A global pandemic, international conflict and rampant inflation have all taken their toll.

As the Conservative Party seeks to extend its 14-year period in Government in the General Election on 4 July 2024, we reflect on how both the mortgage and savings markets have changed since 2010.

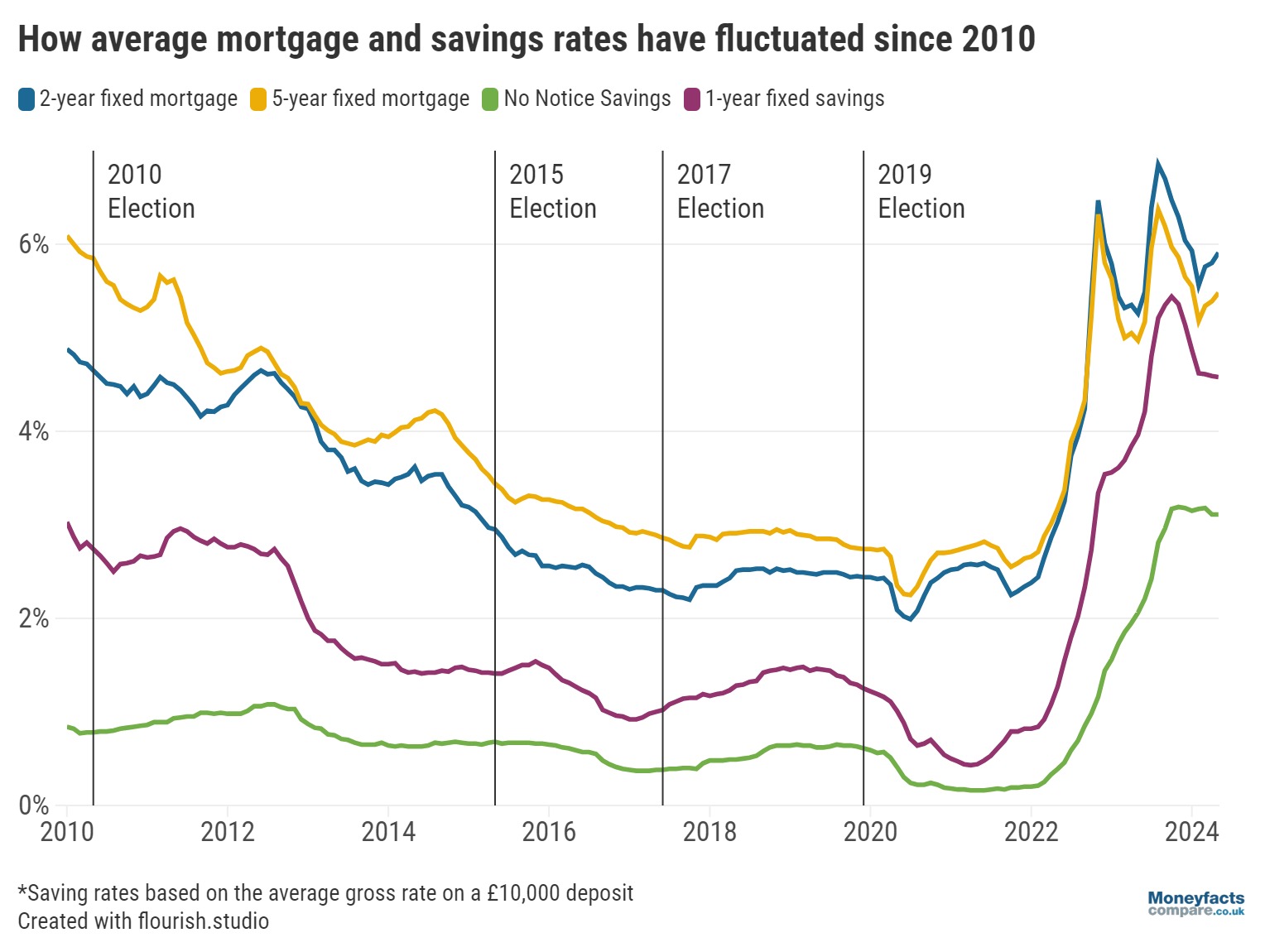

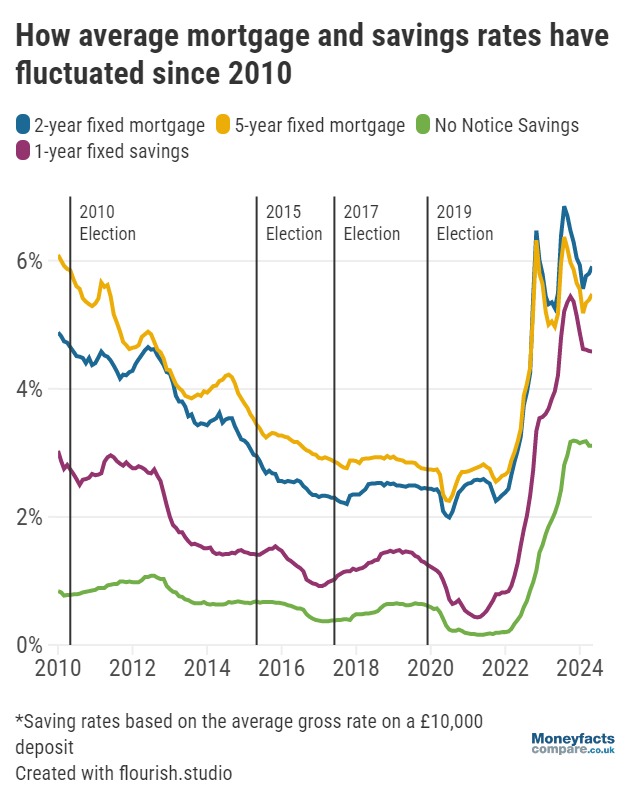

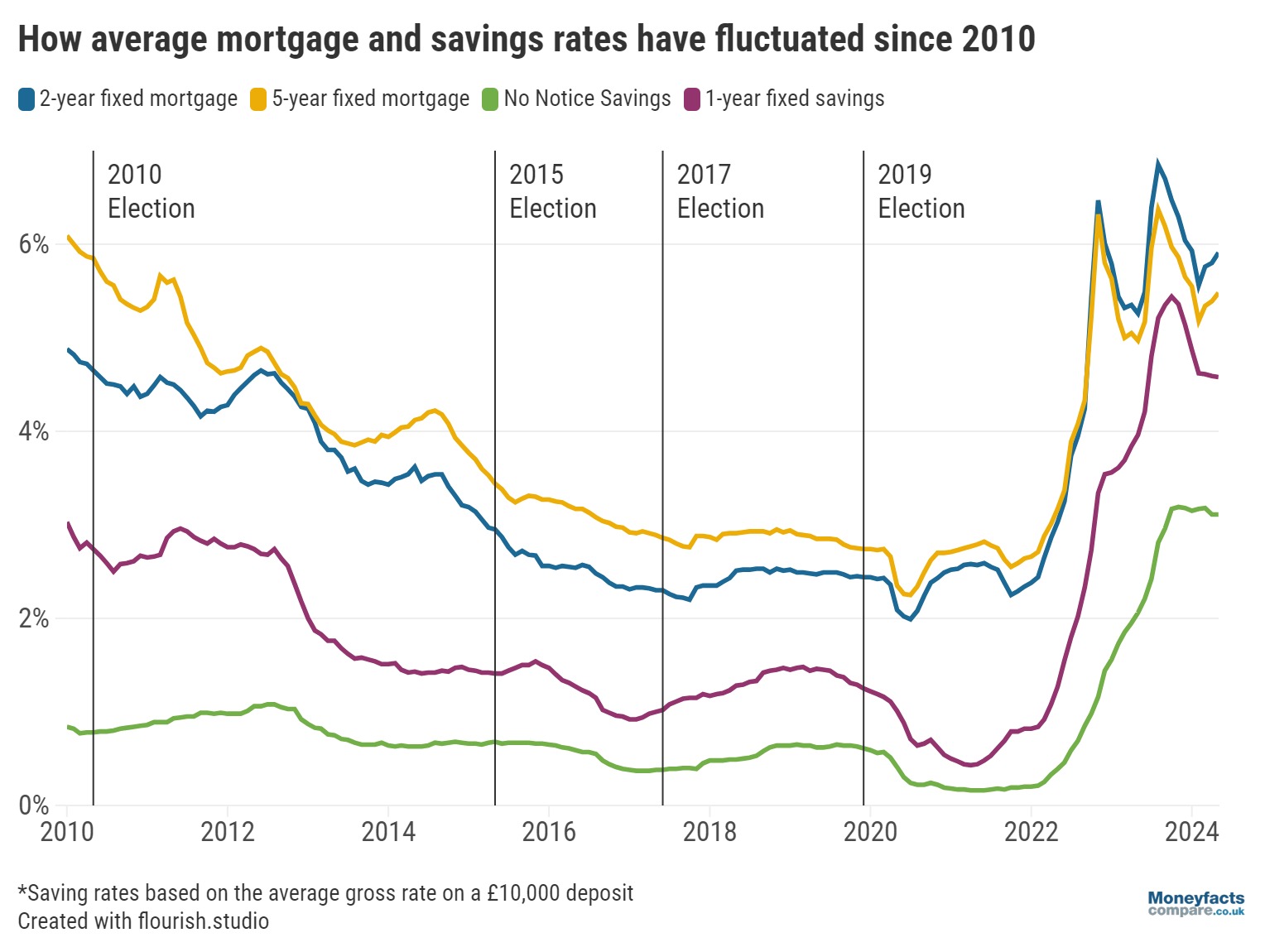

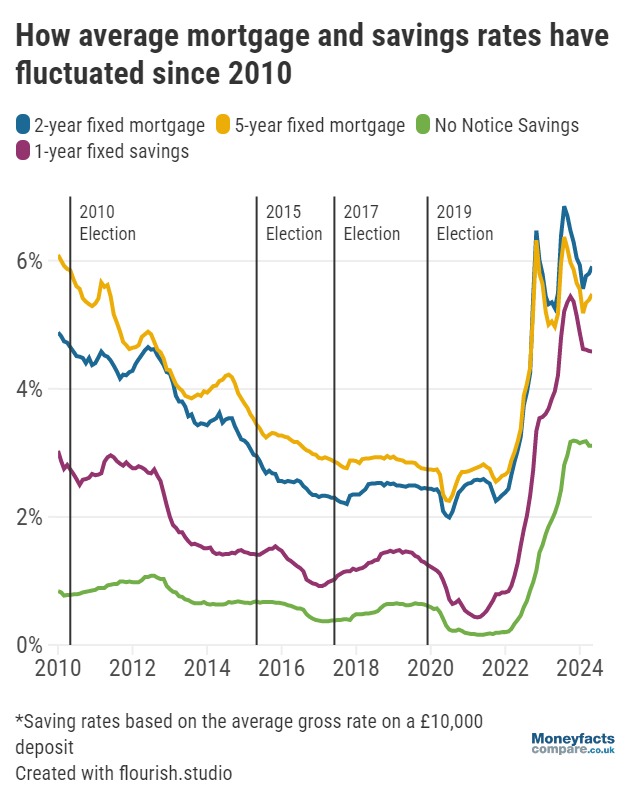

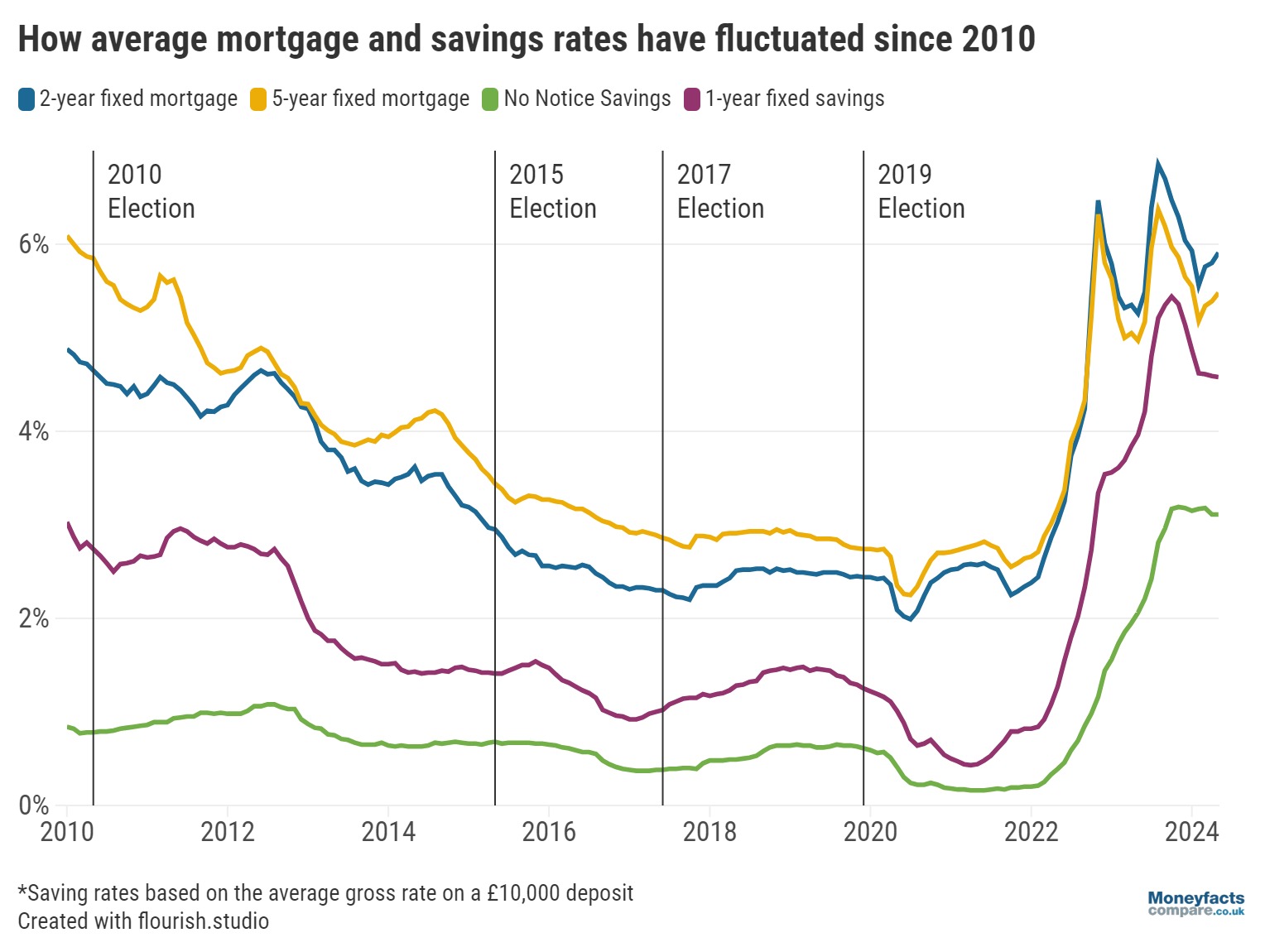

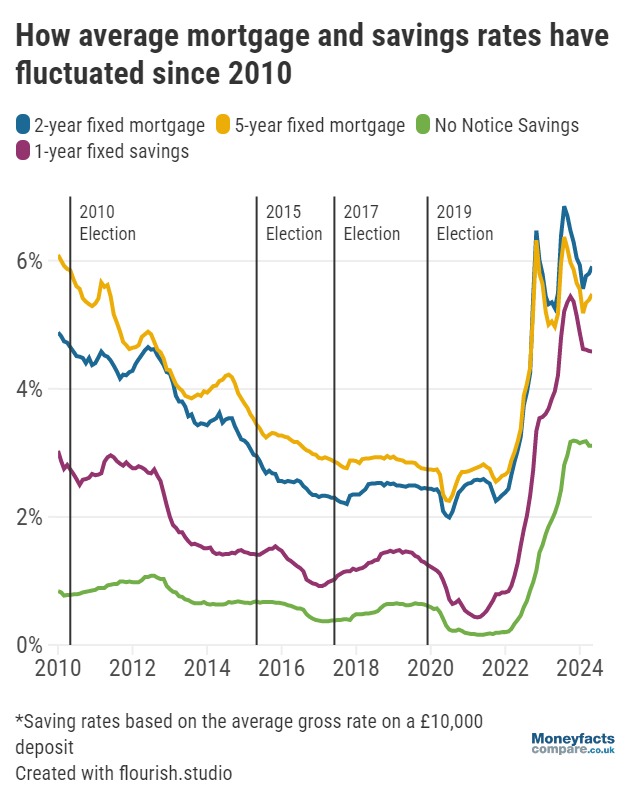

Graph: Average mortgage and savings rates since 2010.

For a large portion of the Conservative Party’s most recent stint in office, mortgage rates held fairly steady; the average rate charged by a two-year deal fluctuated by less than 1% in the seven years between April 2015 and April 2022 (ranging from 1.99% to 2.97%, according to Moneyfacts data).

