This is the first time since June of this year there are no fixed bonds offering a rate of 6.00% AER or more.

Reductions within the savings market mean it’s currently impossible to secure a fixed bond paying 6.00% AER or more.

This comes as Union Bank of India (UK) Ltd, the most recent provider to offer a fixed bond in excess of this threshold, reduced the rates paid by its Fixed Rate Deposits and Union Premier Bonds yesterday.

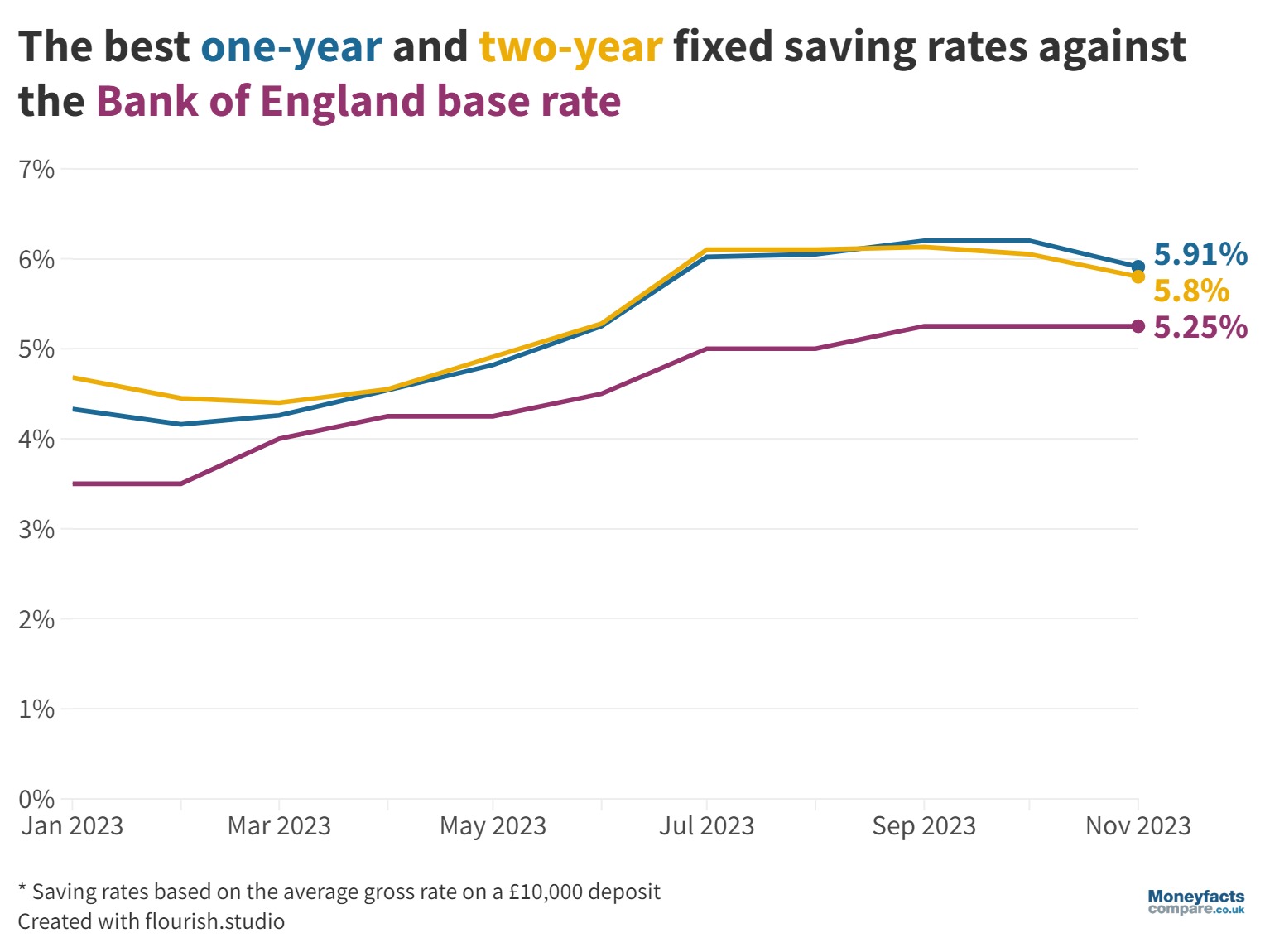

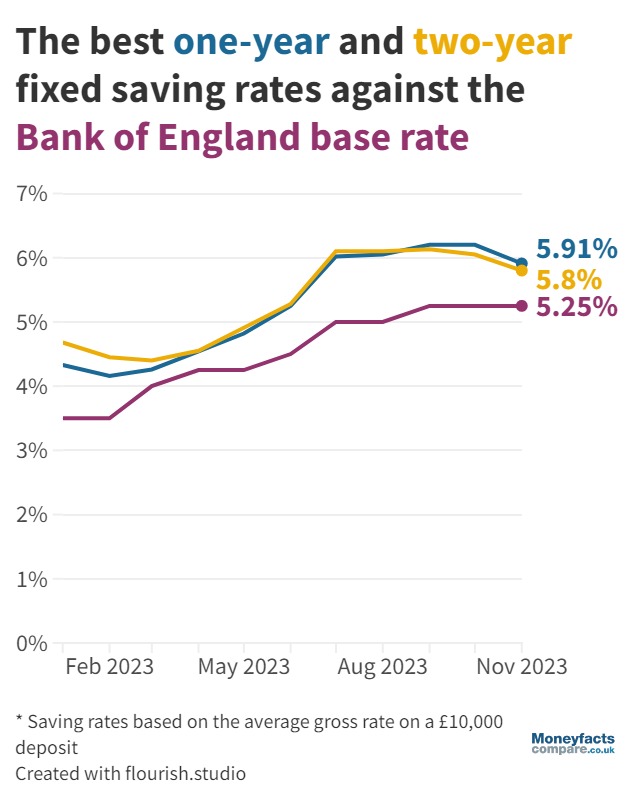

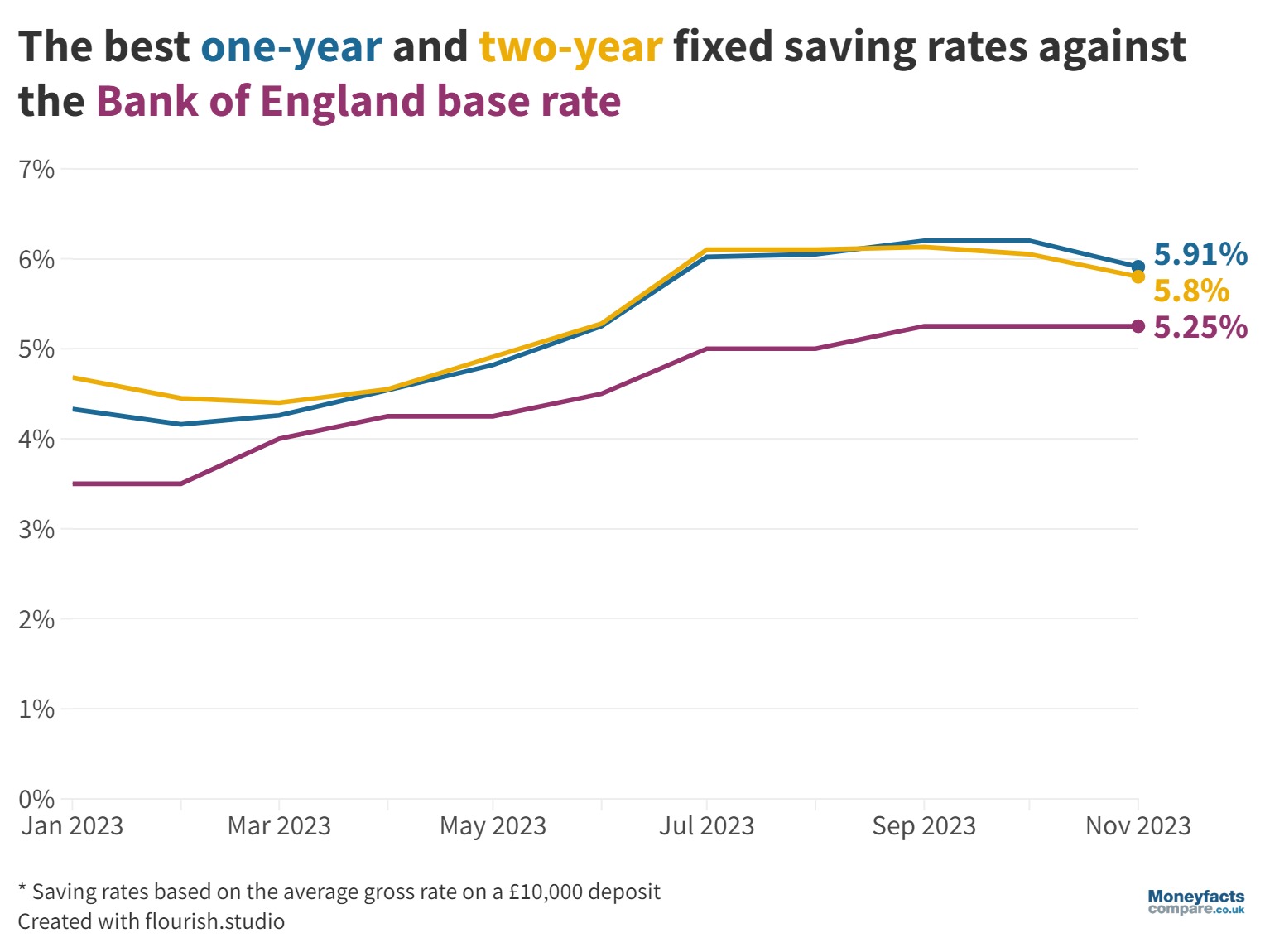

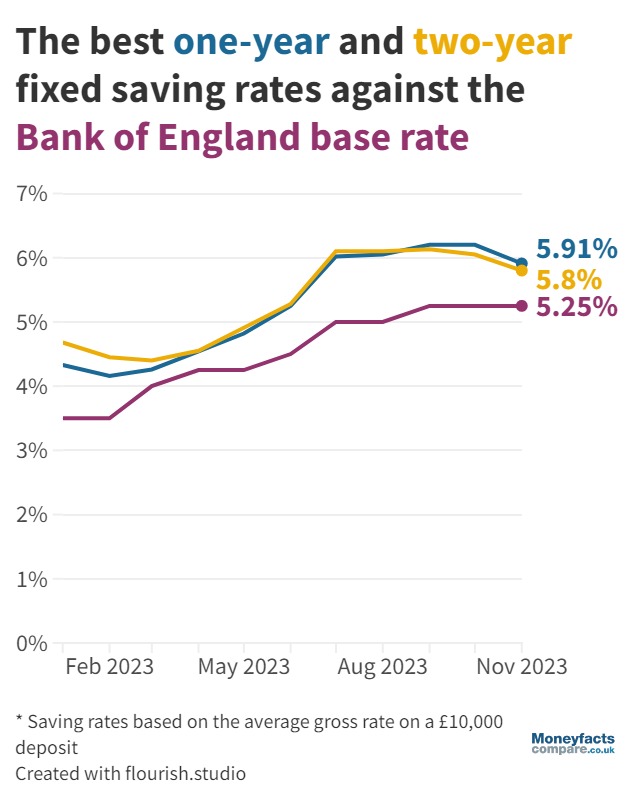

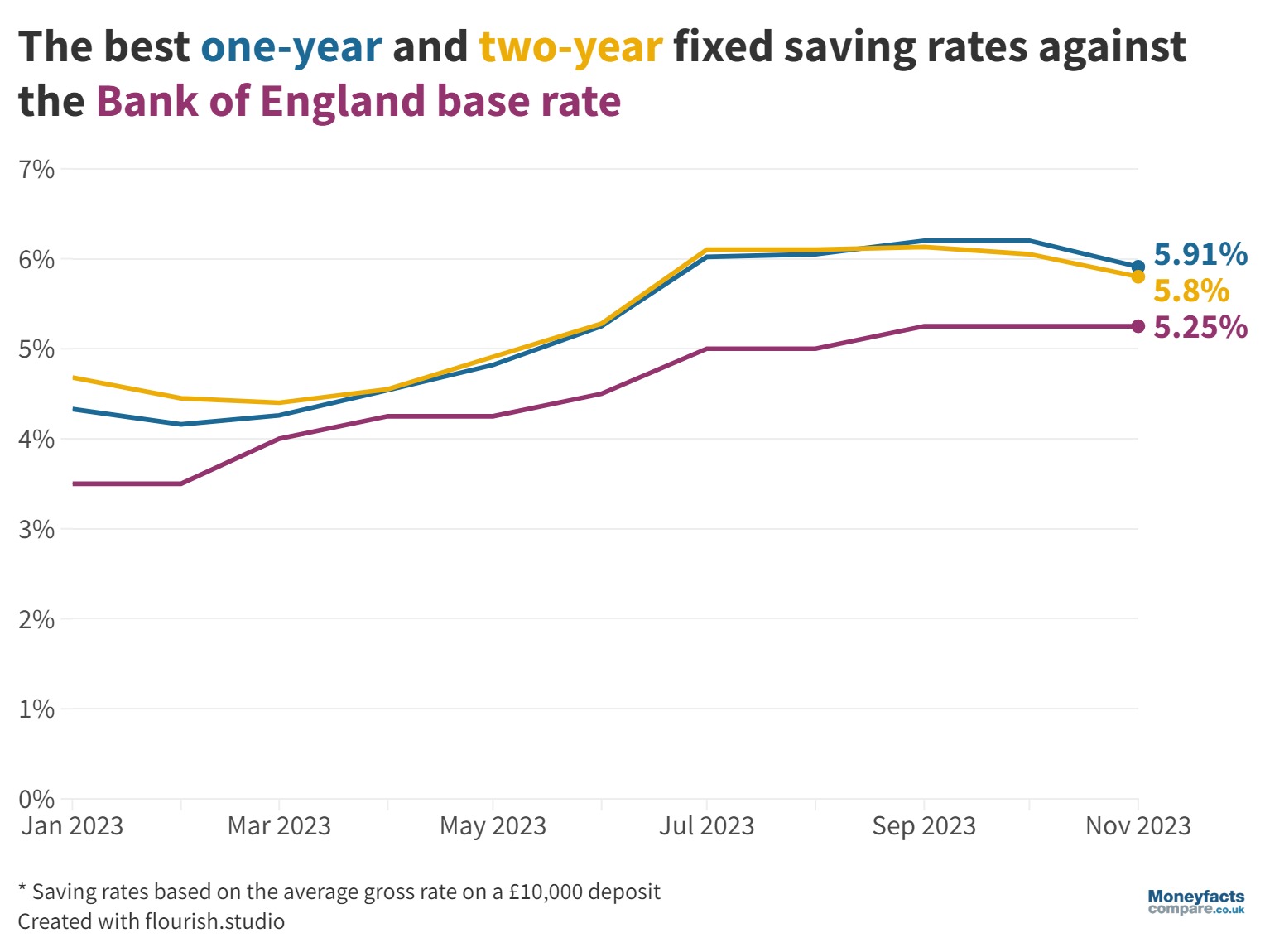

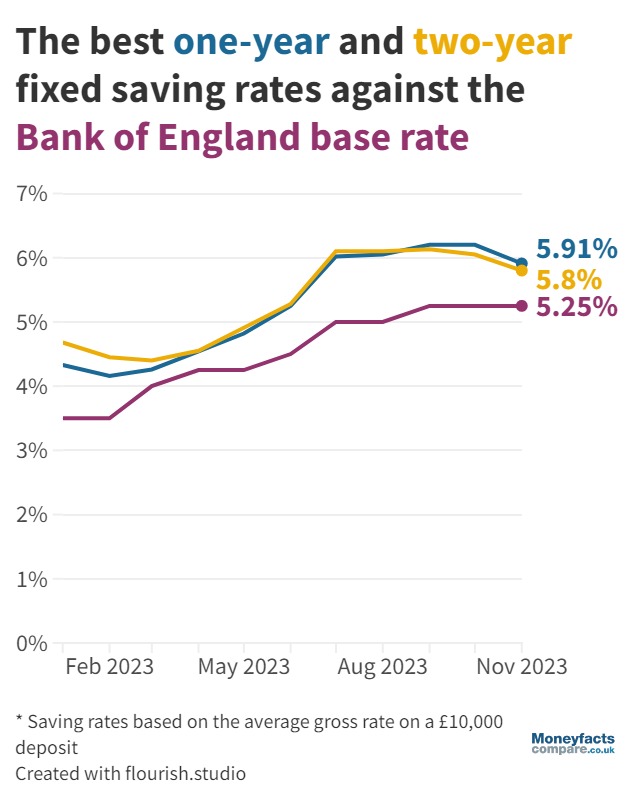

