Nevertheless, those coming to the end of a competitive two-year fixed deal could lose out on almost £350 in interest when they reinvest.

Top returns on a one-year bond recovered lost ground throughout June, however, savers with a competitive fixed deal set to mature this month must brace themselves to earn less when they reinvest.

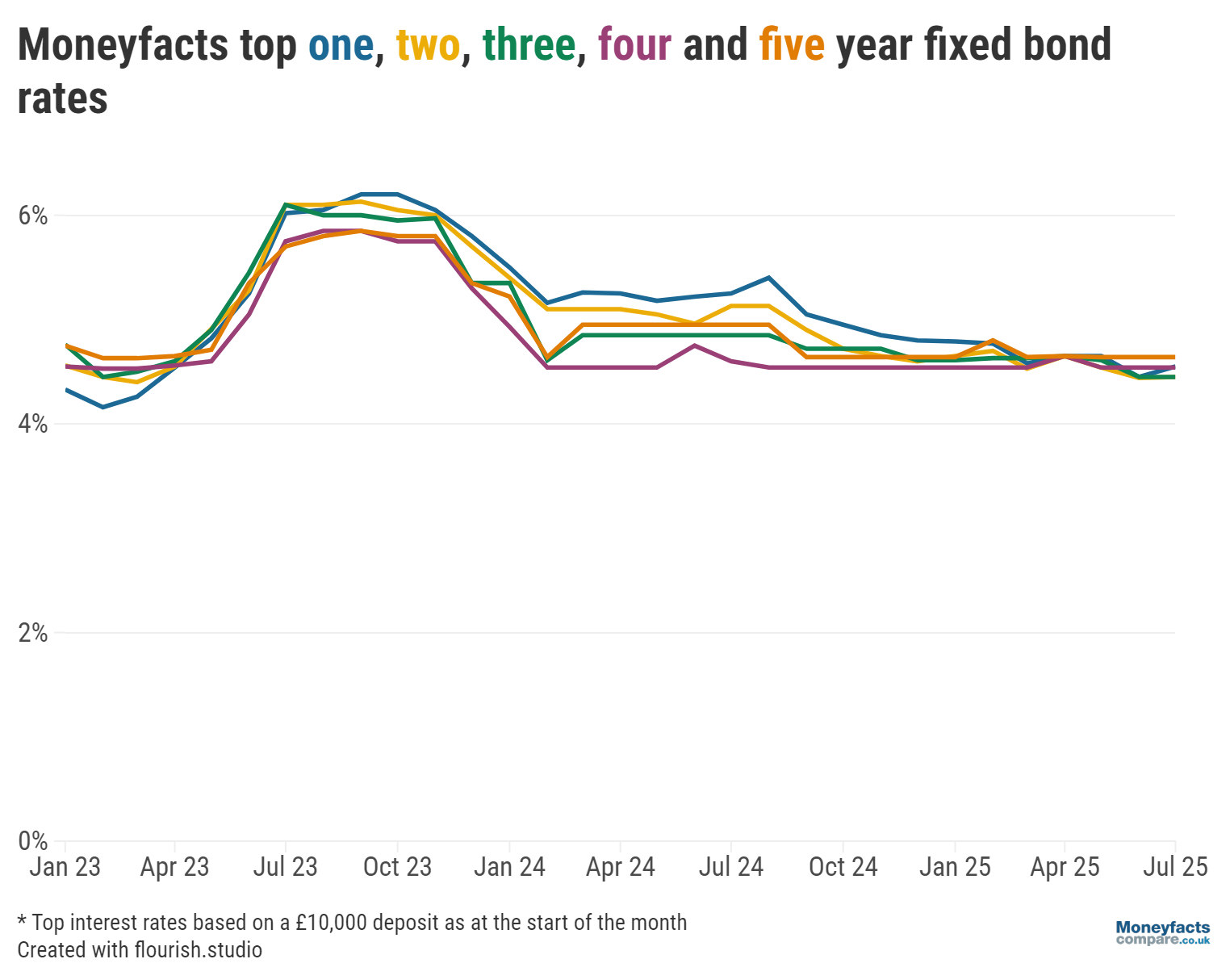

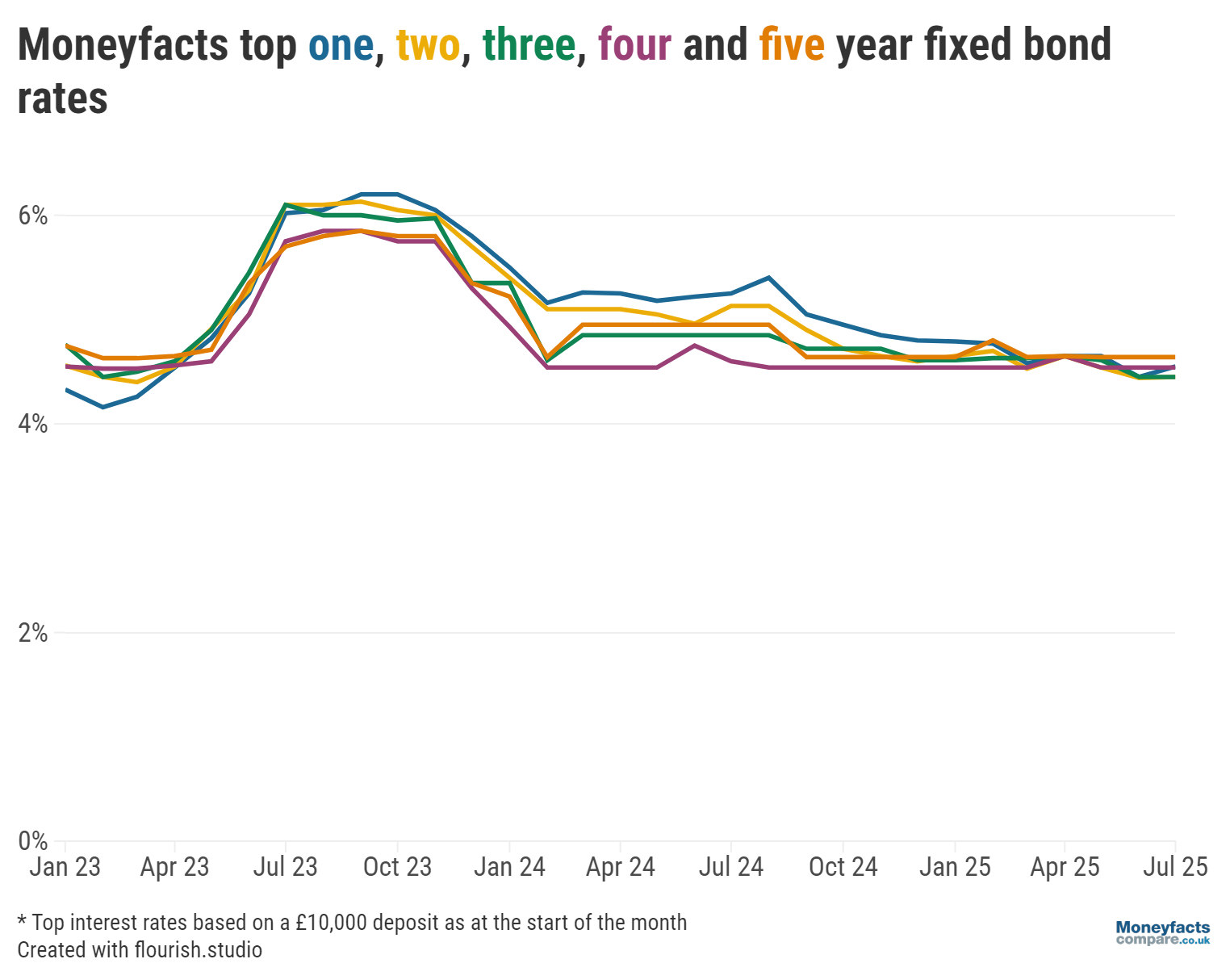

Having previously slumped to 4.45%, the best rate in the sector rose by its biggest monthly margin since to August 2024 to pay 4.55% by July, according to Moneyfacts’ data. Nevertheless, it’s a far cry from the 5.25% available a year ago; savers coming to the end of such a deal would receive £70 less interest upon reinvesting their cash in this month’s top-paying account (based on a £10,000 deposit).

Meanwhile, those who locked their money away in a two-year bond paying a market-leading 6.10% in July 2023 will need to account for a larger loss of interest. While the top two-year fixed rate improved slightly from 4.44% to 4.45% between June and July, it’ll pay almost £350 less than the sector’s best account from two years ago (also based on a £10,000 deposit).

Graph: Best fixed savings rates between January 2023 and July 2025.

Otherwise, leading longer-term fixed rates saw limited movement amid ongoing economic uncertainty and swap market volatility. The best three-year fixed savings rate remained at 4.45%, while the top four- and five-year fixed bonds paid 4.54% and 4.64%, respectively, for a third consecutive month.

Despite top fixed rates having cooled off considerably from their recent highs, there are still plenty of reasons to save.

