But will mortgage lenders continue to reduce rates throughout the remainder of 2025?

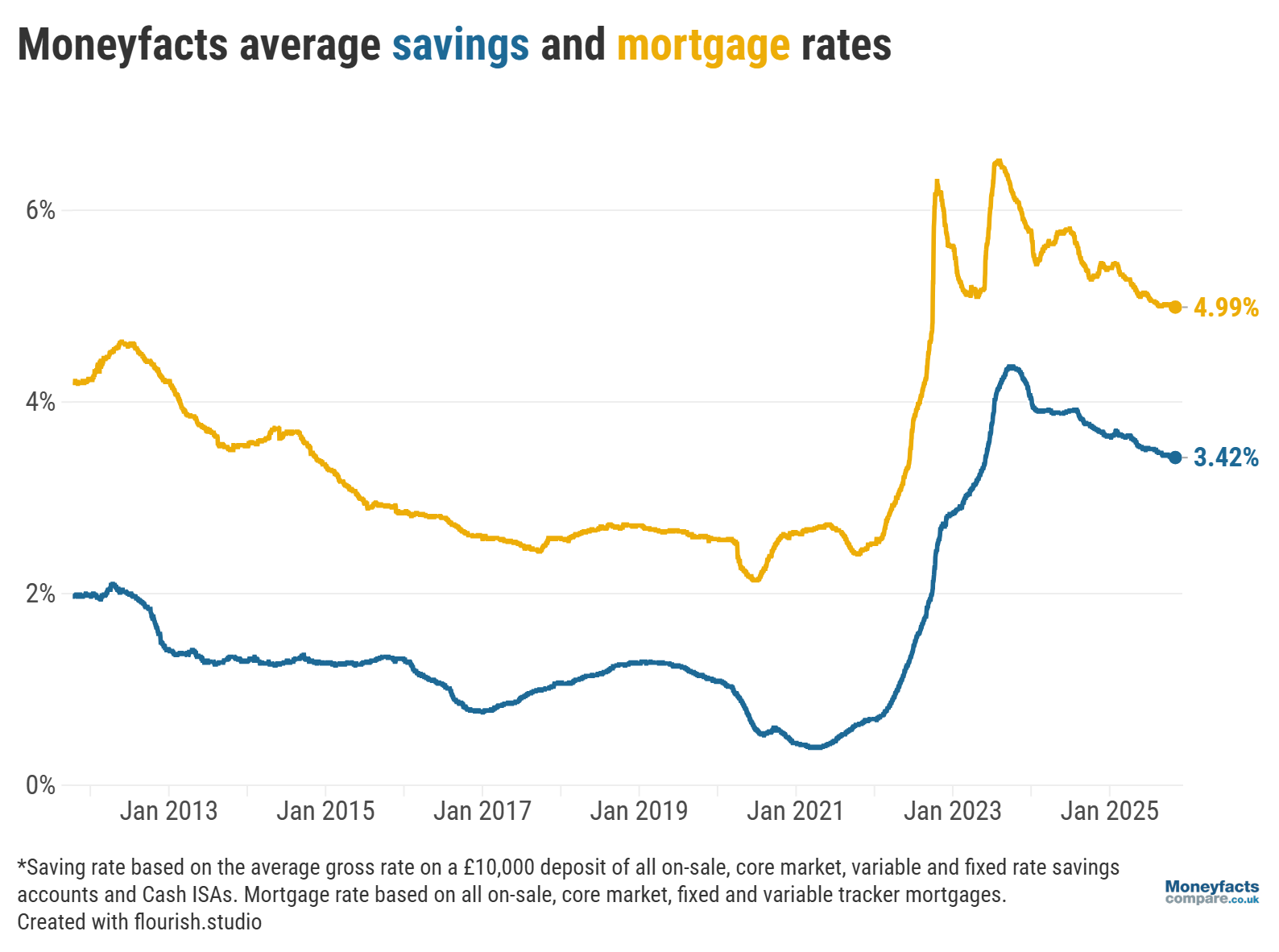

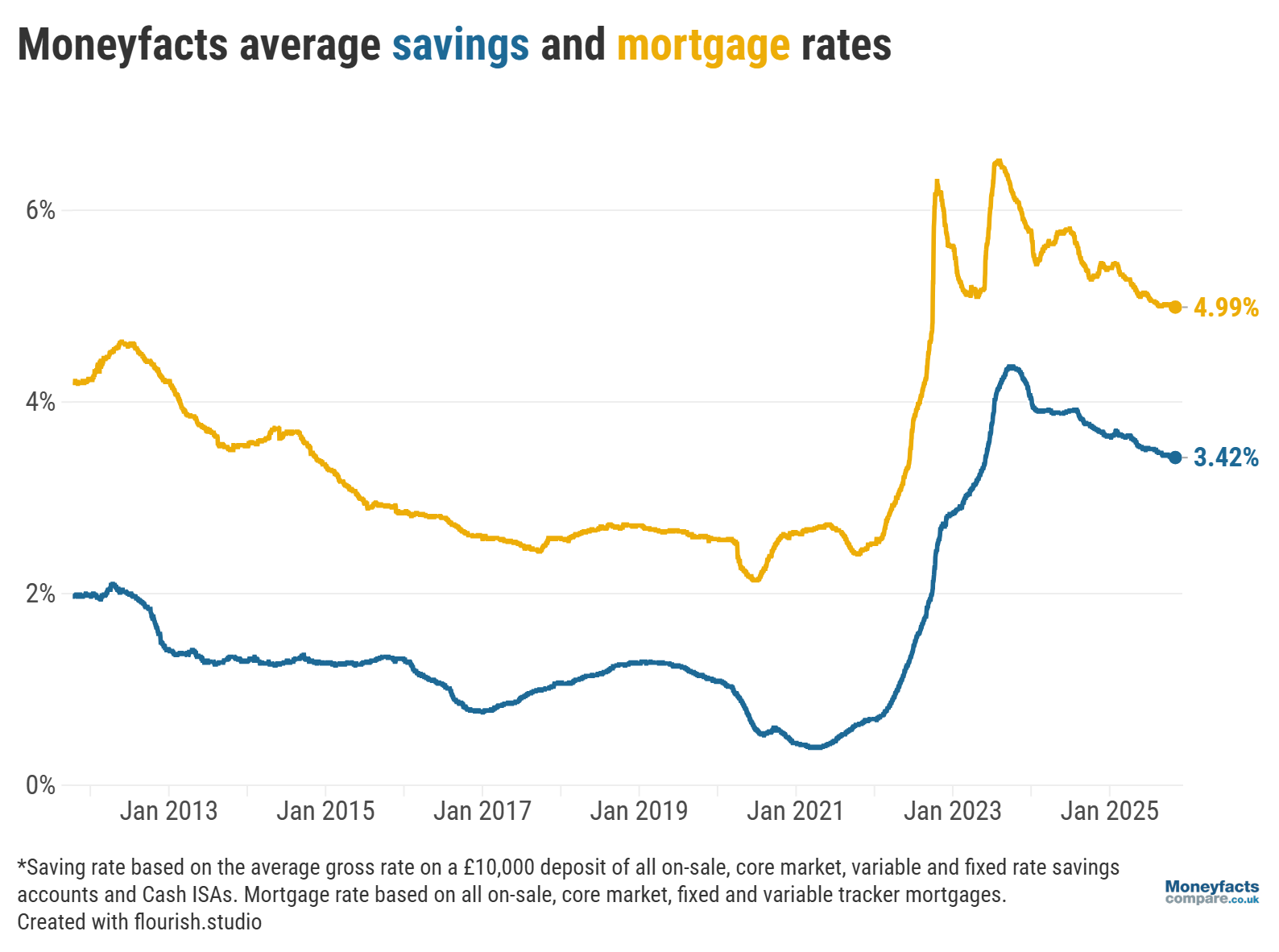

The Moneyfacts Average Mortgage Rate (which is calculated from all on-sale, core market, fixed and variable tracker deals), reached a major milestone today (3 November 2025) as it dropped below 5%.

Now at 4.99%, the Average Mortgage Rate has hovered around the 5% figure for the past couple of months. Aside from temporarily dipping below this threshold on 3 September 2025, the last time the Average Mortgage Rate sat below 5% was in September 2022.

“Borrowers will no doubt be thrilled to see mortgage rates drop, particularly the millions due to come off a cheap fixed rate before the year is over. It is a notable milestone to see the Moneyfacts Average Mortgage Rate drop below 5%, although it remains uncertain on how long this can be sustained,” Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, commented.

It has been a turbulent few years for the mortgage market in the aftermath of the mini-Budget in 2022 and other economic factors, with the Moneyfacts Average Mortgage Rate reflecting these changes.

On 23 September 2022 (the date of the mini-Budget), the Average Mortgage Rate sat at 4.71%. It rose to 5.10% just one week later and rocketed to 6.03% on 8 October 2022.

“The enduring uncertainty in the aftermath of the ‘mini-Budget’ led to not only a rise in rates, but lenders pulled hundreds of deals from sale. The closest comparison to such upheaval was felt due to the COVID-19 pandemic and UK lockdown,” Springall explained.

The Average Mortgage Rate continued to rise and stood above 6% for more than one month, only dropping below this on 22 November 2022 (5.94%).

Mortgage rates fell over the next few months, but this respite proved to be short-lived as soaring inflation prompted the Bank of England to continually raise the base rate, reaching 5.25% in August 2023 where it remained for one year.

