Cash ISAs have proved popular in 2025, but rumours of an impending cut to the annual allowance in next week’s Autumn Budget continue to swirl.

Even though interest rates on cash ISAs have trended downwards throughout 2025, they remain a popular option for savers wanting to protect their money from potential income tax charges. Indeed, Bank of England data shows that savers have deposited a total of £30 billion into cash ISAs since the start of April.

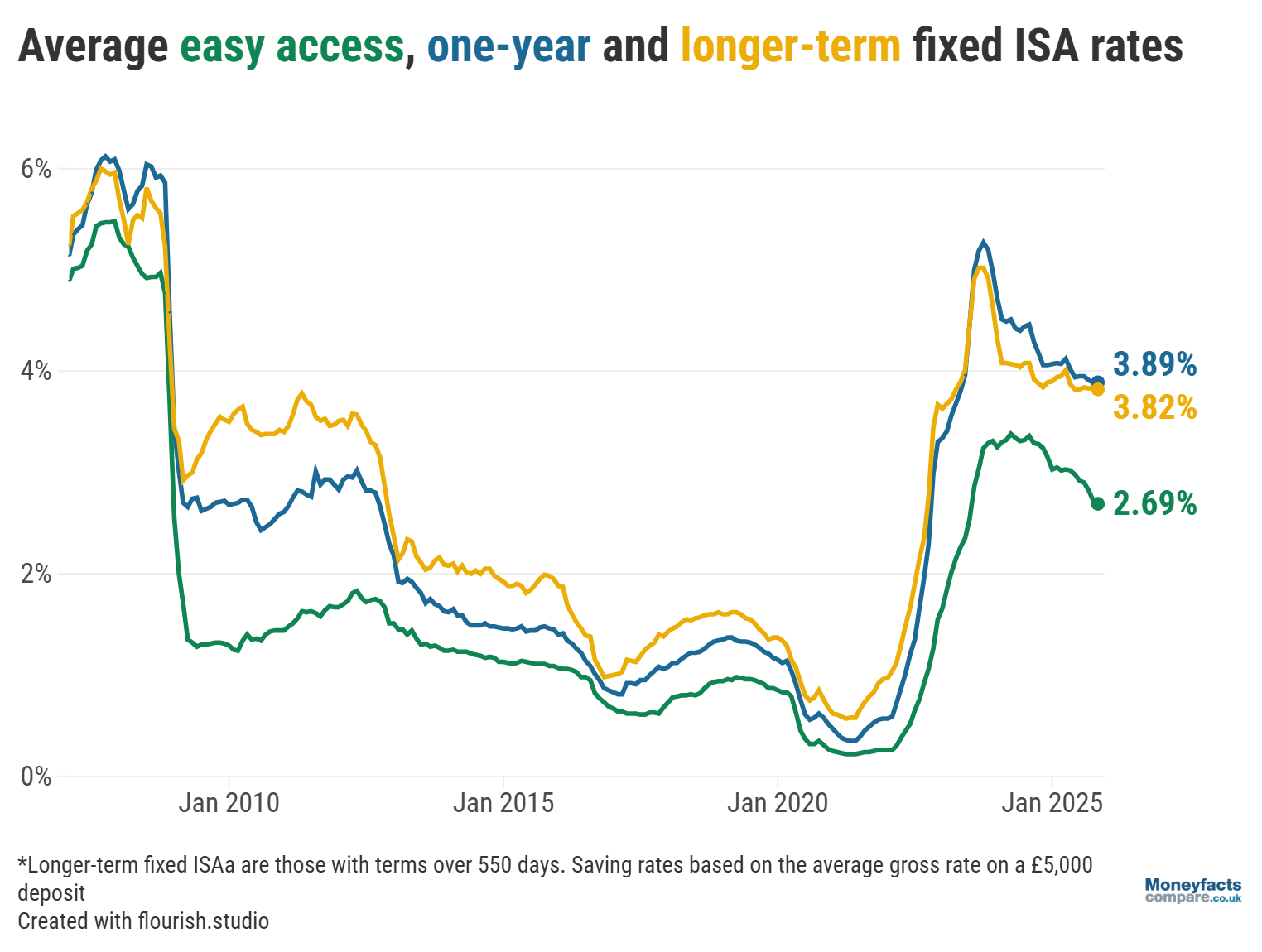

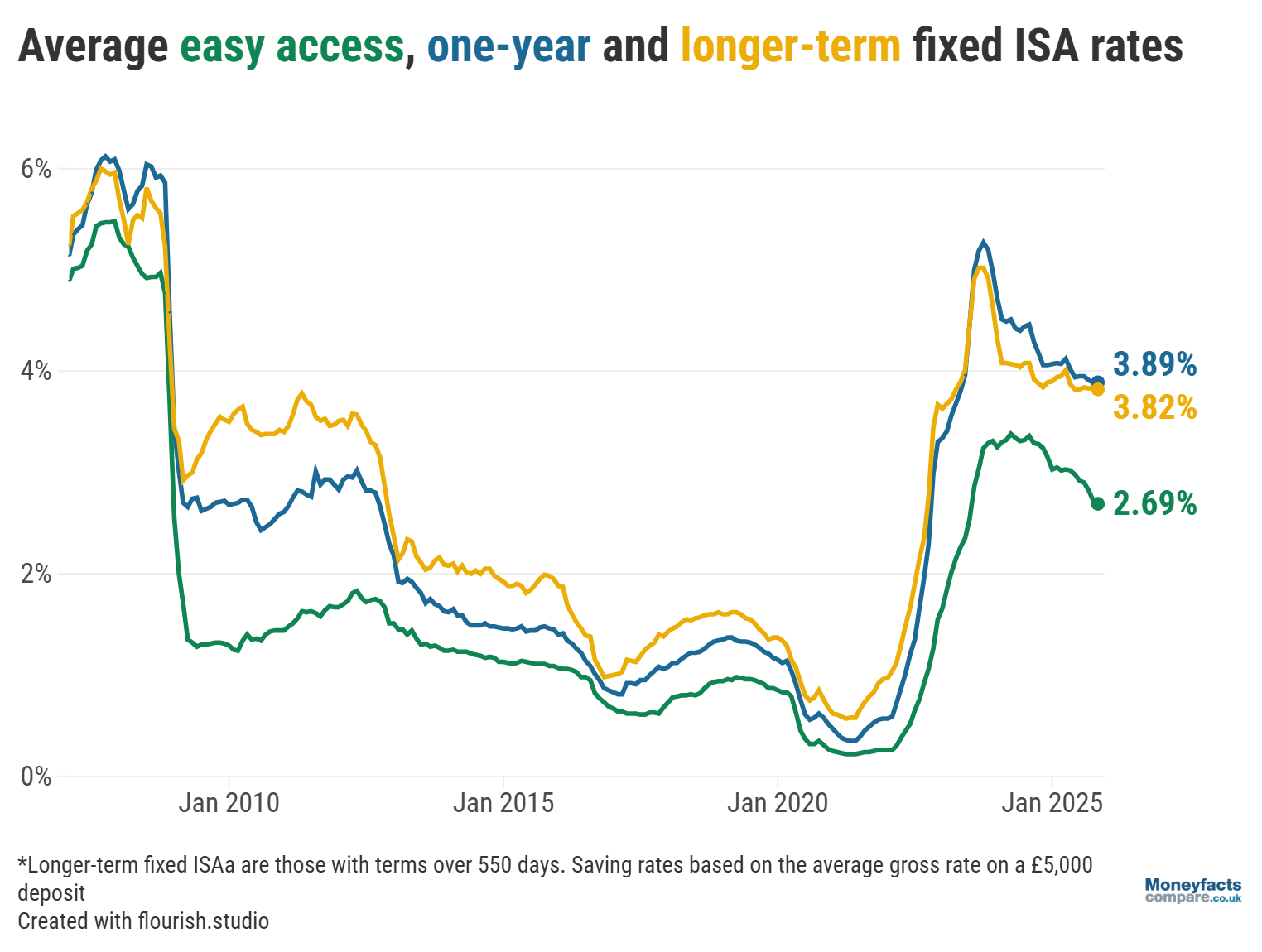

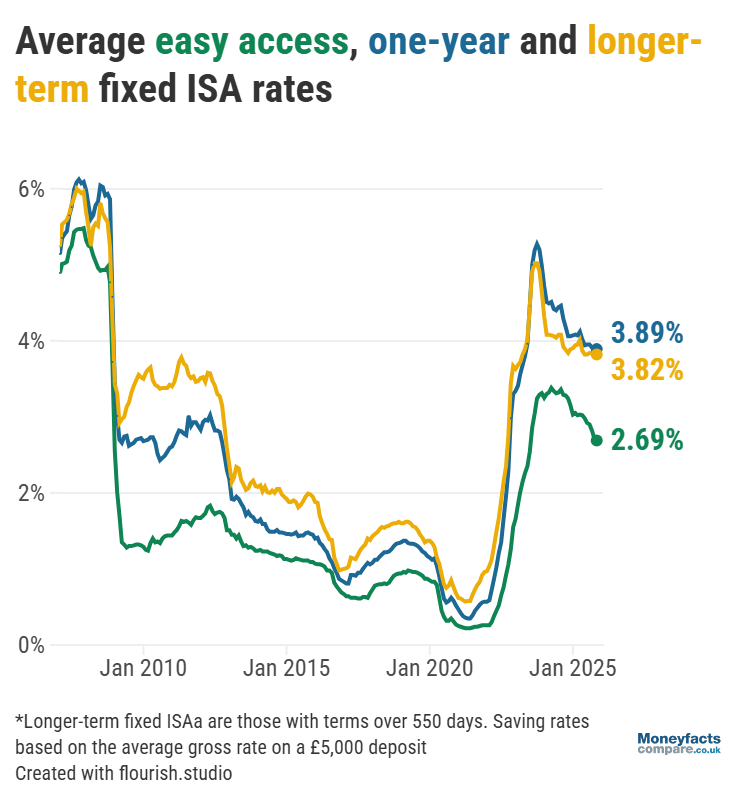

Interest rates continued to fall between the start of October and November, with the average easy access ISA rate dropping from 2.72% to 2.69%, its lowest level since July 2023. This is according to data from the latest Moneyfacts UK Savings Trends Treasury Report.

Average one-year fixed ISA rates stayed more resilient, sticking at 3.89% in November, but the average rate on longer-term ISAs (those with a term of 550 days or more) saw a slight monthly drop from 3.84% to 3.82% in November.

Graph: The average rate on easy access ISAs and longer-term ISAs fell to 2.69% and 3.82% respectively, while the average one-year fixed ISA rate stayed at 3.89%.

However, despite the lower rates, Rachel Springall, Finance Expert at Moneyfacts, points out that “this year has been a milestone for cash ISAs, with the choice of deals and number of providers in this sector reaching record highs”.

