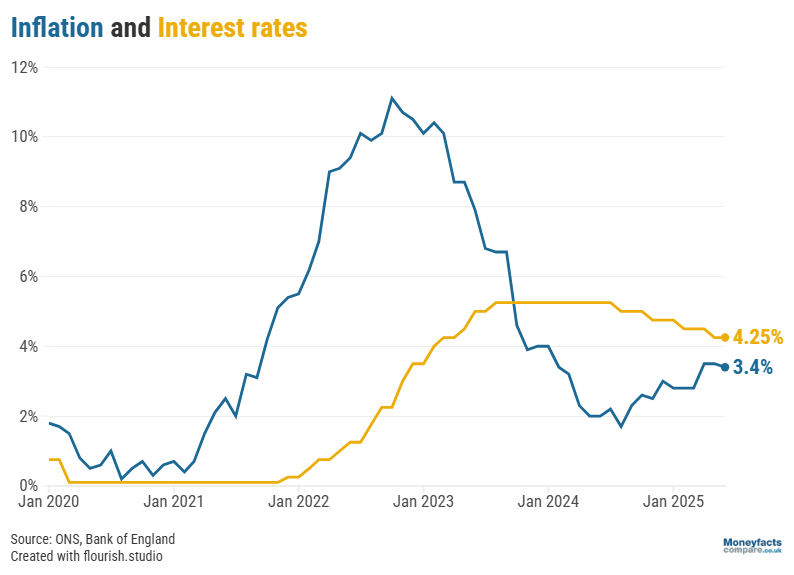

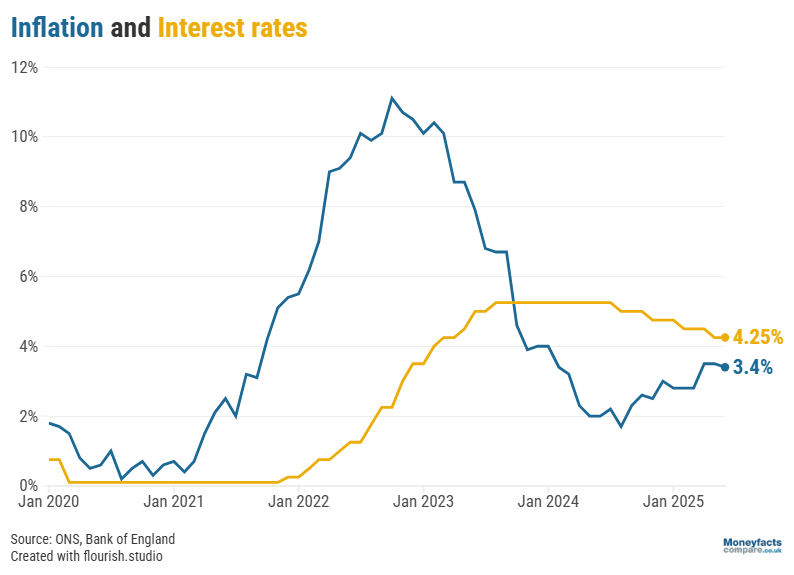

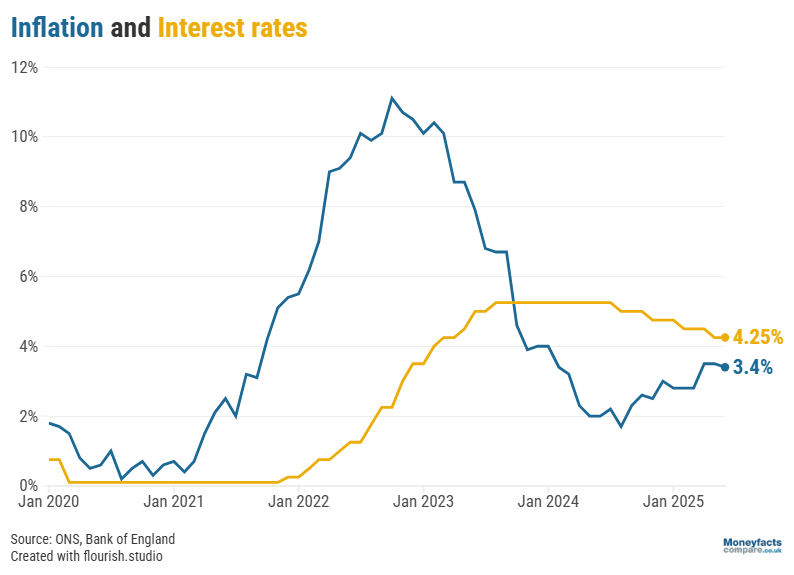

The last time the annual rate of inflation was higher was in January 2024.

While many experts expected inflation to remain at a similar level to May’s figure of 3.4%, it rose to 3.6% in the 12 months to June, according to the most recent data from the Office for National Statistics (ONS).

This is the highest it has been in almost a year and a half, when it reached 4% in January 2024.

The latest rise means inflation has moved even further away from the Bank of England’s target of 2%, which could cast some doubt over whether the base rate will be cut in August.

Inflation tells us how much the prices of goods and services have changed over the past year. When inflation rises, it means that prices are generally more expensive than they were in the same month last year. The main measure of inflation is known as the Consumer Price Index (CPI).

The Bank of England uses the central interest rate, or base rate, as a tool to help control inflation. Read our guide for more information on inflation and how it affects the central interest rate.

The Bank’s Monetary Policy Committee (MPC) is still widely predicted to lower the base rate at its next meeting on 7 August, but the higher-than-expected level of inflation may persuade some members to maintain the base rate at 4.25% and delay any cuts in an effort to control rising prices.

However, inflation is just one factor that the MPC consider when setting the base rate, and the labour market statistics that are due to be released tomorrow (17 July) may also influence their decision.

Graph: The annual rate of inflation rose to 3.6% in June 2025.

Increasing transport costs, including higher air and rail fares, were a major factor for the rise in inflation as they rose by 1.7% in the 12 months to June. By contrast, they rose by just 0.7% in the year to May. Although petrol and diesel prices actually saw a slight marginal fall between May and June, this drop was notably smaller than between the same months last year.

