While the overall inflation rate remained the same in August 2025, food prices soared year-on-year.

The rate of inflation in the year to August remained at 3.8%, the same as July’s figure, according to the latest data from the Office for National Statistics (ONS).

Despite this pause, inflation is still on an overall upwards trend and is predicted to hit 4% before the end of the year.

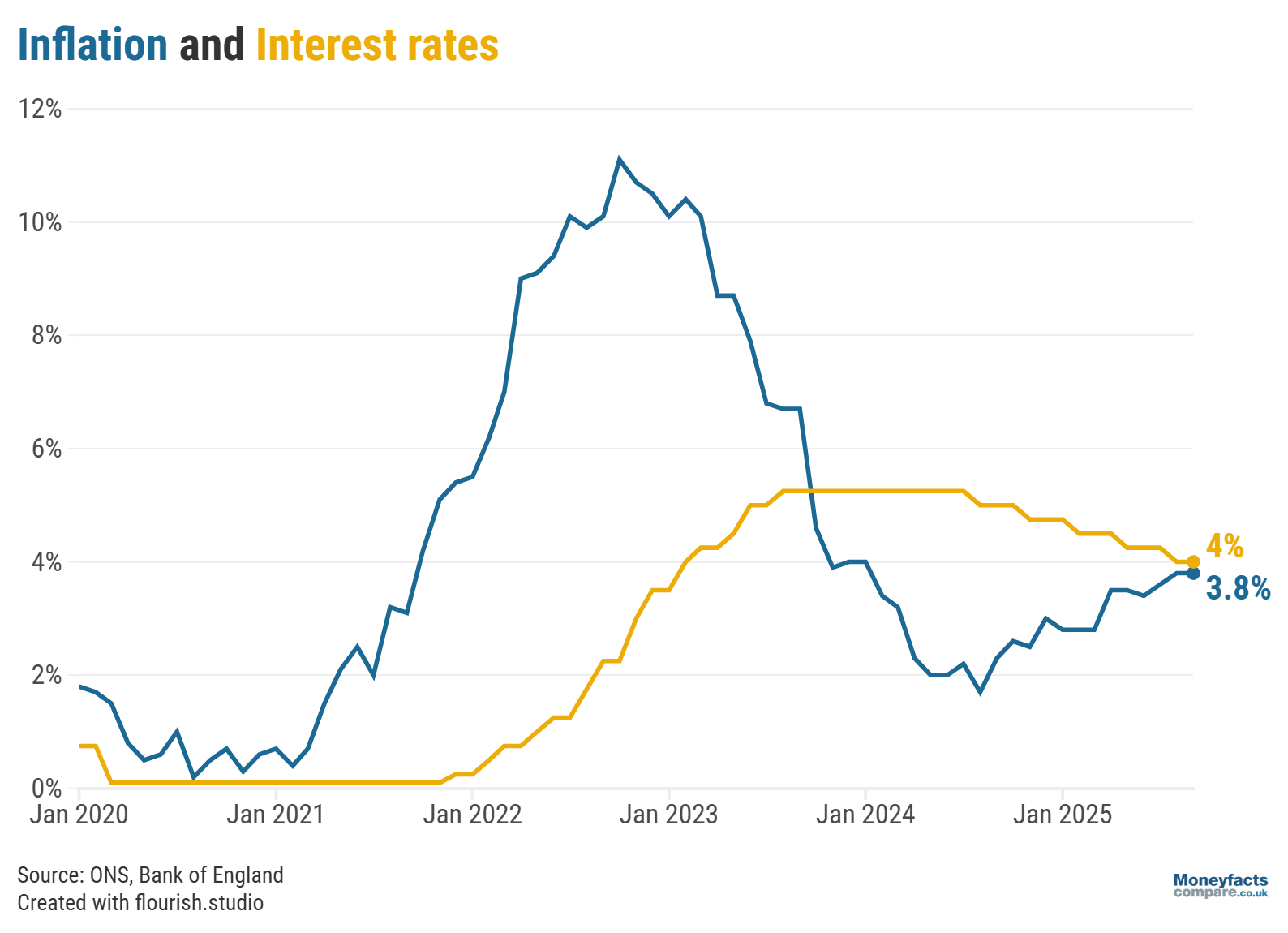

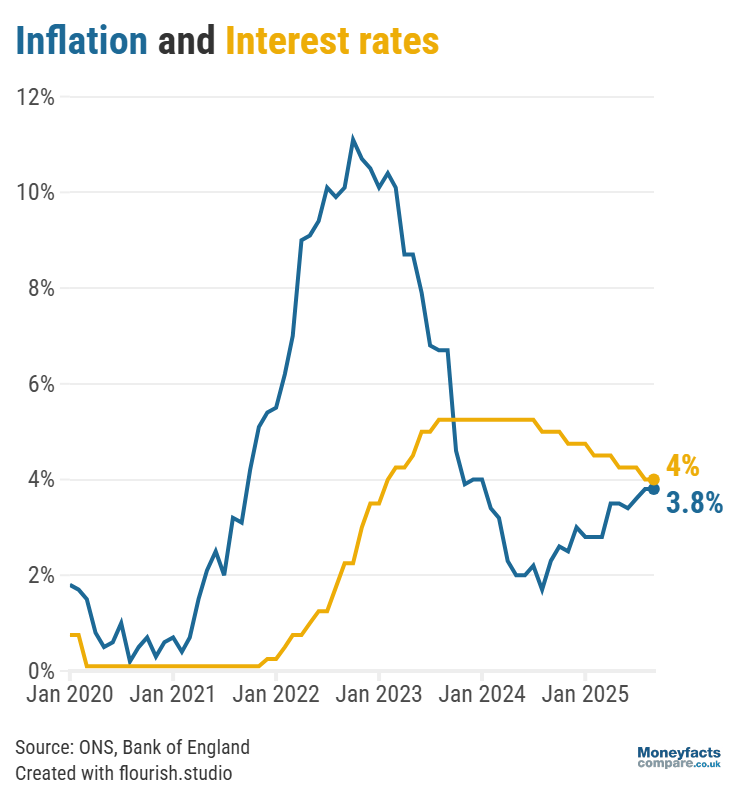

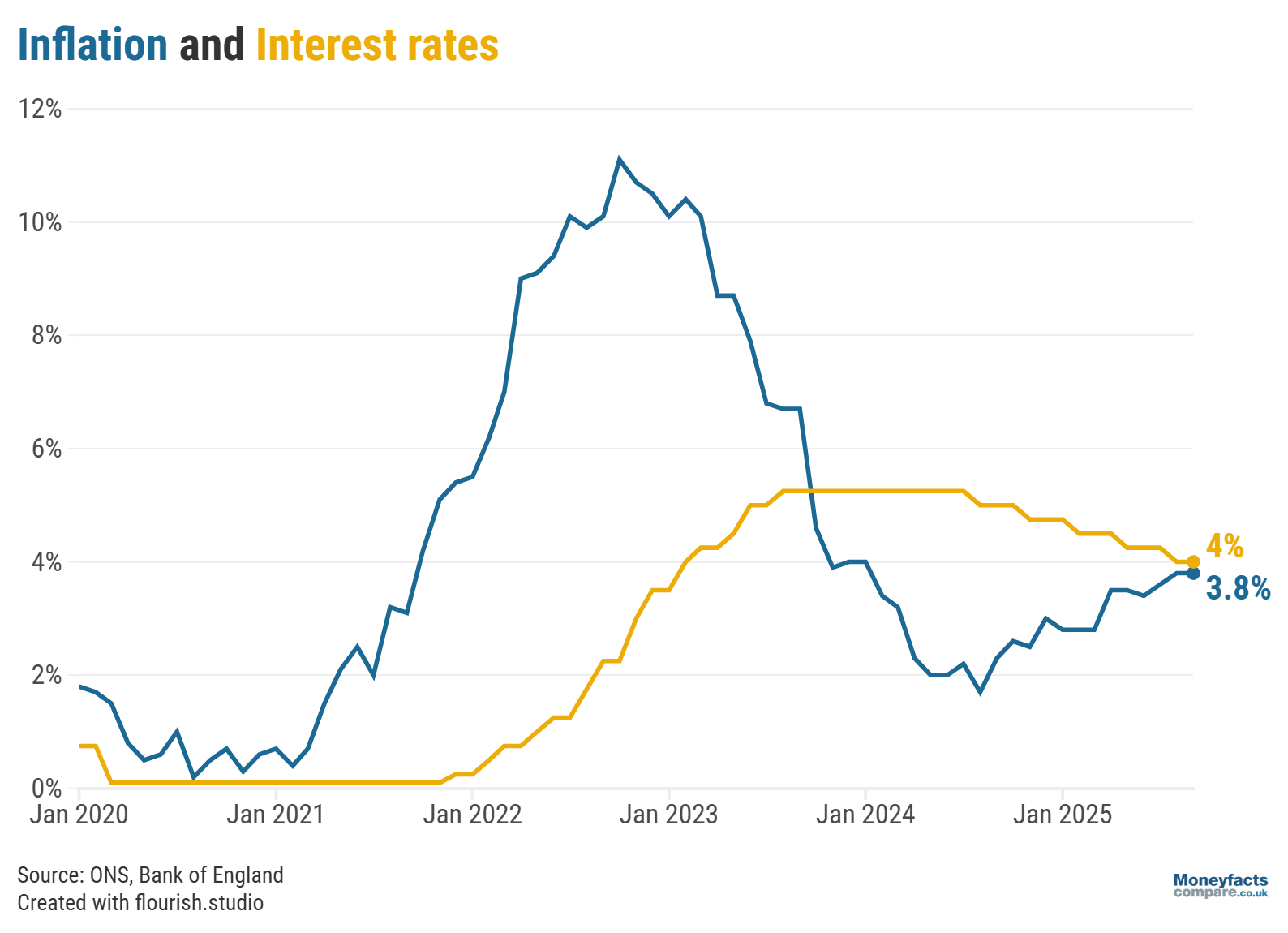

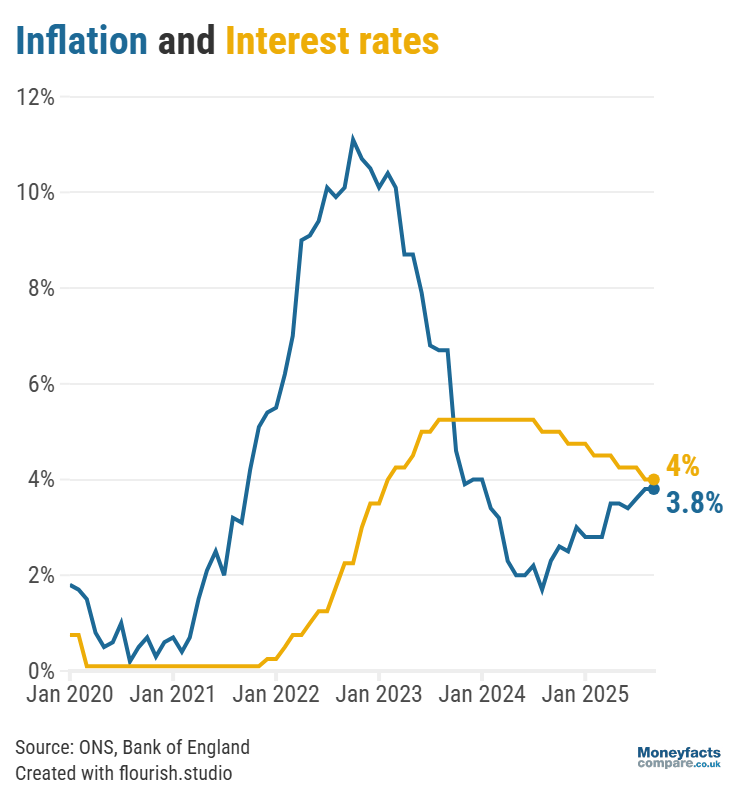

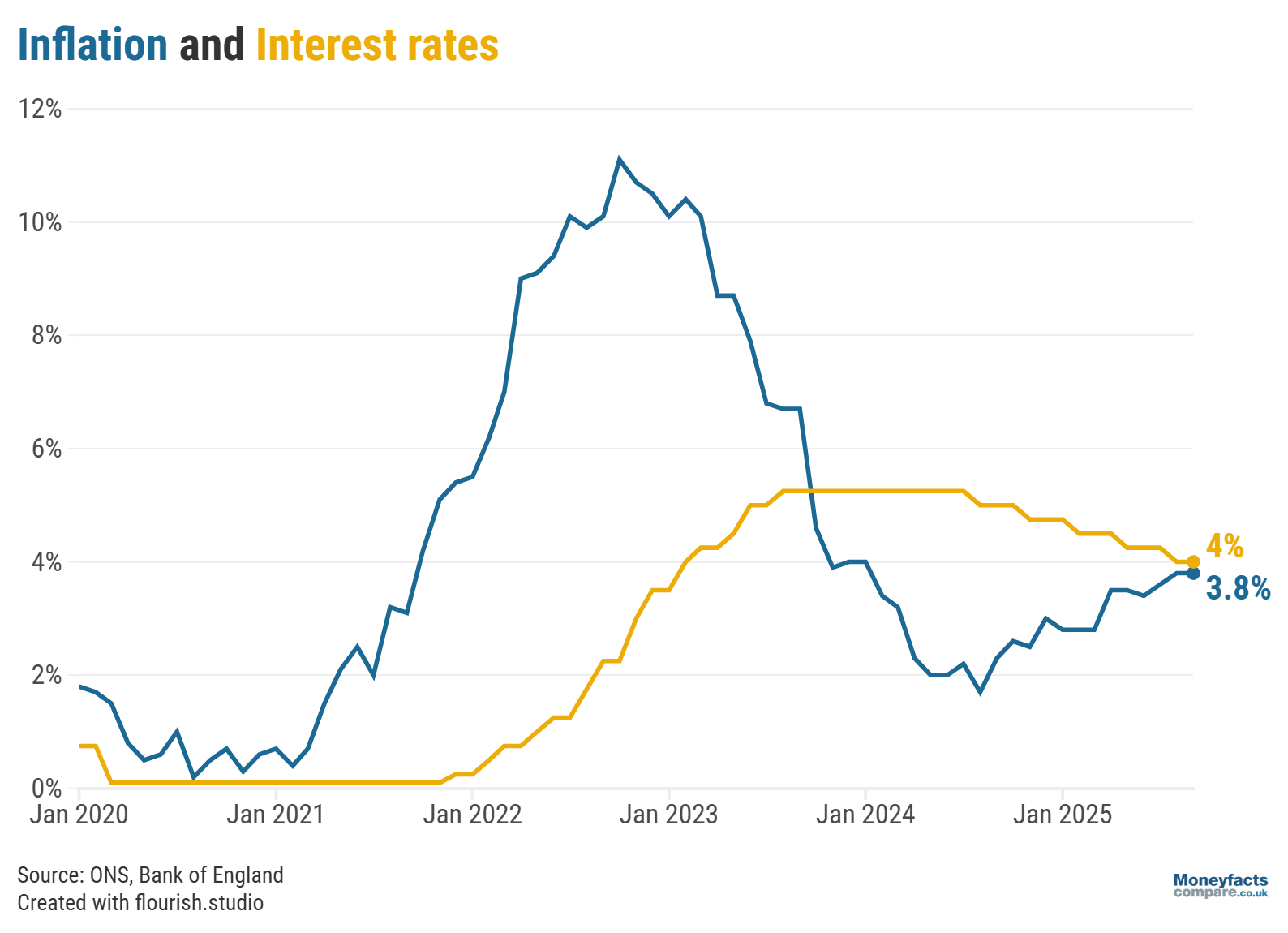

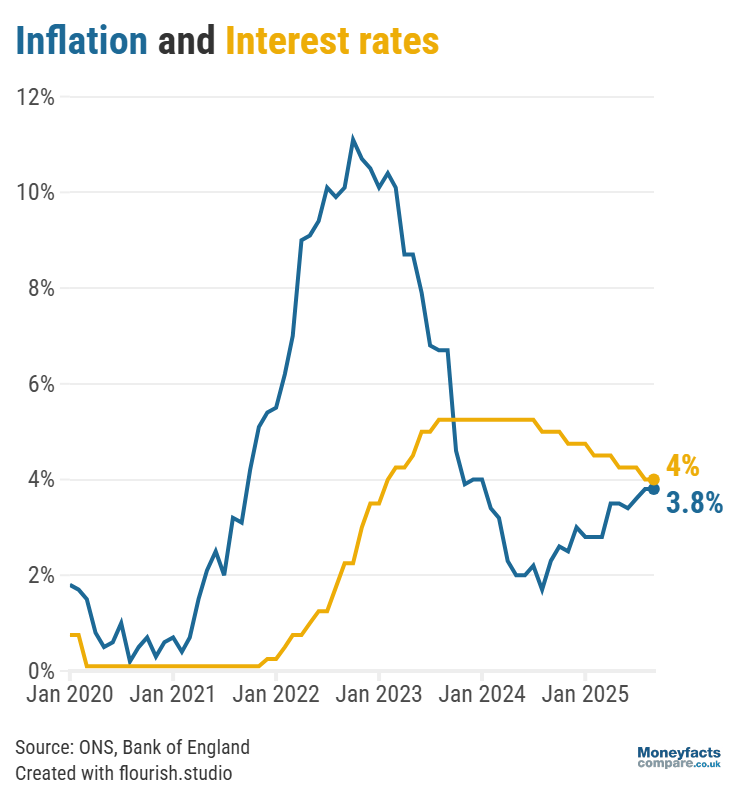

Graph: The annual rate of inflation remained at 3.8% in August 2025, while the base rate stands at 4% after a cut on 7 August.

