Now firmly below the Bank of England’s 2% target, does this mean further base rate cuts are on the horizon?

UK inflation slowed significantly to 1.7% in the year to September, the Office for National Statistics (ONS) today revealed. This exceeds many economists’ expectations and sees the costs of goods and services rise at the weakest rate since April 2021.

With inflation now firmly below the Bank of England’s 2% target, having stood stubbornly at 2.2% for two months previously, these latest figures lay the foundation for possible further cuts to the base rate before the year’s end.

Inflation is a measure of how quickly, or slowly, the prices of goods and services have risen over the past year; Consumer Price Inflation (CPI) is the key metric used by the ONS to quantify the rate of inflation.

While consumers will undoubtedly be pleased to see inflation ease substantially, it’s important to remember this doesn’t mean costs are getting any cheaper. Instead, they continue to rise, albeit at a slower rate than the month before.

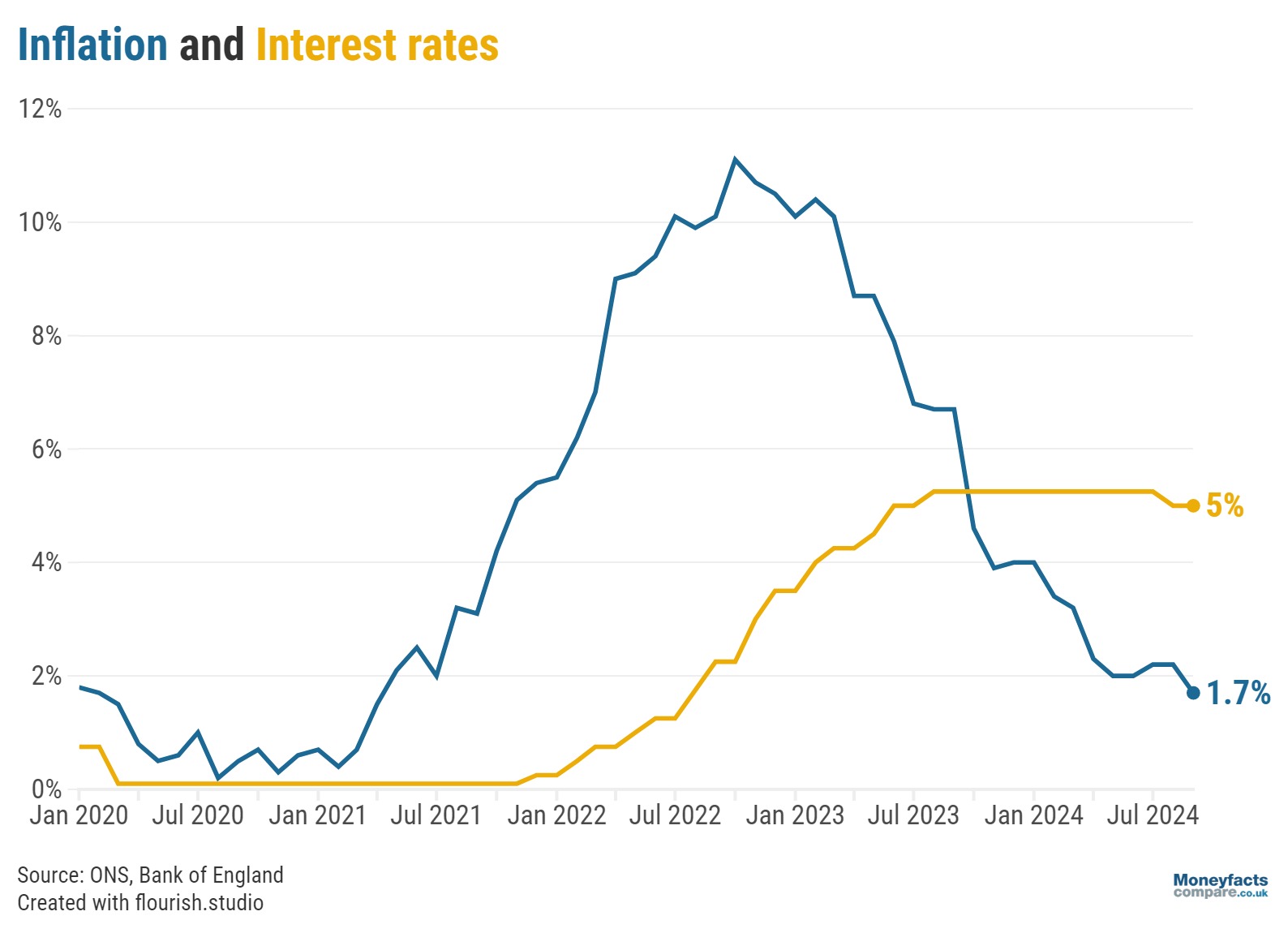

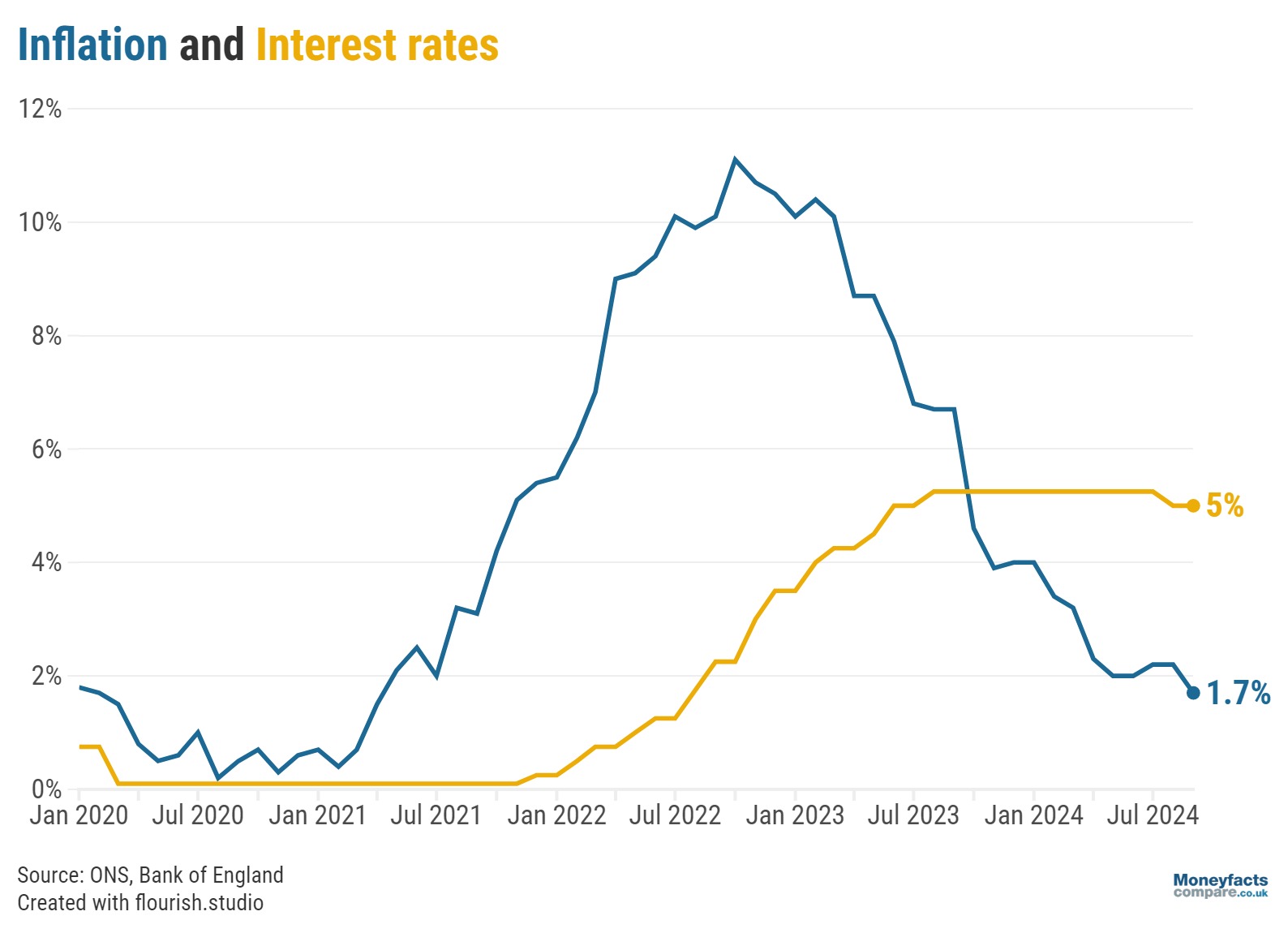

Graph: The rate of inflation plotted against changes to the Bank of England base rate between 2020 and September 2024.

The transport division made the largest downward contribution to inflation, as fuel prices and air fares declined between August and September.

With diesel and petrol dropping 6.0 and 5.5 pence per litre, respectively, this resulted in overall motor fuel prices falling by 10.4% in the year to September.

Meanwhile, with the summer holiday season coming to a close, domestic, European and long-haul flights experienced the fifth largest fall between August and September since the ONS began its monthly collection of prices in 2001. This is in stark contrast to last month, when air fares rose by the second highest amount since August 2001.

Nevertheless, downwards momentum in the sector was partially offset by the annual rate of inflation for food and non-alcoholic beverages strengthening for the first time since March 2023.

