However, this slowdown may prove to be short-lived.

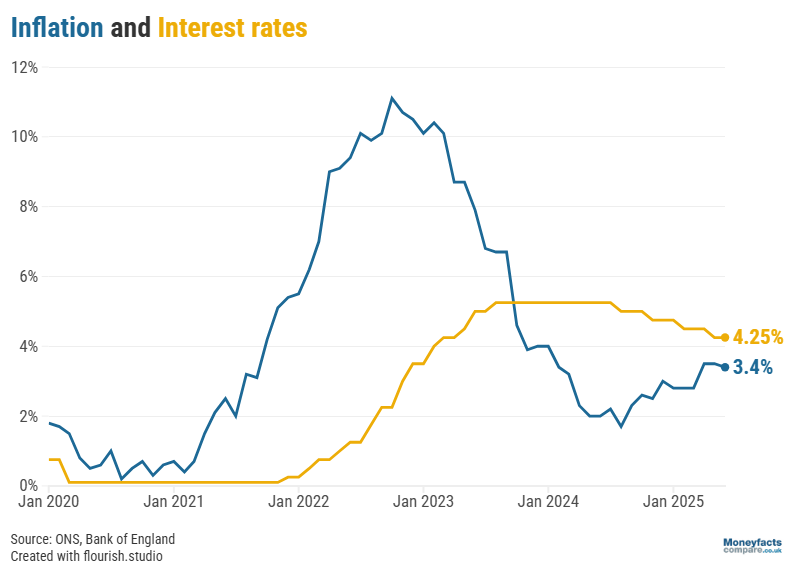

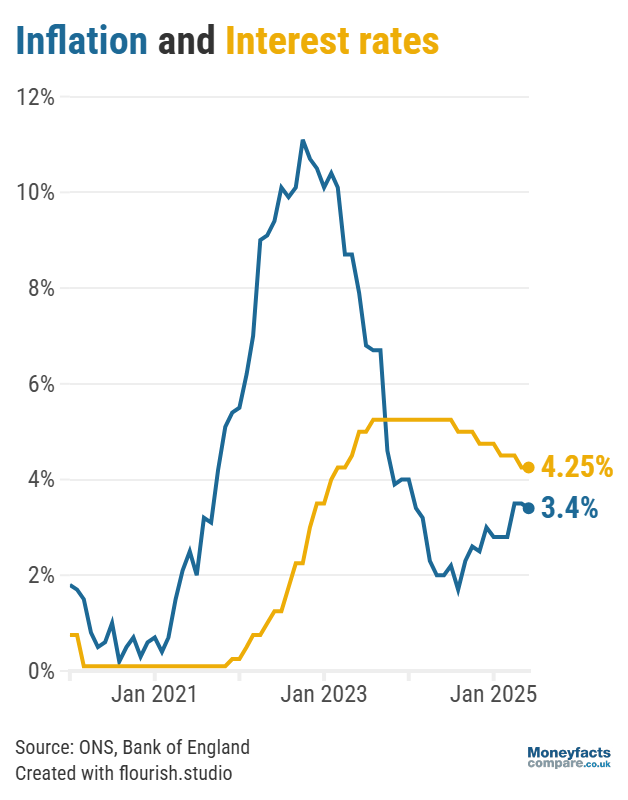

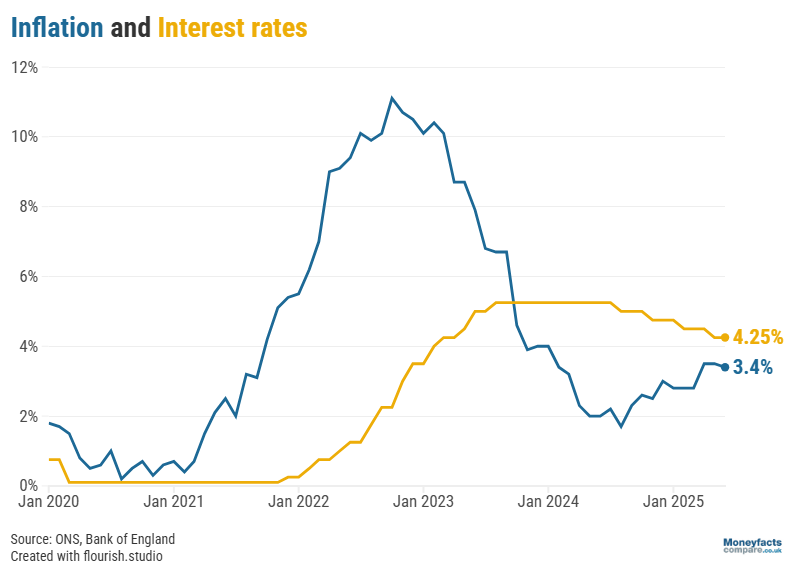

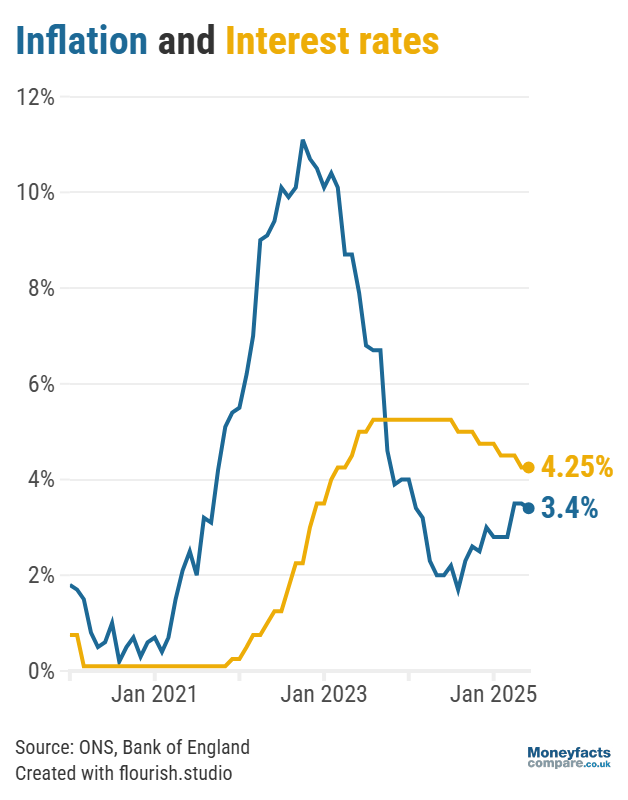

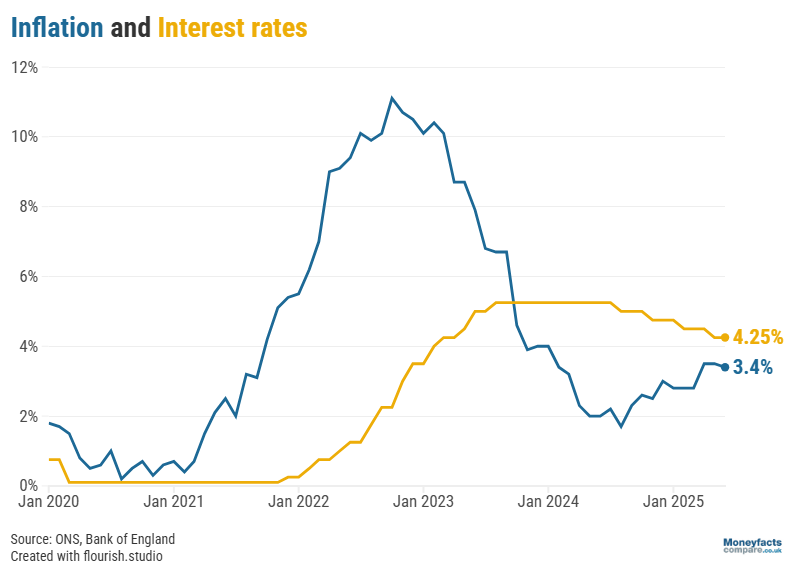

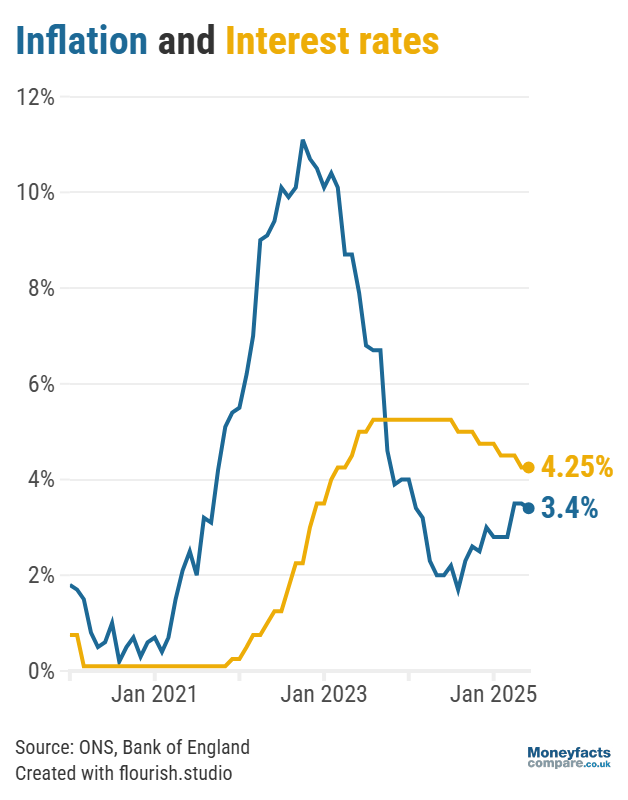

Inflation reportedly dipped to 3.4% in May, according to the latest data released today by the Office for National Statistics (ONS). This is down from the official figure recorded for April, when the rate of inflation skyrocketed to 3.5%.

While it’s positive to see inflation cooling somewhat, it remains considerably above the Government’s target of 2% and is still expected to rise to 3.7% later this year. This could mean this decline is unlikely to continue over the next few months.

The rate of inflation measures how the prices of goods and services have changed over the past year and is calculated with a key metric known as the Consumer Price Index (CPI).

While inflation may have lowered since last month, remember that prices have still risen compared to a year ago.

Furthermore, these latest figures may not be enough to sway tomorrow’s base rate announcement (19 June). Indeed, the Bank of England’s Monetary Policy Committee (MPC) is still widely expected to hold the UK’s central interest rate at 4.25%, largely due to financial instability rising from conflict in the Middle East.

Graph: Inflation dipped to 3.4% in May 2025.

