Rising fuel prices largely responsible for sustained, elevated inflation despite the first monthly fall in the cost of food and non-alcoholic beverages since September 2021.

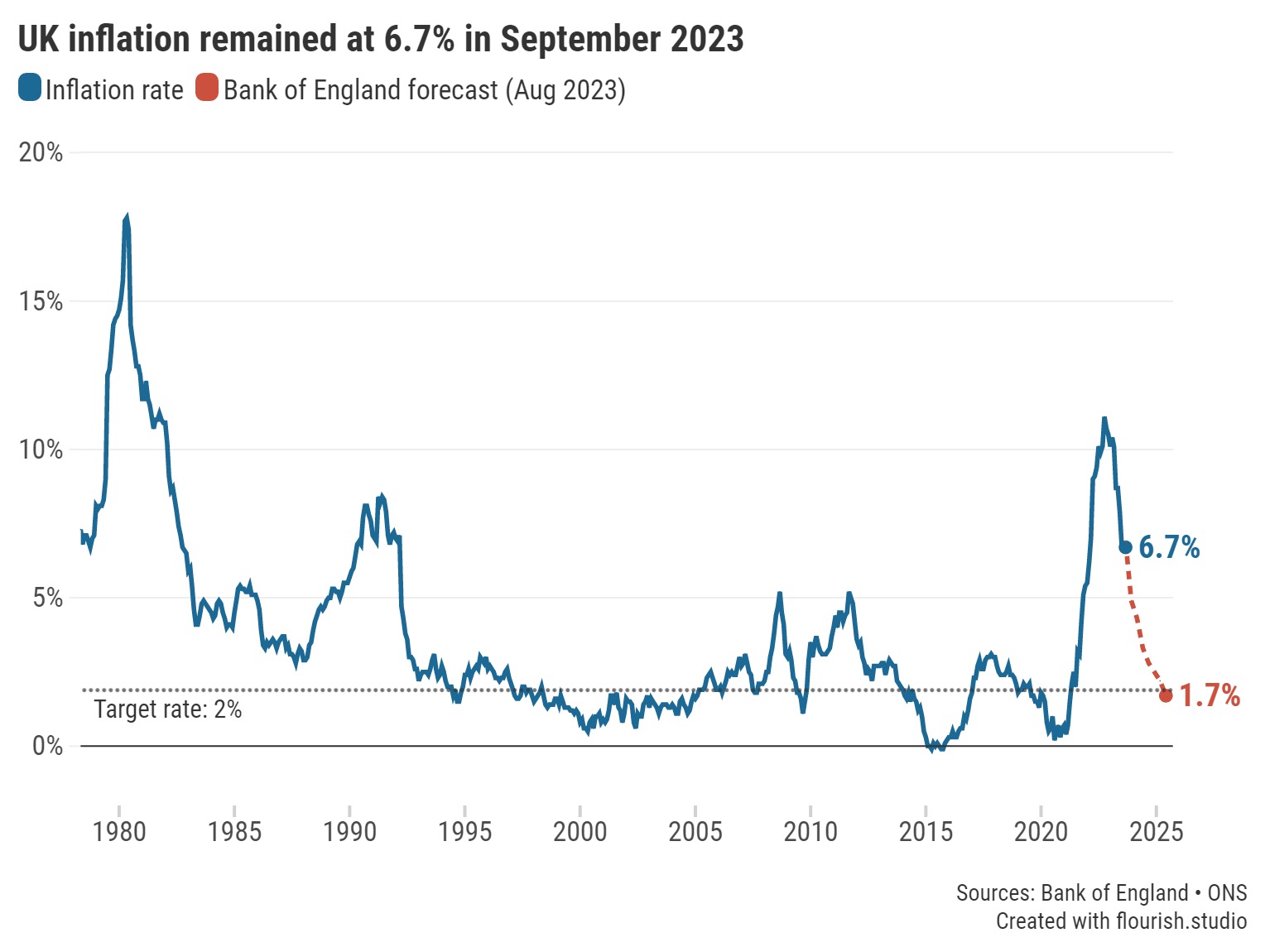

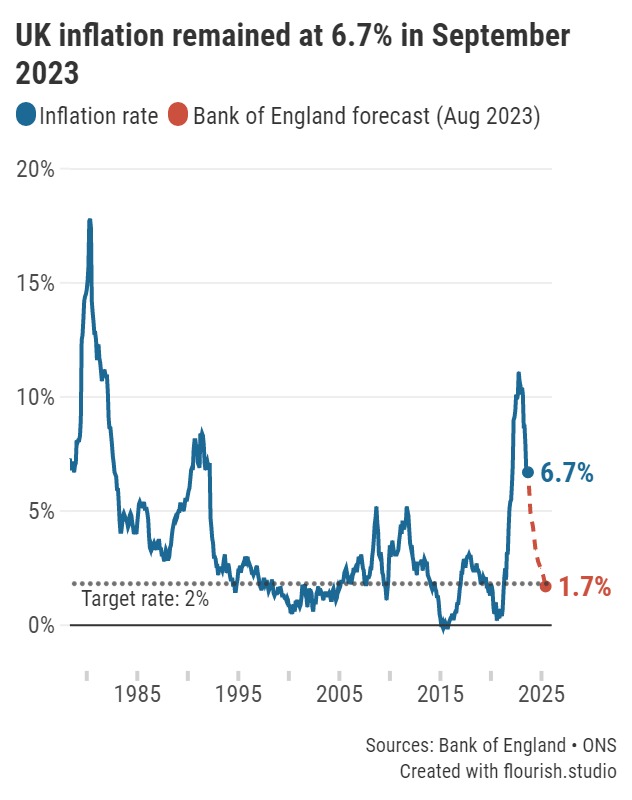

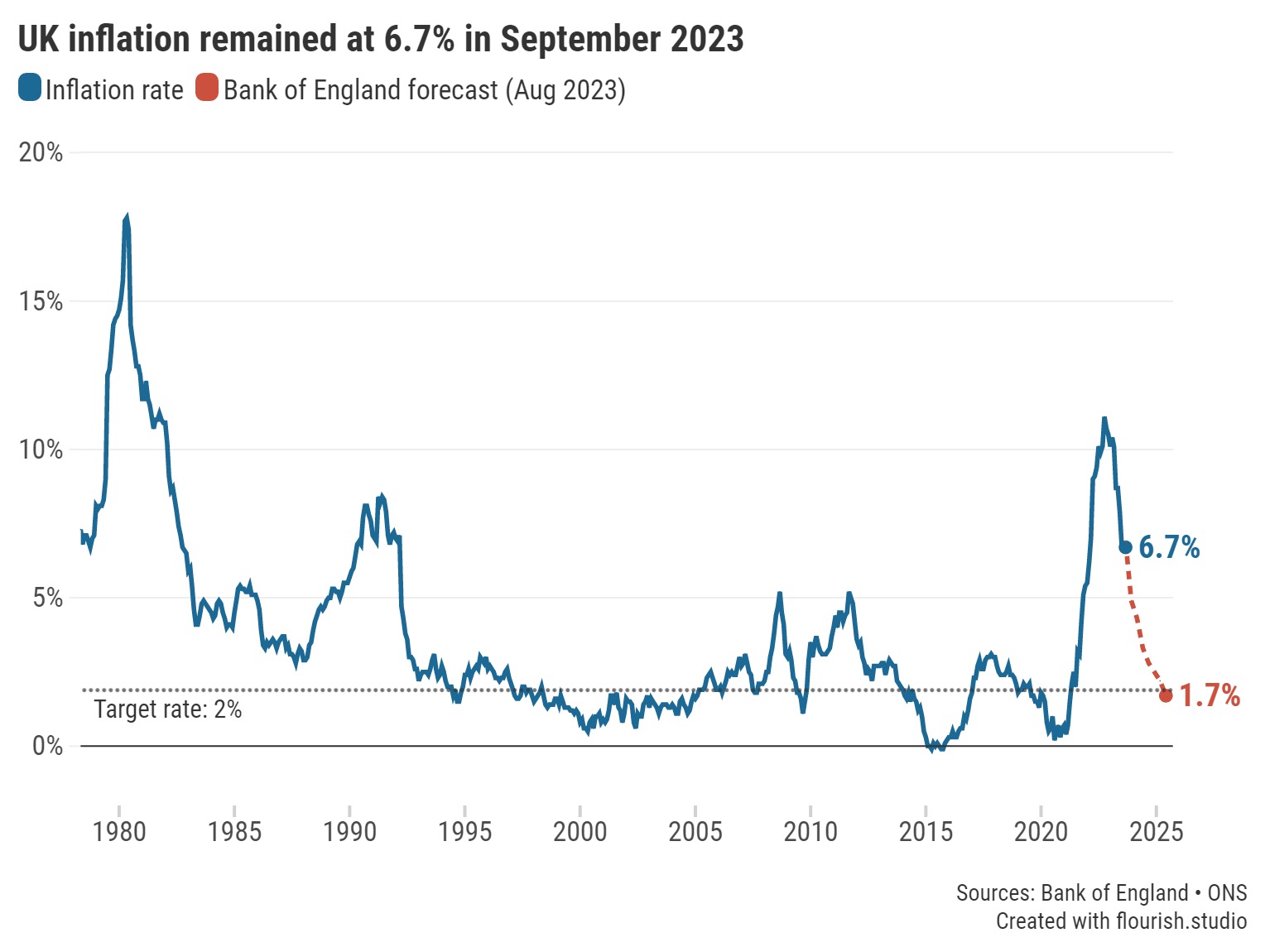

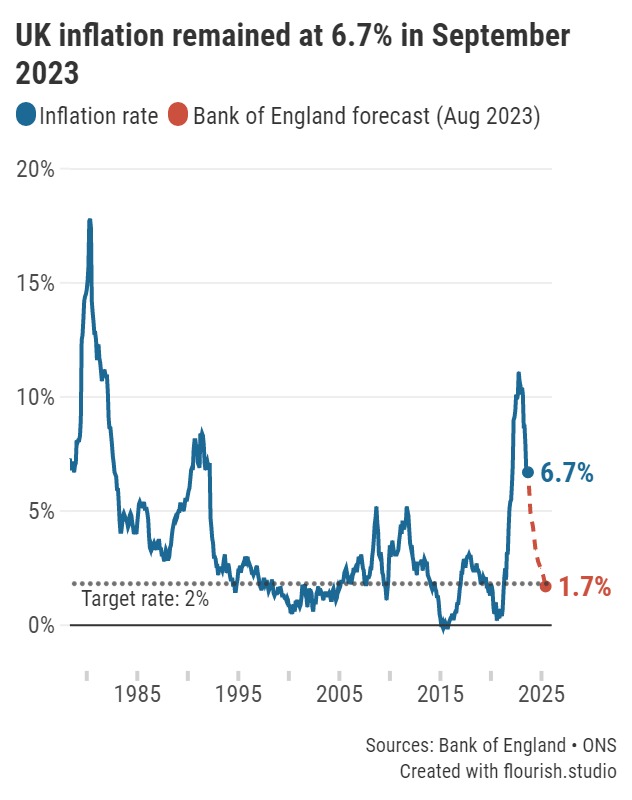

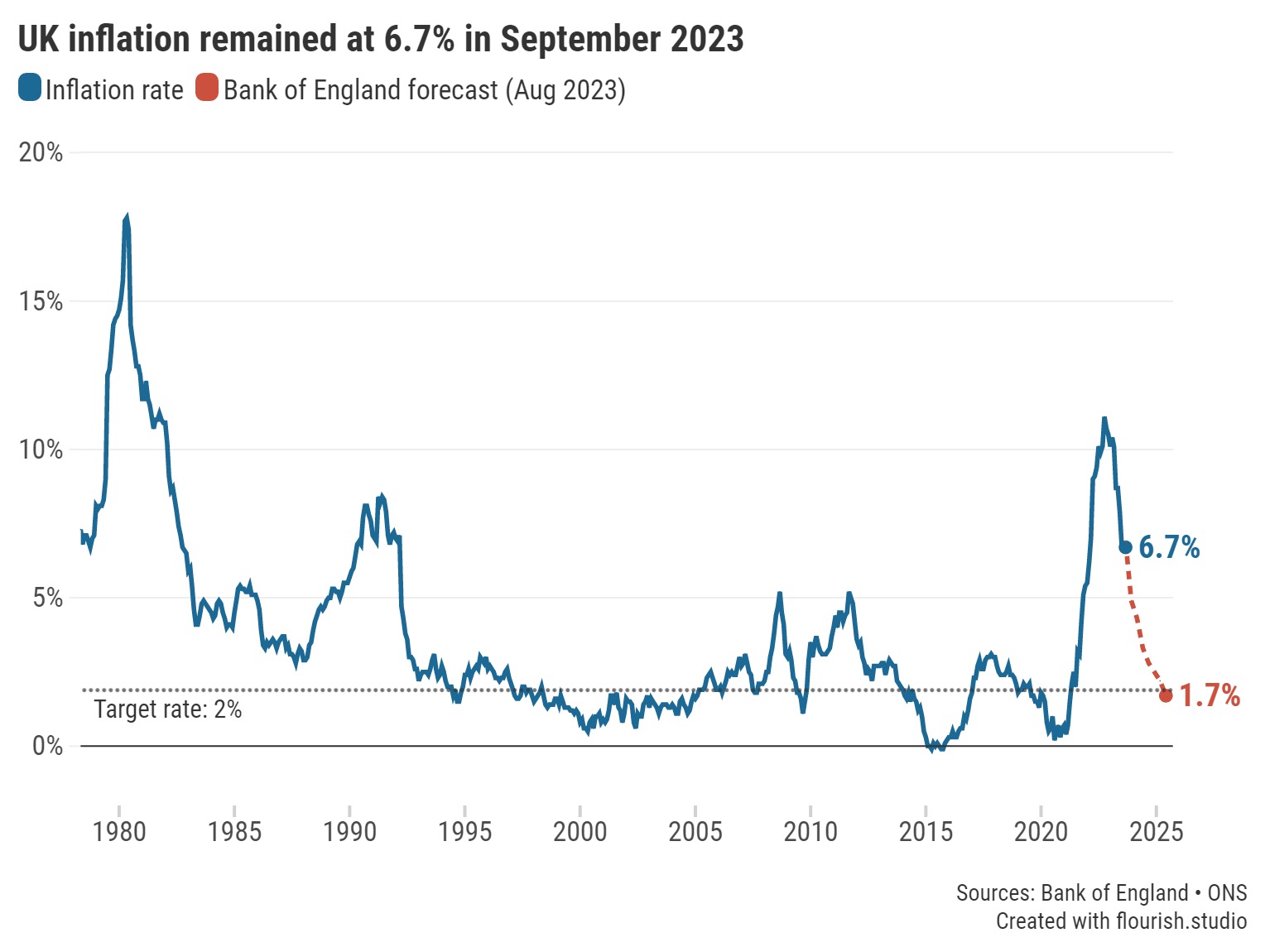

UK inflation held at 6.7% in the year to September, according to today’s announcement from the Office for National Statistics (ONS). This is unchanged from the previous month.

Inflation is an important metric, used to measure how fast the prices of goods and services are rising. While inflation stood still in September, this doesn’t mean prices have stagnated, however. Instead, they are continuing to rise steadily at the same pace as last month.

