Buy-to-let market shows signs of recovery, with over 1,500 more products available compared to this time last year.

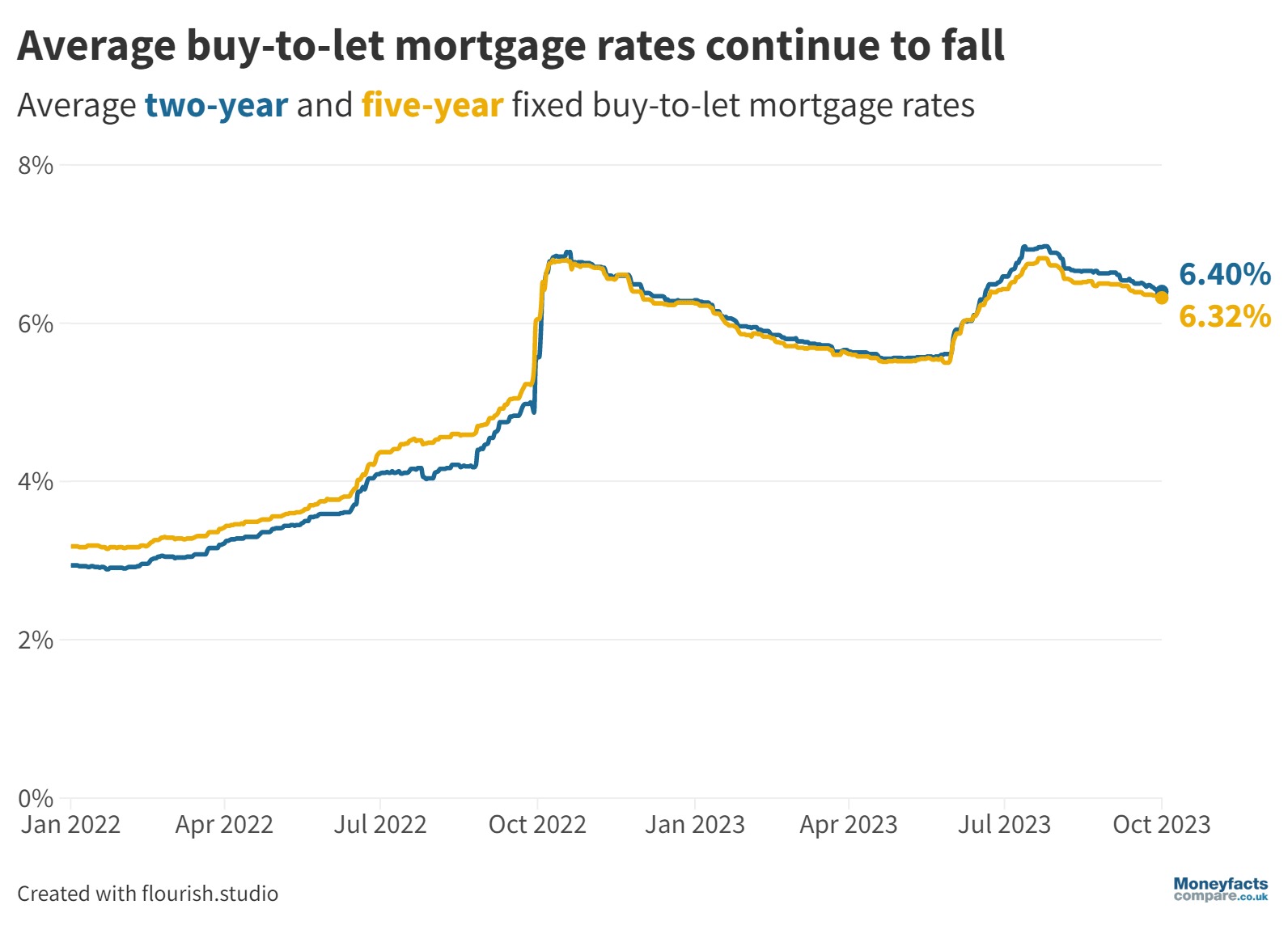

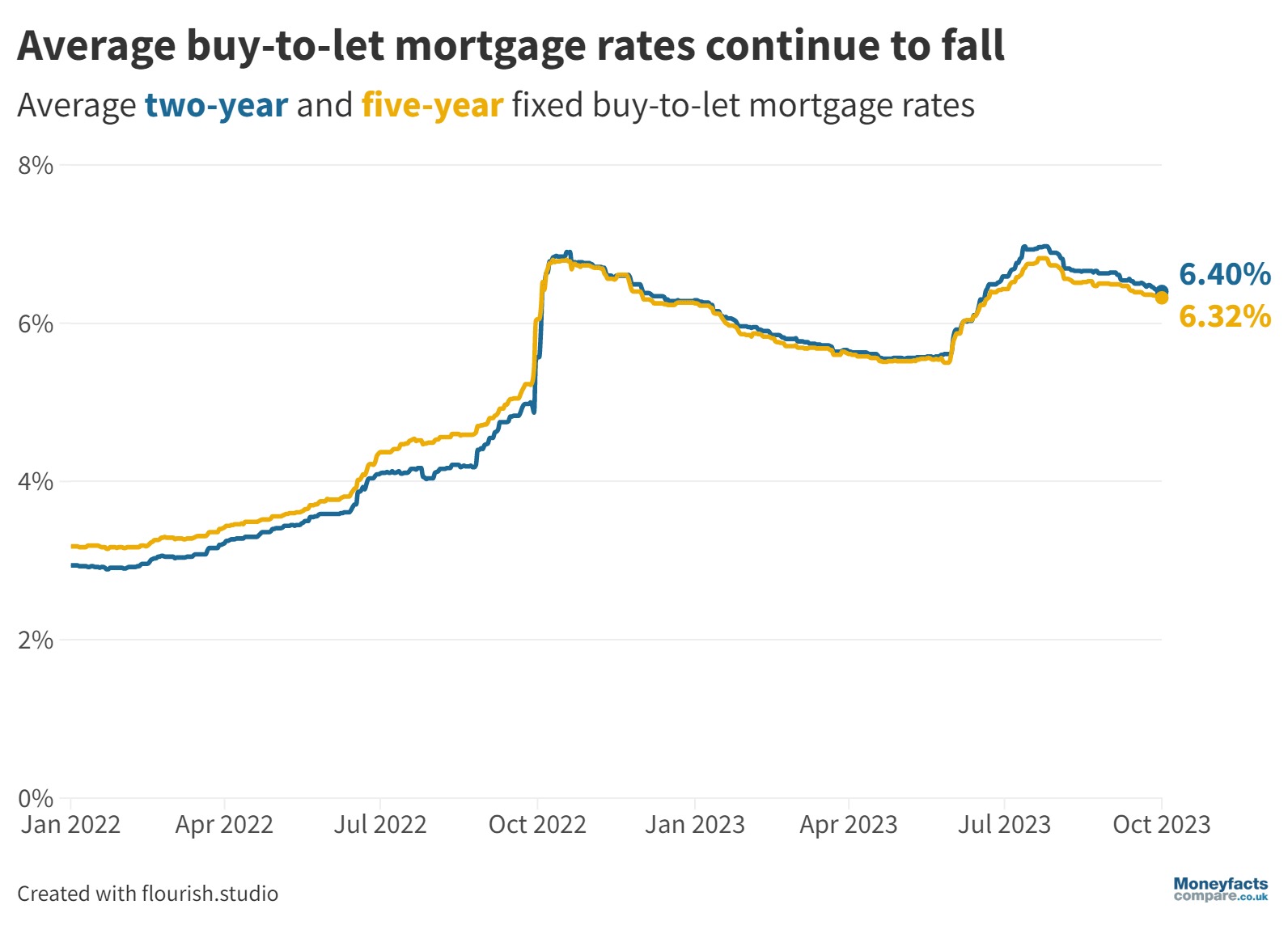

Average fixed rates in the buy-to-let market have fallen month-on-month, Moneyfacts’ data reveals. The start of October saw the average rate for a two-year deal drop to 6.40%, down from 6.64% in September. Similarly, the average five-year fixed rate fell to 6.32% from 6.49% during the same months.

Alongside falling fixed rates, increased product choice is a further encouraging sign the market is recovering from recent turbulence. A year ago, there were less than 1,000 buy-to-let products available; now there are over 2,500.

Average rates can be a useful indicator of whether you’re getting a competitive deal. To compare the best buy-to-let rates currently available, visit our chart.

Caption: The average rate for a two-year and five-year fixed buy-to-let mortgage fell at the start of October

Landlords concerned about rates escalating as they look to refinance may be reassured by the average fixed deal becoming more affordable, as well as healthy product growth in the buy-to-let market.

However, Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, warned that “those coming off a two- or five-year fixed rate deal will need to find more funds to afford higher mortgage repayments”.

This is because the average two-year fixed rate has more than doubled since October 2021, when it sat at 2.92%. Meanwhile, back in October 2018, the average five-year equivalent was 3.40%.

“Some landlords may seriously be considering selling up, as the profitability of a buy-to-let portfolio may not be enough to cover costs. Over the years, landlords’ profit margins have been hit by a cull in mortgage rate tax relief, tax changes for CGT and holiday lets, plus new EPC requirements,” Springall said.

Nevertheless, Oliver Dack, a Spokesperson for Mortgage Advice Bureau (MAB), said the company was seeing ‘greater resilience’ from more experienced landlords who are less likely to sell off part of their portfolio, but emphasised this was on a case-by-case basis.

While average fixed rates in the buy-to-let market remain high, Dack recognised that the recent drop may entice new investors.

“Falling interest rates can lead to lenders taking a positive stance in terms of their affordability assessments, which perhaps may open up opportunities for prospective investors,” he said.

Whether you’re an experienced landlord or new to the buy-to-let scene, it’d be wise to seek independent advice before committing to a deal. Our preferred adviser is Mortgage Advice Bureau, which currently employs over 2,000 advisers across the UK.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.