The number of cash ISAs on the market peaked at 662 in September, giving savers an unprecedented level of choice when it came to selecting a tax-free wrapper for their money.

Although this figure dropped from 658 deals in October to 640 in November, marking the biggest monthly decline in choice since January 2024, there are still significantly more accounts to choose from compared to one year ago.

Our charts are regularly updated with all the latest cash ISA rates. Whether you want the flexibility of an easy access ISA or the guaranteed rate of a fixed ISA, visit our charts to find the right option for you.

The Moneyfacts Savings Trends Index revealed that 44% of respondents kept their money in a cash ISA compared to just 23% who stored their money in stocks and shares ISAs.

Even though investing in a stocks and shares ISA can offer the chance of greater returns, especially over the long term, the volatility of the stock market means there’s a risk that you could get back less than you deposit. By contrast, money in a cash ISA doesn’t carry this risk and is fully protected under the Financial Services Compensation Scheme (FSCS).

“Savers find comfort in cash ISAs, particularly those who are being hit by fiscal drag and do not want to risk their pot in a stocks and shares ISA,” Springall explained.

But, despite the popularity and benefits of cash ISAs, it’s possible that the Chancellor of the Exchequer, Rachel Reeves, will reduce the maximum amount savers can deposit in cash ISAs in the Autumn Budget (which takes place on 26 November).

“Cash ISAs are under threat, with rumours persisting of a cut to the £20,000 yearly allowance,” Springall cautioned, adding that this measure would be “a futile attempt to push risk-averse savers to invest”.

The latest rumours are that the cash ISA allowance could be cut to £12,000, and Springall warns that this could “cause chaos from a retail funding perspective”, as well as giving “savers less reason to use a cash ISA in the first place”.

For example, a saver depositing £12,000 into a one-year fixed ISA paying the average rate of 3.89% would earn approximately £466 in interest over 12 months.

By contrast, if they deposited the same sum into a one-year bond at the average rate of 3.95%, they would earn slightly more interest of around £474, which Springall points out is within the Personal Savings Allowance (PSA) for both basic- and higher-rate taxpayers.

As a result, if the cash ISA allowance is lowered, some savers may no longer require the tax-free benefits offered by a cash ISA and opt for a standard savings account instead to get a better return on their money.

Fixed savings rates continued to fall in November and, as they are expected to fall even further over the coming months, it may be worth locking in a guaranteed return. Find the latest rates on our fixed bond chart.

Alternatively, if you want to withdraw from your savings, you can consider an easy access account. And, with the average rate rising to 2.51% in November, there are still several competitive accounts to choose from.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.