There were a few contributing factors behind last month’s albeit slight fall in the rate of inflation, though the cost of air travel served as a dominant driving force. Air fares dropped by 5.0% in the month to May 2025, marking a significant turnaround from the 14.9% rise seen over the same timeframe in 2024. The ONS attributed this fall to this year’s Easter dates, which fell deeper into April than usual, likely pushing prices higher during the school holidays before dropping back in time for May.

Motor fuel prices also played a part in slowing the rate of inflation, falling by 10.9% in the year to May 2025 – a greater drop compared with the 9.3% dip seen in the 12 months to April 2025. Looking closer, the cost of petrol and diesel each fell by 2.1 and 2.6 pence per litre between April and May, to 132.4 and 139.1 pence per litre respectively. Comparatively, petrol and diesel prices had previously stood at 148.8 and 156.3 pence per litre in May 2024.

However, while these factors led to overall transport costs rising by only 0.7% in the year to May (down from the 3.3% annual rise the previous month), the current Middle Eastern crisis has already begun to affect oil prices, which could likely see a spike in travel costs in the coming months.

What’s more, the fall in inflation was partially offset by rising food prices, which rocketed by 4.4% in the year to May to its highest recorded figure since February 2024.

Inflation remains above the Government’s target of 2% and is eroding savers’ money in real terms. Since the previous inflation announcement, the best non-ISA deals have crept up slightly for variable and short-term fixed rates whereas the ISA market saw most fixed ISA rates rise.

Challenger banks and app-based providers are rife among the top tables as competition continues to attract new customers. Consumers need to consistently search for the best accounts to avoid receiving a raw deal and act swiftly so they can grab the most popular deals before they are pulled or worsen.

Savers continue to be hit by the handful of base rate cuts over the past year as all the top rates for non-ISAs have dropped compared to the market-leaders in June 2024, so those consumers with a variable account or only fixed for a year may now be feeling the pressure. With longer-term rates out-pacing short-term deals it may be a good time for savers to consider the benefits of locking away their cash for the next five years.

Many of the top ISA rates have also been heading on a downward trajectory. Research from the Bank of England shows that £14 billion was invested in ISAs during April, the highest on its records, showing that there is still an appetite among savers to maintain the current ISA allowance. But many investors are still missing out on earning attractive returns as almost £300 billion is sitting in non-interest-bearing accounts.

More than 1,400 savings accounts currently beat the rate of inflation. This includes 133 easy access savings accounts, 122 notice accounts and 706 fixed bonds.

Be sure to visit our charts to compare the latest rates on the market.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.