As almost all average savings rates decline, consumers may need to take action to see their money grow in real terms.

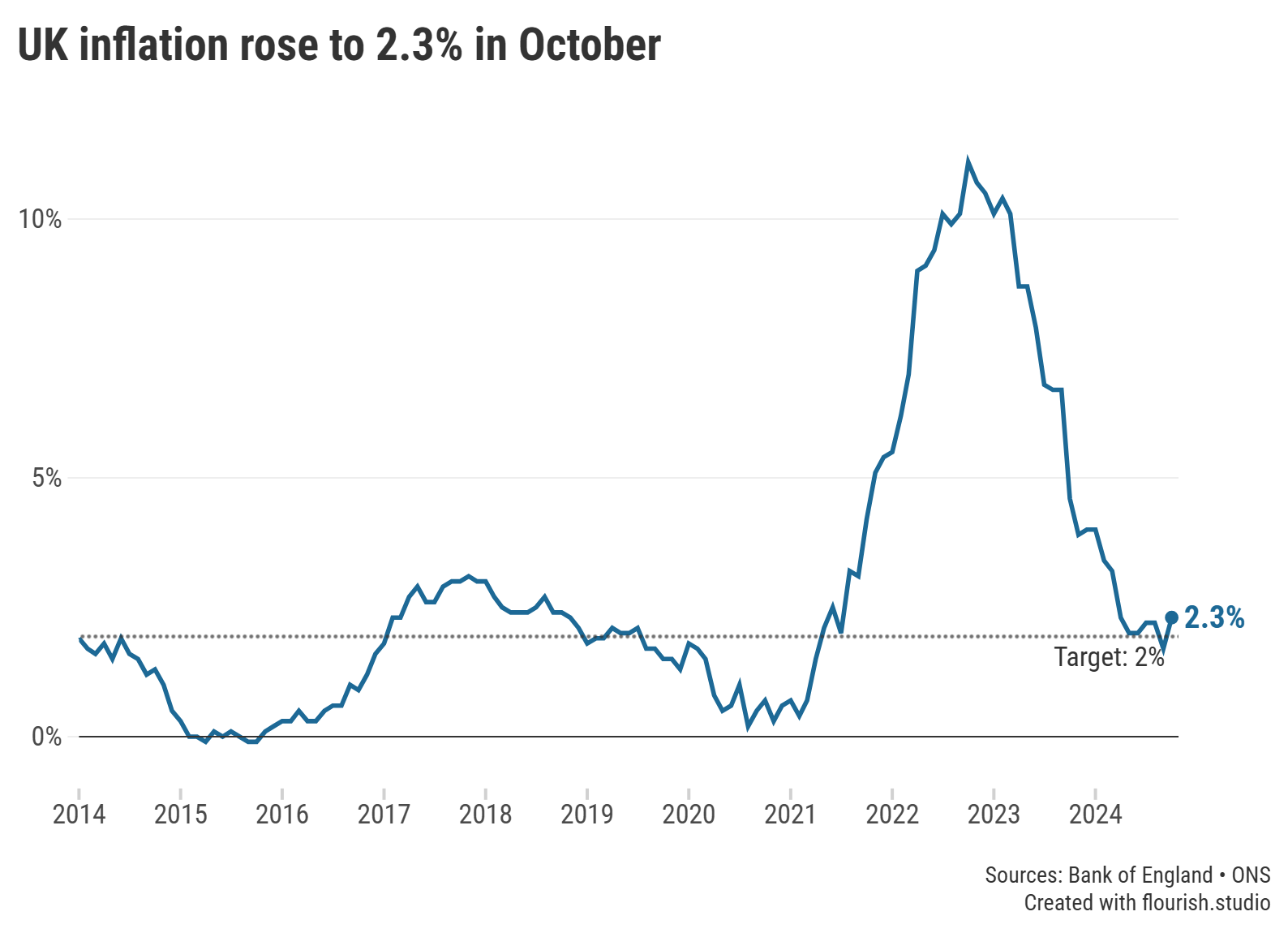

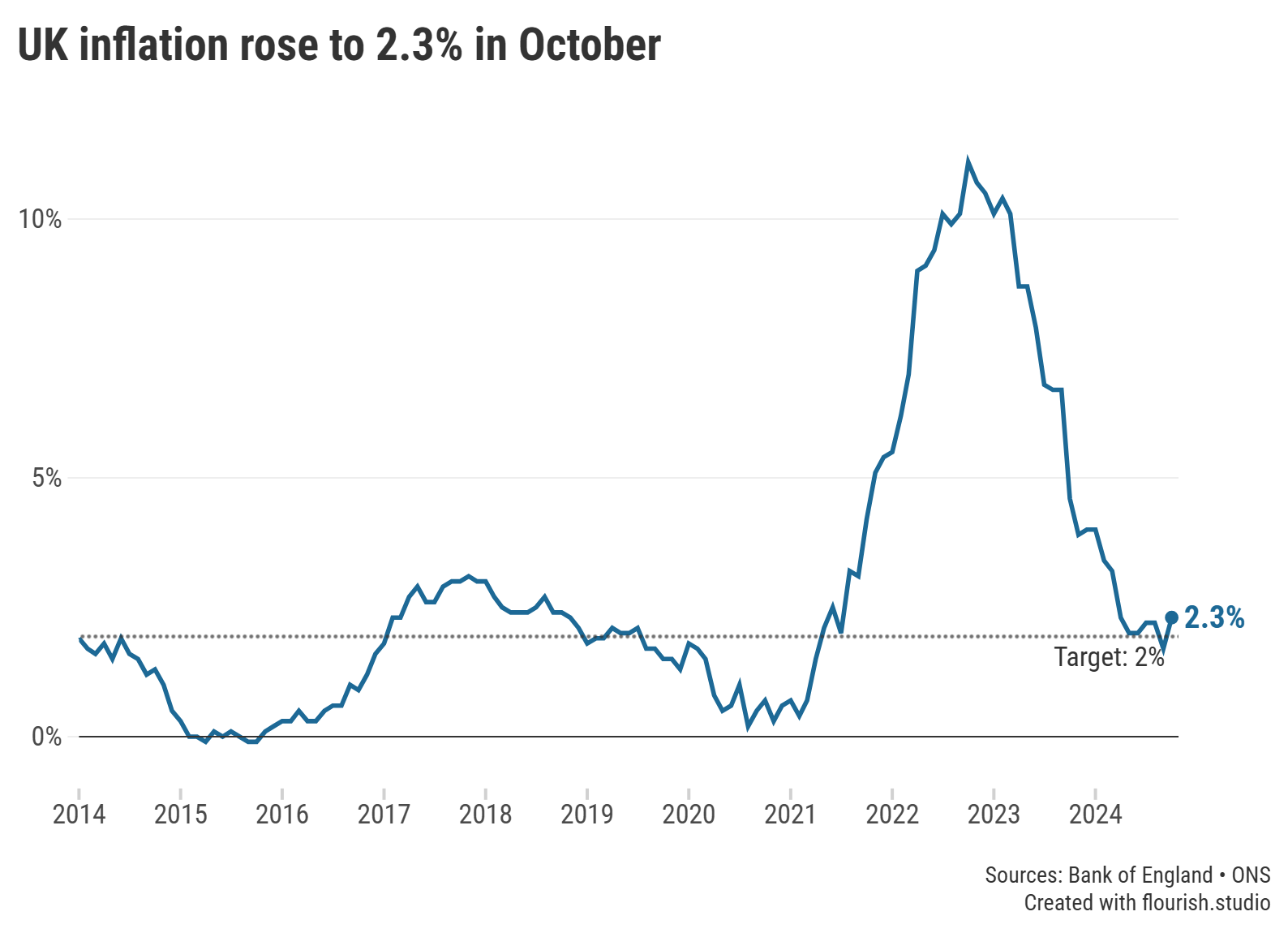

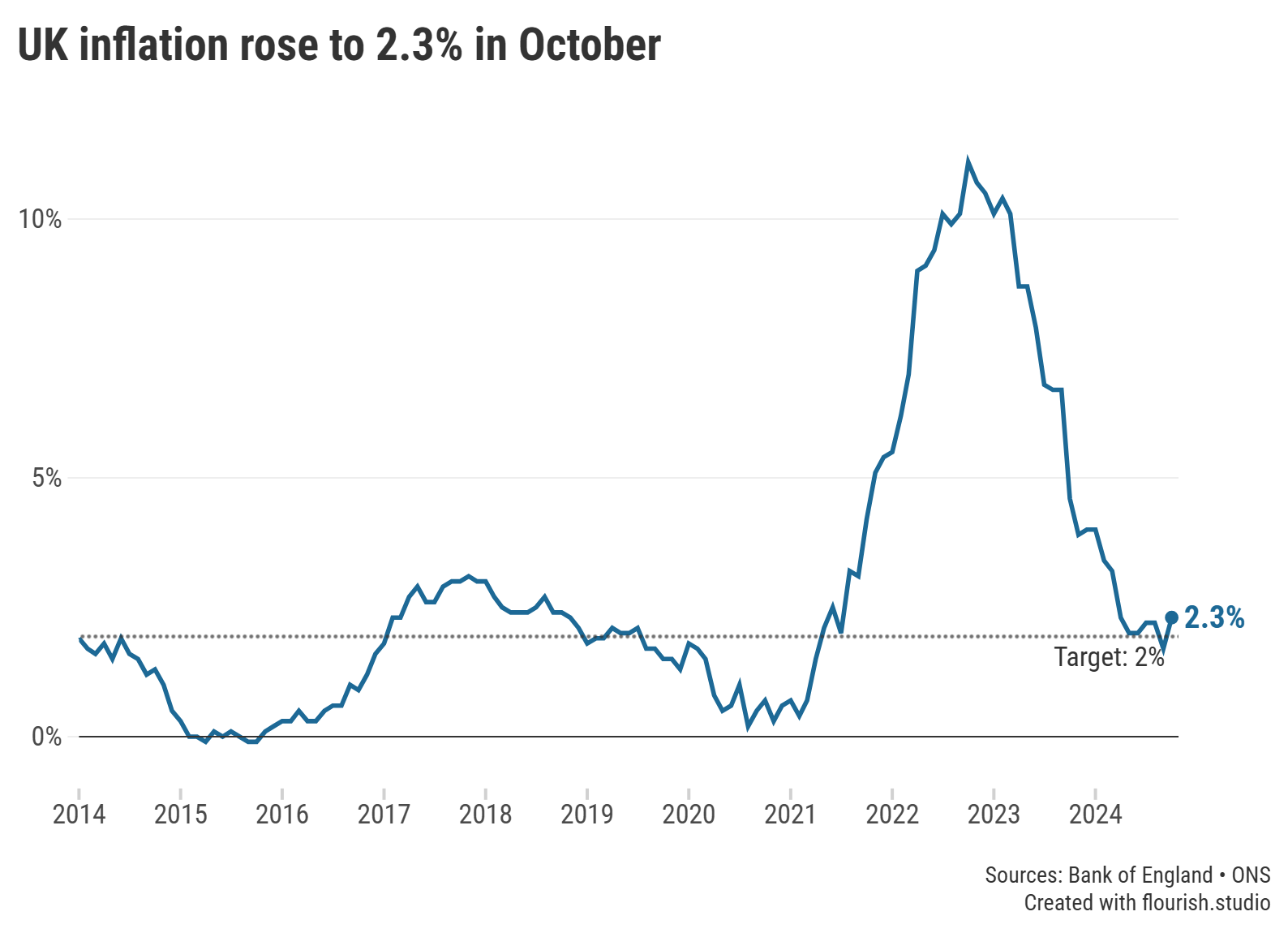

UK inflation accelerated to 2.3% in the year to October, the Office for National Statistics (ONS) today revealed. The sharp rise offsets last month’s significant drop, when the costs of goods and services increased by a more modest 1.7%.

Inflation measures how quickly, or slowly, the prices of goods and services are rising; the metric used by the ONS to quantify the rate of inflation is Consumer Price Inflation (CPI).

An increase in inflation means costs are generally rising more rapidly.

Graph: The rate of UK inflation between 2014 and 2024.

While inflation is forecast to rise heading into 2025, this latest jump is perhaps greater than many expected and casts fresh doubt over the direction of the Bank of England (BoE) base rate in the coming months.

In contrast, less than two weeks ago, the BoE’s Monetary Policy Committee (MPC) voted overwhelmingly in favour of lowering the UK’s central interest rate to 4.75% - a move that has since sent almost all average savings rates tumbling .

With this in mind, it’s crucial savers take time to review their accounts and ensure their hard-earned cash grows in real terms; where a savings account pays less than the rate of inflation, it means your money is losing purchasing power (i.e. the same amount buys you less).

