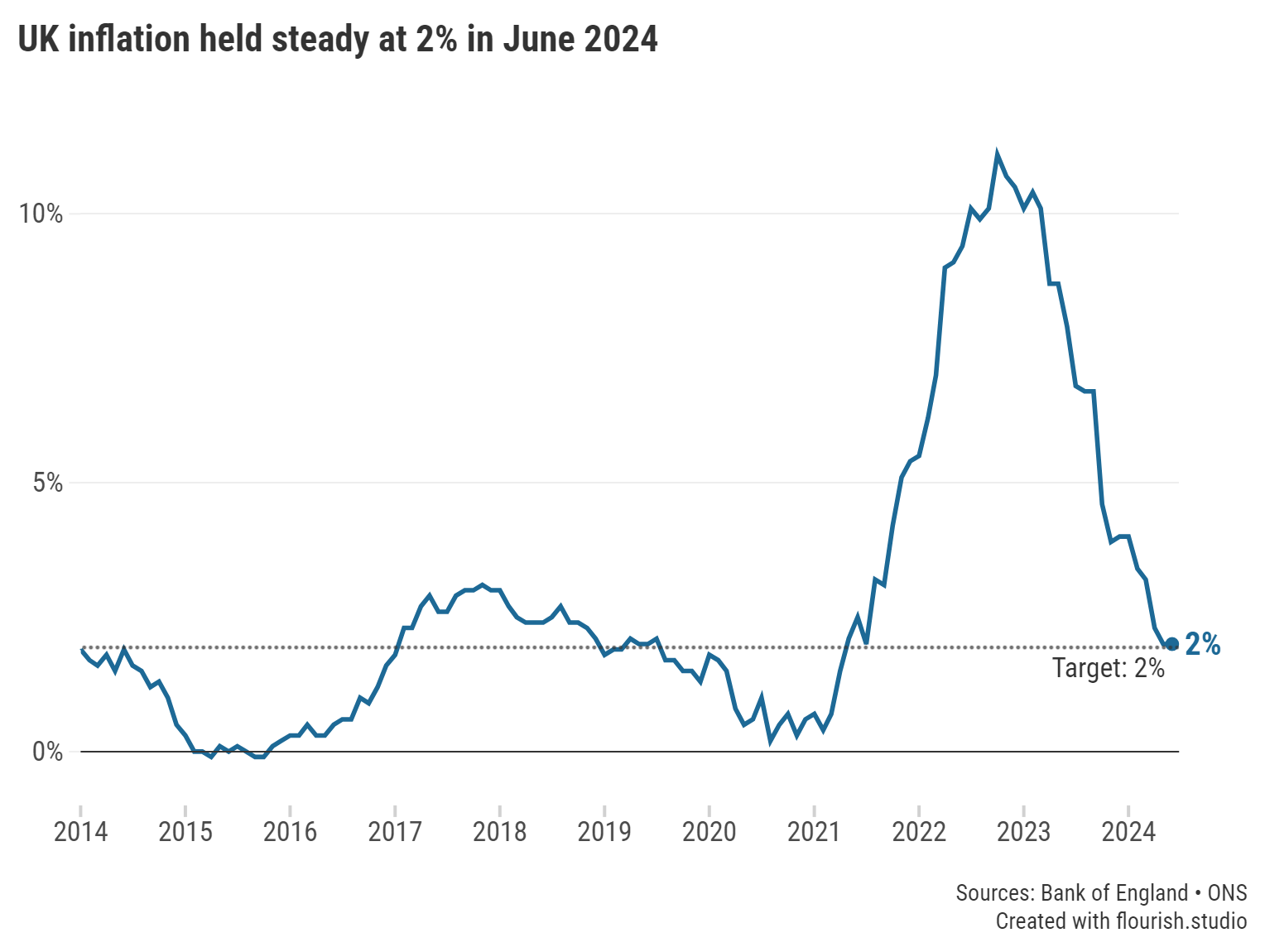

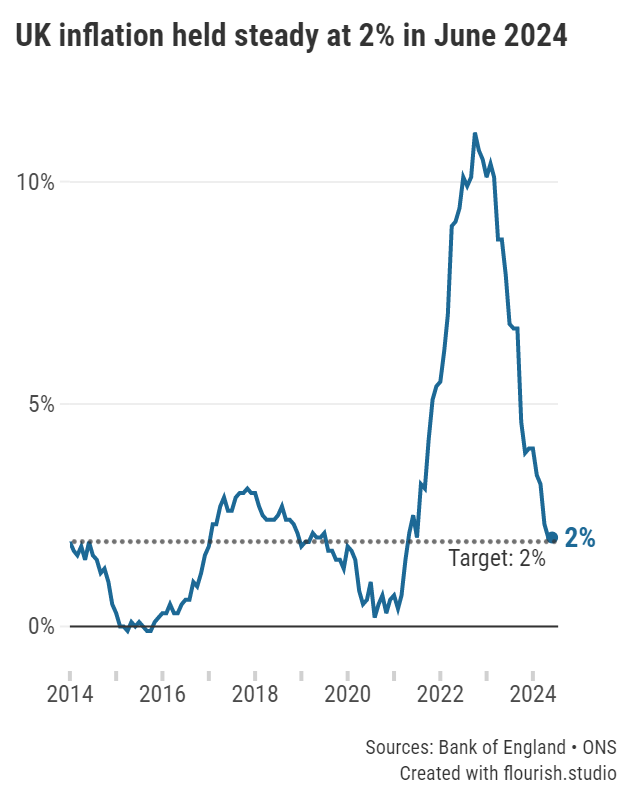

