There are also fewer deals to choose from compared to last month.

The recent, steady decline in fixed mortgage rates came to an abrupt end at the start of October, according to the latest Moneyfacts UK Mortgage Trends Treasury Report - much to the dismay of borrowers.

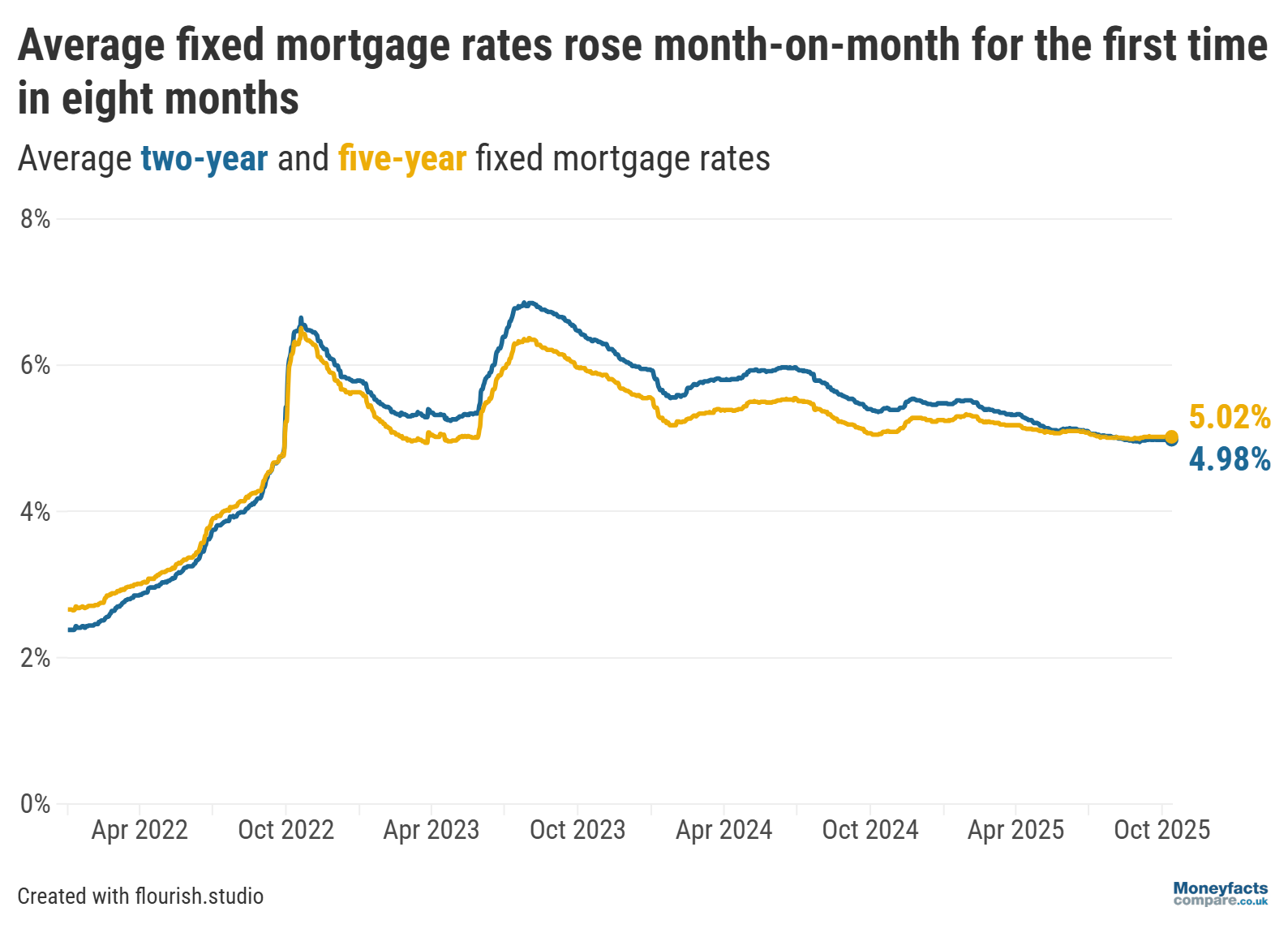

