Savers are being urged to make the most of their annual ISA allowance.

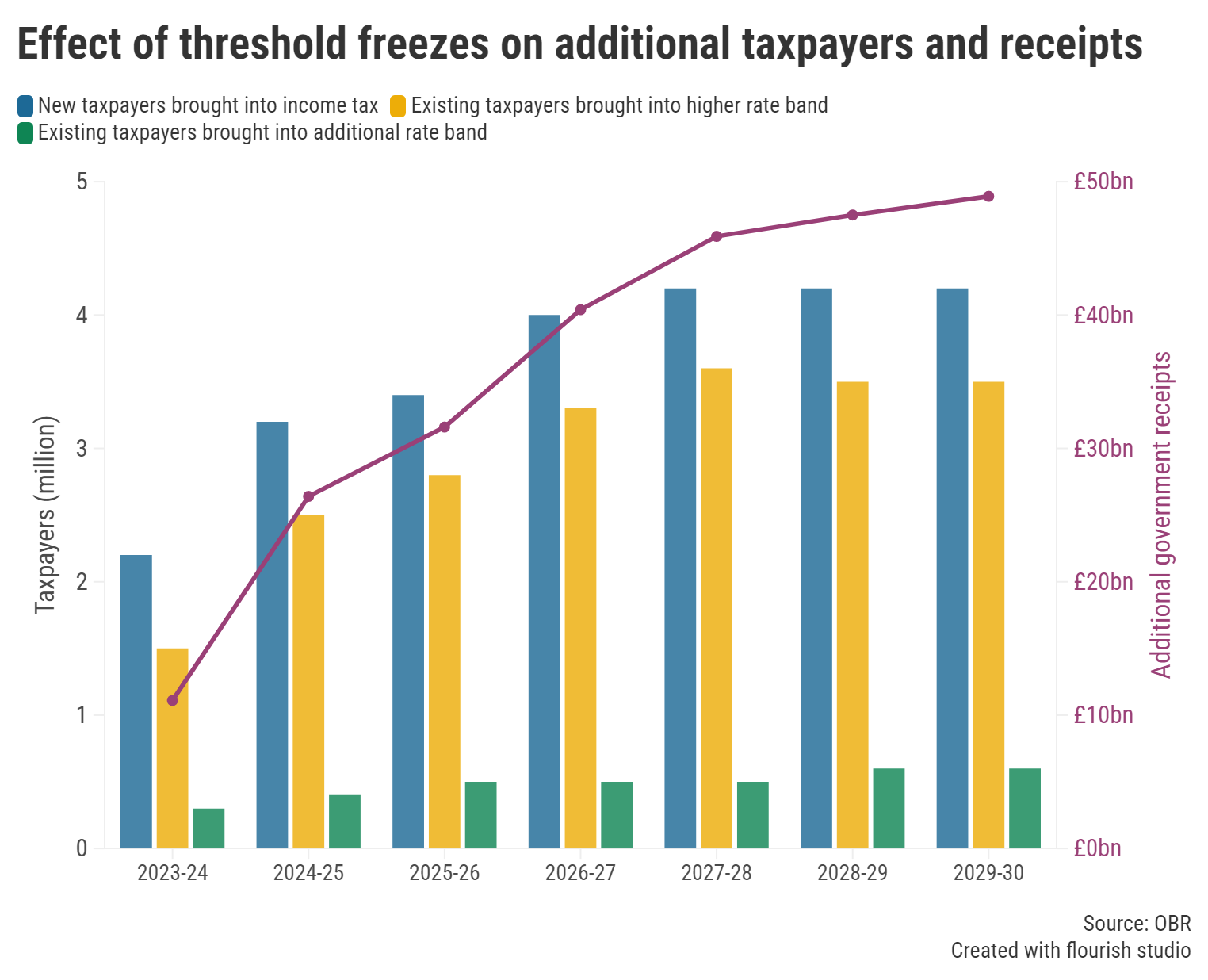

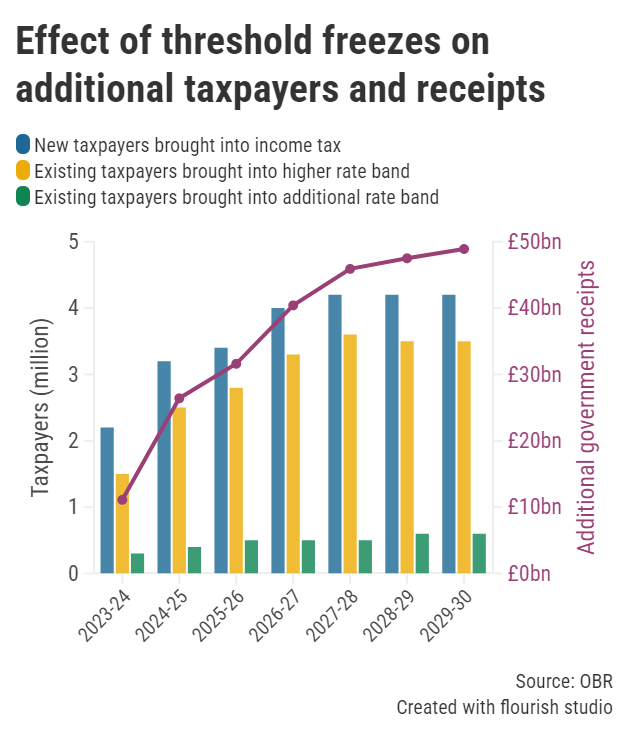

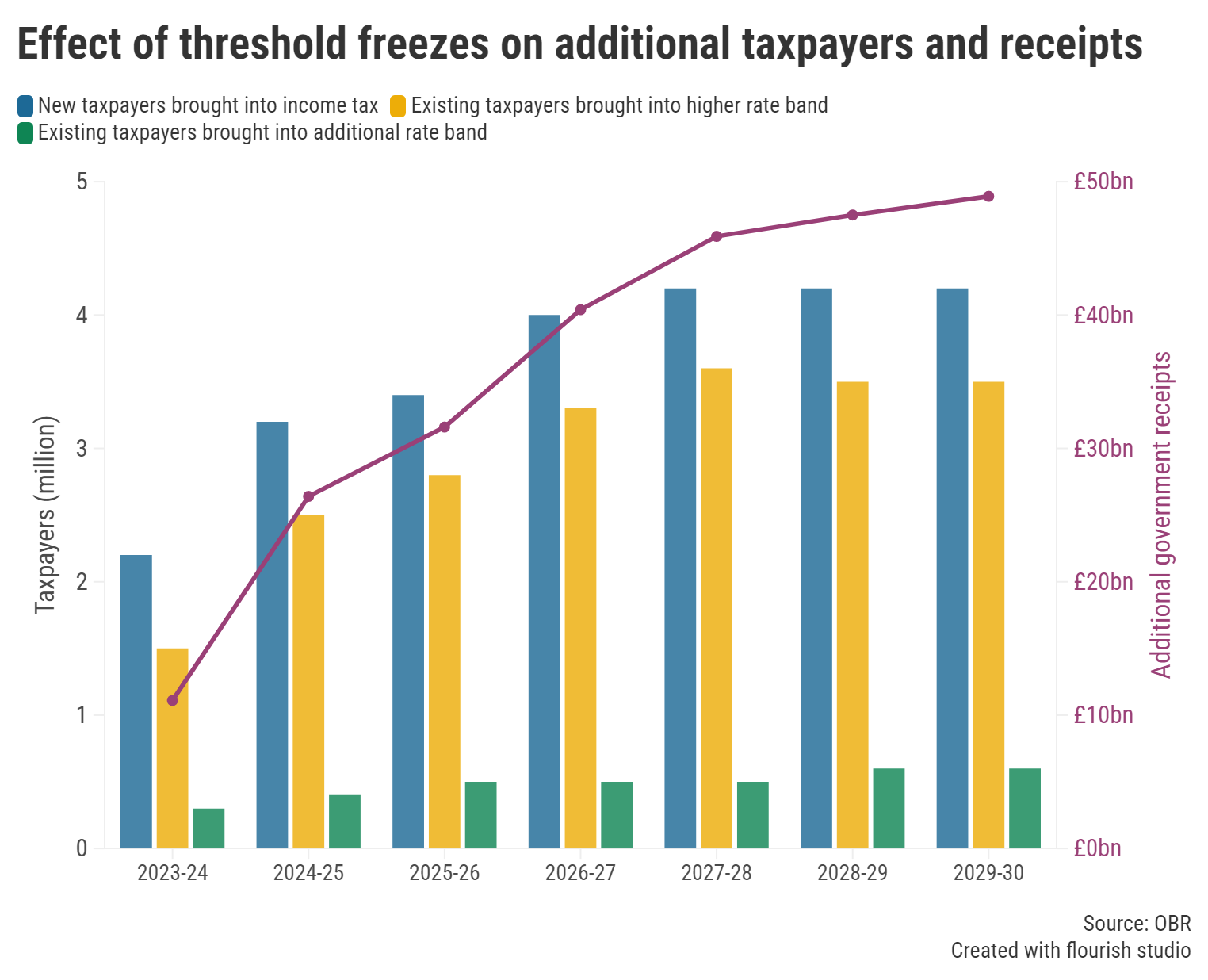

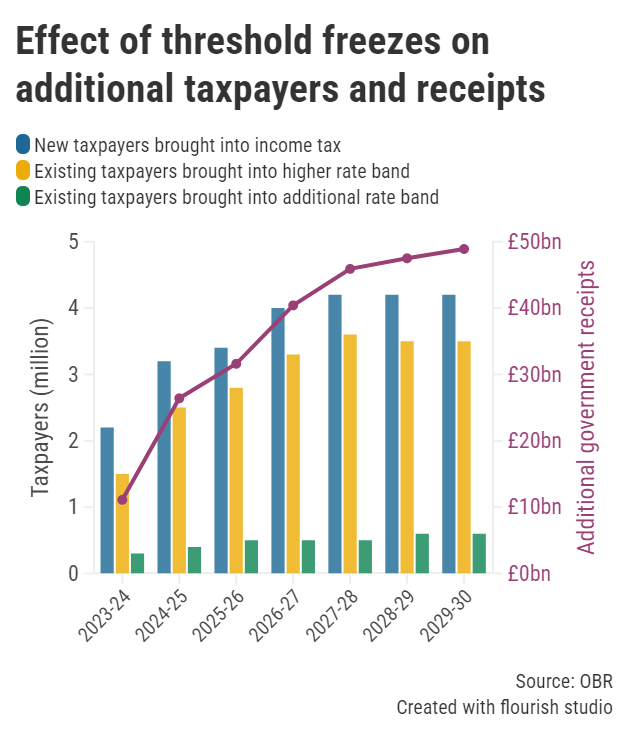

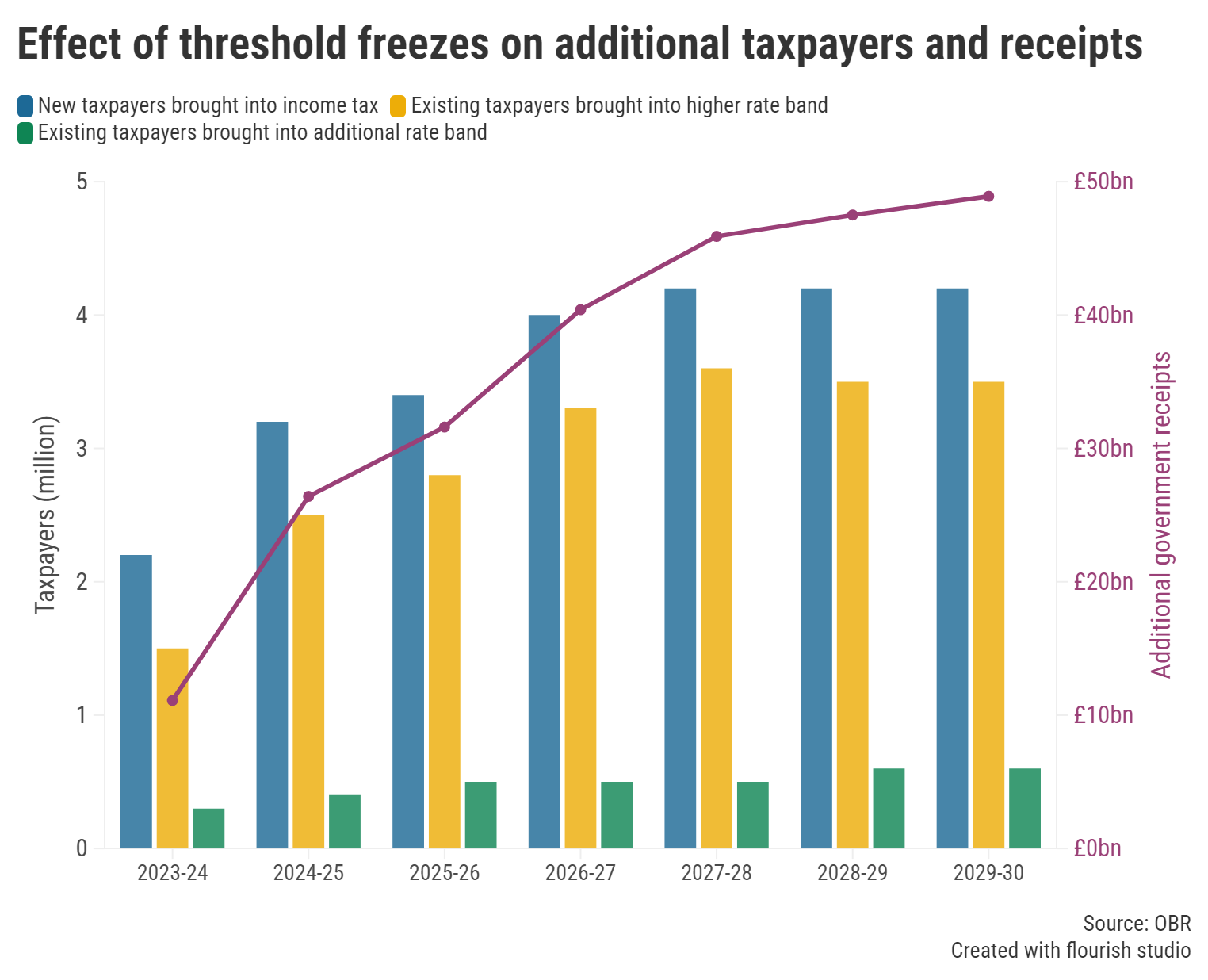

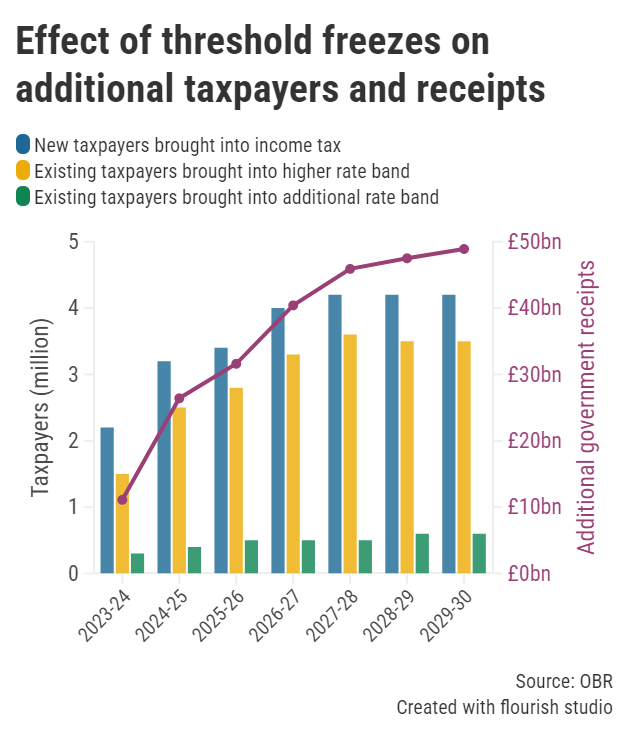

Approximately 3.5 million consumers are on track to become higher-rate taxpayers by 2028/29, according to the latest fiscal risks and sustainability report from the Office for Budget Responsibility (OBR), and, as a result, will be eligible to earn less tax-free interest on their savings.

