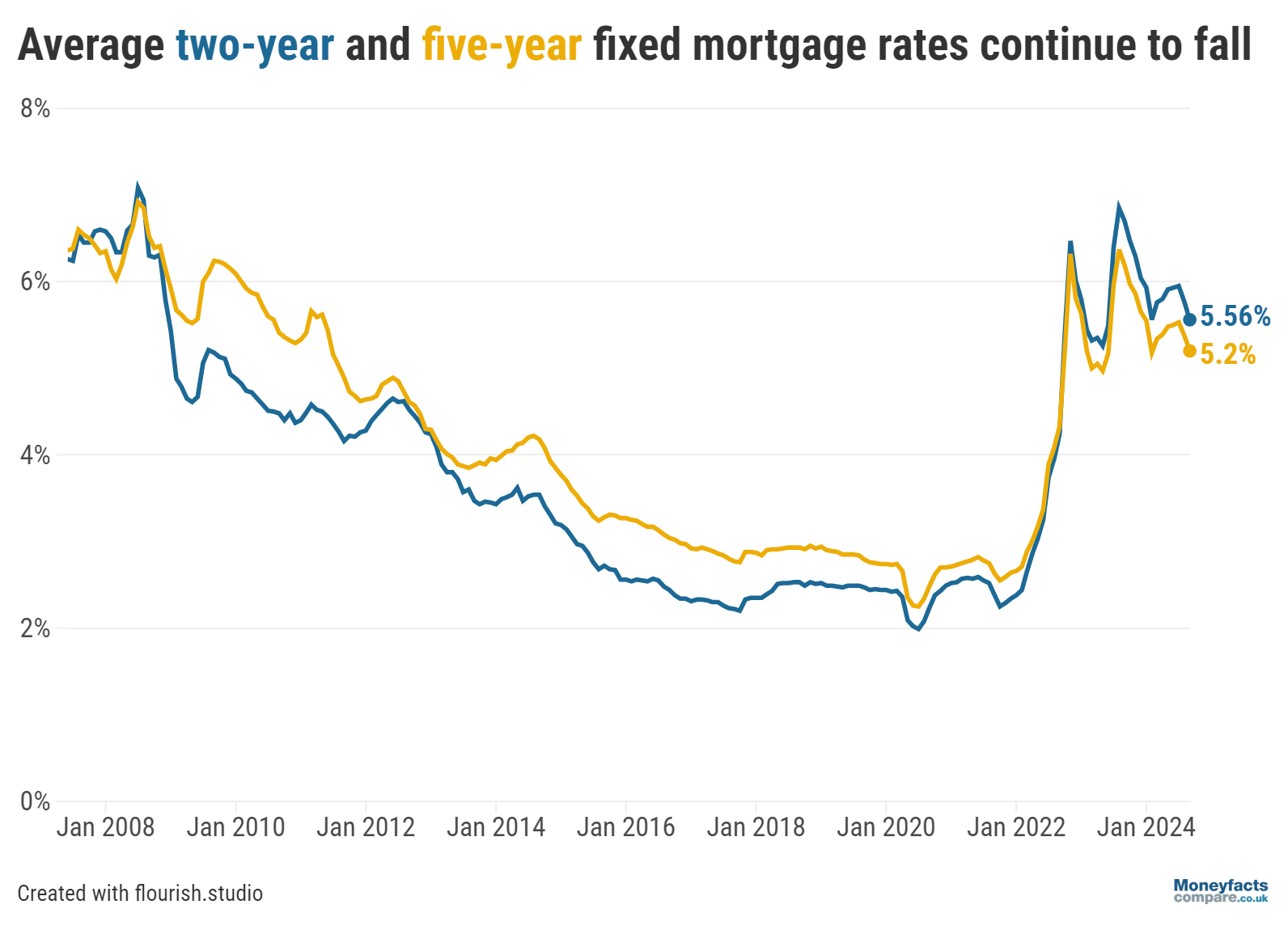

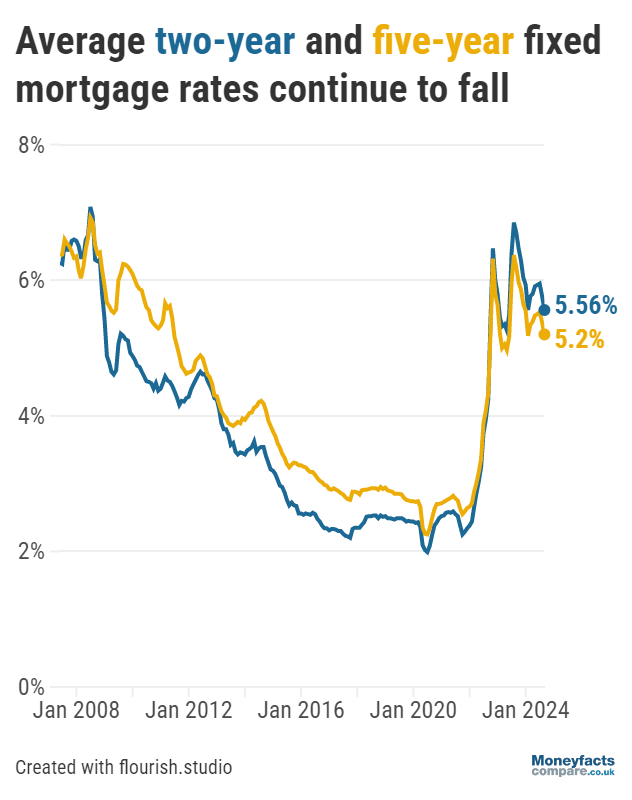

