Is it time you locked away your cash for longer?

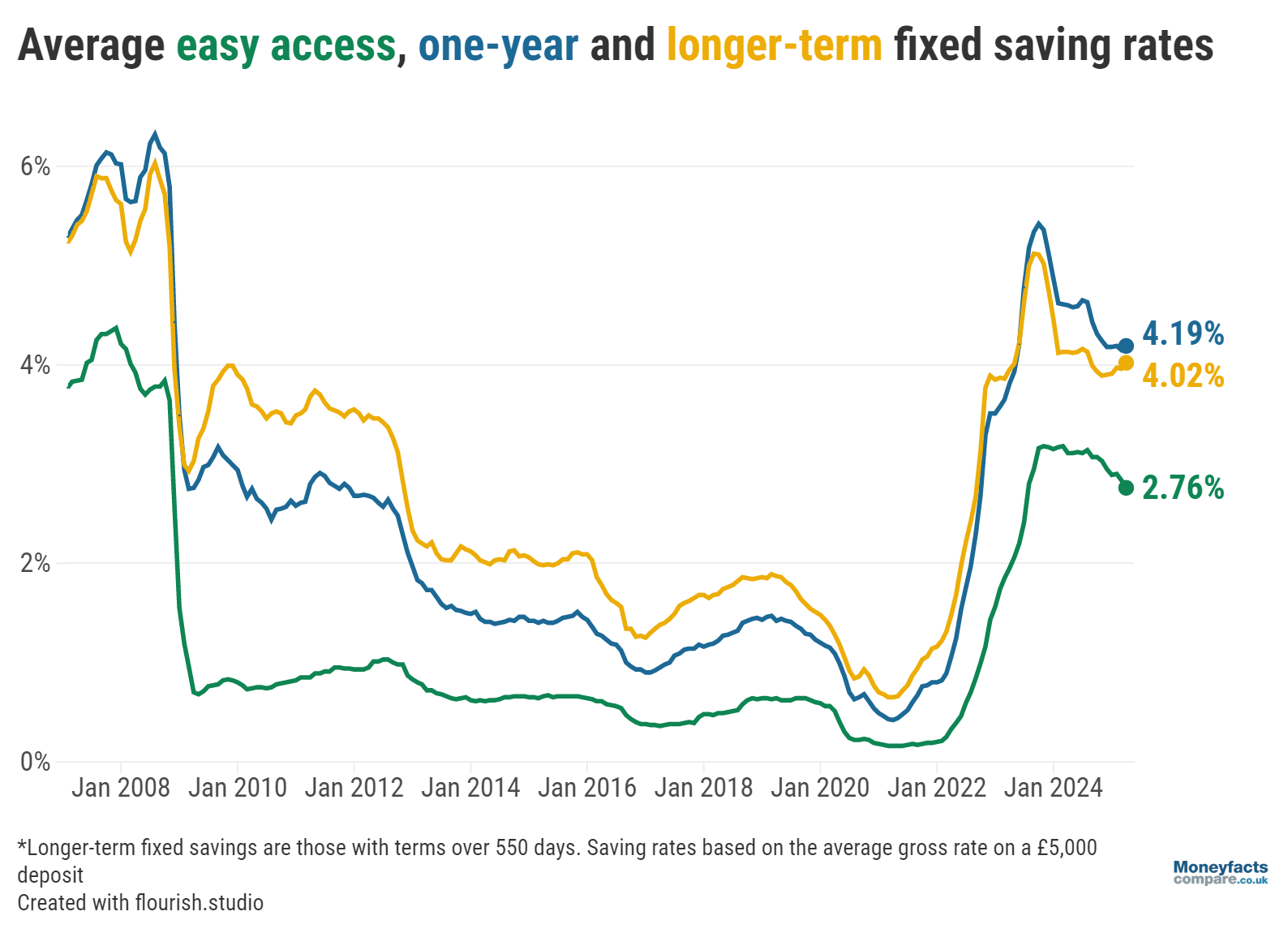

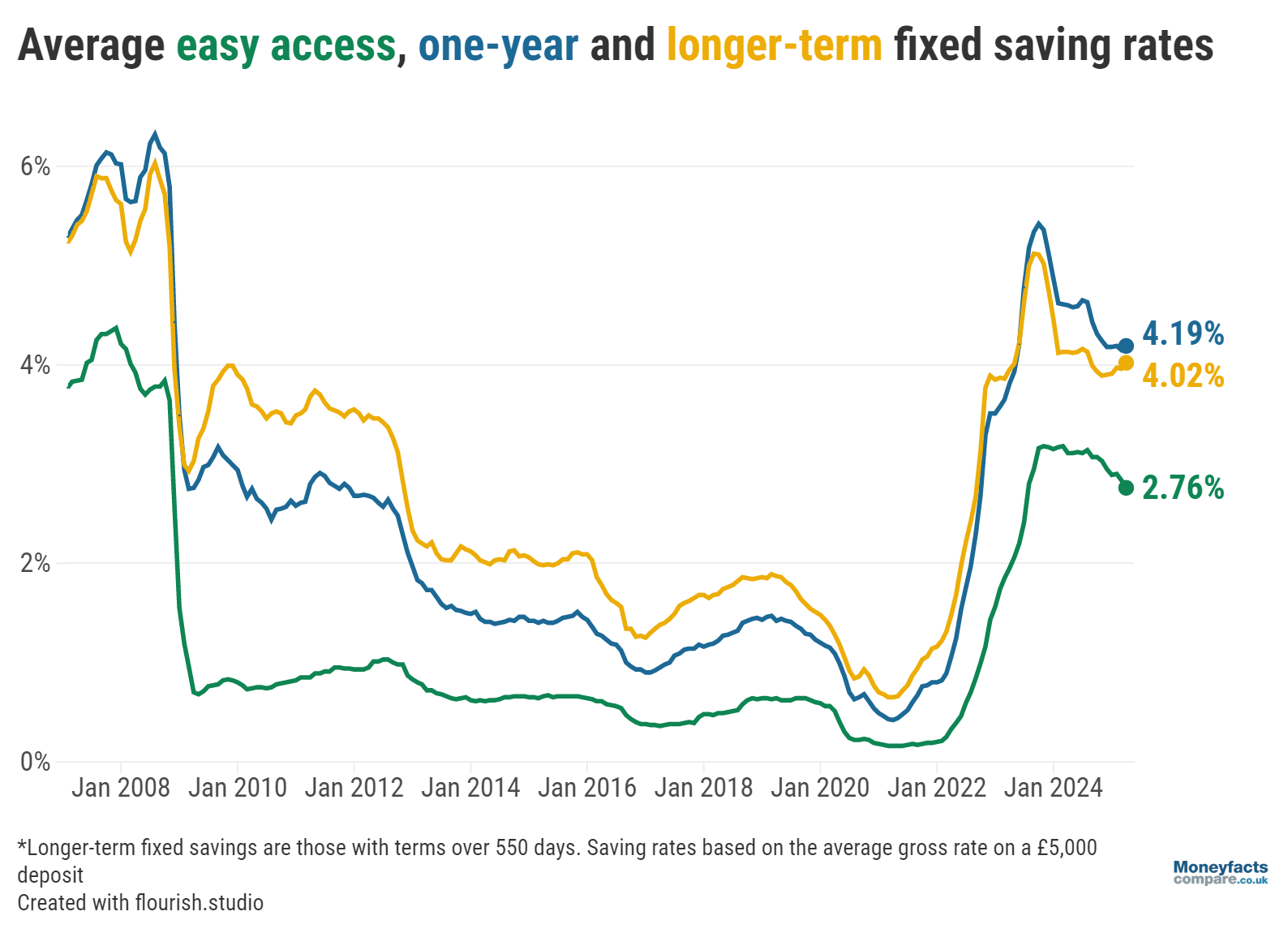

Savers who don’t need immediate access to their cash may want to consider a longer-term fixed account after latest data from the Moneyfacts UK Savings Trends Treasury Report revealed typical returns in the sector breached 4% at the start this month for the first time since August 2024.

It comes as providers rushed to reprice their products throughout March, leading the average rate paid by a longer-term bond (with terms over 550 days) to increase from 3.96% to 4.02% month-on-month. Similarly, with ISA season in full swing, average returns on a longer-term fixed ISA rose from 3.95% to 4.01% over the same timeframe.

Their shorter-term counterparts also saw notable improvements, with the average one-year fixed bond and ISA increasing to pay 4.19% and 4.12%, respectively, on a first-of-month basis. While still more competitive, this left the gap between returns on an average one-year and longer-term bond at its narrowest since July 2023.

Graph: Average easy access, one-year and longer-term fixed savings rates between 2008 and April 2025.

Although average fixed rates have since cooled somewhat, savers can continue to secure well in excess of 4% with the very best two-, three-, four- and five-year bonds. Those with a substantial deposit of at least £10,000 can apply for Close Brothers Savings’ market-leading 2 and 3 Year Fixed Rate Bonds which pay 4.58% gross/AER and 4.55% gross/AER, respectively. Alternatively, Cynergy Bank pays the same three-year fixed rate on a smaller, £1,000 minimum deposit with its Fixed Rate Bond.

