Our mission to make independent and impartial financial information available to all sectors of the population is arguably now more important than ever before.

Moneyfactscompare.co.uk (formerly Moneyfacts.co.uk), one of the UK’s original price comparison websites, is celebrating a quarter of a century of helping consumers make informed financial decisions.

Since its launch in September 2000, millions of people have used our website and its comprehensive charts to discover the best savings and mortgage rates, as well as to compare other types of financial products, including insurance policies, current accounts and credit cards.

“I am enormously proud of the success Moneyfactscompare.co.uk has achieved since the turn of the millennium,” said John Woods, the website’s founder.

A lot has changed over the past 25 years; consumers and their money have endured the highs and lows of a global financial crisis, the COVID-19 pandemic and eight UK Prime Ministers.

However, Woods reaffirmed that the principles of Moneyfactscompare.co.uk remain robust:

“The continuing mission is as strong today as it was at the very beginning with the desire to make independent and impartial financial information accessible to all sectors of the population – arguably that is more important now than it has ever been.”

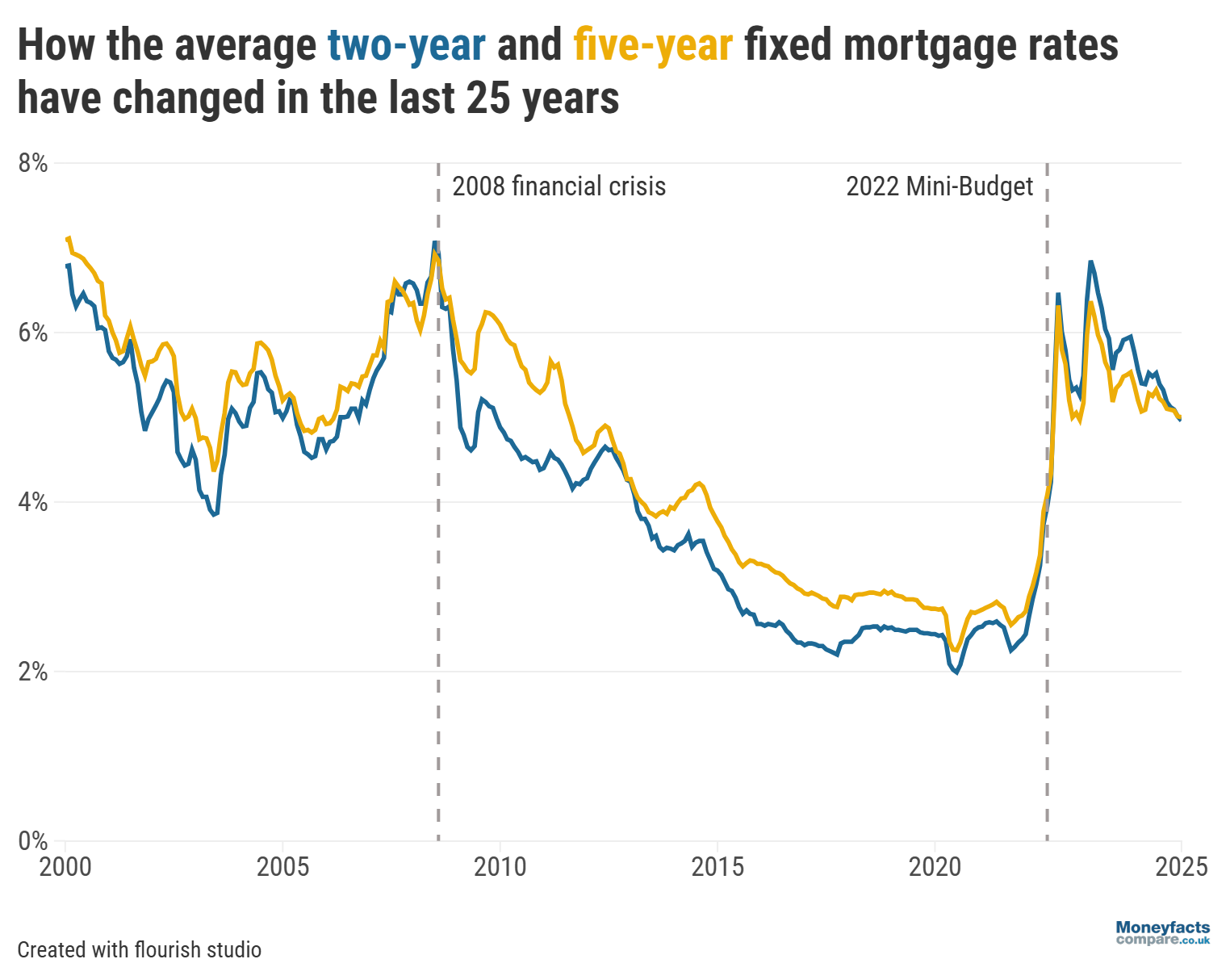

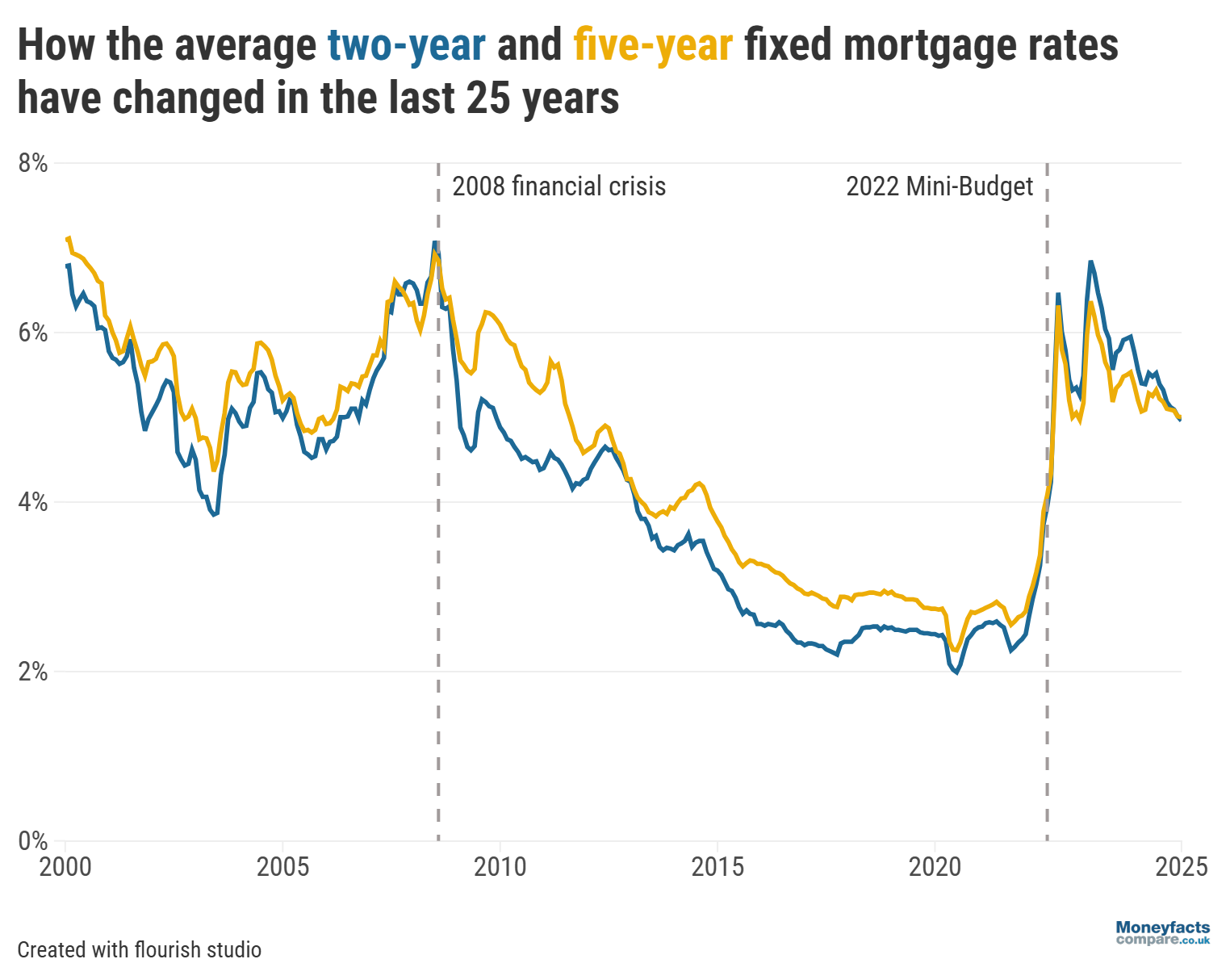

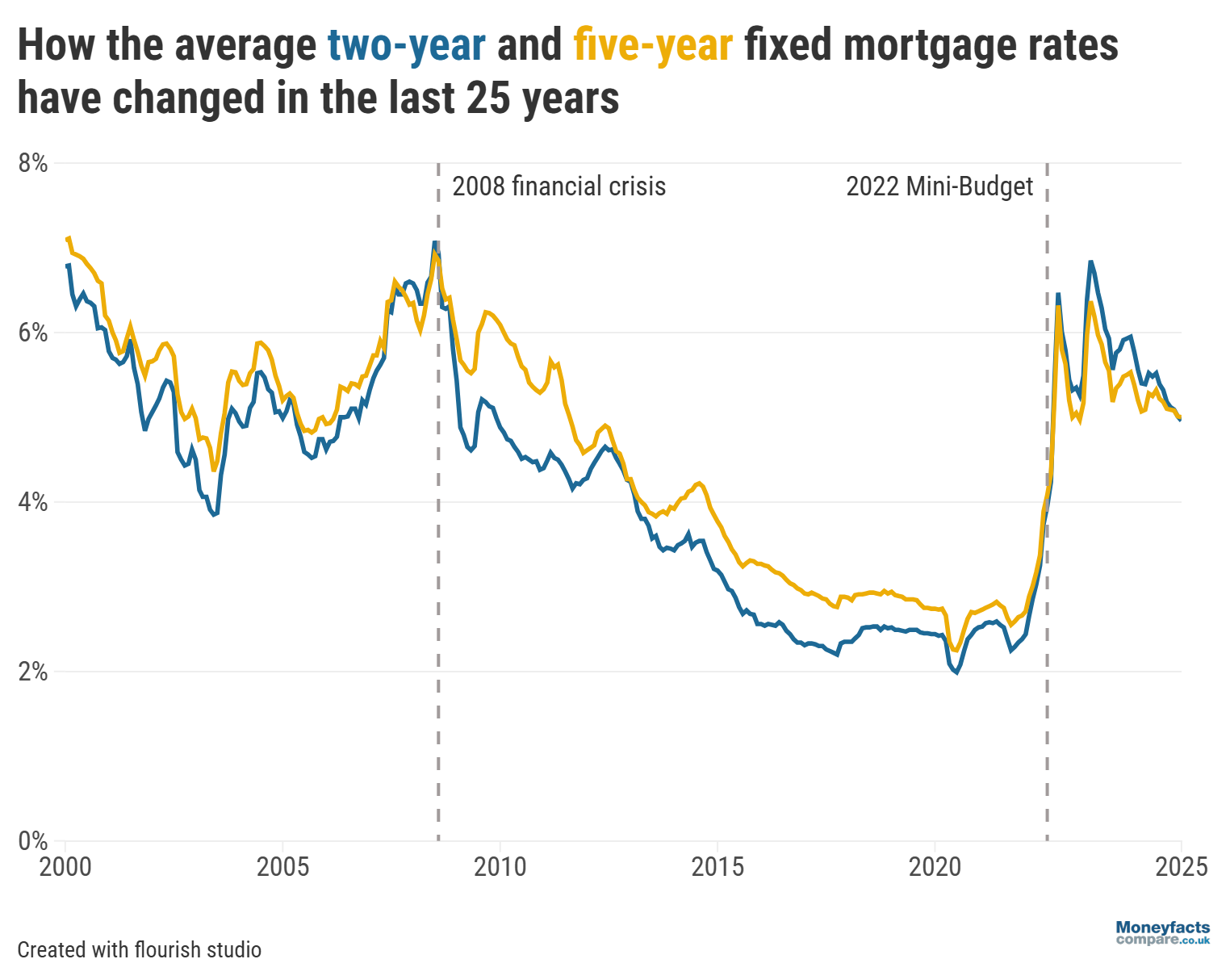

While average mortgage rates loitered around 6.00% at the start of the millennium, borrowers would have been pleased to see pricing ease over the following decades. Despite spiking above the 6.00% threshold again during the 2008 financial crisis, the typical rate charged by a mortgage dropped to around 2.00% by 2020.

However, mortgage rates didn’t remain at this level for very long. Many lenders adjusted their pricing as the Bank of England raised the base rate 14 consecutive times between December 2021 and August 2023 in an attempt to control rampant inflation brought about by the COVID-19 pandemic and Russia’s invasion of Ukraine placing strain upon global supply chains.

This was further compounded by Liz Truss and Kwasi Kwarteng announcing a series of unfunded tax cuts in their September 2022 mini-Budget which spooked the markets and caused many lenders to withdraw deals. As a result, the Moneyfacts Average Mortgage Rate reached 5.76% by June 2024 which saw typical monthly repayments increase by almost £500*.

Graph: Average mortgage rates between 2000 and 2025.

“Affordability may have eased a touch over the past 12 months, but buying a home in 2025 is still too much of a financial stretch for many,” Adam French, Head of News at Moneyfacts, said earlier this month.

“There remains an acute risk that the market could overcorrect or overheat depending on the future path of interest rates, inflation and wage growth despite a recent softening of house price growth.

“We now need a period of stability where modest house price growth allows incomes to catch up so the market can return to more sustainable levels that benefit homeowners, homebuyers and the wider economy,” he added.

Our mortgage charts are regularly updated throughout the day so homemovers, remortgage borrowers and first-time buyers alike can compare the best deals.

However, bear in mind the lowest-priced mortgage may not be the most cost-effective depending on your needs and circumstances. That’s why our weekly mortgage roundup offers some alternative deals that feature on our Moneyfacts Best Buy chart based on their overall true cost.

Alternatively, speak to a mortgage broker for bespoke advice.

