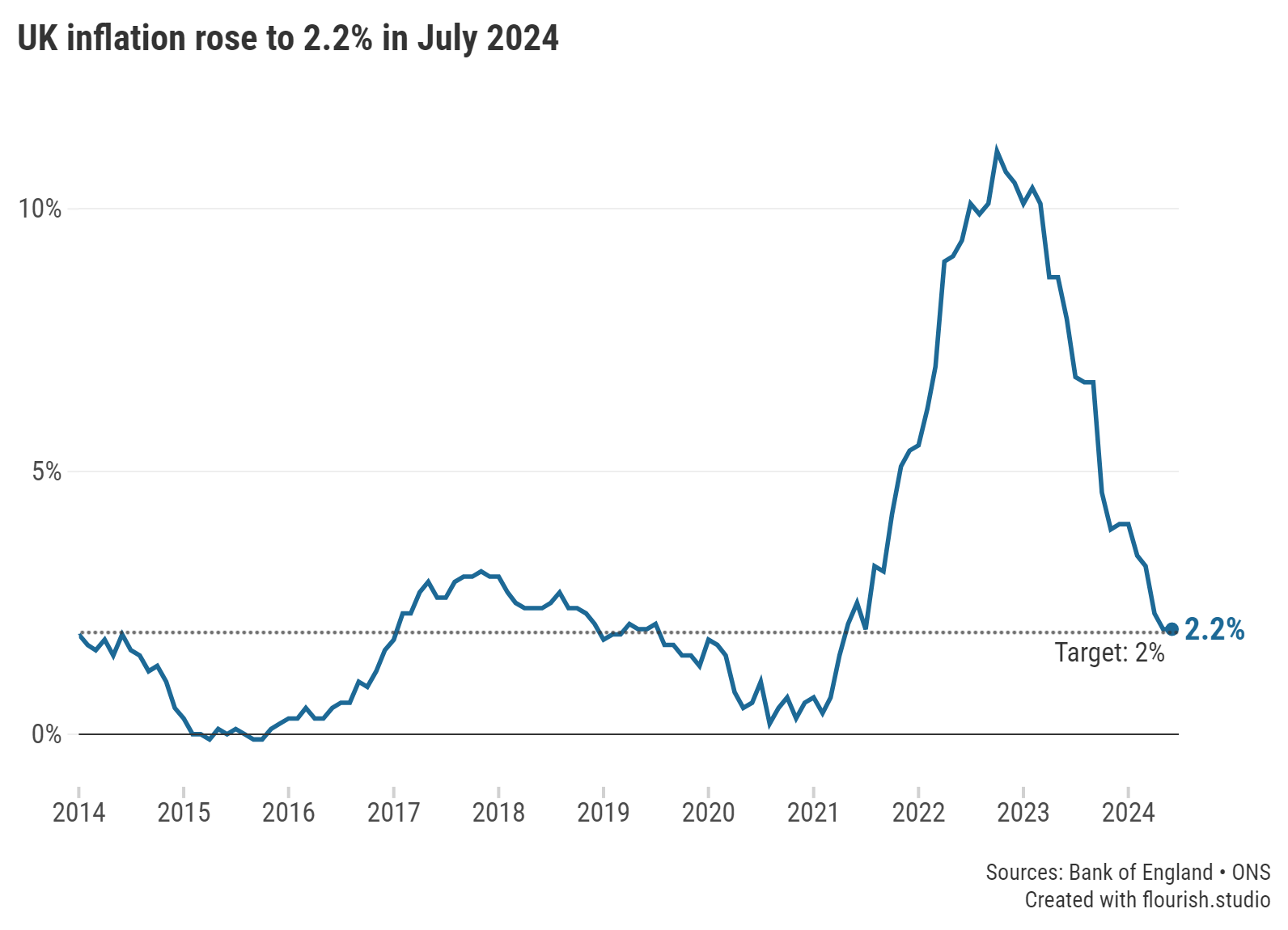

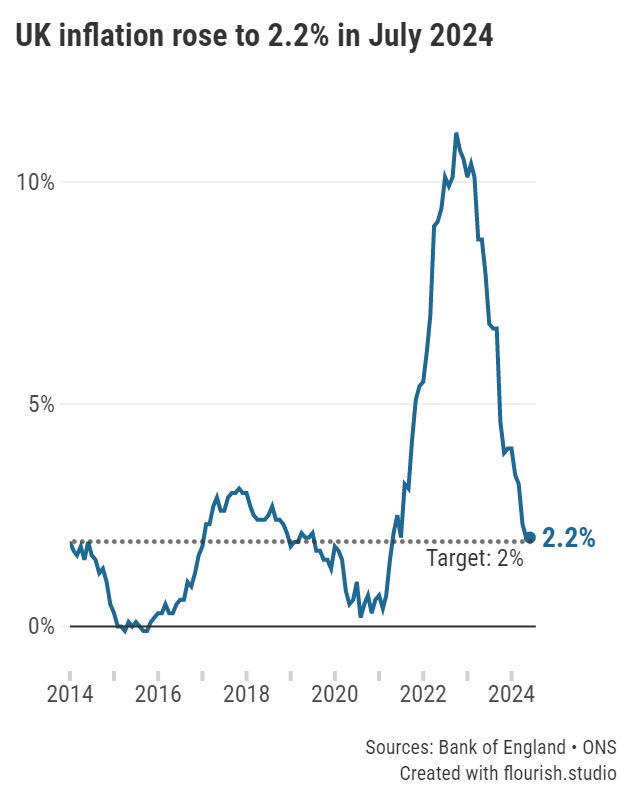

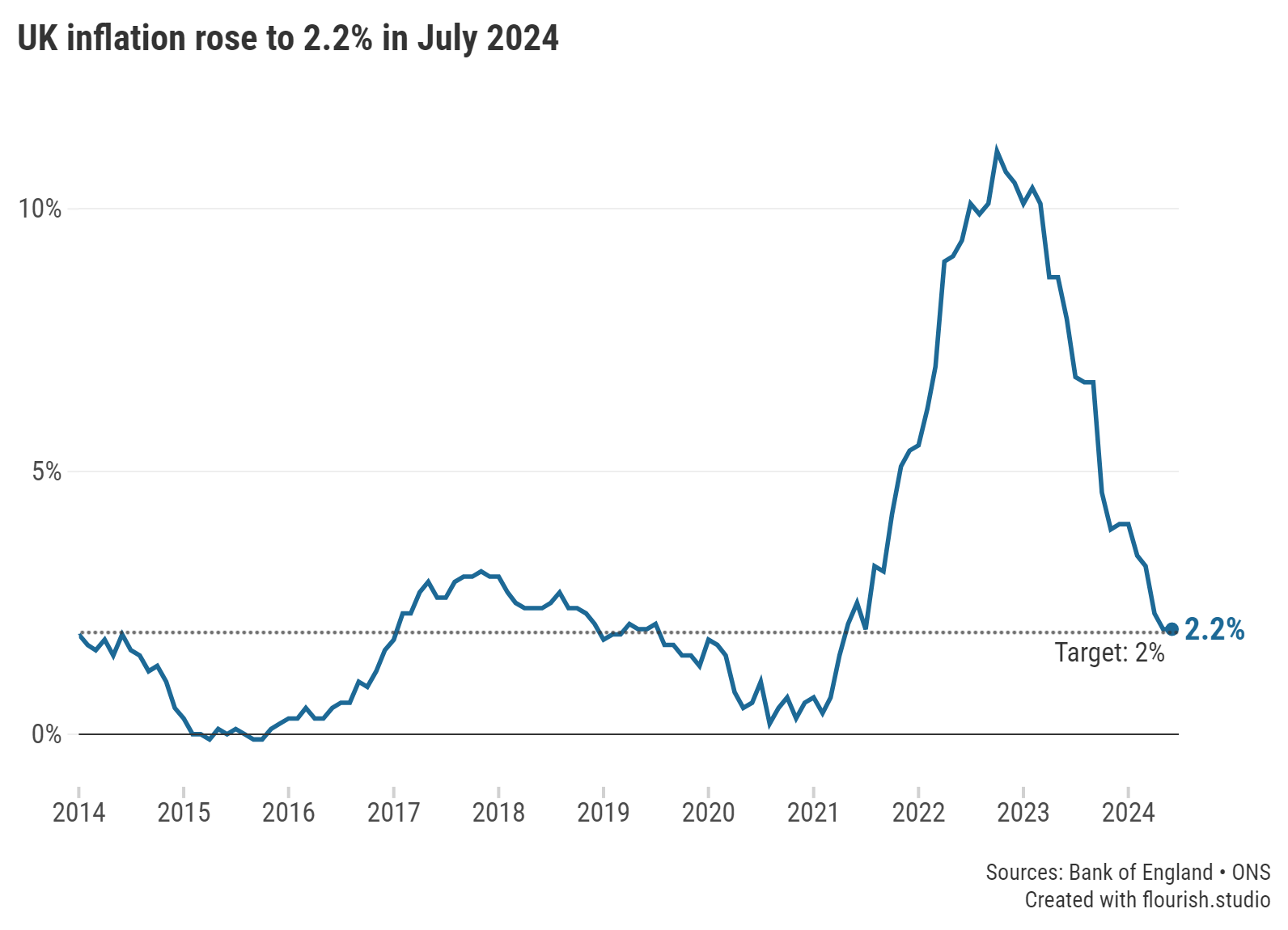

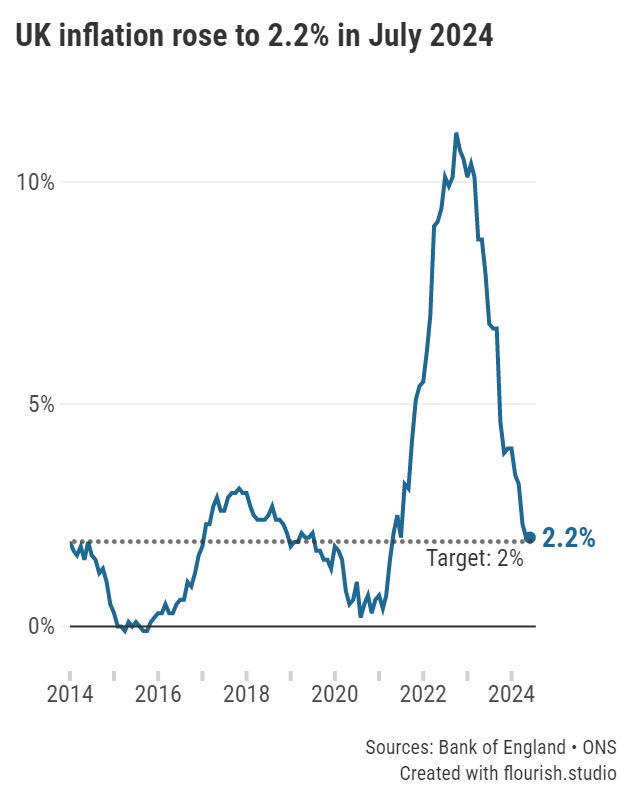

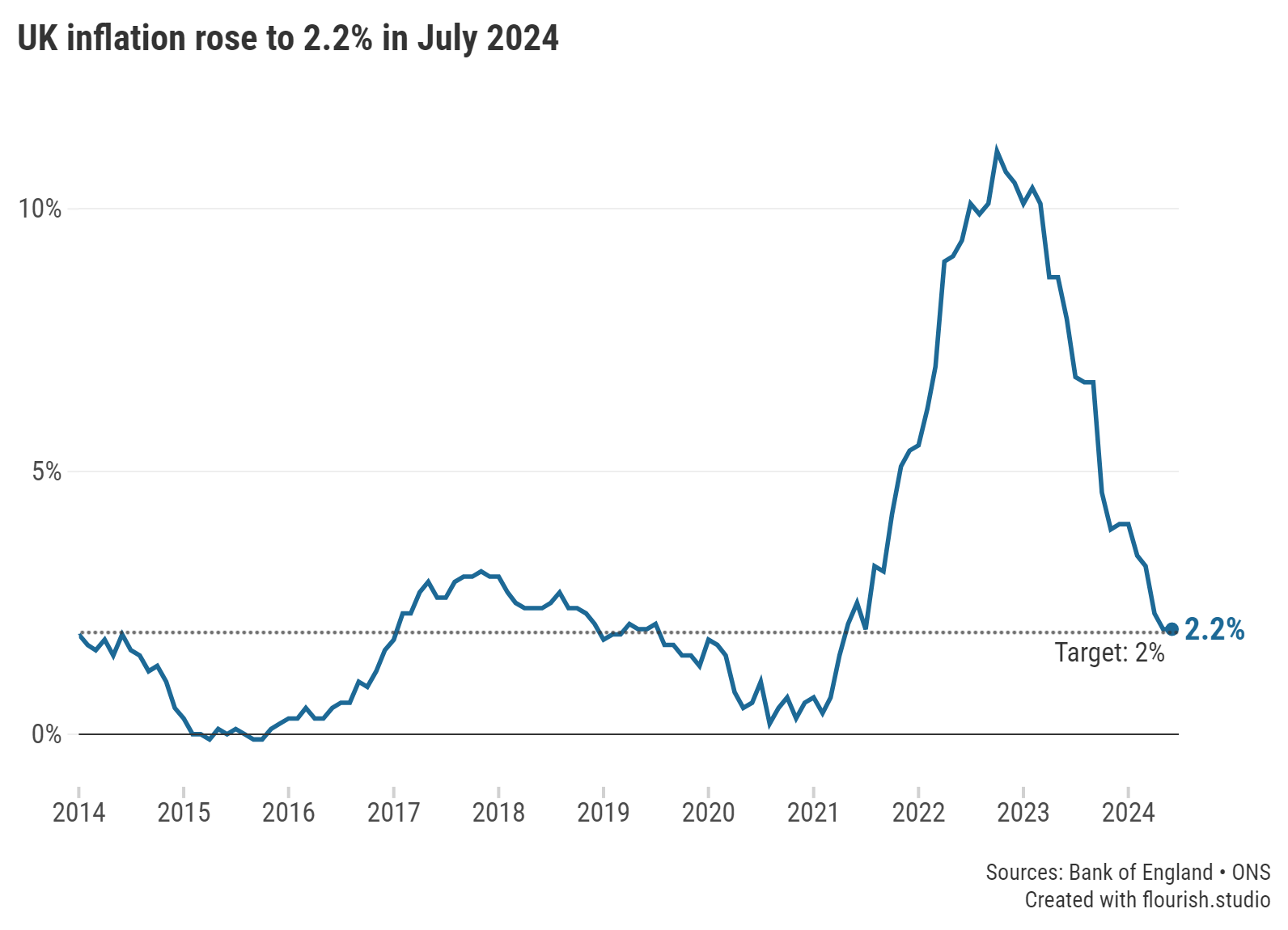

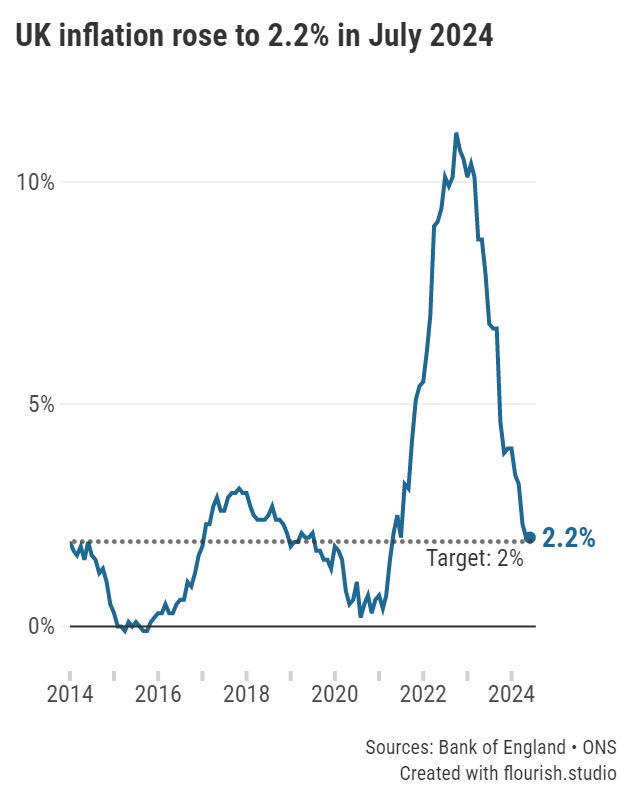

The rate of inflation rose from 2% in June to 2.2% in July.

Marking the first increase this year, inflation rose to 2.2% in July 2024, according to the latest figures from the Office for National Statistics (ONS).

This means that prices have increased at a higher rate in the year to July than they did in the year to June.

The rate of inflation had been on a steady decline since December 2023, and reached the Government’s target of 2% in May 2024, where it held steady until June 2024.

The rate of inflation shows how quickly, or slowly, the prices of goods and services have risen over the past year. The Consumer Price Index (CPI) is the key metric used to show the inflation rate.

