But, with almost all average savings rates declining month-on-month, you may need to act fast.

Savers searching for a new account have more providers to consider as seven challenger banks entered the fray in the month to November. This is according to data from the Moneyfacts UK Savings Trends Treasury Report which found the new additions raised the total number of savings providers to 149 – the highest count since Moneyfacts’ records began in 2007.

Furthermore, the overall number of savings products on the market increased from 2,015 in October to 2,076 at the start of this month – the second highest amount on record.

However, despite more competition, consumers may find they still need to act fast to secure attractive returns on their hard-earned cash, as the average shelf-life of a bond dropped to 35 days at the start of this month – the shortest since March 2024.

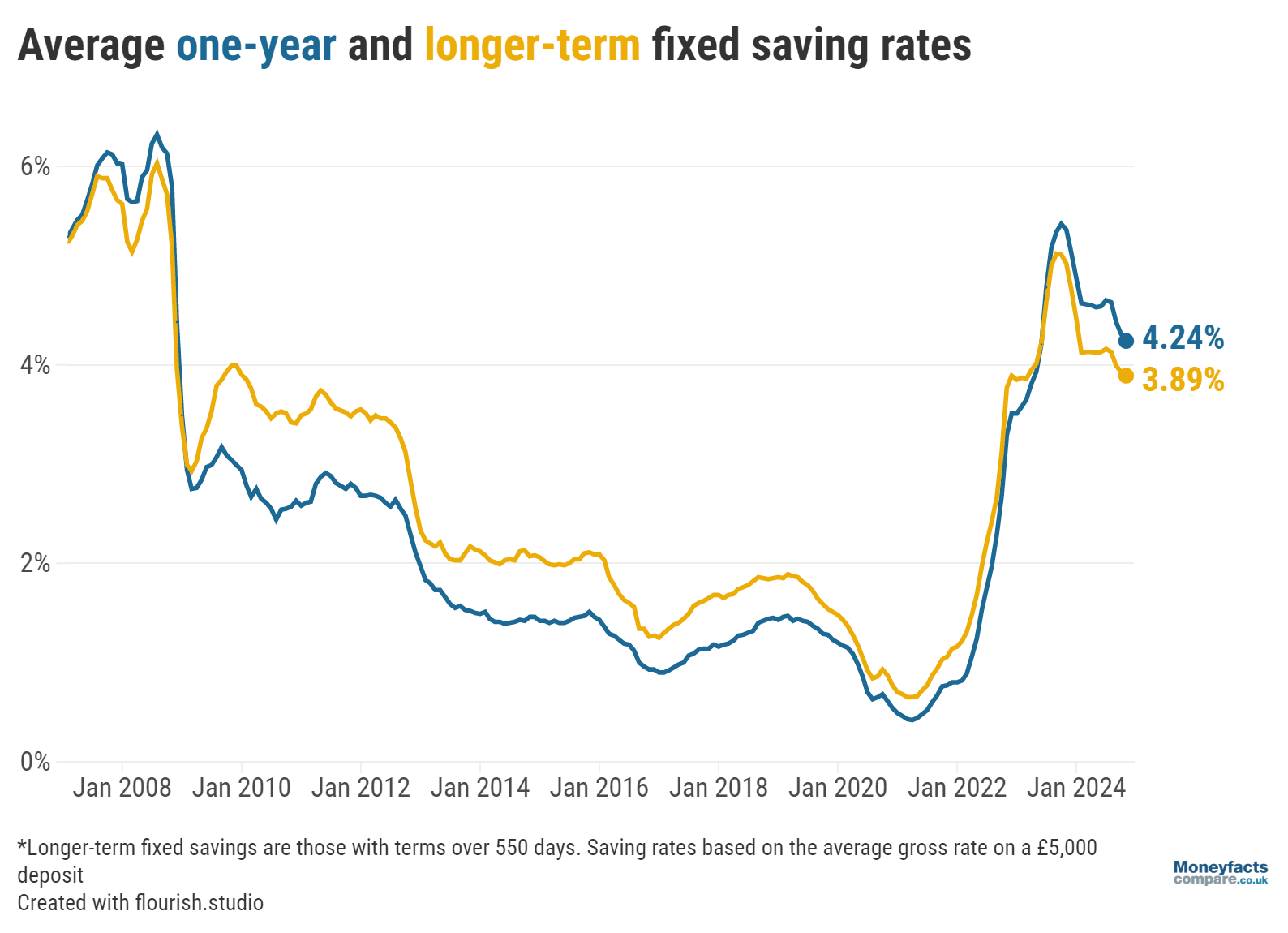

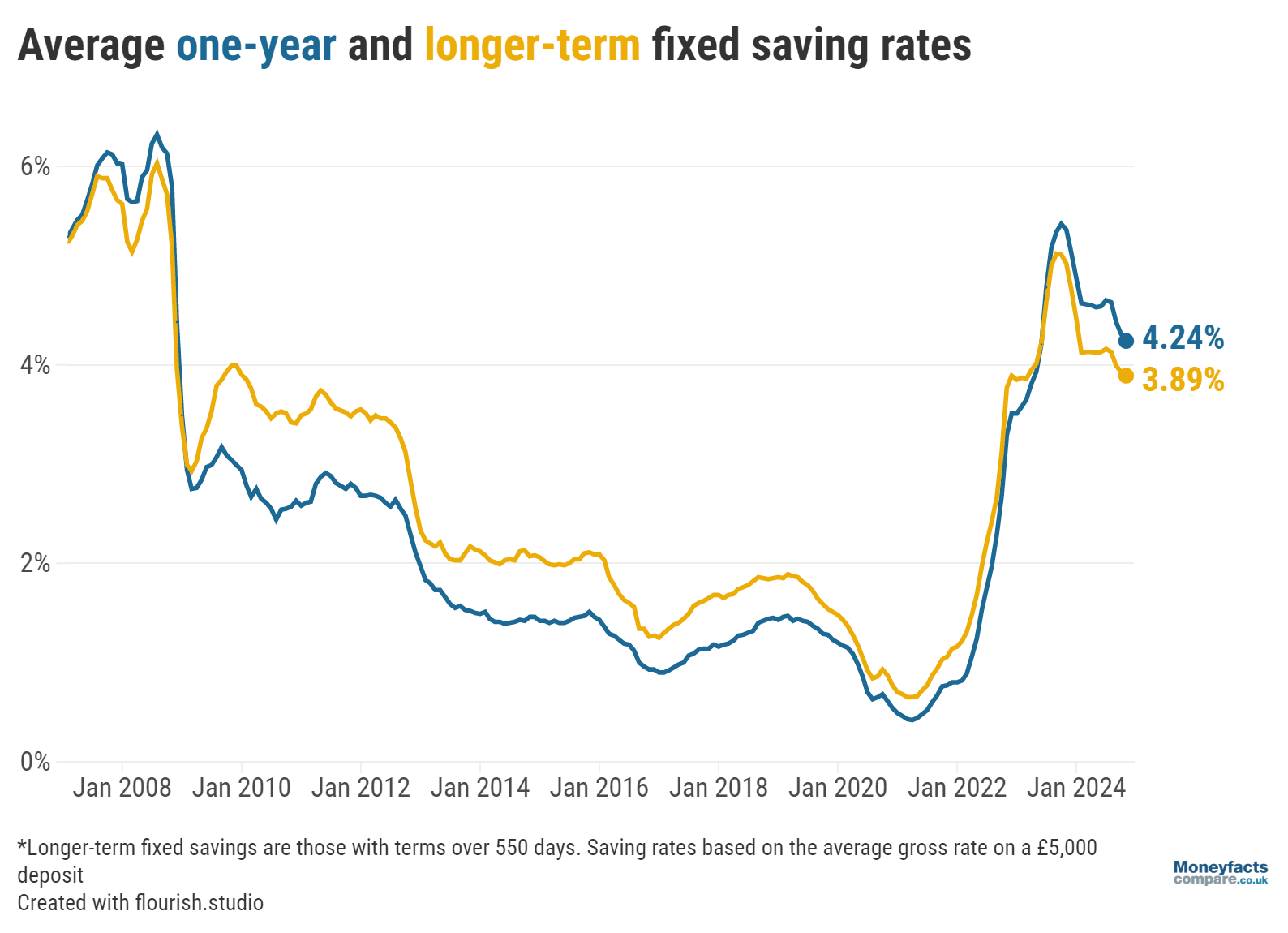

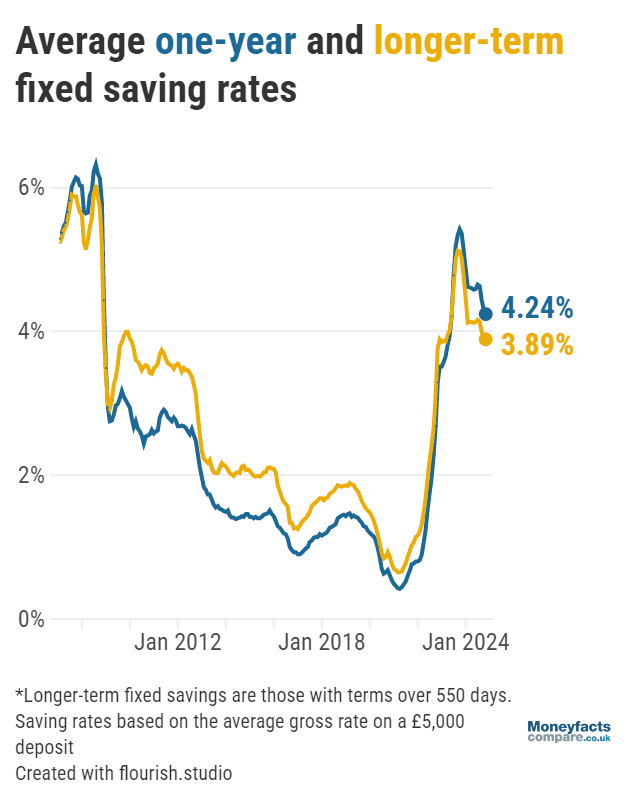

Graph: Average returns on a one-year fixed bond vs longer-term fixed bond between 2008 and 2024.

