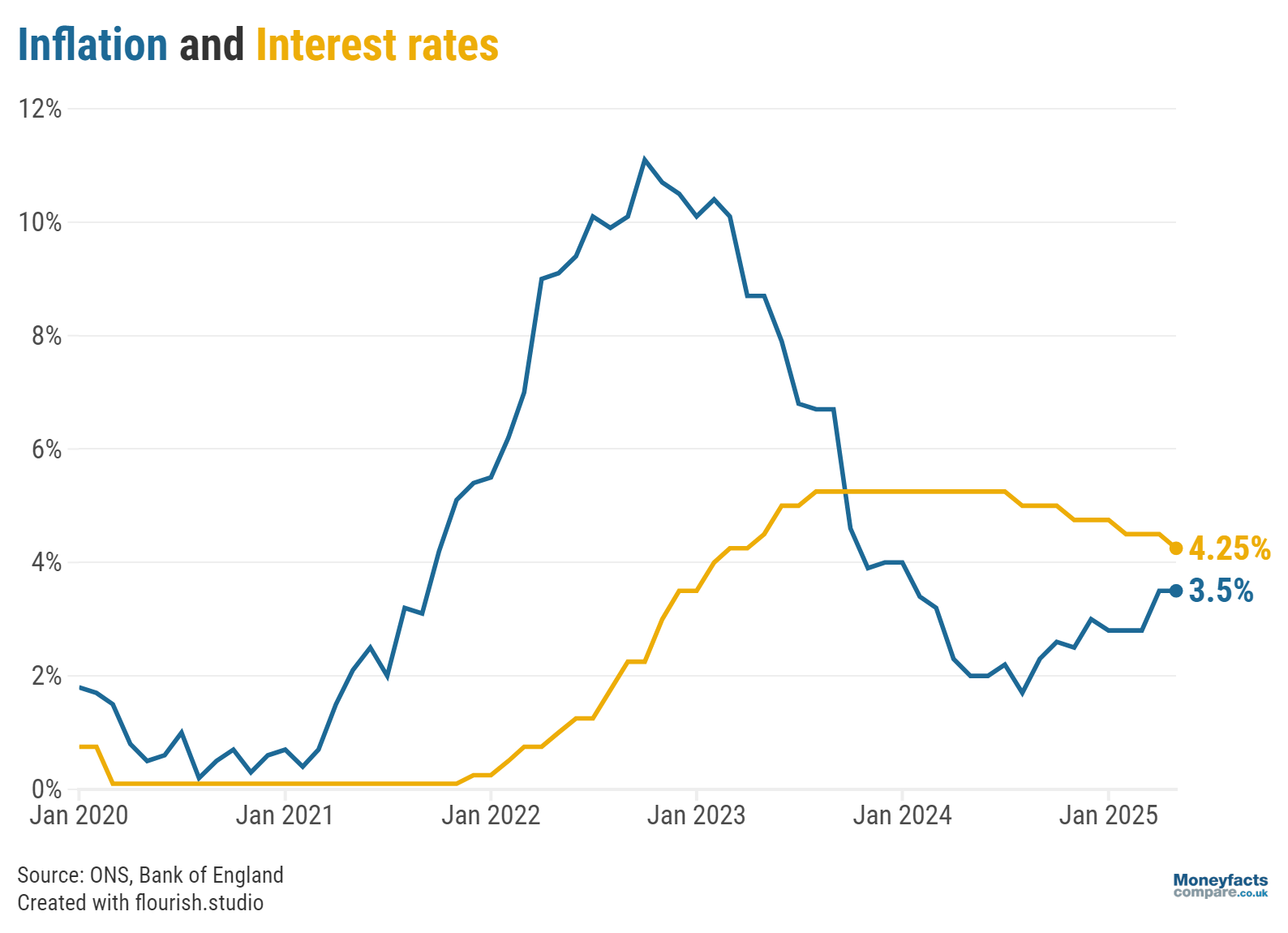

This is the highest inflation has been since January 2024.

