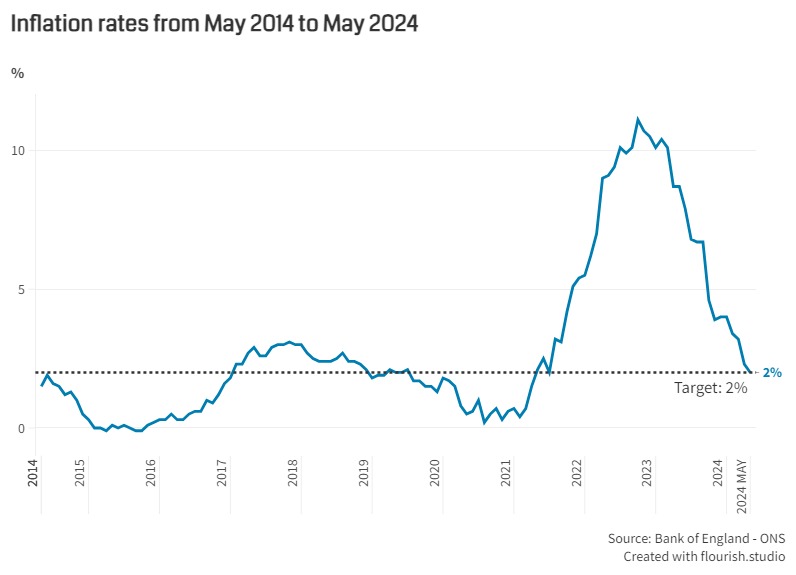

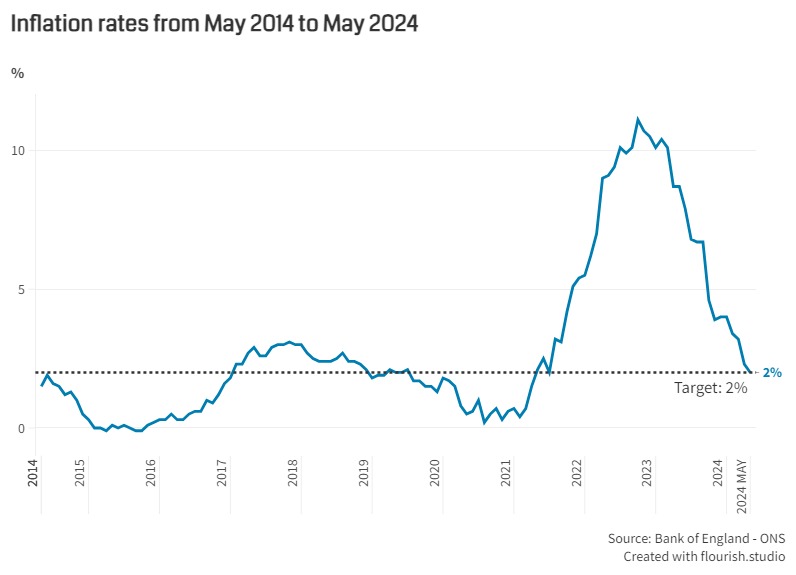

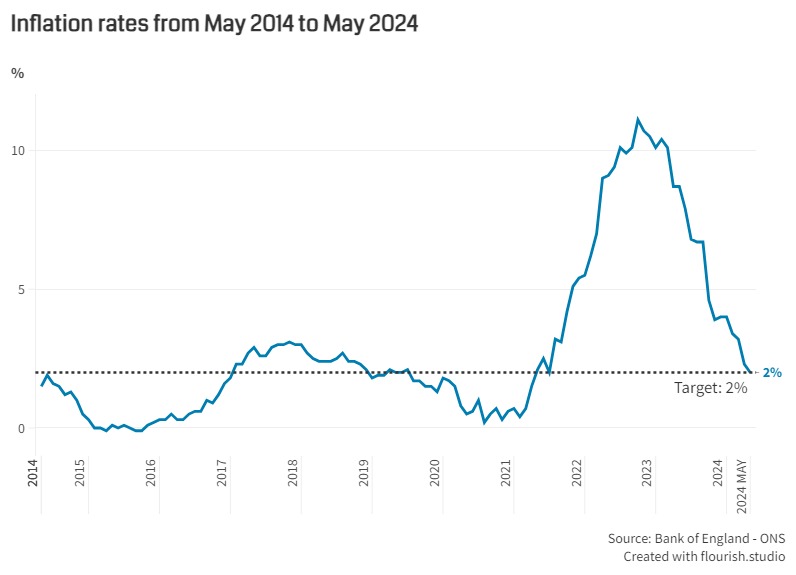

The rate of inflation dropped from 2.3% in April to 2% in May.