A rise in inflation means that prices have seen a larger increase year-on-year compared with the previous month.

Graph: UK Inflation rose to 2.2% in July 2024.

One of the main contributors to the rise in inflation was in housing and household services, which saw annual prices rise to 3.7% in the year to July, up from 2.3% in the year to June.

This was largely due to gas and electricity prices, which fell by 7.8% and 6.8% respectively in July 2024, a smaller drop in prices than in 2023.

This partly explains the slight uptick in inflation this month.

Energy prices are lower than they were last year, but figures from the ONS show that gas prices are around 68% higher than they were in March 2021, while electricity costs are around 45% higher.

The service sector helped to keep inflation down in July, as restaurants and hotels saw prices rise by 4.9% in the year to July, down from 6.3% in the year to June. The slower annual rate is largely explained by a monthly fall in hotel prices of 6.4%, compared with a rise of 8.2% last year.

This fall in prices comes after the sector observed one of the largest increases in costs between May and June.

It is crucial savers keep on top of the changing market and make the switch to ensure they are not getting a raw deal, especially as we have seen some of the top rate deals drop below 5%. It would not be too surprising to see more providers adjusting their rates in reaction.

Since the previous inflation announcement, fixed rates have faced further reductions, so it may be wise for savers to begin considering locking into an interest rate while the majority continue to pay competitive returns. Longer-term rates have suffered the most, seeing drops as large as 0.31% for a five-year term month-on-month.