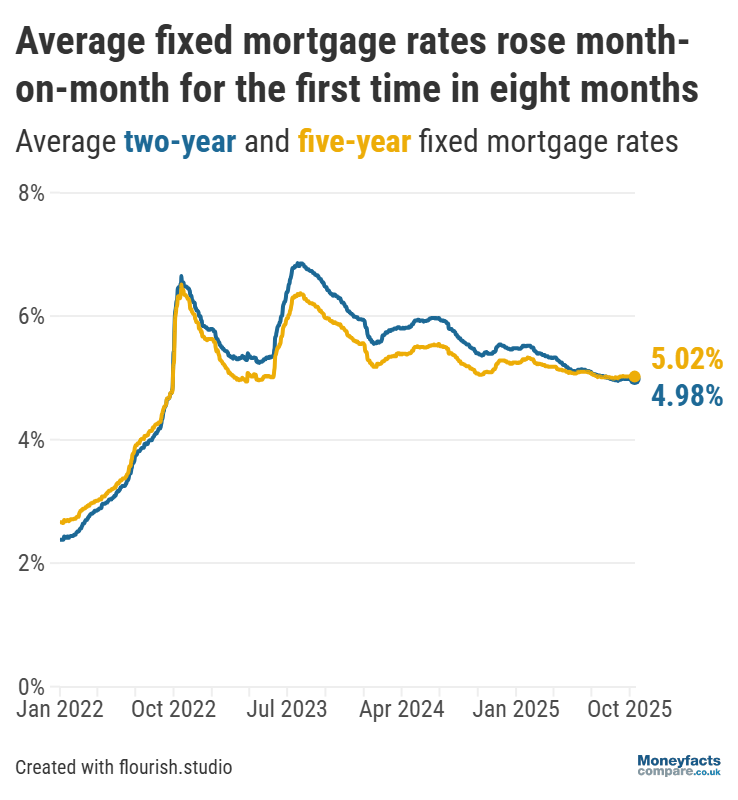

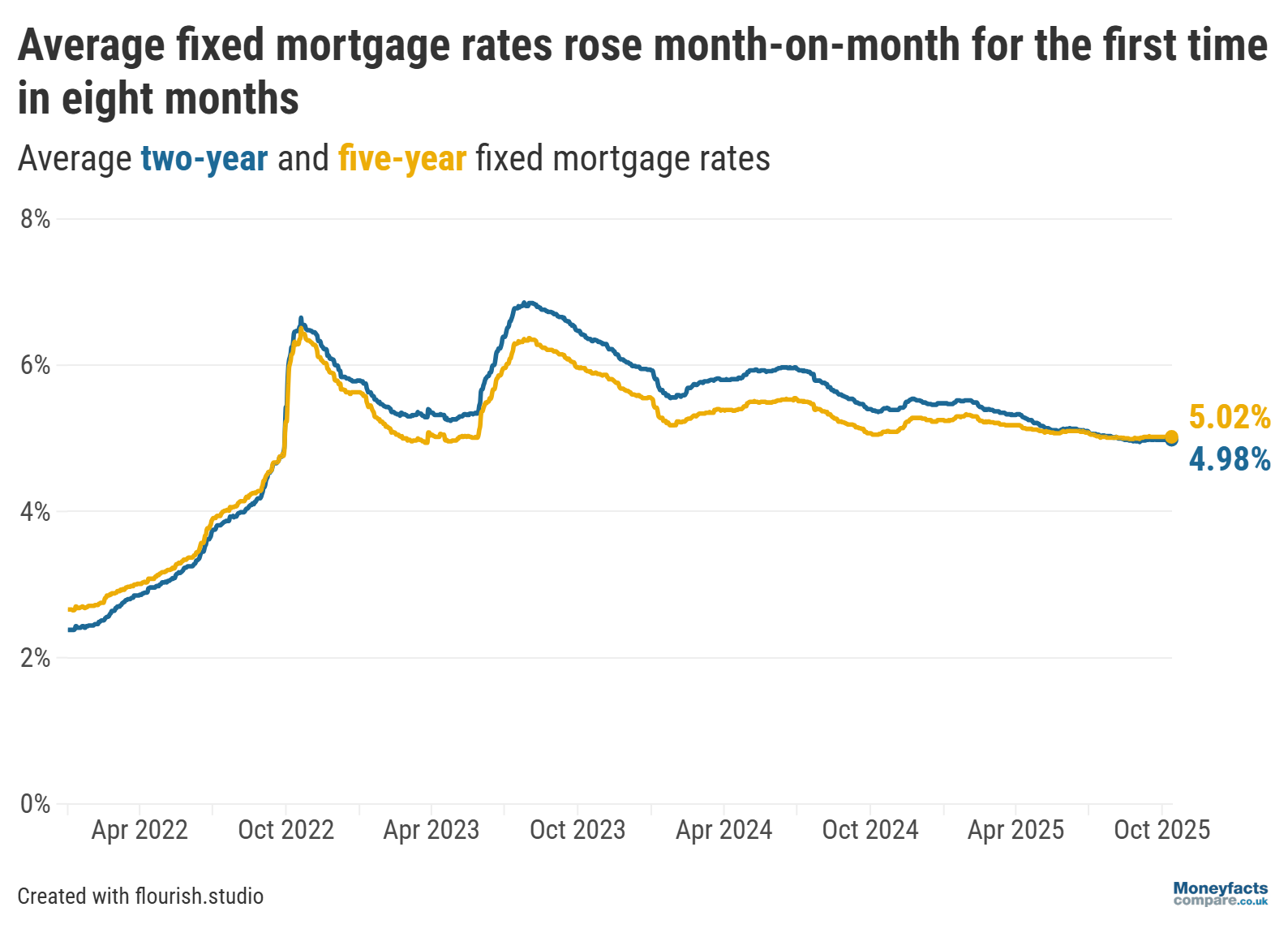

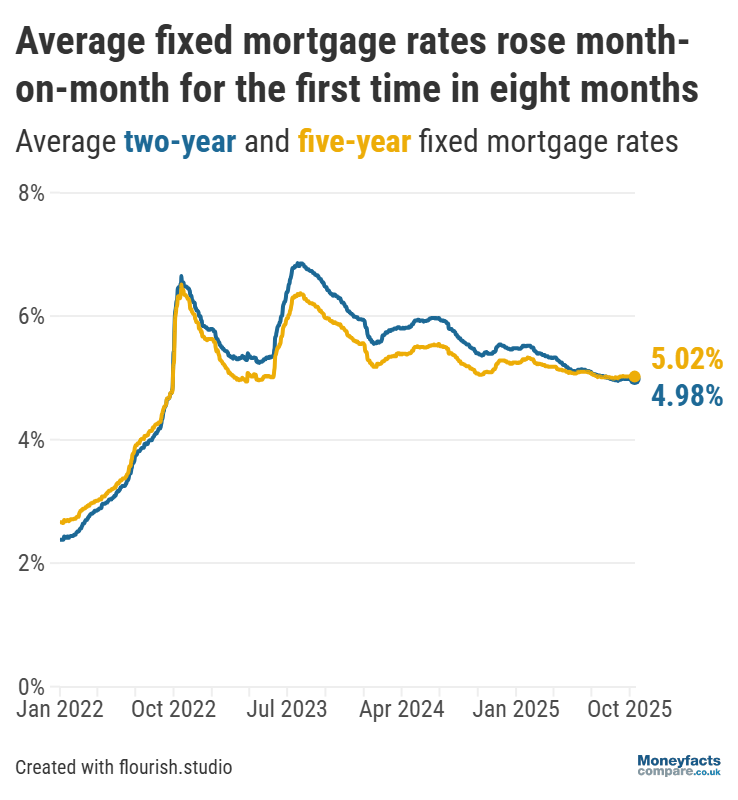

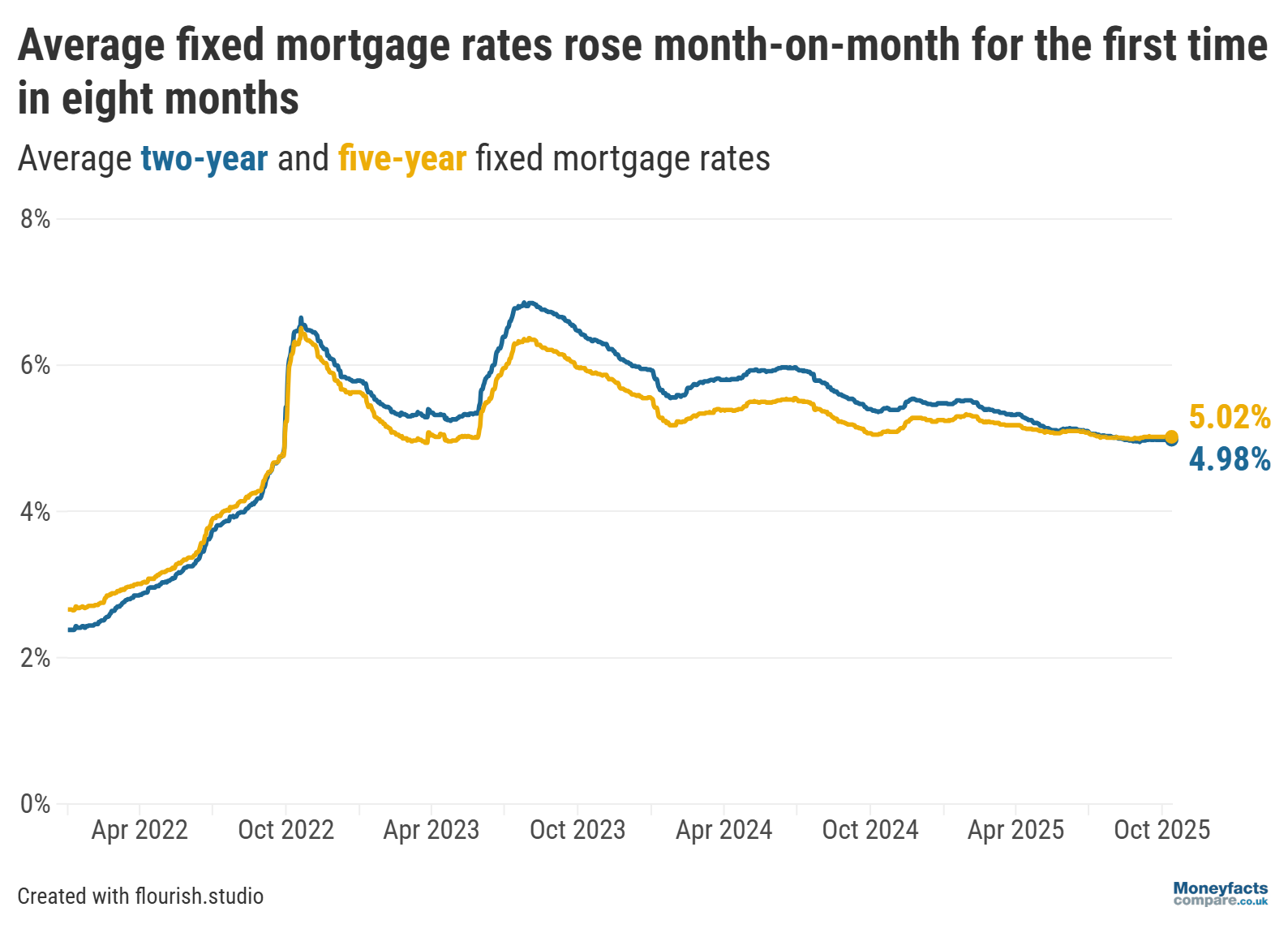