For the first time since July 2021, UK inflation hit the Bank of England’s target of 2% in the 12 months to May 2024, according to data from the Office for National Statistics (ONS).

Inflation has dropped significantly since its recent peak of 11.1% in October 2022, and is now at its lowest level in almost three years.

This is encouraging news for consumers as it means that, even though prices have risen year-on-year, they are not increasing as much as they were previously.

The rate of inflation tells us how quickly, or slowly, prices of goods and services have risen over the past year. The Consumer Price Index (CPI) is the key metric used to show the inflation rate.

Bear in mind that, even if the rate of inflation drops month-on-month, it still means prices are higher than the previous year. It just means they have seen a smaller increase than the previous month.

Despite meeting the target rate of inflation, many experts still predict that the Bank of England will hold the base rate at 5.25% tomorrow (Thursday 20th), with a cut predicted to happen later in the year.

Graph: UK inflation drops to the Bank of England's 2.0% target in May 2024.

Food and non-alcoholic beverages were once again a major factor behind the drop in inflation, as prices on these goods rose just 1.7% in the year to May 2024, compared to 2.9% in the year to April. This is the 14th month in a row that this sector has seen a drop in its annual inflation rate.

Looking at this sector in more detail, annual inflation slowed across all categories, except for oils and fats and milk, cheese and eggs. Meanwhile, breakfast cereals, potato crisps and chocolate bars were some of the items which saw their prices ease the most.

Recreation and culture and furniture and household goods were also major contributors to the drop in inflation. Notably, prices in the furniture and household goods category fell by 1.8% in the year to May, which was the lowest figure since December 2000.

By contrast, prices in the transport category as a whole rose by 0.3% in the year to May, which was its first annual price rise since October 2023. And, in particularly unwelcome news for drivers, petrol prices rose from 144.4 pence per litre in May 2023 to 148.8 pence per litre in May 2024.

Savers will find that there has been a hive of activity within the savings market over the past month, albeit relatively mixed with reductions, increases, launches and withdrawals. As a result, a handful of new providers are offering the top rates, but average rates have remained steady.

One-year fixed bonds have seen a slight uptick month-on-month, however, savers who are about to have their bond expire will find that the current market-leading rate no longer beats that of June 2023, which may be discouraging but to be expected with the growing potential of a base rate cut in the future.

In comparison, those who locked into a two-year term back in 2022 will find that the current top rates pay over 2% more interest and those who fixed for even longer will be able to get significantly higher rates if they decide to fix again.

As inflation hovers around its 2% target, it may be more rewarding for savers to fix for longer, as the longer their savings beat inflation the more cash they can earn in real terms. Meanwhile, variable savings rates have seen little movement but continue to be dominated by challenger banks despite further pushes for fairer rates required by the Financial Conduct Authority’s (FCA) Consumer Duty rules.

Elsewhere, there was some volatility within the ISA market coming into the new tax-year, with many providers making rate changes. Despite this, savers can still grab variable rate and a one-year fixed ISA which pays over 5%. In the longer-term the top rates have seen a boost, which may be ideal for those who wish to utilise their personal allowances and receive a guaranteed return. However, as a whole, the top ISA rates continue to pay less than their savings counterparts.

With several new providers entering the top rate tables it is crucial that savers review their nest egg to ensure their loyalty is being repaid and are willing to switch if more enticing deals appear elsewhere. In any case, savers should consider all relevant criteria and ensure the account is the correct choice for them.

Over 1,600 savings accounts beat the current rate of inflation. Use our charts to compare the top easy access savings accounts, fixed rate bonds and notice accounts.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.