While loan rates rise, 0% balance transfer terms on credit cards lengthen to over 570 days.

Summer proved expensive for many consumers, as credit borrowing rose by £0.1 billion to £1.6 billion in July alone, according to the Bank of England’s most recent Money and Credit report. As a result, many may now be looking to get their finances in order – especially with the festive season fast approaching.

Debt consolidation could be a good option for those wanting to get on top of debts owed to multiple lenders (e.g. if you have outstanding balances on multiple credit cards). This repayment strategy involves taking out a form of credit to pay off any existing debts so you can focus on repaying one lender and only have a single borrowing cost to consider.

Personal loans and balance transfer credit cards are just two ways of consolidating debt.

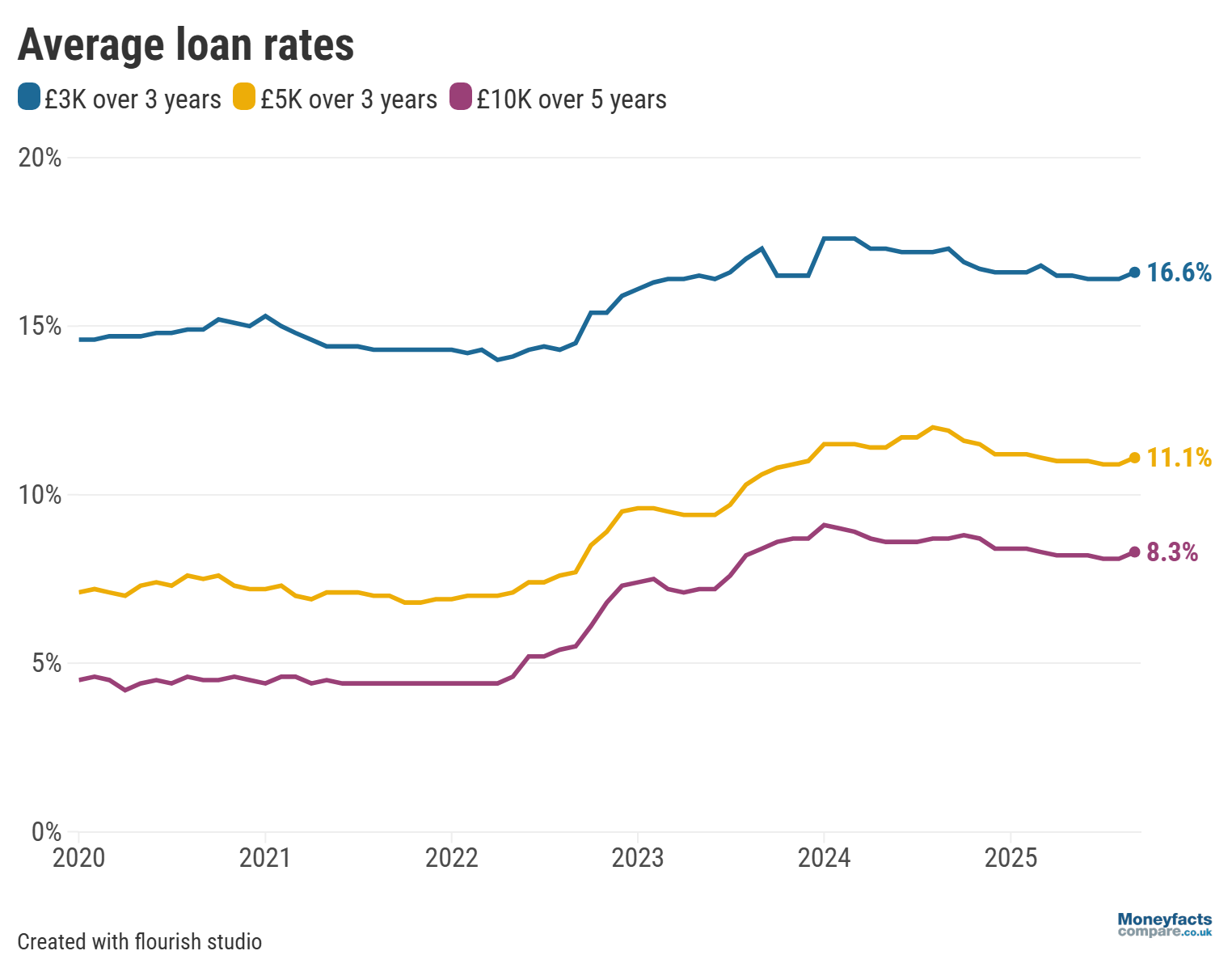

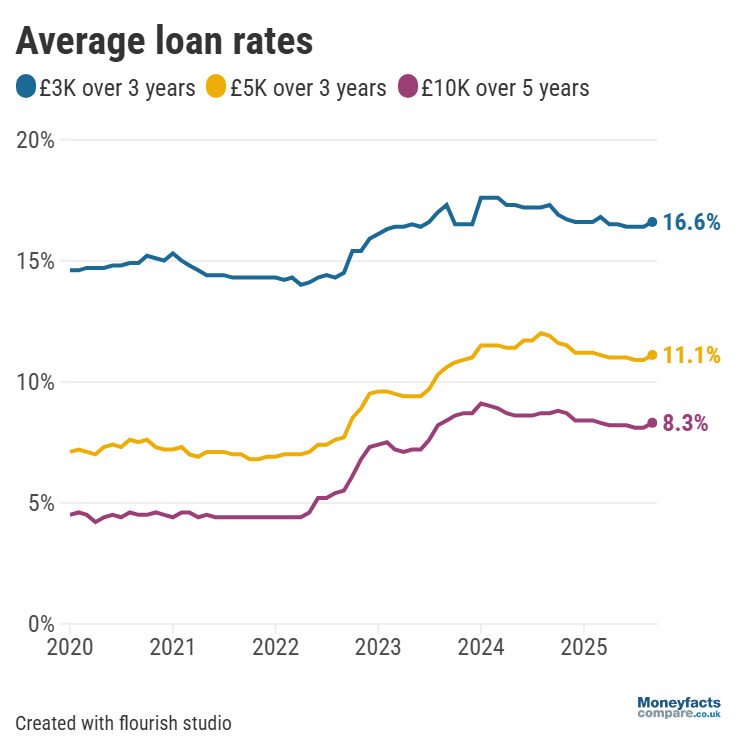

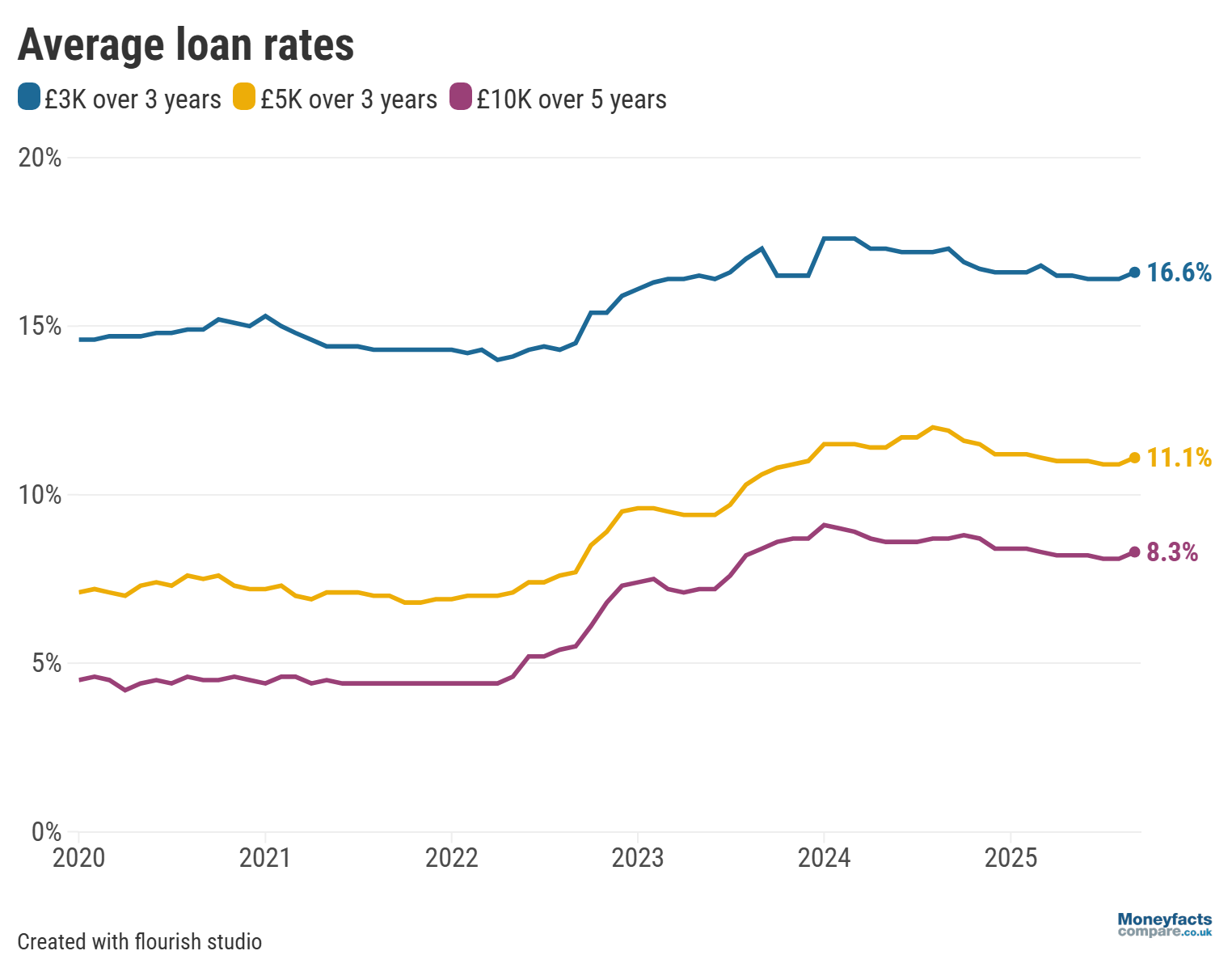

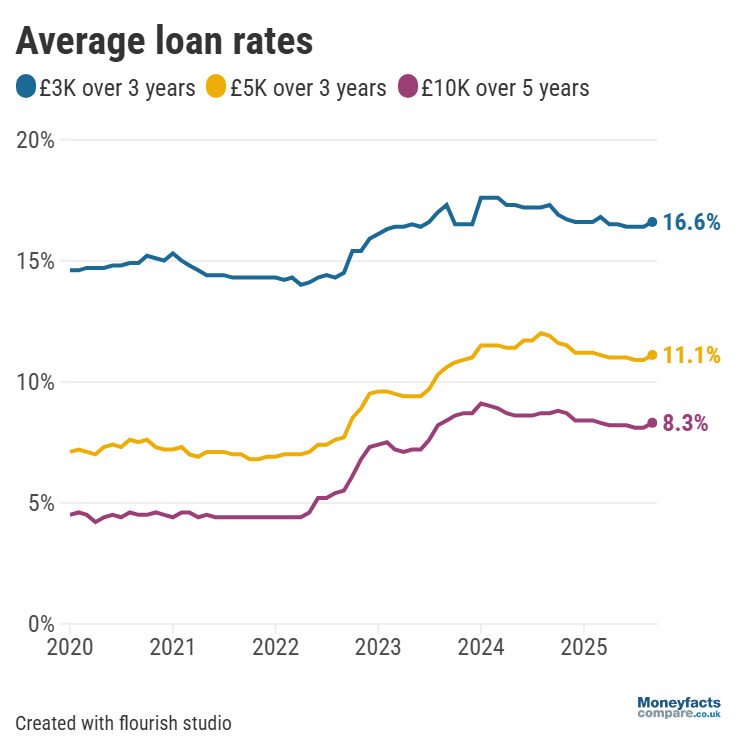