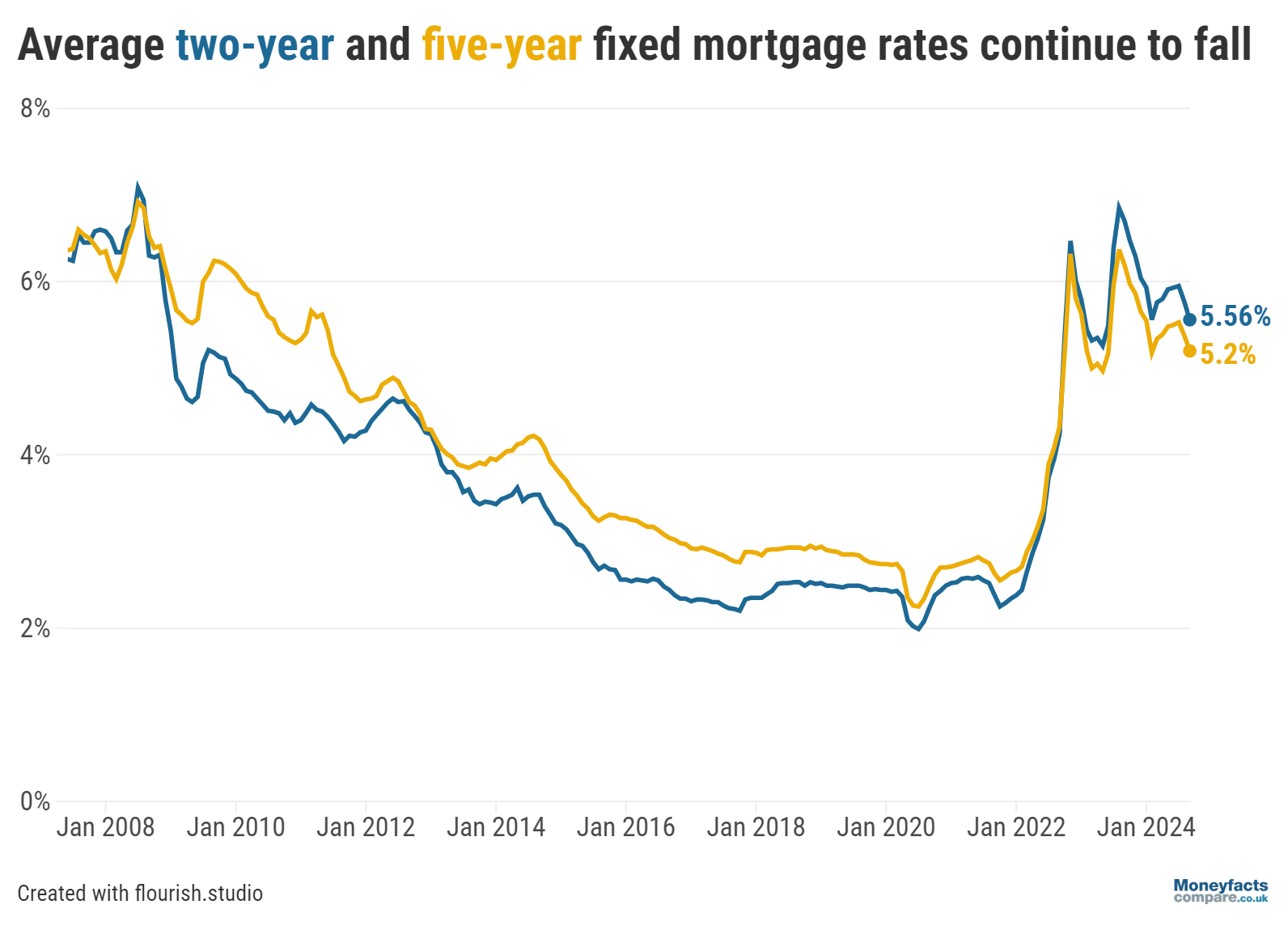

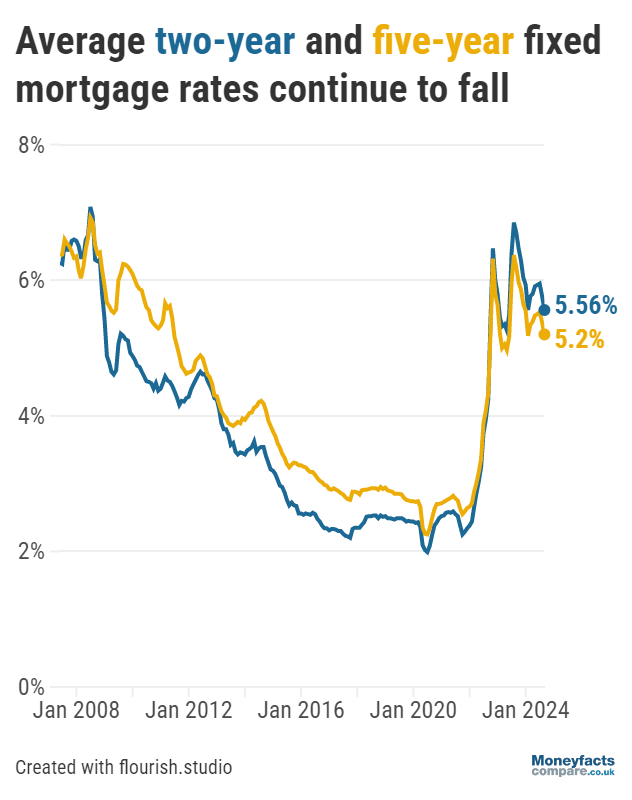

The average prices of two- and five-year fixed deals return to levels unseen for over six months.