Although, typically, base rate cuts usually impact variable rates, we have been seeing an increasing number of providers lowering rates on accounts offering fixed returns. Shorter-term savers are continuing to be incentivised with higher top rates, however, they have been experiencing some drops; the previous market-leading non-ISA one-year bond lasted a couple of weeks, so it is imperative savers act quickly.

For now, top-rate variable accounts have seen little volatility since the previous inflation announcement, but it remains to be seen how long this lasts.

One area of the market to see improvements has been the returns offered on ISAs; longer-term rates have thrived with new market-leading rates across the board. Savers who are open to locking away their cash for a five-year term can now receive the same return on their ISA as its five-year bond counterpart.

However, the best notice accounts have seen a dip in top rates month-on-month and now pay below 5%, which may be bad news for consumers looking to maximise their tax-free savings.

This may not be wholly unexpected, and it would be sensible to expect more reductions to variable rate products alongside the Bank of England’s decision to drop interest rates at the beginning of the month.

Predictions suggest that inflation may begin to slowly tick up again in the coming months as high energy and food prices fall out of the index and as service inflation continues to be a core issue.

During this time, it is crucial that savers do not grow complacent with their pots and switch accounts when attractive deals appear to ensure that inflation does not erode their cash.

There are currently 1,558 savings accounts that now beat the rate of inflation. Visit our charts to compare the top easy access savings accounts, fixed rate bonds and notice accounts.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.