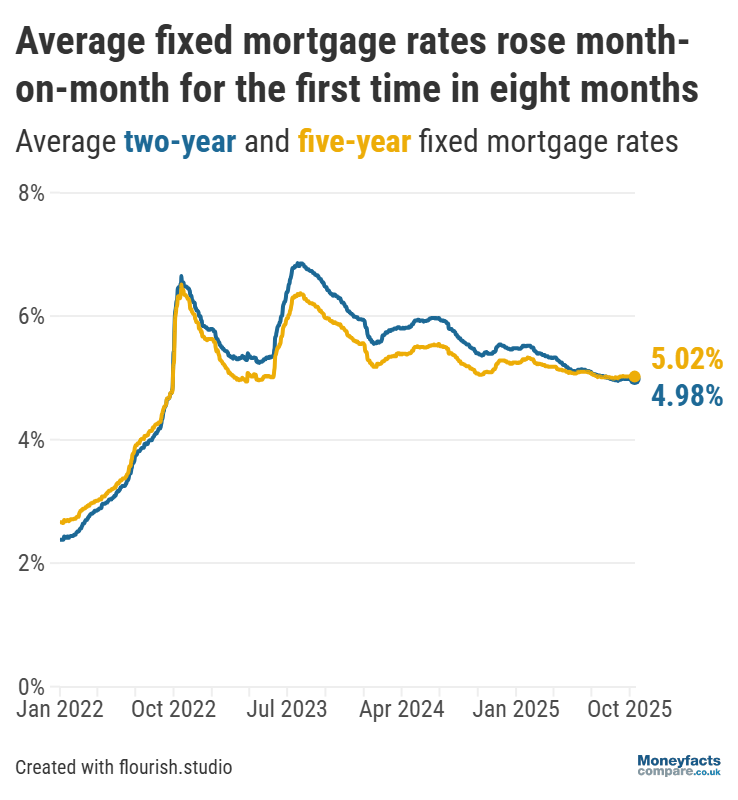

The average rate charged by a two-year fixed deal rose month-on-month for the first time since February 2025 from 4.96% to 4.98%, while the average five-year fixed mortgage rate similarly increased for the first time in eight months from 5.00% to 5.02%, the report revealed.

