However, some of the lowest rates still stand at 5.64%.

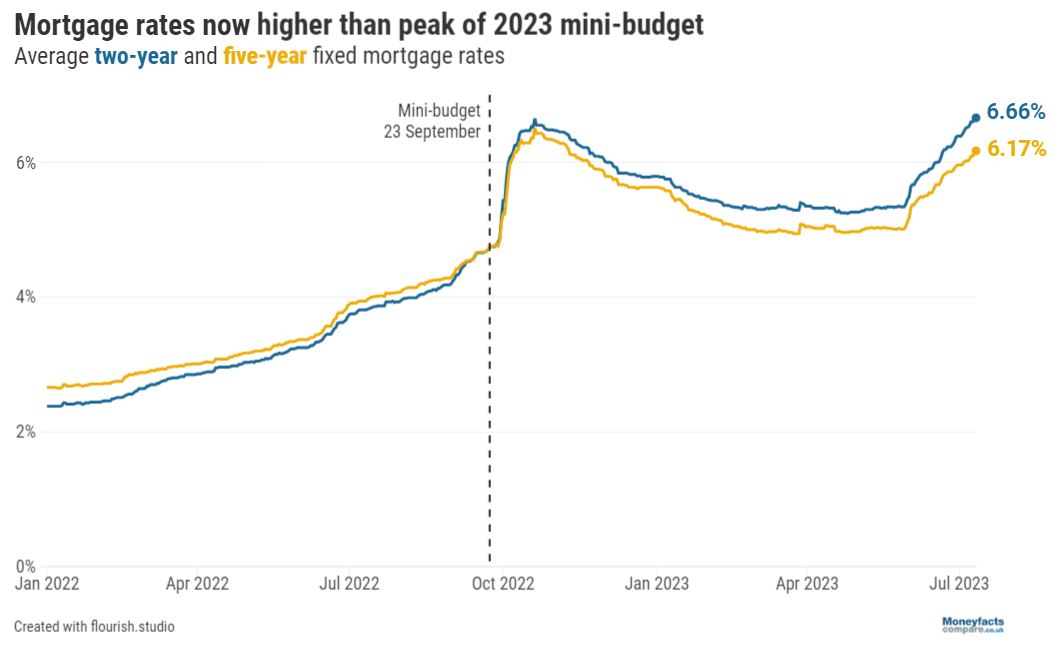

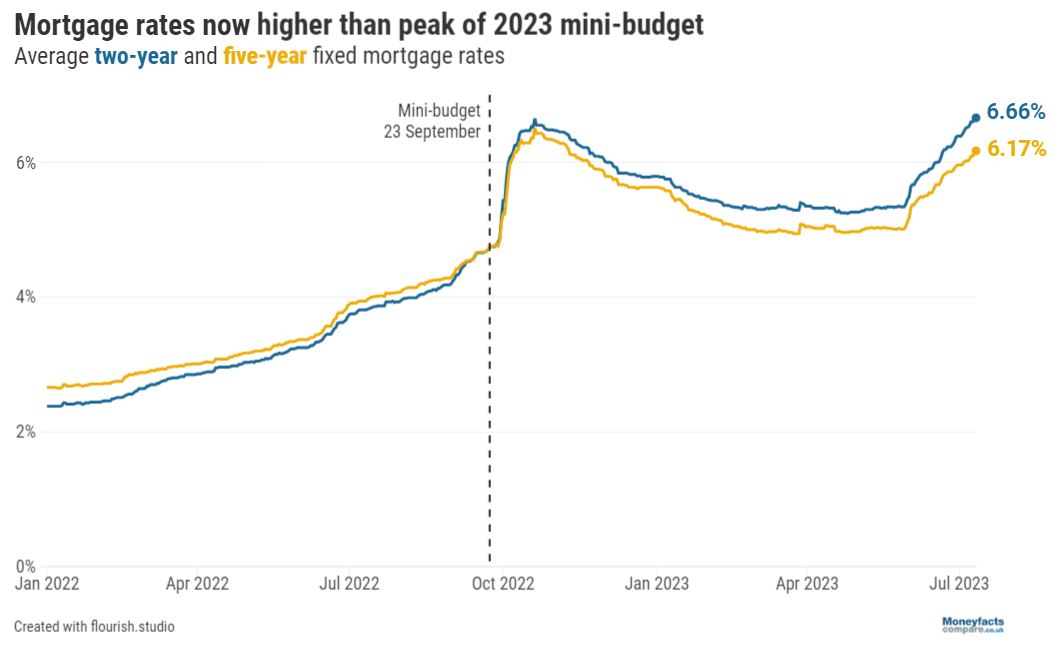

The average two year fixed mortgage rate increased to 6.66% today, surpassing its previous peak on 20 October. This was the day Liz Truss resigned as Prime Minister, with the two and five year rates standing at 6.65% and 6.51% respectively.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said the recent rise in mortgage rates was due to volatile swap rates. Much of this is driven by recent inflation figures, which remain stubbornly high and suggest the Bank of England may need to make further base rate increases.

