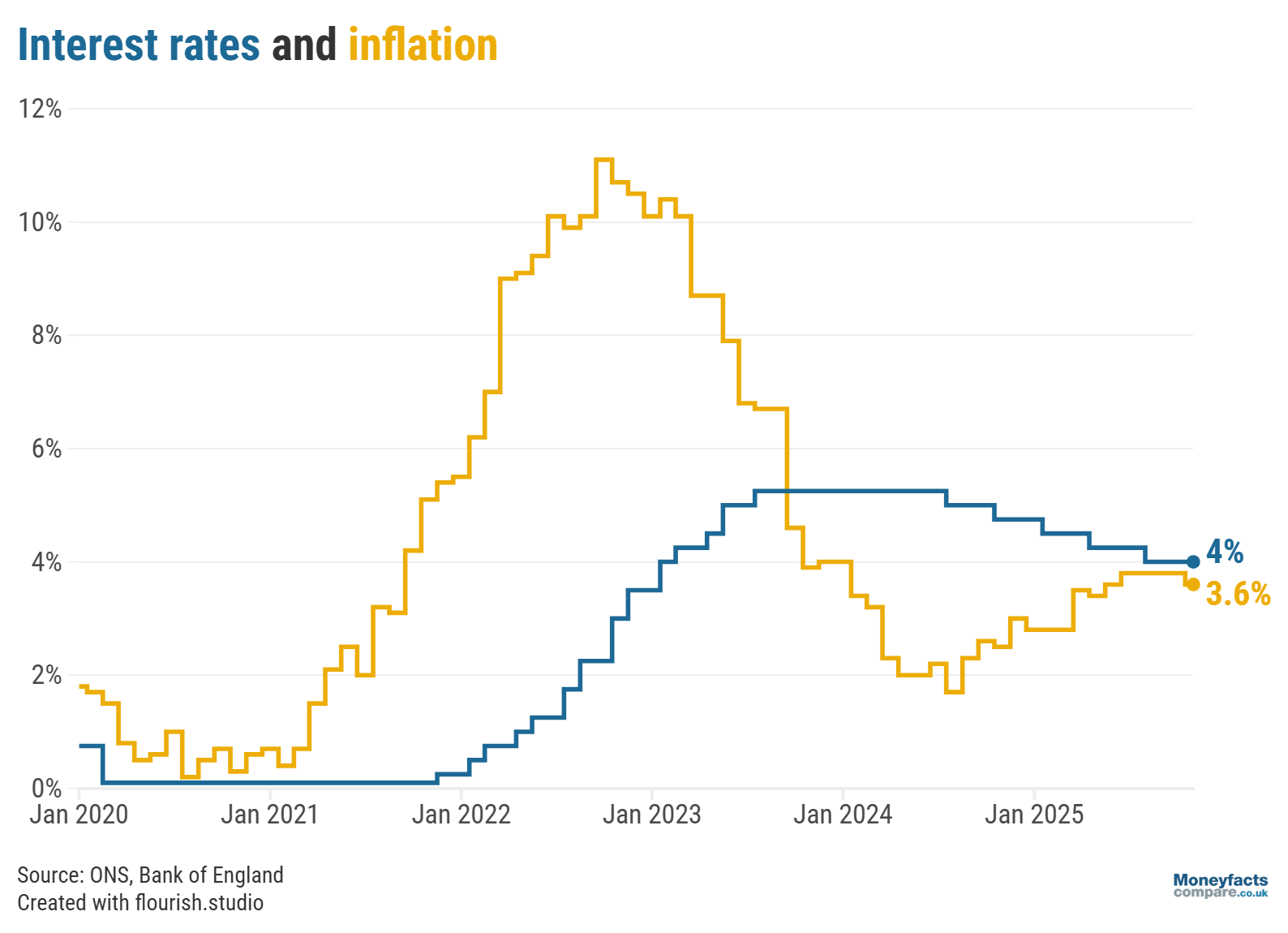

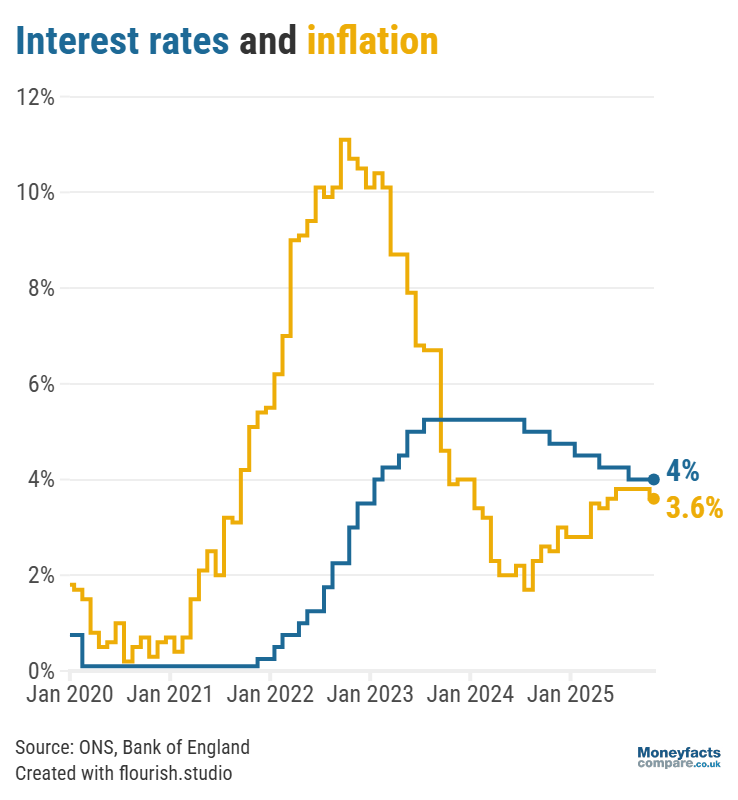

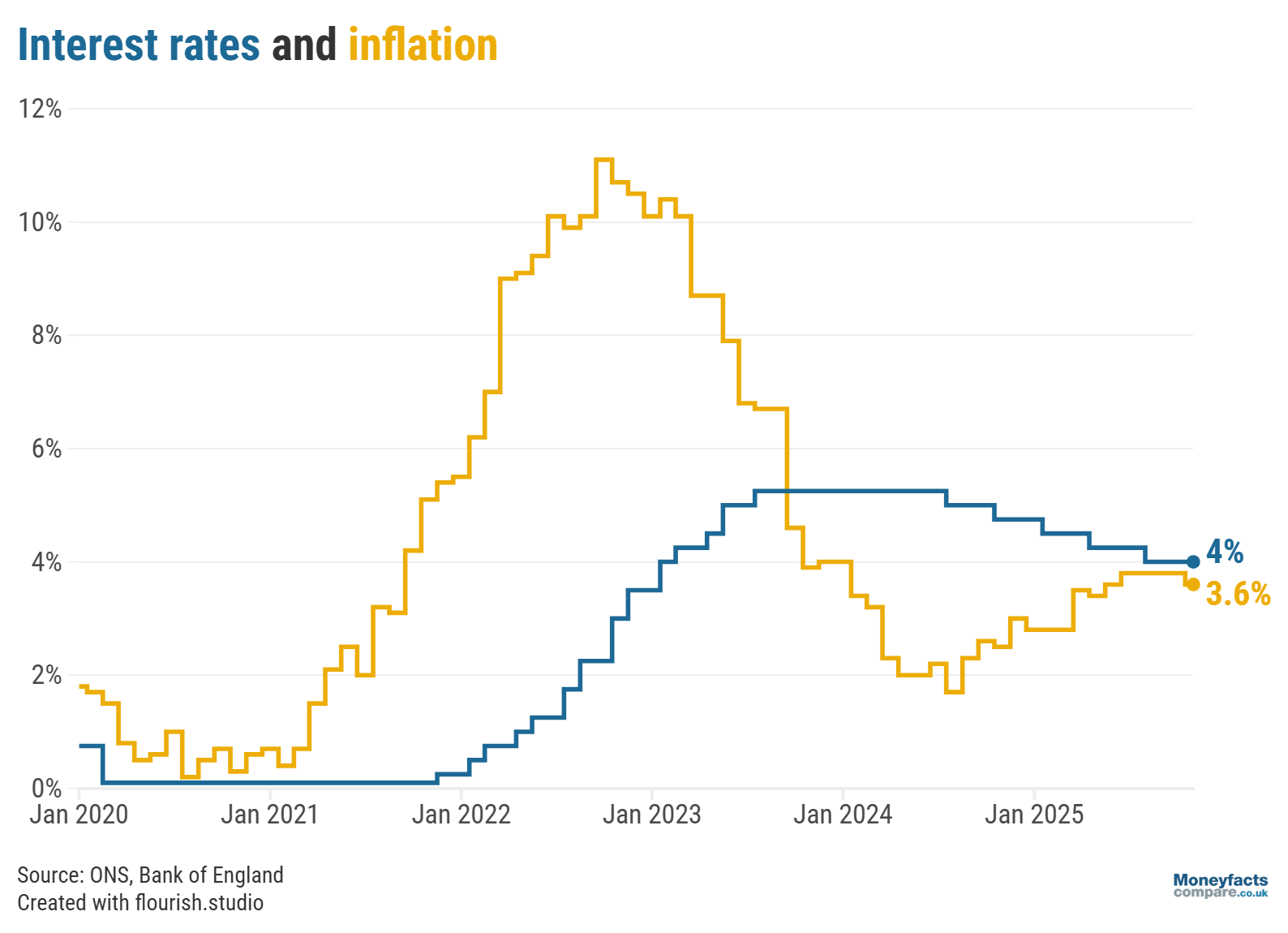

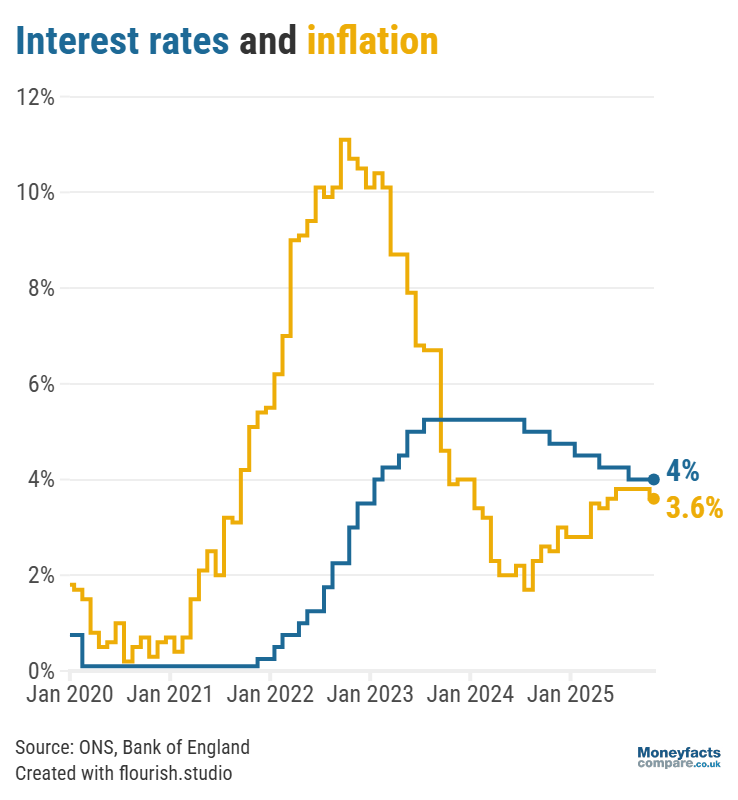

As inflation drops to its lowest level in four months, a Christmas base rate cut seems even more likely.

There were no surprises this morning as the annual rate of UK inflation dropped from 3.8% in September to 3.6% in October, according to the latest data from the Office for National Statistics (ONS).

This is an encouraging sign for consumers, particularly as prices had risen by 3.8% year-on-year for the last three months. Moreover, it seems to support the Bank of England’s belief that inflation had reached its peak (as stated in its November Monetary Policy Report), strengthening expectations that it will remain on a downwards trend for the rest of the year and into 2026.

Even though inflation is lower than September’s figure, this doesn’t mean that prices are getting cheaper. Goods and services still cost more than one year ago, but the lower inflation figure means that prices have risen at a slower pace in the 12 months to October compared to the previous month.

Inflation is measured using the Consumer Price Index (CPI). Read our guide to find out more about the impact inflation can have on your money.