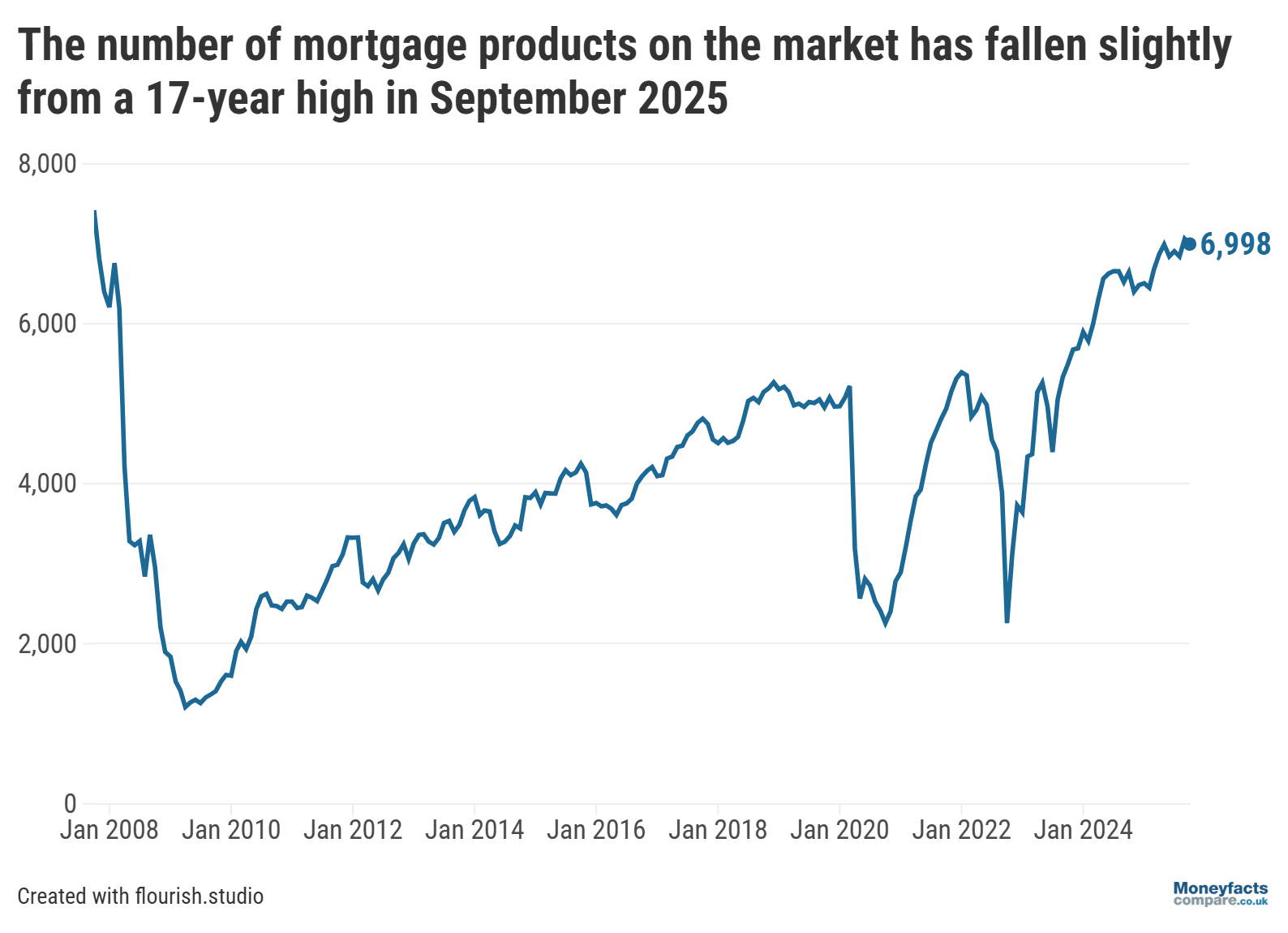

Graph: Average two- and five-year fixed mortgage rates between 2022 and October 2025.

Although average fixed mortgage rates rose month-on-month, there are still plenty of deals priced below these thresholds. Our mortgage charts are regularly updated throughout the day so you can easily find and compare the lowest mortgage rates.

But, bear in mind the deal with the lowest rate may not be the most cost-effective depending on your circumstances. That’s why our weekly mortgage roundup features some Moneyfacts Best Buy alternatives based on their overall true cost.

Swap market volatility and ongoing economic uncertainty likely underpinned the change in direction by causing lenders to adopt a more cautious approach to their pricing.

“There may be little margin of rate movement from lenders in the coming weeks, prolonging the subdued sentiment,” Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, further warned.

With inflation expected to reach 4% before the year’s end (double the Bank of England’s 2% target), she explained that the UK’s central bank is unlikely to make any imminent cuts to the base rate that could help drive mortgage rates down. Even then, she added that the market might not respond to such a change if other factors remain at play.

Nevertheless, Springall reassured borrowers that “it is not all doom and gloom”, as the mortgage market has come a long way in recent years.

For instance, those who locked into a typical two-year fixed deal in October 2023 (at 6.47%) could save £225 per month if they refinanced with a similar mortgage today*.

