A record high number of buy-to-let mortgage deals coupled with lower interest rates is encouraging for landlords.

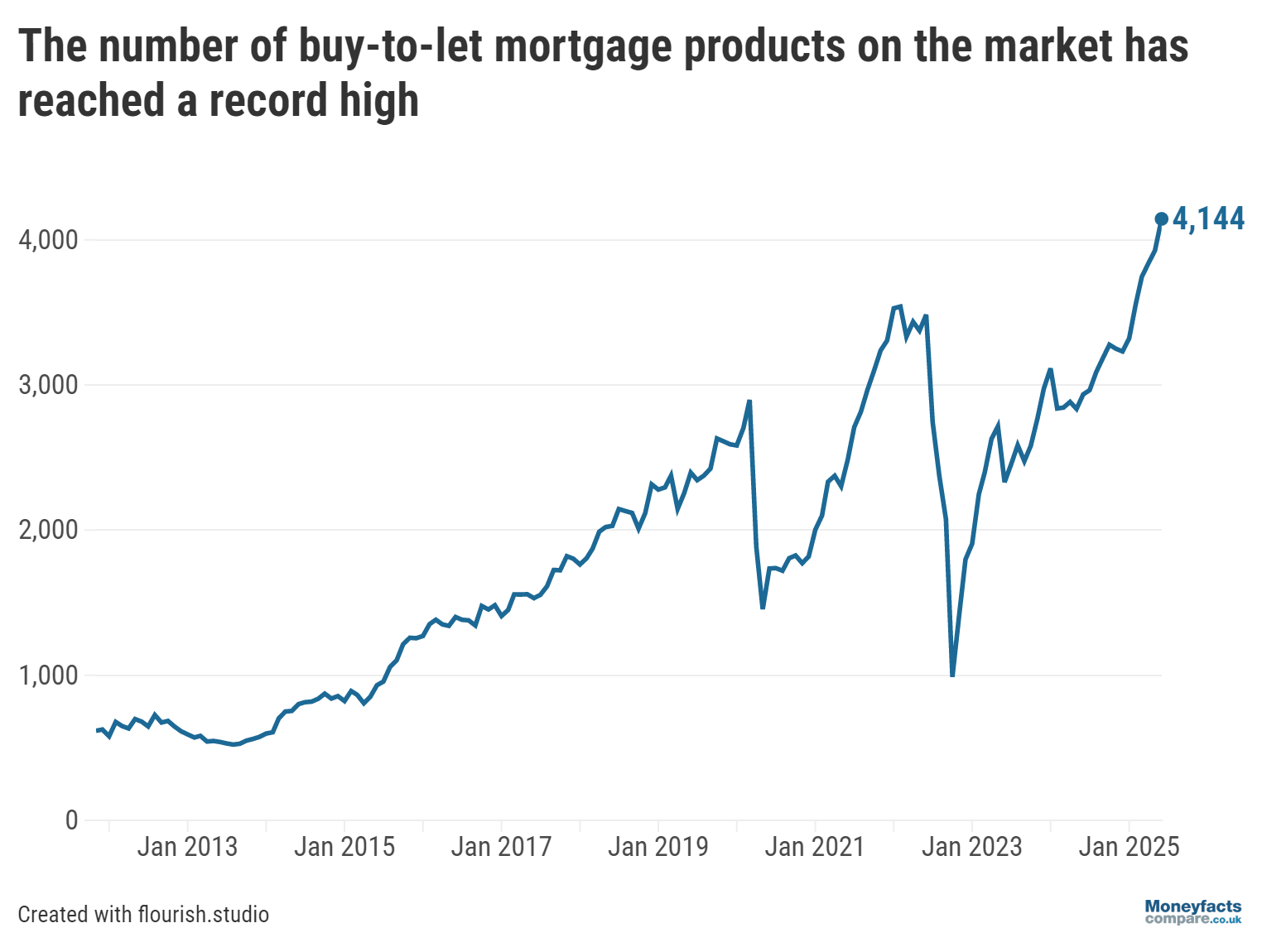

