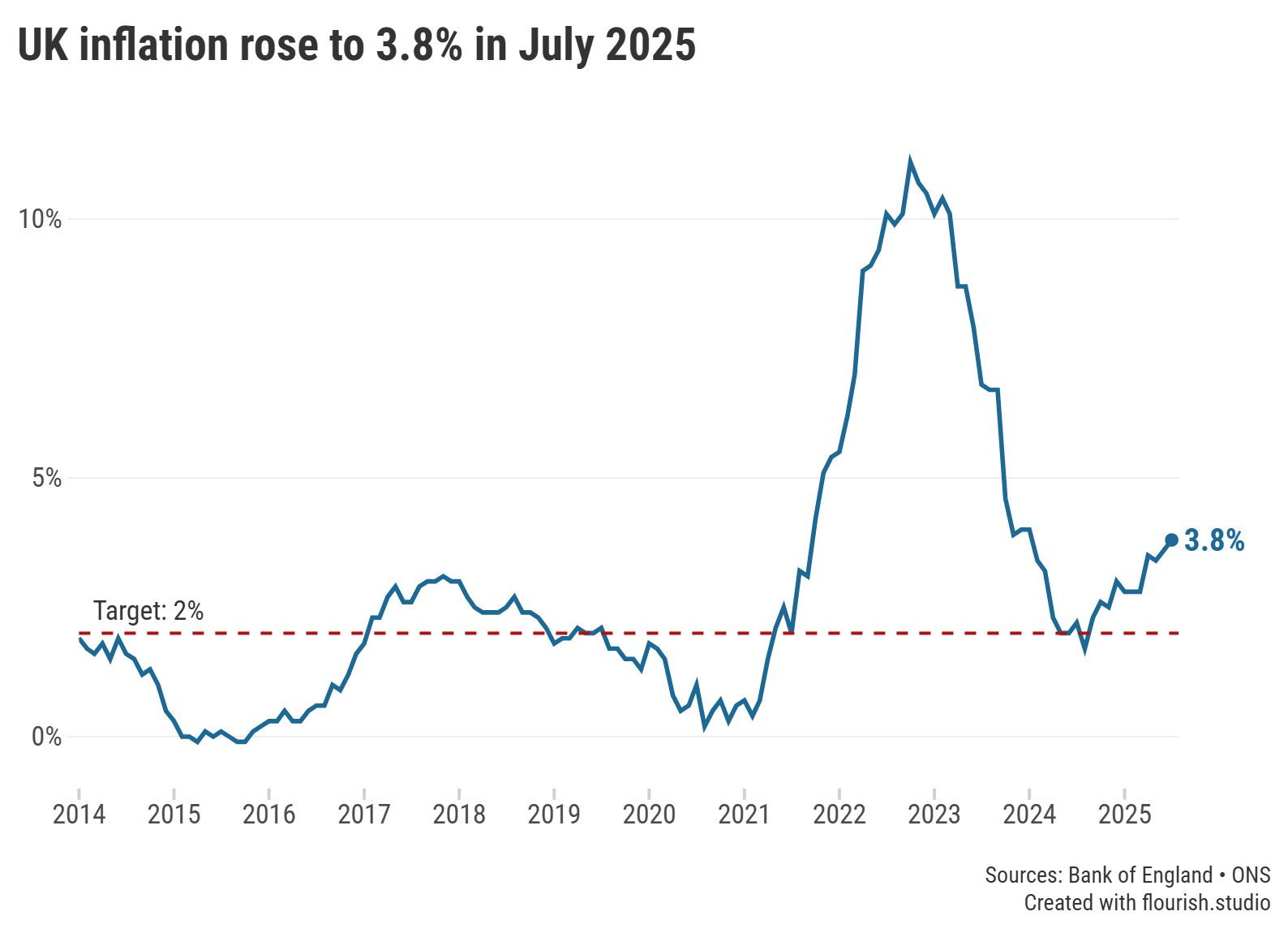

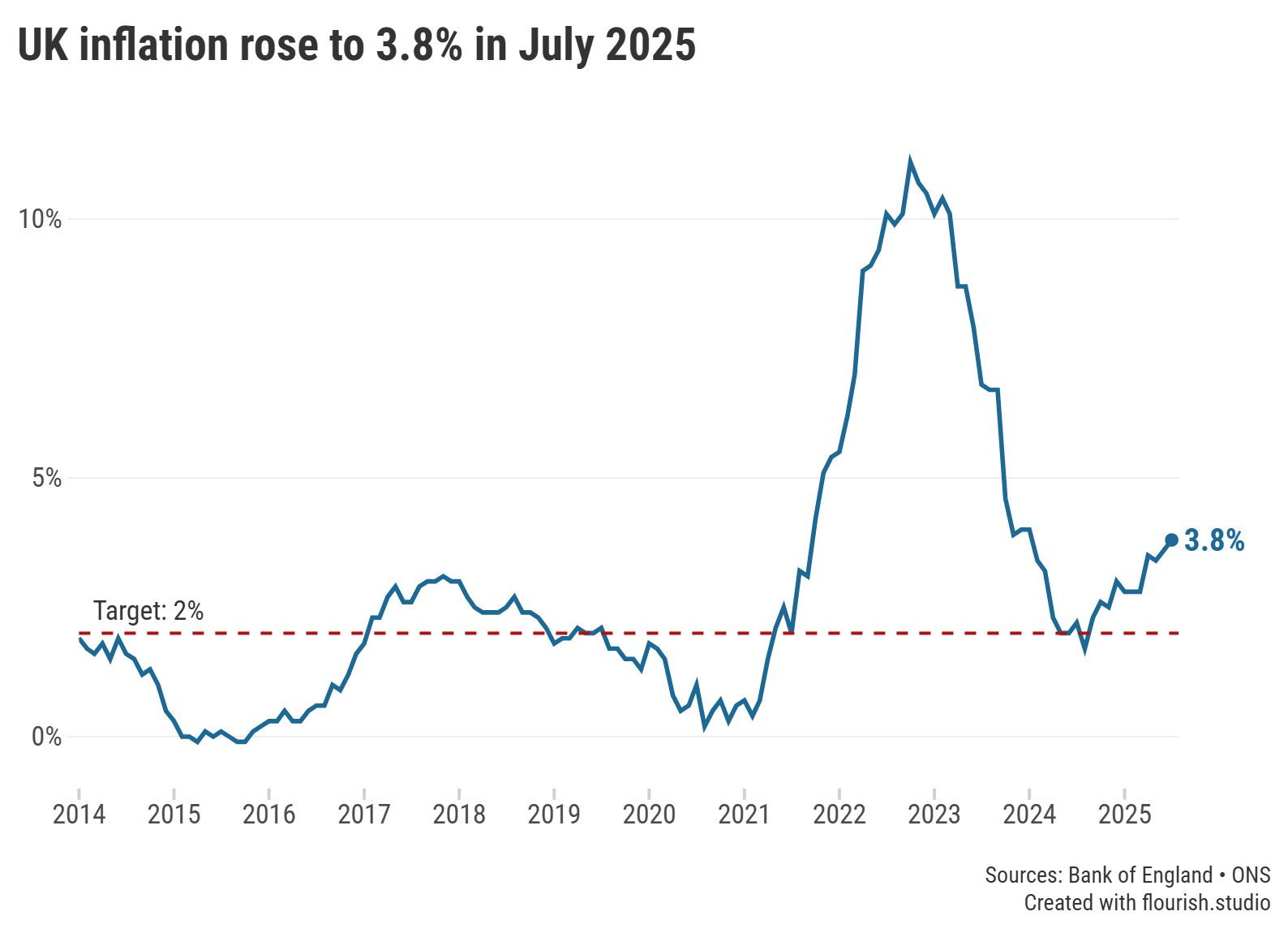

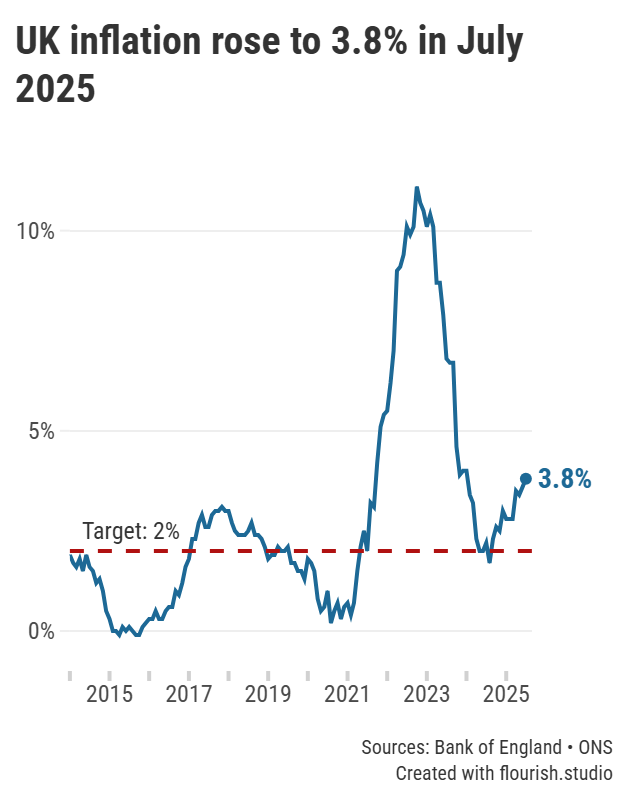

Inflation is now nearly double the Bank of England’s target of 2%.

After the annual rate of inflation rose to 3.6% in June, the overall cost of goods and services increased once again by 3.8% in the year to July, according to the latest data from the Office for National Statistics (ONS).

This is the highest the annual rate of inflation has been since January 2024, when it stood at 4%.

An increase in inflation wasn’t too surprising, but this jump will still be a blow for consumers who are struggling with rising prices, as well as savers who are seeing the value of their money erode in real terms.

The Consumer Price Index (CPI) is the main measure of inflation. Calculated by the Office for National Statistics (ONS), it tells us how much the prices of goods and services have changed over the past year. A higher inflation figure means that, in general, things are more expensive than they were 12 months ago.

Read more in our guide to inflation and what it means for you.

This latest rise in inflation will also cast more doubt on the possibility of any further cuts to the Bank of England base rate in 2025. The base rate, or central interest rate, is an important tool to help the Bank control the level of inflation in the UK, with a higher base rate designed to help curb any price rises.

Even though June’s inflation figure was higher than expected, the Bank’s Monetary Policy Committee (MPC) still decided to lower the base rate to 4.00% at the start of August due to a struggling jobs market and concerns over the economy.