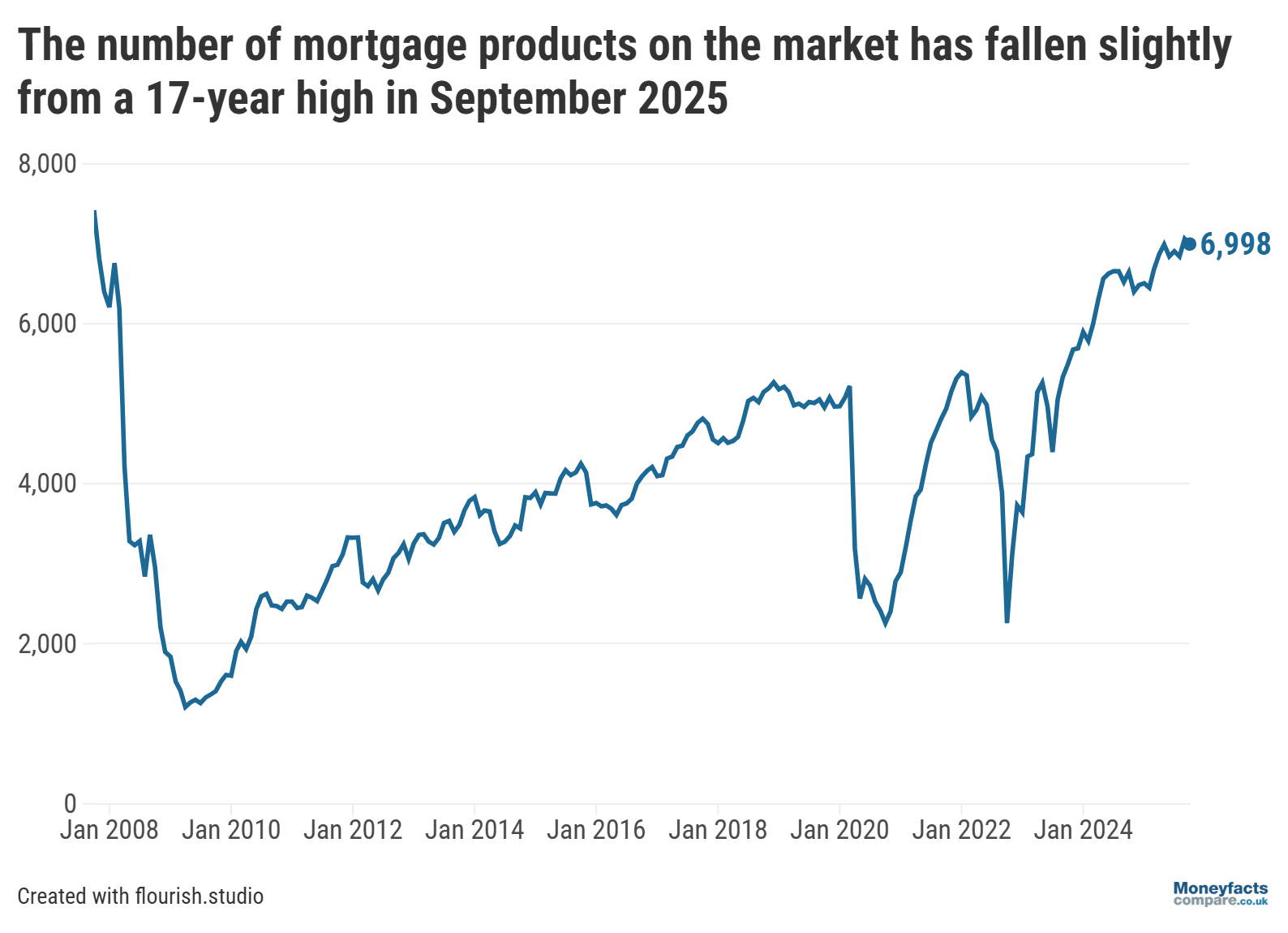

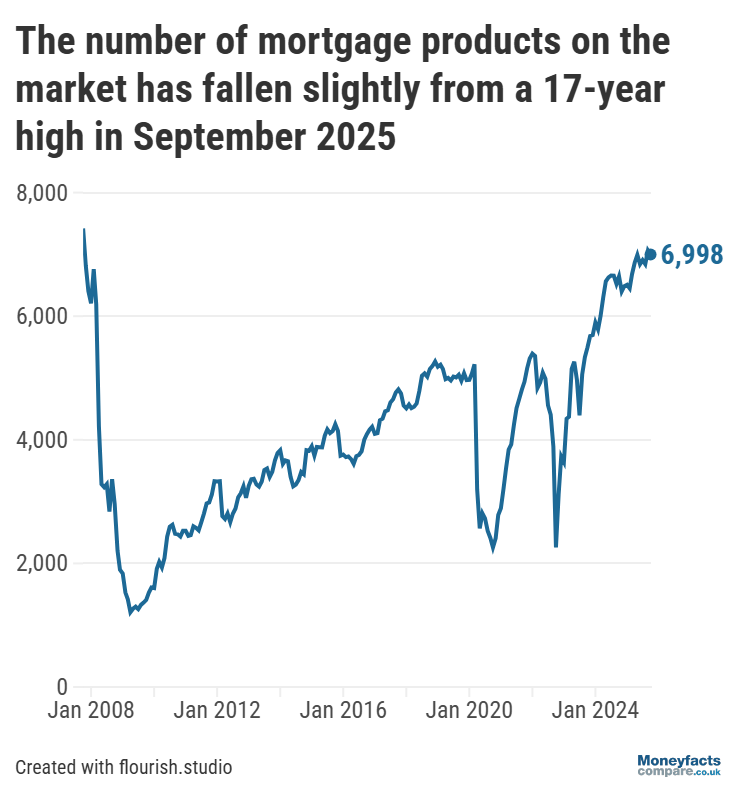

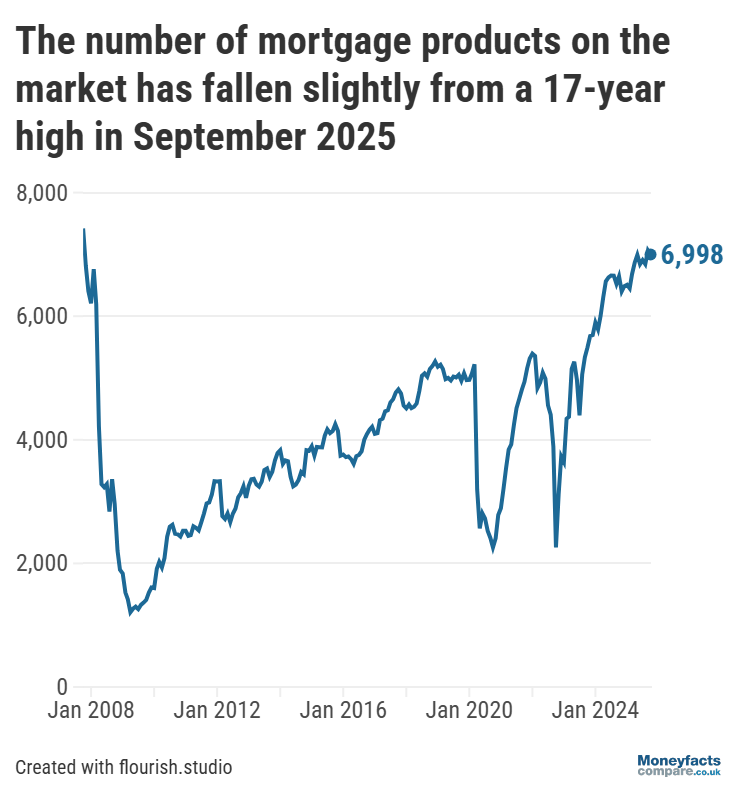

They also have a larger number of products to choose from; although the amount of mortgage deals on the market dipped below 7,000 (to 6,998) between September and October, this far outweighs the 5,495 available two years ago.

Graph: Mortgage product count between 2008 and October 2025.

What’s more, the average shelf-life of a mortgage deal rose above 20 days (to 22 days) for the first time in six months between September and October - a further sign of stability.

However, that’s not to say borrowers aren’t still facing obstacles.

“The repercussions of rising fixed rates and subdued sentiment stifle the Government’s push for lenders to do more to boost UK growth,” said Springall. While positive strides were made in introducing a permanent Mortgage Guarantee Scheme and relaxing loan-to-income (LTI) rules earlier this year, the combination of higher interest rates and lack of affordable housing may prove a challenge.

Borrowers struggling to meet their mortgage repayments would be wise to speak to their lender. Alternatively, those looking for a new deal could seek bespoke advice from a mortgage broker.

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that aren’t available to the public. Mortgage brokers are regulated by the Financial Conduct Authority (FCA) and are required to pass specific qualifications before they can give you advice.

Get friendly, expert advice free of charge as a visitor of Moneyfactscompare.co.uk

Mortgage Advice Bureau have 1,600 UK advisers with 200 awards between them.

Speak to an award-winning mortgage broker today.

Call 0808 149 9177 or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for MoneyfactsCompare visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

*Based on £250,000 repayment mortgage repaid over 25 years.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.