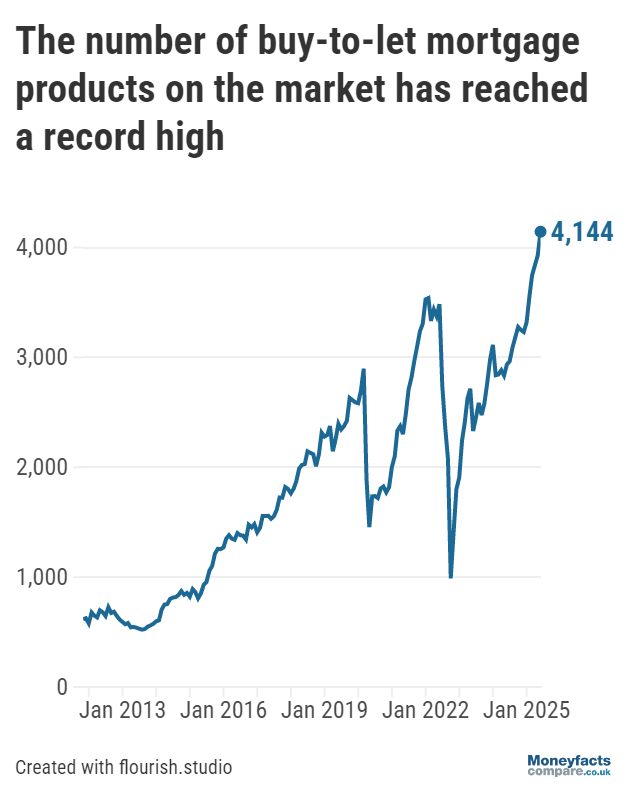

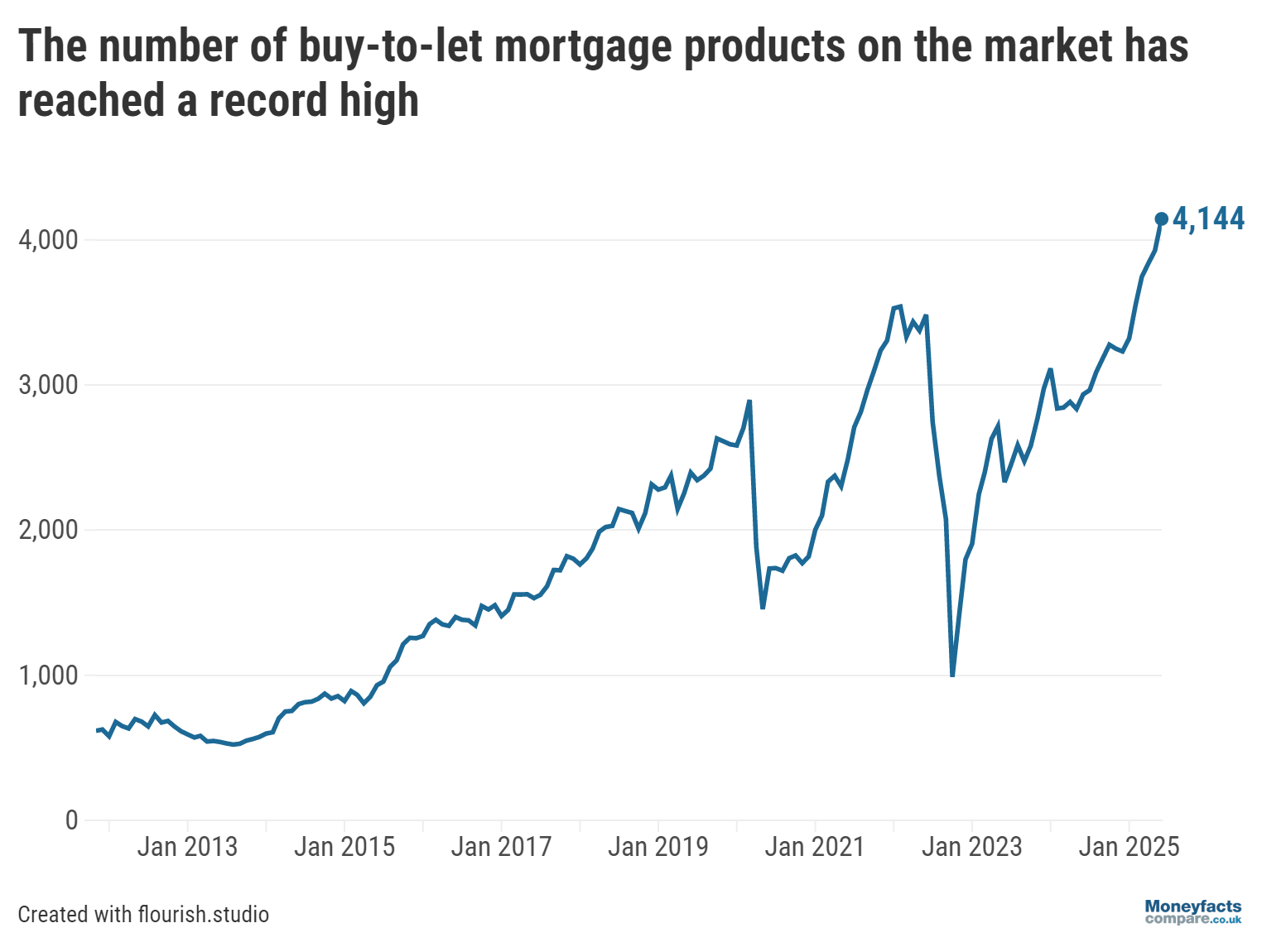

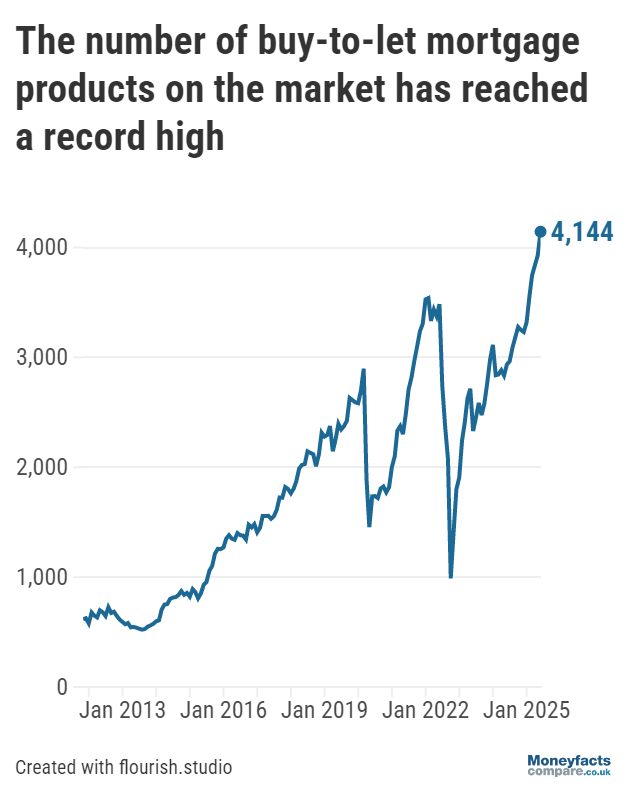

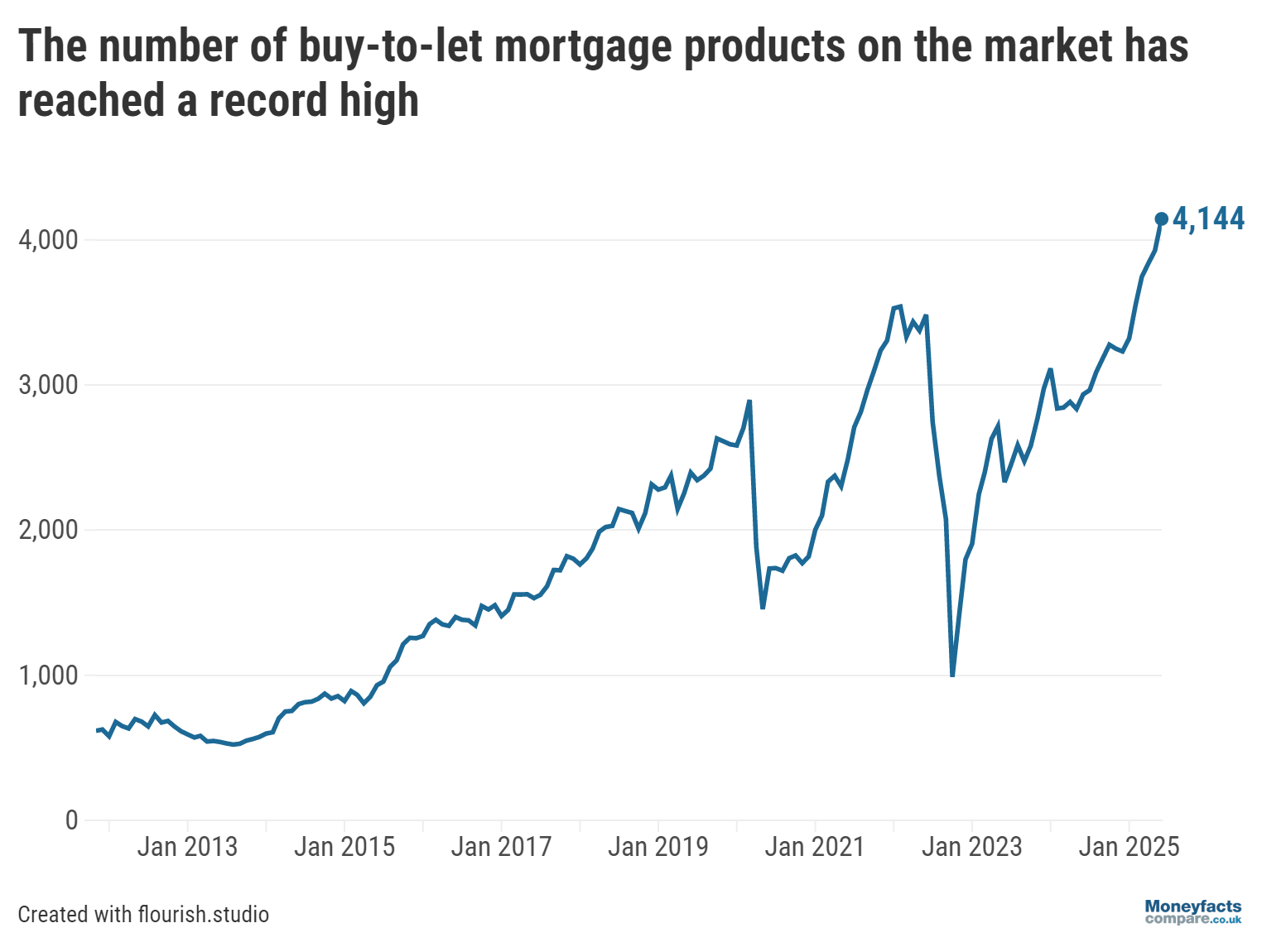