The savings market has seen reduced volatility over the past month, with many of the top rates remaining largely unchanged, which may be promising news to savers who have been slow to secure a competitive deal previously.

A few new challenger banks have entered the scene, and their perks do not go unnoticed as they continue to dominate across ISA and non-ISA accounts.

Volatile fixed bond rates have proved to be challenging for savers, entering and exiting the market rapidly in recent months. It is crucial savers act with haste if they wish to lock into an attractive deal, as base rate cuts are still forecasted this year, meaning providers may be quick to pass on rate reductions.

There are very few existing deals paying around 5%, the majority being variable rates which are especially susceptible to rate changes. As a result, deals paying 5% could exit the market entirely.

Two-year bonds have fared the worst since the previous inflation announcement, seeing a 0.23% reduction. Although savers coming out of a two-year bond will be seeing lower rates compared to 2022 the margin is less harsh compared to its one-year counterpart, showcasing the benefits of fixing for extended terms.

Fixed rate ISAs have also been reduced in some areas, specifically one-year and two-year fixed rates. However, the ISA market has also seen more positive changes within the easy access sector which has seen an increase month-on-month.

Overall, there is a much more positive outlook across most areas of the savings market in comparison to recent months, but it should not be assumed that this will remain the case. With major decisions still to be announced regarding the Budget and interest rates, it is as important as ever savers review their pots and consider securing fixed returns for longer.

Our savings charts are regularly updated throughout the day to show the best fixed, easy access and notice rates currently on the market – over 1,700 of which can better inflation and see your money grow in real terms.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.