However, with predictions that inflation could rise to 4% in September, another lowering of the base rate appears less likely as the Bank is coming under pressure to get inflation closer to its target of 2%.

The inflation figures for August are due on 17 September, just one day before the next base rate announcement.

Graph: The annual rate of inflation rose to 3.8% in July 2025, moving further away from the target of 2%.

The timing of the summer holidays appears to have played a major role in pushing up the level of inflation. For example, the transport sector saw a particularly notable leap in prices, increasing by 3.2% in the year to July compared to an annual rise of 1.7% in June. This was largely due to the cost of airfares, which rose by 30.2% between June and July, the highest July increase since at least 2001 (when data began to be collected each month). Furthermore, the cost of petrol and diesel increased between June and July 2025, whereas these prices dropped over the same period one year earlier.

Elsewhere, the restaurant and hotel sector saw prices rise by 3.4% in the 12 months to July, with last-minute overnight hotel stays having a particularly significant effect.

And, worryingly for those who are struggling with the cost of their food shop, the annual inflation rate of food and non-alcoholic drinks increased for the fourth consecutive month, rising from 4.5% in June to 4.9% in July. Beef, chocolate, instant coffee and fresh orange juice were some of the main drivers of inflation in this sector, which is now at its highest level since February 2024. However, it remains significantly lower than the levels seen in 2023.