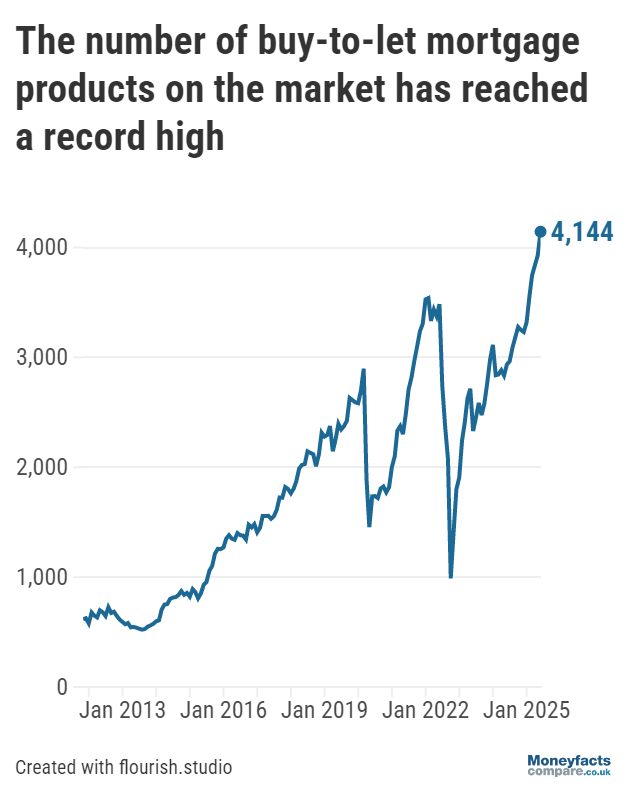

Current and prospective landlords have more buy-to-let mortgage deals to choose from, as the number of fixed and variable deals on the market rose from 3,926 at the start of May to 4,144 at the start of June, according to the most recent analysis by Moneyfactscompare.co.uk.