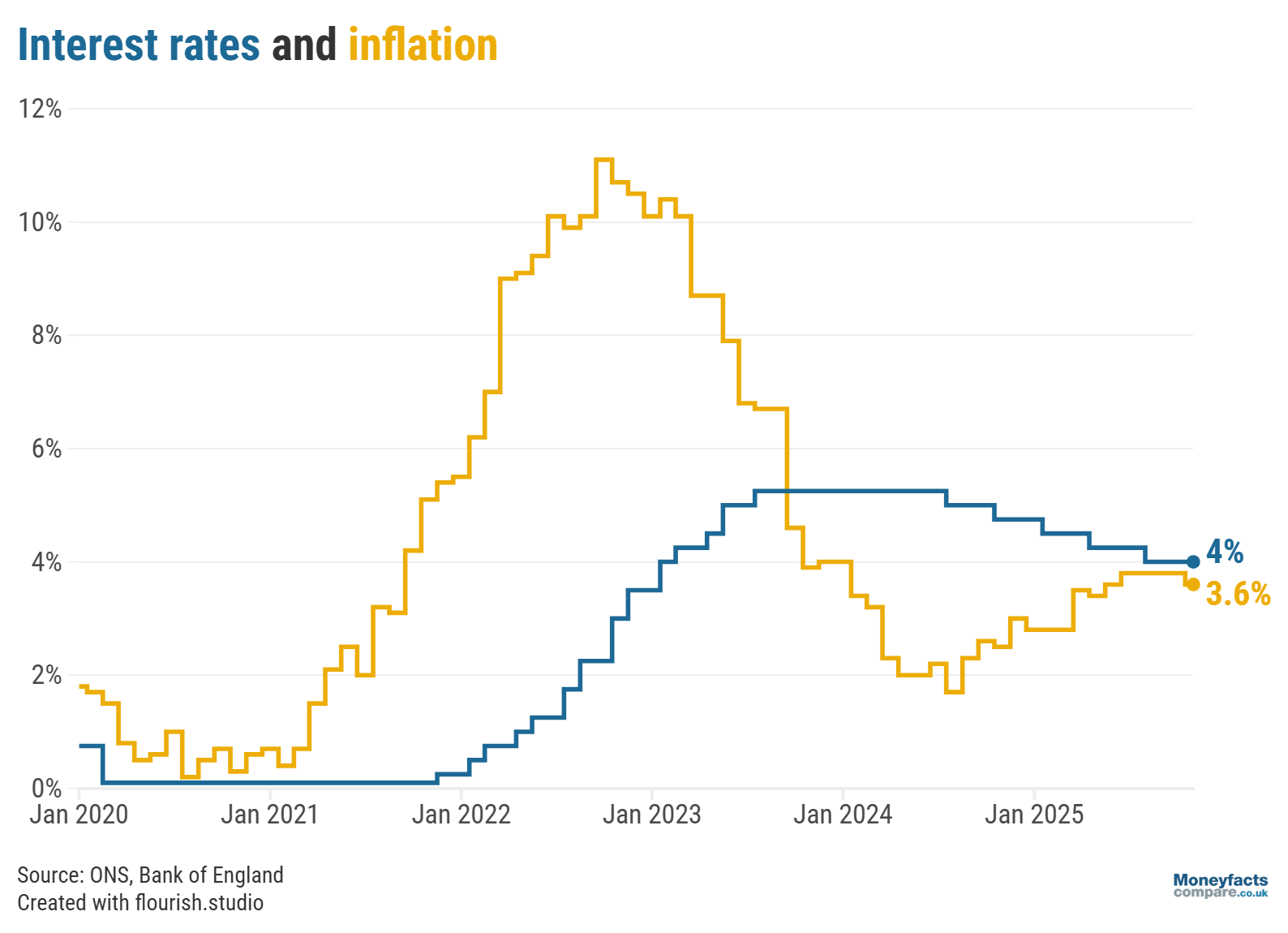

As inflation gets closer to the Bank of England’s target of 2%, it seems increasingly likely that the Monetary Policy Committee (MPC) will lower the base rate on 18 December, particularly as recent figures showed slower GDP growth and rising unemployment.

While savers may be disappointed by this as providers typically lower rates after a base rate reduction, it could be an early Christmas present for prospective mortgage borrowers.

“Since inflation hit this year’s expected peak of 3.8% during September, the Moneyfacts Average Mortgage Rate has fallen below 5%, which will come as a relief to many borrowers. There have been plenty of lenders dropping their fixed rate deals in recent weeks and by more significant margins, with more possibly on the way,” Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk, commented.

“However, if anything unexpected arises from the upcoming Autumn Budget, it could derail these chances,” she added.

Graph: The annual rate of inflation eased to 3.6% in October 2025, while the base rate stands at 4%.