Best fixed savings rates saw an increase earlier this year amid consecutive base rate rises and general market uncertainty – reaching 6.00% gross in June for the first time since 2008.

Now the Bank of England base rate has stayed unchanged at 5.25% the past two times the Monetary Policy Committee (MPC) voted on the matter, both average and best fixed rates have seen a drop.

Our charts are updated regularly throughout the day to show you the best fixed savings rates currently available. Alternatively, read our weekly savings and ISA roundups for more detail on accounts offering top rates.

Caption: The best rates for a one and two-year fixed bond 2023, in contrast with the Bank of England base rate.

While it’s no longer possible to find a fixed bond paying 6.00% AER, savers shouldn’t feel disheartened.

“The good news is that variable savings rates have improved over the same period, largely down to base rate rises slowly trickling through the market and provider competition,” said Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

The best rate for an easy access account is currently offered by Metro Bank at 5.22% AER when taking into consideration the 3.46% bonus included for 12 months. However, this relies on a balance of £500 being reached within 28 days of account opening. Otherwise, the bonus won't apply and the lower, underlying rate will be received. For more information, visit our chart.

Otherwise, if you’re looking for a fixed bond, the market-leading rate now stands at 5.91% AER, which is also offered by Metro Bank.

Although it’s unlikely we’ll see a fixed bond paying 6.00% AER return to the market in the immediate future, it’s not an impossibility.

“There will still be a case for challenger banks to change their offerings in line with their own funding targets, regardless of base rate changes,” explained Springall.

Therefore, it’s important to keep an eye on the savings market to ensure you’re getting competitive returns; you may need to act quick to take advantage of an attractive rate before it disappears.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.