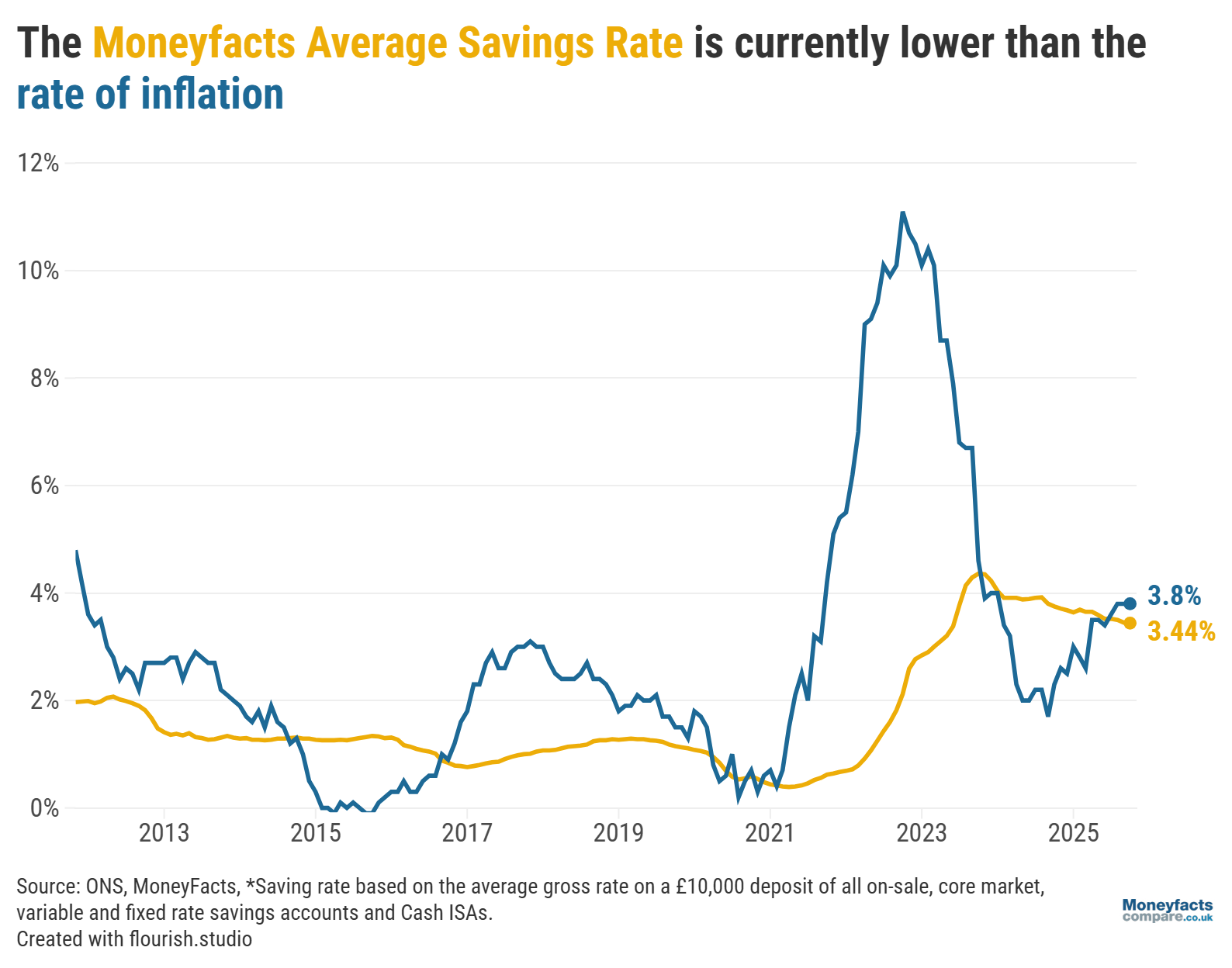

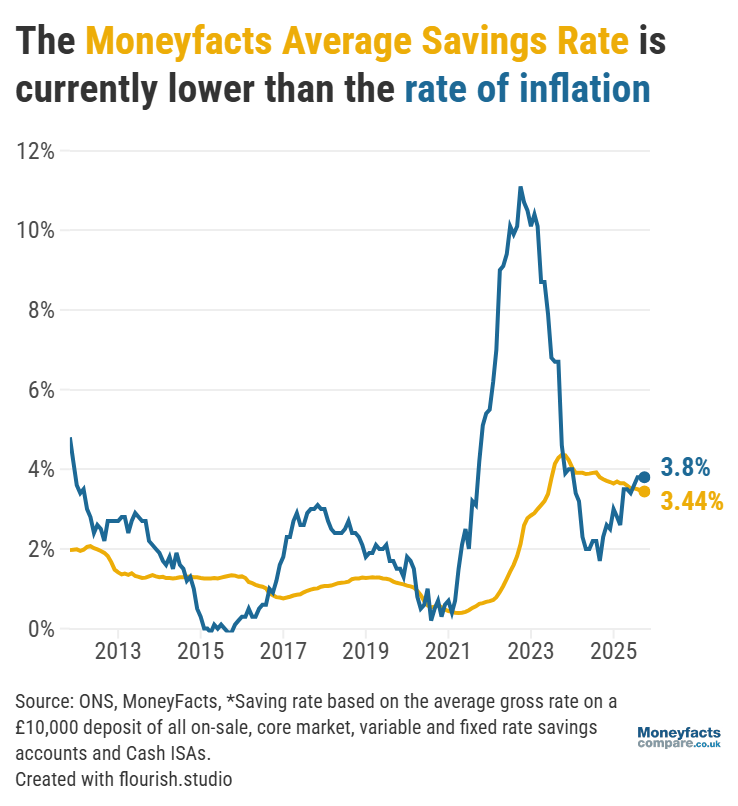

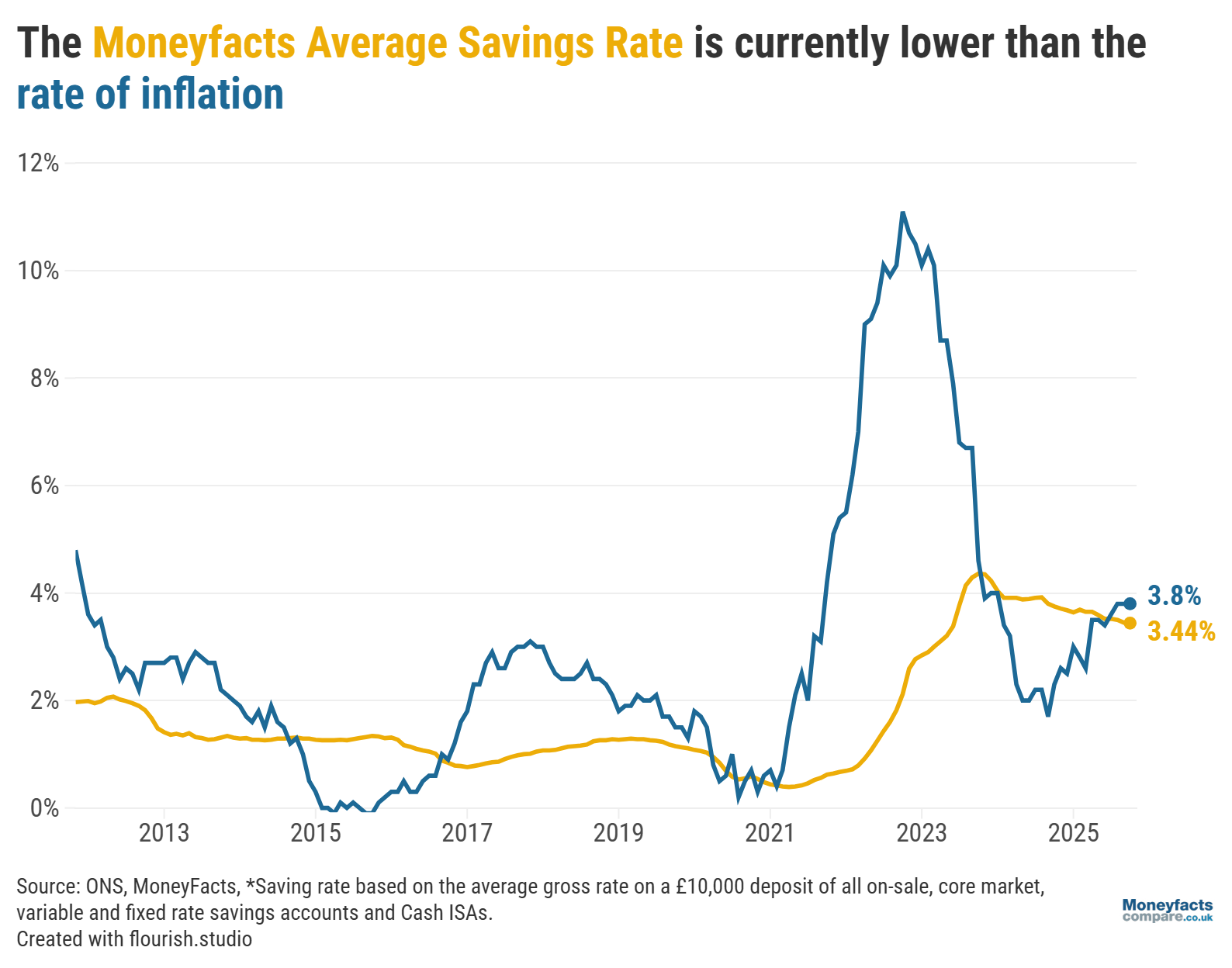

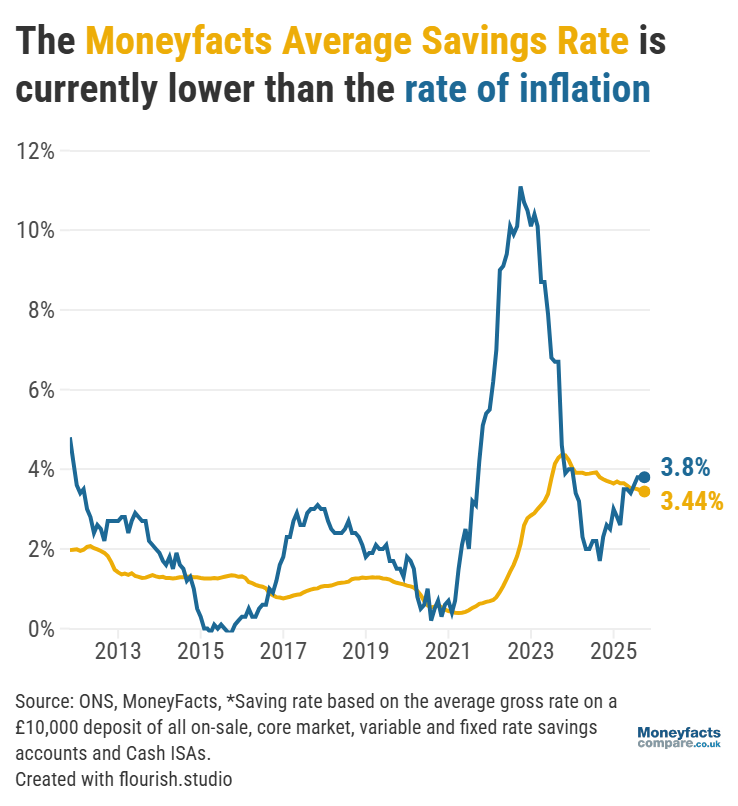

This is the third consecutive month that the annual rate of inflation in the UK was recorded at 3.8%.

The rate of UK inflation stayed at 3.8% in the year to September, according to the latest data from the Office for National Statistics (ONS).

