Easing food prices counteract upwards contributions from fuel costs.

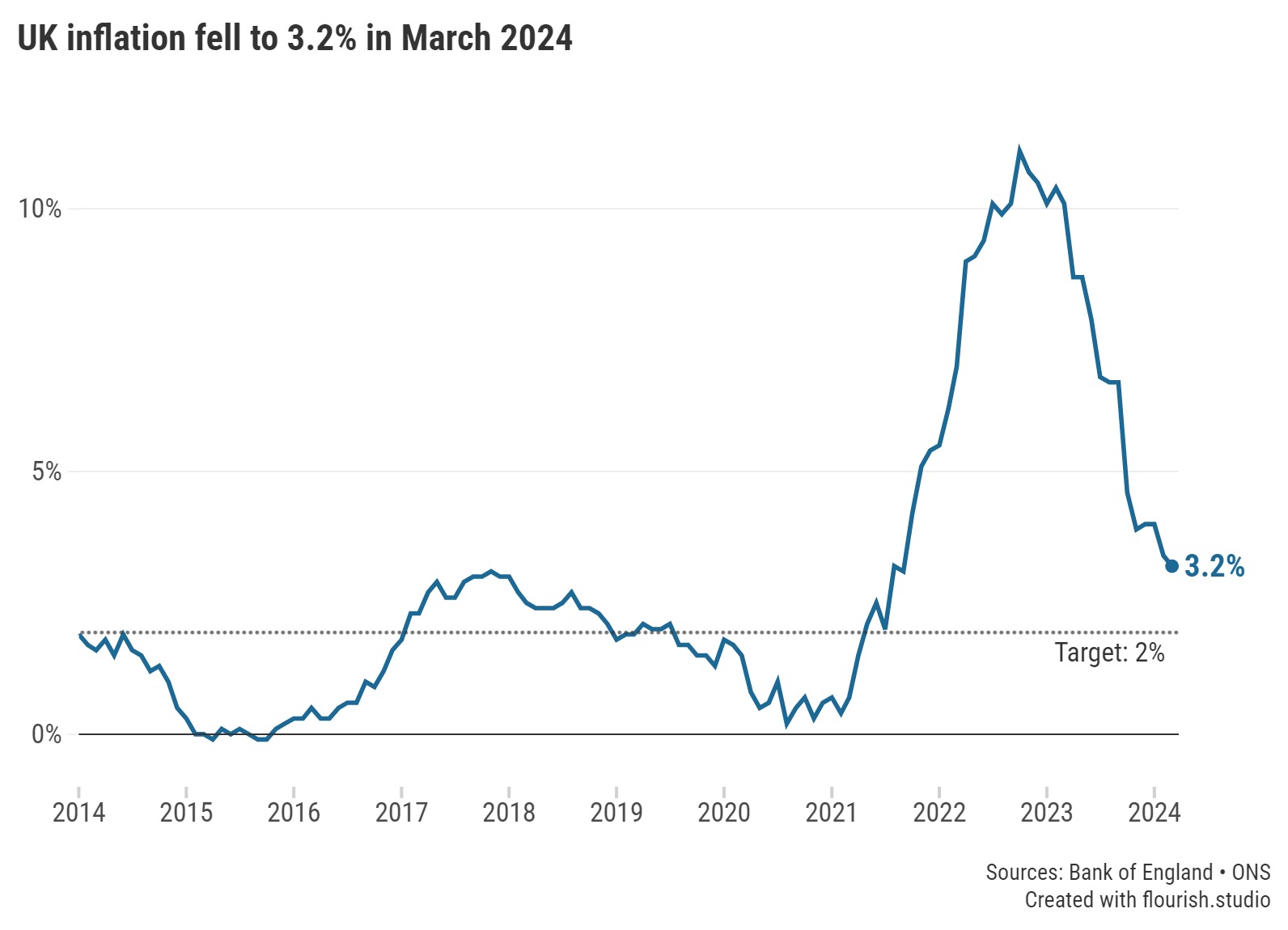

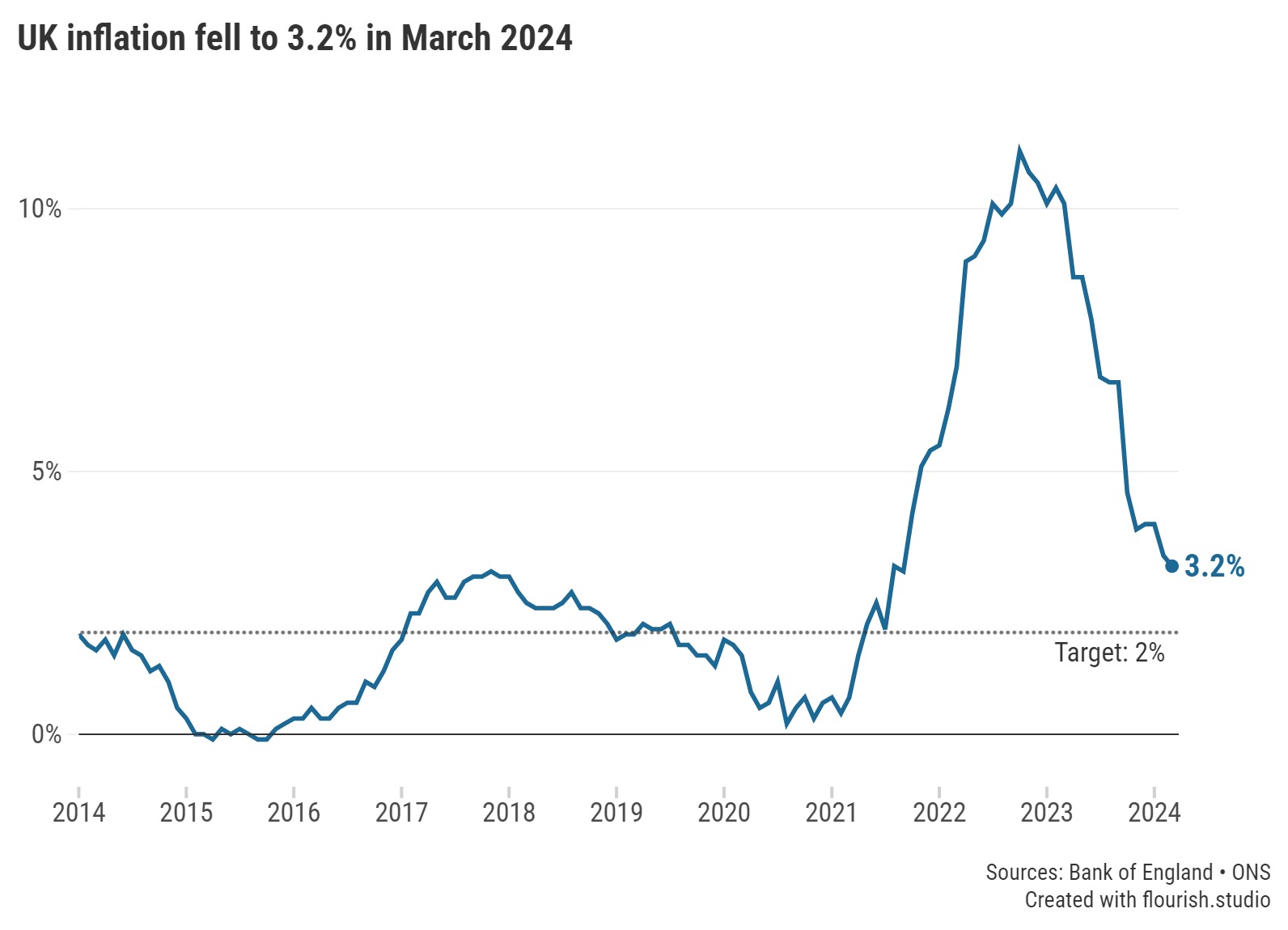

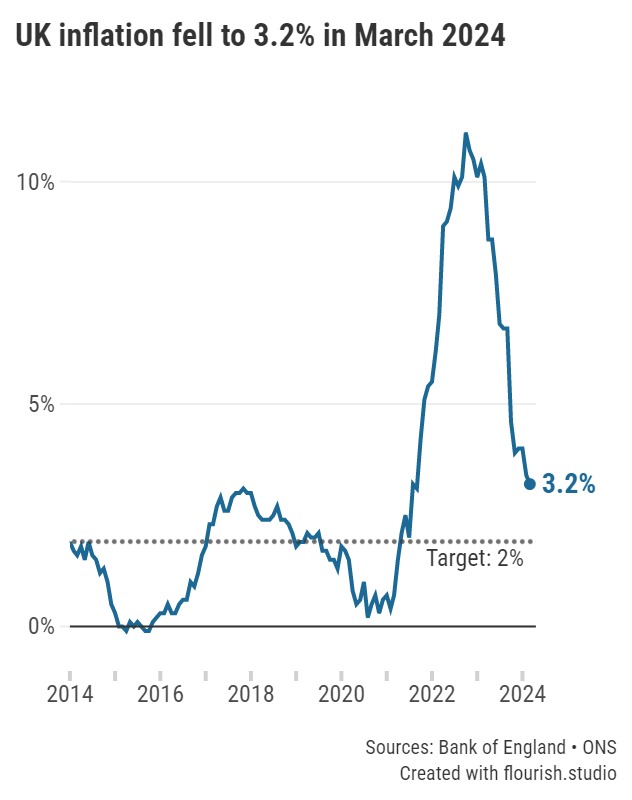

The rate of UK inflation eased to 3.2% in the year to March 2024, today’s release from the Office for National Statistics (ONS) found. While this is down from 3.4% the previous month, many expected a larger drop as the Bank of England seeks to meet its 2.0% target.

Nevertheless, this latest fall reflects a new two-and-a-half-year low; the last time inflation was slower was in September 2021 when the costs of goods and services rose at a rate of 3.1%.

Today’s figures also provide a welcome contrast to across the Atlantic, where US inflation unexpectedly increased to 3.5% within the same period.

Inflation is an important metric which is used to measure how fast the prices of goods and services are rising. While a fall in inflation is good news for consumers, it doesn’t mean these costs are getting any cheaper. Instead, prices are continuing to rise, albeit at a slower rate than the month before.

Graph: UK inflation eased to 3.2% in the year to March 2024, but remains above the Bank of England's 2.0% target.

A deceleration in the rising cost of food continued to have a significant downward effect on inflation in March; the prices of food and non-alcoholic beverages rose by 4.0%, compared to 5.0% in February.