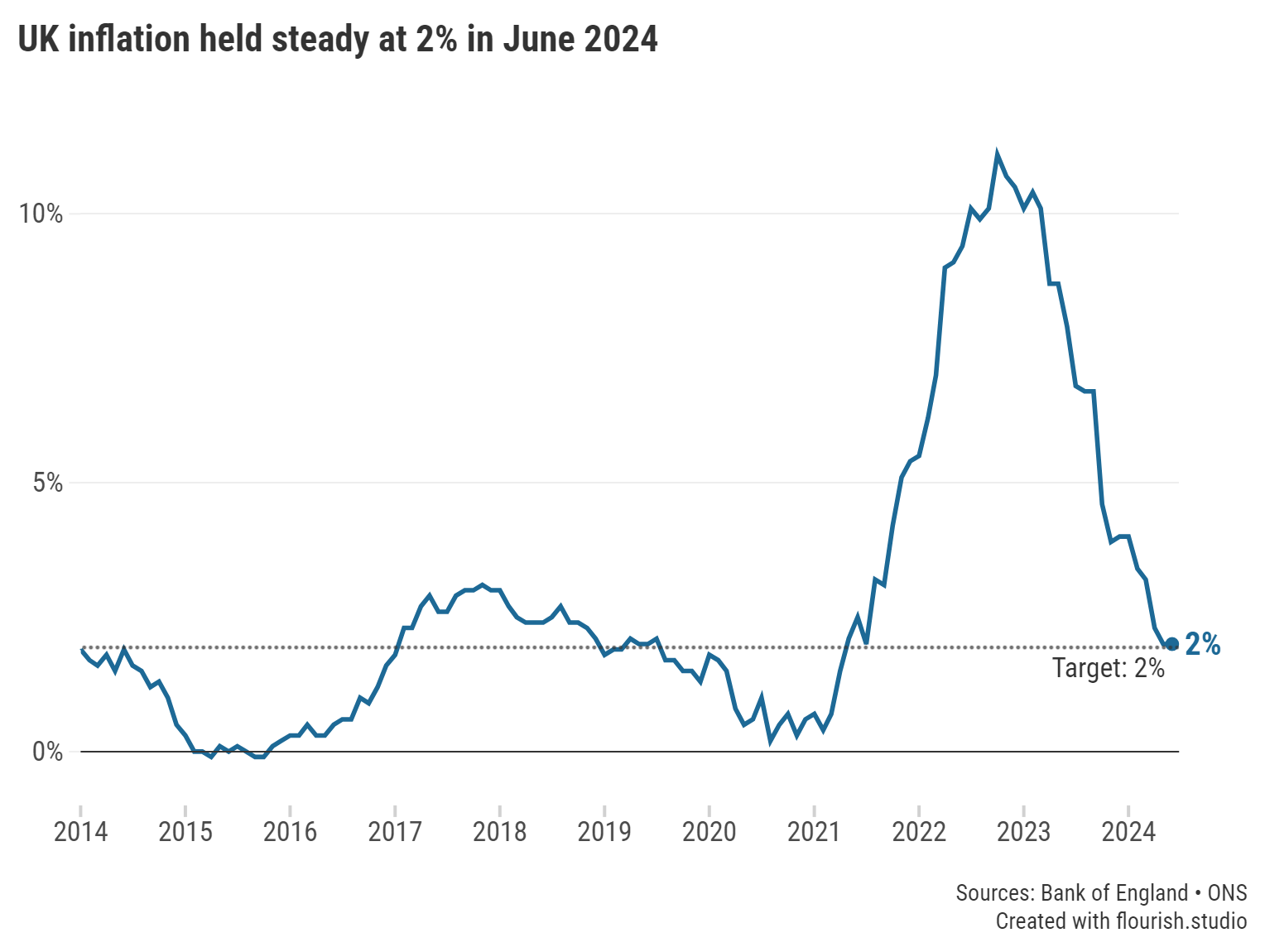

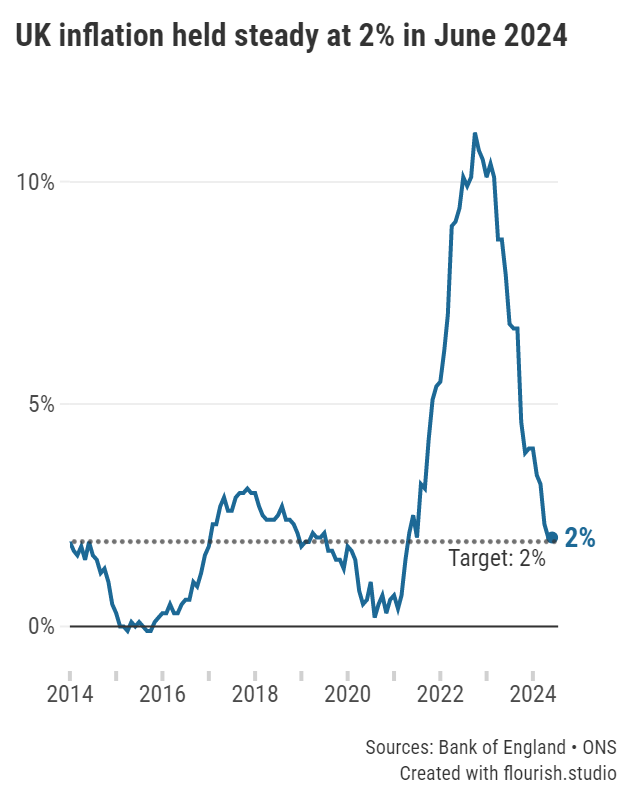