The number of buy-to-let deals available has increased significantly over the past year, with this month once again seeing the highest count registered on Moneyfacts’ electronic records. By contrast, one year ago borrowers had 1,209 fewer deals to choose from at 2,935.

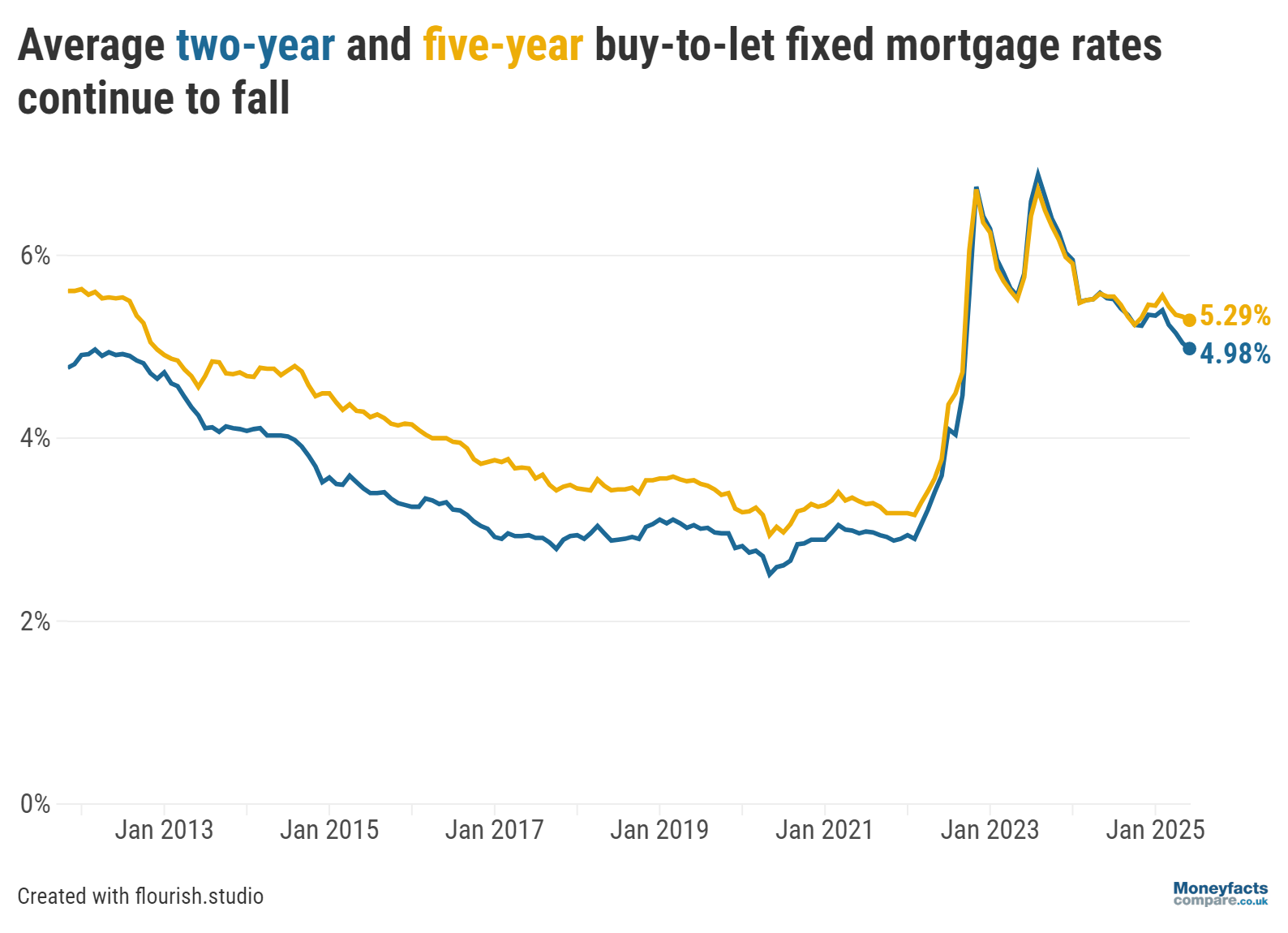

Graph: The number of buy-to-let mortgage products available since 2011, rising to a record high in June 2025.