Housing and household services was a major sector that contributed to the slower pace of inflation, as prices only rose by 5.0% in the year to October compared to 5.9% in September. Gas and electricity prices had a particularly significant impact as they rose by 2.1% and 2.7% respectively in the year to October (down from 13.0% and 8.0% respectively in September). Cheaper accommodation services (such as hotels) also helped inflation to dip as prices fell by 2.2% between September and October compared to a 0.2% drop one year ago.

However, it isn’t all good news for consumers as prices of food and non-alcoholic beverages increased by 4.9% in the year to October, up from 4.5% in September. Although fruit prices saw a marginal drop, the cost of bread and cereals, meat, fish and vegetables all increased and contributed to the higher October figure for food inflation.

Moreover, prices in the transport sector continued to rise by 3.8% year-on-year (the same annual rate as September), with petrol and diesel costs increasing month-on-month.

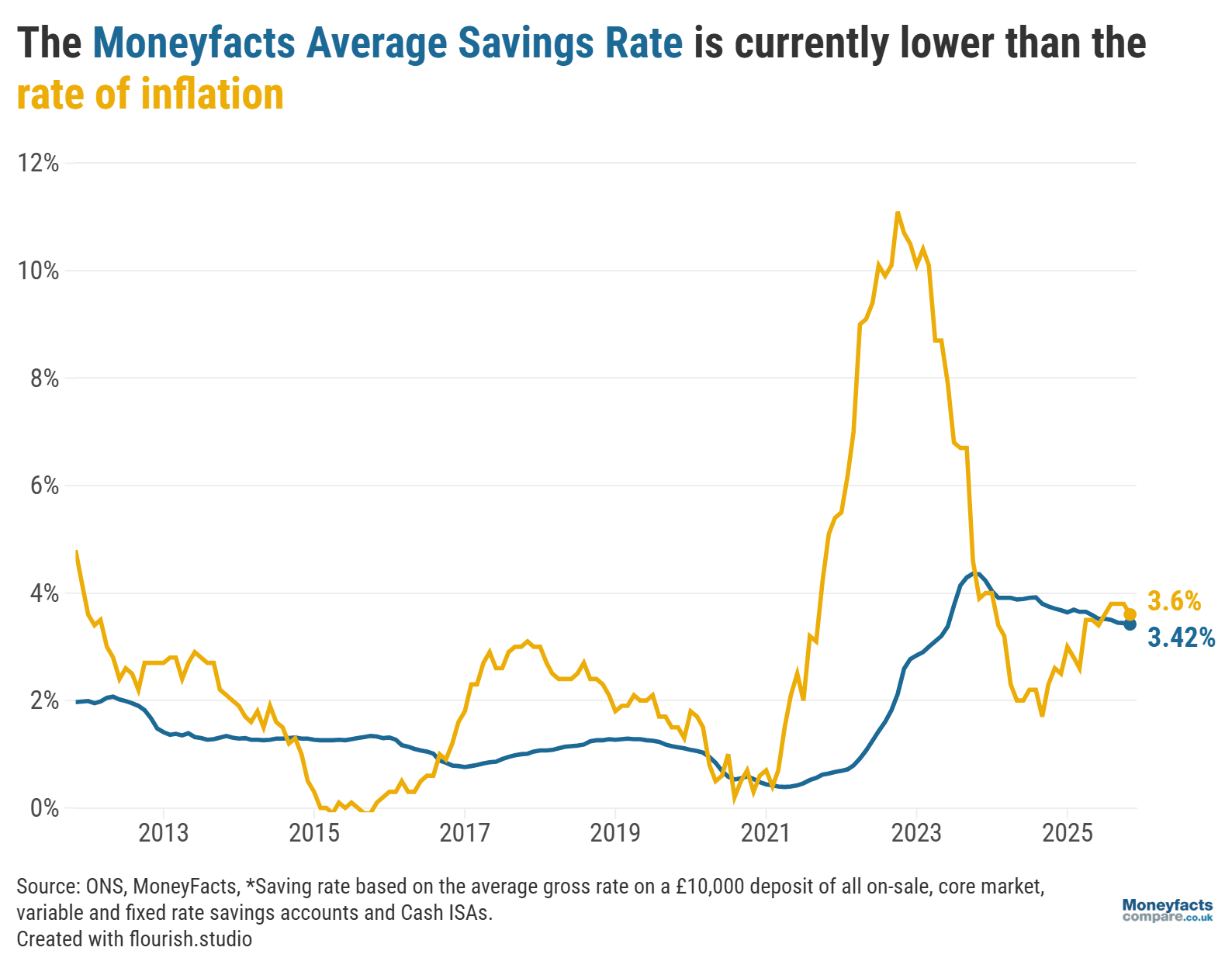

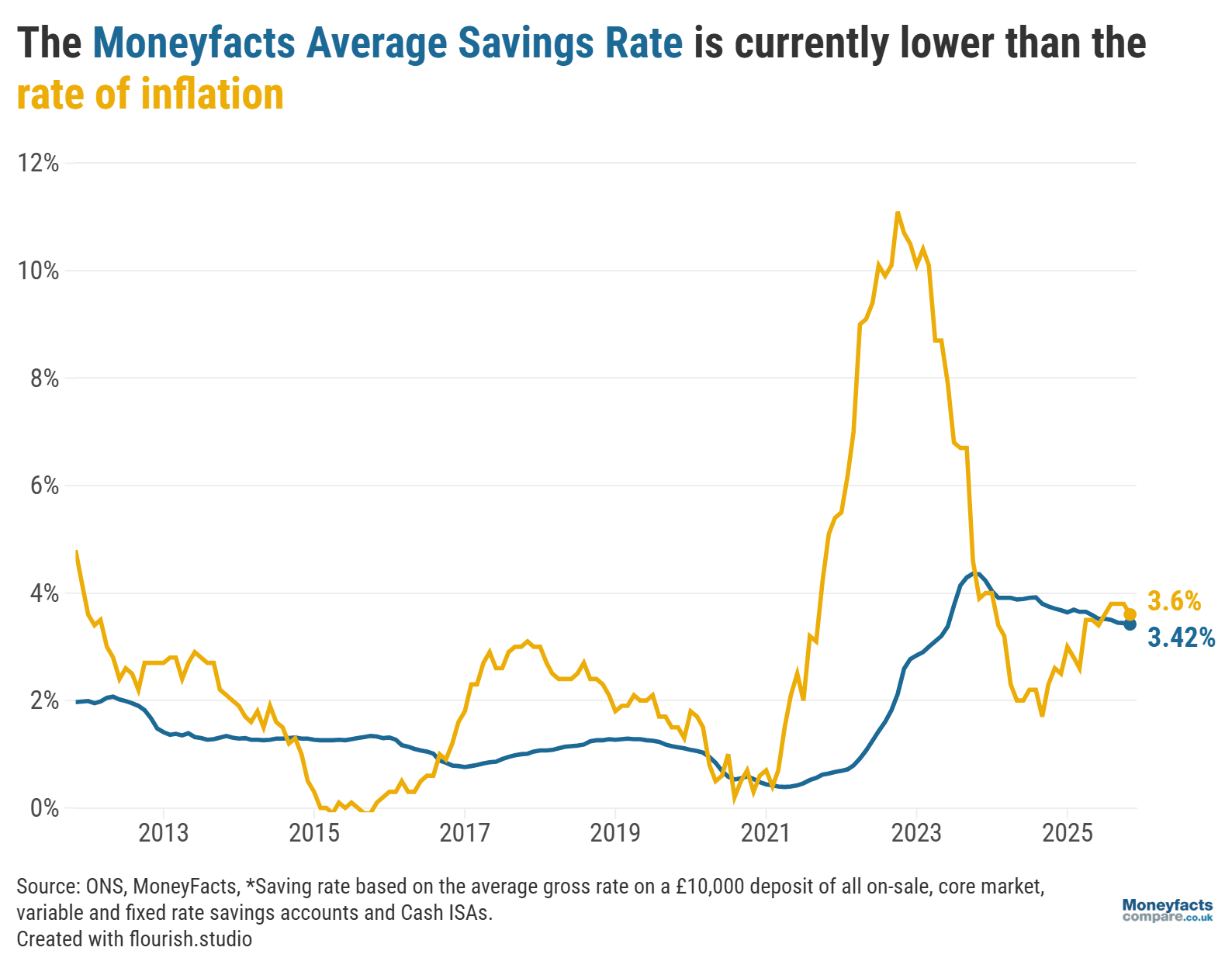

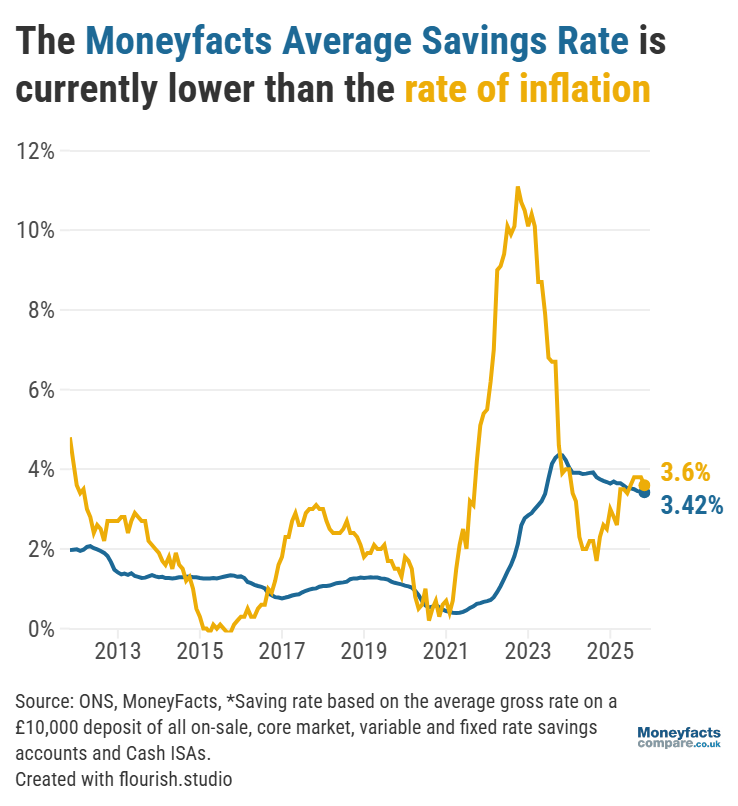

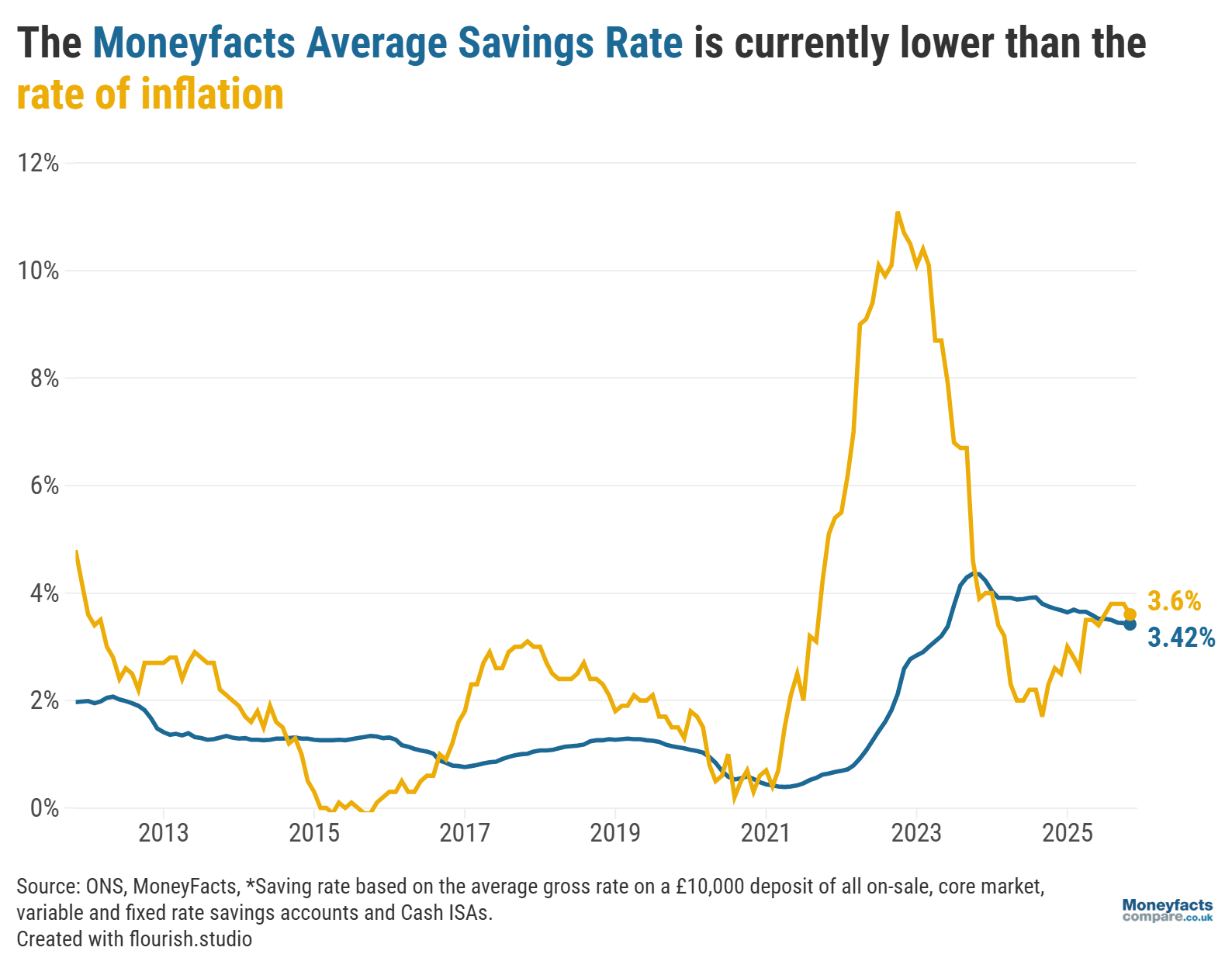

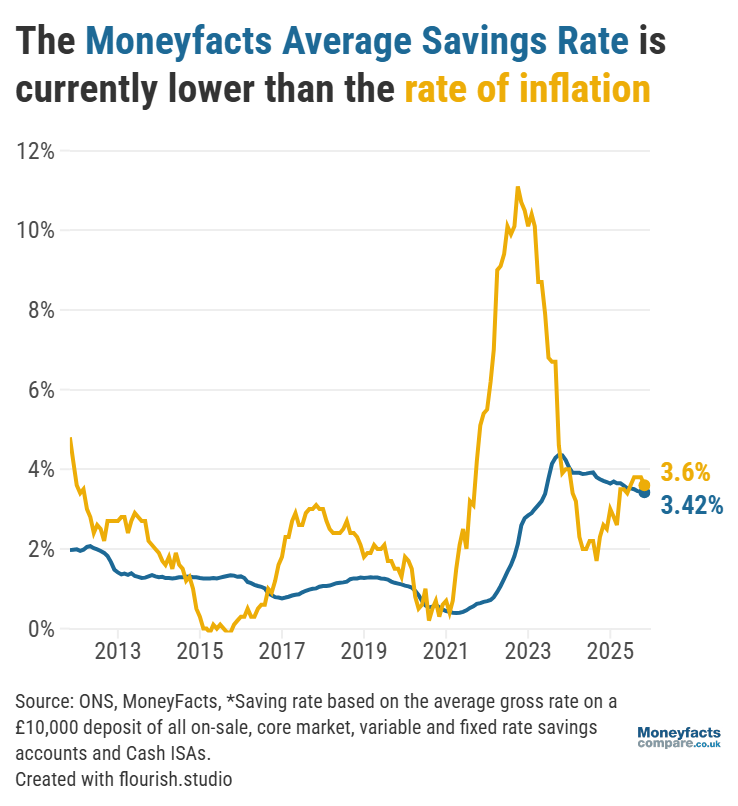

“It has been three years since inflation reached its 11.1% peak, and unsurprisingly, there was then not a single savings account that could outpace this. The rising cost of living is a persistent struggle and what would’ve cost £1,000 in 2022 has now risen by over £100, so it’s no surprise that some savers may feel like they’re falling behind despite inflation being lower,” Eastell explained.

“Today just over one in two accounts offer over 3.6%, but with interest rates trending downward, this number is likely to drop,” she warned.

Even though lower inflation may be seen to offer some respite for consumers, it’s still important for savers to check their accounts and, if they are getting a raw deal, to switch to a more competitive rate. If they are worried about further cuts to savings rates, it may be worth locking away their money for a fixed term, as long as they won’t need to access it for several months or years.

Graph: The Moneyfacts Average Savings Rate is currently 3.42%, which is lower than the rate of inflation (3.6%).

With the lower level of inflation,1,224 savings accounts and ISAs can now pay a higher rate than 3.6% (at the time of the announcement). This includes easy access accounts and fixed bonds, as well as easy access cash ISAs and fixed rate ISAs.

See our charts to discover the latest rates and secure an inflation-beating return on your money.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.