This comes as rising fuel prices counteracted downward contributions made by a fall in the cost of food and non-alcoholic beverages - the first time these prices dropped on the month since September 2021, according to the ONS.

Caption: Inflation remained unchanged at 6.7% in September 2023.

Meanwhile, it’s a similar story in the US, where inflation remained elevated but unchanged at 3.7% in September, according to the U.S. Bureau of Labor Statistics. This prompted questions as to whether the Federal Reserve will increase its central interest rate at the end of the month.

As for the Bank of England base rate, the Monetary Policy Committee (MPC) will next vote on the matter on 2 November.

Inflation remains well above the Government’s target of 2%, and as such it’s still eating into savers’ money in real terms. It’s vital to consider your options to ensure your investments are delivering competitive returns.

Some of the latest top fixed rate deals for savers have fallen slightly since the last inflation announcement, although top rating easy access accounts have continued to rise. As there’s still a good deal of competition and movement at the top end of this market, there’s always the option to spread your cash and take advantage of higher returns while also retaining resilience for any unexpected circumstances.

Otherwise, this cooling in the rise of top savings rates follows on from the Bank of England’s decision to hold the base rate at 5.25% after 14 consecutive rises. Nevertheless, while there’s still substantial activity between providers and competitive deals available, it remains essential that savers are prepared to vote with their feet if their loyalty isn’t being rewarded.

Providers have been especially willing to raise the bar on ISAs this month, with several notable improvements made across the market. With the number of ISA products available not far off its highest on our records and variable rates still rising, now may be a good time to consider options in this area.

Be sure to consider how much access you’ll need to your savings when deciding on which type of account suits you best. Regardless of which options you choose, be aware of less established brands which may be offering more enticing deals but always keep in mind your own personal circumstances.

Popular accounts may be pulled, or their rates decreased, so be sure to act swiftly after finding the best option for you.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.