“After almost a year and a half of savings growth, many savers are slipping back into earning negative real returns as inflation figures jump again. The Moneyfacts Average Savings Rate currently sits at 3.47%, lower than the latest CPI reading of 3.8%,” Caitlyn Eastell, spokesperson at Moneyfactscompare.co.uk, commented.

“Adding insult to injury, there are also hundreds fewer inflation-beating deals available compared to 12 months ago,” she pointed out.

With inflation running higher than the interest savings earn, money left languishing in a low-interest account is losing its spending power – making it tougher to achieve a sense of financial resilience or save towards goals such as a car, house or comfortable retirement. This comes hot on the heels of the latest base rate reduction which had an almost instantaneous effect, with over a dozen savings account providers cutting variable rates within 24 hours and many more likely to tumble in the coming weeks.

This latest inflation increase should prompt savers to review their existing accounts and, if they are earning less than 3.8%, to immediately search for a better deal.

Even though fewer than half of the available savings accounts on the market can beat inflation, there are still more than 900 accounts that can still offer a real return on your money.

This includes 85 easy access accounts and just under 500 fixed rate bonds. Or, to earn tax-free interest, more than 70 variable ISAs and more than 200 fixed rate ISAs can offer inflation-beating rates. See our savings and ISA charts to compare rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.