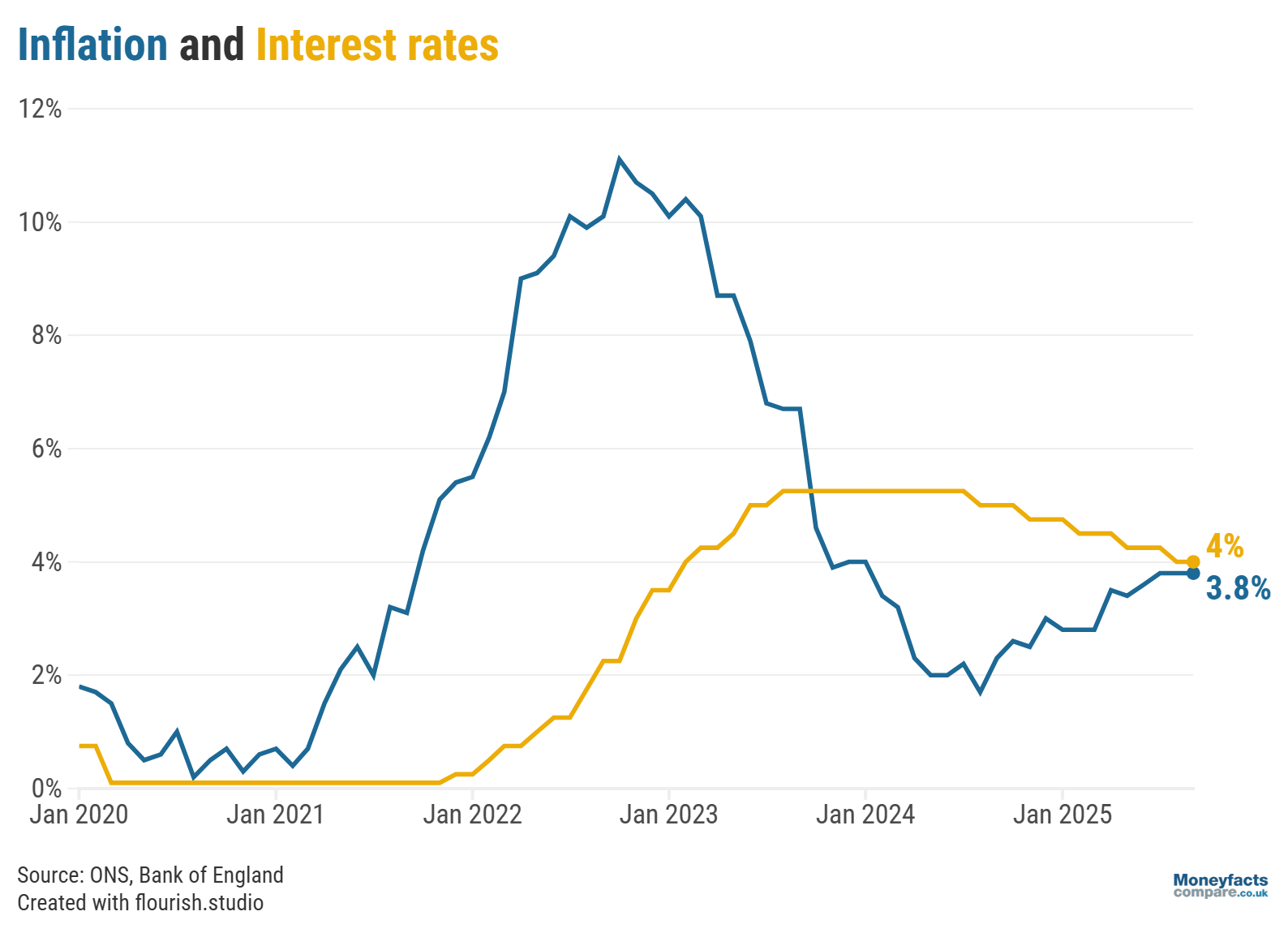

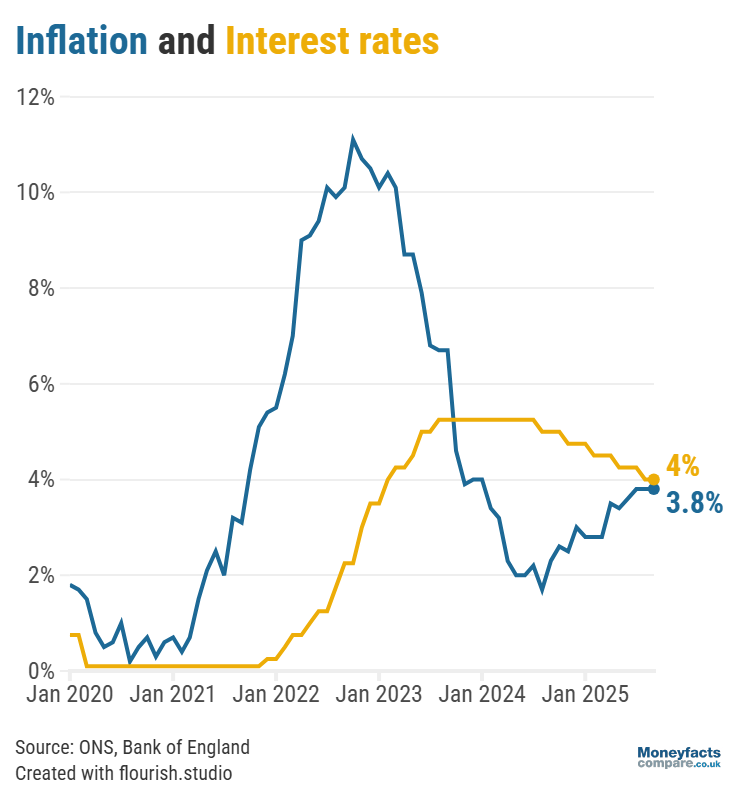

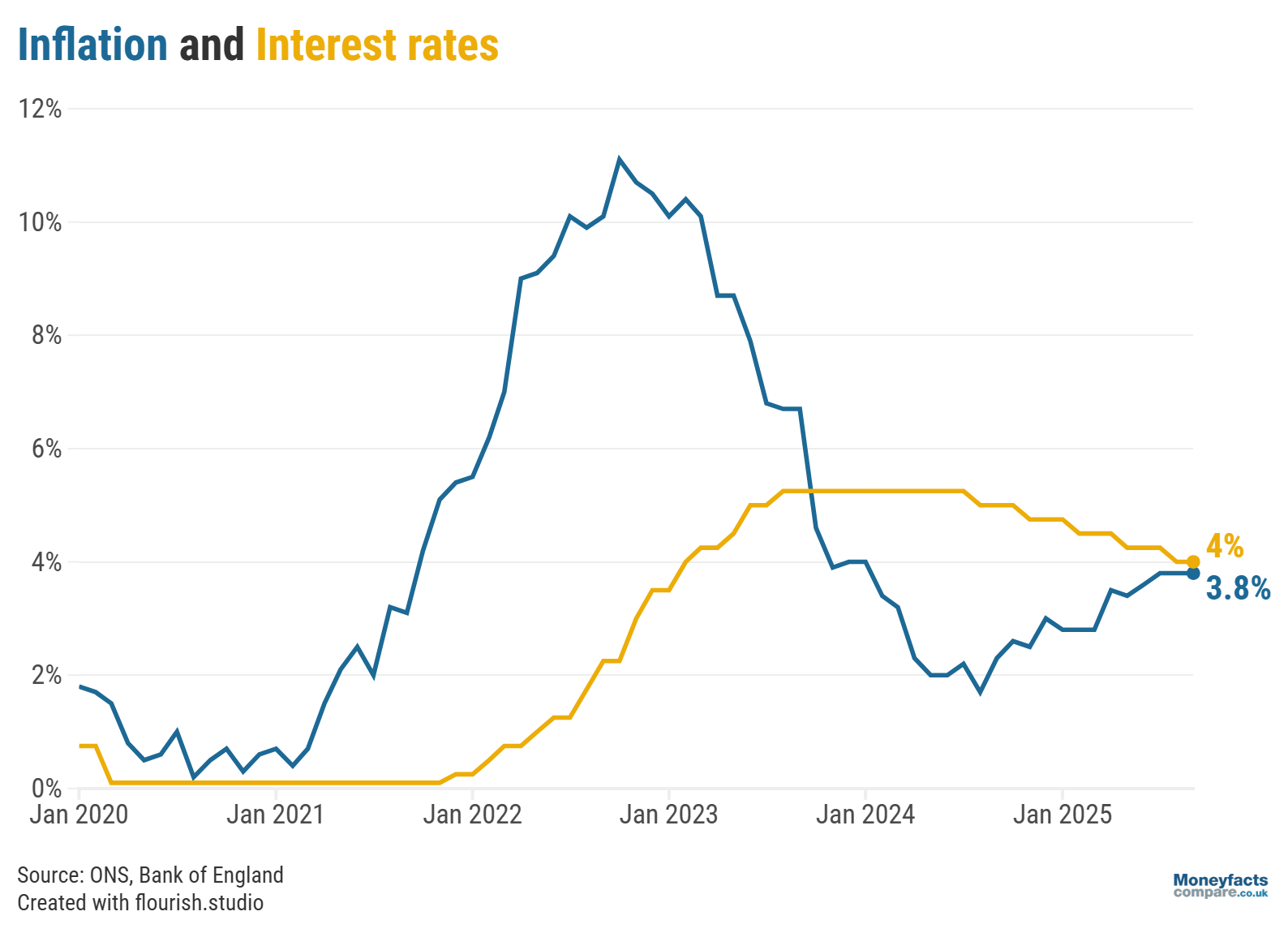

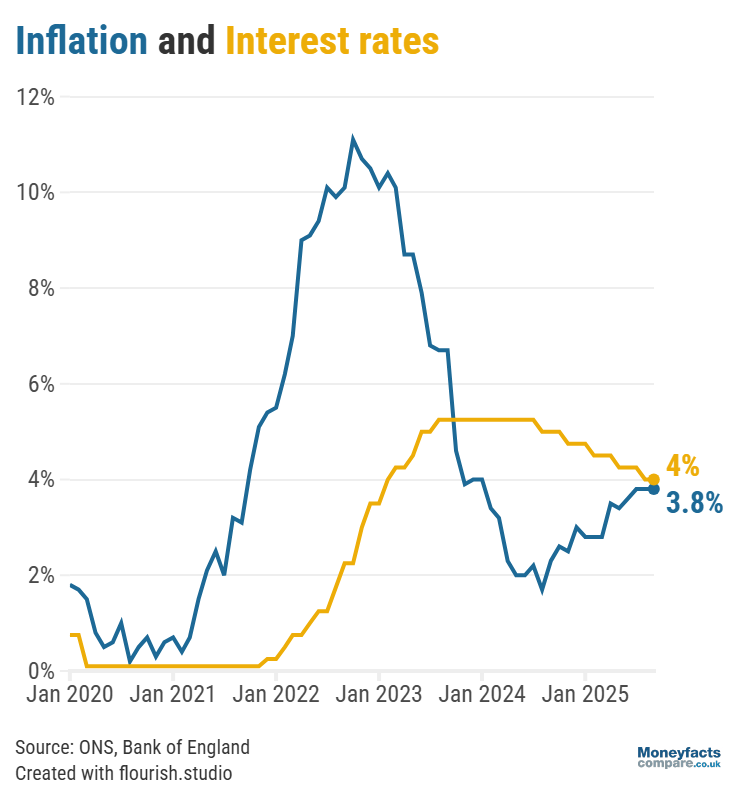

Although this means prices have still risen year-on-year, the increase isn’t as significant as many had feared. The Bank of England had forecast that the annual inflation rate would rise from its August figure of 3.8% to 4% in September, before starting to decline.

Inflation means that the prices of goods and services have increased over the past year. For example, something that cost £10 one year ago would cost £10.38 if it increased at an inflation rate of 3.8%.

Note that, even if inflation stays the same month-on-month, it doesn’t mean prices aren’t rising; it just means prices are rising at the same rate as the previous month.