“Rising rates may well worry borrowers who are coming off fixed rate deals, such as those who locked into a rate below 3% two years ago,” she said.

Based on Moneyfactscompare.co.uk calculations of a £200,000 loan over 25 years, the monthly mortgage repayments on a 3% mortgage would amount to nearly £950. On today’s average two year fixed rate the same mortgage would cost £420 more a month.

The average two year fixed rate is now at its highest point since August 2008, when it stood at 6.94%.

At that time the world entered a financial crisis, with Lehman Brothers collapsing in the US a month later. In the UK, HBOS, the country’s largest mortgage lender, merged with Lloyds TSB.

Mortgage rates fell in subsequent months as the world economy entered a recession.

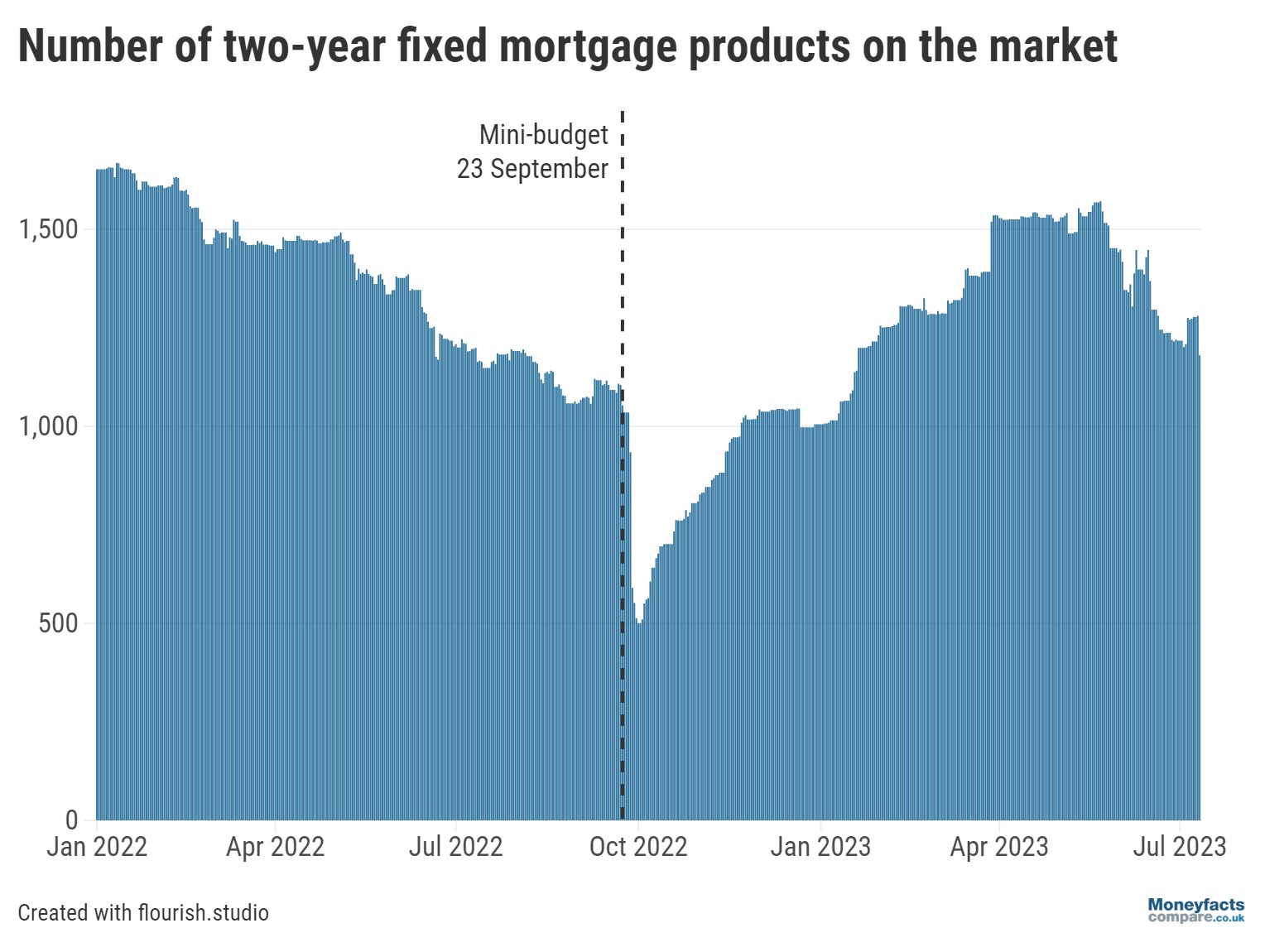

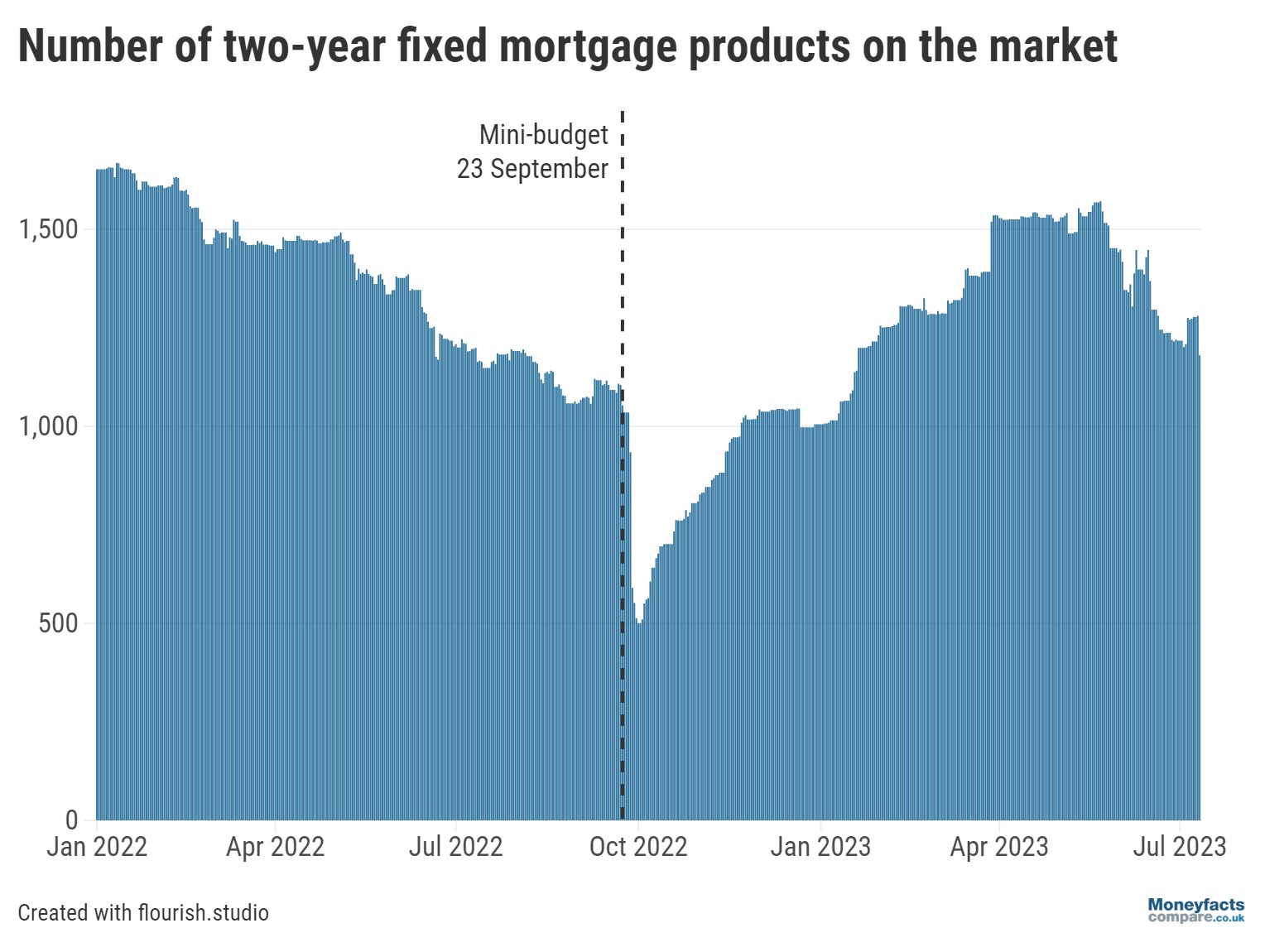

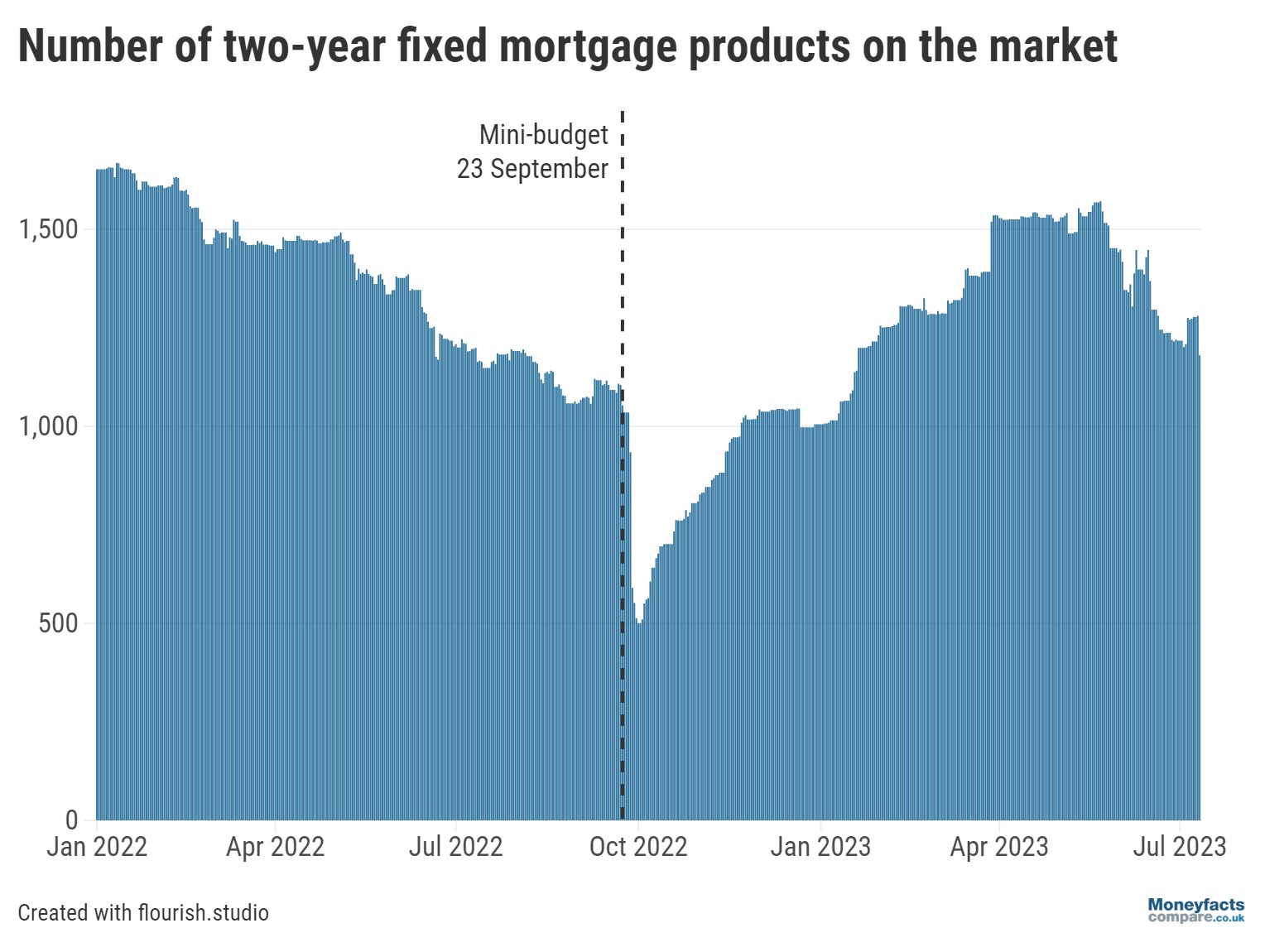

What differs the current market from 20 October is that there are now more 2 year fixed rate deals on sale.

On the day Liz Truss resigned as Prime Minister, there were 762 two year fixed deals on the market. Many of the other lenders refrained from offering any fixed deals until there was more certainty in the market.

Today, this figure has grown to 1,180, from the peak of 1,536 seen at the end of March.

It is important to remember that these are average figures, and the mortgage you’ll be quoted will depend on a variety of factors.

Currently, the lowest two year fixed deal on the market for remortgage borrowers sits at 5.64%. These mortgages, among others, are discussed in our weekly roundup every Wednesday.

Otherwise, you can always seek the advice of an independent mortgage adviser if your fixed deal is due to end soon. Our preferred partners are Mortgage Advice Bureau (MAB), and you can speak to them by clicking here.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.