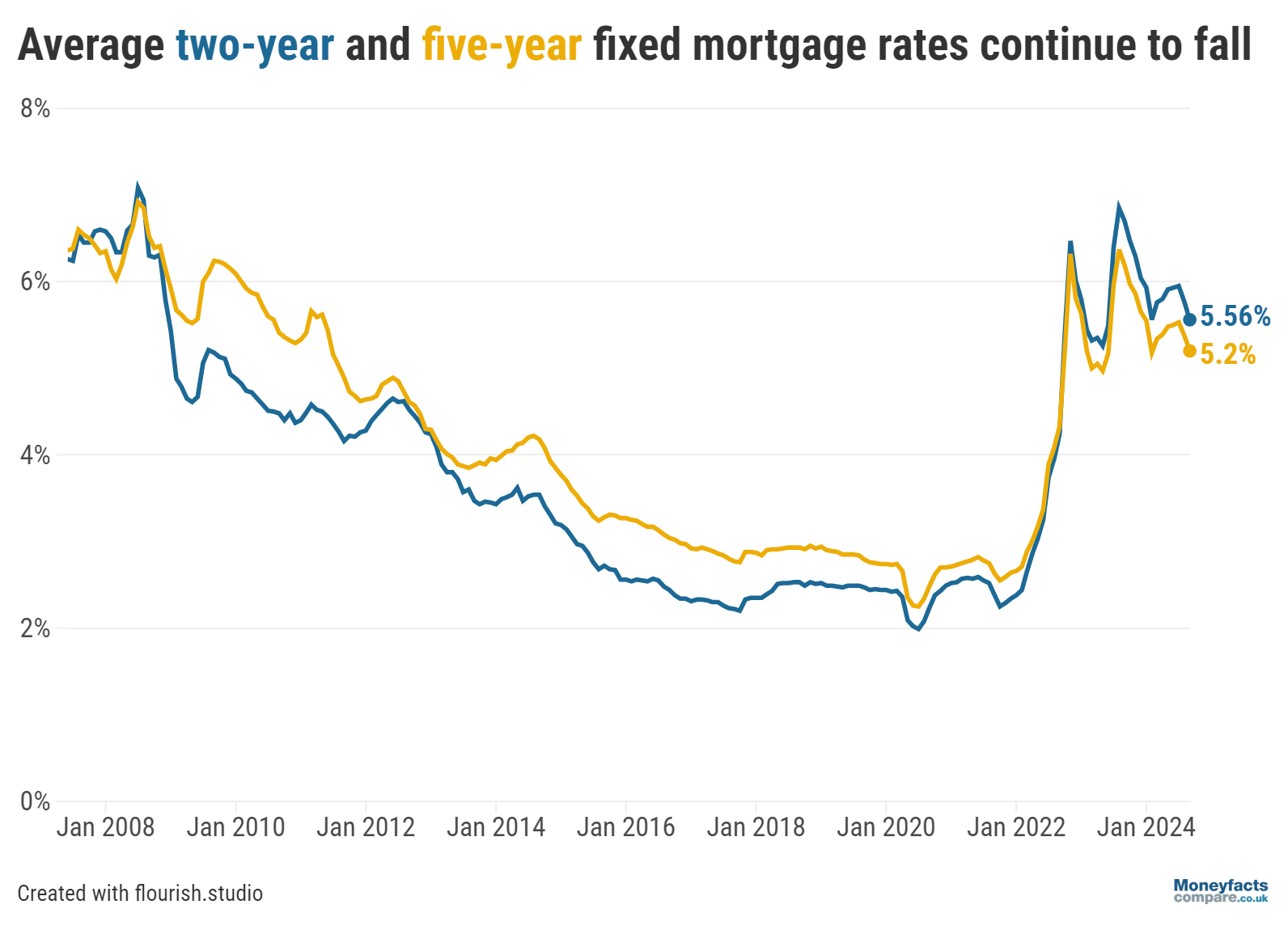

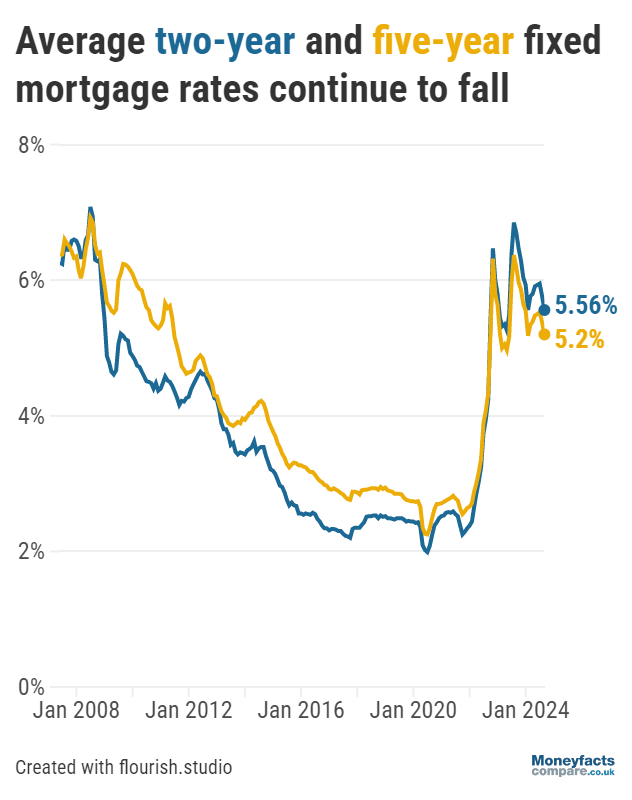

The UK mortgage market continued to experience positive momentum throughout August, with the average prices of two- and five-year fixed deals falling to their lowest levels since February and March 2024, respectively, by the start of this month.

This is according to the Moneyfacts UK Mortgage Trends Treasury Report, which revealed the typical two-year fixed mortgage rate dropped 0.21 percentage points in the month to September, to sit at 5.56%. Meanwhile, the average rate charged for a five-year fixed mortgage stands at 5.20% on a first of month basis, having fallen 0.18 percentage points over the same period.

Graph: Average two and five-year fixed mortgage rates between January 2008 and September 2024

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, expects these latest figures to come as “welcome news for prospective borrowers” after a tumultuous two years which saw “significant rises to mortgage rates”.