Inflation is measured using the Consumer Price Index (CPI). Read our guide to find out more about the impact inflation can have on your money.

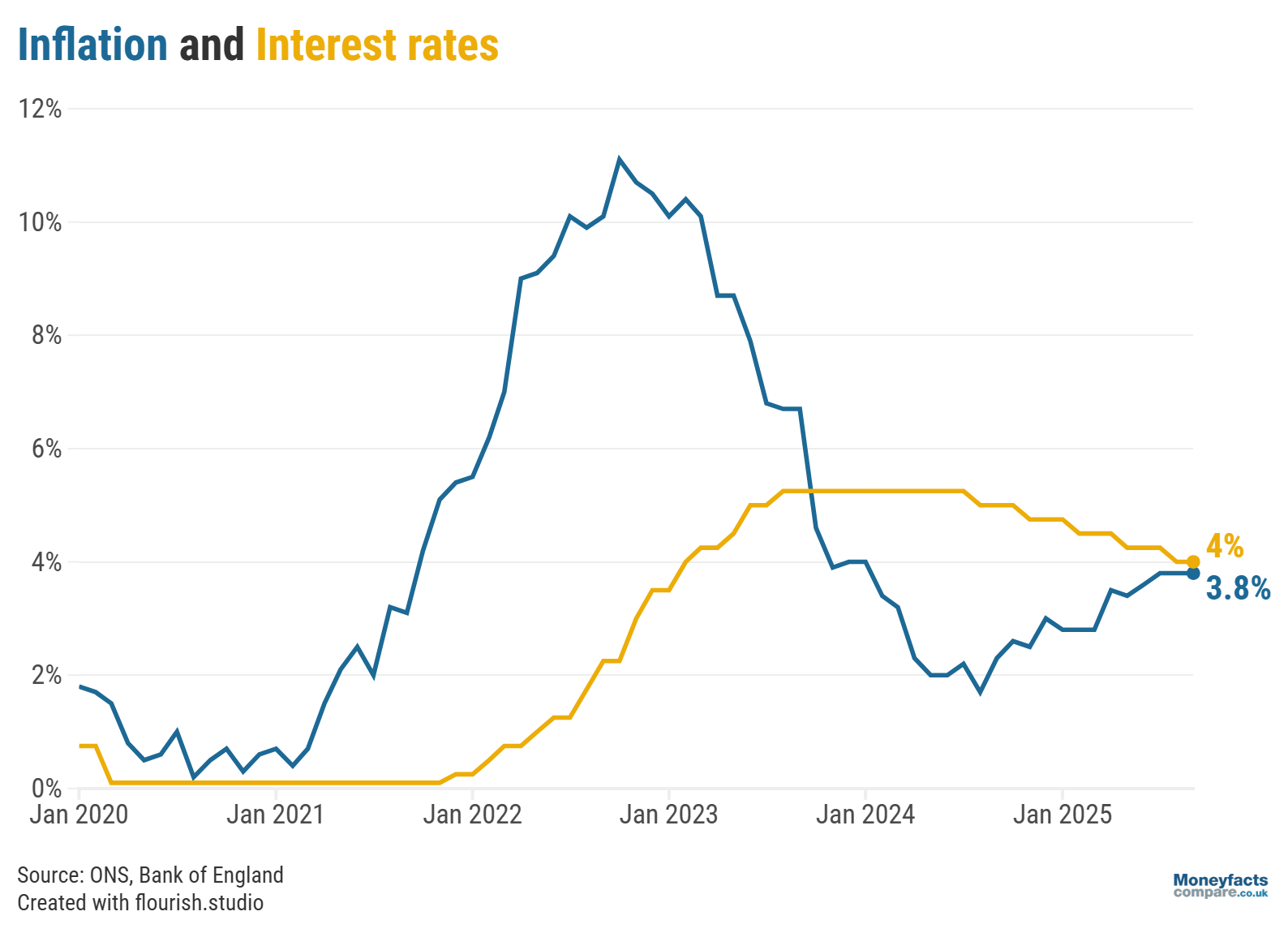

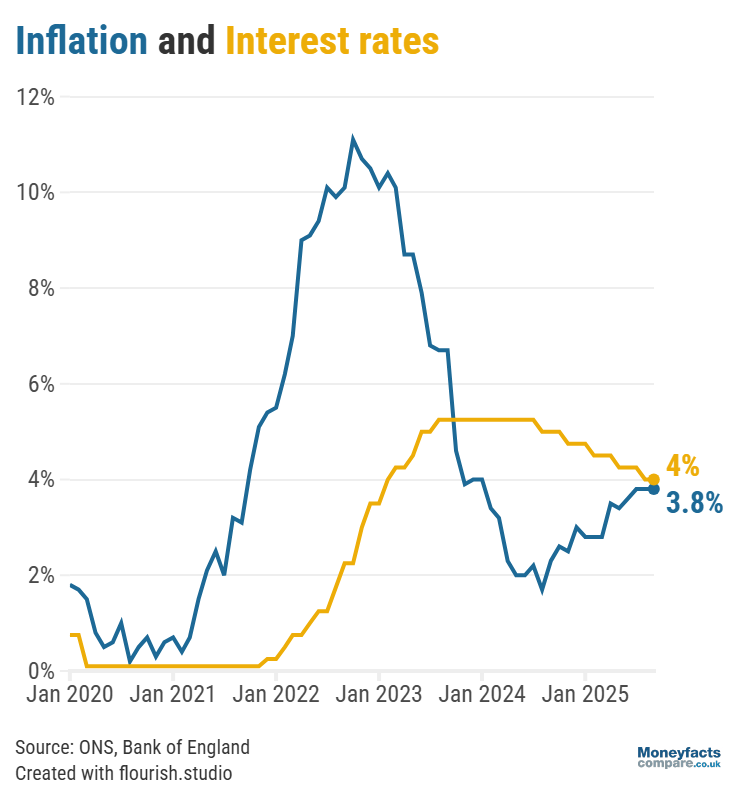

With this slight reprieve in the pace of inflation, there may be renewed hopes that the Bank of England will cut the base rate sooner than previously predicted. However, it’s important to bear in mind that inflation remains significantly higher than the Bank’s target of 2%, which is likely to make it continue its cautious approach to any further cuts. See our guide for more information on the relationship between inflation and the base rate.

Graph: The annual rate of inflation remained at 3.8% in September 2025, while the base rate stands at 4%.

A mix of factors contributed to inflation holding at 3.8%. Perhaps most notably, the annual inflation rate for food and non-alcoholic beverages stood at 4.5% in September, down from an annual rate of 5.1% in August. Encouragingly, on a monthly basis, prices in this category dropped by 0.2% between August and September, the first month-on-month drop since May 2024. Vegetables, bread and cereals, and cheese were some of the main foodstuffs that helped keep the rate of inflation down.

Similarly, the recreation and culture sector recorded an annual inflation rate of 2.7% in September, down from 3.2% in August, with falling live music prices playing a particularly significant role.

On the other hand, the annual inflation rate for the transport sector rose from 2.4% in August to 3.8% in September. Motor fuel prices, air fares and vehicle maintenance and repair costs were some of the key contributors to this sector’s higher inflation figure.

“Inflation is almost double the Bank of England’s 2% target, but despite continued pressure from the rising cost of living, the UK’s household savings ratio remains above 10%, which reflects continued caution among consumers,” Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk, commented.

The household savings ratio is the proportion of a household’s disposable income that isn’t spent and is deposited into savings.