The Personal Savings Allowance (PSA) enables basic-rate taxpayers to take home £1,000 in interest from savings and investments each year before facing a tax bill, however, this threshold is halved to £500 for higher-rate taxpayers.

To make matters worse, the report forecasts a further 0.6 million people will be pushed into the additional-rate tax band over the next four years and will therefore be taxed on any interest they accrue from savings (as they no longer qualify for the PSA).

“The fiscal drag is prevalent, and these latest statistics should be a stark warning for consumers,” said Rachel Springall, Finance Expert at Moneyfactscompare.co.uk.

Graph: The effect of fiscal drag on the number of taxpayers between 2023/24 and 2029/2030.

Fiscal drag is a phenomenon whereby taxpayers are pulled into a higher tax bracket; it often occurs when tax bands are frozen, but wages and inflation continue to rise.

It’s often seen as a ‘stealth tax’ as fiscal drag raises many people’s tax burden, which in turn can help the Government to balance the books without directly hiking tax rates.

While average savings rates have trended downwards lately, some of the best returns remain higher than seen in recent years – putting those with smaller deposits at risk of exceeding their PSA.

“Savers need to take advantage of their ISA allowance and protect their hard-earned cash from tax,” urged Springall. Between 6 April and 5 April the following year, consumers can currently deposit up to £20,000 in total across ISAs, with any returns automatically tax-exempt.

However, it was reported last week that the Chancellor of the Exchequer, Rachel Reeves, is set to lower the amount that can be deposited into cash ISAs in a bid to encourage more people to invest.

“The debate on whether the yearly cash ISA allowance should be cut is ongoing, so savers will no doubt want to maximise their deposits in the meantime,” Springall explained.

Those looking to save tax-efficiently can explore the best ISA rates using our regularly updated charts.

Alternatively, make sure to read our weekly ISA roundup for further details on the most competitive accounts.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.