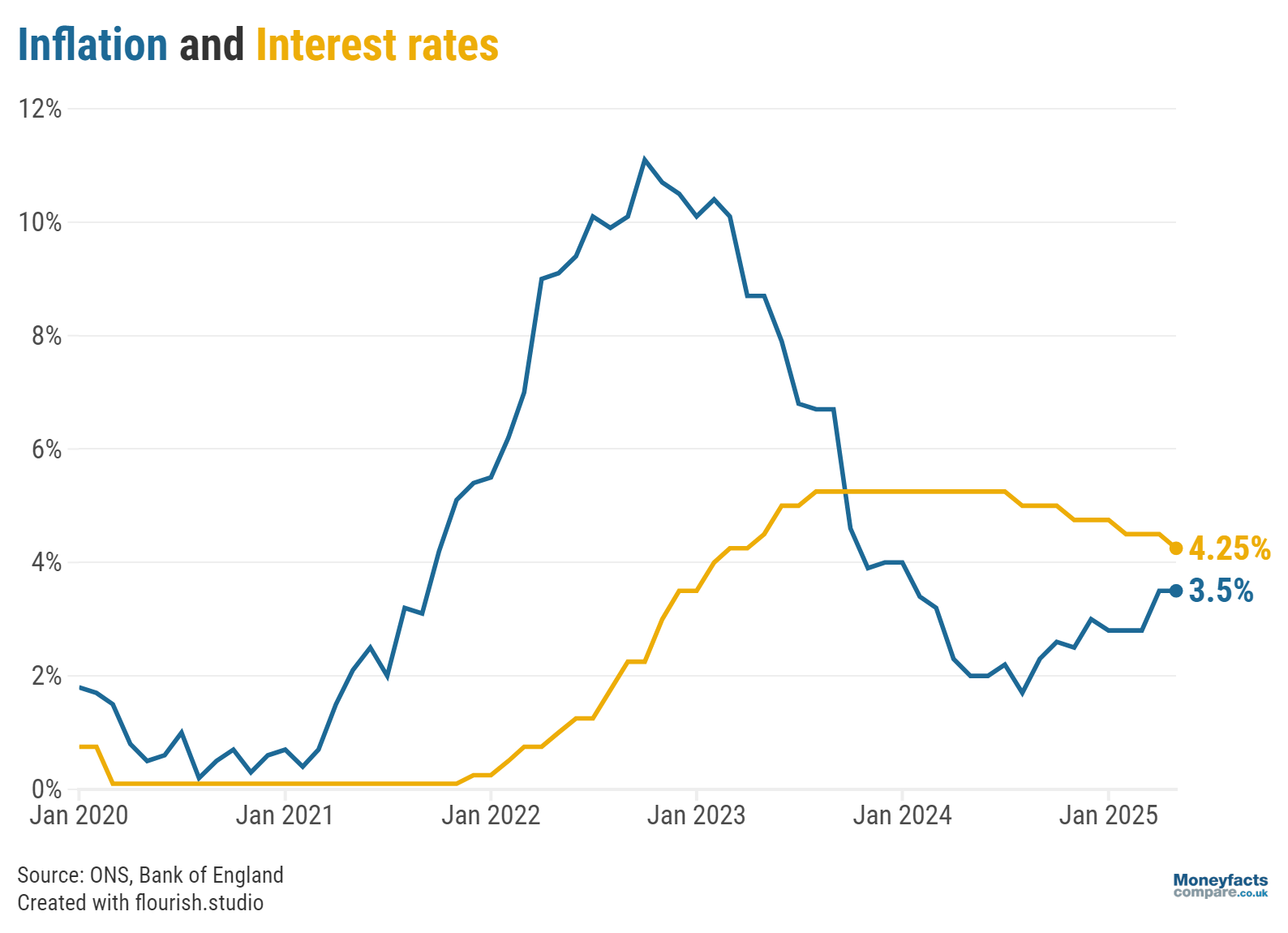

Inflation soared to 3.5% in the year to April, jumping up from 2.6% in March, according to latest data from the Office for National Statistics (ONS).