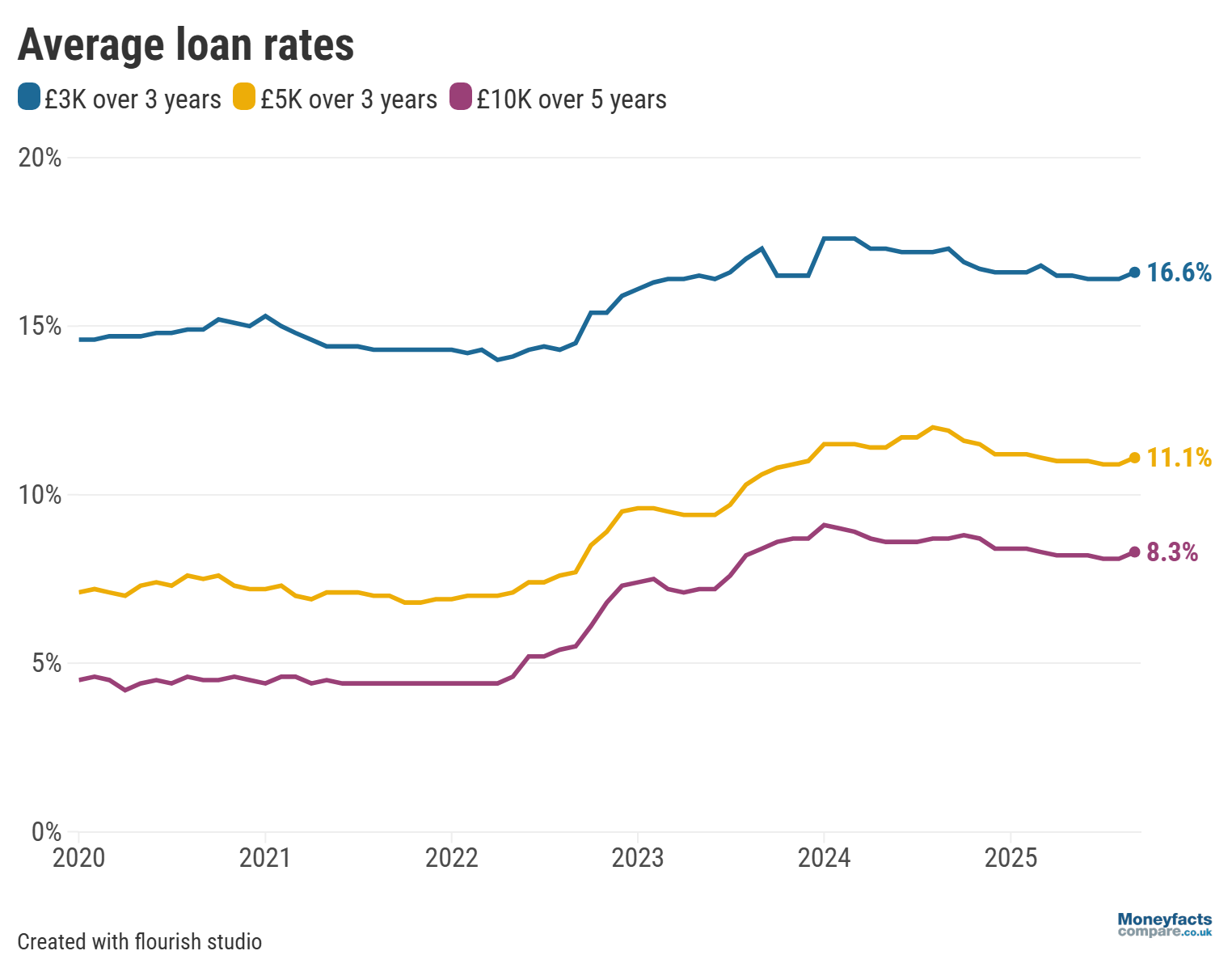

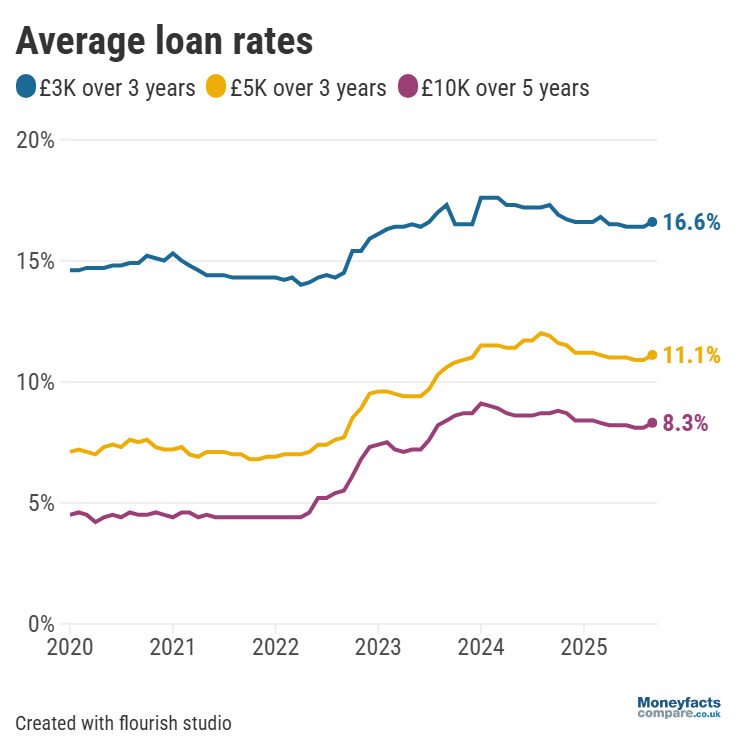

Unfortunately, the average rate (APR) charged by an unsecured personal loan rose to its highest level in six months between June and September 2025, according to data from the latest Moneyfacts UK Unsecured Lending Trends Treasury Report.

For instance, the typical price of a £3,000 unsecured personal loan repaid over three years increased from 16.4% to 16.6% over this timeframe.

Graph: Average APR for personal loans between 2020 and 2025.

Nevertheless, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said loans remain “an ideal choice for those who want a fixed monthly repayment plan and to know exactly when their debts will be repaid”.

“It is worth noting that loan rates can rise and fall due to either seasonal reasons or risk appetite, so a slight rise should not deter consumers from fixing their finances,” she added.

