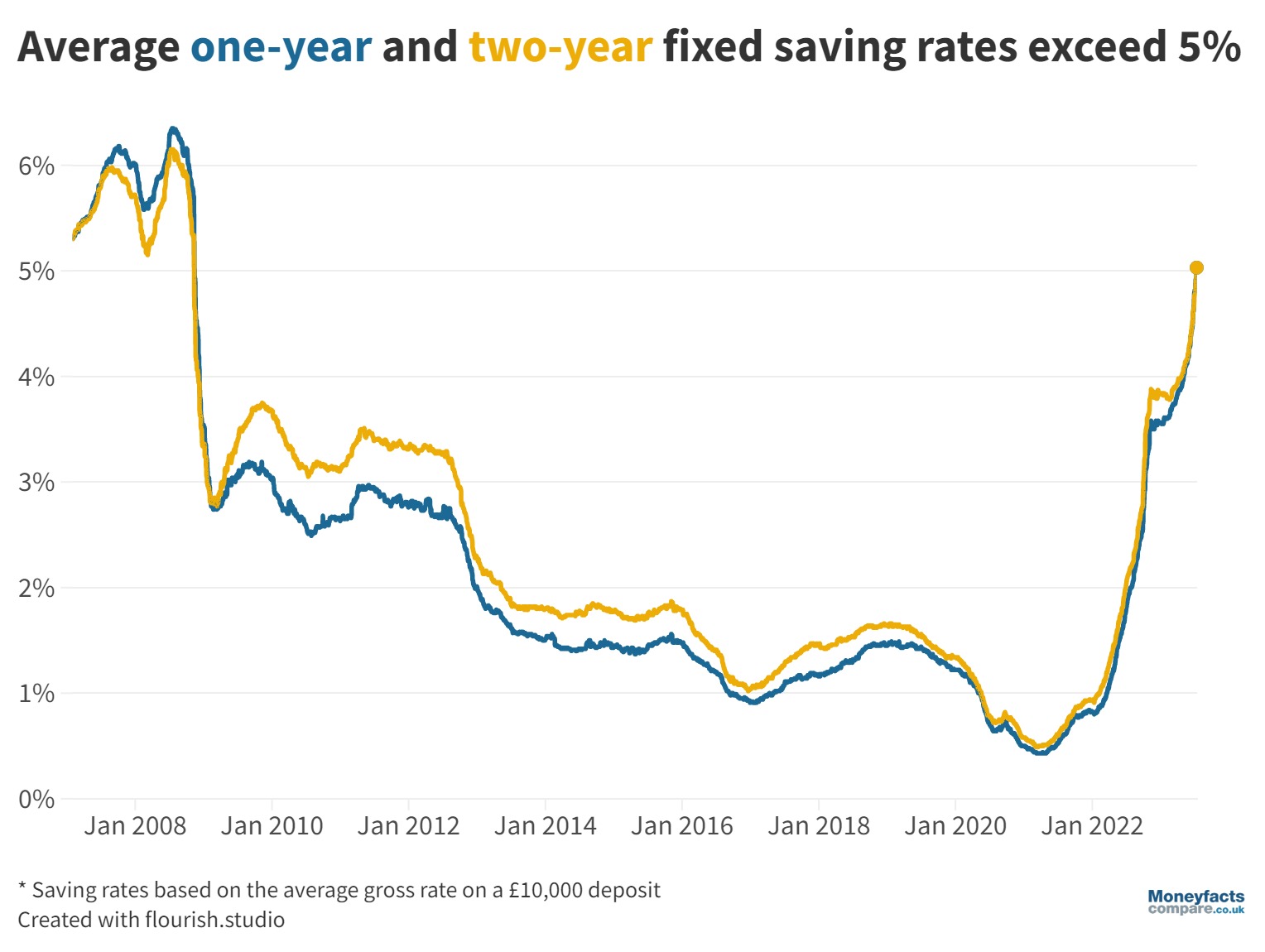

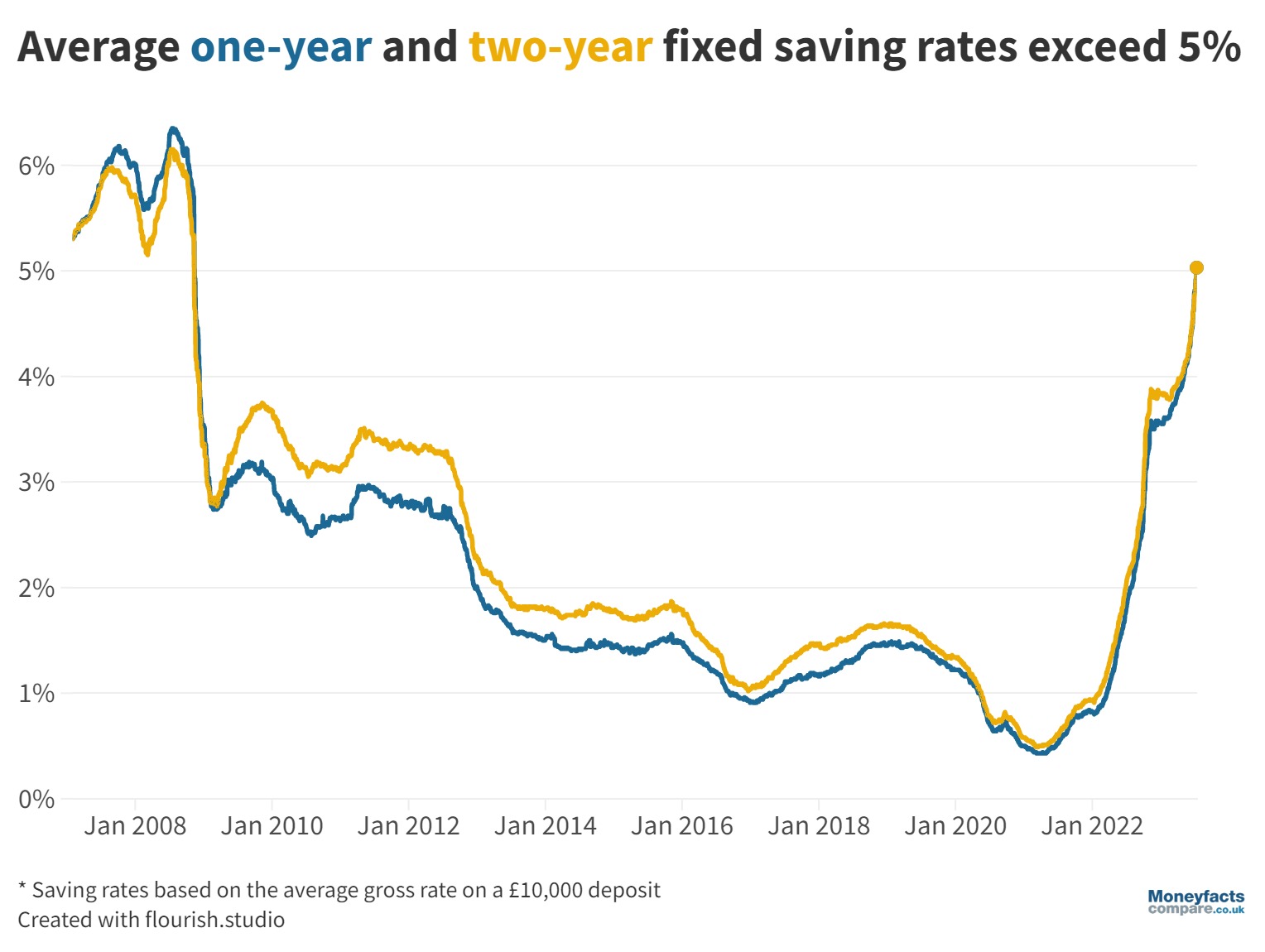

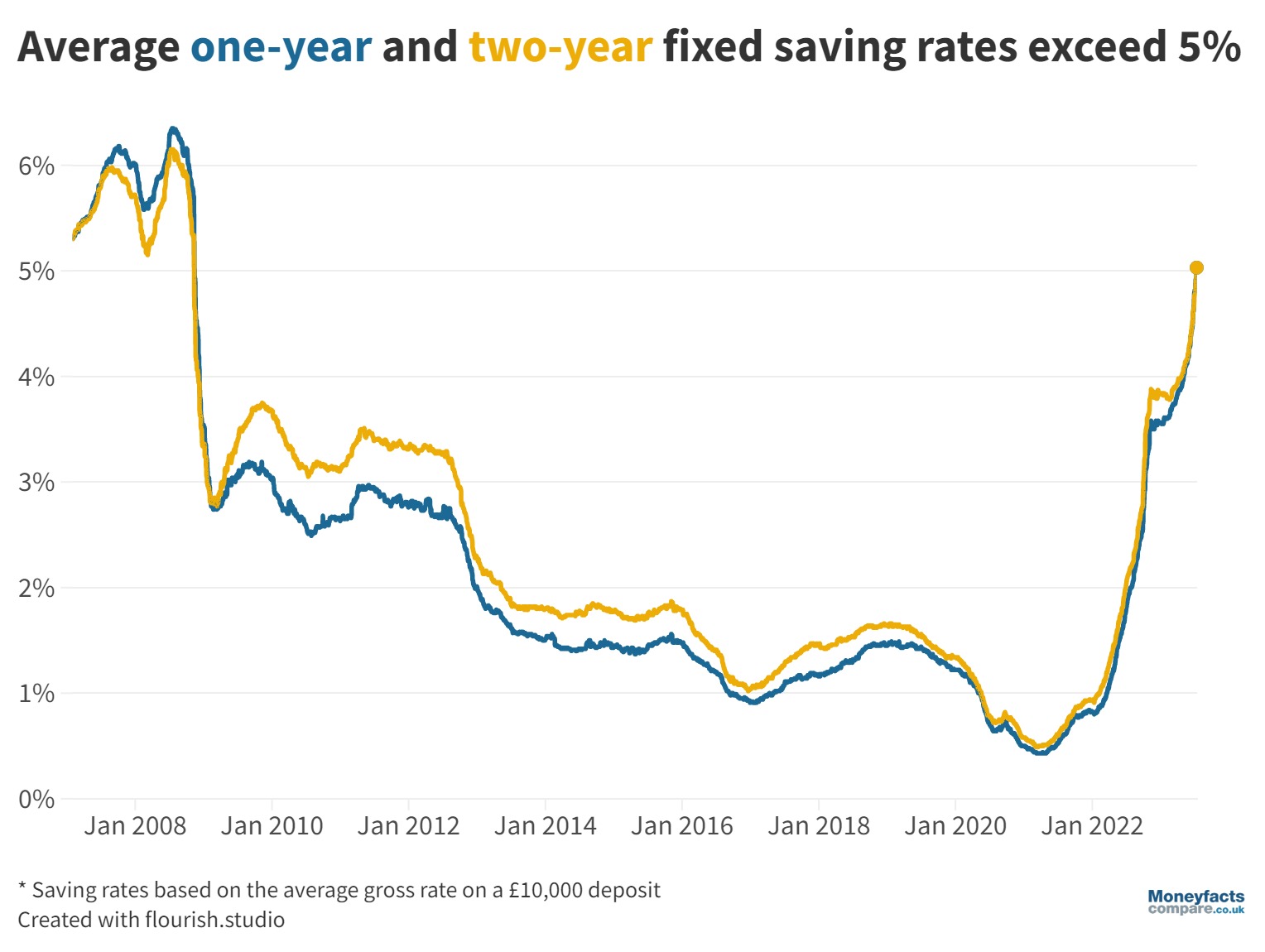

It is the first time these figures have exceeded this point since 2008.

The average returns on one and two year fixed rate bonds both rose to 5.03% gross today. This is the first time both these figures have exceeded the 5% mark since 2008.

The average one year fixed rate bond has increased in rate over the past five consecutive days, and has been rising throughout the year as providers price in further potential Bank of England base rate increases.

In January, it stood at 3.56% gross with the two year counterpart at 3.83% gross.

Average savings rates can give people an idea of whether they are getting value for their savings. Not only this, but they can also provide an overview of how the market is performing. If average rates are rising, then it may be worth reviewing your savings to ensure your provider is keeping up with the market trends.

GRAPH: Average returns on a one and two year fixed rate bond are at their highest since November 2008.

The very best one year fixed rate bonds all offer a rate of 6% AER or more.

FirstSave offers the current market-leading rate of 6.10% AER, with an offer which requires a minimum deposit of £1,000 or £5,000 to have interest paid monthly.

Atom Bank and Monument Bank follow suit on our charts with rates at 6.05% AER.

On the two year chart, FirstSave also offers the best rate of 6.15% AER and needs a minimum deposit of £1,000 to have interest paid on anniversary or £5,000 for the monthly interest option. Investec Bank plc’s deal through Raisin UK then makes second place at 6.06% AER.

These deals can be compared in more detail on our charts.

Otherwise, for a weekly analysis of the best savings deals across the market, make sure to read our Savings roundup every Friday.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.