Many experts had been anticipating a rise in inflation as the impact of higher household bills came into effect, but this figure was greater than many had predicted.

The last time inflation was higher was in January 2024, when it stood at 4%.

The rate of inflation indicates how the prices of goods and services have changed from one year ago. A rise in inflation means that, on the whole, things are more expensive than they were in the same month last year.

The Consumer Price Index (CPI) is the main metric that is used to measure inflation. Read our guide for more information about inflation and what it means.

In its latest Monetary Policy Report published on 8 May, the Bank of England said it expected inflation to rise to 3.4% in April and to 3.7% in September. As April’s inflation figure is marginally higher than the Bank's prediction, many will be wondering what this means for the base rate throughout 2025.

The base rate is typically used by the Bank of England to keep inflation at its target of 2%, so if a higher level of inflation persists, it’s possible that the base rate may not fall as quickly as expected.

With May’s inflation announcement coming on 18 June, one day before the next base rate announcement, the MPC will be closely monitoring inflation and other factors over the coming weeks to decide where to set the central interest rate.

Graph: Inflation rose to 3.5% in April as the base rate was cut in May.

Many were calling last month “awful April” as a range of household bills, including energy and water, were due to rise. So, unsurprisingly, it’s housing and household services that were a major driver of the rise in inflation, as prices in this sector increased by 7.0% in the year to April. Between March and April, gas and electricity prices rose by 7.5% and 2.9% respectively, while water and sewerage prices rocketed by 26.1%, the largest monthly rise since at least February 1988.

In a further blow to households, transport costs also rose by 3.3% in the year to April, compared to an annual rise of 1.2% in March. An increase in Vehicle Excise Duty (VED), or car tax, contributed to this but, more encouragingly for drivers, motor fuel prices dropped by 9.3% in the year to April to partially offset some of the rising costs elsewhere.

Additionally, airfare prices rose by 27.5% between March and April compared to 6.5% during the same period last year, while foreign holidays also saw an increase. This is likely because of the timing of the Easter holidays as flights and holidays are often more expensive during this period.

Easing some of the effects of rising inflation were clothing and footwear, as this sector saw prices decline by 0.4% in the 12 months to April.

After the recent Bank of England base rate cut many providers have been rushing to re-price their offerings, which has ramped up the competition, but challenger banks continue to dominate the market-leading positions.

Unusually, the top variable rates for ISAs and non-ISAs have been mostly unaffected, the leading easy access rate has even seen a slight uptick, whereas their fixed counterparts have been slashed by as much as 0.30% over the past month.

Building a reliable cash pot to fall back onto is crucial, especially with persistent sticky inflation eating its way into savers’ deposits. Research conducted by the Financial Conduct Authority (FCA) has revealed that one in 10 people have no cash savings and another 21% have less than £1,000. Ongoing cost of living pressures mean consumers need to shake any apathy aside and start building a healthy habit that provides attractive returns to avoid receiving a raw deal.

Savers who have invested in a fixed bond over a longer period will be pleased to see that they can receive much better returns now compared to when they initially locked away their cash but the top one- and two-year rates have dipped significantly, which could lose savers as much as £136.

Although fixed bonds continue to pay higher returns, investors planning to make larger deposits will need to be wary of breaching their Personal Savings Allowance (PSA), in which case investing in a headline rate ISA may be better suited.

More than 1,300 savings accounts and ISAs can offer returns that beat the current rate of inflation, including easy access savings accounts and fixed bonds.

If you're looking for an ISA, more than 400 easy access ISA and fixed rate ISAs offer inflation-beating rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.