This is the lowest annual rate since November 2021 and marks the 12th consecutive month of food prices easing from a recent high of 19.2% in March 2023 (the highest annual rate seen in over 45 years, according to the ONS).

However, the downward contributions from these and other divisions were partially offset by fuel prices rising more rapidly month-on-month.

The average price of petrol increased by 2.6 pence per litre between February and March 2024 to stand at 144.8 pence per litre. Meanwhile, the cost of diesel rose by 2.8 pence per litre in that same time to reach 154.1 pence per litre by March. It’s worth noting, though, the figures for both petrol and diesel are down from a year ago.

Savers will find a bit of volatility within top rates since last month, so it’s essential they review their nest egg to ensure it’s still paying competitive returns. As inflation eats away at savers’ hard-earned cash, it’s worth keeping this in mind when comparing accounts to ensure you’re earning a decent real return.

One area of the savings market to see another drop in the top rate is one-year fixed bonds. While the best deals today are still paying over 5.00%, at the start of 2024 the top rate paid 5.50%. Providers have been reducing fixed rates over recent months amid growing expectations for future interest rates to come down; thankfully, such volatility has calmed.

Those savers who are about to have their existing one-year bond mature can beat the market-leader from April 2023, and those savers coming off a two-year fixed bond will find rates more than double the top rates available in April 2022.

In the run-up to the new 2024/25 tax-year it proved to be a positive ISA season. Easy access Cash ISAs thrived, which is great news for those who want to utilise their allowance but require some flexibility with their nest egg.

The new ISA rules may also encourage savers to use ISAs more this year. Those looking to invest for longer will still find the top fixed ISAs are paying less than their fixed rate bond counterparts, but fixed bond rates are higher than this time a year ago, so those who invest could end up breaching their Personal Savings Allowance (PSA).

Indeed, higher rate taxpayers have a £500 limit on any interest earned, and basic rate taxpayers get a £1,000 limit. Those who invest a £20,000 lump sum in an account that pays 5% for one year will earn £1,000.

Switching accounts is essential for any saver who finds their loyalty is not being rewarded. Considering the more unfamiliar brands is wise but it’s important consumers take time to review any restrictive criteria an account can impose to ensure it works for them.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.