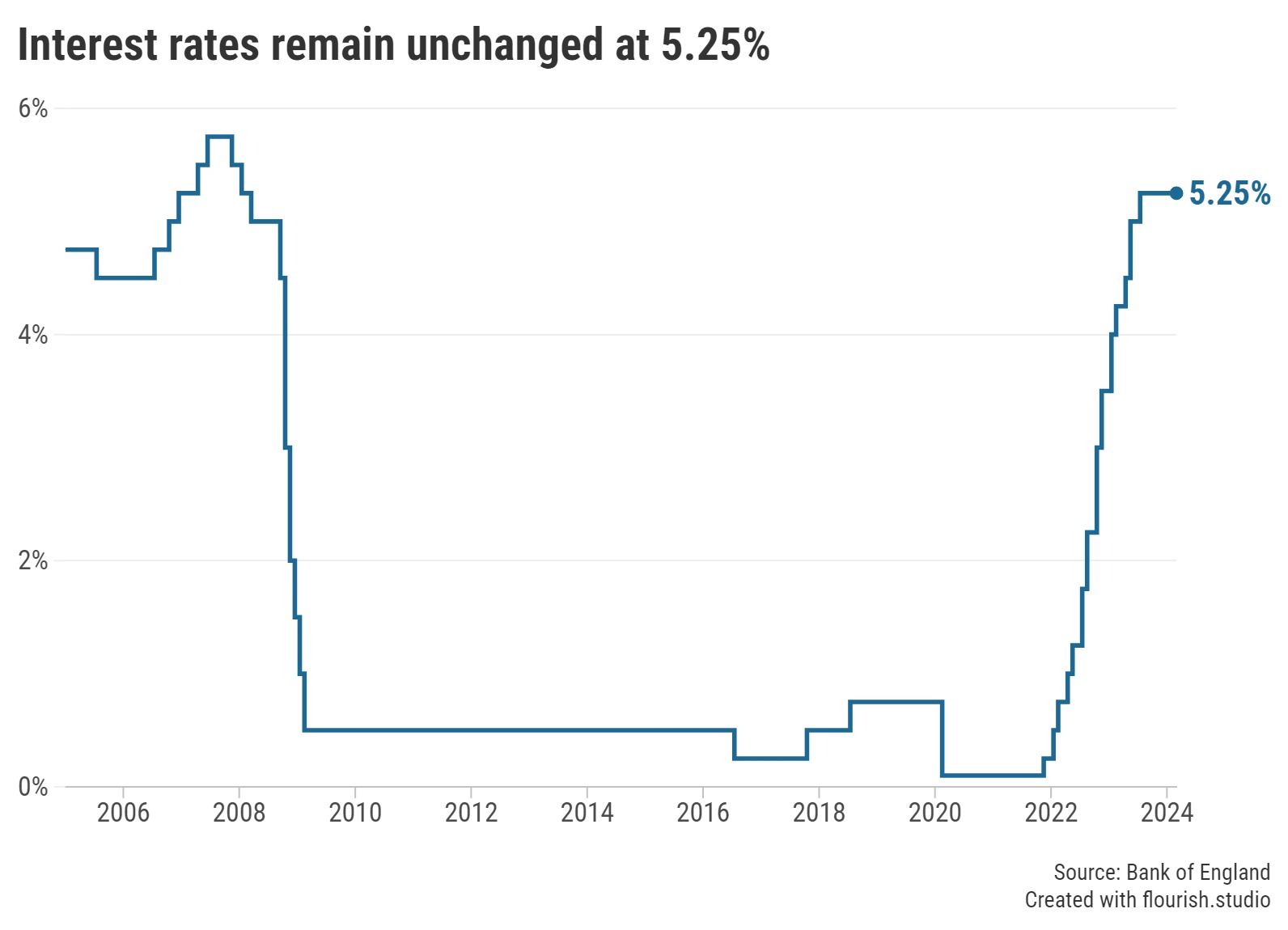

Graph: Changes to the Bank of England base rate since 2005.

While the drop in inflation is a positive sign measures taken by the Bank of England are having the desired effect, this latest base rate announcement may be met with disappointment from borrowers anxiously awaiting relief from high mortgage rates.

At the start of this year, it had seemed mortgage rates were on a downwards trajectory, however, recent swap market volatility resulted in the average price of a fixed deal rising yet again. The average two-year fixed rate now sits at 5.76% on a first-of-month basis, up from 5.56% the previous month. Meanwhile, the average rate charged for a five-year fixed deal rose from 5.18% to 5.34% within the same period.

Nevertheless, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, was quick to find a silver lining, highlighting that these rates are lower than six months ago, when both the average two and five-year fixed mortgage rate stood at over 6.00%.

Springall also reminded borrowers that there’s still room for movement in the mortgage market, despite the UK’s central interest rate going unchanged since August 2023. “No change does not mean stagnation in mortgage rates as other influences remain at play, so borrowers must not be complacent if they are searching for a new deal,” explained Springall.

Indeed, Oliver Dack, Spokesperson for Mortgage Advice Bureau (MAB), said the broker had seen an increased appetite among its clients, stating: “It seems many borrowers no longer rely on changes to the base rate to prompt them to review their current mortgage, and are instead being proactive in looking for a new deal.”

As always, Springall concluded any borrowers worried about finding a new deal would be wise to seek advice from a broker to help navigate the ever-changing mortgage market, while existing customers struggling with repayments should speak to their lender.

Whether you're a first-time buyer, remortgage borrower or moving home, our charts are regularly updated throughout the day to bring you the latest rates.

Meanwhile, in the savings market, the uncertainty of when a potential cut to the base rate will take place has resulted in the market-leading variable accounts and shorter-term bonds outperforming their longer-term counterparts.

Cash ISAs, in particular, have witnessed an increase in competition lately as providers attempt to entice customers looking to use up the last of their ISA allowance before the 2023/24 tax-year ends on 5 April.

However, Springall urged savers looking to take advantage of the top easy access cash ISA rates to check account terms and conditions carefully, noting “some of the best rates are offered on accounts that carry withdrawal restrictions, include a bonus, or are linked to another account”.

Any future reduction to the base rate could see savings rates tumble, as providers are often quicker to pass on cuts compared to rises. With many savers already not seeing their loyalty rewarded, it’s good practice to regularly review top rates and consider switching if more attractive deals are available.

Our dedicated charts are regularly updated throughout the day to show the best notice, easy access and fixed rates available, as well as their ISA counterparts.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.