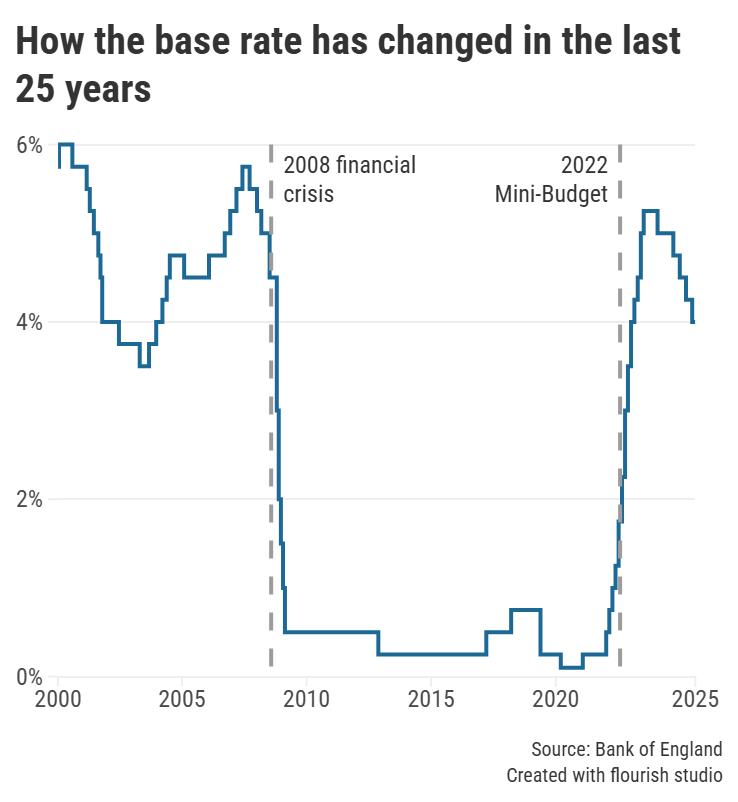

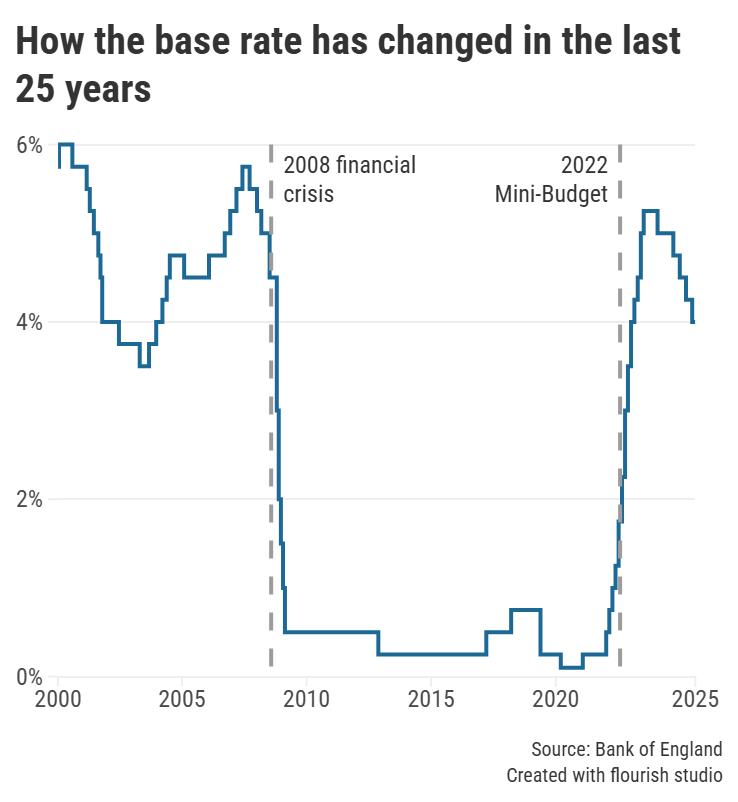

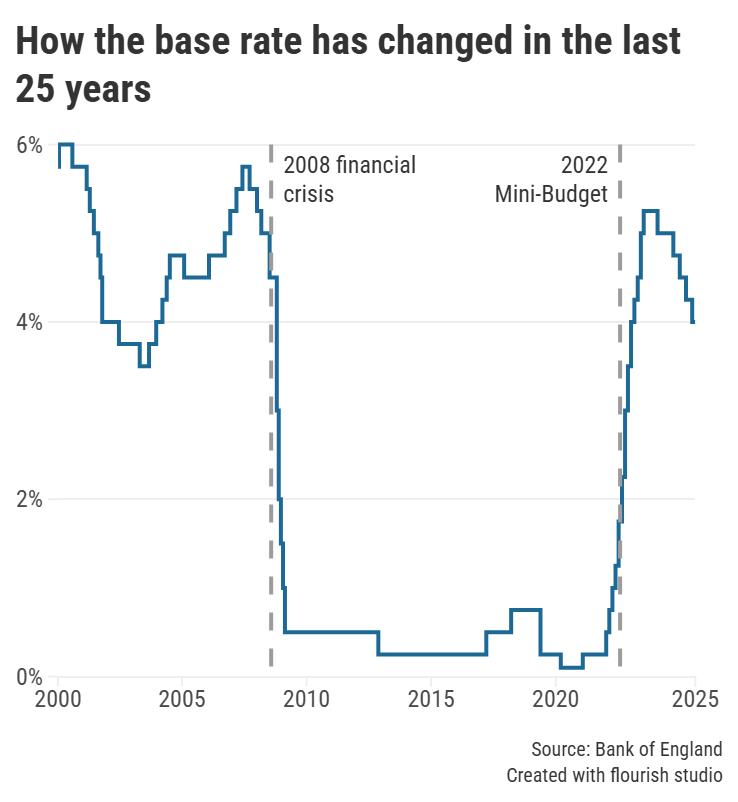

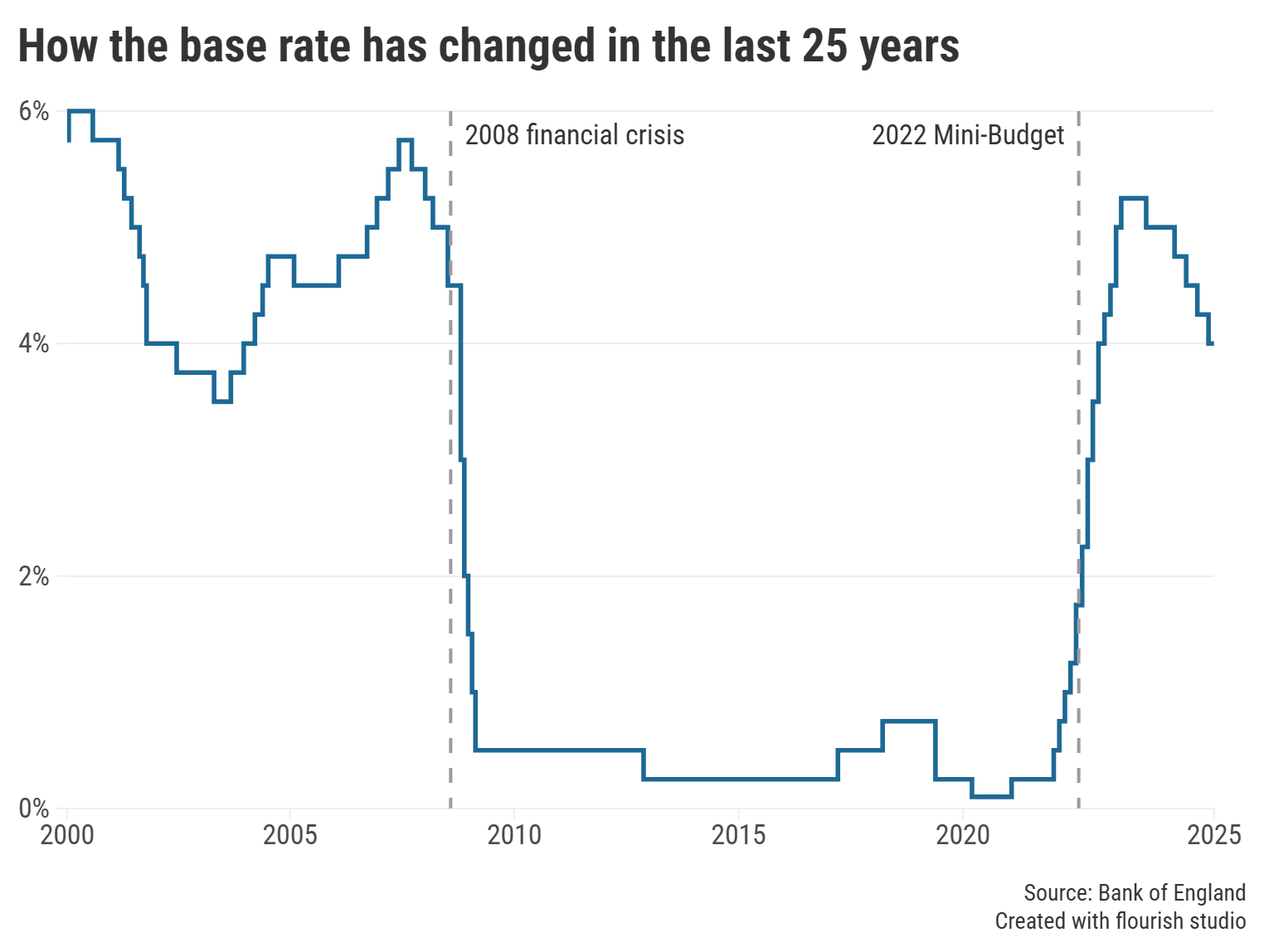

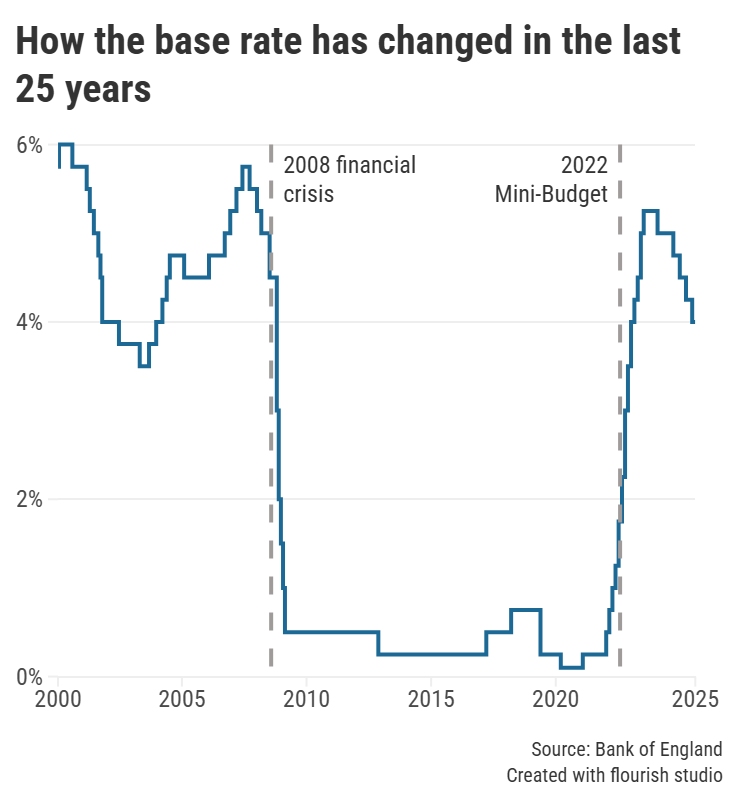

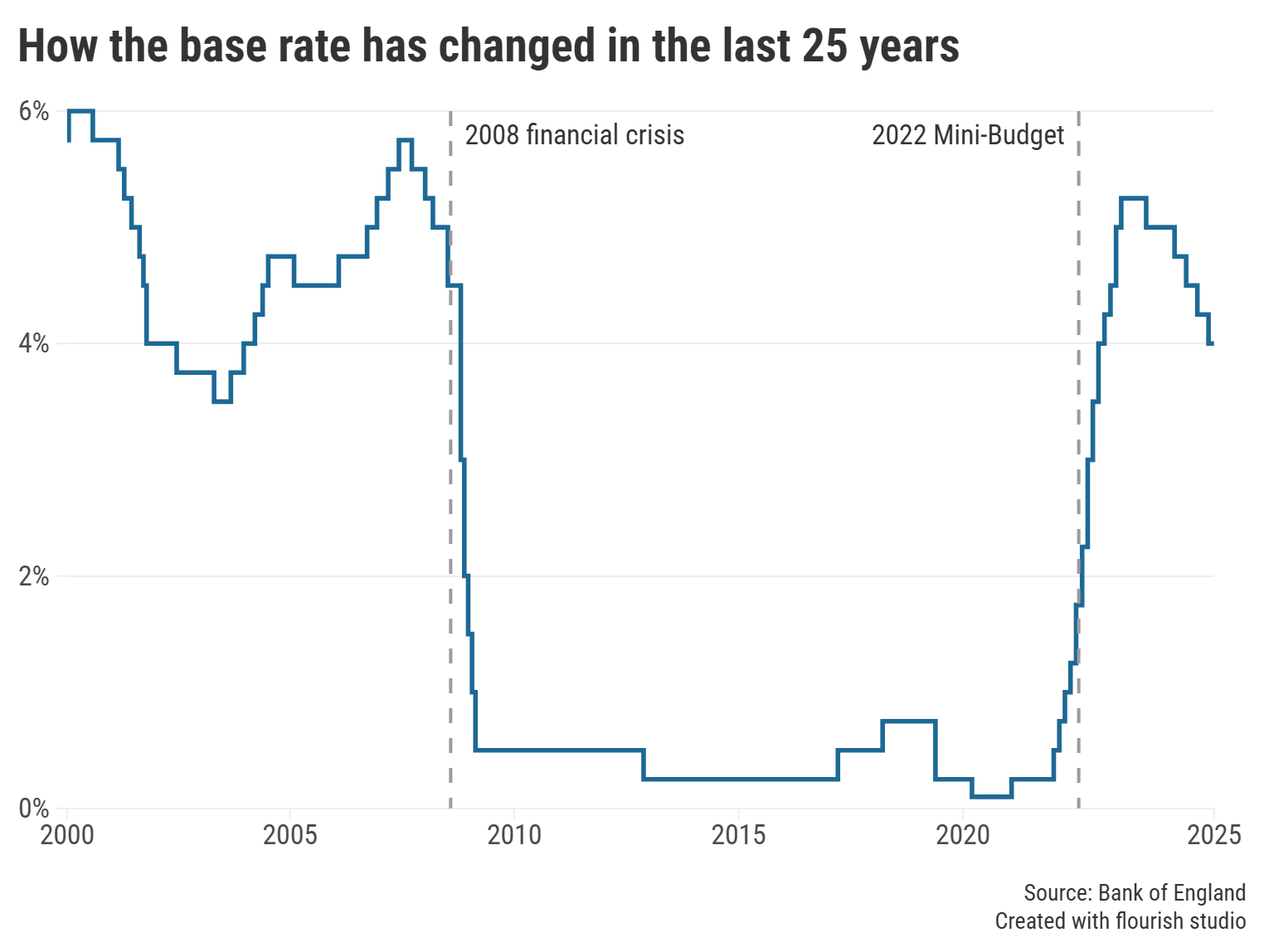

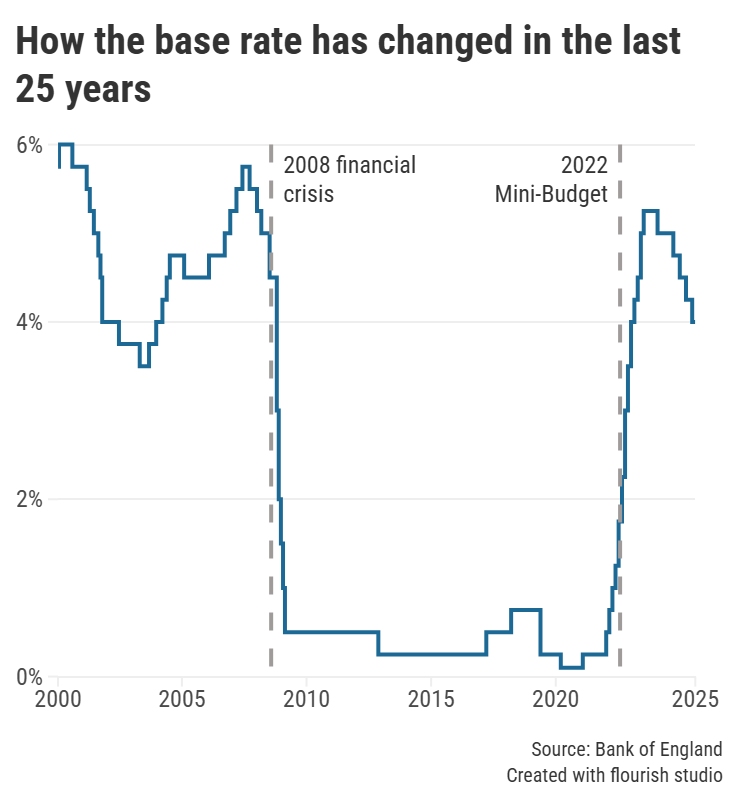

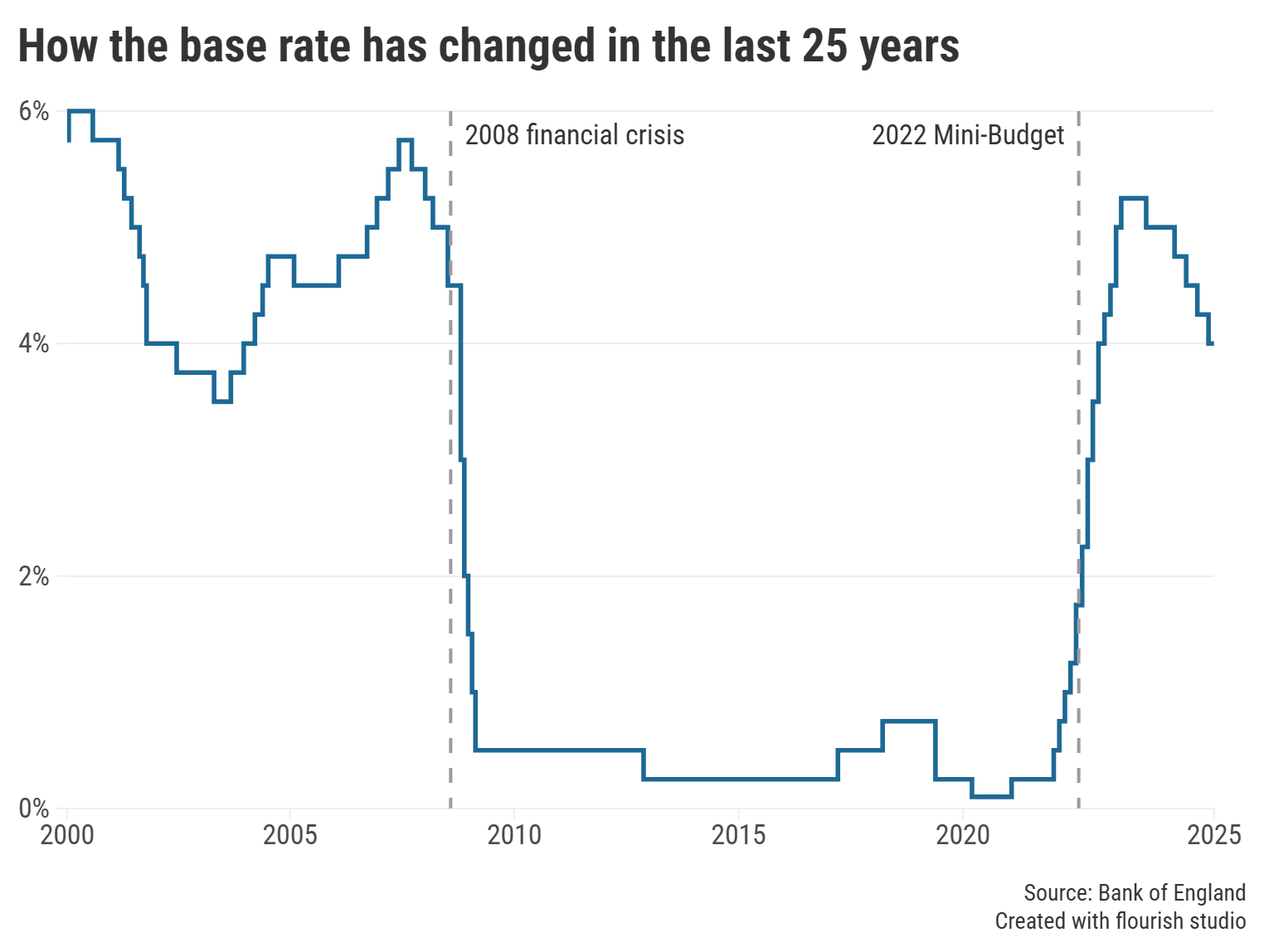

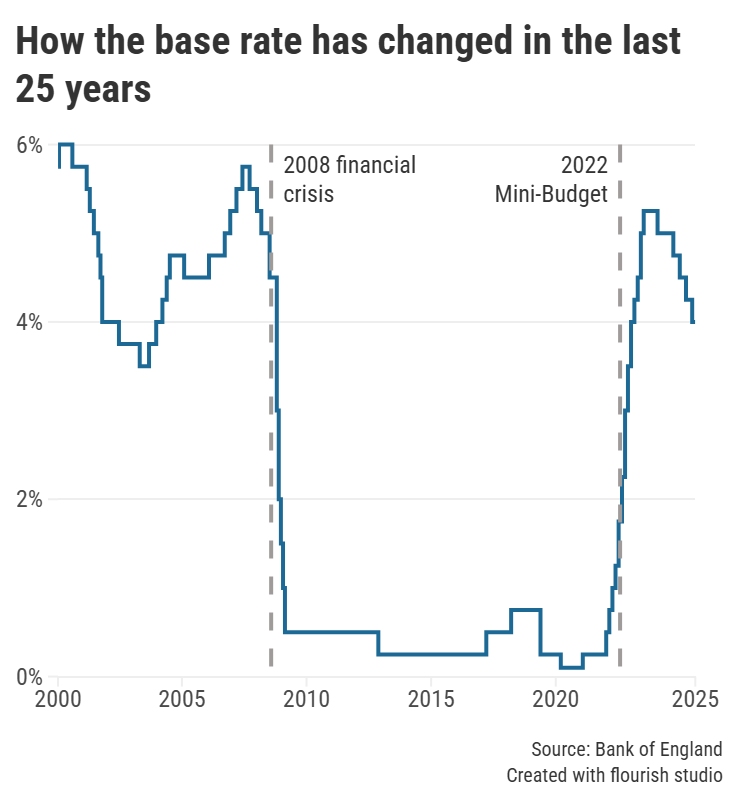