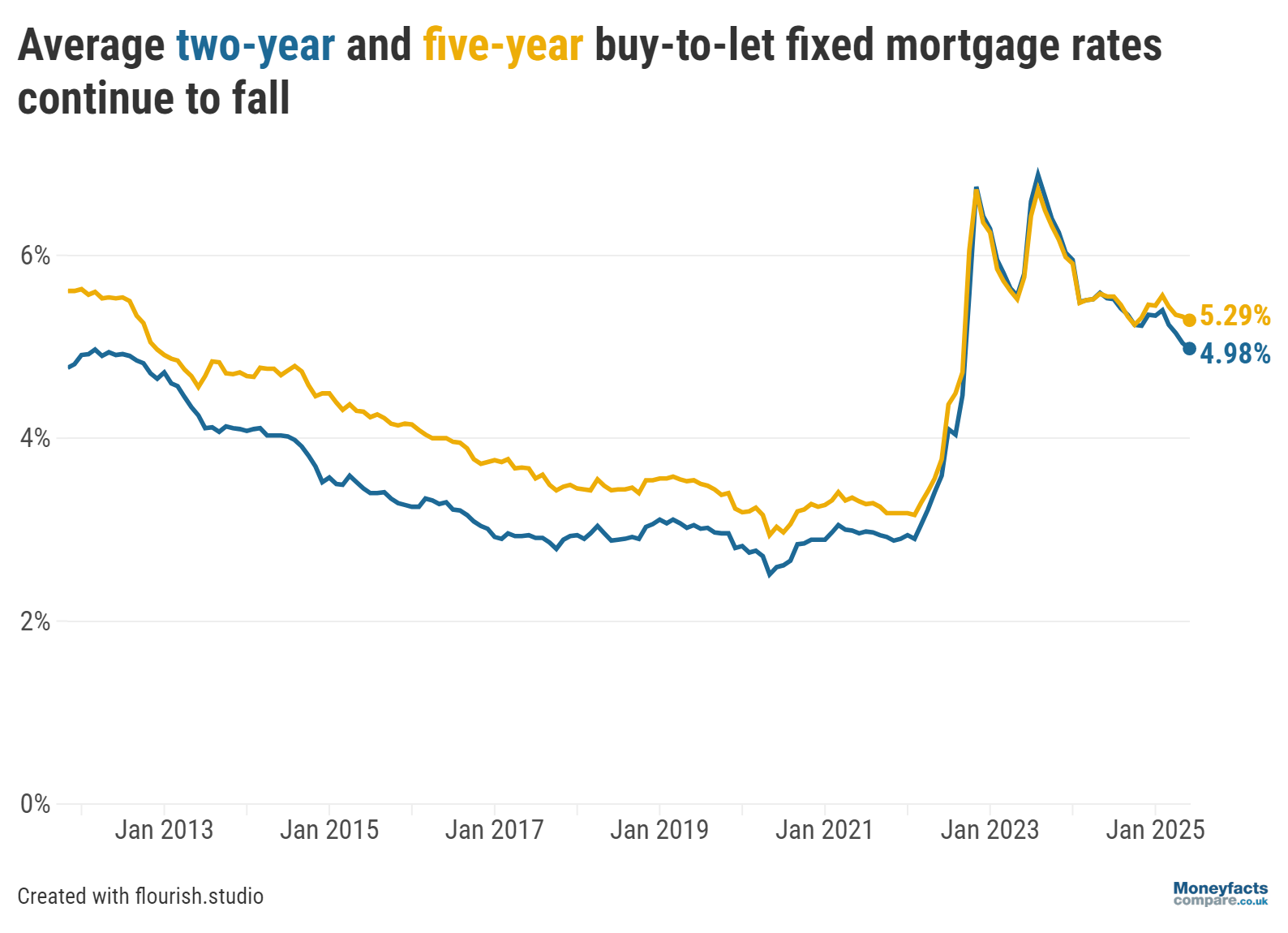

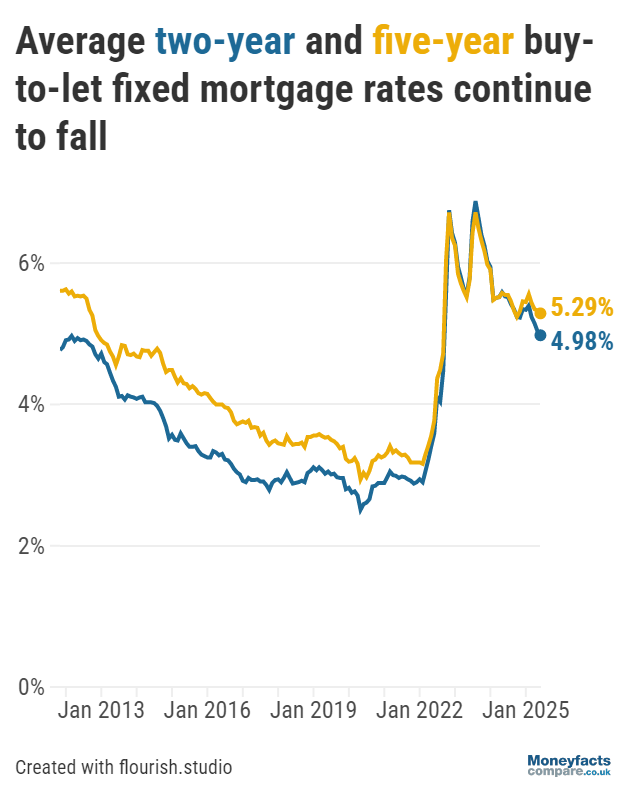

Furthermore, alongside this rise in product availability, average buy-to-let mortgage rates have fallen for the fourth consecutive month.

At 4.98%, the average two-year fixed rate is at its lowest point since September 2022, while the average five-year fixed rate fell to 5.29%, its lowest since October 2024.

These compare to average fixed rates of 5.53% and 5.55% respectively in June 2024.

“The average five-year fixed buy-to-let rate is now at its lowest level in over six months, but year-on-year the rate has not dropped as viciously as its two-year counterpart,” noted Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

Graph: Average two- and five-year fixed buy-to-let mortgage rates between 2011 and 2025.

“Lenders monitor swap rates to gauge future rate expectations, and when they drop it encourages mortgage rate cuts,” she explained.

However, while the increase in product choice and lower rates “might create a positive sentiment for new and existing landlords”, Springall warns that there could be “immense pressure on some to turn around a profit in the future”.

For an up-to-date list of the top interest rates currently available, see our buy-to-let mortgage charts.

Property has traditionally been a popular investment and, while there are still new landlords entering the buy-to-let market, upcoming rule changes may make things more challenging for those renting out a property.

For example, the cost of maintaining a property to a suitable standard for tenants can quickly eat into any profits. And more stringent energy-efficiency regulations could make being a landlord even more costly.

From 2030 onwards, all private landlords need to ensure their properties have an Energy Performance Certificate (EPC) rating of C (or equivalent), compared to a rating of E under the current rules.

This is a welcome change for tenants, but installing improvements such as loft insulation could prove an expensive challenge for landlords, particularly “accidental landlords who are not able to fork out the costs to make renovations” Springall notes.