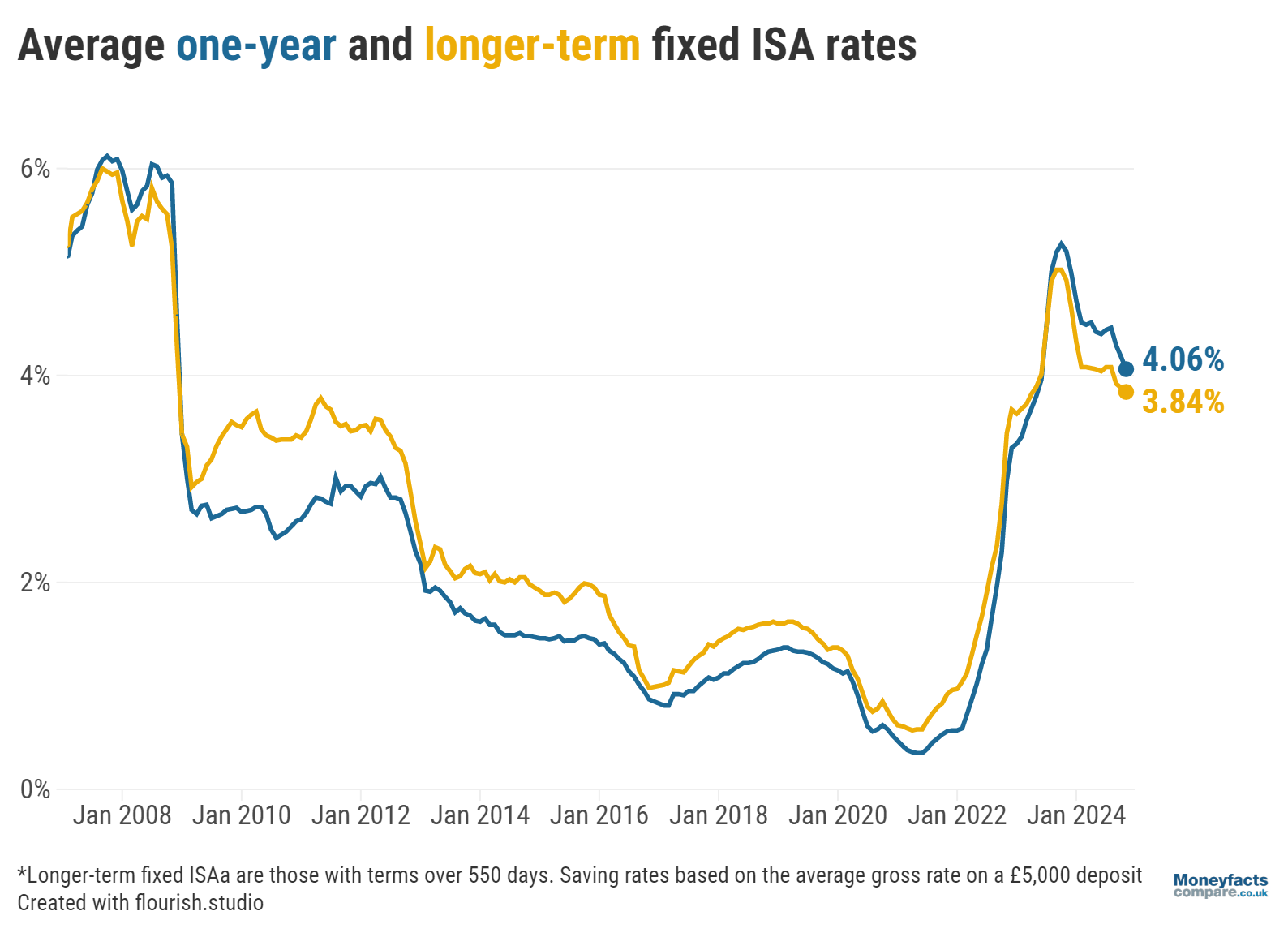

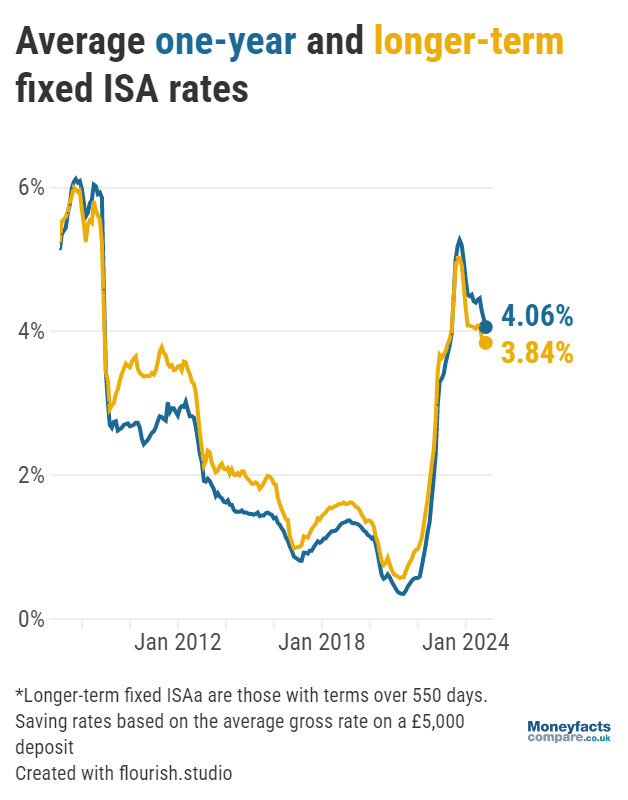

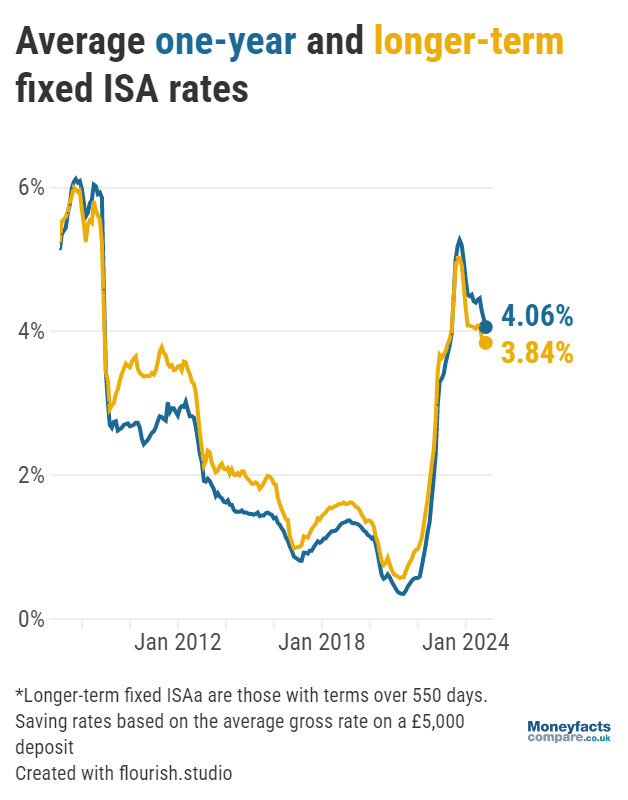

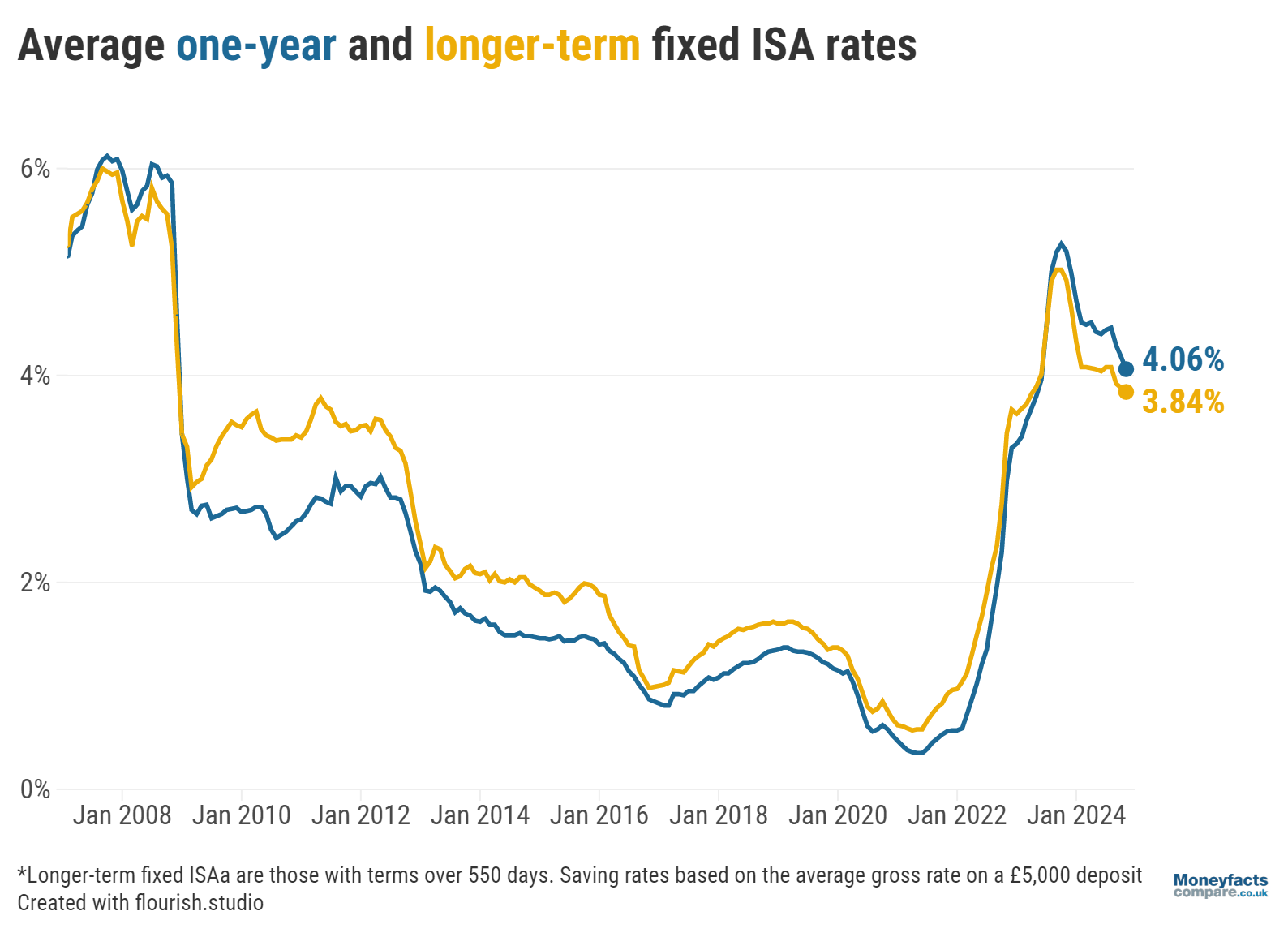

To exacerbate the situation, fixed savings rates fell across the spectrum on a monthly basis. One-year bonds and ISAs fared worse than their longer-term counterparts, shedding 0.07 and 0.12 percentage points, respectively, to pay 4.24% and 4.06% on average. Meanwhile, typical returns on longer-term bonds and ISAs (with terms over 550 days) both dropped 0.04 percentage points to 3.89% and 3.84%, respectively.

Graph: Average returns on a one-year fixed ISA vs longer-term fixed ISA between 2008 and 2024.

This downwards trend could present a challenge for savers. But, with £252 billion dwindling in current or savings accounts earning no interest (according to the Bank of England) and with inflation expected to remain above 2% heading into 2025, it’s crucial savers review their portfolio and consider switching to ensure their money grows in real terms.