As a result, the Average Mortgage Rate edged above 6% once again on 24 June 2023. It stayed above 6% until 17 November 2023, when it dropped to 5.98%, and hasn’t risen above it since.

While there have been fluctuations, the Average Mortgage Rate has been on an overall downwards trend over the past couple of years, to the relief of borrowers.

Graph: The Moneyfacts Average Mortgage Rate dipped to 4.99% at the start of November while the Moneyfacts Average Savings Rate stood at 3.42%.

Our mortgage charts are updated throughout the day to show the latest deals available.

Whether you’re looking to remortgage, move house or buy your first home, visit our charts to compare deals.

Now the Moneyfacts Average Mortgage Rate has fallen below 5%, prospective borrowers will be hoping this trend continues.

However, Springall points out that “sticky inflation makes it less likely for the Bank of England’s Monetary Policy Committee to unanimously agree on making more cuts”, while the “uncertainty” over what will be revealed in the Budget could also have an impact on mortgage rates.

Some experts predict that the Bank of England could lower the base rate sooner than initially thought, due to the slightly lower-than-expected inflation rate in September. Others are more cautious and expect the next base rate cut to be made in 2026 at the earliest.

The Bank’s Monetary Policy Committee (MPC) will announce whether it is changing the base rate on Thursday (6 November), but this may be too soon for any cuts as inflation remains significantly above its target of 2%.

Nevertheless, as the base rate is still expected to decline over the coming year, it seems likely that lenders will gradually lower their mortgage rates which could see the Average Mortgage Rate fall further.

But it’s important to bear in mind that a range of factors affect mortgage rates and how lenders price their deals, as Springall notes that “fixed rate mortgages are more intrinsically linked with swap rates” and “do not always bend to the will of base rate cuts”.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.