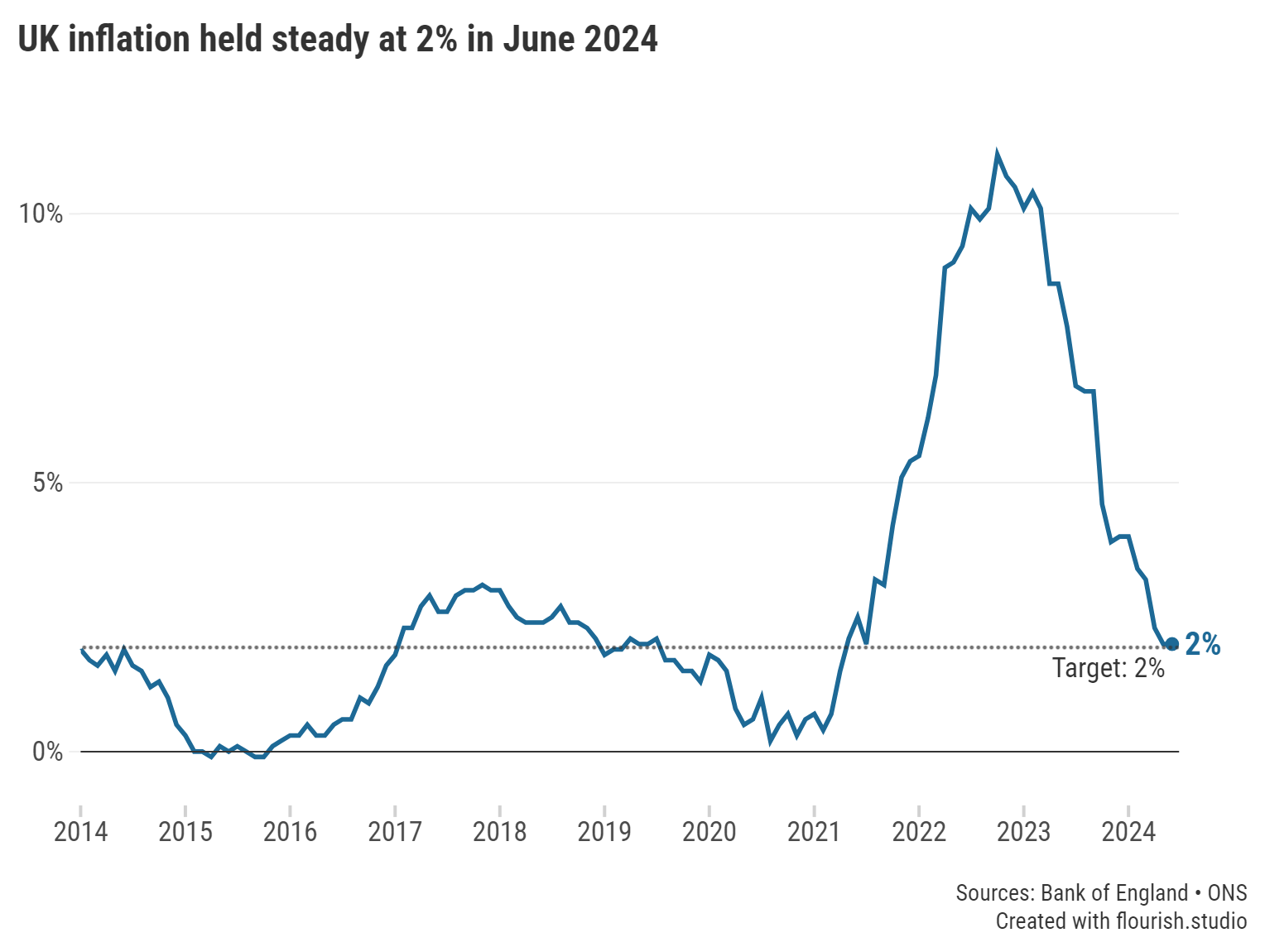

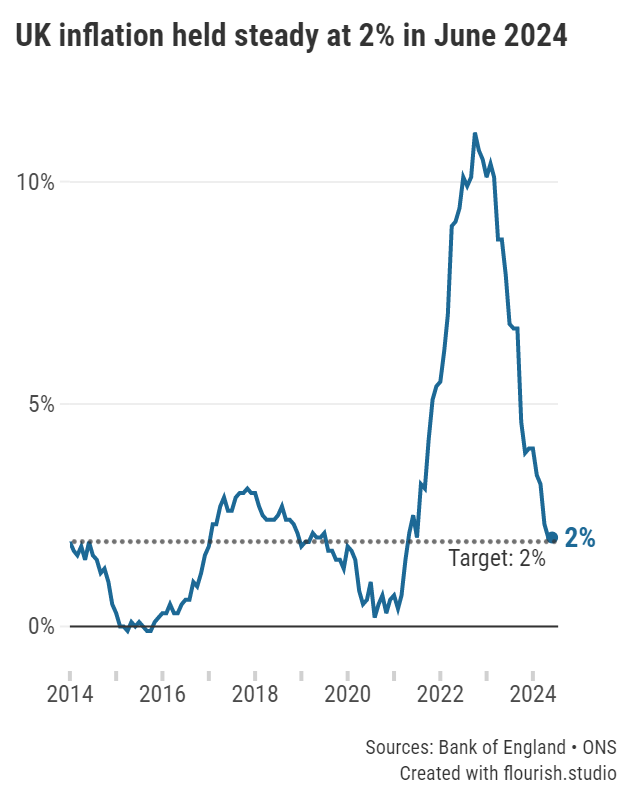

After months of consecutive drops, the rate of inflation remained at 2% in June 2024.