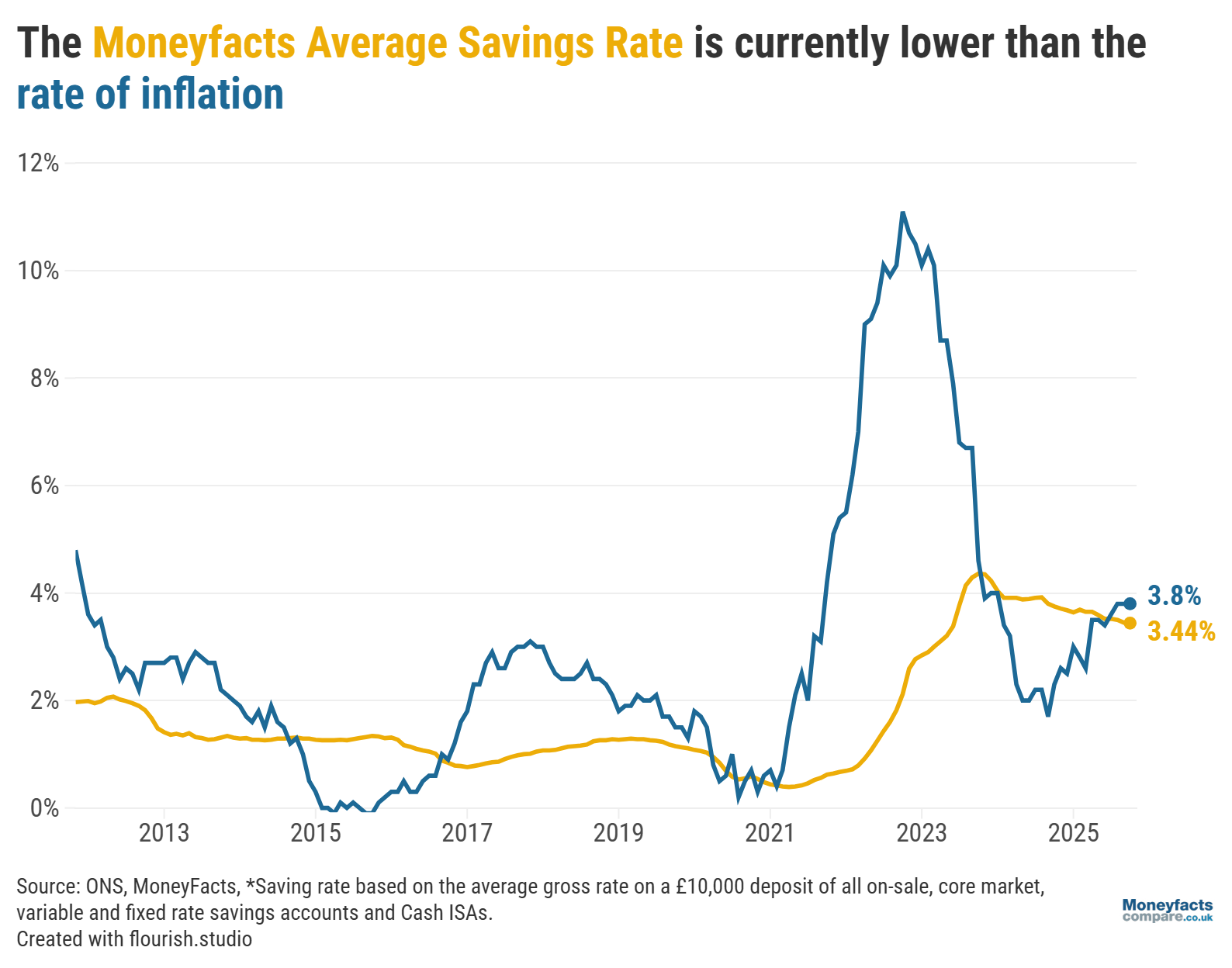

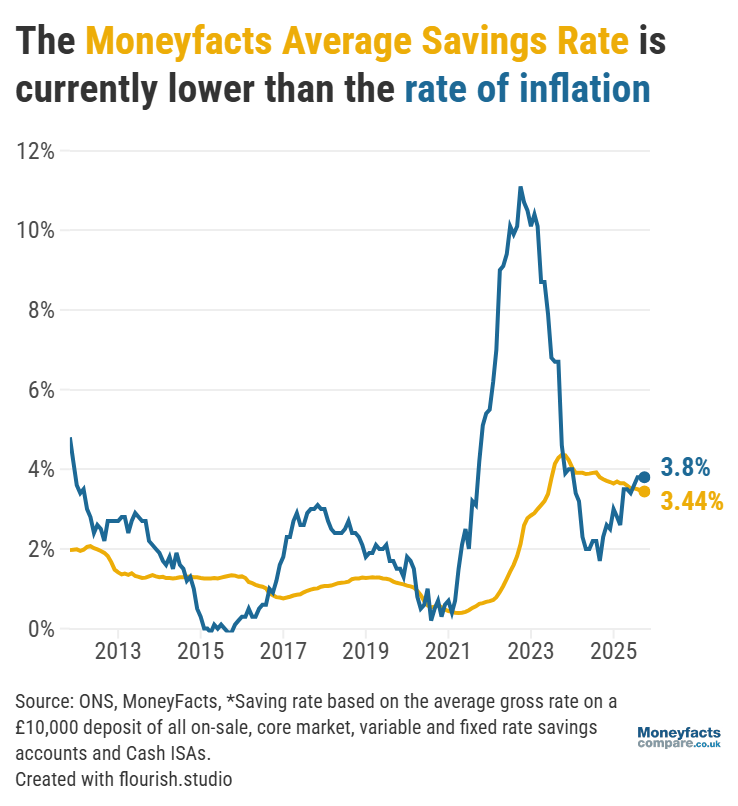

“Savers’ main priority is to build financial security and, with average real returns remaining negative, they may find that the value of their savings is steadily being eroded, making it harder to achieve their financial goals or maintain essential safety nets such as emergency funds,” Eastell continued.

“Even the most competitive rates are struggling to outpace inflation, with less than half able to keep ahead of rising prices,” she warned.

Although some of the leading rates have increased over the past month, the majority are still lower than they were one year ago.

“With the number of inflation-beating deals shrinking, any saver who finds their account falling behind inflation, should immediately switch to a more attractive deal, or consider locking into a fixed bond to secure guaranteed returns on their hard-earned cash,” Eastell urged.

Graph: The Moneyfacts Average Savings Rate is currently at 3.44%, which is lower than the rate of inflation (3.8%).

At the time of the inflation announcement, 978 savings accounts and ISAs could pay a higher rate than inflation. This includes easy access accounts and fixed bonds, as well as easy access cash ISAs and fixed rate ISAs.

See our charts to discover the latest rates and secure an inflation-beating return on your money.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.