Despite the significant drop, figures are higher than economists expected, casting doubt over an imminent cut to interest rates.

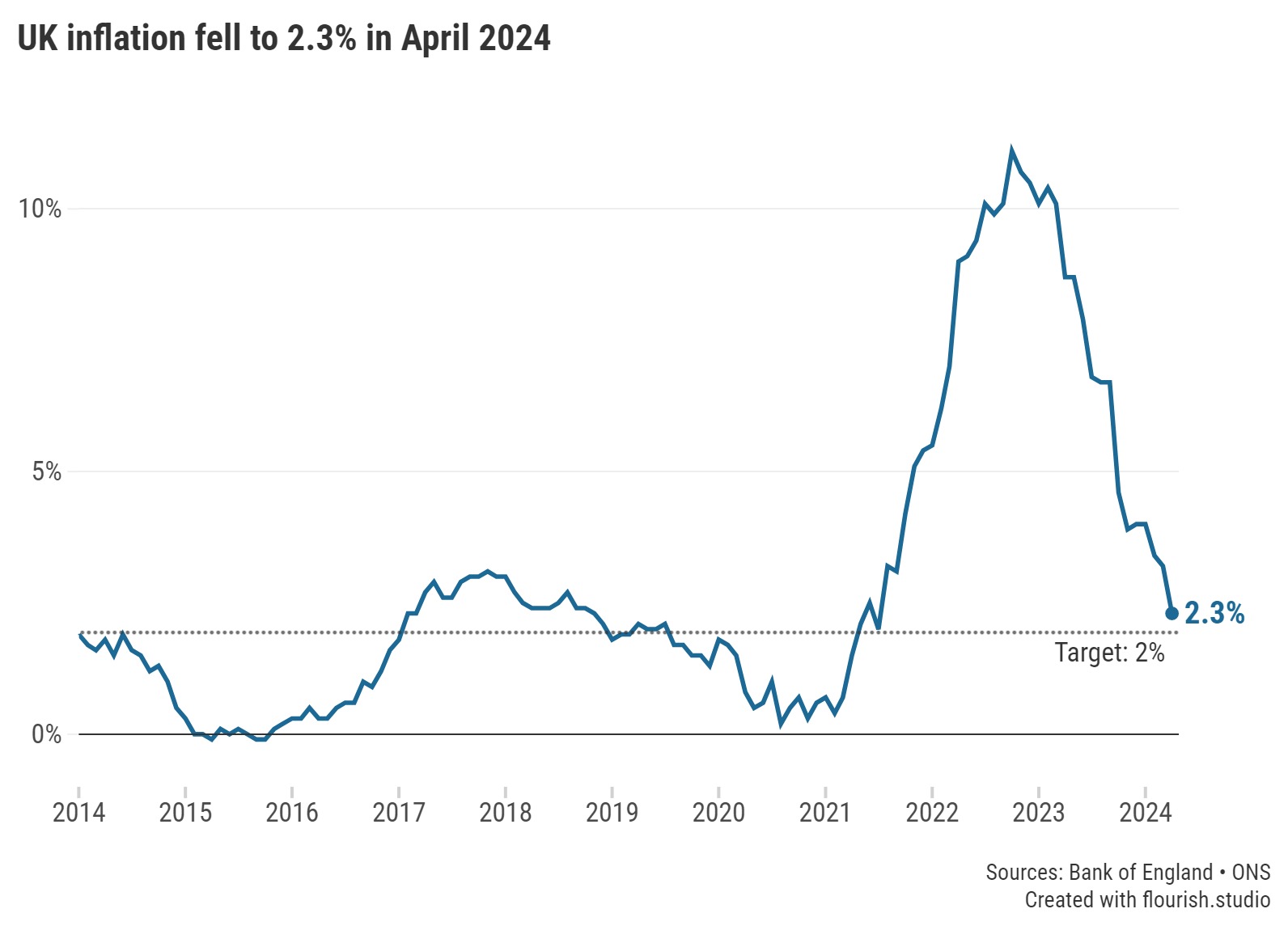

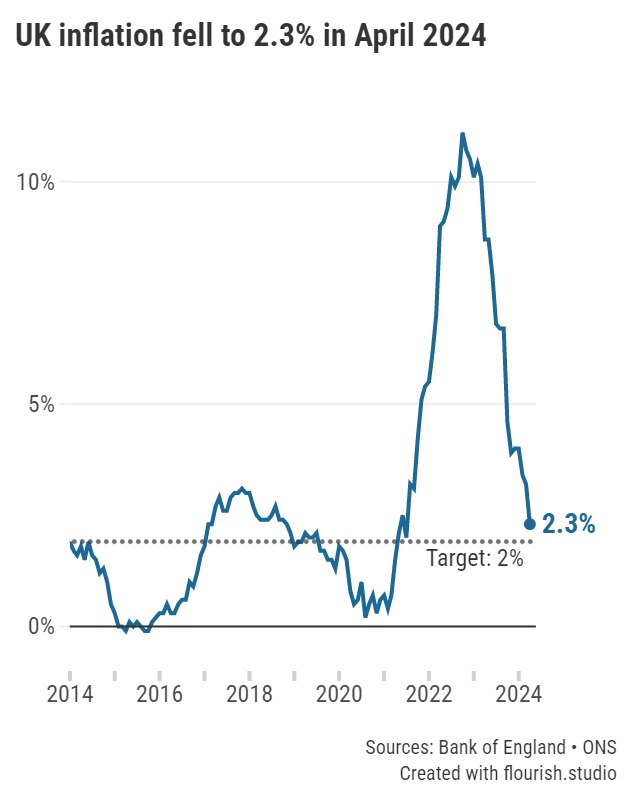

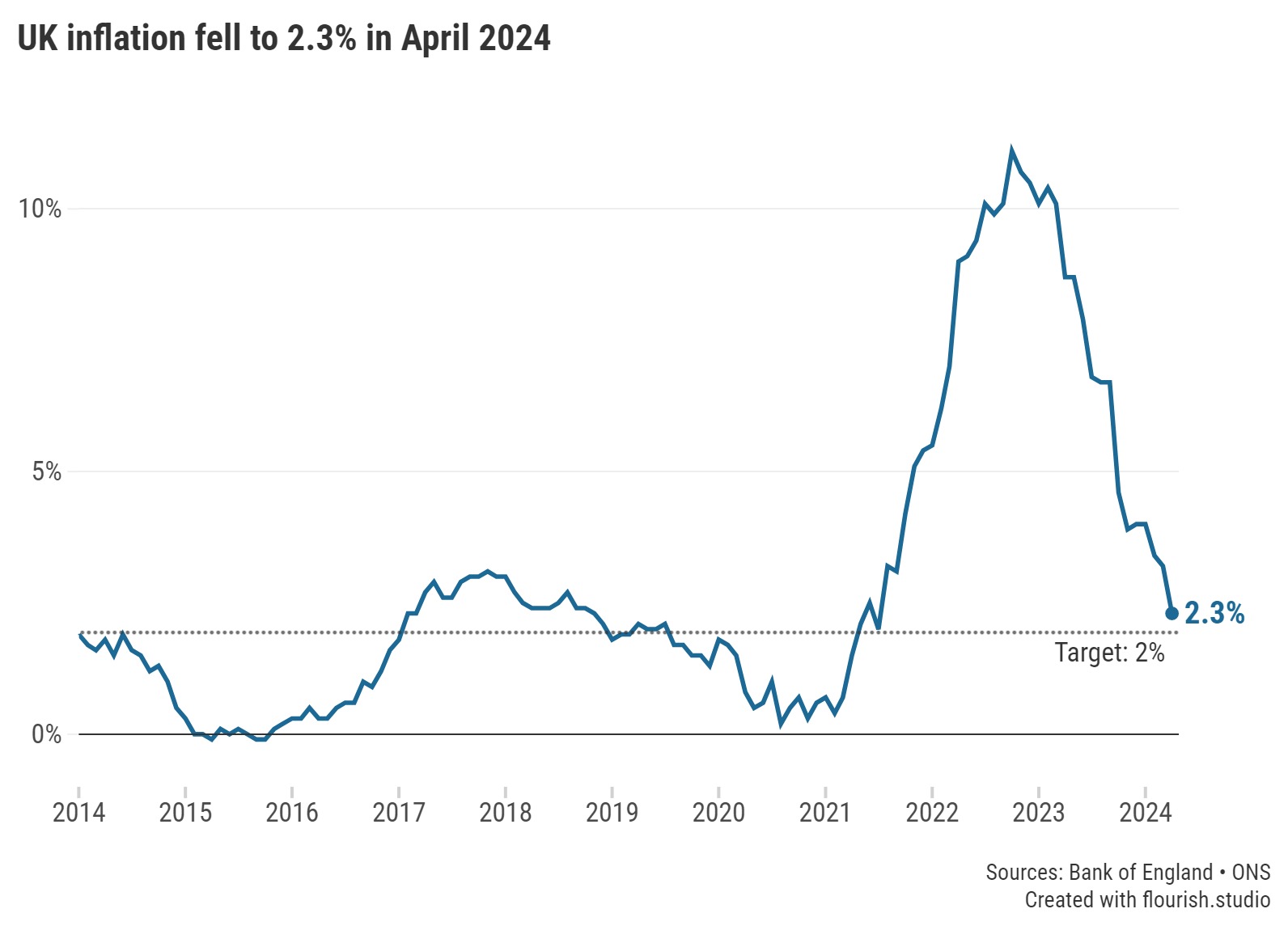

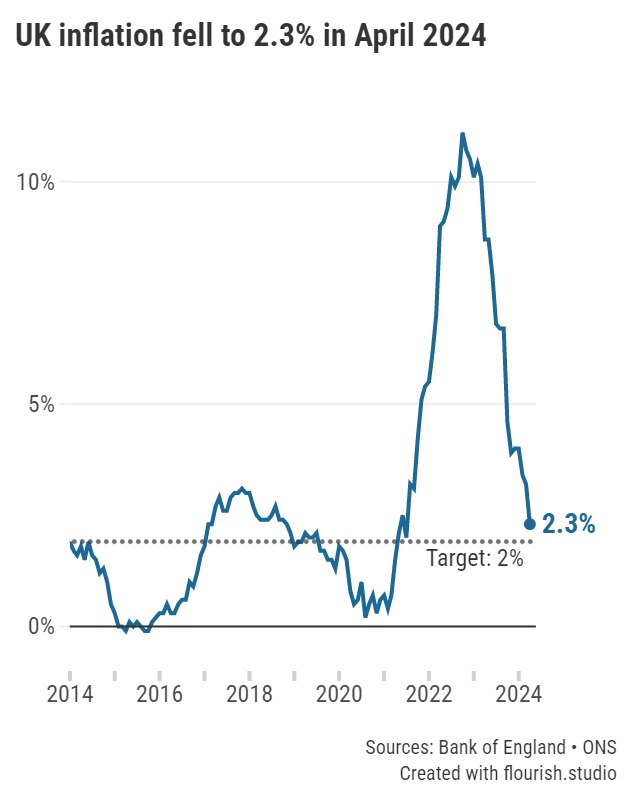

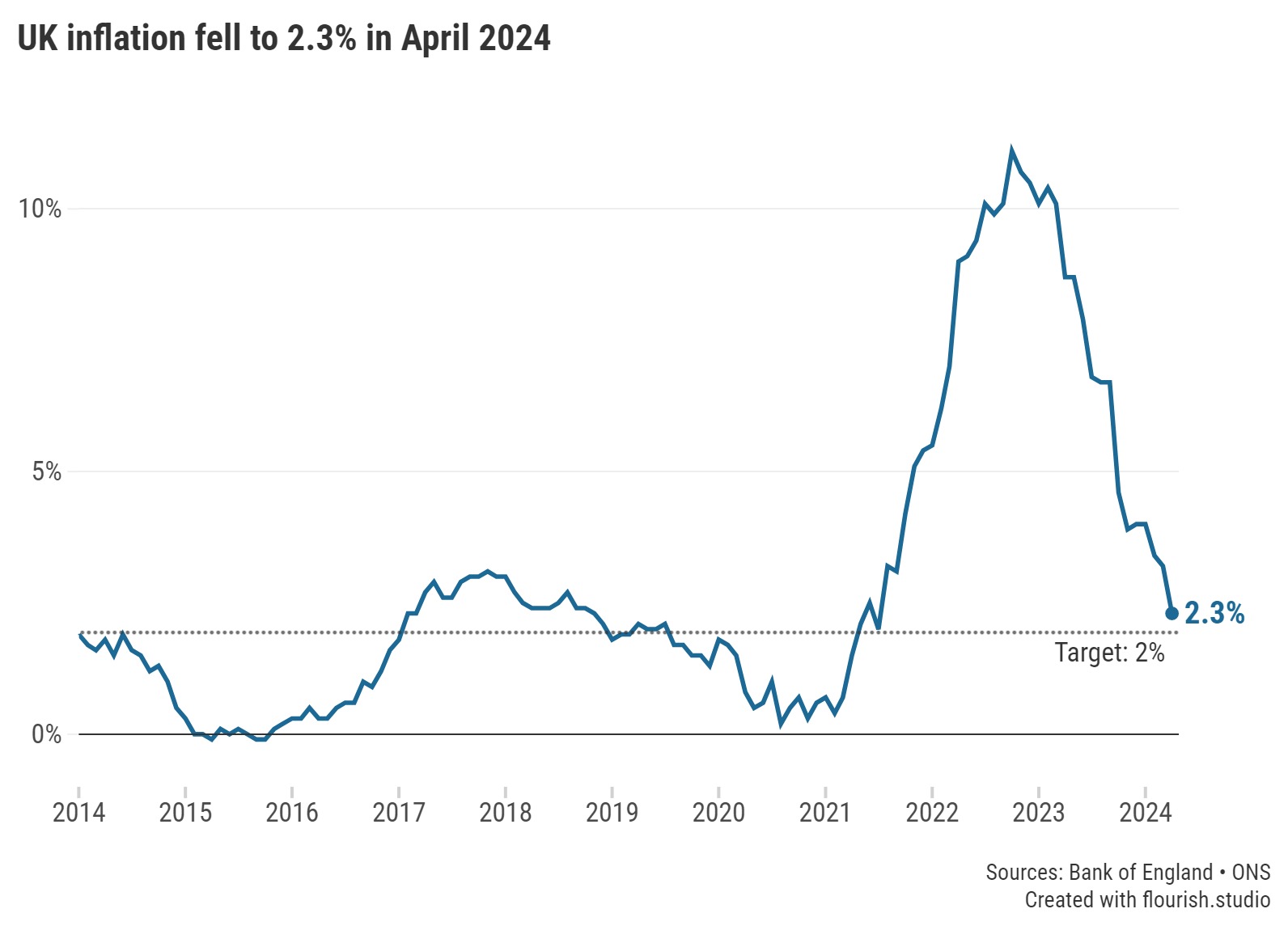

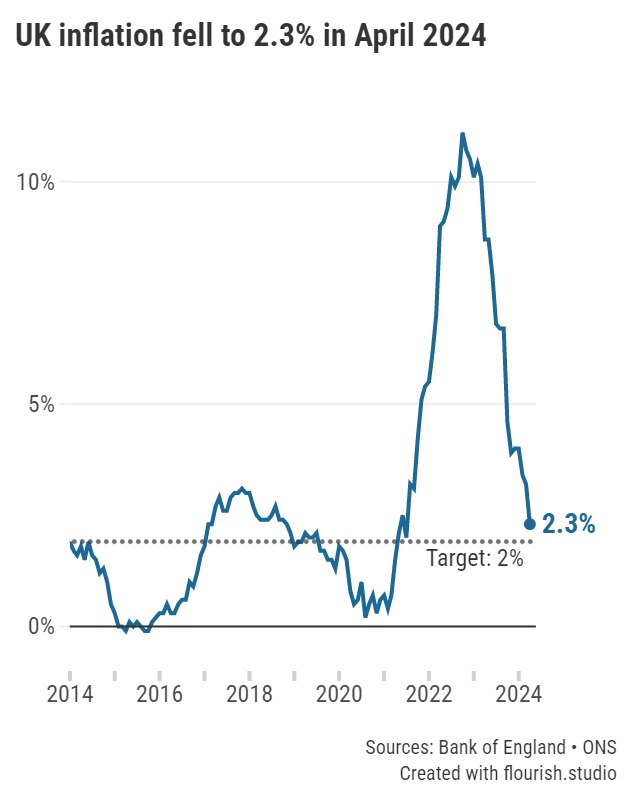

UK inflation fell to a near three-year low of 2.3% in the 12 months to April 2024, the Office for National Statistics (ONS) today revealed. This rate was last slower in July 2021, when the cost of goods and services rose by a more meagre 2.0%.