Food and non-alcoholic beverages also contributed to the uptick in inflation, as prices in this sector rose by 4.5% in the year to June. This is the third consecutive month the sector has recorded a rise in its annual inflation rate and, at 4.5%, it’s now at its highest level since February 2024. Meat, cakes and cheddar cheese were some of the food items behind the rising prices in this sector.

Elsewhere, clothing and footwear prices continued to fluctuate. Prices rose by 0.5% in the 12 months to June, compared with a fall of 0.3% in the 12 months to May.

"Today’s inflation figures come as bad news to savers as it now exceeds the average return they can expect on their savings, and many must now act quickly to avoid inflation eroding their hard-earned wealth by moving their money to the most competitive accounts," commented Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk.

"It is essential savers earning less than the level of inflation shop around for better returns immediately," she added.

Some of the best-paying accounts which include easy access and fixed term accounts pay over 4%, plus the best regular savings accounts, into which you can save smaller amounts each month, are paying around 7%. However, today’s best rates shouldn’t be taken for granted.

While many top paying rates have improved in the past month, it may be a short-term reprieve - there has also been a harsh cut of almost 1% when looking back at one-year fixed rate bonds this time last year.

For now, the gap between the best variable, short-term and long-term rates is on a knife edge, but it could change quickly. Some of the best returns can currently be found with easy access accounts, but these rates are variable, and they are liable to be cut if the Bank of England lowers rates, as expected later this year.

There are just below 1,300 savings accounts and ISAs that can offer returns that beat the current rate of inflation, including more than 100 easy access savings accounts and more than 600 fixed bonds.

If you're looking for an ISA, more than 400 easy access ISAs and fixed rate ISAs offer inflation-beating rates.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.