Moreover, landlords will need to consider the Renters Right Bill, which could come into effect this year. This bill contains many significant changes, including the abolition of section 21 “no fault” evictions and fixed term tenancies which will give renters more security and flexibility. There are also rules around rent increases in the bill, with landlords only able to increase rents once per year to the market rate when the bill becomes law, for example.

While millions of renters could benefit from this bill, Springall points out that “this might be the final straw for existing landlords, leading to them exiting the sector”.

While the buy-to-let mortgage market looks positive for existing landlords and those planning to invest in a rental property, the changes outlined above may give some individuals pause for thought.

New landlords about to purchase their first buy-to-let property also need to consider the extra cost of Stamp Duty Land Tax (SDLT), with the “additional dwellings” surcharge rising from 3% to 5% at the end of October 2024.

This means if a landlord bought a property worth £300,000, they would need to pay around £20,000 in stamp duty compared to £14,000 under the previous rates, in addition to the other costs involved in buying a home.

Additionally, landlords should factor in the tax they need to pay on their rental income, as well as the cost of insuring their rental property.

“An investment in property is more than aiming for a monthly profit, it’s important to understand the longer-term returns of selling the asset, and the tax implications of selling up,” Springall concluded.

If you’re considering applying for a buy-to-let mortgage, whether you’re about to buy your first property or you’re an existing landlord, it’s worth talking to a broker to discuss your options.

Get friendly, expert advice free of charge as a visitor of MoneyfactsCompare

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.