With figures now closing in on the Bank of England’s 2.0% target, the Prime Minister, Rishi Sunak, remarked inflation has returned “back to normal” following the recent peak of 11.1% recorded in October 2022.

Inflation is an important metric, used to measure how fast the prices of goods and services are rising.

While many will be pleased to see a significant fall in inflation, this doesn’t mean costs are getting any cheaper. Instead, prices are continuing to rise, albeit at a slower rate than the month before.

Graph: UK inflation closes in on the Bank of England's 2.0% target.

The falling costs of gas and electricity were largely responsible for slowing inflation this month; prices in these sectors dropped by 27.1% in the year to April 2024 – the largest decline on ONS records (dating back to 1989).

Meanwhile, the price of food and non-alcoholic beverages continued to decelerate for a 13th consecutive month, rising by 2.9% in the year to April compared to 4.0% in March. This is down significantly from a recent high of 19.2% recorded in March 2023 – the highest annual rate seen in over 45 years.

Over 1,350 saving deals could better inflation at the time of the last CPI announcement and, following today’s news, there are now well over 1,500 options to choose from that deliver real returns on your cash.

There has been some volatility across the savings market in recent times, with a mix of rate rises and reductions across the piece. Changes substantially balancing one another out has led to average rates not changing a huge amount recently in the fixed rate arena. Savers who are about to have their existing one-year bond mature can beat the market-leader from May 2023, and those coming off longer-term deals should be able to achieve significantly higher rates if they wish to fix again.

Meanwhile, variable savings rates have remained very steady over the past few months, and this has continued in recent weeks.

As for ISA rates, these rose significantly during ISA season, especially in the buildup to the deadline for utilising allowances on 5 April. Beyond that date, average rates in the sector have settled down again. The top fixed ISAs are paying less than their fixed rate bond counterparts, with very few accounts currently paying over 5% as it stands.

As always, it’s vital that consumers consider all the options and be willing to switch if more attractive options are available. It is always best to review all relevant criteria, as eligibility and access are both important factors to take into account.

Our charts are regularly updated throughout the day to show you the best fixed, easy access and notice savings rates currently available.

Use our charts to find savings accounts that can better inflation.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.