Relatively high inflation not only affects the finances of UK households, as it means our money can buy less than it did one year before, it also influences the level of the Bank of England’s base rate.

The Bank uses the base rate as a tool to help control inflation so, with inflation remaining significantly above its target of 2%, the Monetary Policy Committee (MPC) is widely expected to hold the base rate at its current level of 4% tomorrow (18 September).

Inflation, measured using the Consumer Price Index (CPI), tells us how the prices of goods and services have changed over the past year. So, in August, prices are generally 3.8% higher than last year.

When inflation is high, the Bank of England is typically more likely to hold or increase the base rate. Because a higher base rate keeps the cost of borrowing higher and savings rates higher, it aims to discourage consumers from spending, in turn reducing demand and helping to control inflation. Read more in our guide to the base rate.

Worryingly for households, food prices rose by 5.1% in the year to August, the highest recorded level since January 2024. This is the fifth month in a row that food prices have increased, with cheese, vegetables and milk some of the areas that pushed up food price inflation. The restaurant and hotel sector also saw prices increase over the past year, rising by 3.8% in August compared to 3.4% in the year to July.

However, there were more encouraging signs elsewhere as prices in the transport sector rose by 2.4% in the year to August, down from an annual rate of 3.2% the previous month. The cost of petrol and diesel is now cheaper than one year before, while a smaller annual rise in air fares and falling vehicle maintenance and repair costs also contributed to the slower annual rate of inflation in this sector.