It’s often the case many of the best savings rates can be found from challenger banks as, unlike high street giants, these lesser-known brands rely on offering competitive returns to boost their profile and to entice new customers. While some may worry whether their money is safe with an unfamiliar name, you can rest assured all savings accounts featured on our charts are protected by a depositor protection scheme.

BACB was among those to launch into the fixed savings market in the lead-up to November; paying an above-average 4.70% AER, its Raisin UK – 1 Year Fixed Term Deposit continues to occupy a prominent spot on our one-year bond chart alongside accounts from a number of other providers. As its name suggests, this account operates either online or by mobile app via the third-party savings platform, Raisin UK, following a £1,000 minimum deposit. However, this amount should be considered carefully, as both further additions and withdrawals are prohibited.

Last updated: 05/03/2025

Account: Raisin UK - 1 Year Fixed Term Deposit

Notice/Term: 1 Year Bond

Rate: 4.70% AER

Alternatively, savers wanting to secure fixed returns for longer will find the two-, three- and five-year Fixed Term Savings Accounts from JN Bank have remained competitive in the weeks since the provider rejoined the market on 8 October. In particular, its three- and five-year terms currently offer the market-leading rate in their respective sectors, at 4.60% AER and 4.49% AER. Each of these accounts can be applied for online with a £100 initial investment – a maximum of 11 further additions to which are permitted for 14 days from opening. Additionally manageable over the phone, bear in mind you won’t be able to make withdrawals – as is the case with most fixed bonds.

Last updated: 05/03/2025

Account: Fixed Term Savings Account

Notice/Term: 2 Year Bond

Rate: 4.51% AER

Account: Fixed Term Savings Account

Notice/Term: 3 Year Bond

Rate: 4.60% AER

Account: Fixed Term Savings Account

Notice/Term: 5 Year Bond

Rate: 4.49% AER

These accounts are just a few of the over 1,600 products that could better the rate of inflation when latest figures were released by the Office for National Statistics (ONS) last week. Our savings charts are regularly updated throughout the day and allow you to compare the best rates available, whether you’re looking for an easy access account, fixed bond or ISA.

Each week, we provide more information on accounts offering the best rates in our savings roundup and our ISA roundup.

Information is correct as of the date of publication (shown at the top of this article). Any products featured may be withdrawn by their provider or changed at any time. Links to third parties on this page are paid for by the third party. You can find out more about the individual products by visiting their site. Moneyfactscompare.co.uk will receive a small payment if you use their services after you click through to their site. All information is subject to change without notice. Please check all terms before making any decisions. This information is intended solely to provide guidance and is not financial advice. Moneyfacts will not be liable for any loss arising from your use or reliance on this information. If you are in any doubt, Moneyfacts recommends you obtain independent financial advice.