Inflation saw no change in June as it held at 2% for the second consecutive month, according to the latest figures from the Office for National Statistics (ONS).

This means that prices rose at the same rate in the year to June as they did in the year to May.

The rate of inflation has been falling steadily over the past few months and finally met the Bank of England’s target of 2% in May, but this downward trend has ended, at least for now.

Inflation is one of the factors that the Bank of England’s Monetary Policy Committee (MPC) looks at when deciding whether to change the base rate.

As a result, many will be wondering if these latest inflation figures will be enough to convince the Committee to cut the base rate at their next vote on 1 August.

Inflation is a metric that tells us how quickly, or slowly, prices of goods and services have risen over the past year. The Consumer Price Index (CPI) is the key metric used to show the inflation rate.

Bear in mind that, even though the rate of inflation hasn’t changed month-on-month, it still means prices are higher than the previous year.

Graph: UK Inflation held steady at 2% in June 2024.

Restaurants and hotels saw one of the largest increases in costs, as prices in this sector rose by 6.3% in the year to June 2024. Prices rose by 0.9% between May and June 2024, with hotels seeing a particularly significant monthly increase of 8.8%.

Transport costs also saw a notable rise of 0.7% in the year to June, which was its largest annual price rise since September 2023.

On the other hand, clothing and footwear helped to push down the rate of inflation as many shops offered a range of sales and reductions to attract customers. Prices in this category rose by 1.6% in the year to June 2024 and, on a monthly basis, dropped by 1.2% between May and June.

Prices of food and non-alcoholic beverages also continued to fall from their recent highs as they rose by just 1.5% in the year to June 2024, which was the lowest figure since October 2021. Bread, cereals, meat and fruit were some of the items that contributed the most to this easing in prices.

As inflation continues to soften its burden on savers’ pots, they may find that they can earn more cash in real terms, especially with recent fluctuations in the top rates offered.

However, those investing in the longer-term will find that rates have remained steady. Both variable rate and fixed rate ISAs have seen an increase in average rates, whereas non-ISA savings have seen a mixture of rises and falls across the board.

Many flexible accounts have soared in the past year, largely due to the several consecutive base rate rises throughout 2023 and fairer competition championed by the Financial Conduct Authority (FCA), which may be positive news for those less inclined to lock away their cash. However, with an imminent reduction to interest rates possible, savers should anticipate similar cuts to easy access and notice rates.

It is crucial that when the time comes savers are willing to switch when more enticing deals enter the market.

Fixed rates are continuing to drop and are significantly lower than they were a year ago; savers who are about to have their one-year fix expire can now expect to receive almost 1% less interest compared to the market-leading rate in July 2023. Despite this, savers should still make the most of current top rates as appetite to secure longer-term deals picks up and to keep on top of inflation and base rate for longer.

Within the ISA market the top fixed rates have been volatile. Two- and three-year fixes have benefited the most with new market-leading rates, which may be positive news to those looking to make the most out of their ISA allowances for longer. But if consumers are comfortable with the risk associated with a variable rate then there are still a handful of competitive deals available paying around 5%.

It’s possible that the new Government may well decide to change existing tax savings allowances or policies. Savers with bigger pots could see a cap put onto the amount that can be earnt tax-free. Many may be hopeful for the ISA allowance to rise from £20,000 as this has been unchanged for years, however, these changes are yet to be seen.

It is as crucial as ever that savers keep monitoring their savings to ensure that they are being rewarded. In any case, savers should consider any relevant criteria to ensure the account is suitable for their needs.

Over 1,600 savings accounts now beat the rate of inflation. Use our charts to compare the top easy access savings accounts, fixed rate bonds and notice accounts.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.