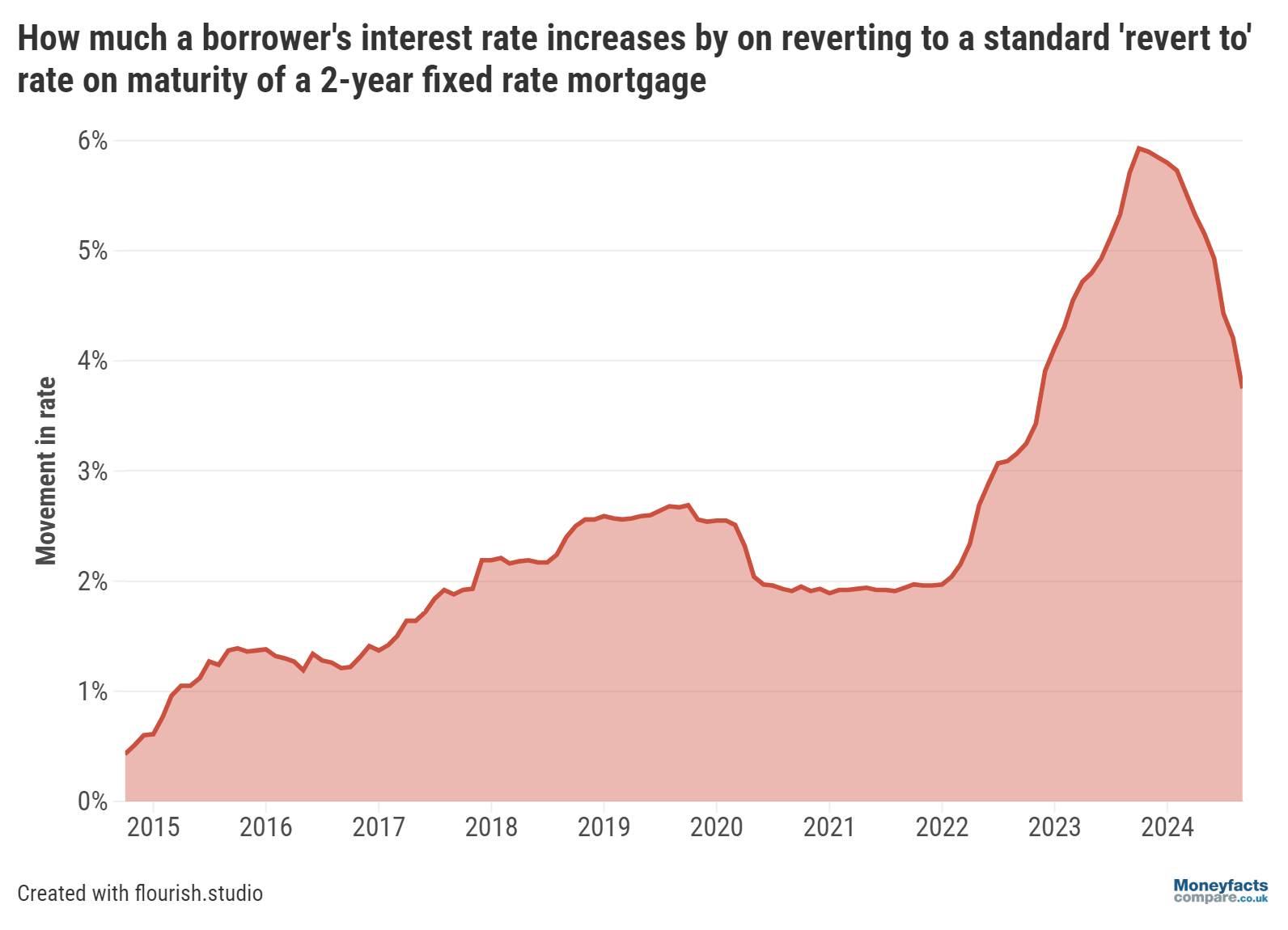

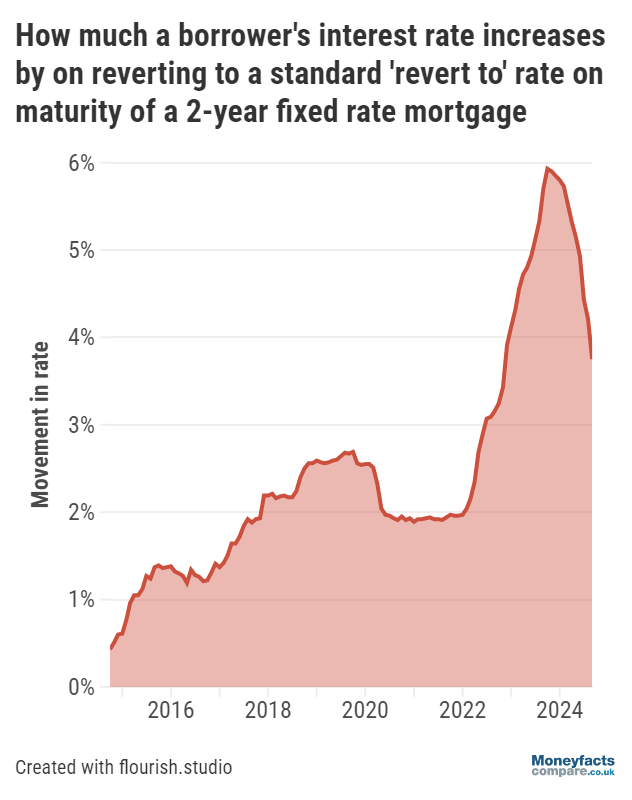

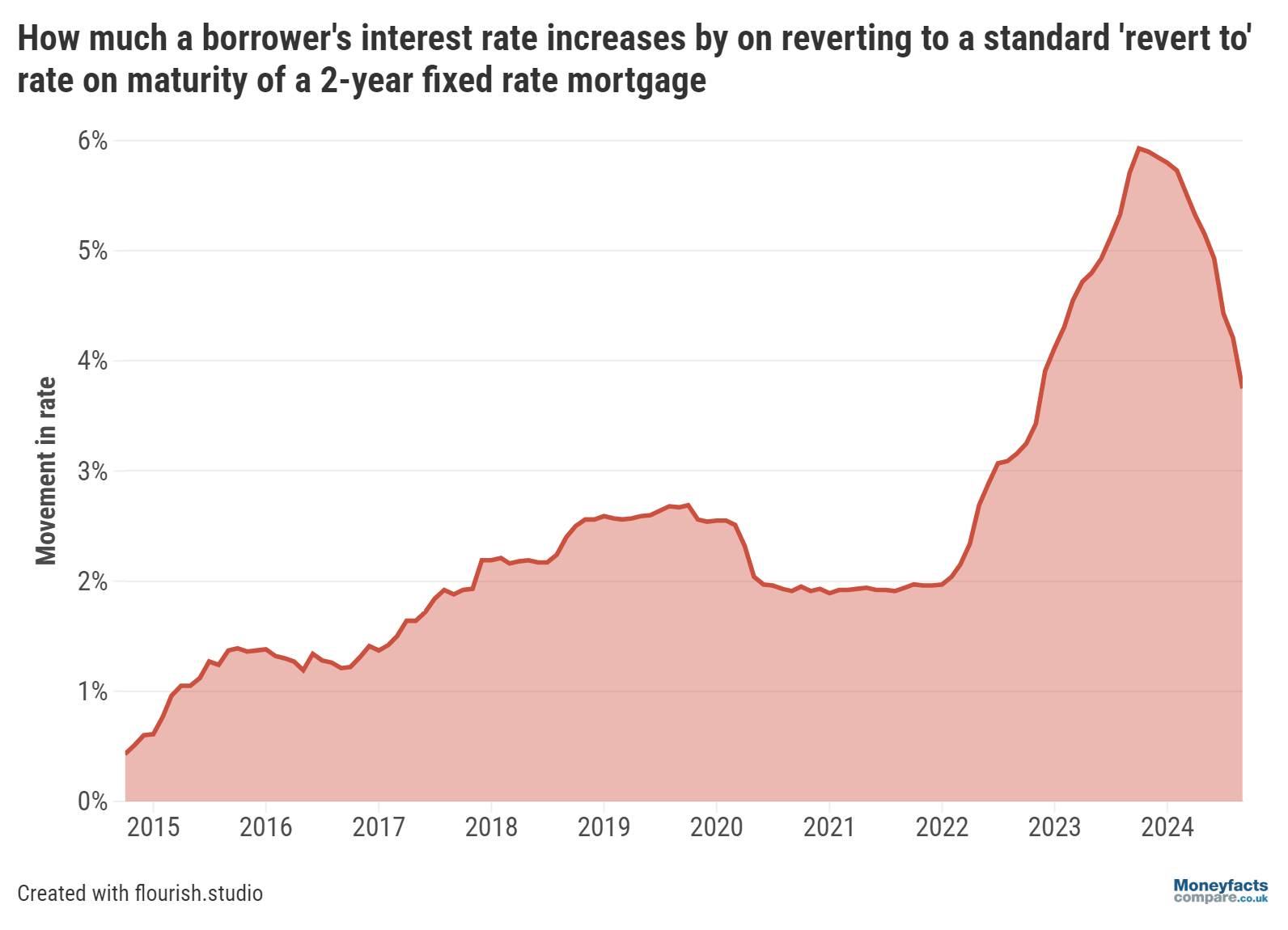

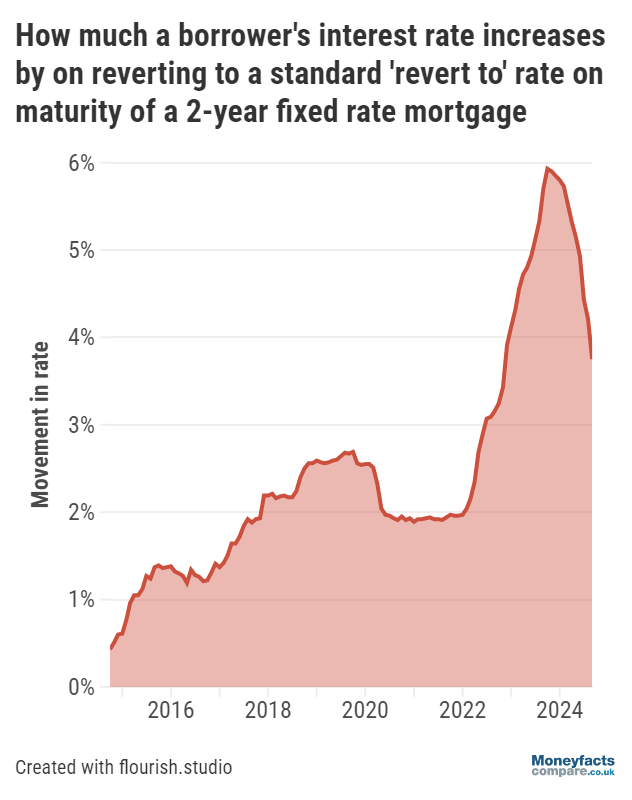

This month marks the second anniversary of the September 2022 mini-Budget which was a catalyst for lenders to withdraw and reprice deals; subsequently, the average two-year fixed mortgage rate rose sharply from 4.24% to 6.70% within a year.

However, with fixed rates falling for a second consecutive month, an increase in the amount of time a product is typically available could be a further sign the market is now in recovery. The average shelf-life of a mortgage deal extended from 17 days in August to 21 days at the start of this month.

After the first cut to the Bank of England base rate in more than four years took place last month, some borrowers may be contemplating whether now is the time to opt for a fixed or variable rate mortgage.

It’s often the case reductions to the base rate are quicker to impact variable deals than fixed rate mortgages. Despite the average two-year tracker rate falling by a considerable 0.27 percentage points in the weeks following the base rate announcement, at 5.68% on a first-of-month basis, it remains more expensive than a typical two-year fix.

Nevertheless, those who believe there will be more cuts to the UK’s central interest rate in the not-too-distant future could consider a variable rate in the hopes any potential reduction will be passed on.