There are currently 1,629 savings accounts that can beat inflation – approximately 100 fewer than when September’s CPI figures were released. You can compare the best rates using our savings charts.

More expensive gas and electricity bills contributed to rising inflation in October. It follows the Office for Gas and Electricity Markets (Ofgem) increasing the energy price cap (the maximum amount a supplier can charge for each unit of electricity and gas used) from £1,568 to £1,717 per year at the start of last month. An increase of just under 10%, Ofgem reports this adds around £12 a month to a typical bill.

This upward momentum was partially offset by a fall in live music and theatre ticket prices, according to Grant Fitzner, Chief Economist at the ONS, as well as the cheaper cost of crude oil causing prices of raw materials to fall.

The vast majority of top rates have remained largely unchanged since the previous inflation announcement; however, short-term bonds and Cash ISAs continue to be slashed and as a result savers can no longer get any fixed returns paying above 5% across both ISAs and non-ISAs. Table-topping longer-term fixed rates are resilient, but there have been a few new brands taking market-leading positions over shorter-terms.

The top easy access account for new customers has suffered significantly over the past month, seeing the largest drop of 0.35%, so it is crucial savers vigilantly monitor the top rates and are prepared to switch if their rate gets cut.

Research conducted by the Bank of England revealed that there is £252bn sitting in UK current or savings accounts earning no interest, which signals the glaring apathy savers have towards their nest eggs. To avoid missing out on interest payments, there is a large selection of accounts for savers to choose from which offer inflation-busting rates. If savers are unsure which deal is best suited to their circumstances it is best to seek professional advice.

Easy access ISAs stand to be the most improved since the previous announcement, with the top rate paying 0.20% more, therefore making it one of the last remaining deals for new customers that pays above 5%, with the other being a non-ISA notice account.

Savers would be wise to secure these attractive deals quickly, especially as the base rate cut announced earlier this month has led to providers passing this on to their variable rates.

Predictions show that inflation is set to take an upwards turn in 2025 but will remain around the Bank of England’s target of 2%, but the future of further cuts to base rate is uncertain. Sensible savers would be wise to lock away their cash for guaranteed returns and can use comparison websites to monitor the best deals available.

Ending this Friday (22 November):

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.