In contrast, savers are more likely to have benefited from periods of high interest rates. While an average savings account paid less than 1.00% in 2020 (when the UK’s central interest rate sat at just 0.10%), returns rose above 4.00% in 2023 as the base rate climbed rapidly.

Graph: Bank of England base rate between 2000 and 2025.

That being said, many would have seen their hard-earned cash eroded by chronically high inflation which reached a 41-year high of 11.1% in October 2022. In fact, Moneyfacts analysis revealed that £1 saved in 2020 is now worth just £0.89 in real terms.

With the base rate having been reduced five times since August last year, savers must be vigilant of banks and building societies passing cuts onto their savings accounts – especially given that inflation has reaccelerated over recent months. When latest figures revealed last week that UK inflation continued to rise at 3.8% in the year to August, fewer than 1,000 savings accounts could outpace the rate at which costs of goods and services are rising and see a real return on savers’ money.

It’s crucial savers review their accounts regularly and consider switching if they’re not receiving a competitive return, as this is key to combating the rising cost of living.

Our savings charts are regularly updated throughout the day so you can find and compare the best rates currently available. Alternatively, read our weekly savings and ISA roundups for more information on accounts offering the most competitive rates, or subscribe for free to our weekly savings newsletter.

*Compared with 2.17%, the Moneyfacts Average Mortgage Rate recorded in June 2020. Based on a £250,000 mortgage repaid over 25 years.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.