For instance, with inflation forecast to creep higher later this year, setting money aside in a competitive account could be crucial for combatting the rising cost of living. Where a savings account offers less than the current rate of inflation, your hard-earned cash is at risk of losing purchasing power (i.e. the same amount of money buys less).

However, savers may need to act fast to take advantage of an attractive fixed deal before it disappears, as expectations for the Bank of England to reduce the UK’s central interest rate threaten to further diminish returns on savings.

Fortunately, challenger banks remain particularly active on our one- and two-year fixed bond charts. “Generally, this sector of the market is more competitive as they are a good way for challenger banks to test savers’ appetites and fund their future lending,” explained Caitlyn Eastell, Spokesperson at Moneyfactcompare.co.uk.

Our savings charts are regularly updated throughout the day so you can easily find and compare the best fixed savings rates currently available.

Alternatively, for more information on accounts offering the most competitive rates, read our weekly savings roundup.

That being said, Eastell reminded seven million higher-rate taxpayers to be mindful of their Personal Savings Allowance (PSA) – especially those with larger deposits who “could be hit with an unexpected tax bill” if they take home more than £500 yearly in interest from their savings.

ISAs remain a popular alternative for those wanting to shield their money from the taxman. While the Chancellor of the Exchequer is expected to lower the amount that can be deposited into cash ISAs each year, for the time being, savers can continue to plough their entire £20,000 annual ISA allowance into these tax wrappers should they wish.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.