The latest service data compiled from banks across the UK marketplace shows the surprising differences in how long it takes to complete the most popular customer requests. Analysis is based on compulsory information that UK banks and building societies publish twice yearly on their websites. Moneyfactscompare.co.uk analysis clearly shows that while most banks do a few things in excellent time, none seem to do everything well.

Particularly noticeable is the fact that many of the big high street banks are failing to excel, often sitting in the middle or even towards the low-end of the table on several important instances of what should be everyday banking events. The reverse of this fact is true of the new challenger banks, with many of these digital banks leading the more well-known brands in terms of excellent customer service.

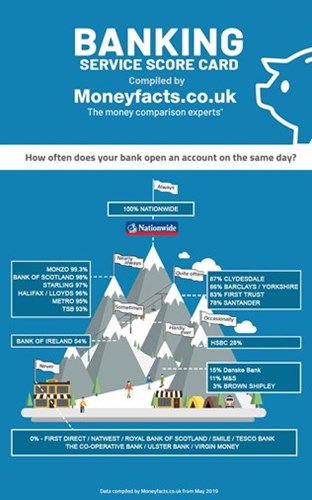

When it comes to opening a new account, figures show that Nationwide Building Society leads the pack, with 100% of accounts opened on the same day as the application. Monzo, Bank of Scotland, Starling Bank, Lloyds Bank, Halifax and Metro Bank all follow very closely behind, with 95% or higher hitting this target. All these banks have a very impressive record that 99% of new account openings are completed in just a single day. It is worth noting however that eight of the banks failed to ever do this – making customers wait for at least 24 hours and, more frequently, up to a week or more to open an account.

This infographic shows which banks open can a bank account on the same day based on data from Moneyfactscompare.co.uk.

When it comes to obtaining a debit card the same day as opening an account however, it’s Tesco Bank that leads the pack, hitting this deadline 100% of the time. Only Metro Bank comes close to this, succeeding with that target 81% of the time, with Danske Bank, Ulster Bank, Royal Bank of Scotland, NatWest and Starling Bank taking up to three days on average. Sadly for some consumers, the remaining banks – including many high street and the newer challenger banks – took between four and 11 days to issue a debit card, with those at the higher end making their customers wait for a week or more.

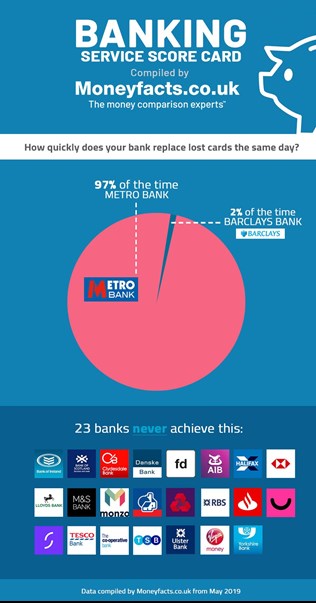

This infographic shows how many banks can replace a lost debit card on the same day based on data from Moneyfactscompare.co.uk.

In terms of internet banking, three main banks stand out as clear leaders: Clydesdale Bank, Yorkshire Bank and Metro Bank all boast same-day access to online banking 100% of the time. Tesco joins this group, with internet banking being possible on the same day for 100% of customers.

Most banks provide an answer and funding for overdraft requests within a single day – many on the same day, making this the most level playing field of the data analysed. However, when it comes to replacement of lost or stolen debit cards, Metro Bank once again surges ahead, providing a new card the same day 97% of the time.

This infographic shows how fast banks can provide new services such as new debit cards, opening a new banking account and arranging an overdraft. Based on data from Moneyfactscompare.co.uk.

All the above can make for surprising reading at times. The performance of some long-standing banks can be lacklustre when it comes to simple operations, such as opening a new account, obtaining an overdraft or simply being issued with a debit card. This tends to support the belief that some of the well-known banks have grown to a size whereby they don’t feel that they need to provide excellent service to individual customers anymore. Certainly, they are currently lagging well behind the far more responsive and customer-friendly services being offered by the new banks, which are starting to challenge the dominance of the big high street names.

Customers who are considering opening a new bank account or moving to a different supplier would be well advised to review the performance standards of the new bank in order to be sure that they will be getting the service experience they expect.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.