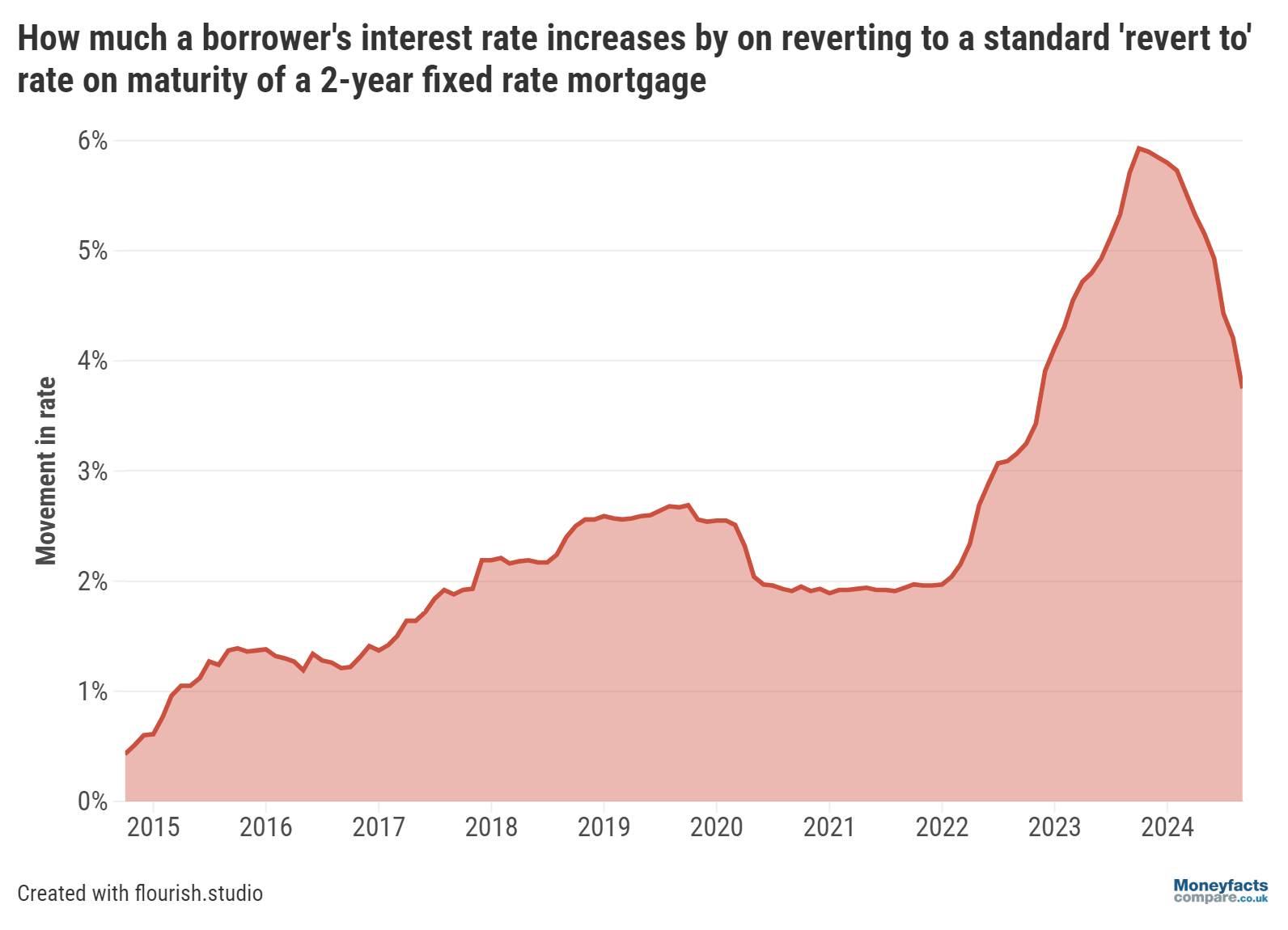

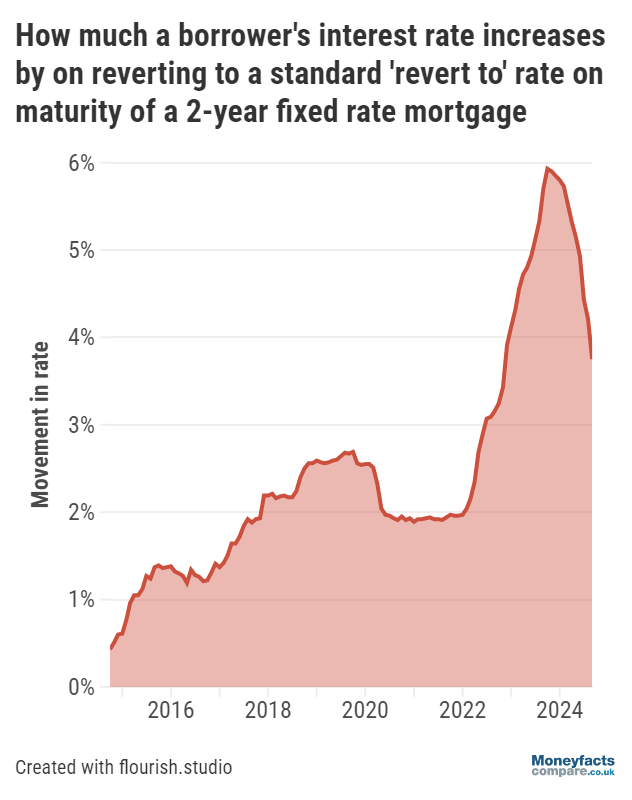

That being said, borrowers awaiting a further decline in mortgage rates while sitting on their lender’s Standard Variable Rate (SVR) will likely find it more cost effective to secure a new fixed deal. Although the average ‘revert to’ rate fell from 8.16% in August to 7.99% by September, monthly repayments at this rate would still be over £300 more expensive than an average-priced two-year fixed mortgage (based on a £200,000 loan repaid over 25 years).

Whether you’re looking for a fixed or variable rate deal, consider seeking advice from a broker to help navigate the market and find the best mortgage for your needs and circumstances.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.