However, 14 consecutive hikes to the Bank of England base rate between December 2021 and August 2023 as it tackled rampant inflation, as well as the tumultuous 2022 mini-Budget, caused mortgage rates to skyrocket. While the average two-year deal sat at less than 2% (1.99%) in July 2020, over three years later this had more than tripled to 6.85%.

Today, the UK’s central interest rate remains at a 15-year high of 5.25%. Although the Bank of England’s Monetary Policy Committee (MPC) is scheduled to vote on the matter later this week, a cut to the base rate isn’t anticipated until later this year.

In the meantime, mortgage borrowers will be disappointed to find interest rates stand higher than has been typical over the past 14 years.

“Those who are coming to the end of a five-year fix in June 2024 can expect to see their interest payments almost double, with average rates rising from 2.85% then to 5.50% now,” explained James Hyde, Spokesperson for Moneyfactscompare.co.uk.

Whether you’re a first-time buyer, looking to move home or remortgaging an existing property, our dedicated charts are regularly updated throughout the day to show you the lowest mortgage rates available.

However, it’s important to remember the lowest rate may not always be the most cost effective or best suited to your needs. Our weekly mortgage roundup therefore also features some alternative deals that earn a place on our Moneyfacts Best Buy Charts based on their overall true cost.

Meanwhile, some savers may only just be starting to see their pots grow in real terms after over a decade of meagre returns. Between December 2012 and October 2022, a typical easy access savings account offered less than 1.00%, despite inflation sitting above 3.0% on average.

Its eroding prowess was further exacerbated by a series of worldwide events which placed strain upon global supply chains, such as the COVID-19 pandemic and Russia’s invasion of Ukraine.

As a result, inflation climbed steadily from the latter half of 2021 to reach a recent peak of 11.1% by October 2022. This was its highest rate in over 40 years, according to the Office for National Statistics (ONS), which found rising food and energy costs were among the largest contributing factors.

Nevertheless, measures taken by the Bank of England have proven effective in slowing the rate at which prices of goods and services are rising. Only last month, the Prime Minister, Rishi Sunak, celebrated inflation returning “back to normal” after the ONS reported a near three-year low of 2.3% for April 2024.

With the average easy access account and one-year fixed bond paying 3.11% and 4.60%, respectively, at the start of the month, while top rates in these sectors still stand in excess of 5.00% AER, savers now have plenty of options when it comes to beating inflation.

Those with funds dwindling in low-paying savings account may therefore want to shop around for a more attractive deal. Before committing to a new account, however, it’s important to consider any other criteria or features to ensure it meets your needs and circumstances.

Our saving charts are regularly updated throughout the day so, whether you’re looking for an ISA, fixed bond or easy access account, you’ll be able to compare the best rates currently available.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.