However, Springall also recognised that loans aren’t as flexible as credit cards and there will be some consumers who’d prefer to move multiple debts onto one card using a balance transfer.

Our loans charts are regularly updated so borrowers can compare the best rates currently available. However, you’re not guaranteed to receive the representative APR advertised by lenders.

It’s also important to check your eligibility before applying, as being refused for a loan can indirectly damage your credit score. Check your eligibility for free with the help of our preferred loans broker, Loans Warehouse.

While the average credit card purchase APR (which includes card fees) remained at a record high of 35.7% between June and September 2025, a number of lenders improved their 0% balance transfer periods over recent months – affording borrowers more breathing space.

HSBC, MBNA, Tesco Bank, Barclaycard and NatWest were among brands to increase 0% balance transfer offers on selected cards to 34 months during this timeframe. This helped to bring the average introductory interest-free balance transfer term to 571 days, as of September.

“This trend of extending 0% offers is unlikely to wane in the coming weeks, as the festive season is fast approaching and there will be borrowers who use cards to make the expense more bearable,” said Springall.

“However, the lengthy 0% introductory balance transfer term is not the only consideration of moving debts, as consumers must be comfortable with any upfront fee,” she reminded. The average balance transfer fee rose marginally to 2.51% between June and September (which would cost borrowers £75.30 to move a £3,000 debt), but Springall warned that credit cards offering some of the longest 0% balance transfer periods may charge much more upfront.

Discover credit cards with the longest introductory interest-free balance transfer periods using our regularly updated charts.

If you clear the balance within this 0% window, you won’t be charged any interest. But, bear in mind the provider will apply interest to any balance left outstanding once the 0% term ends.

With outstanding balances on credit cards growing by 6.6% over the past 12 months, according to a recent study by UK Finance, Springall urged borrowers to only turn to short-term credit as “temporary support to cover unexpected expenses”.

“It remains essential for consumers to pay more than the minimum on any credit card and to switch to a 0% deal if they need more time to get on top of their debts,” she added. The average credit card debt per household currently stands at £2,612, according to the Money Charity (supported by Vanquis Bank); this balance could be cleared in two years by using a 0% balance transfer card and repaying £115 each month.

As well as personal loans and balance transfer credit cards, borrowers could consider using a money transfer card, secured loan or equity release to consolidate their debt.

Find out more about these methods, including their pros and cons, with our guide to debt consolidation.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.