As for those wanting to lock in a fixed rate for longer, JN Bank currently tops our four-year chart with its Fixed Term Savings Account paying 4.51% gross/AER on a £100 minimum investment. Meanwhile, Secure Trust Bank’s 5 Year Fixed Rate Bond (28.May.30) leads our five-year chart and pays 4.56% gross/AER on a minimum deposit of £1,000.

Last updated: 19/05/2025

Account: 2 Year Fixed Rate Bond

Term: 2 Year Bond

Rate: 4.58% AER

Account: 3 Year Fixed Rate Bond

Term: 3 Year Bond

Rate: 4.55% AER

Account: Fixed Rate Bond

Term: 3 Year Bond

Rate: 4.55% AER

Account: Fixed Term Savings Account

Term: 4 Year Bond

Rate: 4.51% AER

Account: 5 Year Fixed Rate Bond (28.May.30)

Term: 28 May 2030

Rate: 4.56% AER

Our savings charts are regularly updated throughout the day to show the best notice, easy access and fixed rates currently available.

You can also find out more information about accounts offering some of the most competitive rates with our weekly savings roundup.

That being said, savers should be mindful they don’t exceed their Personal Savings Allowance (PSA), or they risk being taxed on the interest earned from their savings. Tax liability can sometimes increase in the year in which a fixed bond matures (where interest is made available at the end of the term).

For instance, a basic-rate taxpayer could breach their £1,000 tax-free savings allowance if they were to deposit £5,000 in a five-year bond which paid 4.00% AER on maturity. As for higher-rate taxpayers (who can receive up to £500 in tax-free interest), it might take a smaller deposit of £2,500 under the same conditions to exceed their allowance.

Those concerned about breaching their PSA could opt for a fixed rate cash ISA instead.

Related guide: How are my savings taxed? A guide to the Personal Savings Allowance and HMRC

Average rates paid by cash ISAs have also declined as we move further away from the close competition observed towards the end of 2024/25 tax-year. However, these accounts have consistently proven popular among savers, with the Bank of England reporting £3.5 billion was deposited in cash ISAs in February alone.

“There will be many consumers expected to pay higher-rate tax at 40% this tax-year, around 2.5 million in fact, according to the Office for Budget Responsibility (OBR), so it’s not too surprising to see such healthy deposits made into cash ISAs,” explained Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

Those interested in locking a longer-term fixed rate in with an ISA will find Progressive BS and Chetwood Bank lead our two and three-year charts, respectively, with accounts offering 4.30% gross/AER. The former’s 2 Year Fixed Rate ISA Bond (Issue 20) is only available in branch or by post, while the latter’s HL Active Savings – 3 Year Fixed Rate Cash ISA can be accessed online via the third-party savings platform, Hargreaves Lansdown Active Savings.

Elsewhere, Zopa tops our four-year chart with its Smart ISA – 4 Year Fixed Term ISA pot paying 4.01% AER, while the 5 Year Fixed Rate Cash ISA from Close Brothers Savings offers the best five-year fixed rate.

Last updated: 19/05/2025

Account: 2 Year Fixed Rate ISA Bond (Issue 20)

Notice/Term: 2 Year Bond

Rate: 4.30% AER

Transfers In: Cash ISA

Account: HL Active Savings - 3 Year Fixed Rate Cash ISA

Notice/Term: 24 April 2028

Rate: 4.30% AER

Transfers In: N/A

Account: Smart ISA - 4 Year Fixed Term ISA pot

Notice/Term: 4 Year Bond

Rate: 4.01% AER

Transfers In: Cash ISA

Account: 5 Year Fixed Rate Cash ISA

Notice/Term: 5 Year Bond

Rate: 4.30% AER

Transfers In: Cash ISA, Stocks and Shares ISA

Individual Savings Accounts (more commonly known as ISAs) are a tax-free alternative to traditional savings accounts. Each tax-year, savers can deposit up to £20,000 across ISAs (as per the annual ISA allowance) and won’t be liable for tax on any returns.

Our ISA charts are regularly updated to display the best rates in the sector; alternatively, view our weekly ISA roundup for more information on the most competitive accounts or read our ISA guides to learn more about these tax-free savings accounts.

While easy access accounts also remain a “firm favourite among savers due to their flexibility”, they were “bashed and battered by rate cuts” throughout March, according to Springall.

The average easy access rate (excluding ISAs) dropped 0.08 percentage point to stand at 2.76% by the start of April - its biggest monthly decline since December 2024. This may further incentivise savers to consider a fixed account and lock-in guaranteed returns.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.