“Sticky inflation will no doubt leave many savers disheartened, as the Moneyfacts Average Savings rate shows real returns remain in the negatives for the third consecutive month. Even the market-leading rates leave savers earning less than 1% in real terms, £1 saved in 2020 is now worth just £0.89,” Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk, commented.

“Despite this, savers can still choose from hundreds of inflation and base rate-beating deals, but they would be wise to act quickly as this number could fluctuate because of dropping rates and unpredictable inflation,” she added.

Typically, more attractive returns are offered to savers willing to lock their cash away for longer but, depending on their specific savings goal, this may not be for everyone.

Some savers may opt for a shorter fixed term so they can access their money sooner, but this may not offer the best return. If savers stash away £10,000 today, in five years’ time it will have earned over £2,500, but this may not be the case for shorter terms, especially if rates fall further.

“Savers may be put off by the current conditions of the market but leaving their cash languishing in an account paying 3.8% or less could leave them significantly worse off so it is always worth searching for a more competitive deal,” Eastell concluded.

At the time of the announcement, 976 savings accounts paid a higher interest rate than inflation, including easy access and fixed rate accounts. By contrast, one year ago, more than 1,606 accounts offered an inflation-beating return.

To ensure you’re getting a return on your money in real terms, visit our savings charts and ISA charts to find the best rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.